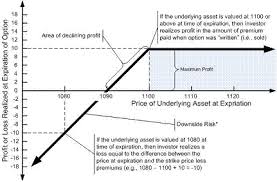

This article focus to explain Investing in Covered Calls Strategy. Here explain Covered Calls Strategy in finance point of view. Investors while using covered calls strategy do not think about short stock, or selling an item that can be not owned by them, but do however, short call options, which is to be generated funds or income with the actual strategy. A reason that an investor would short stock, will be the expectation of it decreasing with value, but because of the perception that it might be acquired back later, with regard to an lesser quantity of which the item was sold.

Investing in Covered Calls Strategy