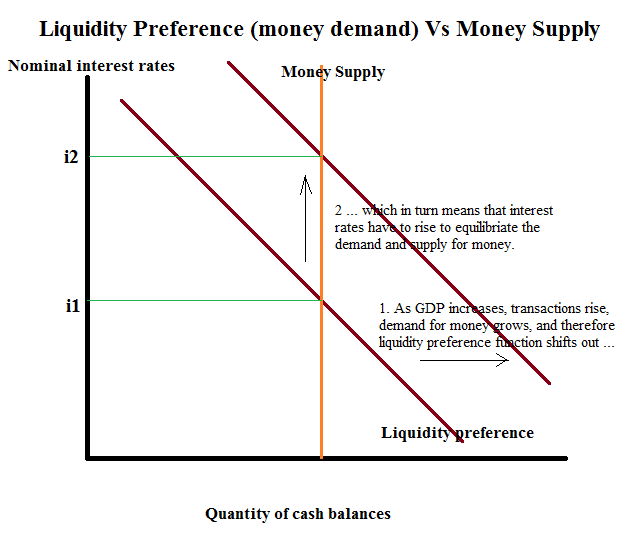

Liquidity Preference theory is the conception that investors demand reasonably limited for securities with longer maturities, which entail greater risk, because they would prefer to hold income, which entails a smaller amount risk. Because interest rates tend to be volatile at any given time, the premium upon short- versus medium-term securities will probably be greater than the actual premium on medium- vs long-term securities. The liquidity preference relation may be represented graphically like a schedule of the bucks demanded at each different monthly interest.

Liquidity Preference