Executive Summary

Modern Banks play an important role in promotion economic development of a country. Banks provide necessary funds for executing various programmers underway in the process of economic development. They collect savings of large masses of people scattered throughout the country which in the absence of banks would have remained idle and unproductive. These scattered amounts are collected, people together and made available to commerce and industry for meeting their requirement.

The title of the Internship report is ‘Deposit & Investment Management of Islami Bank Bangladesh Limited’. Previously Bangladesh was a little known country in the world; it was mainly recognized as a place famous for its dense population, poverty and cyclone. But the scenario has been changed during the last decade; Bangladesh is now regarded as a role model for success in economic growth and development maintaining the regular performances in macroeconomics. At present Islami Bank Bangladesh limited (IBBL) is one of the leading private sector banks in our country as well as South-East Asia with excellence in customers’ service aiming to economic uplift, human resources development, employment generation, achievement of balanced growth and development of the country.

IBBL is the first Islamic Shari’ah based multinational bank in South-East Asia. Islami Bank Bangladesh Limited is one of the leading banks in Bangladesh in terms of volume of business handled. It posses a huge clients base who comes in touch with the bank in so many purposes everyday. The bank runs its general banking, investment and foreign exchange operations based on Islamic Shariah. It has 199 branches till to date including 4 corporate branches with 7 Zonal Offices and the Head Office located at 40, Dilkusha C/A, Dhaka – 1000. There are 38 Authorized Dealer (AD) branches, i.e. branches having licenses to import, export and remittance business.

The Bank established 860 correspondent relationships with 300 banks and exchange houses in 110 countries around the globe.

This report is organized to fulfill the partial requirement of internship for MBA program of University of Dhaka. It includes the session like introduction, organization part, deposit and investment modes, conclusion and recommendation. In first session I have explained about my given topic. Here I have discussed about background, objectives, scope, methodology and limitations of the report. In second session I have tried to describe profile of Islami Bank Bangladesh Limited: the historical background of the IBBL, its mission, vision, objectives, mile stone etc. In Session third I have discussed my major internship area that is deposit and investment management of the IBBL. Session four is the conclusion consists of summary findings and where few recommendations have been suggested.

The approaches suggested in this study are that IBBL should give added emphasis on excellence in customer services to expatriate customers and realization the investment strategy as investment is the prime factor of business. Besides, IBBL should conduct elaborate and large scale study and research on the issues in order to improve the maximization of investment area for earning more and more.

So it has been a nice scope found to work and study extensively with this field. The finding of the study will have both practical and academic value. It will make various interested groups, more critical and careful in respect of ensuring classical customer’s satisfaction level.

2.1 Introduction:

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Islami Bank Bangladesh Limited on March 13, 1983, is the true reflection of this inner urge of its people, which started functioning with effect from March 30, 1983. This Bank is the first of its kind in Southeast Asia. It is committed to conduct all banking and investment activities on the basis of interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent personalities of the Middle East and the Gulf countries, Islami Bank Bangladesh Limited has by now earned the unique position of a leading private commercial bank in Bangladesh.

2.2 Business philosophy of IBBL

The philosophy of IBBL is to the principles of Islamic Shariah. The organization of Islamic conference (OIC) defines an Islamic bank as “a financial institution whose status, rules and procedures expressly state its commitment to the principles of Islamic Shariah and to the banking of the receipt and payment of interest on any of its operations”. The sponsor, perception is that IBBL should be quite different from other privately owned and managed commercial bank operating in Bangladesh, IBBL to grow as a leader in the industry rather than a follower. The leadership will be in the area of service, constant effort being made to add new dimensions so that clients can get “Additional” in the matter of services commensurate with the needs and requirements of the country growing society and developing economy.

2.3 Aims and Objectives of IBBL

To conduct interest free banking

To establish participatory banking instead of banking on debtor-creditor relationship

To invest through different modes permitted under Islamic Shariah

To accept deposits on profit-loss sharing basis

To establish a welfare-oriented banking system

To extend co-operation to the poor, the helpless and the low-income group for their economic uplift

To pay a vital role in human development and employment generation

To contribute towards balanced growth and development of the country through investment operations particularly in the less developed area.

2.4 Goals of IBBL

To establish Ihsan (gracious conduct or kindness) in economic affairs

Establishment of Maroof (proper and good acts, institutions) in economic life

Elimination of Munker (Evil, wrong of injurious practices) from economic life

To achieve maximum economic growth

To maximize employment to ensure maximum distribution of wealth in society

To achieve universal education and to encourage Co-operation in society.

2.5 Mission

To establish Islami banking through the introduction of a welfare oriented banking system and also ensure equity and justice in the field of all economic activities, achieve balanced growth and equitable development through diversified investment operations particularly in the priority sectors and less developed areas of the country.

2.6 Vision

IBBL’s vision is to always strive to achieve superior financially perform ace, be considered a leading Islamic bank by reputation and performance.

• The goal of IBBL is to establish and maintain the modern banking techniques, to ensure soundness and development of the financial system based on Islamic principles and to become the strong and efficient organization with highly motivated professionals, working for the benefit of people , based upon accountability, transparency and integrity in order to ensures stability of financial systems.

• IBBL tries to encourage savings in the form of direct investment

• IBBL also try to encourage investment particularly in projects which are more likely to lead to higher employment.

2.8 Achievement

2.8.1 IBBL’s World rating

As per Bankers’ Almanac (January 2001 edition) published by the Reed Business Information, Windsor Court, England, IBBL’s world Rank is 1771 among 3000 banks selected by them. This position was 1902 among 4500 selected banks as on January 1999 edition. IBBL’s country Rank is 5 among 39 banks as per ratings made by the above Almanac on the basis of IBBL’s Financial Statements of the year 2001.

2.8.2 Award and Prizes: International & National Perspective

IBBL was awarded for several times by international & national organisations. The Global Finance, an internationally reputed London based quarterly magazine, awarded IBBL as the best bank (World Best Bank Awarded) of the country for the year 1999, 2000 and 2005. ICMAB awarded Islami Bank in 2007 as a best corporate Banking award 2007.

IBBL has got the 2nd prize of National Export Fare for its pavilion of Service Organisation in 1985.

2.8.3 Membership of Different Organization / Chamber

Local:

• Bangladesh Institution of Bank Management (BIBM)

• The Institution of Bankers Bangladesh (IBB)

• Bangladesh Association of Banks (BAB)

• Bangladesh Foreign Exchange Dealers’ Association (BAFEDA)

• Central Shariah Board for Islamic Banks of Bangladesh

• Dhaka Chamber of Commerce & Industries

• Islami Bank consultative forum (IBCF)

Foreign:

• International Association of Islamic Banks (IAIB), Jeddah, K.S.A.

• International Chamber & Commerce of Bangladesh

• Accounting and Auditing Organizations for Islamic Financial Institutions (AAOIFI), Manama, Bahrain.

• General Council of Islamic Banks & Financial Institutions (GCIBFI),

• Islamic Financial Service Board, Kuala Lumpur, Malaysia

• Manama, Bahrain (IBBL is a member of its Executive Council)

• Society for Worldwide Inter-bank Financial Telecommunication (SWIFT)

2.9 FINANCIAL HIGHLIGHTS OF THE BANK

Table 2:

| Sl. No. | Particulars | 2008 | 2007 |

| 1 | Paid-up Capital | 4,752.00 | 3,801.60 |

| 2 | Total Capital (Equity) | 18,572.08 | 14,957.74 |

| 3 | Capital Surplus/(deficit) | 1,243.14 | 860.58 |

| 4 | Total Assets (Excluding contra) | 230,879.14 | 191,362.35 |

| 5 | Total Deposits | 200,343.41 | 166,325.29 |

| 6 | Total Investments(excluding Investment in Shares/Securities) | 180,053.94 | 144,920.61 |

| 7 | Total Contingent Liabilities and Commitments | 57,138.06 | 58,650.44 |

| 8 | Investment Deposit Ratio | 89.87% | 87.13% |

| 9 | Percentage of Classified Investment against Total General Investments | 2.39% | 2.93% |

| 10 | Profit after Tax & Provision | 2,674.80 | 1,427.36 |

| 11 | Amount of Classified Investment during current year | 65.11 | 348.32 |

| 12 | Provision kept against Classified Investments | 1,883.43 | 1,703.13 |

| 13 | Provision Surplus/ (deficit) | – | – |

| 14 | Cost of Fund | 9.56% | 9.06% |

| 15 | Profit Earning Assets | 174,797.35 | 157,758.03 |

| 16 | Non- Profit Earning Assets | 56,081.79 | 33,604.32 |

| 17 | Return on Investments | 10.67% | 9.68% |

| 18 | Return on Assets | 1.27% | 0.84% |

| 19 | Income from Investments | 19,952.59 | 14,856.19 |

| 20 | Earnings per Share (Taka) | 56.29 | 30.04 |

| 21 | Net Income per Share (Taka) | 133.58 | 79.56 |

| 22 | Price Earning Ratio (times) | 10.78 | 17.88 |

***

2.10 Performance of IBBL:

Table 3: Performance of IBBL for the last 5 years

(amount in million Taka)

(Note: One Million = Ten Lac) Source: www.islamibankbd.com |

Investment :

An investment is a current commitment of fund for a period of time in order to derive future payments that will compensate the investor for – (i) the time the funds are committed, (ii) expected rate of inflation and (iii) the uncertainty of the future payments. Investment is the action of deploying funds with the intention and expectation that they will earn a positive return for the owner. Funds may be invested in either real assets or financial assets. When resources are used for purchasing fixed and current assets in a production process or for a trading purpose, then it can be termed as real investment. The establishment of a factory or the purchase of raw materials and machinery for production purposes are examples in point. On the other hand, the purchase of a legal right to receive income in the form of capital gains or dividends would be indicative of financial investments. Specific examples of financial investments are: deposits of money in a bank account, the purchase of Mudaraba Savings Bonds or stock in a company. Ultimately, the savings of investors in financial assets are invested by the respective company into real assets in the form of the expansion of plant and equipment. Since Islam condemns hoarding savings and a 2.5 percent annual tax (Zakat) is imposed on savings, the owner of excess savings, if he is unable to invest in real assets, has no option but to invest his savings in financial assets.

When money is deposited with an Islamic Bank, the bank, in turn, makes investments in different forms approved by the Islamic Shariah with the intent to earn a profit. Not only a bank, but also an individual or organization can use Islamic modes of investment to earn profits for wealth maximization. Some popular modes of Islamic Investment are discussed below. A comparison is also attempted between the investment modes of IBBL and these of conventional banks.

INVESTMENT Modes OF IBBL

The word “Modes” literally means “methods”, or in other words, it refers to systematic and detailed rules, stipulations and steps to be followed for accomplishing a specific thing. The thing that needs to be accomplished in this context is, however, the subject matter of each of the said modes, i.e. any of the different types of investment activities (trade, leasing, real estate, manufacturing, agriculture, production etc. or using Shariah expressions Murabaha, Mudaraba, Musharaka, Ijarah, Istisna, etc.). One of the significant and revolutionary development in the banking arena of the world during the last four decades is the emergence and extra ordinary development of Islamic Banking among different countries of the world which has brought the attention of the scholars and general public of the Muslim World and Other World including the world bodies like International Monetary Fund, World Bank etc.

3.1 DEPOSITS

The relationship between a banker and his customer begins with the opening of an account by the former in the name of the latter. Initially, all the accounts are opened with a deposit of money by the customer and hence these accounts are called deposit accounts. The bulk of the resources of a bank are mobilized by accepting deposits from the public. Accepting of deposits of money from the public is one of the essential functions of a banker, according to the definition of banking given in the Banking Regulation Act, 1949.

Customarily, the bank accounts are classified into three categories:

(i) The savings deposit accounts

(ii) The fixed deposit accounts and

(iii) The current accounts.

3.2 DEPOSIT MOBILIZATION

Without multidimensional and diversified products, any financial institution especially banks cannot prosper and compete with other banks effectively. With this idea, IBBL has so far introduced the following deposit products.

Products of IBBL:

- Al Wadeeah Current Account

- Mudaraba Hajj Savings Account (1 Year to 25 Years)

- Mudaraba Waqf Cash Deposit

- Mudaraba Special Savings (Pension) Account (5 Years and 10 Years)

- Mudaraba Muhor Savings Account

- Mudaraba Savings Bond (5 Years and 8 Years)

- Mudaraba Monthly Profit Deposits Scheme (3 Years and 5 Years)

- Mudaraba Term Deposits (3 Months, 6 Months, 12 Months, 24 months and 36 Months)

- Mudaraba Savings Deposits Account

- Mudaraba Special Notice Deposits Account

- Mudaraba Foreign Currency Deposits Account

- Mudaraba Foreign Currency Account (US Dollar)

- Foreign Currency Account (GB Pound Sterling)

- Foreign Currency Account (EURO)

- Private Foreign Currency Account

- Non Resident Dollar Account

IBBL distributes minimum 65% of its investment-income earned through deployment of Mudaraba deposits among the Mudaraba depositors.

IBBL perform deposit mobilization under two principal:

- Mudarabah principal

- Al-wadiah principal

Current account is operated on Al-Wadeeah principle & all other deposit accounts on Mudaraba principle of Islamic Shari’ah.

3.3 GENERAL CHARACTERISTICS OF DEPOSIT ACCOUNT:

3.3.1 Al-Wadeeah Current Account (AWCA):

AWCA accounts are unproductive in nature as far as banks loan able investment fund is concerned sufficient fund has to be kept in liquid form, as current deposits are demand liabilities. Thus huge portion of this fund becomes nonperforming. For this reason banks do not pay any profit of AWCA account holder. Business and companies are the main customers of this product.

3.3.2 Mudaraba Hajj Savings Account (I year to 25 years):

Hajj is one of the five pillars of Islam. Every Muslim cherishes a desire to perform Hajj at least for once in life time. IBBL has introduced a scheme in the name & style of Mudaraba Hajj Savings Scheme to facilitate the intending to perform Hajj properly at appropriate age. Any Muslim intending to perform Hajj by building-up deposit required for meeting Hajj expenses will select one of the 25 alternative choices based on duration of period from 1 year to 25 years for building-up savings by monthly installments under this scheme.

3.3.3 Mudaraba Waqf Cash Deposit Account :

The Bank has introduced Mudaraba Waqf Cash Deposit Account through which savings made from earnings for the purpose of Waqf by the well-off and the rich people of the society can be mobilized and the income to be generated therefore may be spent for different benevolent purposes. Higher profit is given against this account. Profit from this account is utilized for social and human welfare as per instruction of the account holders.

3.3.4 Mudaraba Special Savings (Pension) Account :

Considering the extreme demand amongst the client of Muslim Community in the country, IBBL has introduced an attractive Savings Scheme on the basis of Islamic Shari’ah named Mudaraba Special Savings (Pension) Scheme (MSS) for the middle and the lower middle class professionals and service holders creating an opportunity for them ensuring saving on monthly installment basis for their future financial security and welfare in their retired life.

3.3.5 Mudaraba Muhor Savings Account :

Muhor is wealth, which a husband is to pay to his wife, upon marriage. But there are a large number of married men from all walks of life in our society who did not pay total Muhor to their wives due to their inability. So to enable the intending married Muslims to build up fund to pay the fixed Muhorana (Den Muhor) to their wives at a time, a new Savings scheme named Mudaraba Muhor Savings Account has been introduced. This scheme will help them to save as per their capacity to build up the Muhor amount to be paid to their wives.

3.3.6 Mudaraba Savings Bond (5 years & 8 years) :

Persons-aged 18 years and above eligible to be a party will be eligible to purchase this Mudaraba Savings Bond(s) in single name or in joint names by depositing cash/cheque thought the deposit voucher.

Educational Institutions, Clubs, Associations and other non-Trading and non-profit Earning socio-economic institutions will also be eligible to purchase the Bond(s) in the name of the institutions. Father/Mother/legal guardian will be eligible to purchase Mudaraba Savings Bond(s) on behalf of one minor or two minors mentioning the name and age of the minor(s) with instructions regarding payment/encashment.

3.3.7 Mudaraba Monthly Profit Deposit Scheme (3 years & 5 years) :

Any individual may open Account under this scheme by depositing a minimum amount of Taka 1,00,000.00 and multiplies thereof at a time for 3 or 5 years. Monthly provisional profit shall be given to the Account just after completion of 30 days from the date of opening of the account. The profit amount will be adjusted on completion of each accounting year after declaration of final rate of profit.

3.3.8 Mudaraba Term Deposit Account:

IBBL accepts Mudaraba Term Deposit as per Mudaraba principle of Shariah. Deposits in the Mudaraba Term Deposit accounts are received from the depositors for 3 months, 6 months, 12 months, 24 months, 36 months terms. The depositors share in the profit and bear loss of the Banks investment of udaraba fund. The deposit in MTD will enjoy higher rate of weightage in sharing profit than shared by Mudaraba savings deposit. No Transaction facilities are allowed in this type of deposit.

3.3.9 Mudaraba Savings Deposit Account (MSA):

Mudaraba Savings Account is conducted according to Mudaraba principles. The depositor is the ‘Shahib Al-Mal’ and the Bank is the Mudarib (Organizer). The Bank is authorized to invest the Mudaraba funds at the risk of the depositor. The Bank will arrange proper deployment of the fund. The depositor has got no say in the management. Total profit resulting from such investments will be distributed between the Bank and the depositor as per agreed ratio. At present the ratio is 35:65 (Bank: Depositor). Any loss incurred is to be borne by the depositors.

3.3.10 Mudaraba Special Notice Deposit Account:

The operation of Mudaraba Special Notice Account is subject to Mudaraba principles of Shariah. The nature of the deposit and its operation may be categorized as that of Al-Wadeeah Current Account excepting that these deposits share profit and bear loss of the Bank’s overall performance and its withdrawal is subject to (seven) days prior notice for any amount. Here, minimum initial deposit and balance have been fixed at Tk.25,000/- (Twenty five thousand) only.

3.3.11 Mudaraba Foreign Currency Deposit Account:

Mudaraba Foreign Currency Deposit Scheme (Savings) has been introduced under Mudaraba principle and endeavoring to invest the foreign currency funds in profitable way through its foreign correspondent banks under Shariah principle so as to enable the bank to pay profit to its FC/PFC depositors, who will intend to open/maintain Mudaraba Foreign Currency Deposit (MFCD) Account in minimum 1,000/= US Dollar.

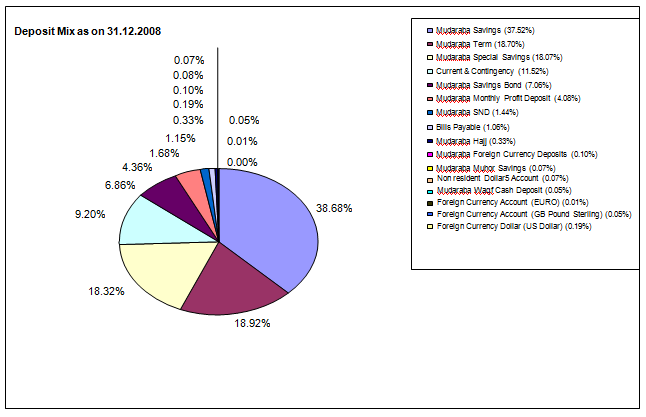

3.4 The amount of total deposits under various deposit products and deposit mix in 2008 and 2007 is given in the following table:

Table 4:

| SL No. | Types of Deposits

| Deposit in Million Taka | Growth | Mix | ||

| 2008 | 2007 | % | 2008 | 2007 | ||

| 1. | Mudaraba Savings | 77,498 | 62,404 | 24.19% | 38.68% | 37.51% |

| 2. | Mudaraba Special Savings | 37,902 | 30,058 | 26.10% | 18.92% | 18.07% |

| 3. | Mudaraba Term | 36,707 | 31,104 | 18.01% | 18.32% | 18.70% |

| 4. | Current & Contingency | 18,407 | 18,640 | -1.25% | 9.20% | 11.21% |

| 5. | Mudaraba Savings Bond | 13,739 | 11,735 | 17.07% | 6.86% | 7.06% |

| 6. | Mudaraba Monthly Profit Deposit | 8,733 | 6,780 | 28.79% | 4.36% | 4.08% |

| 7. | Mudaraba SND | 3,375 | 2,390 | 41.22% | 1.68% | 1.44% |

| 8. | Bills Payable | 2,308 | 1,767 | 30.58% | 1.15% | 1.06% |

| 9. | Mudaraba Hajj | 660 | 553 | 19.31% | 0.33% | 0.33% |

| 10. | Foreign Currency Account (US Dollar) | 378 | 347 | 8.83% | 0.19% | 0.21% |

| 11. | Mudaraba Foreign Currency Deposits | 205 | 174 | 17.80% | 0.10% | 0.10% |

| 12. | Mudaraba Muhor Savings | 151 | 115 | 30.79% | 0.08% | 0.07% |

| 13. | Non Resident Dollar Account | 148 | 162 | -8.41% | 0.07% | 0.10% |

| 14. | Mudaraba Waqf Cash Deposit | 108 | 80 | 35.42% | 0.05% | 0.05% |

| 15. | Foreign Currency Account (EURO) | 16 | 10 | 63.13% | 0.01% | 0.01% |

| 16. | Foreign Currency Account (GB Pound Sterling) | 8 | 6 | 37.44% | 0.00% | 0.00% |

Total Deposits | 200,343 | 166,325 | 20.45% | 100.00% | 100.00% | |

Source: Annual Report 2008

3.5 DEPOSIT STRATEGy

Year wise total Deposit amount (Last 5 years) :

(Taka In Million)

Year | Deposit |

2004 | 87,841.01 |

2005 | 107,779.42 |

2006 | 132,419.40 |

2007 | 166,325.29 |

2008 | 200,343.41 |

Source : www.islamibankbd.com

3.6 Mobilization of Deposits

The year 2008 was one of the successful years of mobilization of deposit. Total deposit stood at Tk.200,343 million as on 31st December 2008 as against Tk.166,325 million of the preceding year registering a growth of Tk.34,018 million, i.e.20.45% growth as compared to the growth rate of 18.16% of the Banking Sector during 2008. The percentage of growth of Deposit in 2007 was 16.70%.

The share of deposit of IBBL in banking sector as on 31.12.2008 was increased to 7.99% from 7.48% as on 31.12.2007.

Total number of depositors of IBBL increased to 4,361,896 as on 31st December, 2008 from 3,802,709 of the preceding year, registering an increase of 14.70% as against increase of 18.57% as on 31.12.2007.

Source : Annual Report 2008

4.1 Objectives and Principles:

The special feature of the Investment policy of Islamic Banks is to invest based on profit-loss sharing system in accordance with the tenets and principles of Islamic Shariah. Earning of the profit is not the only motives and objectives of the Islamic Bank’s Investment policy, rather emphasis is given in attaining social goal and in creating employment opportunities.

The Objectives and Principles of Investment Operations of The Bank are:

• To invest fund strictly in accordance with the principles of Islamic Shariah.

o To diversify its investment portfolio by size of investment portfolio by sectors (Public &Private), by economic purpose, by securities and by geographical area including industrial, commercial & agricultural.

o To ensure mutual benefit both for the bank and the investment client by professional appraisal of investment proposals, judicious sanction of investment, close and constant supervision and monitoring there of.

o To make investment keeping the socio economic requirement of the country in view.

o To increase the number of potential investors by making participatory and productive investment.

o To finance various development schemes for poverty alleviation, increase income and employment generation with a view to accelerate sustainable socio-economic growth and upliftment of the society.

o To invest in the form of goods and commodities rather than give out cash money to the investment clients.

o To encourage social developing enterprises.

o To ensure avoid all the investment forbidden by the Islamic Shariah.

o The bank extends investment under the principles of Bai-murabaha, Bai-Muazzal, Hire Purchase Under Shirkatul Melk and Musharaka.

4.2 Investment Policy of IBBL:

Investment policy of Islamic Bank and non Islamic bank are fully different. The investment policies of Islamic bank are

o Strict observance of Islamic Shariah principles.

o Investment to national priority sectors.

o Diversified investment portfolio: Diversification by size, sector, geographical area, economic purpose, securities and mode of investment.

o Preference to short-term Investments.

o Preference to investment of small size.

o To ensure safety & security of investments

o To look profitability of investments.

o To give support to government denationalization industrial program.

o Investment to trade and commerce sector.

o Investment to industrial sectors.

o Investment to Foreign Trade (import & export).

o Exploration of the possibility of investment in the existing Money & capital Market and help organization of Islamic Money & Capital Market

4. 3 Investment Strategy of IBBL:

Investment strategy of Islamic Bank and interest-based bank are contradictory. The investment strategies of Islamic Bank are:

o To check exodus of investment clients.

o To induct new investment clients.

o To induct good investment clients of other Banks.

o To enhance existing limits of good investment clients.

o Extension of investment transport sector.

o Extension of investment to backward as well as forward linkage industries.

o Extension of investment to real Estate Sector.

o Extension of investment to Jute sector; particularly for trading and export purpose.

o Strengthening supervision, control and monitoring mechanism.

o Training and motivation of manpower to handle increased and diverse volume of investment s.

o To give due consideration to high risk, high return and low risk, low return investment proposals.

o Adaptation of modern technology

4.4 Investment Mechanisms of IBBL

IBBL invests its money in various sectors of the economy through different modes permitted by Islamic Shariah and approved by the Bangladesh Bank. The Modes of Investment are as follows:

1) Bai Mechanism:

• Bai-Murabaha

• Bai-Muazzal

• Bai-Salam

• Bai-Istishana

2) Ijara Mechanism:

• Hire Purchase (HP)

• Hire Purchase under Shirkatul Melk (HPSM)

3) Shirkat Mechanism:

• Mudaraba

• Musharaka

4.4.1 Bai-Murabaha:

Bai- Murabaha may be defined as a contract between a buyer and a seller under which the sells certain specific goods (permissible under Islamic Shariah and the law of the land) to the buyer at a cost plus agreed profit payable in cash or on any fixed future data in lump sum or by installments. The marked up profit may be fixed in lump sum or in percentage of the cost price of the goods.

Important features:

• It is permissible for the client to offer an order to purchase by the bank particular goods deciding its specification and committing him to buy same from the bank on murabaha, i.e. cost plus agreed upon profit.

• It is permissible to make the promise binding upon the client to purchase from the bank, that is, he is to satisfy the promise or to indemnify the damages caused by breaking the promise without excuse.

• It is also permissible to take cash / collateral security to guarantee the implementation of the promise or indemnify the damages.

Stock availability of goods is a basic condition for signing a Bai-murabaha agreement. Therefore, the bank must purchase the goods as per specification of the client to acquire ownership of the same before signing the Bai-Murabaha agreement with the Client.

• After purchase of goods the Bank must bear the risk of goods until those are actually sold and delivered to the Client, i.e., after purchase of the goods by the Bank and before selling of those on Bai-Murabaha to the Client buyer, the bank bear the consequences of any damages or defects, unless there is an agreement with the Client releasing the bank of the defects, that means, if the goods are damaged, bank is liable, if the goods are defective, (a defect that is not included in the release) the Bank bears the responsibility.

• The Bank must deliver the specified Goods to the Client on specified date and at specified place of delivery as per Contract.

• The bank shall the goods at a higher price (Cost + {profit) to earn profit. The cost of goods sold and profit markup therewith shall separately and clearly be mentioned in the Bai-Murabaha agreement. The profit Mark-up may be mentioned in lump sum or in percentage of the purchase/cost price of the goods. But, under no circumstance, the percentage of the profit shall have any relation with time or expressed in relation with time, such as per month, per annum etc.

• The price once fixed as per agreement and deferred cannot be further increased.

• It is permissible for the bank to authorize any third party to buy and receive the goods on Bank behalf. The authorization must be in a separated contract.

Cost and Sale Price of the Goods:

A. Purchase Price/Landed Cost of the goods PLUS

B. Other expenditures incurred by the Bank in connection with the Purchase, Transportation and Storage before sale of the Goods to the Client:

a. Conveyance – TA/DA of Bank Official or the Agent, if any.

b. Commission Paid to the Agent, if any.

c. Cost of Remittance of Fund.

d. Transportation Cost up to Bank’s Godown (if not sold just after purchase).

e. Transit Insurance and Incidental Charges.

f. Other Expenses, except interest incurred (if any). Interest element, if any, is to be paid by the Client himself.

g. Godown Rent and Godown Staff Salary (if the Goods are kept in the Bank’s Godown before sale to the Client).

C. Total Cost Price (A+B) Tk…………………………

D. Estimated Profit of the Bank Tk…………… (Percentage of Profit …………%)

E. Sale Price (C+D) Tk………………………. ( )

4.4.2 Bai-Muazzal:

Bai-Muajjal may be defined as a contract between a Buyer and a Seller under which the Seller sells certain specific goods (permissible under Shariah and Law of the Country), to the Buyer at an agreed fixed price payable at a certain fixed future date in lump sum or within a fixed period by fixed instalments. The seller may also sell the goods purchased by him as per order and specification of the Buyer.

In this Bank, Bai-Muajjal is treated as a contract between the Bank and the Client under which the Bank sells to the Client certain specified goods, purchased as per order and specification of the Client at an agreed price payable within a fixed future date in lump sum or by fixed instalments.

Important features:

It is permissible for the Client to offer an order to purchase by the Bank particular goods deciding its specification and committing himself to buy the same from the Bank on Bai-Muajjal i.e. deferred payment sale at fixed price.

01 It is permissible to make the promise binding upon the Client to purchase from the Bank, that is, he is to either satisfy the promise or to indemnify the damages caused by breaking the promise without excuse.

02 It is permissible to take cash / collateral security to Guarantee the implementation of the promise or to indemnify the damages.

03 It is also permissible to document the debt resulting from Bai-Muajjal by a Guarantor, or a mortgage. or both like any other debt. Mortgage / Guarantee / Cash security may be obtained prior to the signing of the Agreement or at the time of signing the Agreement.

04 Stock and availability of goods is a basic condition for signing a Bai-Muajjal Agreement, Therefore, the Bank must purchase the goods as per specification of the Client to acquire ownership of the same before signing the Bai-Muajjal Agreement with the Client.

05 After purchase of goods the Bank must bear the risk of goods until those are actually delivered to the Client.

06 The Bank must deliver the specified Goods to the Client on specified date and at specified place of delivery as per Contract.

07 The Bank may sell the goods at a higher price than the purchase price to earn profit.

08 The price once fixed as per agreement and deferred can not be further increased.

09 The Bank may sell the goods at one agreed price which will include both the cost price and the profit. Unlike Bai-Murabaha, the Bank may not disclose the cost price and the profit mark-up separately to the Client.

Cost and Sale Price of the Goods:

A. Purchase Price/ Landed cost of the goods

PLUS

B. Other expenditures in connection with the Purchase, Transportation and Storage of the Goods incurred by the Bank before sale to the Client:

a. Conveyance – TA/DA of Bank Official or the Agent, if any.

b. Commission Paid to the Agent, if any.

c. Cost of Remittance of Fund.

d. Transportation Cost up to Bank’s Godown (if not sold just after purchase).

e. Transit Insurance and Incidental Expenses.

f. Other Expenses except interest incurred (if any). Interest element, if any, is to be paid by the Client himself.

g. Godown Rent and Godown Staff Salary (if the Goods are kept in the Bank’s Godown before sale to the Client).

C. Total Cost Price (A+B) Tk………………….

D. Estimated Profit of the Bank Tk…………. (Percentage of Profit ……….%)

E. Sale Price (C + D) Tk……………….. ( )

4.4.3 Bai-Salam:

Bai-Salam may be defined as a contract between a Buyer and a Seller under which the Seller sells in advance the certain commodity(ies)/product(s) permissible under Islamic Shariah and the law of the land to the Buyer at an agreed price payable on execution of the said contract and the commodity(ies)/product(s) is/are delivered as per specification, size, quality, quantity at a future time in a particular place.

In other words, Bai-Salam is a sale whereby the seller undertakes to supply some specific Commodity(ies) /Product(s) to the buyer at a future time in exchange of an advanced price fully paid on the spot. Here the price is paid in cash, but the delivery of the goods is deferred.

Important features:

01. Bai-Salam is a mode of investment allowed by Islamic Shariah in which commodity(ies)/product(s) can be sold without having the said commodity(ies)/ product(s) either in existence or physical/constructive possession of the seller. If

02. the commodity(ies)/product(s) are ready for sale, Bai-Salam is not allowed in Shariah. Then the sale may be done either in Bai-Murabaha or Bai-Muajjal mode of investment.

03. Generally, Industrial and Agricultural products are purchased/sold in advance under Bai-Salam mode of Investment to infuse finance so that production is not hindered due to shortage of fund/cash.

04. It is permissible to obtain collateral security from the seller client to secure the investment from any hazards viz. non-supply/partial supply of commodity(ies)/product(s), supply of low quality commodity(ies)/Product(s) etc.

05. It is also permissible to obtain Mortgage and/or Personal Guarantee from a third party as security before the signing of the Agreement or at the time of signing the Agreement.

06. Bai-Salam on a particular commodity(ies)/product(s) or on a product of a particular field or farm cannot be effected. [for Agricultural Product(s) only]

07. The seller (manufacturer) client may be made agent of the Bank to sell the goods delivered to the Bank by him provided a separate agency agreement is executed between the Bank and the Client (Agent).

4.4.4 Bai-Istishna’a:

Istisna’a is a contract between a manufacturer/seller and a buyer under which the manufacturer/seller sells specific product(s) after having manufactured, permissible under Islamic Shariah and Law of the Country after having manufactured at an agreed price payable in advance or by instalments within a fixed period or on/within a fixed future date on the basis of the order placed by the buyer.

In Istisna’a contract, the buyer is called ‘Al-Mustasni’, the seller ‘Al-Sani’ and the goods or the subject matter of the contract ‘Al-Masnoo’.

PARALLEL ISTISNA’A

If the ultimate buyer does not stipulate in the contract that the seller will manufacture the product(s) by himself, then the seller may enter into a second Istisna’a contract in order to fulfil his contractual obligations in the first contract. This new contract is known as Parallel Istisna’a, whereby the obligations of the seller in the first contract are carried out.

ISTISNA’A IN ISLAMI BANK

01 Islami Bank can utilize Istisna’a in the following ways:

a) Islami Bank may buy a commodity under Istisna’a contract and then sell it on cash or deferred payment basis to a Client of the Bank without receiving prior order from the Client.

Islami Bank in the capacity of a seller may receive order from a Client for manufacturing and supplying certain specified goods under an Istisna’a contract and then enter into a Parallel Istisna’a contract in the capacity of a buyer with a Manufacturer for having the Product(s) manufactured by him i.e. the Islami Bank may obtain an order from a buyer to supply goods under

b) Istisna’a and by a Parallel Istisna’a contract may have the goods made by a Manufacturer by an order.

c) Bank may pay the price to the Manufacturer of the Product(s) in advance or by instalments or on deferred payment basis. They also may receive price of the Product(s) from the ultimate buyer in advance or by instalments or on deferred payment basis.

02 The obligations of Islami Bank as a ‘Seller’ in the first contract and as a ‘Buyer’ in parallel contract are as under:

a) The Islami Bank as a seller in the first contract will remain solely responsible for the execution of its obligations as if the parallel contract is non-existent. Hence, Islami Bank in the first contract would remain liable for any default, negligence or breach of contract ensuing from the parallel contract.

b) In the parallel Istisna’a, the Manufacturer is accountable to Islami Bank in the way and manner by which he performs his obligations. He has no direct legal relationship with the ultimate buyer in the first contract.

c) The second Istisna’a is a parallel contract, but not a contingent transaction on the first contract. Legally speaking they are different contracts with respect to rights and obligations.

d) The Islami Bank as a seller is liable to the ultimate Buyer with regard to any mal-execution of the sub-contractor and any guarantees arising therefrom. It is this very liability that justifies the validity of the Parallel Istisna’a and which also justifies the charging of profit by the Islami Bank, if any.

RULES AND CONDITIONS

01. There must be a contract between the Manufacturer and the Buyer, which shall be the principal instrument to govern the advance selling and buying under Istisna’a.

02. The name, specification, brand, quantity, quality, size, etc. of the Product(s) must be clearly specified in the Contract leaving no ambiguity.

03. Unit price and total price of the product(s) must be fixed and mentioned in the Contract.

04. The time and place of delivery should be mentioned in the contract.

05. Mode of transportation, transportation cost, storage charge/godown rent, insurance etc., if any, should be specified in the Contract.

06. The name of party who will bear the cost of transportation, storage charge/godown rent, insurance etc. also be mentioned in the contract.

07. The seller shall remain responsible for quantity, quality, and specification of the product(s) till physical/constructive delivery of the same to the buyer.

08. Under Istisna’a transaction advance payment of price of the Product(s) under order is not compulsory. The Buyer may pay the price of the goods in advance in full or part as agreed upon, which should be clearly mentioned in the contract.

09. Remaining price, if any, may be paid after receipt of the Product(s) or at any future date(s) or in instalments, if so agreed, and mentioned in the contract.

10. After taking delivery of the Product(s), the Buyer shall be the owner and shall bear all risks till disposal / sale of the Product(s).

11. The Buyer has the right to obtain security, in any form, from the Manufacturer for

a) The total amount that he has paid.

b) The delivery of al-masnoo’ in accordance with the specifications and on due time.

12. The Manufacturer has also the right to obtain security, in any form, to guarantee that the price is payable on due time.

13. It is permissible for the Buyer to insert a fine/penalty / compensation clause in the contract against unfulfilment of obligations by the Manufacturer at a fixed rate per day as mentioned in the contract.

14. If the Product(s) is/are the Product(s) not in conformity with specification, the Buyer has the following options:

Reject or accept it without seeking damages.

15 The contract of Istisna’a may be terminated under the following conditions:

a) Normal fulfilment of obligations by both the parties.

b) Mutual consent of both the parties.

c) Judicial rescission of the contract. This is if a reasonable cause arises to prevent the execution of the contract or its completion, and each party may sue for its rescission.

IMPORTANT FEATURES OF ISTISNA’A

Istisna’a is an exceptional mode of investment allowed by Islamic Shariah in which product(s) can be sold without having the same in existence. If the product(s) are ready for sale, Istisna’a is not allowed in Shariah. Then the sale may be done either in Bai-Murabaha or Bai-Muajjal mode of investment. In this mode, deliveries of goods are deferred and payment of price may also be deferred.

It facilitates the manufacturer sometimes to get the price of the goods in advance, which he may use as capital for producing the goods.

It gives the buyer opportunity to pay the price in some future dates or by instalments.

It is a binding contract and no party is allowed to cancel the Istisna’a contract after the price is paid and received in full or in part or the manufacturer starts the work.

Istisna’a is specially practised in Manufacturing and Industrial sectors. However, it can be practised in agricultural and constructions sectors also.

4.4.5 Hire Purchase (HP), Hire purchase under Shirkatul Melk (HPSM)

MEANING AND DEFINITION

Hire Purchase under Shirkatul Melk is a Special type of contract which has been developed through practice. Actually, it is a synthesis of three contracts:

i) Shirkat

ii) Ijarah; and

iii) Sale

These may be defined as follows:

i) SHIRKATUL MELK

Shirkat means partnership. Shirkatul Melk means share in ownership. When two or more persons supply equity, purchase an asset, own the same jointly, and share the benefit as per agreement and bear the loss in proportion to their respective equity, the contract is called Shirkatul Melk contract.

ii) IJARAH

The term Ijarah has been derived from the Arabic works. Which means consideration, return, wages or rent. This is really the exchange value or consideration, return, wages, rent of service of an asset. Ijarah has been defined as a contract between two parties, the Hiree and Hirer where the Hirer enjoys or reaps a specific service or benefit against a specified consideration or rent from the asset owned by the Hiree. It is a hire agreement under which a certain asset is hired out by the Hiree to a Hirer against fixed rent or rentals for a specified period.

RELATED TERMINOLOGIES OR ELEMENTS OF IJARAH

According to the majority of Fuqaha, there are three general and six detailed elements of Ijarah.

The wording : This includes offer and acceptance.

Contracting parties : This includes a Hiree, the owner of the property, and a Hirer, the party that benefits from the use of the property.

Subject matter of the contract : This includes the rent and the benefit.

The Hiree (Muajjir)- The individual or organization hires/rents out the property of service is called the Hiree (muajjir).

The Hirer (Mustajir)- The individual or organisation hires/takes the hire of the property or service against the consideration rent / wages / remuneration is called the Hirer (mustajir).

The benefit / asset (Maajur) – The benefit which is hired / rented out is called the benefit (Maajur).

iii) SALE

This is a sale contract between a buyer and a seller under which the ownership of certain goods or asset is transferred by seller to the buyer against agreed upon price paid / to be paid by the buyer.

Thus, in Hire Purchase under Shirkatul Melk mode both the Bank and the Client supply equity in equal or unequal proportion for purchase of an asset like land, building, machinery, transports etc. Purchase the asset with that equity money, own the same jointly, share the benefit as per agreement and bear the loss in proportion to their respective equity. The share, part or portion of the asset owned by the Bank is hired out to the Client partner for a fixed rent per unit of time for a fixed period. Lastly the Bank sells and transfers the ownership of it’s share / part / portion to the Client against payment of price fixed for that part either gradually part by part or in lump sum within the hire period or after the expiry of the hire agreement.

STAGES OF HIRE PURCHASE UNDER SHIRKATUL MELK

Thus Hire Purchase under Shirkatul Melk Agreement has got three stages:

i. Purchase under joint ownership.

ii. Hire; and

iii. Sale and /or transfer of ownership to the other partner Hirer.

IMPORTANT FEATURES:

01 . In case of Hire Purchase under Shirkatul Melk transaction the asset / property involved is jointly purchased by the Hiree (Bank) and the Hirer (Client) with specified equity participation under a Shirkatul Melk Contract in which the amount of equity and share in ownership of the asset of each partner (Hiree Bank & Hirer Client) are clearly mentioned. Under this agreement, the Hiree and the Hirer become co-owner of the asset under transaction in proportion to their respective equity participation.

02 . In Hire Purchase under Shirkatul Melk Agreement, the exact ownership of both the Hiree (Bank) and Hirer (Client) must be recognised. However, if the

partners agree and wish that the asset purchased may be registered in the name of any one of them or in the name of any third party, clearly mentioning the same in the Hire Purchase Shirkatul Melk Agreement. However, in IBBL, no third party registration shall be allowed.

03. The share / part of the purchased asset owned by the Hiree (Bank) is put at the disposal / possession of the Hirer (Client) keeping the ownership with him (Bank) for a fixed period under a hire agreement in which the amount of rent per unit of time and the benefit for which rent to be paid along with all other agreed upon stipulations are also to be clearly stated. Under this agreement, the Hirer (Client) becomes the owner of the benefit of the asset but not of the asset itself, in accordance with the specific provisions of the contract which entitles the Hiree (Bank) is entitled for the rentals.

04 As the ownership of hired portion of the asset lies with the Hiree (Bank) and rent is paid by the Hirer (Client) against the specific benefit, the rent is not considered as price or part of price of the asset.

05 In the Hire Purchase under Shirkatul Melk Agreement the Hiree (Bank) does not sell or the Hirer (Client) does not purchase the asset but the Hiree (Bank) promise to sell the asset to the Hirer (Client) part by part only, if the Hirer (Client) pays the cost price / equity / agreed price as fixed for the asset as per stipulations within agreed upon period on which the Hirer also gives undertakings.

06 The promise to transfer legal title by the Hiree and undertakings given by the Hirer to purchase ownership of the hired asset upon payment part by part as per stipulations are effected only when it is actually done by a separate sale contract.

07 As soon as any part of Hiree’s (Bank’s) ownership of the asset is transferred to the Hirer (Client) that becomes the property of the Hirer and hire contract for that share / part and entitlement for rent thereof lapses.

08 In Hire Purchase under Shirkatul Melk Agreement, the Shirkatul Melk contract is effected from the day the equity of both parties deposited and the asset is purchased and continues upto the day on which the full title of Hiree (Bank) is transferred to the Hirer (Client).

09 The hire contract becomes effective from the day on which the Hiree transfers the possession of the hired asset in good order and usable condition to the Hirer, so that the Hirer may make use of the same as per provisions of the agreement.

10 Effectiveness of the sale contract depends on the actual sale and transfer of ownership of the asset by the Hiree to the Hirer. It is sold and transferred part by part, it will become effective part by part and with the sale and transfer of ownership of every share / part. The hire contract for that share / part will lapse and the rent will be reduced proportionately. At the end of the hire period when the full title of the asset will be sold out and transferred to the Hirer (Client), the Hirer will become the owner of both the benefit and the asset consequently the hire contract will fully end.

11 Hire Purchase under Shirkatul Melk is a binding contract for the parties to it – the Bank and the Client who are committed to fulfill / meet their undertakings / obligations in accordance with the relevant agreement.

12 Under this agreement the Bank acts as a partner, as a Hiree and at last as a seller ; on the other hand the Client acts as a partner, as a Hirer and lastly as a purchaser.

13 Ownership risk is borne by both the Hiree and Hirer in proportion to their retained ownership / equity.

14 Under this agreement the role of Hirer is one that of a trustee, the hired asset being a trust property in his hands; he will manage, maintain the asset in favour of the interest of the Hire at his own cost as the exact subject of hirer except in cases of any accident due to any event entirely beyond control of the hirer and natural calamity/disaster (acts of Allah) to be determined by the Bank after proper investigation within the knowledge of the hirer.

15 The Hirer is responsible for keeping the hired asset(s) in good condition throughout the whole period of hire and if the asset is damaged or destroyed due to mismanagement, corruption, negligence, transgressions, default, etc. of the Hirer, he shall be responsible to compensate the Hiree (Bank) for that. Of course, such mismanagement, corruption, negligence, transgressions, default, etc. of the hirer shall be determined by the Hiree (Bank) after proper investigation within the knowledge of the hirer.

16 The Hirer cannot, without obtaining prior written permission of the Hiree (Bank) make any changes in the exact item of the hire, and / or remove it from its place of installation and transfer it to another location.

17 In a Hire Purchase under Shirkatul Melk agreement any stipulation may be made, provided it is not against the nature and requirements of the contract itself, nor does it violate the /this may be the last one devine laws of Islam and is also acceptable to both the parties.

18 Hire Purchase under Shirkatul Melk facilities may be for medium-term or long-term period which may be utilised for the expansion of production and services, as well as housing activities. The duration of Hire Purchase under Shirkatul Melk contract shall not exceed the useful life of the subject / asset of the transaction. The Bank should not normally enter a Hire Purchase under Shirkatul Melk transaction for items with useful life of less than two years.

19 Hire Purchase under Shirkatul Melk transaction facilitates the Client (Hirer) to get benefit from the hired asset in exchange of rental and also to become full owner of the asset by purchasing it part by part.

20 If, for any reason, the hire contract is revoked prior to the transfer of full title of the asset to the Hirer, then the title of the asset will be shared by both Hiree and Hirer – the Hirer will share that part of title which has been transferred to him against payment and the Hiree will share the remaining part.

21 The Hirer to secure the Bank (the Hiree) will pledge / hypothecate / mortgage his portion / part / share in the asset (acquired / to be acquired) and or any other asset / property of his own / third party guarantor to the Bank to fulfill his all liabilities / commitments including the accrued rental, if any.

RULES FOR HIRE PURCHASE UNDER SHIRKATUL MELK

01. It is a condition that the subject (benefit/service) of the contract and the asset (object) should be known comprehensively.

02. It is a condition that the asset(s) to be hired must not be a fungible one (Perishable or consumable) which can not be used more than once or in other words, the asset(s) must be a non-fungible one which can be utilized more than once or the use/benefit/service of which can be separated from the asset(s) itself.

03. It is a condition that the subject (benefit/service) of the contract must actually and legally be attainable/derivable. It is not permissible to hire something, the handing-over of the possession of which is impossible. If the asset is a jointly owned property, any partner, according to the majority of the jurists, may let his portion of the asset(s) to co-owner(s) or the person(s) other than the co-owner(s). However, it is also permissible for a partner to hire his share to the other partner(s).

04. It is a condition that the Hirer shall ensure that he will make use of the asset(s) as per provisions of the Agreement or as per customs/norms/practice, if there is no expressed provision.

05. The hire contract is permissible only when the asset(s) and the benefit/service drived from it is within the category of ‘Halal’ or at least ‘Mobah’ as per Islamic Shariah.

06. The Hiree is under obligation to enable the Hirer to the benefit from the asset(s) by putting the possession of the asset(s) at his disposal in useable condition at the commencement of the hire period.

07. In a hire contract, the period of hire and the rental to be paid per unit of time be clearly stated.

08. Everything that is suitable to be considered a price, in a sale, can be suitable to be considered as rental in a hire contract.

09. It is a condition that the rental falls due from the date of handing-over of the asset to Hirer and not from the date of contract or use of the asset.

10. It is permissible to advance, defer or install the rental in accordance with the Agreement.

11. It is permissible to review the hire period or the rental or the both, if the Hiree and the Hirer mutually agree to do so.

12. The hired asset is a trust in the hands of the Hirer. He will maintain the asset(s) with due produce and shall not be held responsible for the damage or destruction of the asset without transgression, default or negligence, otherwise he must be responsible for the same.

13. The Hiree/owner bears all the costs of legally binding basic repairs & maintenance including the cost of replacement of durable parts on which the permanence and suitability of the hired asset(s) depend or as per Contract.

14. It is permissible to make the Hirer to bear the cost of ordinary routine maintenance, because this cost is normally known and can be considered as part of the rental.

15. It is permissible for the Hirer to let the asset to a third party during the hire period whether for the same rental or more or less as long as the asset is not affected by the change of user and not barred / restricted by the hire agreement/customs to do so.

16. It is permissible to purchase an asset bearing a hire contract. The hire contract may continue since the purchaser agrees to its continuity up to the end of the hire term. All rights and liabilities emanating from the hire contract will transfer to the new owner. But if the sale-contract is drawn and the purchaser is oblivious of the hire contract, he has the right to rescind the purchase contract and the hire continues.

17. As soon as the hire period terminates, the Hirer is under obligation to return the asset to the owner or if the Hiree agrees he may enter a fresh hire contract or purchase it from the Hiree on payment of agreed upon price as per market rate.

18. The hire contract is binding and no one party shall unilaterally rescind except reasons that abrogate binding contract such as damage or destruction.

19. If the hired asset is damaged or destructed by the act of Allah and if the Hiree offers a substitute with the same specifications agreed upon in the hire contract the contract does not terminate.

20. It is also permissible to sell the hired asset by the Hiree to the Hirer during the tenure of the hire period either part by part or in full at a time. As soon as any part or in full the asset is sold during the tenure of the hire agreement the hire contract for that part or for the full asset as the case may be, be lapsed and the rental ceased to apply accordingly.

21. It is permissible for the Hirer to promise or to give undertaking to purchase the hired asset during the tenure of the hire period, either part by part or in full or at the end of the hire period in full. It is also permissible for the Hiree to give similar promise to sell the asset.

22. The hire with promise to purchase and sale is different from the memorandum of sale. The rent paid by the Hirer can not, in any way, be considered as part of the price of the asset, rather it is the price of the service of that asset.

23. In a Hire Purchase under Shirkatul Melk contract, it is permissible to divide the sale/cost price of the asset or ownership of the Hiree to the asset into several parts and to sell each part of ownership on payment of proportionate sale/cost price of the Hiree.

24. Under Hire Purchase under Shirkatul Melk Agreement, both the Hiree and the Hirer must pay their respective equity as agreed upon to purchase the demised asset under joint ownership.

25. Ownership of the asset of both the Hiree and the Hirer should be recognized as per law of the land.

Share Mechanism:

4.4.6. Mudaraba:

Definition

Mudaraba is a partnership in profit whereby one party provides capital and the other party provides skill and labour. The provider of capital is called “Shahib Al-Maal” while the provider of skill and labour is called “Mudarib”.

So, Mudaraba may be defined as a contract of partnership where the Shahib al-maal provides capital to the Mudarib for investing it in a commercial enterprise by applying his labour and endeavor. Both the parties share the profit as per agreed upon ratio and the losses, if any, being borne by the provider of funds i.e. Shahib al-maal except if it is due to breach of trust i.e. misconduct, negligence or violation of the conditions agreed upon by the Mudarib. If there is any loss incurred due to the reasons mentioned above, the Mudarib becomes liable for that.

TYPES OF MUDARABA

Mudaraba Contracts may be divided into 2 types:

Restricted Mudaraba (Al-Mudaraba Al-Muqayyadah)

A restricted Mudaraba (Al-Mudaraba Al-Muqayyadah) is a contract in which the Shahib al-maal impose any restrictions on the actions of the Mudarib but not in a manner that would unduly constrain the Mudarib in his operations.

Restricted Mudaraba may further be divided into three types:

a. Restriction in respect of time or period:

In this type of Mudaraba, the Mudaraba contract includes a clause on duration of the business. After expiry of such period, the Mudaraba shall become void.

b. Restriction in respect of place or location:

In this type of Mudaraba, the Mudaraba contract includes a clause on place or location of the business. The Mudarib shall bound to do the business within the area of such place or location.

Restriction in respect of business:

In this type of Mudaraba, the Shahib al-maal restricts the actions of the Mudarib to a particular type of business as he (Shahib al-maal) considers appropriate.

Unrestricted Mudaraba (Al-Mudaraba Al-Mutlaqah)

An unrestricted Mudaraba (Al Mudaraba Al Mutlaqah) is a contract in which Shahib al-maal permits the Mudarib to administer the Mudaraba capital without any restrictions. In this case, the Mudarib has a wide range of trade or business freedom on the basis of trust and the business expertise he has acquired. Such unrestricted business freedom must be exercised only in accordance with the interests of the parties and the objectives of the Mudaraba contract.

But, if Mudarib wants to have an extraordinary work, which is beyond the normal course of business, he cannot do so without express permission from Shahib al-maal. He is also not authorized to:

o Keep another Mudarib or a partner

o Mix his own capital in that particular Mudaraba without the consent of the Shahib al-maal.

Shariah Rules for Mudaraba

Rules relating to Mudaraba Contract

01. There are two contracting part+-ies in Mudaraba Contract :

The provider of the capital i.e. ‘Shahib al-maal’ and the Mudarib. Both parties should possess the legal capacity to appoint agents and accept agency.

02. The general principle is that a Mudaraba contract is not binding, i.e. each of the contracting parties may terminate it unilaterally except in two cases:

a. When the Mudarib has already commenced the business, in which case the Mudaraba contract becomes binding up to the date of actual or constructive liquidation.

b. When the contracting parties agree to determine a duration for which the contract will remain in operation. In this case, the contract cannot be terminated prior to the end of the specified duration, except by mutual consent of the contracting parties.

01 Mudaraba contract is one of the trust based contracts. Therefore, the Mudarib invests Mudaraba capital on trust basis in which case the Mudarib is not liable for losses except in case of breach of trust, such as misconduct, negligence and breach of the terms of Mudaraba contract. In committing any of the above, Mudarib becomes liable for the Mudaraba capital.

Rules relating to Offer and Acceptance

The wording-“Offer and Acceptance” – by which both the contracting parties express their willingness to conclude a contract and must conform to the following:

01. The wording should explicitly or implicitly indicate the purpose of the contract.

02. Acceptance of the offer is contingent on its taking place during the time which both the parties are negotiating agreement to the contract. However, acceptance is not valid if one party refuses the terms of the offer or leaves the place where the negotiation of the contract is being made before the deal is concluded.

03. Contract is permissible by verbal utterance or in writing and signing it. It is also permissible through correspondence or by the use of modern communication means, e.g., Telex, Fax, E-mail or Internet.

4.4.7. Musharaka:

Definition

Musharaka may be defined as a contract of partnership between two or more individuals or bodies in which all the partners contribute capital, participate in the management, share the profit in proportion to their capital or as per pre-agreed ratio and bear the loss, if any, in proportion to their capital/equity ratio.

In Islami Bank Bangladesh Limited (IBBL), the Bank may take part in a business with its Client(s), where both the Client(s) and the Bank provide capital in fixed proportions, take part in the management of business and share the profit in proportion to their respective capital ratio or at pre-agreed ratio and bear the loss, if any, in proportion to their respective capital/equity ratio.

Important Features:

• The investment client will normally run manage the business.

• The bank shall take part in the policy and decision making as well as overseeing (supervision and monitoring) the operation s of the business of the client. The bank may appoint suitable personal(s) to run the manage business and to maintain books of accounts of the business property.

• As the investment client shall manage the enterprise, the bank may more share of profit to him than that of his proportion capital contribution.

• Loss, if any, shall be shared on the basis of capital ratio.

4.5 Mode Wise Investment:

Mode wise distribution of investment as on 31st December 2003 vis-à-vis corresponding period of last year is given below:

Table No. 01: Mode Wise Investment of IBBL

(Million in Taka)

|

Mode | 2005 | % of Total Investment | Difference | 2006 | % of Total Investment |

| Bai-Murabaha | 51,822.28 | 55.34% | 7,642.81 | 59,465.09 | 52.36% |

| HPSM | 30046.89 | 32.09% | 9,352.30 | 39,399.19 | 34.69% |

| Bai-Muajjal | 5917.18 | 6.32% | 1,004.22 | 6921.4 | 6.09% |

| Purchase & Negotiation | 3179.81 | 3.40% | 1,666.81 | 4846.62 | 4.27% |

| Quard | 1966.13 | 2.10% | 8.07 | 1974.2 | 1.74% |

| Bai-Salam | 641.44 | 0.68% | 264.18 | 905.62 | 0.80% |

| Mudaraba | 50 | 0.05% | 0.00 | 50 | 0.04% |

| Musharaka | 20.42 | 0.02% | -7.47 | 12.95 | 0.01% |

| Total | 93644.15 | 100.00% | 19,930.92 | 113575.07 | 100.00% |

4.6 Investment Sectors:

Table No. 02: Investment Sectors of IBBL

Amount in Million

| Sector | Taka | USD | Percentage |

| Industrial | 54486.49 | 789.66 | 45.25% |

| Commercial | 44473.48 | 644.54 | 36.93% |

| Real estate | 7719.36 | 111.87 | 6.41% |

| Transport | 2720.42 | 39.43 | 2.26% |

| Agriculture | 3412.88 | 49.46 | 2.83% |

| Others | 7589.05 | 109.99 | 6.30% |

| Total | 120401.68 | 1744.95 | 100% |

Source: Islami Bank 25 Years of progress 2008 (published by IBBL).

4.7 Details of Special Investment Schemes under Investment Modes

i. Household Durable Scheme

Islami Bank Bangladesh Limited has introduced Household Durables Investment Scheme which has already created great enthusiasm among the people and received tremendous response from them. Objectives are to assist the service holders with limited income in purchasing household articles such as furniture, electric and electronic equipment etc.

ii. Investment Scheme for Doctors

A good number or newly graduated doctors from Medical Colleges are unemployed. Many of the medical graduates are waiting for job because the opportunity for Government service is limited. If these young doctors could be self-employed by extending investment facilities, they could make modern facilities available at the door-steps of rural people.

In view of the above facts, Islami Bank Bangladesh Limited has taken the initiative an introduced the ” Doctors Investment Scheme” to ensure modern treatment and medical facilities available to the people through extension of Bank’s investment facilities for self-employment of newly graduated doctors and at the same time extending investment facilities to the established medical practitioners to procure modern and sophisticated medical equipment.

iii. Small Business Investment Scheme

Bangladesh a third-wood developing country is rich in natural and human resources. Inspite of vast possibilities, the majority people of the country livein hardship-below poverty tapped, explored and exploited. Physical labour is their only means of earning. A large segment of this populace is active youth force. Many of them are efficient, intelligent and energetic with initiative & drive and have courage to tale risks. But they can not uplift their socio-economic condition due to poverty, lack of financial support and other required facilities.

iv. Housing Investment Scheme

One of the basic human needs is to have a house to live in. A house is in an abode of peace and happiness. Housing has now become an acute problem in the country, especially in the towns, cities and metropolis. With their limited income, it has become almost impossible on the part of the lower middle class, middle class and sometimes, even for upper middle class to solve their housing problem. To meet this basic human need, Islami Bank Bangladesh Limited is committed to contribute to this end to provide a peaceful and happy.

v. Real Estate Investment Program

Professionals, Service-holders, Businessmen, Real Estate Developer and other categories of people who are not entitled for availing investment facilities under Housing Investment Scheme, shall be eligible under this programme Investment is to be extended to build new houses and for extension/ completion of the house already constructed, commercial building, shopping complex, flat apartment etc.

vi. Transport Investment Scheme

Under this scheme, investment in being allowed to the existing successful businessmen and potential entrepreneurs in this sector for all types of road and water transport with simple and easy terms and conditions. The bank is also extending investment facilities to multinational companies, established, business houses and well to do officials and professionals for acquisition of private cars, microbus and jeeps.

vii. Car Investment Scheme

Car is considered as on essential mode of transport in the modern society, particularly by a section of the officials, business houses and business executives and established professionals for movement in discharging their duties and responsibilities punctually and efficiently. Many of these categories of people can not purchase a car on payment of entire purchase value at a time out of their own sources. To meet this need Islami Bank has introduced the ‘Car Investment Scheme’ for the mid and high ranking officials of government and semi-government organizations, corporations; executives and directors of big business houses and companies arid also for persons of different professional groups on easy payment terms and conditions.

viii. Rural Development Scheme of IBBL

Islami Bank Bangladesh limited (IBBL) envisages an economic system based on equity and justice. Taking into consideration that majority of the population below poverty line lives in rual Bangladesh, the Bank has devised a Rural Development Scheme (RDS) with a view to creating employment opportunity for them and alleviates their poverty through income generation activities. The IBBL through its RDS project has been implementing integrated programs for the landless poor, aged laborers and marginal farmers aimed at meeting their basic needs and promoting their comprehensive development. Consciousness among the poor needs should be enhanced so that they can lift their position in the socio-economic structure of the country. In order to consolidate their economic base, invested money should be used in income generating activities so the poorer section of the population can become self-reliant. RSD works for the realization of that objective.

ix. Agricultural Implements Investment Scheme

Bangladesh is predominantly an agricultural country with vast majority of people living in rural areas. Most of our people for their living are dependent on agriculture. Agriculture still contributes the lion share of the gross domestic product. But we could not as yet become self-sufficient in food production. We still import a bulk quantity of food grains from abroad to meet the deficit. We must modernise our agriculture and establish more and more industries in order to minimise imports

The Bank has introduced “Agriculture Implements Investment Scheme” to provide power tillers, power pumps, shallow tube wells, thrasher machine etc. On easy terms unemployed youths for self-employment and to the farmers help augment production in agricultural sector.

x. Micro Industries Investment Scheme

Islami Bank Bangladesh Ltd. has been appreciably participating in this direction by financing industrial sector. With a view to creating wider base for industries, the Bank has decided to launch “Micro Industries Investment Scheme” through its Branches.

4.8 Sector wise Industrial Position of IBBL from 2005 to 2008

The investment in the industrial sector as on 31.12.2008 is Tk.78,788.15 million (approximately), which signifies the commitment of the Bank towards rapid growth of the economy and to increase the per capita income of the people by creating employment opportunities and greater contribution to the national economy.

Sector wise Industrial Position of IBBL from 2005 to 2008

Table No. 07

(Figure in Million Taka)

| Name of the sector | 2005 | % to total Indus. Investment | 2006 | % to total Indus. Investment | 2007 | % to total Indus. Investment | 2008 | % to total Indus. Investment |

| Textile Mills | 12897 | 36 | 17409 | 38 | 24338 | 39 | 35415 | 45 |

| Steel, Re-rolling & Engineering | 7127 | 20 | 6836 | 15 | 7680 | 12 | 7706 | 10 |

| Agro based Industry | 4759 | 13 | 5490 | 12 | 7337 | 12 | 9421 | 12 |

| Garments Industry | 4065 | 11 | 3959 | 9 | 5019 | 8 | 8694 | 11 |

| Food & Beverage | 1683 | 5 | 2742 | 6 | 3788 | 6 | 5027 | 6 |

| Cement Industry | 1288 | 4 | 1657 | 4 | 1489 | 2 | 1562 | 2 |

| Pharmaceuticals | 727 | 2 | 589 | 1 | 1171 | 2 | 1531 | 2 |

| Poultry, Poultry Feed & Hatchery | 517 | 1 | 574 | 1 | 767 | 1 | 468 | 1 |

| Sanitary Wares | 330 | 1 | 409 | 1 | 432 | 1 | 588 | 1 |

| Chemicals, Toiletries & Petroleum | 260 | 1 | 177 | 0 | 243 | 0 | 882 | 1 |

| Printing & Packaging | 242 | 1 | 596 | 1 | 498 | 1 | 708 | 1 |

| Power (Electricity) | 217 | 1 | 546 | 1 | 359 | 1 | 609 | 1 |

| Ceramic & Bricks | 210 | 1 | 320 | 1 | 552 | 1 | 747 | 1 |

| Health Care (Hospital & Others) | 113 | 0 | 216 | 0 | 294 | 0 | 691 | 1 |

| Plastic Industry | 109 | 0 | 528 | 1 | 598 | 1 | 302 | 0 |

| Petrol-Pump & CNG Filling Station | 66 | 0 | 114 | 0 | 127 | 0 | 310 | 0 |

| Information Technology | 56 | 0 | 9 | 0 | 10 | 0 | 22 | 0 |

| Hotel & Restourant | 4 | 0 | 4 | 0 | 9 | 0 | 138 | 0 |

| Other Industries | 923 | 3 | 3891 | 8 | 7931 | 13 | 3967 | 5 |

| Total | 35593 | 100 | 46064 | 100 | 62642 | 100 | 78788 | 100 |

Source: Islami Bank 25 Years progress 2008

4.9 Shari’ah Compliance in IBBL

Alhamdulillah, by the grace of Almighty Allah, IBBL is proceeding towards continuous progress and success with due commitment for compliance of Islamic Shari’ah Principles. Since very inception of IBBL, Shari’ah Council was formed to provide necessary counsel and guideline to the management for effective Shari’ah Compliance in the Bank. During the period January–December, 2007, the Muraqibs of Shari’ah Council had conducted Shari’ah inspection at 176 branches. During the period the doubtful income was detected by the Muraqibs of the Shari’ah Council Secretariat to the tune of Tk. 6,08,14,190/- out of total inspected amount of Tk. 67,80,60,471/- and percentage of doubtful income is 8.97%.

Chart No – 04: Type of Shariah Violation in 2008

Source: Branch Managers’ Conference Book 2008

4.10 Investment Plan for 2008-2012

Currently a “5 year perspective Investment Plan” has been porposed for the year 2008-2012 in continuation of 7 years Plan from 1996-2002 and 5 Years Plan from 2003-2007. The plan has been formulated keeping in view of the national economic priorities and aiming at diversification of the investment portfolio by size, sector, geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic activities and different economic strata of the society within the fold of Bank’s investment operations.

Chart No – 05: Investment Plan of IBBL: 2008 – 2012