Allocative efficiency is a characteristic of an efficient market where capital is assigned in a way that is most beneficial to the parties involved. It is a state of the economy in which production represents consumer preferences; in particular, every good or service is produced up to the point where the last unit provides a marginal benefit to consumers equal to the marginal cost of producing. This occurs when there is an optimal distribution of goods and services, taking into account consumer’s preferences.

Allocative efficiency means that the particular mix of goods a society produces represents the combination that society most desires. For example, often a society with a younger population has a preference for the production of education, overproduction of health care.

In contract theory, allocative efficiency is achieved in a contract in which the skill demanded by the offering party and the skill of the agreeing party are the same. It occurs when parties are able to use the accurate and readily available data reflected in the market to make decisions about how to utilize their resources.

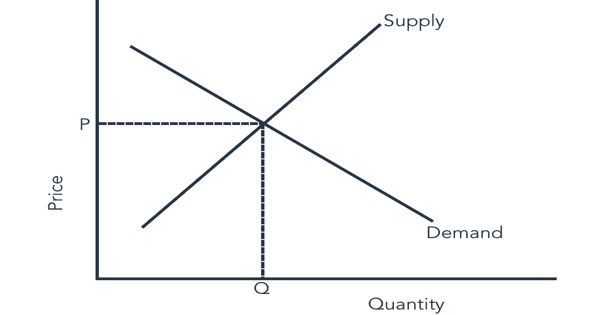

In economics, the point of allocational efficiency for a product or service occurs at the price and quantity defined by the intersection of the supply and demand curves. Although there are different standards of evaluation for the concept of allocative efficiency, the basic principle asserts that in any economic system, choices in resource allocation produce both “winners” and “losers” relative to the choice being evaluated.

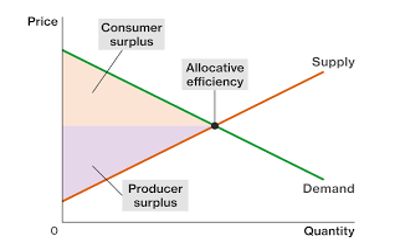

The principles of rational choice, individual maximization, utilitarianism, and market theory further suppose that the outcomes for winners and losers can be identified, compared, and measured. It represents an optimal distribution of goods and services to consumers in an economy, as well as an optimal distribution of financial capital to firms or projects among investors. Under these basic premises, the goal of attaining allocative efficiency can be defined according to some principle where some allocations are subjectively better than others.

An allocatively efficient economy produces an “optimal mix” of commodities. A firm is allocatively efficient when its price is equal to its marginal costs (that is, P = MC) in a perfect market. Therefore the optimal distribution is achieved when the marginal utility of the good equals the marginal cost. The demand curve coincides with the marginal utility curve, which measures the (private) benefit of the additional unit, while the supply curve coincides with the marginal cost curve, which measures the (private) cost of the additional unit. In economics, allocative efficiency materializes at the intersection of the supply and demand curves.

In a perfect market, there are no externalities, implying that the demand curve is also equal to the social benefit of the additional unit, while the supply curve measures the social cost of the additional unit. It occurs when organizations in the public and private sectors spend their resources on projects that will be the most profitable and do the most good for the population, thereby promoting economic growth. Therefore, the market equilibrium, where demand meets supply, is also where the marginal social benefit equals the marginal social costs.

Information Source: