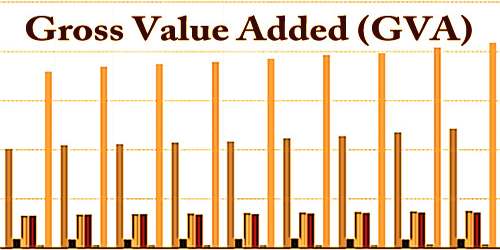

This article describe about Income Tax, which is annual charge levied on both earned income; wages, salaries, commission and unearned income; dividends, interest, rents. It is generally computed as the product of a tax rate times taxable income. It is a key source of funds that the government uses to fund its activities and serve the public. Income Tax has two basic types are (1) Personal income tax, levied on incomes of individuals, households, partnerships, and sole-proprietorships; and (2) Corporation income tax, levied on profits of incorporated firms. It’s concept is a modern innovation and presupposes several things: a money economy, reasonably accurate accounts, a common understanding of receipts, expenses and profits, and an orderly society with reliable records.

Income Tax