Impact of Admission of New Partner in the Value of Goodwill of the Firm

A reputation built up by a firm has an impact on the present profit and future profit to be earned by the firm. The new partner when admitted, has to compensate for all these sacrifices made by the old ones. At the time of the admission of a partner, the existing partners sacrifice part of their share of profit in favor of the new partner. The compensation for such sacrifice can be termed as ‘goodwill’. Hence, at the time of admission of the new partner, it is necessary to account the valuation of goodwill in the firm. Hence, to compensate for the sacrifice made by the existing partners, the goodwill of the firm has to be valued and adjusted.

If the new partner brings in cash for his share of goodwill, in addition to his capital, it is known as a premium method. When the new partner brings nothing but only the capital, and the value of goodwill is erected or raised, this method of treatment is called Revaluation Method. This goodwill is distributed in the sacrificing ratio to the old partners who sacrifice. However, once creating the value of goodwill and writing of the same after admission is done, it can be said to be Memorandum Revaluation Method. Thus, keeping in mind, all these methods, the various ways of treating goodwill in the books of the firm at the time of admission of the new partner, are as follows:

- Share of goodwill brought by the new partner in cash.

- Share of goodwill brought by the new partner in kind.

- Nothing is brought by the new partner as his share of goodwill.

- Share of goodwill brought by the new partner in cash only a portion, not as a whole.

- Hidden goodwill.

(1) When the new partner brings his share of goodwill in cash

When the new partner brings cash towards goodwill in addition to the amount of capital, it is distributed to the existing partners in the sacrificing ratio. It may be retained in the business or after recording the same in the firm, the old partners may withdraw the whole amount or some portion only,

a. When the amount of goodwill brought by the new partner is not recorded in the books and the payment is made to the old partners as an outside or private transaction, it does not affect the transaction of the firm and hence no entry is passed in the books of the firm.

b. When the amount of goodwill brought in by the new partner is retained in the business to increase cash resources, and if there exists already no-goodwill:

(i) Cash/Bank A/C…………………..Dr.

To Goodwill A/c

(Being goodwill brought in by the new partner)

ii) Goodwill A/C………………………Dr.

To old partners’ capital A/C

(Being goodwill credited to old partners in the sacrificing ratio)

c. When there is no-goodwill already appeared in the books and the amount of goodwill brought in by the new partner, is fully or partially withdrawn by the old partners:

i) Cash A/C…………………..Dr.

To Goodwill A/C

(Being goodwill brought by the new partner)

ii) Goodwill A/C…………….Dr.

To old partners’ capital A/C

(Being goodwill divided among old partners)

iii) Old partners’ capital A/C……………Dr.

To Cash/Bank A/C

(Being the amount withdrawn)

(2) When the new partner brings his share of goodwill in kind

Sometimes the new partner may bring only a part of the goodwill in cash or assets. Again, new partners may have an established name in the market among the customers. In such a case, he may be recognized for his goodwill. As a result, he will bring a lesser amount of assets than the amount of credit to him.

This requires two journal entries:

i) All assets A/C……………………….Dr.

Goodwill A/C/New partner’s capital A/C

(Being goodwill brought in kind by the new partner)

ii) Goodwill A/C/New partner’s capital A/C…………….Dr.

To old partners’ capital A/C

(Being goodwill shared by the old partners)

(3) When the new partner is unable to bring his share of goodwill in cash or kind

If the new partner does not bring goodwill in cash or in kind, his share of goodwill must be adjusted through the capital accounts of the partners. If there is no-goodwill already appearing in the books of the firm, goodwill is raised at its full value. If goodwill already appears in the books, it is compared to the full value of goodwill raised or created and the adjustment is done accordingly.

a. When the new partner is unable to bring his share of goodwill and if there is no-goodwill already appearing in the books, goodwill is raised at its full value:

i) Goodwill A/C……………..Dr.

To old partners’ capital A/C

(Being goodwill is created at its full value and credited to the old partners in the old ratio)

* By this entry, goodwill A/C then appears as an asset in the balance sheet of the firm.

b.If the new partner cannot bring his share of goodwill and there appears goodwill already in the books, even then goodwill is raised at its full value. If the raised value of goodwill is equal to the existing value of goodwill, no entry what so ever is needed. If the raised goodwill is more than the existing goodwill, then goodwill will be credited to the old partner’s capital A/C by the excess amount only:

Goodwill A/C………………….Dr. (excess value)

To old partners’ capital A/C

(Being the value of goodwill increased to…./increased by……)

* Goodwill then appears at its full value in the balance sheet of the firm.

If the raised value of goodwill is less than the existing value of goodwill, then excess over the raised value of goodwill is written off:

Old partners’ capital A/C…………….Dr.

To Goodwill A/C

(Being the goodwill written off by the reduction in value)

(4) When the new partner can bring only a portion of his share of goodwill

When the new partner cannot bring the entire amount of his share of goodwill and he brings only a part of this, it is shared by the old partners in sacrificing ratio. Then goodwill A/C is raised in the books for the portion not brought by the new partner which is also credited to the old partners in their sacrificing ratio. Goodwill raised for the part of goodwill not brought in by the new partner is calculated as under: = (Full value of goodwill/share of the goodwill of new partner) X goodwill not brought in

But it should be remembered that, if there exists any goodwill in the books, first it should be written off by crediting to the old partners in the old ratio. Therefore, the entries are:

i) Old partners’ capital A/C………………Dr.

To Goodwill A/C

(Being goodwill written off)

ii Cash/Bank A/C……………………Dr.

To Goodwill A/C

(Being the portion of goodwill brought in by new partner)

iii) Goodwill A/C…………………..Dr.

To old partners’ capital A/C

(Being the goodwill brought in by new partner credited to old partners)

(5) Hidden Goodwill

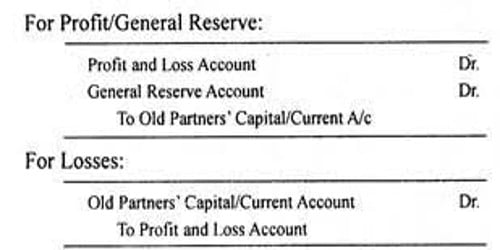

When the value of goodwill is not given in the question, the value of goodwill has to be calculated on the basis of the total capital/net worth of the firm and profit-sharing ratio. If goodwill already appears in the books of accounts, at the time of admission if the partners decide, it can be written off by transferring it to the existing partners’ capital account / current account in the old profit sharing ratio.

A. New partner’s capital X Reciprocal of the share of new partner…XXX

B. Less net worth(excluding goodwill) of new firm………………………….XXX

C. A-B = Value of goodwill………………………………………………………………XXX

Information Source: