Internship Experiance at Hoda Vasi Chowdhury Chartered Accountants

Hoda Vasi Chowdhury (HVC) is one of the top and oldest professional services firms in Bangladesh. For about 50 years, HVC has provided high-quality financial, taxation and management services to a diverse and successful client base operating across various industry and business segment. It started its practice in this vision in 1962 under the name and style “A F Ferguson & Co”, a Scottish firm. Since then, as an innovative and highly professional public accounting and consulting firm, HVC serves as trusted auditor and valued advisor to over 1,000 clients by delivering objective, clear and practical advice to assist their client’s growth and succeed in their chosen field.

HVC is uniquely positioned to impart quality, cost-effective and practical advice to clients that include multinational corporations, private businesses, non-profit organizations, governmental entities, emerging or start-up firms, coupled with the personal relationship, value-based fee structure and service continuity.

In late ninety’s, HVC significantly expanded its management consulting services in order to meet the growing demands of their clients and the challenges of the promising Bangladesh economy.

HVC employs qualified professionals who work under the direct supervision of partners in the fields of auditing, accountancy, taxation, business advisory services, consulting and other special assignments. Presently, HVC has over 200 professionals in various fields in addition to 28 admin and support staffs.

HVC Historic Events:

- 1947 – A. F. Ferguson & Co (AFF) established office in Pakistan – Karachi and Lahore;

- 1961 – AFF took over Price Waterhouse clients on its cessation;

- 1962 – AFF practice started in Chittagong;

- 1963 – Opened Dhaka Office;

- 1972 – Succeeded AFF Bangladesh practice after renaming the firm to HVC;

- 1998 – Restructured & inducted four partners;

- 2001 – Expanded and two more partners joined;

- 2001 – Opened new national office at new commercial hub (Kawran Bazar);

- 2014 – Restructured and inducted two partners &

- 2014 – Became the Authorized ACA Training Employer by ICAEW.

Mission:

- To excel our relentless efforts for the steady growth of our clients.

- To keep pace with global growth and development in technology and professionalism with high ethical standard.

Vision:

To uphold the reputation and recognition as one of the best professional service providers in this region.

Shared Beliefs:

- Outstanding value to clients.

- Commitment and integrity to each other.

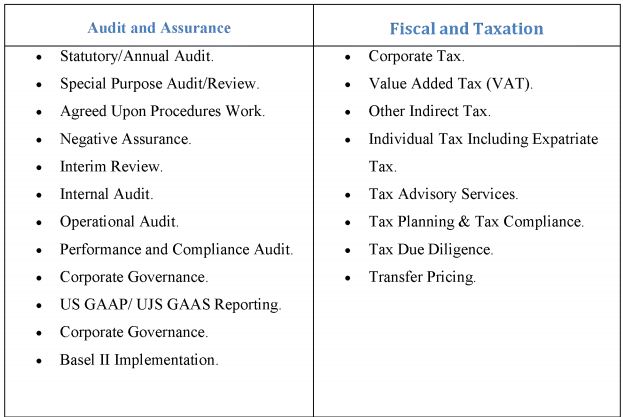

Services Provided by HVC:

HVC helps their clients to keep pace with competitive and fast moving business environment, HVC offers wide range of services. Its expertise extends into different areas of financial, taxation, management and advisory matters. It also renders services to international development agencies and expatriate consultants those are associated with various projects in Bangladesh.

Most of the common areas of services are:

Role of Personal:

Partners: The role of partners is to catch the attention of new clients for providing service and sometimes clients also come over to the firm themselves. The associates must make sure that the existing clients are provided the finest service.

Audit Managers: Audit managers must be Chartered Accountant who can assist partners in different way. He/she should analysis the audit report before signing the audit report.

- a) Supervisors:

It is not necessary for the supervisors to be a chartered account. He can also be a course complete student having huge experiences at the field of accountancy. He is being supervised by the audit manager when and where an audit activity is performed and how it is to be performed.

- b) Senior Student:

An audit senior has some experience in the accountancy field before he is designated as the audit senior of the firm. He is under the direct supervision of audit manager and supervisor.

- C) Semi- Senior Student:

A semi-senior student must complete 1 year of article ship in the firm. He is responsible to the senior student of the firm when he doing any fieldwork.

- d) Junior Student:

Junior- Students are fresher who have joined the audit firm.

Audit Procedure in Bangladesh

General definition of audit process and procedure:

Each and every company maintains their own internal accounting system. Though they have their own accounting system but at the end of the day an independent audit firm checks all their workings and provides opinion about true and fairness of their accounts. Moreover, properly executed audits will identify various problems in a particular firm that is being audited. At the end of the audit, auditors will provide an audit report which shows that whether the company maintains a true and fair view in their reports or not.

Audit process:

It is a systematic order of steps followed by the auditor in the examination of client records. The audit process may vary upon various aspects, example- nature of the engagement, audit objectives provided by the client and types of audit assurance. Furthermore, the process includes understanding every particular client’s environment, conducting the auditing procedure and tests, appraising the audit results and communicating the results to interested parties.

Audit procedure:

It is auditor system in gathering evidence reviewing proof to substantiate the dependability of the accounting records. The inspector assesses whether the data displayed is consistent and sensible. Examples of auditing procedures are observing assets to verify existence and amount (e.g., fixed assets), collecting independent confirmations from external parties (e.g., bank confirmation), evaluating internal control, appraising management’s activities, and obtaining management representations. The review systems to be taken after on an engagement are shown in the review program. The work papers demonstrate what has been done on the review.

Audit process and procedure standards or guidelines in Bangladesh by ICAB:

Institute of Chartered Accountants of Bangladesh guided and regulated the firms of Bangladesh. ICAB has recommended and provided the firm with different subject regarding auditing. Like others it has suggested auditing procedures that can be followed by the audit firm in Bangladesh in its Audit Practice Manual.

Audit process suggested by Audit Practice Manual (APM) may be summarized as follows.

- Planning.

- Collection of evidence.

- Controlling and recording.

- Review and opinion.

Rakeen Development Company (BD) Audit Procedure

Introduction:

In my internship period HVC appointed as a junior auditor for performing the audit of Rakeen Development Company (BD). I was send with two more members to conduct an audit. HVC was engaged with Rakeen from last two years. Moreover, we have been told to study about Rakeen from the financial statement that they have provided publicly last year.

Thus, a brief company overview is described below:

R akeen D evelopm ent C om pany (BD) overview:

Driven by the strong enthusiasm to offer something unique and exceptional to the residents of Bangladesh, Rakeen Development Company was founded under the leadership and guidance of dreamers like Dr. Khater M assaad & Mr. S A K Ekramuzzaman in 2008. Rakeen is an Arabic word which means “Central Pillar” or Trustworthy Support”. Rakeen only believes in top quality assurance while it comes to trust and reliability in real estate sector in Bangladesh.

Their objective is not to provide merely a house to live in but to offer a complete lifestyle destination to their home owners surrounded by an aura of luxury. They provide world class amenities and design perfect solution for the entire family in consideration of the needs and wants of the clients.

Moreover, Rakeen is the first company in the history o f Bangladesh, who has appointed an internationally highly praised foreign construction company to deliver the entire construction work for a residential project.

With the unwavering determination to be the most trusted name in the real estate industry in Bangladesh, Rakeen has launched its first flagship project “BIJOY RAKEEN CITY ” .

Moreover, with the perfect blend of comfort, convenience and aesthetic appeal, this project is located in one of the most sought after residential areas of Dhaka. The entire construction work of the project is being done by ESLA Construction Company of M iddle East which is one of the top 10 construction companies in the M iddle East, internationally acclaimed for their outstanding construction quality and timely completion of the project. At Bijoy Rakeen City, along with luxurious apartments they are also offering blissful living spaces that present an international standard lifestyle and promises to pamper its residents like never before in Bangladesh.

Audit procedure of Rakeen:

Identify F irm ’s overall goals in consideration of R akeen D evelopm ents C om pany (BD): Rakeen Developments Company (BD) tied up with HVC in conducting an audit and to express an opinion as to whether the financial statements that has been prepared shows true and fair view in accordance to Bangladesh Accounting Standard (BAS). HVC considered BAS rules as standards in generating an opinion taking into accounts with misstatements, errors, and irregularities of Rakeen Development Company.

Gather and evaluate initial information:

An audit team including me went to Rakeen’s office in M irpur 14. Our first task was to have a sound knowledge about their business operations, internal control system in consideration of their wants and needs. Moreover, we gather information they are now newly affiliated with ESLA corporations and the construction work is mainly look after by them and everything else is done by Rakeen himself.

Assess General risk of Rakeen Developments Company (BD):

During audit planning and risk assessment, we obtain initial audit evidence in order to:

- Effectively assess the inherent risk of potential financial statement misstatements,

- Identify indicators of possible going concern problems, and

- Identify account specific risk and design an overall audit approach to provide reasonable assurance o f detecting material misstatements.

In General, overall risk might trigger in a company are: property and plant, depreciation, cash and cash equivalents, inventory, receivables, payables, loan interest and tax. These are the main head where it is common to found any sorts of risks in any company. However, as I am a junior my supervisor did not gave me a chance to deal with those rather he assist me to observe expenses.

An example of the risk Areas that I have found by observing “ Operating and Administrative expenses” is:

Salary expense:

- A) Previous year (2014) salary may recorded or given in current accounting period.

- B) More than 15000 Taka salary may paid in cash.

- C) No bank statement may not found.

- D) Over/ under payment might recorded or provided.

- E) TDS / VDS may not deducted.

- F) Undisclosed employee may got payments.

Steps done to check S alary expenses:

A) Checked the account closing balances and opening balances.

B) Checked the transactions on test basis.

C) Checked the various agreement of salary from personal files.

D) Checked payments procedure with walk through tests.

E) Checked list of employees.

F) Obtained BOI approval o f foreign employees.

G ) Checked VDS and TDS.

H) Documented necessary papers for evidences.

Assess Account Specific Risk:

This step implies that to look after every head to find out the risk in it. Our team follows and seek help from the Audit program that is prescribed by the Auditing practice manual so that they can exactly know what the standards is. Through the answer from the questionnaire auditors now determine how much risk is related in a specific head example: payroll, payments cycle, sales, receivables, payables and etc.

Develop Efficient and Effective Audit Plan Program :

The head of the team made an audit plan which includes everything about how the audit is going too accomplished. This is a strategy to deal with the material risk that we found in our initial screening. This plan also includes the client’s acceptance agreement, ethical positions of the HVC, internal control assessments, test of business cycle, analytical review, fraud risk and some other topics.

Conduct Audit testing:

This is the step where actual work started. It is said that many of the auditors cannot audit properly rather they just vouched documents in a large volume. A true skilled auditors will try to understand each and every transactions from top to bottom and they implement their analytical knowledge in auditing. There are many ways we can collect information from the managements. It is not a good sign to rely on just papers sometimes documents can be made.

Thus, auditors sometimes try to talk with the concern person to ju st have a look on his expression. But documents is an essential part of audit evidence. If the auditors wants to document something it can be done by just taking photocopies of necessary documents.

Moreover, auditors writes note/ observation during audit if the necessary documents are not available or he/she found something new. Audit test are performed to validate the evidence as it is gathered and all the works then compiled in a file with a top sheet above. Top sheet is where auditor writes his working done, observations, variance analysis and option on a particular head.

T he observation of operating and adm inistrative expenses:

- Misclassification of expenses:

We have observed that, expenses incurred during the period 1st January 2015 to 30th June 2015 are not recorded in proper head rather we have found some expenses have recorded in the wrong head.

- Cutoff for expenses is not maintained properly.

- No entries are provided against Audit fee and Insurance expenses.

- We have observed that, VAT and TAX are not properly recorded. W e found the company calculates TDS on VAT. Moreover, in some cases TAX & VAT on source has not been deducted.

My Working Experiences at Hoda Vasi Chowdhury & Co

I have joined Hoda Vasi Chowdhury & Co at 1st July 2015 which fulfill the requirement s of my under graduation program. From the beginning I was given basic ideas on how firm’s workflows works. It was very thoughtful of my manager to provide me some materials for studying just to get an idea on assurance and accounting. The main idea was to lessen up the gap between theoretical and real life scenario. It was very much frustrating for me to study some books at the very first day of my career. However, I was called and given an annual report of Rakeen Development Company (BD) to study thoroughly. After reading it carefully I found out that this company is having losses for many years just because they have a huge operating and administrative expenses. However, initially I was able to find out only one aspect but later I learnt many new things to scan an annual report.

Two other senior auditors and I went to Rakeen Developments Company (BD) for doing and interim audit. They make me understand the internal control system of the company. They use ERP system for their accounts. Moreover, they appointed me to look after operating and administration expenses. They also discuss everything in brief so that I can actually perform the tasks.

The practical orientation is necessary for the development and preparation of a person before entering into the corporate world. The things that I have learned at Hoda Vasi Chowdhury & Hoda Vasi Chowdhury & Co are:

- Meaning of responsibility;

- Accountability to the profession;

- Obligation of commitment;

- Auditing and Reporting responsibilities;

- Working with ethics;

- Working Independently;

- Client dealings;

- Bangladesh accounting standard (BAS);

- International standard of auditing (ISA).

- Punctuality and regularity is very important; and

- Ability to interact with different sorts of people.

Nature of the Job:

Worked in a Chartered Accountancy firm named Hoda Vasi Chowdhury & Co, Chartered Accountant as a Probationer student from 1st July 2015 to present.

Job Responsibility:

As I am a probationer student my task was to only look after operating and administrative expenses and that’s why my job responsibility varies from client to client. Thus, my job responsibilities in Rakeen Development Company (BD) are as follows:

- Obtained schedule of operating and administrative expenses from the draft Financial Statements and matched with General Ledger and Trial Balance.

- Performed vertical analysis and identified major heads of expenditure.

- Scanned the ledger from unusual/large transactions and vouched with supporting documents (Purchase order, invoice, delivery challan, bank statement, personal files of employees and bank payment advice approval statements).

- Checked TDS & VDS deductions.

- Checked whether cutoff, maintained or not.

- Checked whether expenses have been classified to appropriate heads.

- Preserved necessary supporting documents.

Findings and Recommendations

Every side of a coin has another side ~ M yron Scholes. Audit procedures are intended to detect material misstatements in the financial statements. Standards are being set to deal with audit by ICAB. Even there is a manual on auditing called “Auditing practice manual” .

Moreover, the auditors are surely skilled in their position even though there are some loopholes in the system that weakens the prestigious profession called Chartered Accountancy.

Now, I would like to share some of the loops that I encountered with during my workings as a junior auditor. I also would like to establish some recommendations regarding those disadvantages. I personally discussed with some of collogues and my supervisor about the loops that I have found and most of them agrees with my observations. The findings and recommendations are given below:

- Time Constraints

Findings: Our team has faced serious time limitations, as from the initial screening of the clients business we thought that we understood everything but later in turns wrong. W e consume huge amount of time just to understand their whole operations process basically accounts. Especially me as a junior auditor, I had to gobble huge information with in short period of time.

Recommendations: From my point of view, if the in-charge or the firm gave us a small training session about the client’s system then it would be lot easier to understand quickly in the field. They provided idea about their financial statements but they did not provide enough information about the clients systems.

- Work programs are not followed properly

Findings: An auditor should follow steps while doing audit as per as Auditing program manual prescribed by ICAB. But in reality I have seen that most o f the points are overlooked for some reasons. Thus, the laws are not followed properly by the auditors which means the auditors might miss some serious issues which was supposed to disclose in the financial statement.

Recommendations: Auditing is a learning continues learning process. I have observed that the senior were once juniors and they tend to follow their seniors. Thus, if those seniors overlook something than the juniors also adopt to those kind of mentality. Moreover, to breakout these traditional practice firms need to make the juniors to understand the importance of the audit manual properly so that the audit become more reliable and effective.

- Methods o f Sampling

Findings: M any auditors use different techniques of sampling to represent the whole population. Some might use weighted percentage techniques or someone might feel comfortable with variance analysis to determine which head to see. Moreover, the basic summary in the sampling methods are used to limit the number of transactions, cost effective, time efficiency and lastly to representative of the whole population.

However, the auditors might fail to detect a material fact in the financial statements.

Recommendations: There should be a specific techniques for sampling which will lead to a united efficiency regarding sampling. Moreover, it would be better to execute thorough testing as possible from the samples they choose out of the entire population.

- Audit evidence

Findings: I have realized after completing my audit in Rakeen Development Company (BD) that most of the auditors believes that audit evidence is persuasive than conclusive. Including me I have seen that we as an auditors grab as much documents we can as evidence. Thus, the size of the documents became huge. But it is not efficient as well as not effective. As an auditors we have to understand that at the end of the day only those transactions which have problems need evidence. That means if an auditor wrote in his observation that client put rent expenses under fuel expense than the only the supporting documents is needed because auditors might have to defense his findings.

Recommendations: A training program can be arranged by the firm before sending juniors in auditing. The training should pass the knowledge of how to take evidence effectively and most importantly to show a sample documents. So that, juniors can recognize or able to know how the documents looks like.

- Management Coordination

Findings: During my Auditing course in BRAC University I had learnt that there is a lack of coordination between management and auditors. I also leant that the management feels burden while the auditors seeks for information from them. Moreover, how the management bullies the auditors by not providing the necessary documents or by delaying. Now, I can truly relate what I had learnt from my university. I personally felt that some of the employees are actually delaying in providing the documents that I have asked for. Legally, they have to provide the documents we asked for but when the management felt of having extra load in work they tend to delay or neglect the auditors.

Recommendations: Some says it is an art to bring documents from the managements or employees. As it requires patience and selective techniques to do so. I believe that there should be a welcoming sessions where the auditors and the managements will get to know each other which will help to reduce the distance that they normally creates. Furthermore, it is the clients’ duty to look at their managements so that they actually provide us the necessary documents. Thus, if the top management regularly takes feedback from the auditors than the problem might resolve.

CONCLUSION

Chartered Accountancy is one of the most prestigious profession in all over the world. This profession requires to maintain standards and procedures in conducting audit consultancy, taxation etc. works. International standards on auditing provides basic guidelines that chartered accountants need to adopt. Apart from auditing procedures provided by International standards on auditing (ISAs) every Chartered Accountant firm has some discretion in their audit procedures depending upon the situation of the respective country and nature of clients.

In this report, I tried to the best of my knowledge to present the audit procedures followed by Hoda Vasi Chowdhury & Co. In conducting their audit works. Mainly, Hoda Vasi Chowdhury & Co. follows the audit procedures set by ICAB in most cases except for area that requires professional judgment. From my working experiences in Hoda Vasi Chowdhury & Co. it has been found that in some respects Hoda Vasi Chowdhury & Co. does not strictly follow the standard of audit procedures.

From the formation of Hoda Vasi Chowdhury & Co. contributes to a great extent in ensuring the transparency in the presentation of financial statements of various entities of various industries of Bangladesh. Proper adoption of standard audit procedures will lead Hoda Vasi Chowdhury & Co. to remain as the one of the top Chartered Accountant firm in Bangladesh.