Whenever a market, hypothetical or real, violates the abstract tenets of pure or ideal neoclassical competition, imperfect competition occurs in economics. Competitive markets, as the name implies, are flawed in nature. The structure of a marketplace can substantially affect the financial performance and behavior of the companies competing within it. The current idea of imperfect as opposed to perfect competition stems from the Cambridge lifestyle of the submit-classical monetary notion.

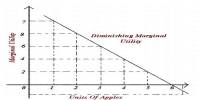

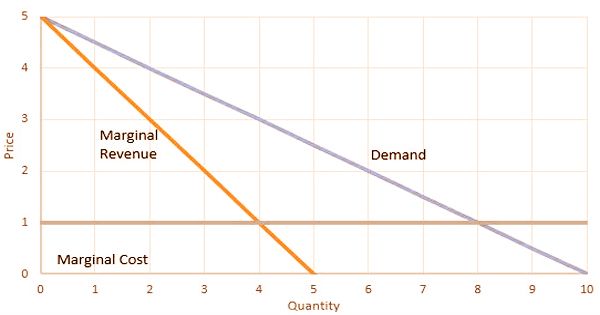

The equilibrium price can be influenced by the behavior of agents when faced with imperfect competition. The degree of market power refers to the ability of corporations to influence the price of a product and, thus, to increase the market price of the good or service above the marginal cost (MC). Nowadays some of the industries and sellers observe it to earn surplus profits. In this marketplace situation, the vendor enjoys the luxury of influencing the rate so that seller can earn a greater income. In addition, the nature of the market can vary from perfect competition to a mere monopoly. Perfect competition is a business condition and a competitive result that is used by economists as a criterion for measurement and performance of economic welfare.

Example of Imperfect Competition

A really perfect marketplace is a theoretical concept in microeconomics this is used as a widespread to degree the effectiveness and efficiency of actual-global markets. In imperfect opposition, the fee of products can growth above their marginal value and as a result have clients lower their stage of buy, and so attain inefficient tiers of manufacturing. If a seller in the market sells a non-identical product, he will increase the prices and gain profits. The following conditions have to be met in a perfect competition setting.:

- Companies sell identical products

- They cannot influence how much they charge for these products

- Market share has no bearing on prices

- Everyone is privy to the same information

- Firms can enter or exit the market without incurring any costs

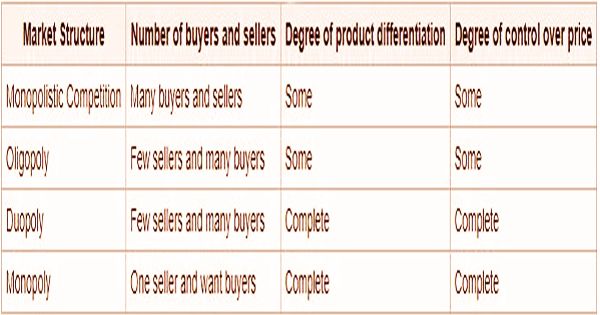

High profits attract other sellers to enter the market and can very quickly leave the market for sellers who are incurring losses. Monopolies, oligopolies, duopolies, monopolistic competition, and monopsony are the most prevalent types of imperfect competition. In Imperfect Competition, there are 4 wide market mechanisms that result.

Characteristics of Imperfect Market Structures

It is immediately evident that very few organizations operate this way in the real world, barring maybe a few exceptions, such as vendors on the market for fleas or farmers. Roy Harrod was the primary economist to increase the concept of ‘imperfect competition’ and, different authors, which include Edward Chamberlin and Joan Robinson renewed its hobby and made principal contributions. Unlike in a perfect competition setting, imperfect competition actually generates opportunities to make more profit, where companies gain only enough to remain afloat.

The strength of price rivalry is another good indicator of how much influence a business has over the price within a market structure. Companies sell various goods and services in an imperfect competition climate, set their own individual rates, compete for market share, and are also shielded by entry and exit barriers, making it more difficult for new companies to challenge them. The Herfindahl Index is the sum of the square market shares of all companies in the market (Herfindahl Index = (Si)2, where Si = company I market share). The Herfindahl Index offers a measure of firm concentration within a market. All vendors in a store should sell exactly identical goods to the very same customers at equivalent fees, all of whom have the same best understanding. In the best competition, there is no space for marketing, product differentiation, creativity, or logo recognition.

Information Sources: