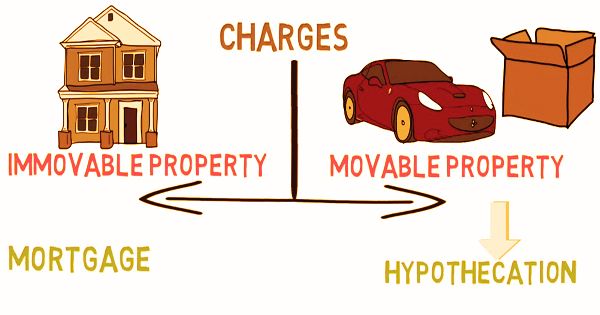

The word “Hypothecation” implies giving the lender an asset as collateral security. It happens when an asset, such as income generated by the asset, is pledged as collateral to secure a loan, without giving up title, possession, or ownership rights. It is the procedure in which a debtor undertakes collateral to secure a debt or pledges collateral to the debtor as a condition preceding the debtor a third party. An investment property, for instance, may go through hypothecation as insurance against a home loan gave by a bank. While the property stays guarantee, the bank has no case on rental pay that comes in; notwithstanding, if the landowner defaults on the advance, the bank may hold onto the property.

The ownership of the safe, under hypothecation, remains with the borrower itself. Mitigating the creditor’s credit risk is the main objective of the mortgage. The borrower owns the collateral if the debtor is unable to pay, and may thus claim its possession, sell it and thereby compensate for the lack of cash inflows. The borrower in fact possesses the house, yet as the house is swore as a guarantee, the home loan moneylender has the privilege to hold onto the house if the borrower can’t meet the reimbursement terms of the credit arrangement which happened during the abandonment emergency. Auto loans are backed by the underlying vehicle in a similar way. On the other hand, unsecured loans do not operate like mortgages because in the event of default, there is no collateral to demand.

Example of Hypothecation

Hypothecation is also a characteristic of financial loans, in particular with repurchase agreements in which a security is bought and resold at a later date with loaned money. In the absence of prior hypothecation of the debtor’s default, the creditor cannot be sure that the debtor will seize appropriate properties. Since hypothecation makes it simpler to get the obligation and conceivably diminishes its value; the borrower needs to hypothecate however much obligation as could be expected yet the confinement of ‘good resources’ for the insurance decreases the nature of the remainder of the account holder’s monetary record and consequently its credit value.

Due to the collateral pledged by the borrower, since hypothecation offers protection to the lender, it is easier to obtain a loan, and the lender may give a lower interest rate than on an unsecured loan. It is also possible to rehypothecate collateral; this occurs when the lender uses an asset held by a creditor for the purpose of trading as its own collateral. For the bank, the security mitigates the acknowledge hazard as well as permits renegotiating all the more effectively or at lower rates; in an underlying hypothecation contract notwithstanding, the account holder can limit such re-utilization of the guarantee.

Example of Hypothecation: In the case of car loans, the car stays with the creditor, but the bank/financier is mortgaged in the same way. The bank takes custody of the vehicle after giving notice if there is any default by the creditor and then sells the same. In order to recover the dues against the principal sum and interest rate, the loan account is credited with the asset’s sales proceeds. Any balance left from that point will be offered back to the borrower. Aside from vehicles, hypothecation should be possible for stocks and bills receivables.

Another prevalent form of mortgage is margin lending in brokerage accounts. Although pledge tends to be similar to hypothecation because both are forms of payments generated on movable assets; there are some variations between pledge, hypothecation, and mortgage. A repo agreement is the most common type of mortgage: the borrower gives the account holder a credit and gets, consequently, the ownership (not the responsibility for) monetary resource until the development of the advance. A reverse repo is a “reverse path” mortgage: borrower and debtor switch positions. If an investor decides to purchase on a margin or sell-short, they accept that, if necessary, such shares will be sold if there is a margin call. In their account, the investor owns the shares, but the broker will sell them to cover the investors’ losses if they give a margin call that the investor may not meet.

Process of Hypothecation

Definitions, insurance, inspection regulations, rights and remedies of each party, security information marked for hypothecation, sales realizations, insurance proceeds, the responsibility of each party, predominant authority, labeling of the properties, etc. The hypothecation deed is an arrangement containing standard features and regulations that typically cover the following points. At the point when banks and representatives utilize hypothecated insurance as a guarantee to back their own exchanges and exchanges with their customer’s arrangement, so as to make sure about a lower cost of acquiring or a discount on charges.

Re-hypothecation happens when the borrower (a bank or broker-dealer) re-uses the debtor’s (a customer such as a hedge fund) posted collateral to back the broker’s own trades and loans. In the stock market, this process also allows for leverage. While some forms of rehypothecation which contribute to market functioning, it may not be available in the event of a default if collateral raised to protect against the risk of counterparty default has been rehypothecated. In reality, hypothecation is a course by which borrowers can raise assets by giving security (mobile) as insurance and still get the opportunity to utilize it since the ownership stays with the borrower. This wellspring of credit is given by the bank/financer at a rate lower than the unstable advance as it gives the conviction that all is good to the loan specialist.

Information Sources: