Internship Experience at Mercantile Bank Limited

Mercantile Bank Limited was incorporated in Bangladesh as a Public Limited Company with limited liability under the Bank Companies Act, 1991 on May 20, 1999 and commenced commercial operation on June 02, 1999. The Bank went for public issue of shares on in 2003 and its shares are listed with Dhaka Stock Exchange and Chittagong Stock Exchange. The Bank has 84 branches spread all over the country. MBL is a highly capitalized new generation Bank with an Authorized Capital and paid-up Capital of Tk. 8000.00 million and Tk. 4968.90 million respectively. With assets of TK. 116,655,283,665 and more than 1668 employees, the bank has diversified activities in retail banking, corporate banking and international trade.

There are 30 sponsors involved in creating Mercantile Bank Limited; the sponsors of the bank have a long heritage of trade, commerce and industry. They are highly regarded for their entrepreneurial competence. The sponsors happen to be members of different professional groups among whom are also renowned banking professionals having vast range of banking knowledge. There are also members who are associated with other financial institutions insurance Companies, leasing companies etc.

MBL undertakes all types of banking transactions to support the development of trade and commerce in the country. MBL’s services are also available for the entrepreneurs to set up new ventures and industrial units. The bank gives special emphasis on Export, Import, Trade Finance, SME Finance, Retail Credit and Finance to women Entrepreneurs. To provide clientele services in respect of International Trade it has established wide correspondent banking relationship with local and foreign banks covering major trade and financial centers at home and abroad.

With the passage of time it has expanded its number of branches and variety of services along with its core business of taking deposits and granting loans. Rising trend of the bank’s profitability over the last 13 years is also materialized. The MBL is committed to the delivery of the superior shareholders’ value.

Current Scenario:

Mercantile Bank Limited is a new generation Bank. It is committed to provide high quality financial services/products to contribute to the growth of GDP of the country through stimulating trade & commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and over all sustainable socio-economic development of the country.

In achieving the aforesaid objectives of a Bank, Credit Management has paramount importance as the greatest share of total revenue a Bank generates from it. Existence of the bank depends on prudent management of its credit operation where maximum risk is centered in it and. In most of cases, the failure of a commercial bank is usually associated with the problem in credit management as well as the result of shrinkage in the value of assets. Therefore, credit management has not only featured domination in the assets structure of the bank but also critically important to the success of the bank.

The standards of credit relate to safety, liquidity and profitability whereas these dynamic factors are also related to different aspects such as interest or margin, credit spread, nature and extent of risk and credit dispersal. In the Kawran Bazar Branch’s Credit Department, there are six officials are working continuously with great effort and teamwork and they have quite efficient skills and talent to perform the jobs in this department. The Bangladesh Bank, Credit Division at Head Office of MBL and the respective officers of branch in the section control this credit department.

The officers believe in teamwork and extreme hard working. In all business dealings, credit officers are guided by the principles of honesty, integrity and safe-guard the interest of the depositors and credit customers of the bank. Credit officers principally perform credit management task by providing fund (credit) to customers and receiving fund back by charging interest along with installments with obeying rules and regulations of the Bangladesh Bank and Head Office as well as maintaining the best business practices in the Bank. However, the key to safe, liquid, healthy and profitable credit operations lies on the quality of credit management which is performed by the credit officers.

Mission of MBL

“Will become most caring, focused for equitable growth based on diversified deployment of resources, and nevertheless would remain healthy and gainfully profitable Bank”

Vision of MBL

“Would make finest corporate citizen”

MBL dreams to become the “Bank of Choice” of the general public that includes both the consumer and the corporate clients. It has created a cadre of young professionals in banking profession which has helped boosting productivity in the bank.

Objective

Strategic objectives

- To achieve positive Economic Value Added (EVA) each year.

- To be market leader in product innovation.

- To be one of the top three financial institutions in Bangladesh in terms of cost efficiency.

- To be one of the top five financial institutions in Bangladesh in terms of market share in all significant market segment they serve.

Financial objective

- To achieve 20% return on shareholders’ equity or more, on average

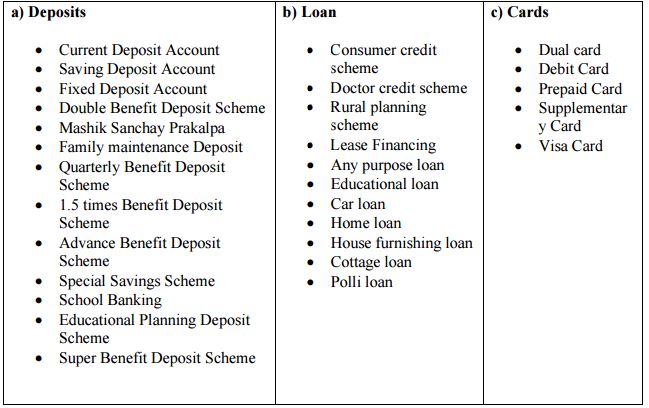

Product and Services

MBL has launched a number of financial products and services since its inception. These products and services are categorized in five sectors i.e. Retail Banking, Corporate Banking, SME Banking, Foreign Trade Business & E-banking

Retail Banking Service

Corporate Banking Service

- Short term finance

- Long term finance

- Real estate finance

- Import finance

- Work order finance

- Export finance

- Structured finance

- Loan syndication

SME Banking Service

- Chaka

- Annaynna

- Chalti Muldhan

- Single payment Loan

Foreign Trade Business

- Foreign correspondents

- Nostro Accounts

E-banking Service

- Online banking

- Mobile banking

- SMS banking

- SWIFT

- Locker Facility

Departments of Mercantile Bank Limited

In branch level, MBL has three departments. These are-

- General Banking

- Credit Department

- Foreign Exchange Department

Account opening

Major Functions of General Banking

- Issuance of Demand Draft/Telegraphic Transfer/Pay Order/Fixed Deposit Revenue

- Interbank Transaction, Inter Branch Credit

- Credit Proposals and Credit Processing

Major Functions of Credit Department

- Documentation and Loan Disbursement

- Overview on all returns

- Opening of L/C (Back To Back, Local/ Foreign)

Major Functions of Foreign Exchange Department

- Purchase of foreign bills

- Negotiating of foreign bills

- Payment against Import Bill

- Export guarantees

- Endorsement of Traveling

Internship Experience

Prologue

After completion of academic study, all of us will have to enter into professional world. Before facing with real world, to work as an intern in an organization is best opportunity to practice corporate culture and utilize academic learning. I got the privilege to work at Mercantile Bank Limited for a period of 12 consecutive weeks.

I experienced that every desk is assigned with specific jobs and particular persons take responsibility as well as to carry out the jobs. In cooperating with all the persons I worked with, I came to learn a lot of things which will help me not only in professional life but also in my personal life.

I worked at Kawran Bazar Branch from January 1, 2013 to March 31, 2013 and these three month journey of my internship with Mercantile Bank Limited was very delightful. I enjoyed my works and all the stuffs, officers of the bank are very friendly and helpful.

As I worked as an intern there, I was assigned at different desks of all the divisions of bank.

Accounts Department

At the beginning of internship period, I worked at ‘Accounts’ under General Banking Division and I worked there from 1st January to 12th February 2013. Accounts department is responsible for analyzing all the transactions which are held in bank and keeping records of all transactions.

Everyday all transaction lists, vouchers, cheques are received from different divisions. Then the respective officers in Accounts analyze and register all transactions. My principle jobs in accounts were organizing the vouchers, matched the vouchers with transaction lists. There are three types of vouchers and these are categorized as Cash, Transfer and Clearing vouchers. There are automated transaction lists which are called as ‘Supplementary’. My job was to check vouchers and then attach all vouchers with respective Supplementary sheets. After attaching, next job was balancing. Balancing means doing summation and ensuring that value of debit and credit is equal. Then the job was to make a cover where total numbers of transactions are counted and recorded. Then prepare it for binding in an organized format. All of these tasks are day to day activities of accounts department.

Cash Department

I worked in cash department from 13th February to 23rd February. My duty was to register value of cheques and deposits slips and gave serial (tracer) number to the respective cheques and deposit slips according to the register entry number. Cheques are registered in debit (Dr.) account because bank gives money to customer with cheque which is debit and deposit slips are registered in credit account because with using deposit slip customer deposit money to bank. At the end of the day I had to sum up register entries and checked them with automated transaction list through the computer. Another job I did there was sorting the cheques according to the account number. I had to also sort out the Demand Payable Slip (DPS) according their types.

There are three types of DPS such as 3years, 5years and 8 years. From 1st day to 10th day of every month is considered as DPS collection period.

Foreign Exchange Department

Foreign Exchange is a vast department in MBL and I worked here from 24th February to 28th

Credit Department

February 2013. My job was to prepare the Letter of Credit (L/C) files for the clients with corresponding papers (i.e. commercial invoice, pro-forma invoice, L/C opening forms etc.). I had to write and fill up some application forms i.e. IMP (Import) Form, EXP (Export) Form with taking information from different register books. I also sorted out the vouchers of Foreign Exchange Department.

The last department I was appointed at credit department. My job was to prepare file for applicants with the corresponding papers (i.e. applicant’s information, company invoices, TIN, VAT certificate, credit report etc.) and help them to fill up it. I attached stamp in some of the papers like as Demand Promissory Note and then gave some seals like as Signature Verifying seal. I also printed out vouchers and sorted them. Another job was to prepare the data of individual and corporate clients, listed them in a table and synchronized with the framework in MS Excel. I also made entry of the transactions in daily basis in register books.

Loan Facility Parameters of MBL:

The Loan facility parameters for the Bank have been set as under:

(a) The Bank in general will approve / renew trade finance facility for the period of 01 (one) year from the date of approval / last expiry date.

(b) The Bank will extend medium term loan for 3(three) years period.

(c) The Bank will extend long term loan for maximum period of 7 (seven) year including grace period of 6(six) months to 18(eighteen) months (depending on the nature of Project) for project finance but in case of need, in syndication or club financing, the Bank may extend the period of loan up to-+ 8(eight) years or as per consensus of the syndicated members. However, in case of House Building Loan (General), the repayment period will be maximum of 15(fifteen) years.

(d) House Building Loan to Bank’s employee shall be governed as per policy guidelines of “Employees House Building Loan” scheme.

(e) Besides above, the Bank will extend credit facilities under special program like Consumer Credit Scheme, Small Loan Scheme, SME Financing, Doctor’s Credit Scheme, Women Entrepreneurship Development Project, Personal Loan, Car Loan, House Building Loan (General) / Mortgage Loan, NBFI’s as per policy set / to be set by the Bank under the policy guidelines of the specific scheme.

(f) The rate of Interest / Commission / Charges / Fees etc. would be as per the approved schedule of charges with variation permissible as per Bangladesh Bank guidelines and with the approval of competent authority.

(g) The interest rate to be charged and to be paid out on quarterly basis except the especial schemes and unless otherwise specified in the approved terms.

(h) Repayment of term loan would be fixed preferably on monthly/quarterly basis.

(i) In general, the cash margin for L/C would be 10% of the L/C amount or on the basis of Banker – Customer relationship subject to the minimum requirement of Bangladesh Bank whichever is higher.

(j) For the import of Capital machinery, the cash margin for L/C would be 25% – 30% or on the basis of Banker – Customer relationship subject to the minimum requirement of Bangladesh Bank whichever is higher.

(k) Any exception, as mentioned above, would be specifically approved by the competent authority of the Bank.

(l) Security accepted against credit facilities shall be properly valued and shall be effected in accordance with Laws of the country in which the security is held. An appropriate margin of security will be taken to reflect such factor as the disposal costs or potential price movements of the underlying assets. Accepted Securities are: Cash/Cash equivalent, Land and Building (in the form of registered mortgage with registered IGPA), hypothecation / ownership of Plant and Machinery, stock of goods, assignment of bills / receivables, book debts, pledge of shares, guarantee / Corporate Guarantee, etc.

(m) Valuation of the lended property/Building/Machinery/Stock of Raw materials/Finished products shall be done by the Bank’s enlisted professional surveyors duly checked by the Bank officials.

(n) Mortgage formalities including execution of registered irrevocable power of attorney must be completed as per legal vetting of the Bank’s approved/enlisted Lawyer.

(o) The value of the mortgage property shall be preferably double of the facility to be extended depending upon other security coverage.

(p) The security condition may be relaxed depending upon the Credit worthiness of the customer / Banker-Customer relationship / potentiality of the business of the client.

(q) Any exception of the parameters mentioned above are subject to be approved by the competent authority as per delegated power approved by the Board of Directors

A Sample Case of Loan Creation By MBL

Mr. K.M. Tanvir is the proprietor of ‘Kazi Enterprise’. Kazi Enterprise is a toy wholesaling enterprise. It has an own showroom. It has also a warehouse which is run on rent. Mr. K.M. Tanvir has seven (07) years experience in this business. He has a Current Deposit (CD) account in the Kawran Bazar branch of MBL in the name of ‘Kazi Enterprise’. Mr. K.M. Tanvir required a sum of money as working capital because of expansion his business. He applied to the bank for a loan in valued BDT 8.00 lac. Kazi Enterprise is a small enterprise with fixed asset in valued BDT 20 lac and has only ten (10) workers.

Now here is an explanation that how this loan has been processed by the branch and Credit Division of MBL

Step 1- Firstly, a loan application was submitted by Mr. K.M. Tanvir and received by the bank officials.

Step 2- From this step, proposal preparing process was started. In this step, borrower was evaluated on the basis age of the business, nature, form and legal papers of the business. On these terms, Kazi Enterprise had to fulfill all the requirements.

Mr. K.M. Tanvir submitted the required papers. Some of these are

- Last year’s income statement

- Last year’s balance sheet

- Price & list of inventory

- Bank solvency certificate

There were also some important documents verified by the loan officer like- trade license, TIN certificate, VAT certificate, rental deed etc.

Step 3– Then loan officer obtains borrower’s credit information from Credit Information Bureau send it to Bangladesh Bank for clean CIB report.

Step 4- Kazi Enterprise presented three (03) guarantors on behalf of the borrower. One person of them is a physician and another person is a businessman of his area. Both of them fulfilled all the requirements as guarantor. Another guarantor is Mr. K.M. Tanvir’s wife.

Step 5– Then the bank went to the borrower’s business site to evaluate the business and its condition.

Step 6- Then loan officer verified all documents. After all verifying, loan officer sent the proposal to the Credit Division, Head Office. After some days, Credit Division sent the sanction letter. Credit Division sanctioned a loan valued BDT 2.00 lac. NPV, IRR, installment amount were calculated by the officer of Credit Division.

General information about the sanctioned loan as follows

- Sanctioned Amount – 8.00 lac,

- No. of installment- 36,

- Rate of interest- 15%,

- Installment amount- Tk. 27,733,

- Processing fee charged- Tk. 500,

- Risk Fund: 1%,

- Service Charge- 1%

- Application Fee- Tk. 200.

Credit Division also gave the permission to disburse the loan

Step 7- A master file opened and all the related papers were attached with that file. Then, a controlling loan account no. was given by the loan officer.

Step 8- Mr. K.M. Tanvir, owner of the Kazi Enterprise and officers signed the charged documents and loan officer put them in the file. Guarantors also had to sign in charged documents.

Step 9- Loan officer opened the account in the name of Kazi Enterprise and put the limit of amount over there. After that, loan officer issue the check book and gave it to Mr. K.M. Tanvir. The loan officer will receive postdated check leafs each of them is equal to installment amount and one undated check leaf which is equal to the whole loan amount.

Therefore, this is the full sample process of lending to the clients.

Conclusion

Mercantile Bank has established credit relationship with many reputed multinational companies, semi-government organization as its customer group ranges from individuals, organizations and small businesses covering all sectors of Corporate and Retail businesses. MBL has aim to contribute in potential sectors like as agriculture, electronics, SME, healthcare etc. by providing not only credit services but also taking essential steps to expand these sectors through participating actively in economic development of the country.

Though MBL has been facing a number of problems regarding to credit service, it has been able to achieve “AA-” credit rating in last two consecutive years which indicates a banking entity with high credit quality, higher safety and have superiority in customer service. In believing, MBL will make a positive attempt to be more outward looking in their goals and emphasize on the domestic scenario more closely and analyze any certain trends and strategies of their competitors.