Hyperinflation is a term to describe rapid, excessive, and out-of-control general price increases in an economy. In economics, hyperinflation is very high and typically accelerating inflation. While inflation is a measure of the pace of rising prices for goods and services, hyperinflation is rapidly rising inflation, typically measuring more than 50% per month. It quickly erodes the real value of the local currency, as the prices of all goods increase. It can cause a surge in prices for basic goods—such as food and fuel—as they become scarce.

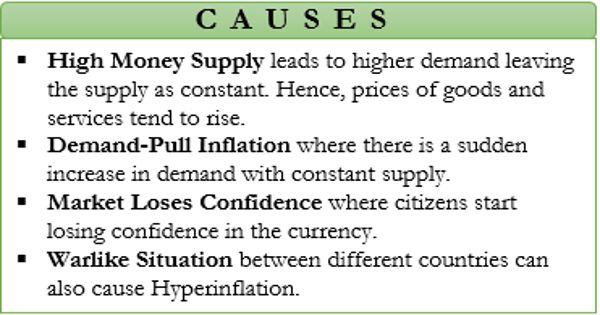

Hyperinflation commonly occurs when there is a significant rise in the money supply that is not supported by economic growth. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies, in recent history often the US dollar. Although hyperinflation is a rare event for developed economies, it has occurred many times throughout history in countries such as China, Germany, Russia, Hungary, and Argentina. Prices typically remain stable in terms of other relatively stable currencies.

Hyperinflation can occur in times of war and economic turmoil in the underlying production economy, in conjunction with a central bank printing an excessive amount of money. The increase in money supply is often caused by a government printing and injecting more money into the domestic economy or to cover budget deficits. Unlike low inflation, where the process of rising prices is protracted and not generally noticeable except by studying past market prices, hyperinflation sees a rapid and continuing increase in nominal prices, the nominal cost of goods, and in the supply of currency. It causes consumers and businesses to need more money to buy products due to higher prices.

There are two winners in hyperinflation. The first beneficiaries are those who took out loans and find that higher prices make their debt worthless by comparison until it is virtually wiped out. Exporters are also winners because the falling value of the local currency makes exports cheaper compared to foreign competitors.

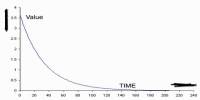

Typically, however, the general price level rises even more rapidly than the money supply as people try ridding themselves of the devaluing currency as quickly as possible. Hyperinflation quickly devalues the local currency in foreign exchange markets as the relative value in comparison to other currencies drops. As this happens, the real stock of money (i.e., the amount of circulating money divided by the price level) decreases considerably. This situation will drive holders of the domestic currency to minimize their holdings and switch to more stable foreign currencies.

Information Source