Executive Summary:

Mutual Trust Bank limited a private sector commercial bank. The bank has its head office at Dhaka and 50 branches. The bank conducts all types of commercial banking activities including foreign exchange business and other financial services. The Company carries out international business through a Global Network of Foreign Correspondent Banks. While running orientation with MTBL Principal Branch; generally I was placed in two vital departments, but I have gathered knowledge other department. My placing department is Customer Relationship Management and Credit Appraisal and Credit Management Of Mutual Trust Bank Ltd. Different kinds of experience were gathered while performing the job during the Internship period. During the period of internship there were lots of constrains, but the employee of Mutual Trust Bank Ltd solved it through authentic determination and the proper guidance. Customer Relationship is the starting point of all General banking operations. It is the department, which provides day-to-day services to the customers. General Banking Department comprises of account opening, short collection, remittance, clearing, cash etc. Through this sections the department establishes Banker relationship, collects bills from customers, remit funds of customers from one place to another, honor cheque drawn. General Banking department provide these service in a faster and better manner. The conventional banking operations MTB strives to introduce an array of products and services and already launched a number of consumer banking products with the aim of popularizing consumer banking operations and offer higher return to its clients. These are :- Saving Deposit, Current Deposit, Fixed Deposit, Short Term Deposit, Brick by Brick Savings Scheme, Monthly Benefit Plan, Children Education Plan, Best Invest Plan, MTBL Millionaire Plan, Festival Saving Plan, MTBL Double Sarver Plan, MTBL Triple Sarver Plan, Unique Saving Plan etc. Mutual Trust Bank online banking offers a customer to deposit or withdraw any sum of money from any branch anywhere.

Bank Credit is an important catalyst for banking about economic development in a country. Without adequate finance, there can be no growth or maintenance of a stable economy. The credit department approves the loans and advances of Corporate Banking division.

The main function is monitoring credit facilities granted by the corporate banking unit. The credit department of MTBL is divided into two parts: SME & Credit. Under SME the credit products are- Consumer Financing, Consumer Loan Scheme, Home Loan Scheme, Home Repair/ Renovation Loan Scheme, Auto Loan Scheme. And in credit, the consumers are offered Continues loan, Term loan, Export Finance. Though Mutual Trust Bank is going well in the market but it faced some problems. To recover this problem I gave some recommendation that will help them to work successfully in the future.

Background of the Study:

Banking sector plays a significant role in achieving the high economic growth of the country. A Bank is a financial Institution whose main aim is to earn profit through accepting deposit of money and making loan and advances. So, the Banking system occupies an important place and plays an important role in a nation’s economy building. Also it plays a pivotal role in the economic development of a country and forms the core of the money market in an advanced country. In recent time this sector over the world has been changing a lot due to regulation, technological innovation, globalization etc. Banking sector in Bangladesh is lagging behind in adopting these changes. To thrive well in this changing environment, not only development of appropriate infrastructure is necessary but also infusion of professionalism into banking service is essential. It should be concerned that one can’t be professional unless it would be engaged in real world business.

A professional is a person who is skilled in the theoretical, scientific and practical aspect of an occupation and who performs with a high degree of competence. It develops professional attitude towards banking business. This sort of financial intermediary accepting deposits and granting loans; offers the widest menu of services for different business ventures. These types of institutions are borrowing public money and offering the credit services as well as growing and more innovating services like investment advice, security undertaking and financial planning. Commercial banks have significantly expanded their financial services to the clients and government around the world.

Banks are one of the key sectors in contributing the development of economy of the global village. In processing the economic development, country requires banking sector to handle efficiently the capital resources to the proper development agencies. People and the government itself are very much dependent due to service providence of the financial market for the process of economic development to function properly. While making a reasonable amount of profit after meeting the cost of fund, commercial banks are mobilizing their funds from one group to another.

The importance of commercial banks are measured in varies ways, such as the bank offers services through payment system, checking accounts, money transfers, credit cards, credit service, foreign exchange service, investment service, electronic service etc. Banking abilities are very much important.

Organizations are the product of human integrity, created to serve one to specific needs of a community, be it a neighborhood, a state, or multiple nations. An organization is a group of people working towards as common objects of providing value to the people served. Business organizations of even modest size created systems to use financial and technical resources to provide products, services, and/or experiences valued by one or more segment of society, including customers, owners, and employees.

Locating and attracting well-qualified individuals to fill vacancies is really a challenging task for the organization. Improved technology and procedures in the recent years accentuated the need for specially trained and educated personnel in the workforce. From skilled tool- makers to senior executives, the demand for qualified human power is increasing day by day. It is becoming critical as business expansions as well as technological development make new demands for the quantity and quality of personnel. An organization cannot survive without the human resources to keep it alive, vigorous and growing.

Organizational culture describes the fundamental assumptions about the organization’s value, beliefs, norms, symbols, language, rituals and myths that give meaning to organizational membership and are collectively accepted by a group as guides to excepted behaviors. As a relatively new concept, organizational culture is open to many interpretations. Some managers think of organizational culture as simple ‘the way we do things around here’ while others believe, it is more complex “set of share value, believes and assumptions that get every one headed in the same directions. Most of the managers agree that when members are aware of the organizational culture, formal controls are less necessary.

Although a few human activities occur without motivation, nearly all-conscious behavior is motivated, or caused. It requires no motivation to grow hair, but getting a haircut does. Eventually, anyone will fall asleep without motivation, but going to bed is a conscious act requiring motivation.

Internal needs and drives tensions that are affected by one’s environment. For example, the need for food products is a tension or hunger. The hungry person then examines the surrounding to see which foods are available to satisfy that hunger. Results occur when motivated employees are provided with the opportunity (such as proper training) to perform and the resources (such as proper tools) to do so.

The presence of goals and the awareness of incentives to satisfy one’s needs are also powerful motivation factors leading to the release of effort.

In this paper we will focus on an organization that are striving and that hire employees to serve the needs of customers or clients. By focusing on serving customers, organizations indirectly help society when they accomplish the purpose for which they were created.

Objective of the Study:

Primary objective:

To find out the reality in practical life.

To fulfill the requirement for the completion of graduate (BBA) program.

Secondary Objective:

To identify the customer service and the credit

To develop the practical knowledge by the practical orientation of work.

To build up the pillar of the career for near future.

To know about the Mutual Trust Bank Ltd (MTBL) operational activities.

Research Methodology:

Some fundamental steps of research methodology have been adopted through my specialization field of study of BBA program and also from the fields of other areas. In my study I had to go for personal interaction with the organizational people of Mutual Trust Bank Ltd., (Principal Branch) to conduct the research work.

Sources of Information:

Both primary and secondary sources of information were being pursued with regards to the presentations of this study. The following procedure and sources I accessed:

Primary Source:

Personal observation

Working at different desks of the bank

Face to face conversation with other officer

Face to face conversation with client

Secondary Source:

Annual report of MTBL 2010.

Files and Folders

Statement affairs

Bank rate sheets

Progress report of Bank

Websites

Different circulars sent by Head Office and Bangladesh Bank

Some books on Banking

An overview of Mutual Trust Bank Limited (MTBL):

“A bank is an establishment which makes to individuals such advantage of money as may be required and safely made and to which individuals entrust money when not needed by them to use.”……Kinlay

Mutual Trust Bank Limited a private sector commercial bank. The bank has its head office at Dhaka and 50 branches. The management of the bank is vested in 13-member board of directors, including representatives of the 3 sponsor firms. The managing director is its chief executive. The bank conducts all types of commercial banking activities including foreign exchange business and other financial services. During the first two years of operations, the bank’s main focus was on the delivery of personalized customer services and expansion of its clientele base.

Mutual Trust Bank started its operation on October 24, 1999 as a private sector bank with an authorized capital of Tk. 995 million and paid up capital of Tk.150 million. The paid up capital of the bank amounted to Tk. 850.40 million as on December 31, 2010. Total capital of the bank as June 31th, 2010 stood at Tk.1114.52 million consisting of shareholders’ equity of Tk. 1504.79 million. The Capital Adequacy Ratio (CAR) of the bank was 11.83% as on June 31, 2010 as against the minimum requirement of 9% indicating a sound capital base of bank.

Mutual Trust Bank Limited is the growing private sector bank in Bangladesh offering full range of Personal, Corporate, International Trade, Foreign Exchange, Lease Finance and Capital Market Services. Mutual Trust Bank Limited is the preferred choice in banking for friendly and personalized services, cutting edge technology, tailored solutions for business needs, global reach in trade and commerce and high yield on investments, assuring Excellence in Banking Services.

Background of Mutual Trust Bank Limited

The Company was incorporated on September 29, 1999 under the Companies Act 1994 as a public company limited by shares for carrying out all kinds of banking activities with Authorized Capital of Tk. 38,00,000,000 divided into 38,000,000 ordinary shares of Tk.100 each.

The Company was also issued Certificate for Commencement of Business on the same day and was granted license on October 05, 1999 by Bangladesh Bank under the Banking Companies Act 1991 and started its banking operation on October 24, 1999. As envisaged in the Memorandum of Association and as licensed by Bangladesh Bank under the provisions of the Banking Companies Act 1991, the Company started its banking operation and entitled to carry out the following types of banking business:

(i) All types of commercial banking activities including Money Market operations.

(ii) Investment in Merchant Banking activities.

(iii) Investment in Company activities.

(iv) Financiers, Promoters, Capitalists etc.

(v) Financial Intermediary Services.

(vi) Any related Financial Services.

The Company (Bank) operates through its Head Office at Dhaka and 54 branches and 3 SME Service Centers. The Company/ Bank carry out international business through a Global Network of Foreign Correspondent Banks.

Mission

We aspire to be one of the most admired banks in the nation and be recognized as an innovative and client-focused company, enabled by cutting-edge technology, a dynamic workforce and a wide array of financial products and services.

Vision

Mutual Trust Bank’s vision is based on a philosophy known as MTB3V. We envision MTB to be:

One of the Best Performing Banks in Bangladesh

The Bank of Choice

A Truly World-class Bank

Capital Base

Authorized Capital: 38, 00,000,000.

Paid up Capital : 389,026 million

Slogan :You can bank on us

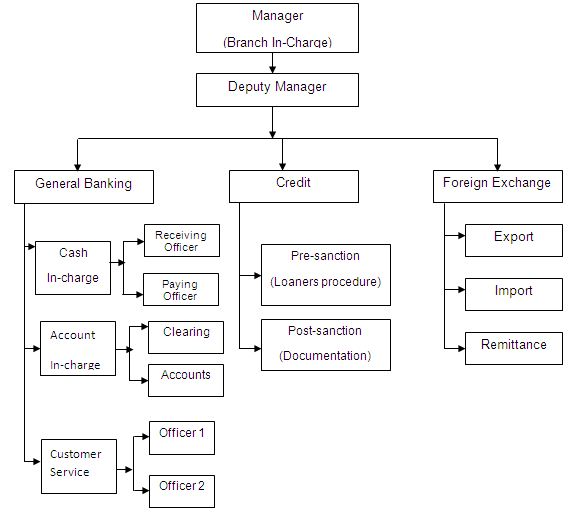

Management Structure (In Principal Branch)

Credit Division

Loans & Advances is the nerve center of a Bank. MTBL have a comprehensive selection of facilities to offer, from a simple personal loan, credit cards, auto loan and overdraft facilities to home loan. MTBL strive to remain competitive and are committed to constantly reviewing both MTBL lending policies and rates to ensure that our customers get the best deals in town.

Mission and Vision for Credit Management of MTBL

MTBL mission is ‘to make as the most preferred bank of the customers by ensuring prompt and quality services with highly motivated and skilled manpower, using updated technology, covering wide range of financial activities, maintaining transparency, accountability and integrity and thereby ensuring a stable and sound financial operational system.

- Extend all types of credit facilities at competitive price with prudence & efficiency

- Offer wide range of financial products

- Encourage loans & advances to productive income generating activities and there by create employment opportunities and improve standard of living of the common people. Loans and advances for productive purpose, which will alleviate poverty, will be given priority.

- Prioritize welfare oriented banking services.

- Diversify lending activities by avoiding undesirable sectoral concentration and ensuring balanced geographical dispersal.

- Design loan operations keeping social and economic and environmental factors in to consideration.

- Attach due importance to consumer credit, personal loan, SME loan and agricultural credit.

- Prefer lending which will be judiciously backed by acceptable security.

- Ensure borrower’s stake in the activity.

- Encourage syndicated/Club financing in prospective/ profitable ventures.

- Invest at reasonable lending rates.

- Monitor and ensure end use of loans/advances for the sanctioned purpose.

- Constantly explore prospective and profitable ventures to achieve institutional and national objectives.

- Prefer short term lending through small and medium enterprises

- Extend credit which would contribute within defined risk limitation to the bank’s achievement of profitable growth and judicious return on the bank’s capital.

- Not to enter in to any speculative uncovered foreign exchange risk in investing/lending fund.

Credit Policy of MTBL

To achieve MTBL goal for maximizing the stakeholders’ value and protect the interest of the depositors as well as to improve asset quality, MTBL will abide by but will not be confined to the following credit principles, which should guide our behavior in our lending decisions:

Assessment of the customer’s character, integrity and willingness to repay will form basis of lending.

Customers having capacity and ability to repay shall only be lent

Possibility of default will be worked out before lending.

Credit will be extended in the areas, risks of which can be sufficiently understood and managed.

Independent credit participation in the credit process shall be ensured

Ethical behavior in all credit activities shall be ensured.

Encourage pro-activeness in identifying, managing and communicating credit risks.

Maintain due diligence in ensuring that credit exposures and activities including processing function comply with MTBL requirements as well as requirement of regulatory authority.

Risk and reward to be optimized.

Diversified credit portfolio to be built and maintained.

Credit will normally be financed from customers’ deposits and not out of short-term temporary funds or borrowing from other banks.

The bank shall offer suitable credit services and products for the market in which it operates.

Credit will be allowed in a manner which will in no way compromise with the Bank’s standard of excellence and to customers who will not compromise with such standards.

All credit extension must comply with the requirement of Bank Company Act- 1991 and amendments thereof made from time to time and all the requirements of other regulatory authorities.

Prevention of extending credit facilities to the CIB black listed persons/entities.

Laws and Norms

All credit operations- processing of credit proposals, sanctioning, documentation, disbursement and follow up to be made in strict compliance with the policy guidelines, existing laws and norms, circulars issued/to be issued by Bangladesh Bank and other competent authorities from time to time.

Product Range/ Types of Loan Facilities :

MTBL credit products include conventional products like Cash Credit, Secured Overdraft (SOD), Industrial Term Loan, loan General, House Building loan, Bank Guarantee, Letter of Credit, LTR/Bill Purchase/ Back to Back L/C under import/ export finance, Lease Finance, Consumer Credit etc. Large scale Industrial Finance may also be considered under consortium arrangement. A list of MTBL’s credit products are below:

Term Loans: The term of loan is determined on the basis of gestation period of a project generation of income by the use of the loan. Such loans are provided for Farm Machinery, Dairy, Poultry, etc. It is categorized in three segments:

Over Draft (OD)

OD is some kind of advance. In this case, the customer can over draw from his/her current account. There is a limit of overdraw, which is set by the bank. A customer can with draw that much amount of money from their account. For this there is an interest charge on the over draw amount. This facility does not provide for everyone, the bank will provide only those who will fulfill the requirement. It means that only real customer can get this kind of facility.

Cash Credit (Hypo)

It allows to individuals or firm for trading as well as whole-sale purpose or to industries to meet up the working capital requirements against hypothecation of goods as primary security fall under this type of lending. It is a continuous credit. It allowed fewer than two categories:

1. Commercial Lending

2. Working Capital

Cash Credit (Pledge)

Financial accommodation to individual/firm for trading as well as whole sale purpose or to industries as working capital against pledge of goods primary security falls under this head of advance. It also a continuous credit and like the above allowed under the categories:

1. Commercial Lending

2. Working Capital

SOD (General)

Advance allowed to individual/firm against financial obligation (i.e. lien of FDR/PS/BSP etc.) and against assignment of work order for execution of contract works fall under this head. This advance is generally allowed for allowed for definite period and specMTBL purpose. It is not a continuous credit.

SOD (Imports)

Advances allowed for purchasing foreign currency for opening L/C for imports of goods fall under this type of leading. This is also an advance for a temporary period, which is known as preemptor finance and falls under the category ‘Commercial Lending’.

PAD

Payment made by the bank against lodgment of shipping documents of goods imported through L/C falls under this type head. It is an interim type of advance connected with import and is generally liquidated shortly against payments usually made by the party for retirements of documents for release of import goods from the customer authority. It falls under the category “Commercial Lending”.

LTR

Advances allowed for retirement of shipping documents and release of goods imported through L/C without effective control over the goods delivered to the customer fall under this head. The goods are handed over the importer under trust with arrangement that sales proceed should be deposited to liquidate the advances within a given period. This is also temporary advance connected with import that is known post-import finance under category ‘Commercial lending’.

IBP

Payment made through purchase of inlands bill to meet urgent requirements of customer fall under this type of credit facility. This temporary advance is adjusted from the proceeds of bills purchased for collection. It falls under the category ‘Commercial Lending’.

FDBP

Payment made to a party through purchase of foreign documentary bills fall under this head. This temporary advance is adjustable from the proceeds of negotiable shipping/export documents. It falls under category ‘Export Credit’.

LDBP

Payment made to a party through purchase of local documentary bills fall under this head. This temporary liability is adjustable from proceeds of the bill.

Micro Credit

Loan has given only to the Army Person for the purpose of Repairing and reconstruction of dwelling Houses.

Features of different credit

MTB Home Loan :

Planning to own a home is one of life’s most rewarding challenges. Whether it is purchasing a new house or a new apartment, MTB has a wide range of home loan options that can be customized

to your specific need. An experienced, dedicated team of experts and a complete loan package is in place, to meet all your housing finance needs. MTB Home Loan helps you fulfill your dream.

Features:

Loan for residential apartment/house purchase

Loan amounts from BDT 5,00,000 to BDT 1,00,00,000

Loan tenor from 3 to 25 years

Loan amount up to 80% of the property value

Aggregation of co-applicant’s income

Competitive interest rates

Quick and simple processing and approval time

Loan for apartment under construction

Partial or early settlement options available

MTB Home Equity Loan :

Planning to build/uplift/renovate a home or furnish your home? MTB Home Equity loan provides a packaged financial assistance to individuals for fulfillment of your dream home. It’s time to get your coveted home by MTB Home Equity Loan.

Features:

Loan for house construction, extension, renovation, face upliftment, finishing work

Loan amounts from BDT 5,00,000 to BDT 1,00,00,000

Loan tenor from 3 to 25 years

Loan amount up to 80% of the property value

Financing at different stages of construction work

Partial disbursement facility of approved loan

Aggregation of co-applicant’s income

Competitive interest rates

Quick and simple processing and approval time

Partial or early settlement options available

Auto Loan:

To own a car is everyone’s dream as well as a part of today’s living, which enhances standard and quality of life. Auto Loan scheme has been designed to help materialize your long cherished dream of a car of your own. Purchase of new/ reconditioned cars is allowed under this scheme. Salaried executives, professionals, businessmen, govt. officials or self employed persons are eligible to avail this loan.

Loan amount under this scheme is 70% of car value but maximum of Tk. 20 lac. With the objective of extending financial support to small businessmen, this loan scheme has been introduced. It has been designed to get business loans on easy terms and without any hassle.

Only the genuine business men having entrepreneurship quality and honesty, to run and expand their business smoothly. Maximum loan under the scheme will be up to Tk. 50 lac. No collateral security is required up to Tk. 5 lac. Collateral security is required for loan above 5 lac.

Features

Loan amounts from Tk. 3, 00,000 to Tk. 20, 00,000

Financing up to 80% of vehicle price

Flexible repayment of 12 – 60 months

No hidden charges

Competitive interest rate

Easy documentation and quick processing

Option for early settlement

Credit Analysis

The division of the bank responsible for analyzing and recommendations on the fate of most loan applications is the credit department. Experience has shown that this department must satisfactorily answer three major questions regarding each loan application:

· Is the borrower creditworthy? How do you know?

· Can the loan agreement are adequately protected and the customer has a high probability of being able to service the loan without excessive strain?

· Can the bank perfect its claim against the assets or earnings of the customer so that, in the event of default, bank funds can be recovered rapidly at low cost and with low risk?

· Let’s look in turn at each of these three key issues in the “yes” or “no” decision a bank must make on every loan request.

Is the Borrower Creditworthy?

The question that must be deal with before any other is whether or not the customer can service the loan-that is, pay out the credit when due, with a comfortable margin for error. This usually involves a detailed study of six aspects of the loan application- character, capacity, collateral, conditions, and control. All must be satisfactory for the loan to be a good one from the lender’s point of view.

Character

The loan officer must be convinced that the customer has a well-defined purpose for requesting bank credit and a serious intention to repay. If the officer is not sure exactly why the customer is requesting a loan, this purpose must be clarified to the bank’s satisfaction.

Responsibility, truthfulness, serious purpose, and serious intention to repay all monies owed make up what a loan officer calls character.

Capacity

The loan officer must be sure that the customer requesting credit has the authority to request a loan and the legal standing to sign a binding loan agreement. This customer characteristic is known as the capacity to borrow money. For example, in most states a minor (e.g., under age 18 or 21) cannot legally be held responsible for a credit agreement; thus, the bank would have great difficulty collectors on such a loan.

Collateral

In assessing the collateral aspect of a loan request, the loan officer must ask, does the borrower possess adequate net worth or own enough quality assets to provide adequate support for the loan? The loan officer is particularly sensitive to such features as the age, condition, and degree of specialization of the borrower’s assets.

Conditions

The loan officer and credit analyst must be aware of recent trends in the borrower’s line of work or industry and how changing economic conditions might affect the loan.

Control

The last factor in assessing a borrower’s creditworthy status is control which centers on such questions as whether changes in law and regulation could adversely affect the borrower and whether the loan request meets the bank’s and the regulatory authorities’ standards for loan quality.

Can the Loan Agreement Be Properly Structured and documented?

The five Cs of credit aid the loan officer and bank credit analyst in answering the broad question: Is the borrower creditworthy? Once that question is answered, however, a second issue must be faced: Can the proposed loan agreement be structured and documented to satisfy the needs of both borrower and bank?

A properly structured loan agreement must also protect the bank and those it represents- principally its depositors and stockholders- by imposing certain restrictions (covenants) on the borrower’s activities then these activities could threaten the recovery of bank funds. The process of recovering the bank’s funds- when and where the bank can take action to get its funds returned-also must be carefully spelled out in a loan agreement.

Credit Approval Process of the MTBL:

The primary factor determining the quality of the bank’s credit portfolio is the ability of each borrower to honor, on a timely basis. All credit comities made to the bank. The authorizing credit personnel prior to credit approval must accurately determine this. If the report of the project appraisal is very satisfactory to approve the loan proposal, than the following steps furnish the approval procedure:

- Make a proposal by the client to the bank

- Give all the necessary documents

- Bank will send the parties statement to the Bangladesh Bank, their CIB (Credit Information Bureau) will inquiry that whether this party is defaulter or a new one.

- Bank will take the collateral from the party and analysis that how much it will cover the total loans.

- Bank will send this proposal to the head office. In the head office the Board of Directors and Managing Director will approve the loan.

- Head office will send the approval to the branch office.

- Branch office will give the sanction letter to the party.

- Bank will take the security and make it in their favor.

Loan Disbursement

After completing all the necessary steps for sanctioning loans bank will create a loan account by the name of the party and deposit the money to that account. Bank will give cheque books to the party and advise them to draw the money and use it as soon as possible, because whenever the money will transfer to the account interest will count from that time

Analyzing the Year Wise Loan Disbursement by MTB

YEAR | AMOUNT OF LENDING (in million/Tk.) |

2004 | 525.75 |

2005 | 1,603.95 |

2006 | 1,897.63 |

2007 | 4,358.31 |

2008 | 6,804.45 |

2009 | 9,738.32 |

TOTAL | 24,928.41 |

Table: 03

From the graph we can say that in the year 2010 the total loan disbursement is 39% (Tk 9738.32 million) to compare with other financial years. In the year 2009the loan disbursement was 28% (Tk 6804.45 million) and in the year 2006, 2007 & 2008 the loan disbursement was 7% (Tk 1603.95 million), 8% (Tk 1897.63 million) & 18% (Tk 4358.31 million). So according to this graph we can easily say that the bank’s loan disbursement is increasing day by day. It is a positive sign for the bank. After establishing the bank, disbursement of loan is not so high because of their inexperience and inadequate loan disbursement policy. Now the bank has an attractive loan policy which attracts the customers. If we see the percentage increase by the year than in the loan disbursement is 39% and in the previous year it was 28%. So the percentage increases by 11% only. In the year 2006 & 2007 the percentage increased by 10%. In compare, the increasing percentage is about to same that is in 2009 the increasing percentage was 11% which is more than 1% in the previous year. It may be the good sign for the bank because the loan disbursement is increasing or steady not decreasing. Bank’s main earning source is loan disbursement, like: interest earning. It is a big part of the bank’s total earning. So the bank should take care in this loan side.

Analyzing the Sector-wise Lending by MTBL (million/Tk)

SECTOR | 2008 | 2009 | 2010 |

| Cash Credit | 179.92 | 165.83 | 257.06 |

| Cash Collateral | 148.59 | 199.53 | 220.66 |

| Overdraft | 355.07 | 529.89 | 736.52 |

| SOD | 1,676.17 | 2,153.63 | 3,011.33 |

| Marriage Loans (ML) | 87.35 | 81.90 | 74.03 |

| Car Loan (CL) | 17.00 | 26.26 | 28.28 |

| House Building Loan(HBL) | 89.16 | 100.23 | 397.73 |

| Term Loans | 284.34 | 834.56 | 1,744.04 |

| Staff Loans | 11.23 | 20.94 | 46.16 |

| Consumer Durable Scheme (CDS) | 33.04 | 25.70 | 25.87 |

| Repair & Recon. of Dwelling House (RRDH) | 247.38 | 233.35 | 222.08 |

| Loan Against Trust Receipts (LTR) | 987.85 | 2,044.41 | 1,823.81 |

| Payment Against Documents (PAD) | 209.01 | 257.49 | 114.46 |

| Bill Purchased & Discounted | 30.49 | 114.04 | 354.86 |

| Other Loans | 1.72 | 16.69 | 681.42 |

| Total Loans & Advances | 4,358.31 | 6,804.45 | 9,738.32 |

Table: 04

Loan-Pricing Policy Used By MTBL

In pricing a business loan, Bank management must consider the cost of raising loan able funds and the operating costs of running the Bank. This means that Banks must know what their costs are in order to consistently make profitable, correctly priced loans of any type. There is no substitute for a well-designed management information system when it comes to pricing loans.

Mutual Trust Bank Limited is generally used the simplest loan-pricing model which assumes that the rate of interest charged on any loan includes four components: (1) the cost to the Bank of raising adequate funds to lend, (2) the Bank’s no funds operating costs (including wages and salaries of loan personnel and the cost of materials and physical facilities used in granting and administering a loan), (3) necessary compensation paid to the Bank for the degree of default risk inherent in a loan request, (4) Bank’s desired profit margin.

Signs for Classification

First and foremost requirement for any credit managers is to identify a problem credit in its earliest stages by recognizing the signs of deterioration. Such signs include but not limited to the following:

- Non-payment of interest or principal or both on due dates or past dues beyond a reasonable period or recurring past dues.

- In case of Overdraft no movement in the account beyond a reasonable period.

- Deterioration in financial condition of the client, as gathered from client’s latest financial statement.

- A shortfall in collateral coverage, particularly if the collateral was a key factor in the decision-making.

- Death or withdrawal of key owner(s) or management personnel.

- Company filing for bankruptcy or voluntary dissolution.

- Adverse market report about the company itself or its principal owners.

- Steps to Follow for Classification

- Recheck the account, for all outstanding, including any outstanding in allied or sister company or in owner’s or partners’ or directors personal names.

- Thoroughly review loan documentation to confirm, “We have what we need”, documents are in proper from, properly executed and current (i.e. not time barred).

- If possible take current market value of the securities according to liquidation basis. And take a close look at the assets and liabilities to determine who has the prior right on those assets.

- If Grantors are involved, look closely at the net worth statement and send demand notice.

Once the account is classified Sub-Standard, credit lines must be frozen.

Loan Recovery Policy of MTBL:

Bank usually expects to get its money in timely and normal manner. But often for several reason this manner may deteriorate and can produce loss to the bank. Like other banks, BBL has thought about this matter and formulated some steps to recover or make its money inflow regular. But recovery of a bad loan is one of the tough jobs in banking. In fact it incurs some additional costs as well. However recovery process includes:

Determine recovery strategy and action plan.

Make sure that adequate amount of provision has been kept against risky assets.

Notice client about their overdue statement.

Remind clients about their outstanding.

RM visits the client and pursue for repayment of the due installment.

Report to Bangladesh Bank for updating client’s CIB if the overdue installment continues more than six months and seek advises from them.

Give final reminder mentioning legal action to be followed after certain days

Try to acquire security and collateral items for collection of loan.

Letter to different banks and associations.

Send legal notice and take legal actions.

Recovery Performance

The recovery performance of the bank was not so good during the period 1999-2002. Because the bank was recently established and the management was new & inexperienced in the banking sector. Also the credit administration and monitoring of this bank was inexperienced. The management has to think about a well-designed Recovery Policy.

MTBL Introduced a New Recovery Policy In 2003

MTBL has introduced a new department called Early Warning System Department (EWSD). The bank as a matter of priority in its policy wants to ensure quality of its Loan Portfolio by strengthening post disbursement recovery measures as well as by prioritizing on Early Warning System (EWS) to check the growth of non-performing assets.

The secondary task of this department is to collect money from the classified clients. But in the other banks the Branch Manager does this job. Other than that the recovery criteria are more or less same for the banks. At the very begging they send reminder letter. Then they send letter to inform them that they (bank) are going to sue against the client. Finally the banks sue against the client.

Notes for assessment of category

Estimate the cost of continued collection efforts against any money, which can be reasonably expected to be recovered. Include in the cost (i) employee man-hour, (ii) legal expenses, (iii) charge of any external collection agency if used.

Why Recovery takes so much time

Only because of existing rules and regulation recovery is a time consuming procedure. I think an example will make this thing clear. Let, Mr. X took loan from Y bank by giving a land as registered mortgage and become bad. Now bank cannot sell the land without the permission of court though the land was as registered mortgage to bank. So bank has to sue against Mr. X and court send notice to Mr. X. But Mr. X can delay his coming by saying he is sick and asking for more time. Court gives new date to settle the matter. Then on new date a person came to the court saying that he is the brother of the client and the land is their father’s property. And most importantly, client didn’t notify him before give the land to the bank. So court asks him to prove his claim. Finally, if court gives injunction in favor of bank, they face problem to sell the land. Because client put mussel-men protect the land from bank. Moreover people are not interested buy land on occasion from court. Finally the interesting thing is most of the time the same client but the land in another name.

Operating Profit:

Mutual Trust bank earned an operating profit of Tk. 969.47 million in 2010compared to Tk. 651.85 million in 2009achieving a growth of 48.73%. This growth is a remarkable achievement considering the socio-political environment that prevailed in the country during 2010. After keeping provision on loans and advances Profit Before Tax stood at Tk. 874.47 million. The Net Profit for the year stood at Tk. 478.28 million compared to the previous year’s Tk. 336.17 million. Earning per share (EPS) in 2010 increased Tk. 50.32 registering a 42.27% growth as against Tk. 35.37 during the preceding year. Bank’s Return on Asset (ROA) in 2010 was 1.82% as against 1.74% in 2009.

Conclusion:

As an internee of Mutual trust bank limited I have truly enjoyed my internship from the learning and experience viewpoint. I am confident that this three months internship program at MTBL will definitely help me to realize further career in the job or personal life. Mutual Trust Bank Limited is a very modern bank in the banking business area. It was incorporated in the year 1999. So within this short time the bank already get the popularity in the people and the attractiveness of the bank increase day by day. When this bank starts its operation, their first target customer was the army person, but with the demand of general people the bank is also doing business with the general people.

The bank is spreading its operation through all over the Bangladesh. Recently this bank has 54 branches in all over the Bangladesh. So very recent it will increase their branches to meet up the people’s demand and the process is continuing. The Bank already has shown impressive performance in different financial sector. The bank now should start new services and take different types of marketing strategy to get more customers in this competitive market of banking business.

In its lending operations, the Bank has learnt a lot from its past experiences. Hopefully the MTBL is able to improve in all its areas especially in the lending operations.

We hope that this bank will compete with the first class banks of Bangladesh very soon.