Executive Summary

This internship report is a partial requirement for the Masters of Business Administration (MBA). As part of the internship program, I was placed Uttara Bank Ltd. at Green Road Branch in Dhaka during the period of internship. I have landed a lot about commercial Banking operation of this organization.

Green Road Branch began its journey with the inauguration of the Uttara bank in Dhaka. This report is an assigned job as a pertain fulfillment of course teacher Mohammad Mesbah Uddin.

It’s an optimum aggregated outcome of “The Leadership Style on”. Analyzing the leadership Style on a particular organization is a really tuff job is accomplish, but we have enjoyed it very much.

Some of the problems of the Green Road Branch are summed details in report,-lack of new clients, shortage of staff, staff de-motivation due to late working hours, over dependence of few staff, and few clients, absence of training, insignificant marketing efforts. As business community now has more option to avail international trade service through a number of institutions practically more customer orientation is to satisfy customer needs and retain this customer. Finally, some policies implementation and recommendation for future improvement of the branch.

Green Road Branch began its operation in 1994 with the inauguration of Uttara bank; Green Road Branch conducts all types of commercial business activities. The bank is also rendering personal credit, services related to local and foreign remittances and also all types of foreign Exchange Business. The bank strategy is gradually cover total area of banking this report cover the total area of banking of Green Road Branch. The report intends to cover a comprehensive analysis of overall activities of Green Road Branch, an appraisal of performance and management effectiveness. Green Road Branch came into attention of every one when it became first among all the branch of Uttara bank whereas Uttara bank stood in first position among all commercial bank. Uttara bank Green Road Branch is operating through 16 people, among them 1 AGM, 3 Senior principal officer , 2 are officer grade –1, 4 are assistant officer,2 Junior officer, 1 messenger, 2 guard and other part time labor.

INTRODUCTION

Background of the Study

Uttara Bank Ltd. is a commercial privet bank. It starts its operation from 1972. During this sort period of time, the bank creates a milestone of success in banking sector. This bank holds an experienced team of banking professional. They achieve this success because of their determination, hardworking professional team members, creativity in banking, proper management and so on. In this report we will see a brief of how it generates its banking activity.

As a partial fulfillment of Masters of Business Administration (MBA) internship it is a requirement at the end of the completion of all credit courses. The main purpose is to be familiar with the real world situation and practical experience in a business firm.

Objectives of the Study

The objectives of the report is to have a real live exposure in the banking

Sector. It will help to develop my knowledge in sector. This practical

Orientation gives us a change to co-ordinate of theoretical knowledge with

the practical experience. The following are of objective for this practical

Orientation in bank.

• To find out the position of Uttara Bank Limited in the banking industry.

• To find out how its present strategy is working.

• To analyze the comparative performance of Uttara Bank Limited and some other selected private commercial banks.

• To know the successive position of each bank.

• To analyze the bank’s performance in some key areas.

• To find out existing problems of the bank.

• To formulate alternative strategies fir solving the problems.

• To recommend some better solutions for solving the problems.

• To formulate an implementation plan for the recommended steps.

• To formulate contingency plan as a safeguard for changing.

Research Methodology

Research Design

Both descriptive and exploratory researches have been selected to analyze this paper. Here the researcher discussed the credit appraisal procedure of UBL and critically analyze the appraisal procedure with the standard one. Comparison analysis has also been taken part in this study.

Data Collection Procedures

There are two main sources of collecting data. To complete this report data has been collected from both primary and secondary sources. The primary data has been gathered by formal discussion with the credit officials and borrowers. Some secondary data has also been collected to make the report more concrete. These data has been collected from different financial statements, annual reports etc

Limitations

To prepare this report, I have faced some limitations, which are mentioned below.

Limitation of time: It was one of the main constraints that hindered to cover all.

Aspects of the study

Lack of Secondary: The annual brochure was the main secondary information0source of information that was not enough to complete the report and private the reader a clear idea about the bank.

Limitation of the Scope: While collecting data, they did not disclose much information due to the confidentially of the organization.

Chapter 2

EVALUATION OF BANKING SYSTEM OF BANGLADESH

Evolution of Bank

The modern banking system is an evolutionary growth right from the Middle Ages. The genesis of modern bank lay in the functions performed by the Merchant with wide reputation commanding confidence far and near could easily finance domestic and foreign trade. The famous merchant houses established branches to trade centers at home and abroad began to use credit devises to accommodate their customers Jagath Seth, for example, had his branch office in London in the 18th century. Even earlier the indigenous hounds, which finance domestic trade in India was the innovations of the local merchants. In this credit operation in these credit operations in the ancient merchant houses lay the germs for the development of the important credit instrument lately known as bill of exchange and these merchants were virtually forerunner of the modern exchange banks.

The second ancestor of banks was the moneylender. People with surplus quite unaccustomed with money lending business and trade secrets could safely keep their surplus with the moneylender for investment by the letter on firms of a share of profit. The moneylender thus was an embryonic banker performing duel functions lending money and mobilization of savings. Exactly the modern bank does this as a lineal descendant of the ancient moneylender. The third in the chain of ancestors stood the goldsmith have safe vaults for the safe upkeep or their gold stocks. They were the embodiments of safety and security. Naturally, people with valuables and jewelers approached goldsmiths for safe custard. Initially the goldsmiths charged commission for safe upkeep. The practice later on changed as the goldsmith utilized the deposits for earning profits. A modern Bank then comes in itself the functions of all the there ancestors like the merchant it makes a specialty of financing foreign trade like the money lender collects savings and end like the goldsmith provides a convenient mechanism by which people can make payments to each other.

Development of banking in Bangladesh

Bank system was practiced in the Indian subcontinent from the ancient period. In Indian subcontinent merchants, goldsmith moneylenders were the primary bankers. During the Meghan

period banking and credit business was enchanted rapidly. Then the agency house of jagth Seth was similar to the merchant house of Lombardy Street. In 1700 AD “Hindustan Bank” was established as the first joint stock bank. In 1784 “Bengal Bank” and in 1786 General bank of India was lunched. Then both the bank absolved respectively in 1793 and 1832.

During the early period of nineteenth century in 1806 “Bank of Bengal” in 1840 “Bank of Bombay” and in 1843 “Bank of Madras” was established. These Banks were called Presidency Bank. Then in 1920 these three banks merged to “Imperial Bank of India”. In 1947 after the separation bank business in our country faced a severe disaster as non Muslim Bankers left to India. Then “Reserve bank of India” acted as the “Central Bank of Pakistan” in 1948 to re-build the Bank Business “State Bank of Pakistan” was established as central bank of Pakistan.

In 1971 Bangladesh became independent. After liberation “Bangladesh Bank” was automated with the assets and liabilities of former “State Bank of Pakistan”. It is the central bank of Bangladesh. During Pakistan period in our country there were 1090 branches of 12 commercial banks. Three foreign banks were also active with 14 branch offices. Before liberation 80% of banking activities of our country was controlled by Pakistan. Consequently Bangladesh traders and industrialists didn’t get notable help from the Commercial Banks. After liberation reformed the destroyed economy on 26th March 1972 the banking sector of Bangladesh was nationalized. After nationalization government of Bangladesh changed the entire bank to six banks which are Sonali Bank, Rupali Bank, Janata bank, Agrani Bank, Public Bank & Uttara bank. Their role in development of trade and commerce of Bangladesh as well as in the development of economy.

Banking structure in Bangladesh

Banking system of Bangladesh comprises of different types of bank and financial institutions. The name of our central bank is “Bangladesh Bank” it is the director and regulator of banking system of Bangladesh. Banking structure in Bangladesh is briefly described below.

• Bangladesh Bank is the central bank of Bangladesh. It is director of money market in Bangladesh. It regulates the activities of other banks of Bangladesh through credit control, exchange control etc.

• Commercial bank both the public and private sectors of commercial bank are active in Bangladesh. There are 4 nationalized commercial banks- Sonali Bank, Rupali Bank, Agrani Bank, janata bank.

• In 1983 priority gives on private sector of banking business. As a result two nationalize bank was handed over to private sector, which are Pubali and Uttara bank and now Rupali bank is supposed to hand over in the private sector.

• Now in our country a large number of private banks are doing banking business.

Hierarchy Analysis

Banking sector has a vital role to play in the economic activities and development of any country. In Bangladesh, the banking sector dominates the financial sector and macroeconomic management largely depends on the performance of the banking sector. In the 80’s for the first time a number of banks in the private sector were allowed. Subsequently in the mid 90’s some more banks in private sector also commenced operations. Finally, in 1999, 3rd generation of private sector banks was given permission to operate.

At present there are 51 scheduled banks operating all over the country. Out of these, 9 are state-owned (including five specialized banks), 29 are private commercial banks and the rest 13 are foreign commercial banks. Private commercial banks are divided into three groups according to their commencement of business.

The groups are familiar in the name of 1st generation, 2nd generation and 3rd generation banks. These are shortly noted below:

1st Generation Banks (Established 1982-1988):

National Bank Ltd, The City Bank Ltd , United Commercial bank Ltd, AB Bank Ltd, IFIC Bank Ltd , Islami Bank Bangladesh Ltd and Al-Baraka Bank Ltd .

2nd Generation Banks (Established 1992-1996):

Eastern Bank Ltd, NCC Bank Ltd, Southeast Bank Ltd, Dhaka Bank Ltd, Al Arafah Islami Bank Ltd, Social Investment Bank Ltd and Dutch-Bangla Bank Ltd.

3rd Generation Banks (Established 1999 to present):

Mercantile Bank Ltd, Standard Bank Ltd, One Bank Ltd, EXIM Bank Ltd, Premier Bank Ltd, Mutual Trust Bank Ltd, First Security Bank Ltd, Bank Asia Ltd, The Trust Bank Ltd, Jamuna Bank Ltd, BRAC Bank, and Shahjalal Islami Bank Ltd.

Chapter

3

ORGANIZATIONAL PART

• UBL is one the largest private banks in Bangladesh

• It operates through 199 fully computerized branches ensuring best possible and fastest services to its valued clients.

• The bank has more than 600 foreign correspondents worldwide.

• Total number of employees nearly 3,000.

• The Board of directors consists of 14 members.

• The banks is headed by the Meaning Director who is the Chief Executive Officer

• The head office is located at Bank’s own 18-storied building at Motijheel, the commercial center of the capital, Dhaka.

UBL Networks

Corporate offices (corporate branch & Local office) 2

Regional office 12

World wide affiliates 600

Total Branches (including corporate branch & local office) 202

Authorized Dealer Branches 38

Treasury & Dealing Room 1

Training Institute 1

Man power 300

BOARD OF DIRECTORS

Chairman

Mr. Azharul Islam

Vice-Chairman

Mr. Md. Asaduzzaman

Directors

Mr.Md.Mahfuzus Subhan Prof.Mirza Mazharul Islam

Mr.Sarwar Boudius Salam Prof.Sharif Md.Shahjahan

Mr.Abu Hossain Siddique Mr.Syed A.N. M.Wahed

Mr.Abdul Barq Alvi Mr.Mustafizur Rahman

Mr.Faruque Alamgir Mr.Shah Habibul Haque

Col.Engr.M.S.Kamal(Retd)

Managing director

Mr.Shamsuddin Ahmed

Chairman Mr.Azharul Islam

Vice Chairman Mr.Md.Asaduzzam

Directors Mr.Md.Mahfuzus Subhan

Mr.Sarwar Boudius Salam

Mr. Abu Hossain Siddique

Mr. Shah Habibul Haque

Managing Director Mr.Shamsuddin Ahmed

DIFFERENT WINGS

HEAD OFFICE

Chairman Secretariat

Managing Director’s Secretariat

Board Department

Share Department

MIS & Computer Department

Establishment Department

Stationary &Records Department

Transport Department

Human Resources Division

Personnel Department

Test Key Department

Disciplinary Department

Marketing Division

Business Development Department

Branches Department

Engineering Department

Public Relations Department

Credit Risk Management Division

Credit Approval Department

Credit Admin & Monitoring Department

Credit Marketing Department

Credit Recovery Department

Central Accounts Division

Accounts Department

Reconciliation Department

International control & Compliance Division

Audit & Inspection Department

Monitoring Department

Compliance Department

International Division

Treasury Division

REGIONAL OFFICES

Dhaka Central Zone Dhaka North Zone Dhaka South Zone

Narayangang Zone Mymensing Zone Chittagong Zone

Khulna Zone Barisal Zone Comilla Zone

Sylhet Zone Bogra Zone Rajshahi Zone

Chapter

4

GENERAL BANKING

Topic to be covered

General Banking————————————————— 29

Deposit scheme—————————————————————- 30

Account Opening Department picture ————————– 31

Demand Deposit Account—————————————- 32

Opening Procedure———————————————— 33-37

Local Remittance Department———————————————— 38

Transaction Types————————————————- 39-43

Cash Department————————————————– 43

Clearing Department———————————————- 44-51

Loans and advance of Green Road Branch——————- 52-54

SWOT Analysis ————————————————– 55

General Banking

“Meeting day to day banking”

General Banking Department usually performs a lot of important banking activities. General banking department is that department which is mostly exposed to the maximum number of bank customers. It is the introductory department of the bank to its customers. All business concerns earn a profit through selling either a product or a service. A bank does not produce any tangible product to sell but does offer a variety of financial services to its customers. The Green Road Branch of UBL has all the required sections of general banking and these sections are run by manpower with high quality banking knowledge. Hence, a touch of rich customer service is prevailing in the branch.

In UBL the following departments are under general banking section:

(a) Account opening department.

(b) Local remittance department.

(c) Cash department.

(d) Clearing department.

(e) Collection department.

In the following Chapters brief discussion on the above departments are presented respectively.

Deposit Schemes

Foreign Currency

Non-Resident Foreign Currency Deposit Account (NFCD)

Foreign Currency Account

Resident Foreign Currency Deposit Account (RFCD)

Local Currency

Savings Account

FDR Account

STD Account

Loan/Advance Schemes

Consumers Credit Scheme

Personal Loan Scheme

International Banking

Treasury and dealing room

Lease Financing

Home Remittances

(A) Account Opening Department

“Communication with the Client”

The relationship between a banker and his customer begins with the opening of an account by the former in the name of the latter. Initially all the accounts are opened with a deposit of money by the customer and hence these accounts are called deposits accounts. Banker solicits deposits from the members of the public belonging to different walks of life, engaged in numerous economic activities and having different financial status. There is one officer performing various functions in this department.

Functions of the Department

The following are the main functions performed by the department:

(i) Accepting of Deposit

(ii) Opening of Account

(iii) Check Book issue

(iv) Transfer of an Account

(v) Closing of Account

Accepting of Deposits

Deposits are life-blood of a commercial bank. Without deposits there are no businesses for the commercial banks of any nature (NCBs, PCBs or FCBs). In this branch the various types of accounts are offered to various customers, which are grouped into:

A. Demand deposit account.

B. Time deposit account.

Demand Deposit Account

The amount in accounts are payable on demand so it is called demand deposit account. The following accounts are under demand deposit accounts:

1. Current account.

2. Savings account.

3. Short Notice Term Deposit (STD).

4.

1. Current account:

This type of account is opened by both individuals and business concerns. Frequent transactions (deposits as well as withdrawal) are allowed in this type of account. A current a/c holder can draw checks on his account for any amount for any numbers of times in a day as the balance in his account permits. This account provides no interest. The minimum balance to be maintained is Tk 2000. No new account can be opened with a check.

2. Savings Account

Individuals for savings purposes open this type of account. Current Interest rate of these accounts is 6.00 % per annum. A minimum balance of Tk1000 is required to be maintained in a SB account interest on SB account is calculated and accrued monthly and credited to the account half yearly. Interest calculation is made for each month on the basis of the lowest balance at credit of an account in that month. A depositor can withdraw from his SB account not more than twice a week up to an amount not exceeding 25% of the balance in the account.

3. Special Notice Term Deposit (STD):

The deposits in this account are withdrawal on prior notice varying from 7 to 29 days and 30 days or more. The interest is paid on the balance of the account. Current interest rate is 6.00% per annum.

Opening Procedure

For opening such A/C, application in the prescribed form along with a set of specimen signature duly verified by Bangladesh mission abroad or by a reputable bank of any other person known to the bank, should be obtained by the brandies. In case of persons, already maintain any F.C A/C or N.F.C.D. A/C with them, reference to that F.C A/C will serve, the purpose of introduction, the branch may verify the signature from the specimen signature and already available with them. Only one such F.C A/C can be maintained and the balance in the A/ C should not exceed $ 30.000/- or equivalent pound sterling at any one time. The A/C holder is also required to submit photocopies of passport, visa, and work permit/contract. As this is a current account no Interest is paid to the A/C holder.

Time Deposit Account

The amount in this a/c is payable only after stipulated time. The following a/cs are under time deposit a/c:

(a) Fixed Deposits which are repayable after the expiry of fixed period and are negotiable.

(b) Bearer Certificate of Deposits (BCD), which are repayable after expiry of fixed period

But are negotiable. These are not renewable.

(c) Non-resident Foreign Currency deposits are term deposits maturing after 1 month, 3months, 6months and 1 year. This a/c’s can be opened either in U.S. dollar or pound sterling. No interest is paid in case of premature encashment.

Fixed Deposit Account

These are deposit, which are made with the bank for a fixed period specified in advance. The band need not maintain each reserve against these deposits and therefore, bank gives high rate of interest on such deposits. A FDR is issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest and the date on which the deposit will fall due for payment.

Particulars Rate of Interest

Interest Rate on Deposits:

Savings Deposits

Special Notice Deposits (STD)

6.00%

5.50%

Fixed Deposit (Time Deposits)

a) 3 (three) Months

b) 6 (six) Months

c) 1(one) Year

d) 2(two) Years and above

e) 3(three) years

9.50%

10.00%

10.50%

11.50%

Table: Interest rate on deposits

Opening of Account

It includes the following stages:

• Account opening procedure

• Classification of customers

Monthly deposits and payment amount of Uttara Bank Ltd.

Deposits amount Period Payable at the end of the period Period Payable at the end of the period

500 5 41243.00 10 116170.00

1000 5 82486.00 10 232339.00

2000 5 164973.00 10 464678.00

3000 5 247459.00 10 697017.00

5000 5 412432.00 10 1161695.00

10000 5 824864.00 10 2323391.00

1) Account opening procedure

Documents needed for each Accounts Separately:

Current/Saving Deposit Accounts:

1. Savings Accounts:

1. An existing Savings Account holder’s identification.

2. Photocopy of National ID card /Passport / Chairman/Conditioner Certificates.

3. Two (2) copies of Passport size photograph.

4. One (1) copy of passport size photograph of nominee.

5. Duly fill up the application form and KYC form.

2. Current Account:

Proprietorship Firm:

a) Name of authorized persons, designation, specimen, signature Card.

b) Trade License.

c) Photocopy of national ID card/passport/Chairman Certificate.

d) An existing current Account holder’s identification.

Partnership Firm:

a) Account must be opened in the name of the firm.

b) The form should describe the names and addresses of all the partners.

c) Trade License from city corp. is needed.

d) Partnership Deed.

e) Letter of authority is achieved

Limited Company:

a) Certificate of incorporation.

b) Certificate of Commencement of Business.

c) Form XII.

d) Memorandum of Association.

e) Article of Association.

f) Power of attorney.

g) Resolution of the Board of Director s authorizing opening of an account.

Societies/Club/Associations:

Other than above-mentioned common documents resolution of who will operate the account must be noted.

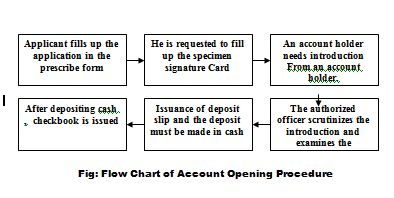

Fig: Flow Chart of Account Opening Procedure

Closing of Account

The following circumstances are usually considered in case of closing an account or justifying the stoppage of the operation of an account:

• Notice given by the customer himself or if the customer is desirous to close the account.

• Death of the customer.

• Customer’s insanity and insolvency.

• If the branch finds that the account is inoperative for a long period.

• If Garnishee Order is issued by the Court of Law on the bank branch.

A customer can close out his A/C at any time by submitting an application to the branch. Upon the request of a customer an account can be closed. After receiving an application from the customer to close an Account, the following procedure is followed by a banker. The customer should be asked to draw the final cheque for the amount standing to the credit of his a/c less the amount of closing and other incidental charges and surrender the unused cheque leaves. The a/c should be debited for the account closing charges etc. and an authorized officer of the Bank should destroy unused cheque leaves. In case of joint a/c the application for closing the a/c is to be signed by all the joint holders even if the A/C- is operate by either of them. The last check for withdrawal of the available balance in the A/C is to be signed by all the joint holders.

Local Remittance Department

“Banking for Common People”

UBL has its branches spread throughout the country and therefore, it serves as best mediums for remittance of funds from one place to another. This service is available to both customers and non-customers of the bank. The department, which provides the facility, is known as local remittance department

Functions of the Local Remittance Department

The following are the main functions performed by the credit department:

a) Issuing & Payment of Demand Draft.

b) All related correspondence with other Branches & Banks

c) Compliance of Audit & Inspection

d) Balance of D.D. payable & D.D. Paid with advice

e) Attached to Sanchaya Patra and Wage Earners Development Bonds.

f) Payment of Incoming TT.

g) Issuing, encashment of Pay Order and maintenance of record and proof sheet.

h) Issuing and encashment of all kinds of Sanchaya Patras and wage Earners Development Bond.

i) All related statements & correspondences with Bangladesh Bank & other Branches.

j) Issuance of Local Drafts

k) Issuing and encashment of BCD.

l) All related correspondences.

m) Issuing of Outgoing TT.

n) Issuance of Local Drafts.

o) Issuance of T.T. ICA. IBCA & IBDA.

Transaction Types

Collection of Cheque

• Up to TK. 25,000 @ .15%, Minimum TK. 10.

• Above Tk.25, 000- 1,00,000, @ .15% Minimum Tk.50.

• Above 1,00,000-5,00,000 @ .10%, Minimum Tk.150.

• Above 5,00,000 @ .05%, Minimum Tk.600-Maximum 1,200

Name of Transaction Transaction Code

Bank Draft 1

Mail Transfer (M.T) 3

T.T 4

B.Cs 6

S.Cs 7

Cash Remittances 8

Sundries 9

Head Office Transaction 10

Foreign Exchange Transaction 12

Reversing & Cancellation 27

Bank Charge for DD Issuing

@ .15% Minimum Tk. 25.

Cancellation of DD

Up to 1000————————-Tk.25.

Above 1000————————Tk.40.

Payment Order

Up to Tk. 1000————————Tk.10.

1,000-1,00,000 ————————-Tk.25.

1,00,000-5,00,000———————-Tk.50.

Above Tk.5,00,000—————————Tk.100.

Cancellation of Pay order

Up to Tk. 500————–Tk.10.

Above Tk. 500————-Tk.25.

Rate of Govt. Excise Duty for a financial year( Effective from 01-07-03)

Tk.10,000———————————— Tk.0

Tk.10,000-1,00,000———————— Tk.120.

Tk.1,00,000-10,00,000——————— Tk.250.

Tk.10,00,000-1,000,000——————–Tk.550.

Tk.1,000,000-5,000,000——————-Tk.2500.

Above Tk.5,000,000———————–Tk.5000.

Remittance of Fund

Any one of the following methods may make remittance of funds from one place to another.

1) Telegraphic Transfer (T.T)

2) Demand Draft (D.D)

3) Pay order (P/O)

1) Telegraphic Transfer (T.T)

It is an order from the Issuing branch to the Drawee Bank /Branch for payment of a certain sum of money to the beneficiary. Telex/ Telegram sends the payment instruction and funds are paid to the beneficiary through his account maintained with the Drawee branch or through a pay order if no a/c is maintained with the drawee branch.

a) T.T Issue Process:

1. The Applicant fill up the relevant part of the prescribed Application form in triplicate duly signs the same and gives it to the Remittance Department.

2. Remittance Department will fill up the commission part meant for Bank’s use and request the Applicant to deposit necessary cash or check at the Teller’s Counter.

3. The Teller after processing the Application form, Cash or check will validate the Application form .The first copy is treated as Debit Ticket while the second copy is treated as Credit Ticket and sent to Remittance Department for further processing. The third copy is handed over to the applicant as customer’s copy.

4. Remittance Department will prepare the Telex/Telegram in appropriate form, sign it and send it to the telex Operator/Dispatch Department for transmission of the message.

5. Remittance Department will prepare the necessary advice

6. Debit Advice is sent to the client if client’s a/c is debited for the amount of T.T

7. Debit ticket is used to debit the client’s account if necessary.

8. T.T Confirmation Advice is sent to the Drawee Branch.

9. Credit Ticket (2nd copy of the Application Form) is used to credit the UBL General Accounts.

b) Accounting Entry

• Dr. Cash /client’s A/C

• Cr. UBL General A/C

• Cr. Communication.

• Cr. Commission.

c. Payment of T. T’s:

• On receipt of T.T payment the Drawee branch passes Instructions the following entries if the T.T is found to be correct on verification of Test Number.

i. Dr. UBL General A/c

Cr. Remittance Awaiting Disposal- T.T Payable A/c

ii. Dr. Remittances Awaiting Disposal -T.T Payable A/c

Cr. client’s Account /P.O. A/C.

In case the beneficiary does not maintain any a/c with the Drawee branch a P.O is issued in favor of the payee and sent to his banker/local address as the case may be.

• Every branch maintains a prescribed T.T. Payable Register. All the particulars of T.Ts are to be properly recorded in this Register duly authenticated. A separate type of T.T confirmatory advice is sent to the Drawee branch on the same day. On receipt of the T.T Confirmatory advice/ confirmation copy of Telegram from the Issuing branch, the particulars of the T.T are verified with reference to particulars already recorded in the T.T payable Register.

The Confirmatory advises are kept attached with the relative Ticket No further responding entry is required to be passed on receipt of such confirmation copy. On payment of T.T the particulars are to be incorporated in the Extracts of Responding Debit entries as usual and sent to HORC.

2) Demand Draft (D.D)

Local Draft is an instrument containing an order of the Issuing branch upon another branch known as Drawee branch, for payment of a certain sum of money to the payee or to his order on demand by the beneficiary presenting the draft itself.

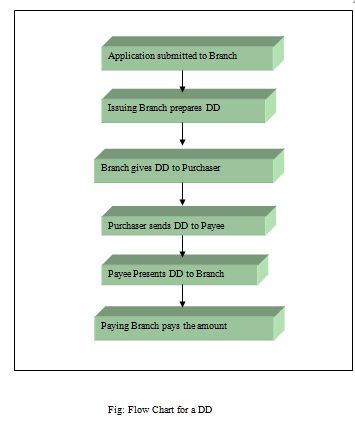

Fig: Flow Chart for a DD

3) Pay Order

a. Pay Order Issue Process:

For issuing a pay order the client is to submit an Application to the Remittance Department in the prescribed form (in triplicate) properly filled up and duly signed by applicant. The processing of the pay order Application form, deposit of cash/cheque at the Teller’s counter and finally issuing an order etc, are similar to those of processing of D.D. Application.

As in case of D.D each branch should use a running control serial number of their own for issuance of a pay order. This control serial number should be introduced at the beginning of each year, which will continue till the end of the year. A fresh number should be introduced at the beginning of the next calendar year and so on.

b. Charges:

For issuing each pay Order commission at the rate prescribed by Head Office is realized from the client and credited to Income A/c as usual.

c. Entries:

Dr. Teller’s Cash /Client’s a/c ———————————————————Debit

Cr. pay Order a/c. ———————————————————————- Credit

Cr. commission a/c. ——————————————————————–Credit

Cash Payment

Cash payment of different instruments is made in the cash section. Procedure of cash payment against cheque is discussed under elaborately. Cash payment of cheque includes few steps:

1) First of the entire client comes to the counter with the check and give it to the officer in charge there. The officer checks whether there are two signatures on the back of the cheque and checks his balance in the computer. After that the officer will give it to the cash in charge.

2) Then the cash in charge verifies the signature from the signature card and permits the officer in computer to debit the client’s account by giving posting. A posted seal with teller number is given.

3) Then the cheque is given to the teller person and he after checking everything asks the drawer to give another signature on the back of the cheque.

4) If the signature matches with the one given previously then the teller will make payment keeping the paying cheque with him while writing the denomination on the back of the cheque.

5) Cash paid seal is given on the cheque and make entry in the payment register.

There are few things that shall be scrutinized and checked before making payments.

i. Name of the drawer

ii. Account number

iii. Specimen signature

iv. The validity of the cheque and make it sure that it is not post dated or undated.

v. The amount in words and figures are same.

Cash Balance calculation

The calculation is done by the officer in charge of cash section and then manager or authorized officer will check the balance and sign in the cash balance book. The balance is maintained in the balance book. Opening balance of current day is the closing balance of the previous day. Total receive of the current day is added with the opening balance and total payment is deducted for calculating the closing balance or cash balance.

Clearing Department

“Clearing House Operation”

According to the Article 37(2) of Bangladesh Bank Order, 1972,the banks, which are the member of the clearinghouse, are called as Scheduled Banks. The scheduled banks clear the chouse drawn upon one another through the clearinghouse. This is an arrangement by the central bank where everyday the representative of the member banks gathers to clear the chouse. Banks for credit of the proceeds to the customers’ accounts accept Chouse and other similar instruments. The bank receives many such instruments during the day from account holders. Many of these instruments are drawn payable at other banks. If they were to be presented at the drawee banks to collect the proceeds, it would be necessary to employ many messengers for the purpose. Similarly, there would be many chouse drawn on this the messengers of other banks would present bank and them at the counter. The whole process of collection and payment would involve considerable labor, delay, risk and expenditure. All the labor. Risk, delay and expenditure are substantially reduced, by the representatives of all the banks meeting at a specified time, for exchanging the instruments and arriving at the net position regarding receipt or payment. The place where the banks meet and settle their dues is called the Clearinghouse.

Functions of the Department

The following are the main functions performed by the department:

a) Pass outward instruments to the Clearing-House.

b) Pass inward instruments to respective department.

c) Return instruments incase of dishonor.

d) Prepare IBCA or IBDA for the respective branch and HO.

Accounting Entries of Clearing Department

The following entries are given if the cheques are honored,

Customer A/C ________________________Debit

UBL General A/C _________________________Credit

UBL Principal Branch clears its cheques through the Head Office as well as the cheques of other branches, because it is only permitted. The other branches send the instruments through I.B.D.A UBL Principal Branch acts as an agent in this case. For this concern branch gives the following entries,

UBL General A/C__________________Debit

Customers A/C____________________________Credit

If the instrument is dishonored, the instrument is returned to the concerned branch through I.B.D.A. along with the following entries, Incase of return(For Inward instrument)

UBL General A/C ____________________ Debit

Customers A/C _______________________________Credit.

In case of return(For Outward instrument)

Customer A/C _________________________Debit

UBL General A/C___________________________Credit.

Bills & Claque Collection

Checks, drafts etc. are drown on bank located outside clearing house are sent for collection. Principal Branch collects its client’s above-mentioned instruments from other branches of UBL and branches other than UBL. In case of out ward bills for collection customers account is credited after finishing the collection processor. And in case of in ward bills customers account is debited for this purpose. So it place dual role as follows:

i) Collecting Banker

ii) Paying Banker.

There is one officer working over desk in this department.

Functions of the Department

The following are the main functions performed by the department:

a) Preparing of Outward and Inward Collection Item.

b) Inter-Branch Transfer.

c) Batch posting and checking as and when required.

d) Other works as and when require.

Applicability of Collection

Collection is done when:

(i) Paying Bank is located out side Dhaka City.

(ii) Paying Bank is other branches of UBL situated inside Dhaka City.

(i)

(j) Paying Bank is Outside Dhaka City

Collection department of Principal Branch, UBL sends outward bills for collection (OBC) to the concerned paying bank to get inter Bank Credit Advice (IBCA) from paying Bank. If the paying bank dishonors the instrument, the same is returned to principal Branch.

(ii)The Paying Bank of their Own Branches Inside Dhaka City

Collection Department sends transfer delivery item to other branches of same bank situated inside Dhaka City. Upon receiving IBCA customer’s a/c is credited.

Daily Task

The routine daily tasks of the Accounts Department are as follows:

1. Recording the transactions in the cashbook.

2. Recording the transactions in general and subsidiary ledger.

3. Preparing the daily position of the branch comprising of deposit and cash.

4. Preparing the daily Statement of Affairs showing all the assets and liability of the branch as per General Ledger and Subsidiary Ledger separately.

5. Making payment of all the expenses of the branch.

6. Recording inters branch fund transfer and providing accounting treatment in this regard.

7. Checking whether all the vouchers are correctly passed to ensure the conformity with the ‘Activity Report’; if otherwise making it correct by calling the respective official to rectify the voucher.

8. Recording of the vouchers in the Voucher Register.

9. Packing of the correct vouchers according to the debit voucher and the credit voucher.

Clients services

No. of clients of the branch are increases. Branch always well concern no. Of clients and their service level. All the people of the branch take their seats before 15 minutes of starting works and not go out with out authority permission or clients presence. Cash received and payment are made very swift for the clients remittance, both local and foreign, bills collection and payment are swift always cautious about customer seating arrangements, good behavior with entertainment to customer, quick issuing of D, D, T.T.P.O., M.T. quick clearing, forwarding, statements prepared for clients.60% of customer has reliability of its services.

Major Problems In General Banking

Problem in general banking arises while issuing and responding different types of D.D, M.T, and P.O. T.T, SC.LSC, D.D. IBP, D.D.P. due to different between actual amount and written amount in those botchers. This problem most repeated occurs in general banking for misunderstanding of written amount or not consciously read the amount in words in advice. Another problem is while issuing and responding of M.T, T, T, and same message are sending from different branch. These happen due not use the seal of message confirmation by telephone. Then it needs to send several message and much hazards occurs in reconciliation. Another problem occur due to not getting of advice of Mt., T, T, DD from different branch. And making schedule for reconciliation is not possible for head office. Another problem occur in clean cash when so many Boucher may attach with other categories. Most serious problem is that many branch of Uttara bank have not telephone

Consumer-Credit Scheme :

UBL started Uttaran Consumers Credit Scheme from 1996.UBL offers opportunity of Financial assistance for –

Motor cycle/car- New or re-conditioned.

Refrigerator/ Deep Freeze.

Television/ VCR /VCP/VCD

Radio/ Two-in-one/ Three – in – one

Air-Conditioner/ Water Cooler/ Water Pump

Washing Machine.

Personal Computer/ UPS/ Printer/ Type writer

Sewing Machine.

House hold furniture- Wooden & Steel.

Cellular Telephone.

Fax

Photocopier.

Electric Fan- Ceiling/ Pedestal/ Table.

Bi-Cycle

Dish Antenna.

Baby Taxi, Tempo/Microbus (For self employed persons)

Kitchen articles such as Oven, Micro-oven, Toaster, Blender, Pressure Cooker etc.

Special Features :

No collateral security is required.

Simple rate of interest.

Quick sanction.

Maximum Loan amount Tk.3,00,000/-

5% incentive on total interest charged

Required Documents:

Documents related to applicant’s job to prove him self.

Two copies passport size photographs.

Photograph of nominee (if any) duly attested by the account holder.

Monthly Deposit Scheme

a) Any adult Bangladeshi National will be eligible to open this account.

b) The period of the scheme will be 5 (five) years and 10 (ten) years term.

c) Monthly installment will be Tk.500/-, 1000/-, 2000/-, 3000/-, 5000/- & 10000/-

d) Monthly installment to be deposited within 10th day of the month.

After due date a penalty of Tk.50/- will be realised from the A/C holder.

If the A/C holder fails to deposit 3(three) consecutive monthly

installments,the account will be automatically closed.

e) No cheque book will be issued against the account.

f ) Deposit may be encashed before maturity. But no interest will be

paid if encashed before 1(one) year of deposit.

f) Advance will be allowed up to 80% of the deposit after completion of

one year

g) Interest will be paid at Savings rate if encashed after 1(one) year of

deposit.

h) Advance will be allowed upto 80% of the deposit after completion

of one year.

i) Full amount including interest will be paid on maturity.

j) Govt. tax, Surcharge, Source Tax, Levy, Govt. Excise duty will be recovered from the depositor’s A/C.

k) Account holder can appoint a nominee against the account.

l) Bank reserves the right to close the account at any time and make

amendment / alteration of the terms & conditions of the scheme

without assigning any reason.

m) Amount will be paid on the following matrix:

Personal Loan :

Personal Loan Scheme for Salaried Officers-

Emergency expenses for own marriage of a service- holder or his dependents.

Emergency expenses of urgent surgical operation/ medical treatment.

Emergency educational expenses of the children for admission/purchase of books, examination fees etc.

Special Features :

Any permanent salaried employee aged between 20 to 55 years is eligible to get loan.

No collateral security is required.

Maximum Amount of loan Tk. 1,00,000.

Maximum period of loan upto 3 years.

Required Documents :

Documents related to applicant’s job to prove himself.

Two copies passport size photographs.

Photograph of nominee (if any) duly attested by the account holder.

Loans and advance of GREEN ROAD BRANCH

Categories of loans offered by the branch

Agriculture

Large and medium scale industries

Export

Other commercial lending (jute and fertilizer)

Small and cottage industries

Consumer Loan

Personal loan

Others

a) Housing loans

b) Residential

c) Commercials d) Transport e) Cold storage f) Brick field g) Gold loans h) Against work orders i) Against work FDR J) Loans against sanchaypatra k) loans against WEBD, ICB, unit certificate l ) loans against life insurance policy k) Others special program

Loans Advances

The portfolio of loans and advances at end of the year 2007 stood at Tk. 26788.47 million with an decrease of Tk. 4000.55 million fall was 13 percent. The outstanding amount at the same period of previous year was Tk. 30789.02 million.

Precaution while sanction of new loans:

Banker must analysis borrower nature of business, experience in business, qualification, and goodwill. Income sources, profit from invested money, ability to repayment of loans money.

Before submit loans proposal banker must properly examine risk and guaranteed value from loans.

• With a view to properly assessed the proposal of the borrower banker must filled application including borrower cash flow, personal net worth, description of mortgage assets, assets and liability ratio and submit the proposal to H/O.

• Banker must be insuring that borrower mortgage property is not pledged to other bank.

• While sanction loans above 10-lac proposal must be submitted to Bangladesh bank with details description of use of loans money.

• Lending risk must analysis before sanction Tk.50 lac.

• Banker must inspect practically while renews of loans with a view to Asses property actual market value.

Sanctions of Loans and subsequent stages:

• All security document and charges document must be properly completed.

• Banker must be ensured utilization of money so that one sources sanctioned loans may not other sources by the borrower.

• The bank must inform any unwillingness of utilization of loans money by the borrower and proper legal action must be taken against him.

• Bank must rewarded and encourage those borrower who regular repayment of loans and must give preference to him for loan sanction.

• Branch must present report to Bangladesh B.R.P.D. About problem and performance of recovery of classified loans, legal action against those borrowers according to Bangladesh bank B.R.P.D. circulation.

Branch manager must be ensuring about obedience of all the above steps.

Classified loans and provision

Performance of loans recovery

2000 2001 2003

Un recovered loans 495.25 480.16 382.00

Suit money 166.43 105.48 255.19

Recovered 19.10 18.00 5.7

% Recovered by suits 11.5% 17.06% 2.23%

Major findings

Loans are un-recovered as these are sanctioned against improper documents.

Loans are given as the order of direct higher authority.

Loans are not properly utilized, loans was cautioned for one sector but used in other sector.

Lack of sufficient interest. Financial loss in business of the creditor.

Loans are given without proper inspection of pledged assets or hypothecation.

Loans are un-recovered due to value of the collateral assets are not properly assessed.

Maximum loans are cash credit instead of collateral credit.

Loans are un-recovered due to present govt. policy has lack ness to take legal action against loan defaulter.

Loans are sanction-limited sector.

Maximum loans are c.c./ abnormal money excess of c.c.

Loans are sanctioned against discrepant documents/ documents are not properly examined.

Loans are given loans are given without following Bangladesh bank B.P.R.D.

Creditor is not available found in the country

Credit management and recovery of classified loans:

As classified loans increase provision rate, create adverse effect on investment .in order to accelerate the investment, reduce inflation and to attain target growth rate the following guideline have to be follow:

Undertaking step for recovering of all classified money.

Properly audit creditor financial situation, willingness of repayment of loans money, creditor sources of income property.

Bank must take urgent measure for recovery of loan money.

Examining properly all documents and charges documents. And submitting to harm dept. takes immediate legal action by examining the accurateness of all the documents and amended documents by the direction of head office.

Employing well-qualified advocates for UN recovered loans money collection against powerful and large amount creditor.

Branch manager have to be concern regarding quick settlement of all suit cases, in the case date bank representative must present in the court and provide information to the competent authority.

Strictly follow guideline of Bangladesh bank while sanction loans.

Take accurate guarantee from the creditor so that creditor get no provision/ evasion of not pay bank due money.

Branch must achieve annual and half yearly budget target so that amount of classified loans may be concern by higher authority and take appropriate action.

Bank have to be set up a more strengthen R&M department. Branch manager have to be directly consult with the Deputy GM of R &M.

Head office has to employee a former D.C. as a legal advisor in order accelerated recovery of classified loans.

Measure must be taken all debts before they are being classified or before expiry dates that loans not be classified.

Precaution must be taken while approval of loans proposal in H.O. must justify real situation of using loans granted loans, incase e of any discrepant document or any claim against loans must inform H.O. for not sectioning loans to that applicant.

SWOT ANALYSIS OF UBL

S Sound profitability and growth with good internal capital generation

Larger corporate client base

Experienced and efficient management team and human resource

Quaity products and services

Company reputation and goodwill

Large number of Branches all over the country

W Lack of adequate marketing (advertising and promotion) effort

Lack of full scale automation

Lack of trained employes.

Not all branches provide online services

O Scope of market penetration through diversified products

Automation of transaction processes and online branch banking

Regulatory environment favoring private sector development

Value addition in products and services

Increasing purchasng power of people

Increasing trend in international business

T Increased competition for market share in the industry

Frequent changes of banking rules by the Central Bank

Market pressure for lowering of lending rate

National and global political unrest

Default culture of credit

Chapter

5

FOREIGN EXCHANGE

Topic to be covered

Foreign exchange ————————————————- 58

Nature of L/C —————————————————– 59-61

Back to back L/C————————————————– 62-63

Foreign remittance———————————————– 64-65

Foreign exchange

Foreign Exchange is very lucrative & profitable in modern Banking business. It’s recognized as a way of generating maximum profit with low investment. In other Banking like advance needs high capital investment. But foreign exchange required comparatively low investment. In foreign business complexity is high due to rapid change in technology especially for a bank consists of so many branches dispersed in a wide region. The system is easy for a bank to control rich in capital equipped with modern technology concentrated in a small areas. Technology is necessary to prepare quick statement, getting information, preparing reports. Now technology is a turbulent in foreign exchange business. To survive in the competition a bank has to adapt with this changes. For this it will require skilled manpower, on line banking, 24- hours banking services, high capital investment. Problems arise in foreign exchange for changes in economical and political business environmental changes of the country. Changes in exchanges rate, change in currency rate, govt. rules and regulations, create problems while dealing in foreign business. So it needs always a conscious mind for successfully dealing in foreign business.

Parties concerned with L/C:

How to open an L/C

For opening an L/C there must be a relationship between banker and customer through opening an account with the bank.

Procedures for opening bank accounts:

1. Before opening accounts clients must submit some paper

a) In case of company must submit annual financial statement

b) In case of individual must submit all types of income tax payment certificate.

There are three types of bank account,

A) Savings account b) current account c) STD

a) For opening bank account first have to fill up application form

b) Then have to use to reference that have existing relation ship with the bank or all ready maintain accounts with the bank.

c) Two copies resent attest p.p. photograph.

d) Put three-specimen signature on the signature cards.

e) Write in details amount of deposits and nominee person address relation with account holders who will hold the account in the absence of clients.

f) Enclosed memorandum of associations and articles of associations along with form.

1. L/C must be open through current account.

2. Perquisite for opening L/C

Have to take some charge documents from the party

a) Trading licensee b) Chamber of commerce certificate c) Last fiscal year income tax certificate.

Then the importer have to submit a proposal for opening L/C along with-

L/C application.

License no.

Performa invoice.

Party’s application.

L.c. set

IRC.

Insurance covered note.

Nature of L/C

1. Cash L/C (sight)

2. Cash L/C

3. Inland B/B L/C (sight)

4. Foreign B/B L/C

5. L/c under AID loans

6. Import from EPZ B/B/L/C)

7. Import from EPZ B/B/L/C) (sight)

8. Import from EPZ 9CASH L/C (SIGHT)

9. L/C UNDER sta.

10. Others

A L/C is most suitable under following conditions

• When the importer is not well known. The exporter selling on credit may wish to have the promise of payment.

• When the importer doesn’t want to pay the exporter until it is reasonable certain that the merchandise has been shipped in good condition.

L/C procedure:

The various steps involved in the operation of credit are described as follows

The importer and exporter have contract before a L/C has been issued.

The importer applies for a L/C from his banker known as the issuing bank. He may use his credit lines.

The issuing bank opens the L/C that is channeled through its overseas correspondent bank, known as advising bank.

The advising bank informs the exporter of the arrival of the credit.

Exporter ships the goods to the importer or other designed place as stipulated in the L/C.

Meanwhile the exporter also prepares his own documents and collects transport documents or other documents from relevant parties. All documents will be sent to his banker, which is acting as negotiating bank.

Negotiation of export bills occurs when the banker agrees to provide him with finance. In such case he obtains payment immediately upon presentation of documents. If not the documents will be sent to the issuing bank for payment or an approval basis in the next step.

Documents are sent to issuing banker reimbursing bank, which is a bank nominated by the issuing bank to honor reimbursement from negotiating bank for reimbursement or payment.

Issuing bank honors to its undertaken to pay the negotiating bank on condition that the documents comply with the L/C terms and conditions.

Issuing bank releases documents to the importer when the letter makes payment to the former or against the letter trust receipt facilities.

The importer takes delivery of goods upon presentation of the transport (usually shipping documents)

Parties involved in letter of credit

The applicant:

The applicant is the parties who generally approaches in order to issue the L/C. generally the applicant ids the exporter who reaches an agreement with the exporter before approach in the bank to issue the L/C.

The issuing bank;

The bank issuing the L/C is known as issuing bank and it is usually the bank with which the importer maintains an account. The issuing bank undertakes an absolute obligation to pay upon presentation of documents.

The advising bank

The correspondent bank sends the L/C is commonly referred to as advising bank. The advising bank simply advises the L/C without any obligation on its part. However, the advising bank shall take reasonable care to check the apparent authenticity of the credit that it advises.

The beneficiary:

The beneficiary or exporter is the party entitled to draw payment under L/C. The Beneficiary will have to present the required documents to avail payment under L/C.

The Confirming bank:

The confirming bank confirms that the issuing bank has issued a letter of credit. The confirming directly obligated on the credit to the extent of its confirmation and by confirming it acquires the right and obligation of an issuer.

The negotiating bank;

The bank that agrees to examine the documents under the L/C and pay t5he beneficiary is called the negotiating bank. Typically, the advising bank is nominated as the negotiating bank.

Back to back L/C

Back to back L/c is mostly issued in Bangladesh. When a beneficiary receives a letter of credit, which is not transferable, and he cannot furnish the goods himself, he may arrange with his banker to issue a second credit, which is known as back-to-back L/C to supplier to supply the goods.

As both L/C cover the same goods the back to back credit must be issued with identical terms to the muster L/C, except that the credit amount, unit price if any are smaller. The expiry date under the back-to-back credit is earlier while the latest shipment date may have to be advanced. The bank issuing back-to-back credit will obtain repayment through muster credit, which is deposited to the issuing bank of the back-to-back credit. The bank must try to maintain control of the documents and hold them after payment to the supplier pending receipt of its customer’s invoices and present the documents itself for payment under the muster credit in favor of its customer.

Advantage and disadvantage of L/C

Advantages:

• An importer can assure that the exporter has complied with certain terms and condition as specified in L/C before payment.

• Importer can insist on shipment of goods within a certain time stipulated a latest shipment date.

• He can get advice from the banker according to L/C terms.

• He can ask for financial assistance from the banker.

• Protection offered by UCP500.

Disadvantages:

• Since bank deals with documents only goods may not be the same as those specified in the credit.

• Issuing bank obliged to pay even though the conditions of goods may be poor.

• L/C commission is relatively high.

Advantages for exporter:

• The risk for nonpayment is lower as complies provided with L/C.

• It is a safe method through which prompt payment obtain after shipment.

• Exporter can get expertise advice from the banker.

• The exporter can get financial assistance before the buyer makes payment.

Disadvantages:

• Sometimes terms and condition cannot fulfill such as unreasonable shipment date adding on L/C the clause of “restriction of a designated vessel to be informed by L/C amendment

• The goods shipped before receiving payment and so it is not 100 percent safe.

Main business of Foreign exchange department

The primary business of foreign exchange department of Green Road Branch is to make reimbursements and payments on behalf of the issuing bank. Besides acting as the correspondent bank for reimbursing bank or the payee bank, branch also advice s negotiates, and confirm letter of credits. Acting as the negotiating and confirming Green Road Branch earns a commission, which is a percentage of the total L/C amount. This

Percentage varies depending on the risk of non-payment by the importer. On the other hand branch earns a flat rate fixed commission when it acts as the advising bank as well as when it authorized to make reimbursement on behalf of the issuing bank. Reimbursement made either to ACU Dollar account AMEX Calcutta, or to US$ dollar account in AMEX New York. These reimbursements contribute to major portion revenue of foreign exchange department.

Service offered by foreign exchange department of Green Road Branch

Green Road Branch offered a wide services for its relation ships other bank and clients both home and aboard. These Service are related to trade finance, international payment, investment, trading services.

Credit items

• Letter of credit (L/C) negotiation

• Letter of credit (L/C) confirmation.

Non-credit items

• Letter of credit (L/C) advising.

• Reimbursement authorizations.

• Payment instruction.

• Export bills collections.

Foreign remittance

All types of L/C money, student’s fees, and other charges are sending to foreign country through remittance. After negotiation between importer and exporter, getting all documents, payments of goods are made to the exporter bank (advising bank) from U.S.A. Amex bank, but must be arrangement with that bank. After entering the goods in the importer country, getting bills of entry from the custom, exporter send all documents to the issuing bank. Issuing bank then judge the accurateness of these documents and calculate total due with interest, commission, and other charges, deduct amount of margin that was prepaid while opening L/C after preparing dock statement-all the entry transaction is reported to a c-form to Bangladesh bank where total foreign currency record is maintain in commodity wise.

Foreign Remittance

The Uttara Bank Ltd. Made new arrangements and fruitful strategies with money exchange company in United Kingdom, Middle East and United States. In 2004 they earn Tk. 2466 million but in 2005 there is dramatically increase Tk. 4158. Total amount of foreign remittance through exchange houses and banks was BDT 8473 million. The amount in the same period of the last year was TK 4158 million. But due to the economic slowdown in the year 2007 this bank earns Tk. 4932 million.

There are two kind of foreign remittance. These are: –

a. Foreign Inward Remittance.

b. Foreign Outward Remittance.

Problems of foreign exchange remittance

• Still many country of the world has not open exchange house like Japan, Korea, Canada, Belgium and others so clients cannot get promptly remittance.

• Every year many exporter collect cash assistance by showing false documents to Bangladesh bank. As a result much currency is going away of the country that is a major problem for import and foreign currency of the country.

• As still there Is no remittance with many countries taking this opportunities one class of broker are benefited, dollars are going away of the country, the rate of exchange of Tk. Are decreases.

Solutions of cash remittance problems

• Adequate measure have been taken for quick remittance, exchange warehouse have to set in each country where Bangladeshi are available.

• Cash remittance may be a profitable sources of foreign income in the absence of others export business.

• Adequate rewards have to be given all those foreign Bangladeshi who send their money through remittance.

• Card systems have to introduce opening a nostros account of each individual-then amount of cash remittance will be increases.

Chapter

6

BIBLIOGRAPHY AND ANNUAL REPORT OF THE BANK

Topic to be covered

Bibliography ———————————————- 68

Balance sheet——————————————– 69-70

Profit and loss account——– ———————– 71

Cash flow statement———————————– 72

Bibliography

• Annual Report of Uttara Bank Limited, 2004

• Annual Report of Uttara Bank Limited, 2005

• Brochure of Uttara Bank Limited.

• Web-www.uttarabank-bd.com.bd.

• Bank management, Fifth Edition, George H. Hemple, Donald G. Simonson.

• Business Communication, Sixth Edition, Raymond v. Lesiker Jhon D. Pettit, JR.

• Commercial Banking, Fourth Edition, by Edward W Reed / Edward K. Gill.

• Financial Institutions Management, A Modern Perspective Anthony Saunders.

• Marketing Management, Third Edition by Kotler & Armstrong.

• Advertising & Promotion, Sixth Edition by Belch & Belch.

CONCLUSION

New Market Bank Ltd is the largest non-government organization through out or this region. It is working mass people about aquaculture, social welfare and income generation of this region.

Leadership style process accomplished half of its organizational activities. Employees are the lifeblood of organization and leadership style are the way to motivate and maintain that.

Work mood is associated leadership style in many senses. An appropriate leadership style can bring the job satisfaction among employees.

Uttara Bank Ltd, Green Road Branch, Dhaka. It is such non-government organization is highly concerned with those factors of Leadership style. They apply an effect ion style to implement the organizational objectives. From apply an effective style to seen that effective Leadership style bring a great and fruitful success of the organizations.

Recommendations

Uttara Bank Ltd. is the 2nd generation bank and providing its service since many years. Since its establishment it has provided so many banking services to the people of this country, but it need to walk with the concept of modern banking system. Today the 3rd generation banks are providing the modern banking services such as- internet banking, SMS banking, debit and credit card facilities, ATMs services, electronic banking, corporate banking, retail banking and SME banking etc. whereas Uttara bank are still providing their traditional banking service. I think it should go more effectively to the general people of the country with the concept of modern banking system. Now a day it is very difficult for any bank or financial institute to run its operation smoothly because of hard competition. So to survive in the market it should come out from its traditional concept and provide modern banking service.