The Loan Life Coverage Ratio (LLCR) is a metric that is used to calculate a project’s ability to adequately cover its debt obligations. The ratio is characterized as: Net Present Value of Cashflow Available for Debt Service (“CFADS”) / Outstanding Debt in the period. LLCR is like the obligation administration inclusion proportion (DSCR), yet it is all the more usually utilized in venture financing due to its drawn-out nature. A single point in time is recorded by the DSCR, while the LLCR addresses the whole loan period.

The LLCR is a very common ratio used in project financing to determine the possible risks of projects. LLCR financial modeling is now a common metric measured in a project finance model and has been largely standardized, but as defined in the transaction term sheet, it must still be consistent with the local financial procedure of the financiers.

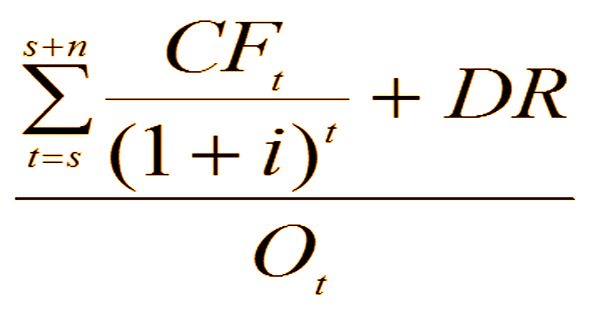

The formula for the Loan Life Coverage Ratio (LLCR) is:

Where:

CFt = Cash-flows available for debt service at year t

t = the time period (year)

s = the number of years expected to pay the debt back

i = the weighted average cost of capital (WACC) expressed as an interest rate

DR = Cash reserve available to repay the debt (the debt reserve)

Ot = The debt balance outstanding at the time of evaluation

The ratio is usually determined either annually, semi-annually, or quarterly over the remaining duration of the loan when calculating the LLCR.

In any task account undertaking, computing the two proportions is a standard advance in surveying the venture. The loan life coverage ratio is a ratio of the occasions over the incomes of a task that can reimburse an extraordinary obligation over the life of an advance. A ratio of 1.0x implies that LLCR is at an equal the initial investment level. The higher the ratio, the loaner has less possible risk. However, unlike the DSCR, which calculates the ability of the project to pay the debt over a period of time, the LLCR takes into account the various cash flow cycles available for debt service, as well as the overall amount of outstanding debt.

Example of Loan Life Coverage Ratio (LLCR)

The ratio is one of the viewpoints utilized for appraisals of the credit nature of a venture from a bank’s viewpoint. Related ratios are: Project Life Coverage Ratio (PLCR) and Reserve Life Coverage Ratio (RLCR). Depending on the project’s risk profile, the lender often needs a debt service reserve account. In such a scenario, LLCR’s numerator will contain the balance of the reserve account. Invariably, project funding arrangements include covenants stipulating amounts of LLCR.

The loan life coverage ratio generally is in a range from 1.25 for exceptionally outfitted foundation speculation to 2.5 or higher in a venture with a more uncertain salary, for example, oil and gas exchanges. One of the LLCR’s drawbacks is that it does not take on bad phases because it is simply a discounted average that can smooth out rough patches. For this reason, if a project has stable cash flow and a loan repayment history, a reasonable rule of thumb is that the LLCR should be approximately equal to the average coverage ratio for debt service.

Information Sources: