Personal finance encompasses all of an individual’s or household’s financial decisions and actions, including budgeting, insurance, mortgage planning, savings, and retirement planning. All psychological and financial aspects that may have an impact on your financial goals and objectives should be considered during financial planning. Personal finance is concerned with achieving personal financial objectives, such as having enough money to fulfill immediate financial demands, planning for retirement, or investing for your child’s college education.

Personal finance education is therefore required to assist an individual or a family in making sound financial decisions throughout their lives. In a nutshell, personal financial planning is a long-term strategy for your financial future that considers all aspects of your financial condition and how they affect your capacity to meet your goals and objectives.

It’s critical to become financially literate in order to distinguish between good and bad advice and make informed decisions with your money and savings. There are several ways you may use to truly consider yourself a savvy spender and saver, allowing you to fully enjoy financial freedom.

Importance of Personal Finance –

Personal finance has become a vital element of human life, and it is now more important than ever in the COVID-19 world. Some of the most important components of personal finance are listed here:

- In the current economic and social circumstances, personal finance plays a significant role in shaping the direction and character of human life.

- Personal finance plays an important role in an individual’s and family’s personal progress by looking at opportunities and staying updated across the globe while being aware of any potential threats.

- It has become more important to educate the financially literate in order to obtain the majority of income and necessary savings, where the study of personal finance aids in distinguishing between advantageous and inexpensive financial decisions, as well as in making wise selections.

- Some seminaries offer seminars on money management; nonetheless, it is necessary to have a foundation of information through free online courses, articles, blogs, and podcasts.

- Furthermore, a fresh idea, tiny personal finance, integrates enhancing tactics, such as budgeting, emergency fund preparation, debt elimination, judiciously leveraged credit cards, retirement savings, and so on.

Budgeting, setting up an emergency fund, paying off debt, intelligently managing credit cards, saving for retirement and other tactics are all part of smart personal finance. Furthermore, understanding the principles of personal finance, from savings accounts to budgeting, can assist us in building a better future by reducing risks.

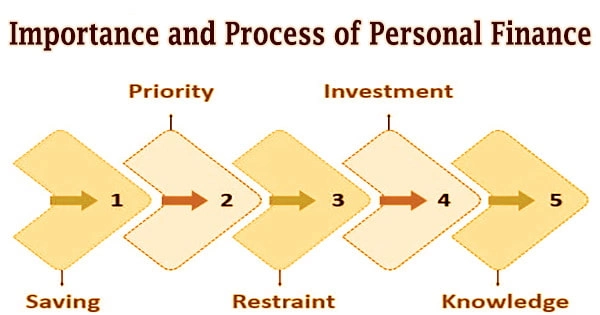

Process of Personal Finance –

Personal financial planning can assist you in laying the groundwork for a secure financial future. You can start thinking about philosophy once you’ve established some basic procedures. Learning a new set of skills isn’t the answer to putting your money back on track.

Simply, the process of personal finance can be explained as follows;

- Studying the current condition: Obtaining a precise understanding of the strengths and weaknesses by determining the specific present conditions in terms of where we stand and how the current situation is being handled.

- Preparing up doable goals: Setting goals based on personal preferences is crucial for determining which direction to take the next step or where an individual should go in the future.

- Determining all courses of action: In the current circumstance, identifying the required plan and method, as well as analyzing the time-frame work, expenses, and opportunities related to each and every individual subject of activities, should be captured.

- Checking out the alternatives: The inadequacy of resources necessitated deciding on all known options and weighing the benefits and drawbacks. Also, selecting the alternative by reducing the risks to a manageable level.

- Applying a suitable area of action: It is now more important than ever to take action, make investments, and follow the rules.

- Following up is pivotal: Following up is a vital step. Because the conditions are constantly changing and the environment is changing, it is necessary to be dynamic and to assess the possibilities from time to time in order to achieve the best results.

The financial planning advice you receive will depend on how complicated your situation is. It should always be structured to match your goals and objectives, as well as give a financial plan. Fortunately, you won’t have to spend a lot of money to learn how to handle it better. Everything you need to know is available for free online and in library books. Almost all media outlets provide personal money advice on a regular basis.