Executive Summary

Now a day in the competitive world practical experience is a must. It is possible to gather theoretical knowledge by passing through books but it is insufficient to acquire practical experience. For a student internship training is the only way to gather practical experience.

Internship program is an indispensable part of BBA (Bachelor of Business Administration) program that bridge the gap between the theoretical knowledge and practical situation. I was assigned to the Arab Bangladesh Bank Ltd. (ABBL) at Karwan Bazar Branch, Dhaka to take the real banking experience in order to reinforce knowledge acquired so far from the BBA program. I was placed in ABBL to complete my internship.

In this report, efforts have been made to identify the import-export and remittances procedure of Foreign Exchange Department of AB Bank Limited. Foreign exchange include foreign currency and any instrument drown, accepted, made or issued, clause (13), article-16 of the Bangladesh order, the area of foreign exchange is import, export and remittances. And this report is focus on also import, export and remittances. Import and export both are focus on letter of Credit (L/C).

Back to Back L/C is a pre shipment finance by way of opening L/C in favor of a local or foreign supplier for purchase of raw material or the finish mechanism, as the case may be, to execute export order. Export bill for collection are document which are presented to the bank by the seller or exporter to collect from the buyer through the buyer bank. To execute export order under L/C or firm contract the bank award Packing credit facility to meet client working capital management.

The main activity of remittances department are, People are sent money from foreign country, When we go to foreign country in that time need dollar endorsement like-Traveler Cheque (TC), Foreign Demand Draft (FDD), Telegraphic Transfer (TT) this types of works are done by this department.

Through all departments and sections are covered in the internship program it is not possible to depth the activities of Foreign Exchange Branch because of time limitation. However, highest effort has been given to achieve the objective the internship program.

Chapter-1

ORGANIZATION OVERVIEW

OVER VIEW OF THE BANK AND BRANCH

1.1 Introduction of ABBL

AB Bank is the First private bank in Bangladesh. Government permitted private banks to enter in to banking because of sustained poor performance by the banks of nationalized sector. AB Bank limited (ABBL) is sailed as the leading private commercial bank in the baking suture from its journey on April 12, 1982 with opening of its first branch at Karwan Bazar in Dhaka. It was the brainchild of group dynamic entrepreneurs of Bangladesh.

1.2 CORPORATE INFORMATION AT A GLANCE:

(INFORMATION AS PER LAST ANNUAL REPORT 2009)

Name of the bank : AB Bank Of Bangladesh Limited

Status : Public Limited Company

Nature of Business : Private Commercial Bank

Date of Incorporation : 31st December, 1981

Commencement of Business : 27th February 1982

Inauguration of the Jubilee Road Branch : 26th July, 1994,

Head Office, BCIC Bhaban, 30-31,

Dilkusha Commercial Area, Dhaka.

Registration No : C281461 (1992)/95

Chairman : Mr. M. Wahidul Haque

Managing Director : Kaiser A. Chowdhury

Authorized Capital : TK. 800 Million

Paid up Capital : TK. 519.76 Million

Directors : 8

Number of branches : 81

Deposit : TK. 27,361.44 Million

Loan : TK. 21,384.63 Million

Number of Employees : 1525

Telephone : ( +8802 )9560312

Telefax : ( +8802 )956-4122-23

SWIFT Code : ABBLBDDH

E-mail : info@abbank.com.bd

Web Site : www.abbank.com.bd

1.3 Vision & Mission:

Vision Statement

“To be the trendsetter for innovative banking with excellence & perfection”

Mission Statement

“To be the best performing bank in the country”

Goal of the Bank

To exceed customer expectations through innovative financial products & services and establish a strong presence to recognize shareholders expectations and optimize there rewards through dedicated workforce.

Long term Goal: Keeping ahead of other competitors in productivity and profitability.

Short Term Goal: To attain budgetary targets fixed in each areas of business.

1.4 Change of Name:

AB Bank believes in modernization. The bank took a conscious decision to rejuvenate its past identity – an identity that the bank carried as Arab Bangladesh Bank Limited for twenty five long years. As a result of this decision, the bank chose to rename itself as AB Bank Limited and the Bangladesh Bank put its affirmative stamp on November 14, 2007 vide Bangladesh Bank BPRD circular letter no.-10 dated 22 November 2007. Prior to that shareholders of the bank approved the change of name in the Extra-Ordinary General Meeting held on 4 September 2007.

1.5 Birth of Logo:

The coat of arms of the new logo is inspired by traditional “shital Pati” or sleeping mat”. The knit and the pattern of interlace in the new logo that echoes the intricate weave of Shital Pati symbolizes bonding. This bonding reflects the new spirit of AB Bank.

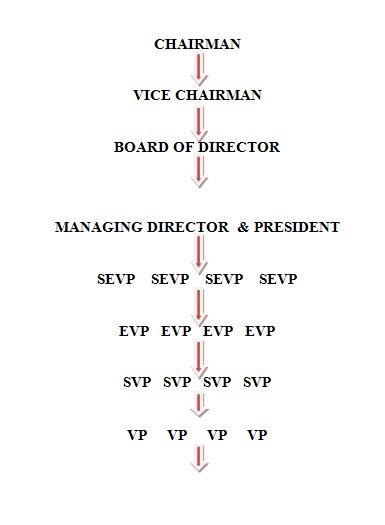

1.6 Management & Organizational Structure of ABBL

AB Bank Limited, the first private sector bank under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh incorporated on 31st December 1981, under the Companies Act (Act VII) of 1913 as a limited company having its Head Office in Dhaka. The Bank started functioning from 12th April 1982 with the approval of Bangladesh Bank under the guidelines, rules and regulations given for scheduled commercial banks operating in Bangladesh. It was initially a Joint Venture Commercial Bank between Bangladeshi sponsors and Dubai Bank Limited, Dubai (U.A.E).

1.7 Composition of the Board of Directors

Board of directors consists of Chairman, Vice Chairman, Directors and President & Managing Director and Company Secretary.

| Chairman | M. Wahidul Haque |

| Vice- Chairman | Salim Ahmed |

| Director | Feroz Ahmed |

| Director | M. A. Awal |

| Director | Shishir Ranjan Bose FCA |

| Director | Faheemul Huq |

| Director | Syed Afzal Hasan Uddin |

| Director | Mishaal Kabir |

| Director | Md Salah Uddin |

| Director | Md Mesbahul Hoque |

| Director | Md. Anwar Jamil Siddiqui |

| Director | Dr. M. Imtiaz Hossain |

| Director | Runa Zakia Shahrood Khan |

| President & Managing Director | Kaiser A. Chowdhury |

(Source: www.abbank.com)

1.8 Capital Structure of ABBL

The authorized share capital of AB Bank Ltd. Was Tk. 282.34 million, divided into 2.82 million ordinary shares of Tk. 100 each. The paid-up capital of the bank was Tk.85 million, out of which, Tk.80 million was provided by the sponsor directors. The government of the Peoples Republic of Bangladesh subscribed Tk. 5 million in the share capital of the Bank and has since nominated one director in the board as per Article 95 of the Memorandum and Article of Association in 1983. During 1984, issuing Public shares of Tk. 15 million raised the paid-up capital. The authorized capital has been raised to Tk.200 crore and paid up capital 74.32 crore as on 31.12.2007.

In the past paid up capital AB Bank, Dubai Bank Limited had the major share comprising 60% of total share holdings. Dubai Bank Ltd. Was the joint sponsor with the local four entrepreneurs. In 1986, Dubai Bank Ltd. Merged with the Union Bank of Middle East (UBME) and subsequently Union Bank of Middle East (UBME) inherited the shares. They continued as shareholders till early part of 1987 when they decided to off-load their investment in Bangladesh. In terms of Article 23 (a) and 23 (b) of the Articles of association of the company and with necessary approvals of the relevant authorities including the Bangladesh Bank, the shares held by them in the company have been transferred to Group “A” shareholders.

1.9 Milestones in the Development of the Organization

AB Bank reached 28 years of its journey, which started with a single Branch operation at Karwan Bazar, Dhaka way back in 1982. AB Bank being the pioneer in private sector banking in Bangladesh will be the first to achieve this milestone. Over the years, AB Bank has contributed in many ways towards development of the private sector banking in the country. AB thrived on customer service and relationship banking, which brought new dimensions to this particular service sector and many more new entrants to banking sector, followed AB.

Table 2.1: Corporate event of A B Bank Ltd.

| Commencement of Business: | February27 1982 |

| First meeting of the Board of Directors: | February 5, 1982 |

| Opening of the first Branch (Karwan Bazar Branch): | April 12, 1982 |

| Listing with Dhaka stock Exchange (DSE): | December 28,1983 |

| Publication of prospectus for IPO: | May 5.1984 |

| Opening of principal Branch | January 16,1986 |

| Opening of ABIFL-Subsidiary of Hong Kong | November 1995 |

| Listing with the Chittagong Stock Exchange | January, 1996 |

| First Foreign Branch at Mumbai, India | April 1996 |

| Launching of ATM | April 12,2002 |

| Operating of Merchant Banking Wing (MBW) | November 2 2002 |

| Incorporate of AB Bank Foundation | November 3 2003 |

| Launching of VISA Card | December 23,2004 |

| Operating of Islamic Banking Branch | December 23,2004 |

| Online Share Transaction in CDS | May 7 ,2006 |

| Obtained permission as a Security Custodian from Securities and Exchange Commission | January 22 ,2007 |

| Arab Bangladesh Bank Ltd. Changed its name to AB Bank Limited (ABBL) | November 14, 2007 |

| Raise the Authorized Capital Tk.600, 00, 00,000/- divided into 6, 00, 00,000 ordinary shares of Tk.100/- each | January 29, 2009 |

(Source: www.abbank.com)

1.10 Customer services

Like some bank AB Bank Limited (LTD) has also provide different types of services with his potential customers. The services of AB Bank Limited are:

v Corporate Service

- Floating of public Issue

- Loan syndication

v Personal banking Services

- Deposit account

Current Account

Saving Account

Short Term Deposit

Fixed Deposit

- Foreign Exchange Transaction

- Customer Credit Scheme

- E-cash 24 Hour Banking

- Branch Banking

- ATM and Credit Card

- Personal and Car Loan

- Safe Deposit Locker

- Utility Bill Payment

- Opening Student File

v International Trade and Foreign Exchange

v Lease financing

v Capital market Service

1.11 ORGANOGRAM:

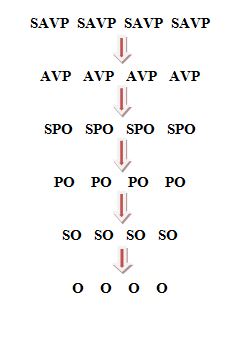

1.12 Introducing the branch

AB Bank Ltd. Karwan Bazar Branch is one of the largest branches of ABBL is located in BSEC Bhaban,Karwan Bazar C/A. It started its function in the year 1986. Presently there are 56 employees in this branch as of 31st March,2011 which includes One VP, two SAVP, Six AVPs, 4 Senior Principal Officers, 5 Principal Officers, 5 Senior Officers, 18 Officers, three Management Trainee Officer, One assistant and others are messengers, tellers, typist and security guards.

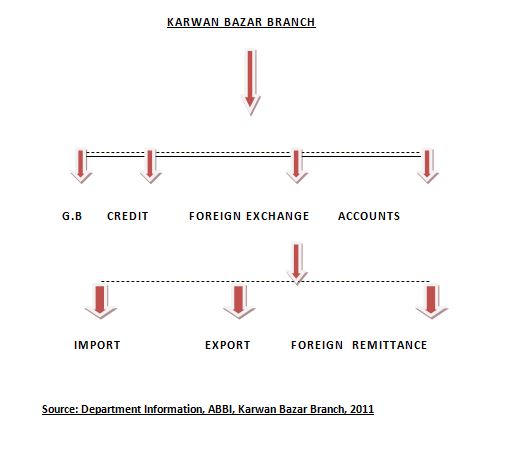

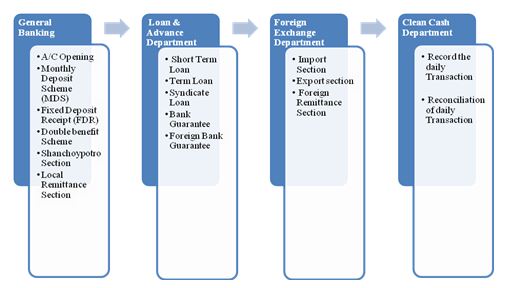

1.13 Flow Chart of Internship Organogram in AB Bank Ltd of Karwan Bazar Branch

1.14 Flow Chart of AB Bank Ltd. Karwan Bazar Branch:

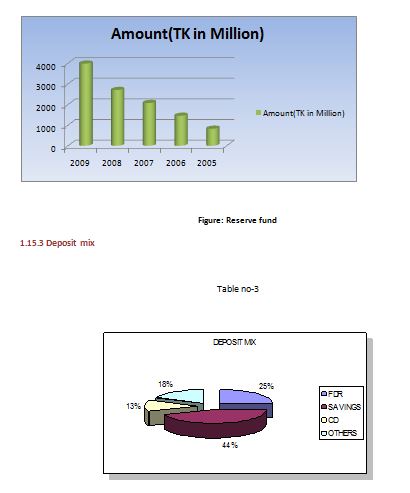

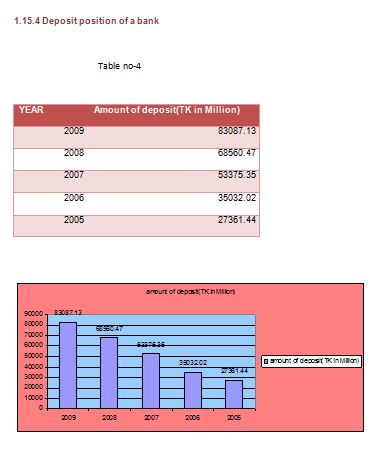

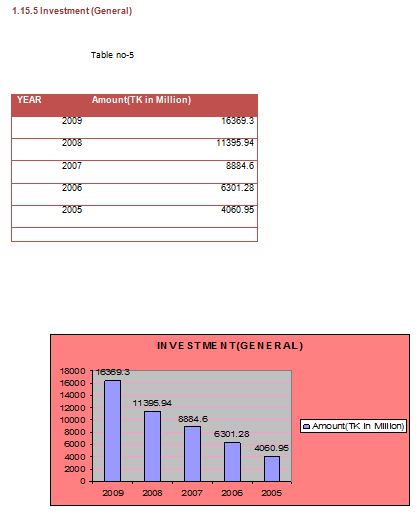

1.15 PERFORMANCE OF AB BANK

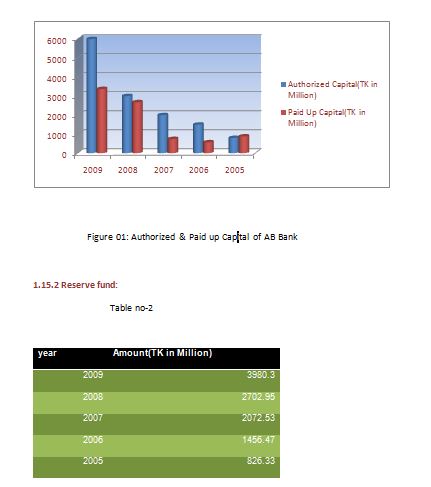

1.15.1 Analysis of Capital Structure:

Table no-1

| Year | Authorized Capital(TK in Million) | Paid Up Capital(TK in Million) |

2009 | 6000 | 3373.96 |

2008 | 3000 | 2677.75 |

2007 | 2000 | 743.26 |

2006 | 1500 | 571.14 |

2005 | 800 | 878.85 |

Chapter-2

INTRODUCTION OF THE STUDY

2.1 Introduction

It is necessary for all BBA (Bachelors of Business Students) to prepare an internship report at the end of this program. On the other hand internship is a course which is related to our course curriculum. As a student of BBA in American International University-Bangladesh (AIUB) my intention is to capture some theoretical concept and to know how implement this theoretical concept in our real life solution. Students are applying this concept in different organizations.

AB bank limited has started its business with all the features of a corporate Bank and the products of both corporate and retail banking system; to facilitate the daily clientele requirements. ABBL is always try to improve their service in every sectors but in today’s comprehensive business world AB banks need to offer additional concentration to the clients requirement in order to stay in the top.

In addition of all short of traditional banking activities, AB bank provides on-line banking service and a comprehensive range of financial service national and multinational companies in the country. It also undertakes the share and debentures, works as issue manager, and participates in other operations in MONAY MARKET and CAPITAL MARKAT. As a member of Dhaka stock exchange and Chittagong stock exchange.

Today is the time of competition. As a business student I am very interested to know the business world. On the other hand foreign trade is one of the parts of business. Foreign trade is divided in three categories like Import, Export and Remittance. Import and export both are related to letter of credit (L/C).

Letter of Credit is one kind of commitment or assurance or bank guarantee. The commitment is behalf of importer to exporter. If exporter will present his performance as far terms and condition and provide the asked documents, accordingly bank will make payment against the performance. There are different reason importers and exporters are involved in Letter of credit (L/C) like: Lack of trust between importers and exporters

contracts.Safe mode of transaction; Lack of confident to provide the payment in due date; Effective payment of shipping goods and services.

2.2 Rationale of the study

Foreign exchange transaction plays a vital role in the economic development of a nation. Foreign exchange transaction comprises both international trade & remittance. There are various rules and restrictions in international trade that means import and export transactions. To export or import any items the exporters or importers need financial support. The commercial banks of Bangladesh play an important role by providing them financial support through loan, various incentives and advising letter of credit. This paper empirically discuss with the rules, restrictions and procedures of foreign exchange transactions comprising LC advise, negotiation of documentary bills, repatriation of proceeds and its impact on profits. An easy and simple procedure of such transactions may help the exporters and importers to increase their business in future.

2.3 Scope of the report

The scope of the organizational part covers the organizational structure, background, vision, mission, objective, functions and rules, restrictions, procedures of foreign exchange transactions of the organization.

2.4 Objective of the study

To prepare the report I have acquainted with day-to-day foreign exchange functions of ABBL, know the progress of foreign exchange and foreign trade of ABBL, to gain in-depth knowledge of export, import and remittance of ABBL highlighting the foreign exchange activities of this bank. The primary & secondary objectives of this report are-

v Primary Objective

The main objective is to know the significant relation that exists between import-export and branch performance in this sector. On the other hand the significant relation that exists between import-export and business world.

v Secondary objective

To know and focus the whole import-export mechanisms.

To know and focus the remittances activates.

To know and focus the rules and regulation of import-export mechanisms.

Identify some problems and also make some recommendations.

To observe the working environment in commercial banks.

To apply theoretical knowledge in the practical field.

2.5 Methodology of the Report

Methodology includes-

* Direct observation

* Face-to-face discussion with employees of different departments

* Study of files, circulars and practical work.

* Annual Report of 2009 etc.

This study includes both quantitative and qualitative data. However, this report is basically qualitative in nature. In all the cases depending on the requirements data have been collected from different sources.

# Source of Data

This report is based on both primary & secondary sources of information that has been collected from the various sources like different publications, library sources, books, articles, etc. For collecting primary data, I ask the respective officer(s). Others are like –

* Exposure on different desk of the bank;

* File study.

* Getting information from face to face dealing with the client

* Personal interview with branch officials or executives

The secondary sources are –

* Annual Report of AB Bank Bangladesh Ltd,

* Web site of ABBL

* Periodicals published by the Bangladesh Bank;

* Different publications regarding banking functions, foreign exchange operation, and export-import policies.

# Time preference

The time preference of the study relates to the period covering the years 2005 to 2009. And also shown some analysis from 2008 to 2010 as a per month analysis & evaluation. All these years has been taken for different analysis purposes.

# Data processing and analysis

Data processing has been done manually after checking and editing. For analyzing excel is used.

2.6 Limitation of the study

AB Bank Ltd. is a large financial institution; therefore it is not possible to find out the true pictures within a short period. To prepare the report I faced some problems & limitations. Those limitations are unavoidable for me. That may causes reduction in the quality of my report. Some of the major problems are pointed below-

= Difficulties to communication and collect data.

= Difficulties to gather data in a specific way.

= In many cases, up to date information is not published.

= Organization confidentiality.

= Time constraints are one of the major problems/limitations to know the information.

Chapter-3

Foreign Trade & Foreign Exchange Transactions

(Theoretical Framework)

3.1 Foreign Exchange

Foreign Exchange means foreign currency and it includes any instrument

drawn, accepted, made or issued under clause (13), Article 16 of the Bangladesh Bank Order, 1972. All deposits, credits and balances payable in any foreign currency and draft, travelers cheque, letter of credit and bill of exchange expressed or drawn in Bangladeshi currency but payable in any foreign currencies.

Foreign Exchange Act. 1947 defines foreign exchange as “Foreign currency and includes deposits, credits, and balances payable in foreign currency as well as drafts, travelers cheques, letter of credit, bills of exchange drawn in local currency but , payable in foreign currency”.

According to Dr. Paul Einzig, “Foreign exchange is the system or process of converting one national currency into another and transferring money from thecountry to another.” Foreign exchange deals with foreign trade and foreign currency.

3.2 Foreign Trade

No country is self-sufficient in all the goods. Some countries have special advantage to produce some items. Bangladesh can manufacture readymade garments easily due to lower cost of labor. So Bangladesh is exporting readymade garments to USA where as USA is exporting machinery to Bangladesh due to their favorable transaction to that item. These kinds of cross border transaction or exchange of goods are called foreign trade.

3.3 Foreign Exchange and Foreign Trade

ABBL undertakes spot purchase and sales foreign currencies by deploying its own fund.

Foreign exchange and foreign trades of a country are conducted according to the law of that country. AB Bank Ltd. performs all its banking operations including foreign exchange activities according to that law.AB banks conduct their foreign exchange businesses mainly into two ways:

a) Bank provides service as an agent for the transaction and earns service charge, commission etc.

b) Bank invests its fund for the purchase of foreign currencies and sale of such currencies on the basis of present transaction and may earn profit thereof.

3.4 Foreign Exchange Transactions

Conversion of currencies or exchanges is known as foreign exchange transactions. The conversion may arise for a transaction between a bank and its customers or between a bank and another bank at home or abroad. The transaction involves at least two currencies. For a bank in Bangladesh, the process of conversion frequently involves conversion of Bangladeshi taka into foreign currencies or vice- versa.

For instance, one of the customers of your bank wishes to send an amount of $1000 to his son in USA. Assuming that this remittance is permissible or that permission from the exchange control authority has been obtained, you will issue a draft in favour of the beneficiary for $1000 drawn on your USA correspondent or a branch of yours, if any, in favour of your customer’s son and ask your customer to pay the equivalent amount in Taka. The transaction involves two things: payment of $ 1000 from your dollar account – your Nostro account maintained with your USA branch or correspondent and recovery of its taka equivalent at the ruling ready (spot) rate of exchange between taka and dollar. In another instance, your customer may ask you to buy a draft for Tk.10000 drawn on a bank in Iran towards the value of jute bags supplied to the Iranian buyer against a letter of credit open by a bank of Iran. If you are satisfied that the documents accompanying the drafts are in order, you will pay the taka amount and ask that bank of Iran to pay you equivalent amount in dollar or Iranian Real.

In the illustration given above, remittance of $1000 to USA would involve conversion of local currency into a foreign currency and in the later case the transaction would involve conversion of a foreign currency- dollar or Iranian Rial into local currency.

3.5 Wings of Foreign Exchange

A Bank’s Foreign exchange department has three definite wings through which foreign exchange transactions are conducted.

Foreign Exchange

Import Section Export Section Remittance Section

The achievement of AB Bank in the above three areas of foreign exchange business has been quite phenomenal. The Bank has been providing services to import and export trade and for repatriation of hard-earned foreign exchange of Bangladeshis living and working abroad and has, by now, consolidated its position in these areas. The following chapters will discuss about these areas in details.

Chapter-4

Wings of Foreign Exchange: Import

4.1 Introduction

Import trade of Bangladesh is controlled under the Import & Export control Act (IEC) 1950. Authorized Dealer Banks will import the goods into Bangladesh following import policy, public notice, F, E circular & other instructions from competent authorities from time to time.

Definition on Import:

Buying of goods & services form foreign countries for sales is considered as import. The person or organization who import the goods & services form foreign countries is known Importer and from which goods & services are imported is known as Exporter. In case of Import, the importers are asked by their Exporters to open a Letter of Credit (L/C). So that there payment against goods & services is ensured.

4.2 General Provision for Import

Regulation of Import – Import of goods under this order shall be regulated as under:

# Banned list: Banned goods are not allowed to import through the foreign exchange transaction. Such as Live Swine, Eggs of shrimps and prawns etc.

# Restricted list: Any item, which is restricted by the “Import Policy Order 1997-2002” in Annexure –1(b) shall be importable only on fulfilment of the conditions (b) specified therein against the item.

# Free Importable Items: The items which are not included either in the Banned list or Restricted list shall be freely importable:

# In addition to the conditions mentioned in the Restricted and Banned Lists the conditions restrictions and procedures for import of various items mentioned in the test portion of this Order, shall as usual apply in case of import of those items.

4.3General conditions of Import Goods

1) Import Trade Control Schedule Numbers- For import purpose use of new ITC Numbers with at least six digits corresponding to the classification of goods as given in the Import Trade Control Schedule 1998, based on the Harmonized Commodity Description and Coding System shall be mandatory.

2) NOC on the basis of ROR (Right of Refusal): No objection Certificate on the basis of right of Refusal form any authority shall not be required for import of any freely importable item by any Public Sector Agency. However, in cases where a public sector agency is required to import banned or restricted items included in the control list prior permission of the Ministry of Commerce shall have to be obtained on the basis of ROR issued by the ministry of Industries or by the Sponsoring Ministry/Division or by both as the case may be.

3) Restriction regarding source of procurement of goods:

(a) Goods from Israel or goods originating form that country shall not be importable. Goods shall also not be importable in the flag vessels of that country.

(b) All kinds of import from and export to Serbia and Montenegro, fragments of former Socialist Republic of Yugoslavia shall be banned.

4) Pre- Shipment Inspection: Unless otherwise specified pre-shipment inspection of imported goods shall not be obligatory in case of import be the private sector importers.

5) Shipment of Bangladesh Flag Vessels: Subject to waiver specified below shipment of goods shall normally be made on Bangladesh flag vessels.

4.4 Types of Importer

Goods are imported for personal use, commercial or industrial purpose. So there are three kinds of importer such as:

- Personal Importer.

- Commercial Importer.

- Industrial Importer.

4.5 Authorized Dealers

Authorised Dealer means a Bank, Authorised by Bangladesh Bank to deal in Foreign Exchange under the Foreign Exchange Regulation (FER) Act 1947. But there are some persons or firms, authorized by Bangladesh Bank to deal in Foreign Exchange with limited scope are called Authorized Money Changers. To get a license for authorization a bank will apply the General Manager, Foreign Exchange Policy Department, Bangladesh Bank, Head Office, Dhaka complying the subsequent conditions:

- The Bank must have adequate manpower trained in Foreign Exchange.

- Prospect to attract reasonable volume of Foreign Exchange business in the desired location.

- The bank meticulously complies with the instruction of Bangladesh Bank.

- The bank will commit to deal in Foreign Exchange within the limit & will submit periodical returns as instructed by Bangladesh Bank.

4.5.1 Functions of Authorized Dealer

Authorized Dealer can handle all kinds of Foreign Exchange transaction as per Foreign Exchange Regulation (FER) Act 1947 under the instruction of Bangladesh Bank. Following are the main function of an Authorized Dealer:

- Exchange of Foreign Currencies.

- To make arrangement with Foreign Correspondent.

- Buying & Selling Foreign currencies.

- Handling of Inward & Outward Remittance

- Opening of L/C & Settlement of Payment.

- Investment in Foreign Trade.

- Opening & Maintenance of Accounts with Foreign Banks under intimation to Bangladesh Bank.

- Export Documents handling.

4.6 Letter of Credit (L/C)

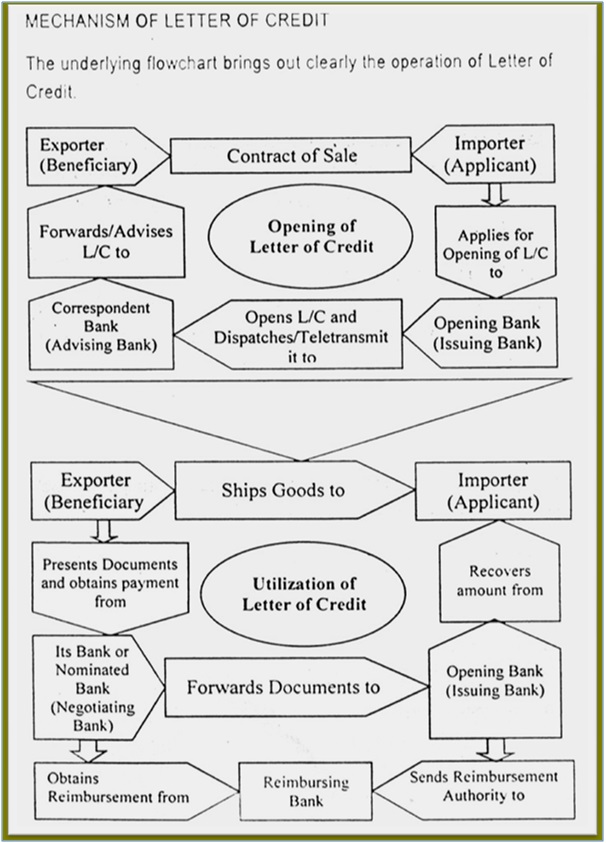

Letter of Credit (L/C) is a payment guarantee to the seller by the issuing bank on behalf of the importer. In other words, it is a letter of the Issuing Bank to the beneficiary undertaking to effect payment under some agreed conditions. L/C is called documentary Letter of Credit, because the undertaking of the Issuing Bank is subject to presentation of some specified documents. Through the L/C Buyers & Sellers enter into a contract for buying and selling goods/ services and the buyer instructs his bank to issue L/C in favour of the seller. Here bank assumes fiduciary function between the buyer and seller.

4.6.1 Flowchart of L/C

Accounting treatment for opening L/C:

For opening L/C, importer will apply to the issuing bank. In that case, importer is called applicant or opener. After opening it bank will create a contingent liability. In that case, the accounting posting will be the following-

Customer liability …….. Dr.

Contingent liability………..Cr.

- While paying money but the issuing bank, issuing bank will reverse the above entry & the entry will be-

Contingent liability…….. Dr.

Customers liability…………..Cr.

- Then the issuing bank will give another entry-

Payment Against Document(PAD)……….. Dr.

AB General Account…………………………….. Cr.

Exchange gain…………………………………….Cr.

PAD will debit because the bank will pay the money against some documents. AB General Account is a miscellaneous account. It will be credited because by this entry ABBL creates a liability. He has to pay the money to the advising bank. & the gain made by the transaction is shown at Exchange Gain Account. All this entries are made after receiving some documents from the exporters. The above procedure is called Lodging. After giving the above entry, ABBL will inform the clients for collecting the documents from the bank.

After opening L/C, ABBL (Issuing Bank) must receive the documents for any other proceedings. These documents are-

- Bill of Lading

- Invoice

- Packing List

- Country of Origin

4.7 Different Parties to a Documentary Credit

Normally the subsequent parties are related to a documentary credit. Such as

1) The Issuing Bank: This is the bank who issues Documentary credit on account of it’s client.

2) The advising Bank: This is a Bank acting as Agent of the Issuing Bank, to advise the L/C to the beneficiary.

3) The confirming Bank: This Bank gives the beneficiary a double assurance of payment. This is a third Bank undertake to make payment, to the beneficiary, if the Issuing Bank fail to make Payment.

4) Negotiating Bank: This Bank provides value to the beneficiary against presentation of documents complying credit terms. Usually this is exporter’s Bank who purchases the export documents.

5) Reimbursing Bank: This is a Bank acting as Agent of the Issuing Bank Authorised to make payment or to honour reimbursing claim of the Negotiating Bank.

6) The Transferring Bank: If the L/C is transferable then the 1st beneficiary through a bank nominated by the Issuing Bank this bank is called the Transferring Bank.

7) The Applicant: Importer or buyer is the applicant of a Letter of Credit. Applicant must be the client of the Issuing Bank.

8) The beneficiary: Exporter or Seller of the goods is the Beneficiary of a Letter of Credit.

9) Notify Party: The Party / Bank to whom the arrival of shipment has to be notified or to be informed is called notify party.

4.8 Import Procedure

To import a person should be an importer. In accordance with Import & Export Control Act, 1950 the office of chief Controller of Import & Export provides the registration (TRC) to the importer. After getting this person has to secure a letter of credit authorization from Bangladesh Bank. Then he becomes a qualified importer; He is the person who requests or instructs the opening bank to open an L/C. He is also called opener or applicant of the Letter of Credit.

4.8.1 Import Registration Certificate

Import Registration Certificates are issued by the office of chief controller of imports and exports. Intending importers are to submit applications to CCI & for registration along with required documents are as follows:

- I. Application

- II. Trade License

- III. Nationality Certificate

- IV. Income tax certificate along with TIN

- V. Bank Certificate

- VI. Membership certificate from Trade Association Certificate of incorporation, Article and Memorandum of Association. Partnership Deed for partnership firm.

4.8.2 Procedure for Registration

To obtain import registration certificate (IRC) the applicant will submit the following paper to the CCI & E through this nominated Bank.

a) Questionnaire duly filled in & signed by the applicant

b) Trade License

c) Membership certificate from chamber of commerce or any other trade Association

d) Nationality Certificate

e) Income tax registration certificate.

f) Partnership deed/certificate of registration with the register of join stock companies where applicable.

On being satisfied, the CCI & E issues IRC obtain original copy of treasury challan for payment of registration fee.

4.9 Preliminary Steps for Opening L/C

Before opening the L/C Bank will takes the subsequent steps:

1) Applicant to be Bank’s A/C Holder: Bank will open the L/C on behalf of an entity who has an account with the Bank. Unknown person will not be allowed to open L/C.

2) Registered importer: Before opening the L/C bank must confirm that the L/C applicant is a registered importer or personal user, and the IRC of the importer has been renewed for the current year.

3) Permissible item: The item to be imported must be permissible and not banned item. If the item is from conditional list, the condition must fulfill to import the same.

4) Market Report: Bank will verify the marketability of the item & market price of the goods. Some times the importer may misappropriate the Bank’s money through over invoicing.

5) Sufficient Security or margin: Price of some items fluctuates frequently. In case of those items Bank will be more careful to take sufficient cash margin or other security.

6) Business Establishment: Bank should not open an L/C on be half of a floating businessman. The importer must have business establishment, particularly he must have business network for marketing the item to be imported.

7) Restricted Country: Goods not to be imported from Israil.

8) Credit report of the beneficiary: It the amount of L/C in one item exceeds TK. 5.00 lac, suppliers credit report is mandatory. Bank will collect credit report of the beneficiary through its correspondent in abroad.

9) Application of the client to open the L/C: The client will approach to open the L/C in Bank’s prescribed form, duly stamped & signed, along with the following paper & documents: Such as

- Indent / Performa invoice.

- Insurance cover note with money receipt.

- LCAF duly filled in & signed.

- Membership certificate form chamber of commerce / Trade Association.

- Tax payment certificate / declaration.

- IMP & TM form signed by the importer

- Charge documents

- IRC, Pass book, Trade license Membership certificate & VAT, registration certificate in case of new client.

- Export L/C in case of back-to-back L/C.

10) Permission From Ministry of Commerce: If the goods to be imported under CIF (cost insurance & freight), then permission form ministry of commerce to be obtained.

11) Creditability of the Client: In consideration of all the above points, if Bank become satisfied regarding the client then L/C may be ope3ned on behalf of the client. Before opening the L/C bank will issue & authenticate a set of LCAF in the name of the importer.

4.10 Presentation of the Documents

The seller being satisfied with the terms and the conditions of the credit proceeds to dispatch the required goods to the buyer. Them he has to present the documents evidencing dispatching of goods to the negotiating bank on or before the stipulated expiry date of the credit. After receiving all the documents, the negotiating bank them checks the document against the credit. If the documents are found in order the bank will pay accept or negotiate to Bank. Then bank checks the documents. The usual documents are:

- Invoice

- Bill of lading

- Certificate of origin

- Packing List

- Shipping Advice

- Nor negotiable copy of bill of lading

- Bill of exchange

- Pre-shipment inspection report

- Shipment Certificate

4.11 Steps Involved in Import procedures:

# Procurement of IRC from the concerned authority

# Signing purchase contract with the seller

# Requesting the concerned bank (importer’s bank) to open an L/C on behalf of the importer favouring the exporter/seller/beneficiary.

# The issuing bank opens/issues the L/C in accordance with the instructions/request of the importer & request another bank(advising bank) located in sellers /exporter’s country to advice the L/C to the beneficiary. The issuing may also request the advising bank to confirm the credit, if necessary.

# The advising bank advises the seller that the L/C has been issued.

# As soon as the exporter /seller receives the L/C & is satisfied that he can meet L/C terms & conditions, he is in a position to make shipment of the goods.

# After making shipment of the goods in favour of the importer the exporter’s submit the documents to the negotiating bank for negotiation.

Chapter-5

Wings of Foreign Exchange: Export

5.1 Introduction

The export policy 1997-2002 has been formulated by the government to operate within imperative and opportunities of the market economy with a view to maximizing export growth and narrowing down the gap between import payment and export earning. As per existing Export Policy an Exporter can export any goods or services except the items listed as band and restricted in the said policy.Duration of present EPO-5 years effected from 1st July 1998, but valid till announcement of new policy.

Foreign Exchange Regulation Act, 1947 Clearly states that nobody can export by post and otherwise than by post any goods either directly or indirectly to any place outside Bangladesh, unless a declaration is furnished by the exporter to the collector of customs or to such other person as the Bangladesh Bank (BB) may specify in this behalf that foreign exchange representing the full export value of the goods has been or will be disposed of in a manner and within a period specified by BB. So a clear lawful procedure must be followed in case of export of goods & services.

5.2 Meaning of export

– Selling goods to foreign countries against of foreign currency.

– Export means lawfully carrying get of anything from one country to another country for sale. The import and export trade of the country is regulated by the IEC Act. 1950.

5.3 Export Policy

As per export policy order, 1997-2002 now in force an exporter can export any goods or services except the items listed as banned and restricted in the said policy.

5.3.1 Objectives of Export / Export Policy

Growth of national wealth, increase of production in export sectors, generation of employment & flow of capital and to achieve the growth of GDP target @7%.

5.3.2 Exporter Registration

An exporter must obtain Export Registration Certificate from the office of the Chief Controller of Import & Export (CCI & E). The procedure for obtaining Export Registration Certificate (ERC). Procedures for obtaining export registration certificate (ERC) from the CCI & E, the following documents are required:

1) Application as per format prescribed by CCI & E.

2) Bank Solvency Certificate.

3) Membership Certificate from a Chamber of Commerce.

4) Nationality certificate.

5) Partnership deed (Registered / Un-Registered) for partnership business concern.

6) Memorandum & Articles of Association & its incorporation certificate for public limited company.

7) Income Tax payment certificate (TIN)

8) Recent passport size photographs of the applicant.

9) Treasury challan showing payment of fees for ERC.

5.3.3 Securing the order:

After getting ERC Certificate the exporter may proceed to secure the export order. He can do this by contacting the buyers directly or through agent. In this purpose the exporter may get help from:

- Licence officer

- Buyers local agent

- Export promotion organization

- Bangladesh Mission Abroad

- Chamber of Commerce(local & foreign)

- Trade fair etc

5.4 Classification of Export

i. Export under L/C: Exporters are allowed to export the commodity under irrevocable L/C, under this type of export, exporter will ship the goods as per terms of the credit and will get payment as per arrangement of the credit.

ii. A firm Contract/Consignment Basis Export: Exports are allowed against firm contract. As per contract, exporter will ship the goods and the buyer will make payment after selling the consignment.

iii. Export against Advance Payment: Sometimes exporter receives payment in advance. In that case AD should obtain a declaration from the exporter on the “Advance Receipt Voucher certifying the purpose of the remittance. Then the exporter will export the goods against the advance payment. Export section ABBL, New market Branch deals with two types of L/C that are as follows-

5.5 Back-to-back letter of credit

Back-to-back L/C is a secondary L/C (New Import L/C) opened by the seller’s bank based on the original L/C (Master L/C) to purchase the raw materials and accessories for manufacturing of the export product (s) required by the seller.

Under the ‘Back to Back’ concept, the seller as the Beneficiary of the master L/C offer it as a ‘security’ to the advising Bank for the issuance of the second L/C. The beneficiary of the Back-to-Back L/C may be located inside or outside the original beneficiary’s country. In case of a Bark-to-Back L/C, the bank takes no cash security (margin). Bank liens the Master L/C and the drawn bill is an Usance/ Time bill.

5.6 Export letter of credit

The other type of L/C facility offered by the bank is Export L/C. Bangladesh exports a large quantity of goods and services to foreign households. Readymade textile garments (both knitted and wove), jute, jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exporters exports to foreign countries. Garments Sector Is the largest sector that exports the lion share of the country’s export. Bangladesh exports most of its ready-made garments products to USA and European Community (EC) countries. Bangladesh exports about 40% of its readymade garments products to USA.

5.6.1 Formalities Required for Export L/C

The export trade of the country is regulated by the Imports & Exports (Control) Act, 1950. There are a number of formalities that an exporter has to fulfill before and after shipment of goods. These formalities or procedures are enumerated as follows –

A. EXPORT REGISTRATION CERTIFICATE (ERC): The exports from Bangladesh are subject to export trade control exercised by the Ministry of Commerce through Chief Controller of Imports & Exports (CCI&E). No exporter is allowed to export any commodity permissible for export from Bangladesh unless he is registered with CCI&E and holds valid ERC. The ERC is required to be renewed every year. The ERC number is to be incorporated on EXP (Export) Forms and other documents connected with exports.

B. THE EXP FORM: Foreign Exchange Regulation (FER) Act- 1947 prohibit export of any goods directly or indirectly to any place outside Bangladesh unless the exporter furnish a declaration to the effect that the export value of goods has been or will be repatriated into the country within a period time specified by the Bangladesh Bank. So, repatriation of export proceed is mandatory for all exported goods or services. Accordingly, before shipment of goods an exporter must declare on Export Form (Exp) prescribed by Bangladesh Bank and issued by the Authorized Dealer (Exporters Bank). The EXP Forms are numbered serially and issued in quadruplicate. For delay in repatriation of export proceeds or non-realization of export proceeds, the exporters render themselves for action under Foreign Exchange Regulation Act 1947. Authorized Dealers (AD) and their officials who certify the export forms also render themselves of such action by the Central bank. An EXP Form usually contains the following particulars –

i. Name and address of the Authorized Dealer;

ii. Particulars of the commodity to be exported with particulars and code no;

iii. Country of destination;

iv. Port of destination;

v. Quantity;

vi. L/C value in foreign currency;

vii. Terms of sale;

viii. Name and address of Importer/ Consignee;

ix. Bill of Lading/Railway Receipt/Airway Bill/Truck Receipt/Post Parcel Receipt no. and date;

x. Port of Shipment/Post Office of Dispatch;

xi Land custom post

xii. Shipment Date;

xiii. Name of the Exporter with address;

xiv. Registration number and date;

xv. Sector (public or private) under which the exporter fails.

C. SECURING THE ORDER: Upon registration, the exporter may proceed to secure the export order. Contracting the buyers directly through correspondence can do this.

D. SIGNING of THE CONTRACT: While making a contract, the following points are to be mentioned: a) Description of the goods;

b) Quantity of the commodity;

c) Price of the commodity;

d) Shipment; e) Insurance and marks;

f) Inspection, and

g) Arbitration.

E. PROCURING THE MATERIALS: After making the deal and on having the L/C opened in his favour, the next step for the exporter is set about the task of procuring or manufacturing the contracted merchandise.

F. REGISTRATION of SALE: This is needed when the proposed items to be exported are raw jute and jute-made goods.

G. SHIPMENT OF GOODS: The following documents are normally involved at the stage of shipment: (a) EXP From, (b) photocopy of registration certificate, (c) photocopy of contract, (d) photocopy of the L/C, (e) customs copy of ERF Form for shipment of jute-made goods and EPC Form for raw jute, (f) freight certificate from the bank in case of payment of the freight if the port of lading is involved, (g) railway receipt, berg receipt or truck receipt, (h) shipping instructions, and (i) insurance policy.

5.7 Export Documents:

After due passing of EXP, the exporter then execute shipment. As evidence of export and as per terms of the export L/C, Contract, exporter must prepare document in order to get his payment and to facilitate release of goods by the buyer abroad. Document are of (2 (two) types.

i) Financial document: The Financial document, prepared by exporter is known as Bill of Exchange or Draft. It is prepare by the exporter directing the L/C issuing Bank to pay sum of money at a certain date or determinable future time to negotiating Bank or order. The parties to a Drafts are Drawer, Drawee, Payee, Endorser & Endorsee..

ii)Commercial Document : The documents evidencing description and other details of goods shipped and supporting other terms and condition of L/C Contract are commercial documents.

Some Vital commercial documents are:

Invoice/ Commercial Invoice

Bill of Lading/Airway bill/Truck Receipt

Packing/ weighment/ Measurement List

Certificate of origin

Pre-shipment Certificate

GSP Certificate issued by EPB.

5.8 inland letter of credit (ILC)

ILC means L/C within the same country. This type of L/Cs is opened when seller does not believe the buyer though they are in the same country and also in the cases where the sales contract is of a big amount. ABBL has couple of ILC.

5.8.1 Settlement of local bill

The settlement of local bills is done in the following ways –

- The customer submits the L/C to the branch along with the documents to negotiate

- The branch officials scrutinizes the documents to ensure the conformity with the terms and conditions;

- The documents are then forwarded to the L/C Opening Bank;

- The L/C Issuing Bank gives the acceptance and forwards an acceptance letter;

Payment is given to the customer on either by collection basis or by purchasing the document.

A LBPD Register is maintained to record the acceptance of the issuing bank. Until the acceptance is obtained, the record is kept in a collection register.

5.8.2 modes of payment for export bills under L/C

Broadly payment methods under a L/C are as follows-

Payment Method

Sight Payment Deferred Payment

I) SIGHT PAYMENT CREDIT: In a Sight Payment Credit, the bank pays the stipulated sum immediately against the exporter’s presentation of the documents.

II) DEFERRED PAYMENT CREDIT: In deferred payment, the bank agrees to pay on a specified future date or event, after presentation of the export documents. No bill of exchange is involved. In UBL, payment is given to the party at the rate of D.A 60-90-120-180 as the case may be. But the Head office is paid at T.T clean rate. The difference between the two rates us the exchange trading for the branch. Another two types come under the same heads. These are as follows-

- NEGOTIATION CREDIT: In Negotiation credit, the exporter has to present a bill of exchange, payable to him in addition to other documents, that the bank negotiates.

- acceptance CREDIT: In acceptance credit, the exporter presents a bill of exchange payable to him and drawn at the agreed tenor (that is, on a specified future date or event) on the bank that is to accept it. The bank signs its acceptance on the bill and returns it to the exporter. The exporter can then represent it for payment on maturity. Alternatively he can discount it in order to obtain immediate payment.

5.8.3 advising L/C

When export L/C is transmitted to the bank for advising, the bank sends an Advising Letter to the beneficiary depicting that L/C has been issued.

5.8.4 Test key arrangement

Test key arrangement is a secret code maid by the banks for the authentication for their telex massage. It is a systematic procedure by which a test number is given and the person to whom this number is given can easily authenticate the same test number by maintaining that same procedure. ABBL has test key arrangements with so many banks for the authentication of L/C messages and for transfer of funds,

5.8.5 Export Financing

To meet up the cost of the goods to be exported, the exporter may require Bank finance. Besides, he may require finance for godown rent, electricity bill, freight etc. Even after shipment of the goods, exporter may require Bank finance to meet-up his current expenditure up to repatriation of the export proceeds. There are two types of export finance:

i) Pre-shipment Finance

Pre-shipment investment is finance, allowed by a Bank to an exporter, to meet the cost up to the shipment of the goods to overseas buyer. The purpose to the investment is to purchase Raw materials or finished goods or manufacturing processing. Packing and transporting the goods.

ii) Post -Shipment Finance

There is a fine gap between export of the goods and realization of the proceeds. So exporter may require finance in that period to continue his business. So bank may finance against export documents ensuring the following:

a. Export documents comply with the credit terms.

b. Buyer is bonafide.

c. Party’s past performance is satisfactory.

d. Any other security in case of export under contract.

5.9 Settlement for Export Claims

In terms of export policy order 1997-2002 of exchange control Manual Bangladesh Bank, produces of export bills must be repatriated within a maximum period of four months. This is period may be extended by Bangladesh Bank on reasonable grounds, it has already been pointed out that side by emphasis has also been given on settlement of the foreign buyer’s claims arising out exports, as quick settlement of export claims is an indirect incentive to the overseas buyer for our products. If the buyer becomes reluctant to accept discrepant documents without discount. like may allow discount on the request of the exporter, if discount is less than 10% of the export value, subject to post facto approval from export promotion Bureau. If the discount is more than 10% prior approval is required is required. Foreign commission, brokerage or other trade charges related to export might be allowed up to 5% without Bangladesh bank permission, but for more than 5%, permission is required. In case of export of books, journals, and magazines, 33% discount id allowable. Export claim may be deducted from the bill value or may be remitted against claim after full realization of the export proceeds.

5.10 A Simple flowchart of Export Business Mechanism

Exporter- Consult Export Policy order get ERC

¯

Contract Buyer-Settle sales terms

¯

Issue Pro-forma Invoice – to exporter abroad

¯

Export L/C-Check carefully by exporter & exporter’s Bank

¯

EXP Passing – Issued by AD signed by exporter and AD

¯

Shipment – Submit document of goods or the item exported Documents

¯

Submit document by the exporter to their Bank

¯

Negotiation – Payment made by the exporter bank to the exporter

Or Collection – I documents are discrepant/ unaccepted

¯

Reimbursement – Getting payment by the negotiating Bank

Chapter-6

Wings of Foreign Exchange: Remittance

6.1 Introduction

Remittance means sum of money remitted from one place to another. We send money from one place to another through post office, Banks etc. When money is transferred from one country to another then it is called foreign remittance. In all respect ABBL follows exchange control manual published in I986 by Bangladesh Bank. Respect of foreign remittance we are to follow that manual and circular time to lime from circulated Bangladesh Bank.

6.2 What is Remittance?

Remittance means transfer of money/funds from one place to another. Money fund goes comes from one place to another through post office, Bank, etc.

6.3. Types of Remittance

- Inward Remittance

- Outward Remittance

Inward: Inward remittance means remittance received from foreign countries or abroad.

Outward: When foreign currency transferred from home country to other country them it is called foreign outward remittance.

6.4 Instrument of Remittance-

1. Cash

2. TC (Travelers Cheque)

3. FDD (Foreign Demand Draft)

I. TT (Telegraphic transfer)

5. MI (Mail Transfer)

6. PO (Payment Order)

7. IMO (International money order)

8. Cheque etc.

Foreign currency A/Cs under WES which plays a vital role on our all foreign exchange are opened by Bangladesh Nationals serving and earning abroad having income from sources other than Bangladesh (FCAD, FCAP, PC AY, RCADM). It is noted that current A/C also plays a vital role in foreign business.

Upon approach by the PLS A/C holder the respective A/C is opened by A/D

amongst others as under-

1) Filling properly the relative A/C opening form.

2) Obtaining declaration

3) Copy of passport- 1 st 7 pages i-e- upto visa (original PP to produce)

4) Service contract.

5) Letter of authority

6) 3 PP size photos of the A/C holder

7) 1 PP size Photos of the nominee

8) Signature cards due and both A/C holder and nominee etc.

6.5 Foreign Remittance (Inward)

Inward remittance coining in to our country from other countries financed by the purchases of freely convertible foreign countries by A/D defeat to non Resident Thana A/Cs of foreign banks.

6.5.1 Purposes of inward Remittance

1. Indenting commission

2. Donation

3. Family maintenance Draft

4. Export proceeds

5. Foreign investment

6. Others.

6.6 Foreign Remittance (Outward)

When foreign Currency transferred from home country to other it is called foreign outward remittance. Generally it includes all the remittance of invisible items: in broad sense it also includes the remittances against visible items.

On March 24, 2004 Bangladeshi Taka was declared convertible for current account international transaction. As a result remittance becomes more liberalized.

Outward remittance include sale of Foreign Currency by T.T, M.T, Draft, T.C or in cash for private, official and commercial purpose.

6.6.1 Who can remit?

a) Any Bangladeshi Nationals who want to travel can remit/bear foreign currency up to a minimum limit fixed by Bangladesh Bank from time to time.

b) Exporters for business travel as per quota fixed by Bangladesh Bank

c) Student who are residing abroad for study purpose having permission from

Bangladesh Govt./Bangladesh Bank.

d) Medical treatment and other purposes having Bangladesh Bank permission.

e) Bangladeshi Nationals warring abroad can also remit out of balance held in their foreign currency A/Cs against direct remittances.

f) Foreign Nationals, Diplomatic missions, Embassy, juridical persons etc. Working/ residing in our country may also remit out of the fund already remitted to our country.

g) Foreign nationals come to our country for visit purpose and on cash foreign currency into local currency may also remit in freeing currency upto maximum limit of his convened amount.

h) In Foreign National those who are working in our country also remit out of their salary subject to approval of a Bangladesh Bank’ Bangladesh Bank/Bangladesh Govt. (excluding f)

i) Importers may also allow remitting foreign currency for their import as per import policy of Bangladesh Government.

j) Any persons who want to take sample from abroad may also remit foreign currency as per Bangladesh Bank Rule

6.6.2 Instrument of Outward Remittance

a) Cash (say US Dollar, Stg. SRL etc.)

b) TC (Say US Dollar, Stg. SRL etc.)

c) T.T (Telegraphic transfer or cable transfer).

d) M.T (Mail Transfer).

e) P.0 (Payment Order).

f) I.M.O (International Money Order).

g) Cheque etc.

6.6.3 Papers/ document to be obtained for out ward remittance

a) For Import Imp. Form duly signed.

b) Oilier than import T/M form to be filled in.

c) Permission from Bangladesh Bank if and when required.

d) Papers regarding on casement when issued foreign travels.

e) Declaration signed by the applicant in case of issuance or foreign currency for membership, fees for application, registration, admission examination (TOFEEL, SAT etc.)

6.7 Present limit for outward remittance

A. Private Remittance

I) Family Maintenance:

a) Foreign nationals working in Bangladesh may remit 50% of salary and 100% of leave salary as also actual savings and admissible pension benefits for their family maintenance.

b) Moderate amount of foreign currency for maintenance abroad of family members (spouse, children, parents) of Bangladesh nationals are allowed.

II) Membership/Registration fees etc;

ADs are allowed to remit membership fees of foreign professionals and scientific institutions and fees for application, registration, admission, examinations in connection with admission into foreign educational institutions, supported by demand notice1 or letter of the concerned institution.

III) Education:

ADs may release foreign exchange favoring Bangladeshi students staying abroad or willing to proceed abroad for study. According to the following drill :

i. Application by the student as per prescribed format

ii. Admission letter issued by the concerned institution

iii. Estimate relating to tuition fee lodging and incidental expense issued by the concerned institution

iv. Attested copies of educational certificates

v. Valid passport

IV) Travel:

Private travel quota entitlement of Bangladeshi national is set at US$ 3,000 per year for visit to countries other than SAARC member countries and Myanmar. Quota for SAARC member countries and Myanmar is US$ 1,000 for travel by air and US$ 500 for travel by overland route.

V) Health and Medical:

The ADs may release up to US$ 10,000 for medical treatment abroad on the basis of the recommendation of the medical board.

VI) “Foreign nationals

a) The ADs may issue T.C. to foreign nationals without any limit and currency notes up to US& 300 against surrender of equivalent foreign currency.

b) ADs may allow re-conversion of unspent taka fund of foreign tourist exchange on production Encashment Certificate of Foreign Currency

VII) Remittance for hajj:

ADs may release F.C. to the intending pilgrims as per institutions / circular to be issued by Bangladesh Bank each year.

B) Official and business travel / travel quota for new exporter

ADs may release up to US$ 6,000 to a new exporter for business travel abroad against recommendation of EPB.

travel quota for importer

1. Subject to annual upper limit of US$ 5,000 importers are entitled to a

Business Travel quota @ 1% of their imports settled during the previous

financial year.

2. Local products are also entitled to a Business Travel quota as above.

C. Exporters retention quota

Merchandise exporters may retain up to 40% realized FOB value of their export. It is 7.5% for export of goods having high import content.

6.8 MONEY TRANSFER:

Foreign Remittance through Exchange House

For Inward Remittance, AB Bank established extensive drawing arrangement network with Banks and Exchange Companies located in the important countries of the world.

Ria financial services:

RIA Financial Services, Inc. (“Ria”), a subsidiary of Euronet Worldwide, Inc. (NASDAQ: EEFT) and a leading global money transfer company, money transfer can be done worldwide in over 85 countries. Since being set up in 1987 Ria has become the third-largest global money transfer company. It provides a fast, reliable and secure money transfer service using quality technology to ensure easiest and fastest ways to send money to Gambia.

AB Bank ltd has signed an electronic fund transfer (EFT) agreement with Ria Financial Services, a US-based worldwide money transfer company, says a press release. Ria Financial Services has a network of more than 11000 agents & 100 retails worldwide. It mainly operates in 48 US states,Canada, Europe,Asia,Australia 7 the Dominician Republic.This new service will give expatriate Bangladeshis around the world hassle-free remittance facilities. Kaiser A. Chowdhury, Presedient & Managing director of AB Bank Limited & juan Bianchi, President & CEO of Ria Financial Services, signed the agreement on behalf of their sides in Dhaka.

Chapter-7

Analytical Part of the Project

7.1 Introduction

The banking sector of Bangladesh played an important role towards economic growth of Bangladesh. From the beginning of financial year 2009 Bangladesh Bank took initiatives in reforming financial sector. Steps for prevention of money laundering, loan write off policy and effective measures to gain accountability and transparency made banking operations more acceptable. As a result, the image of banking sector has been elevated. Bangladesh Bank also identified five core risks areas for management of the banks and provided necessary guidelines for implementation. Those are: Foreign Exchange Risk Management, Asset Liability Management, Prevention of Money Laundering, Credit Risk Management, Internal Control and Compliance. This initiative will bring in overall discipline in the sector and enhance operational profit. AB Bank also maintains the rules and procedures impose by BB and try to overcome the adverse situation and contribute in the economic growth of the country.

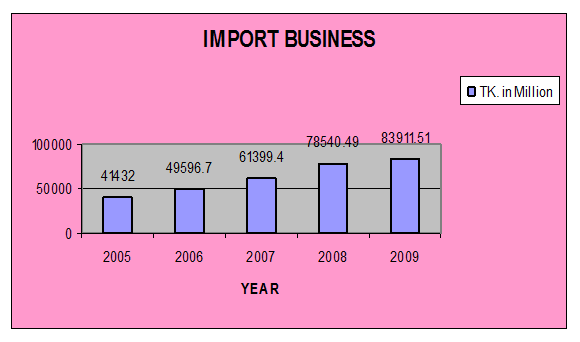

7.2 IMPORT

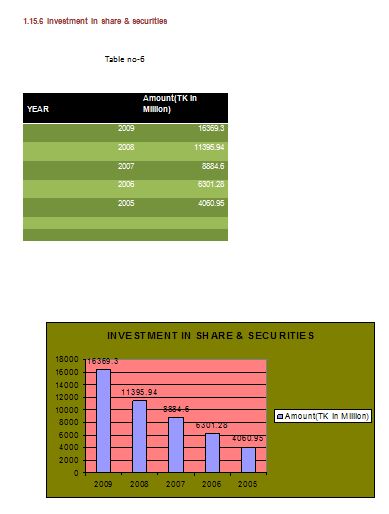

Here the IMPORT from year 2005-2009 are analyzed and try to show its impact :

(Tk. in million)

| Particulars | 2009 | 2008 | 2007 | 2006 | 2005 |

| Import Business | 83911.51 | 78540.49 | 61399.4 | 49596.7 | 41432 |

Export Business76240.7776465.6255790.4246234.631285Foreign Remittance2452.331428.46710.32343.8223

This chart simply shows in 2009 import business stood at Tk. 83911.51 million as compared to the volume of Tk. 78540.49 million in 2008.from 2005 to 2009, it is increasing.

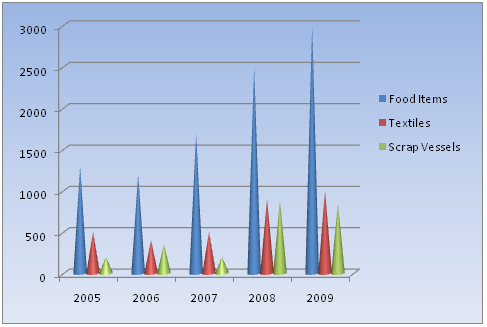

International trade is one of the important components of the AB Banks foreign exchange business. Major Import finance was in the areas of food items, textiles & scrap vessels among others.

MAJOR IMPORT BY AB BANK(FIG.IN CRORE)

| YEAR | 2005 | 2006 | 2007 | 2008 | 2009 |

| Food Items | 1300 | 1200 | 1700 | 2500 | 3000 |

| Textiles | 500 | 400 | 500 | 900 | 1000 |

| Scrap Vessels | 200 | 350 | 200 | 880 | 845 |

Fig: Import as a item wise from 2005 to 2009

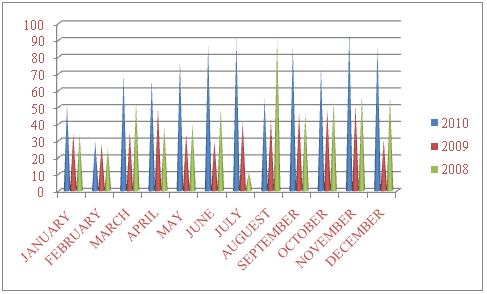

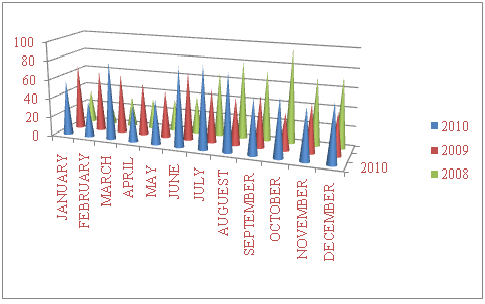

Import as a per month from 2008 to 2010 are given below:

TK. In Crore.

| MONTH | 2010 | 2009 | 2008 |

| JANUARY | 50.9 | 34.06 | 33.37 |

| FEBRUARY | 29.2 | 27.68 | 25.34 |

| MARCH | 69.14 | 34.69 | 52.69 |

| APRIL | 66.24 | 49.24 | 38.09 |

| MAY | 77.32 | 33.79 | 39.97 |

| JUNE | 87.51 | 29.65 | 49.64 |

| JULY | 90.12 | 41.23 | 11.25 |

| AUGUEST | 55.38 | 42.23 | 90.96 |

| SEPTEMBER | 86.07 | 46.47 | 46.45 |

| OCTOBER | 73.24 | 48.6 | 53.28 |

| NOVEMBER | 94.54 | 51.08 | 56.85 |

| DECEMBER | 86.78 | 30.01 | 55.92 |

( This data only for Karwan bazaar Branch @AB Bank)

Fig: Monthly Import from 2008 to 2010

7.3 EXPORT

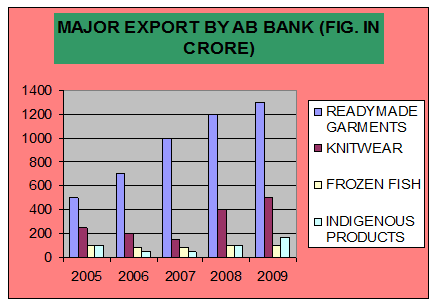

AB Bank Export volume growth was 15.67 percent as the total export reached tk. 76240.77 crore at the end of the year 2009. Export business concentration was in the area of frozen fish, readymade garments, knitwear & other indigenous products.

MAJOR EXPORT BY AB BANK(FIG.IN CRORE)

| YEAR | 2005 | 2006 | 2007 | 2008 | 2009 |

| READYMADE GARMENTS | 500 | 700 | 1000 | 1200 | 1300 |

| KNITWEAR | 250 | 200 | 150 | 400 | 500 |

| FROZEN FISH | 100 | 80 | 80 | 100 | 100 |

| INDIGENOUS PRODUCTS | 100 | 50 | 50 | 100 | 168 |

AB Banks foreign correspondence relationships is spread across the world converting important financial centers including important financial houses. This network of over 300 correspondents has helped bank in expanding its international trade.

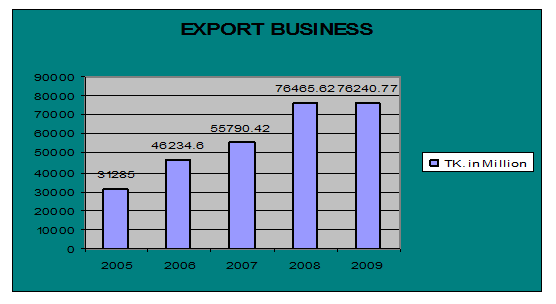

EXPORT BUSINESS

| YEAR | TK. in Million |

2005 | 31285 |

2006 | 46234.6 |

2007 | 55790.42 |

2008 | 76465.62 |

2009 | 76240.77 |

Figure: Export from 2005 to 2009

Export business of the bank increased a little bit during the year 2009 but less than the year 2005 and 2006 & 2007. Export business handled by the Bank during the year 2009 amounted to Tk. 76240.77 million of the preceding year.

Export as a per month from 2008 to 2010 are given below:

EXPORT L/C(NEGOTIATED/BILLS FOR COLLECTION)

as a per month from 2008 to 2010

| MONTH | 2010 | 2009 | 2008 |

| JANUARY | 57.35 | 69.42 | 34.97 |

| FEBRUARY | 37.46 | 64.4 | 23.79 |

| MARCH | 81.54 | 62.71 | 32.13 |

| APRIL | 38.33 | 55.78 | 32.34 |

| MAY | 46.75 | 49.1 | 33.95 |

| JUNE | 82.41 | 71.1 | 39.53 |

| JULY | 86.56 | 55.69 | 67.71 |

| AUGUEST | 81.52 | 49.53 | 81.85 |

| SEPTEMBER | 58.15 | 54.07 | 74.36 |

| OCTOBER | 61.49 | 38.77 | 98.46 |

| NOVEMBER | 54.66 | 50.4 | 70.63 |

| DECEMBER | 61.49 | 44.7 | 73.22 |

( This data only for Karwan bazaar Branch @AB Bank)

EXPORT as a per month from 2008 to 2010

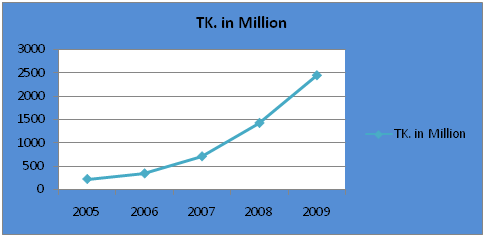

7.4 Remittance

| YEAR | TK. in Million |

2005 | 223 |

2006 | 343.8 |

2007 | 710.32 |

2008 | 1428.46 |

2009 | 2452.33 |

The volume of foreign remittance in the year 2009 stood at Tk. 2452.33 million as compared to Tk. 1428.46 million in the preceding year registering an increase of 23.74 percent. Because extensive use of the technology along with large delivery has significantly fostered the growth of ABBL remittance business. ABBL has seen a successful year in 2009 in terms of expansion of its remittance business through its correspondent and exchange houses.

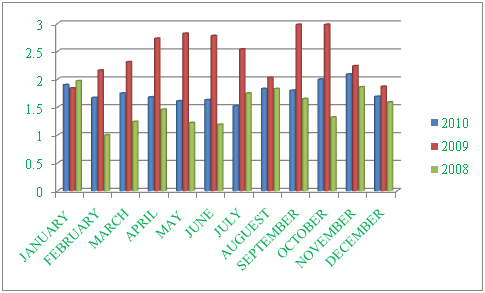

INWARD REMITTENCE, RECEIVED DURING THE MONTHLY BASIS FROM THE YEAR 2008 TO 2010

Million in US$

| MONTH | 2010 | 2009 | 2008 |

| JANUARY | 1.9 | 1.84 | 1.97 |

| FEBRUARY | 1.67 | 2.16 | 1 |

| MARCH | 1.75 | 2.31 | 1.24 |

| APRIL | 1.68 | 2.73 | 1.46 |

| MAY | 1.61 | 2.82 | 1.22 |

| JUNE | 1.63 | 2.78 | 1.19 |

| JULY | 1.52 | 2.54 | 1.75 |

| AUGUEST | 1.83 | 2.03 | 1.83 |

| SEPTEMBER | 1.8 | 2.98 | 1.65 |

| OCTOBER | 2 | 2.98 | 1.32 |

| NOVEMBER | 2.09 | 2.24 | 1.86 |

| DECEMBER | 1.69 | 1.87 | 1.59 |

US $ IN MILLION

From this graph, it has beeb shown that in 2009 it was the better compare the left two years. As a per month there is a variation from month by month.

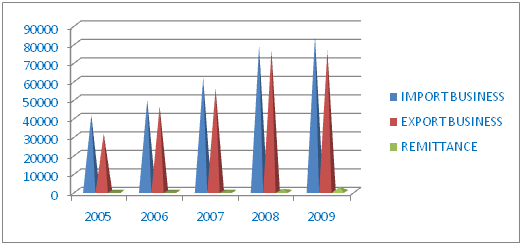

7.5 Comparison of Three Wings

Million In TK.

| YEAR | IMPORT BUSINESS | EXPORT BUSINESS | REMITTANCE |

2005 | 41432 | 31285 | 223 |

2006 | 49596.7 | 46234.6 | 343.8 |

2007 | 61399.4 | 55790.42 | 710.32 |

2008 | 78540.49 | 76465.62 | 1428.46 |

2009 | 83911.51 | 76240.77 | 2452.33 |

Comparison of Three Wings

The amount of Foreign Remittance is always lower than others and then the Import is higher than the Export. It’s been same as in all the year. The amount of remittance has been increasing year by year but very little. This trend same in Import section as increasing but the amount of Export is been remain same by last two years.

7.6 Conclusion

During the last five years, the foreign trade financing of the Bank has witnessed steady growth. The AB Bank Ltd, under Bangladesh Bank’s rules & regulation, try to be more flexible to the clients to increase the profit from the Foreign Exchange year by year. Thus ABBL committed to the clients by their services and it has been proved by their last five years of Foreign Trade profile.

Chapter-8

Problems, Recommendations,

Prospects & Conclusion

8.1 Problems

The problems facing in ABBL are given below:

# Business in conventional banking system foreign currency is considered as goods not as currency and its value fluctuates continuously, which is too much difficult to understand.

# Banks deal with documents not with goods. So, today’s banking system is based on documents.

# Because all other sections of ABBL, Foreign exchange section is based on most part of computerized data and due to this reason it has to face some problems.

# Import has always been greater than export for every year. The increase in import from 2005 to 2009 for each bank has been approximately BDT 30000 million for every concerned bank. Whereas the rise in export has been approximately BDT 25000 million. This shows our dependency on foreign goods hence foreign trade. This is also the cause of negative balance of trade of Bangladesh.

# Rising demand for foreign currency creates rising trend in their price or value hence making our local currency weaker than before.

# Foreign remittance inward has also increased over the years for each bank but it is much lower than increase in import. Thus this low inflow of foreign currency into the country cannot cover up the balance of payment deficit.

# Backward linkage is a problem for foreign exchange, which is re related to back-to-back L/C. Backward linkage refers to those small industries that support the large industry. For example: for the production of a shirt, cloth, button and other accessories are required. Any problem of these small industries has effect on the large industry.

In case of export, the exporter has to purchase some raw material from abroad. Because, some importers give some restriction on export. For example they may say that the exporter must purchase the cloth from Japan. In this case, our foreign currency is going to Japan and we are unable to use our local cloth. So, our local cloth industry is corrupted. Again, if for any reason, the exporter fails to receive that cloth in time, then he will be unable to produce that shirt and export in time will not be possible. As a result, relationship between the importer and exporter will hampered and the exporter will not be willing to import from that exporter again, and our country will loose foreign currency.

# To avoid this situation, the exporter is needed to have stock lot for which he will have to engage much money. Moreover it will incur inventory cost.

# Very few commodities are occupying major share of our export such as RMG, jute, frozen food etc. It should be spread out.

# The periphery of our export market is very narrow.

8.2 Recommendations

# Usage of latest technology such as swift, ATM computer should be increased. As a result customer dealing will be increased. And transaction will be made at a few minutes.

# Employee should be skilled in operating technology. If all the persons will be skilled, no person depends on others specific person for operating to perform the transactions.

# Function should be divided. If the function is divided according to its criteria; every person will be efficient in his particular area. And there will be no chance for making mistake. In foreign exchange, swift operator will be done many other functions such as making vouchers, filling the loan and investment form. As a result foreign exchange function is hampered.

# Foreign exchange section should be well accommodated and should be well furnished. Client cannot make noise in this section and transactions will be made smoothly.

# ABBL should publish manual for their foreign exchange section. Consequently, the officers of this section will be able to conduct their affairs easily without any discussion with the Vice Principal. As a result, it will save their time. Wherever they face any problem, they will follow the manual directly.

# It should diversify its item.

# More importance should be given on export because it assesses most of the variation in profit.

# As per coefficient of variation remittance is the most risky sector so attempts should be taken for lowering the risky ness.

8.3 Prospects

In spite of present limitations in the field of foreign exchange, banking system has tremendous potentiality in Bangladesh. Based on the notes taken from the entire above sources this report is written up gradually, at the time of the interview I have found that the ABBL is offering a full-fledged foreign exchange services. I have also found that in respect of foreign exchange dealings this branch has a good reputation among other branches of ABBL. The bank is also keeping a close eye on relevant developments & changes in Foreign Exchange policies, procedures and rules & regulations.

# ABBL handles more than 9% of country’s export and import trade.

# The bank has developed a wide network of correspondents for conducting foreign exchange business effectively and efficiently through out the world.

8.4 Conclusion

The banking sector of Bangladesh is passing through a tremendous reform under the economic deregulation and opening up the economy. Currently this sector is becoming extremely competitive with the arrival of multinational banks as well as emerging and technological infrastructure, effective credit management, higher performance level utmost customer satisfaction and the transactions of foreign exchange. During the three month internship program at Foreign Exchange Branch almost all the desk have been observed more or less. This internship program, at first, has been arranged for gaining knowledge of practical banking and to compare this practical knowledge with theoretical knowledge. Through all departments and section are covered in the internship program it is not possible to go to depth activities of this branch because of time limitation. However, highest effort has hen given to achieve the objective of internship program.