Introduction

Origin of the Report:

It is very important that all MBA students to engage in any organization for minimum three months as an thesis to gain practical knowledge, and after three months he/she has to submit an thesis report. The report is the outcome of the assigned thesis suggested by the guide teacher.

The topic of my thesis report on Organizational development “HRM practices in Dhaka Bank Limited” and I have completed my three months project theisis Dhaka Bank Limited.

Objective of the study

The objective of this study is to fulfill the requirement of project theisis:

- Human Resource Management practices.

- Employee Personnel practices.

- Developing Employees practices.

- Compensation of Employees practices.

- Performance Appraisal of Employees practices.

Methodology of the Report

Different data and information are required to meet the goal of this report. Those data and information were collected from various sources, such as primary and secondary which is showed below.

Primary sources of data:

Primary data are collected from questionnairesf.

Secondary sources of data:

- Annul report of Dhaka Bank Limited.

- Several types of Academic test books.

- Different publication regarding Banking functions.

- Information about the organization from their company profile.

- Web sites of Bangladesh Bank, Dhaka Bank Limited etc.

Scope of the Report:

The scope of this report is mostly limited to Dhaka Bank Limited, as the report is based on practical observations, and also limited to the related departments of this report. There was no scope of doing outside surveys except getting some help from secondary data of other banks. The report scope was narrowed to the branch operations and practices.

As I was sent to Dhaka Bank Limited, Uttara Branch, the scope of the study is only limited of this branch. The report covers its HRM practices of Dhaka Bank Limited. The report also covers details about Dhaka Bank Limited.

Limitation of study:

- Limitation of employment personal.

- Limitation of practices in human resource management.

- Limitation of employees’ development in this organization.

- Limitation of benefit and compensation of employees.

Back ground

Bangladesh economy has been experiencing a rapid growth since the ’90s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers’ remittance, local and foreign investments in construction, communication, power, food processing and service enterprises ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives as well as to channelize consumer investments in a profitable manner. A group of highly acclaimed businessmen of the country grouped together to responded to this need and established Dhaka Bank Limited in the year 1995.

The Bank was incorporated as a public limited company under the Companies Act. 1994. The Bank started its commercial operation on July 05, 1995 with an authorized capital of Tk. 1,000 million and paid up capital of Tk. 100 million. The paid up capital of the Bank stood at Tk 1,289,501,900 as on June 30, 2006. The total equity (capital and reserves) of the Bank as on June 30, 2006 stood at Tk 2,188,529,224.

The Bank has 40 branches across the country and a wide network of correspondents all over the world. The Bank has plans to open more branches in the current fiscal year to expand the network.

Our Mission

To be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking.

Our Vision

At Dhaka Bank, we draw our inspiration from the distant stars. Our team is committed to assure a standard that makes every banking transaction a pleasurable experience. Our endeavor is to offer you razor sharp sparkle through accuracy, reliability, timely delivery, cutting edge technology, and tailored solution for business needs, global reach in trade and commerce and high yield on your investments.

Our Goal

Our people, products and processes are aligned to meet the demand of our discerning customers. Our goal is to achieve a distinction like the luminaries in the sky. Our prime objective is to deliver a quality that demonstrates a true reflection of our vision – Excellence in Banking.

The Value:

- Customer Focus

- Integrity

- Teamwork

- Respect for the individual

- Quality

- Responsible citizenship.

Organizational Structure

Founder Advisor: Mirza Abbas Uddin Ahmed

Former Vice Chairperson: Afroza Abbas

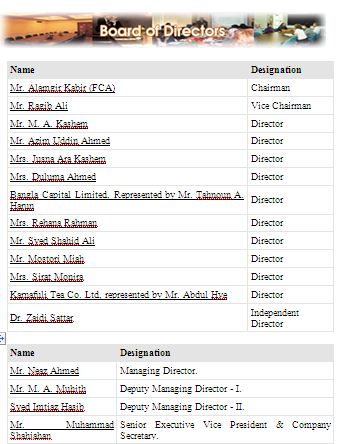

Board of Directors

Chairman: Mr. Khondoker Fazle Rashid

Vice Chairman: Mr. Altaf Hossain Sarker

Directors: Mr. Abdul Hai Sarker

Mr. A.T.M. Hayatuzzaman Khan

Mrs. Afroza Abbas

Mr. Mohammed Hanif

Mr. Md. Amirullah

Mr. Mainul Islam

Mr. Tahidul Hossain Chowdhury

Mr. M.N.H. Bulu

Mr. Khandaker Mohammad Shahjahan

Mrs. Hosna Ara Shahid

Managing Director: Shahed Noman

Company Secretary: Arham Masudul Huq

Corporate Information

Name of the company: Dhaka Bank Limited

Legal Form: A public limited company incorporated In Bangladesh on April 06, 1995 under The Companies Act 1994 and listed in Dhaka Stock Exchange limited and Chittagong Stock Exchange Limited.

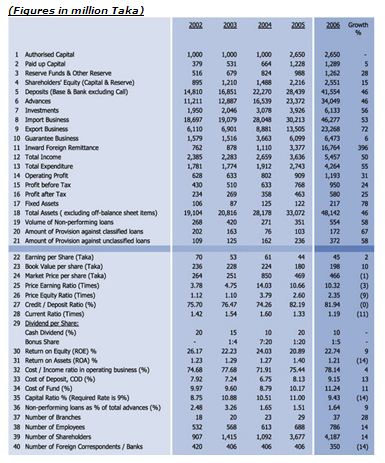

Financial Highlights

The Banking sector in Bangladesh

The Banking sector in Bangladesh

The commercial banking system dominates Bangladesh’s financial sector. Bangladesh Bank is the Central Bank of Bangladesh and the chief regulatory authority in the sector. The banking system consists of four nationalized commercial Banks, around forty private commercial banks, nine foreign multinational banks and some specialized banks. The Nobel-prize winning Grameen Bank is a specialized micro-finance institution, which revolutionized the concept of micro-credit and contributed greatly towards poverty reduction and the empowerment of women in Bangladesh.

Types of Banks;

- Central Bank

- Nationalized Commercial Banks

- Private Commercial Banks

- Foreign Banks

- Specialized Banks

- References

- External links

Bangladesh Bank (Central Bank)

Pursuant to Bangladesh Bank Order, 1972 the Government of Bangladesh reorganized the Dhaka branch of the State Bank of Pakistan as the central bank of the country, and named it Bangladesh Bank with retrospective effect from 16th December, 1971.

Nationalized Commercial Banks

The banking system of Bangladesh is dominated by the 4 Nationalized Commercial Banks, which together controlled more than 54% of deposits and operated 3388 branches (54% of the total) as of December 31, 2004. The nationalized commercial banks are:

- Sonali Bank

- Janata Bank

- Agrani Bank

- Rupali Bank

Private Commercial Banks

Private Banks are the highest growth sector due to the dismal performances of government banks (above). They tend to offer better service and products.

- AB Bank Limited

- BRAC Bank Limited

- Eastern Bank Limited

- Dutch Bangla Bank Limited

- Dhaka Bank Limited

- Islami Bank Bangladesh Ltd

- Pubali Bank Limited

- Uttara Bank Limited

- IFIC Bank Limited

- National Bank Limited

- The City Bank Limited

- United Commercial Bank Limited

- NCC Bank Limited

- Prime Bank Limited

- Southeast Bank Limited

- Al-Arafah Islami Bank Limited

- Social Investment Bank Limited

- Standard Bank Limited

- One Bank Limited

- EXIM Bank Limited

- Mercantile Bank Limited

- Bangladesh Commerce Bank Limited

- Jamuna Bank Limited

Foreign Banks

- Citigroup

- HSBC

- Standard Chartered Bank

- Commercial Bank of Ceylon

- State Bank of India

- Habib Bank

- National Bank of Pakistan

- Woori Bank

- Bank Alfalah

- ICB Islami Bank

Specialized Banks

Out of the specialized banks, two (Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank) were created to meet the credit needs of the agricultural sector while the other two ( Bangladesh Shilpa Bank (BSB) & Bangladesh Shilpa Rin Sangtha (BSRS) are for extending term loans to the industrial sector. The Specialized banks are:

- Grameen Bank

- Bangladesh Krishi Bank

- Bangladesh Shilpa Bank

- Rajshahi Krishi Unnayan Bank

- Bangladesh Shilpa Rin Sangstha

- Basic Bank Ltd (Bank of Small Industries and Commerce)

- Bangladesh Somobay Bank Limited(Cooperative Bank)

- The Dhaka Mercantile Co-operative Bank Limited (DMCBL)

Profile of Southeast Bank Limited History of Establishment:

Southeast Bank is one of the few banks permitted by the Bangladesh bank in the early 90s; the other banks permitted earlier were Dutch- Bangla Bank, Al- Arafah Islami Bank, Prime Bank, Dhaka Bank, Eastern Bank. These banks are known as the second generation bank and fortunate to remain immune from the bad loan culture. However, the performance of these banks is not the same, the Southeast Bank Limited remained as one of the top the same, and the Southeast Bank Limited remained as one of the top performers among them. Its performance also bas been reflected in its good loan being the 3.5 percent as against the national average of 33 percent in the private banking sector.

The emergence of southeast Bank limited at the junction of liberation of global economic activities, after the URUGUAY ROUND has been an important event in the financial sector of Bangladesh. The experience of the prosperous economies of Asian countries and in particular of South Asia has been the driving force and the strategies behind operational policy option of the Bank. The company philosophy “A Bank with vision” has been preciously the essence of the legend of bank’s success.

Mission:

The bank has chalked out the following corporate objectives in order to ensure smooth achievement of its goals:

- To be the most caring and customer friendly and service oriented bank.

- To create a technology based most efficient banking environment for its customers

- To ensure ethics and transparency in all levels

- To ensure sustainable growth and establish full value of the honorable shareholders and

- Above all, to add effective contribution to the national economy

Eventually the Bank emphasizes on:

- Providing high quality financial services in export and import trade

- Providing efficient customer service

- Maintaining corporate and business ethics

- Being trusted repository of customers’ money and their financial adviser

- Making its products superior and rewarding to the customers

- Display team spirit and professionalism

- Sound Capital Base

- Enhancement of shareholders wealth

- Fulfilling its social commitments by expanding its charitable and humanitarian activities

Vision:

The gist of our vision is Southeast Bank Limited believes in togetherness with its customers, in Pits march on the road to growth and progress with services. To achieve the desired goal, there will be pursuit of excellence at all stages with a climate of continuous improvement, because, in Southeast Bank Limited, we believe, the line of excellence is never ending. Bank’s strategic plans and networking will strengthen its competitive edge over others in rapidly changing competitive environments. Its personalized quality services to the customers with the trend of constant improvement will be cornerstone to achieve our operational success.

Objectives

Whether in treasury, consumer or corporate banking, Southeast Bank Limited is committed to provide the best. Meeting the demand of discerning customers is not the sole objective. The Bank believes that to provide standard financial services is to deliver a quality that makes every transaction of pleasurable experience. The bank also believes that Customer is always right and in the core of everything. So providing them friendly and personalized service, tailor-made solutions for business needs, global reach in trade and commerce at the doorsteps and high yield on investments are the core objectives of the bank. But the bank also tries to do the best in conjunction with achieving the ultimate objective of a business organization.- Wealth Maximization.

No of branch:

The Southeast Bank has 47 branches of the six divisions in the county. Forty sevent branches of Southeast Bank to contribute in our economic development and they properly service the people of the country.

Total No of Employees:

At present Southeast Bank Limited have 1786 over employee and employer surrounding several branches of Bangladesh. All are maintain a significant co-operative relationship between themselves to accommodate better service to the people & society of Bangladesh.

Human resource practices in Dhaka Bank Limited

Employee’s are the core resources of any organization, without them, one can not run their organization, and human resources is conducted with the growth of development of people toward higher level of competency, creativity and fulfillment. It keep employee’s become better more responsible person and then it tries to create a climate in which they contribute to the limits of their improved abilities. It assumes that expanded capabilities and opportunities for people with lead directly to improvements in operating effectiveness. Essentially, the human resource approach means that people better result. Dhaka Bank Limited always determine what jobs need to be done, and how many and types of workers will be required. So, establishing the structure of the bank assists in determining the skills, knowledge and abilities of jobholders. To ensure appropriate personnel are available to meet the requirements set during the strategic planning process, human resource managers engage in HRP. This effort is to determine what HRM requirements exists for current and future supplies and demands for workers. Because this bank believes that the quality work comes from quality workers who are well motivated and ready to take challenge to provide better service.

Strategies of Dhak Bank Limited

DBL believes in the practice of Market- Oriented Strategic Planning, developing and maintaining a viable fit between the organization’s objectives, skills and resources. The aim of such approach is to shape and reshape the bank’s businesses and services so that they yield target profits and growth. The strategic planning of DBL involves repeated cycles of corporate and business planning as well as divisional and products or marketing planning. Since the growth and profits of banking business largely depend upon the locations of branches where larger concentration of other businesses and industries are involved DBL primarily focused on location-based strategy. Every year an overall profit target as well as individual targets for each line of business (export, import, loans & advances etc) is set for each branch location by the corporate bodies in collaboration with the regional heads and branch managers.

Corporate Government

Like all the other local banks, DBL has a conventional structure. A corporate body conducts a meeting on a weekly basis; the committee is called the Executive Committee. The committee includes Chairman, Vice Chairman, and the group of Directors, Managing Director (MD), Deputy Managing Director (DMD), and Company Secretary. This executive committee approves the various proposals brought by the management prior to implementation. All the proposals are placed to the committee through the managing Director of the Bank.

Board of Directors

Executive Vice Presidents

- Muhammad Shahjahan

- Giash Uddin Ahmed

- Shahabuddin Md. Jafar

- Shahid Hossain

- A.F.M. Shariful Islam

- Lutfur Kabir

- A.K.M. Nurul Alam

- Senior Vice Presidents

- Md. Altafur Rahman

- Md. Anwar Hossain

- Haradhan Banik

- Md. Abdul Wali

- M. Kamal Hossain

- Abdul Hamid Mia

- S.M. Intekhab Alam

- Md. Sawkat Hossain

- Mustafizur Rahman

- Pritish Kumar Sarker

- Shahid Atiqul Islam

Vice Presidents

- Mohammad Mahmud Hasan

- Mozammel Hossain Chowdhury

- Md. Shamsul Huda

- Anowar Uddin

- Mahfuzur Rahman Khan

- Mirza Akhteruzzan Begg

- Kamal Uddin

First Vice Presidents

- Mahbubur Rahman Shabbir

- Abu Syed Md. Mohiuddin

- Golam Akbar Chowdhury

- Syed Nurul Bashar

- Md. Abdul Naim

- Mohammad Hafizur Rahman

- Nur Hossain Hafizur Rahman

- Nur Hossain Chowdhury

- Fazle Kader Ahmed

- Md. Shahjahan Sarker

- Shafiur Rahman

- Md. Zakir Hossain

- Abdul Batin Chowdhury

- Nuruddin Md. Sadeque Hussain

Meaning of HRM

Human resource management (HRM) is the strategic and coherent approach to the management of an organization’s most valued assets – the people working there who individually and collectively contribute to the achievement of the objectives of the business. The terms “human resource management” and “human resources” (HR) have largely replaced the term “personnel management” as a description of the processes involved in managing people in organizations. In simple sense, Human Resource Management (HRM) means employing people, developing their resources, utilizing maintaining and compensating their services in tune with the job and organizational requirement.

Academic theory

The goal of human resource management is to help an organization to meet strategic goals by attracting, and maintaining employees and also to manage them effectively. The key word here perhaps is “fit”, i.e. a HRM approach seeks to ensure a fit between the management of an organization’s employees, and the overall strategic direction of the company.

The basic premise of the academic theory of HRM is that humans are not machines; therefore we need to have an interdisciplinary examination of people in the workplace. Fields such as psychology, industrial engineering, industrial, Legal/Paralegal Studies and organizational psychology, industrial relations, sociology, and critical theories: postmodernism, post-structuralism play a major role. Many colleges and universities offer bachelor and master degrees in Human Resources Management.

One widely used scheme to describe the role of HRM, developed by Dave Ulrich, defines 4 fields for the HRM function:

- Strategic business partner

- Change management

- Employee champion

- Administration

However, many HR functions these days struggle to get beyond the roles of administration and employee champion, and are seen rather as reactive as strategically proactive partners for the top management. In addition, HR organizations also have the difficulty in proving how their activities and processes add value to the company. Only in the recent years HR scholars and HR professionals are focusing to develop models that can measure if HR adds value.

Critical Theory

Postmodernism plays an important part in Academic Theory and particularly in Critical Theory. Indeed Karen Legge in ‘Human Resource Management: Rhetorics and Realities’ poses the debate of whether HRM is a modernist project or a postmodern discourse (Legge 2004). In many ways, critically or not, many writers contend that HRM itself is an attempt to move away from the modernist traditions of personnel (man as machine) towards a postmodernist view of HRM (man as individuals). Critiques include the notion that because ‘Human’ is the subject we should recognize that people are complex and that it is only through various discourses that we understand the world. Man is not Machine, no matter what attempts are made to change it.

Critical Theory, in particular postmodernism (poststructuralist), recognizes that because the subject is people in the workplace, the subject is a complex one, and therefore simplistic notions of ‘the best way’ or a unitary perspective on the subject are too simplistic. It also considers the complex subject of power, power games, and office politics. Power in the workplace is a vast and complex subject that cannot be easily defined. This leaves many critics to suggest that Management ‘Gurus’, consultants, ‘best practice’ and HR models are often overly simplistic, but in order to sell an idea, they are simplified, and often lead Management as a whole to fall into the trap of oversimplifying the relationship.

History of HRM

Introduction:

This assignment traces the history of Human Resource Management from

the Industrial Revolution in the 18th century to present times. The assignment discusses key periods and movements in this field and expands on their contribution to modern Human Resource Management. In discussing the history of Human Resources Management it is important to offer a definition of the subject. Human Resource. Management can be described as “The comprehensive set of managerial activities and tasks concerned with developing and maintaining a qualified workforce – human resources – in ways that contribute to

The Industrial Revolution

The momentum for the industrial revolution grew through the 17th century. Agricultural methods were continually improving, creating surpluses that were used for trade. In addition, technical advances were also occurring, for example the Spinning Jenny and the Steam Engine. These advances created a need for improved work methods, productivity and quality that led to the beginning of the Industrial Revolution.

Adam Smith

In 1776, Adam Smith wrote about the economic advantages of the division of labor in his work The Wealth of Nations. Smith (1776) proposed that work could be made more efficient through specialization and he suggested that work should be broken down into simple tasks. From this division he saw three advantages:

In modern business the Human Resources Management function is complex and as such has resulted in the formation of Human resource departments/divisions in companies to handle this function. The Human resource function has become a wholly integrated part of the total corporate strategy. The function is diverse and covers many facets including Manpower planning, recruitment and selection, employee motivation, performance monitoring and appraisal, industrial relations, provision management of employee benefits and employee education training and development.

Functions of Human Resource Management The Management of Workplace

HR Management needs to change from an ethnocentric view (“our way is the best way”) to a culturally relative perspective (“let’s take the best of a variety of ways”). This shift in philosophy has to be ingrained in the managerial framework of the HR Management in planning, organizing, leading and controlling of organizational resources.

Planning a Mentoring Program

One of the best ways to handle workplace diversity issues is through initiating a Diversity Mentoring Program. This could entail involving different departmental managers in a mentoring program to coach and provide feedback to employees who are different from them. In order for the program to run successfully, it is wise to provide practical training for these managers or seek help from consultants and experts in this field.

Organizing Talents Strategically

Many companies are now realizing the advantages of a diverse workplace. As more and more companies are going global in their market expansions either physically or virtually (for example, E-commerce-related companies), there is a necessity to employ diverse talents to understand the various niches of the market. With this trend in place, a HR Manager must be able to organize the pool of diverse talents strategically for the organization. Management must consider how a diverse workforce can enable the company to attain new markets and other organizational goals in order to harness the full potential of workplace diversity.

A HR Manager must conduct regular organizational assessments on issues like pay, benefits, work environment, management and promotional opportunities to assess the progress over the long term. There is also a need to develop appropriate measuring tools to measure the impact of diversity initiatives at the organization through organization-wide feedback surveys and other methods. Without proper control and evaluation, some of these diversity initiatives may just fizzle out, without resolving any real problems that may surface due to workplace diversity.

Challenges of Human Resource Management

The role of the Human Resource Manager is evolving with the change in competitive market environment and the realization that Human Resource Management must play a more strategic role in the success of an organization. Organizations that do not put their emphasis on attracting and retaining talents may find themselves in dire consequences, as their competitors may be outplaying them in the strategic employment of their human resources.

With the increase in competition, locally or globally, organizations must become more adaptable, resilient, agile, and customer-focused to succeed. And within this change in environment, the HR professional has to evolve to become a strategic partner, an employee sponsor or advocate, and a change mentor within the organization. In order to succeed, HR must be a business driven function with a thorough understanding of the organization’s big picture and be able to influence key decisions and policies. In general, the focus of today’s HR Manager is on strategic personnel retention and talents development. HR professionals will be coaches, counselors, mentors, and succession planners to help motivate organization’s members and their loyalty. The HR manager will also promote and fight for values, ethics, beliefs, and spirituality within their organizations, especially in the management of workplace diversity.

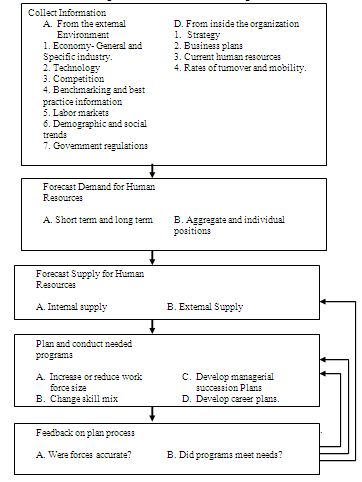

Meaning of Human Resource Planning

An organization would not build a new plant, conduct the ribbon-cutting ceremony, and then begin to worry about how to staff the facility. A firm cannot hire several hundred engineers and get them on board overnight, nor can it develop management talent in just a few weeks. Foresight is necessary to ensure that appropriately qualified staff will be available to implement an organization’s future plans. The tighter the labor market, the more forward planning is required to avoid future problems due to understaffing. On the other hand, planning ahead in a declining economy is also critical in minimizing expensive overstaffing and possible layoffs. Human resource planning is concerned with the flow of people into, through, and out of an organization. HR planning involves anticipating the need for labor and the supply of labor and then planning the programs necessary to ensure that the organization will have the right mix of employees and skills when and where they are needed. The forecasting methods described below provide key input for these processes.

Human resource experts can also take on a strategic role in collaboration with the top management team to plan a strategy for the firm that capitalizes on or builds the organization’s unique human, resource competencies. For instance, Marriott Corporation’s goal of being the provider of choice for food and lodging services was supplemented by the goal of becoming the “employer of choice”- as well. Executives decided that unless Marriott was a very’ attractive employer, it would not be able to obtain the number and quality of people it needed, for a growth and high-quality service strategy. The company adopted initiatives to broaden its recruiting base, but ‘it also worked hard at retaining and motivating current employees, To that end, changes were made in career paths, job responsibilities, work teams, and reward systems.

At Colgate-Palmolive, a global HR team was formed to help the organization meet its goal of “becoming the best truly global consumer products company.” Top HR managers and key senior line managers worked together on the team to translate business plans into human resource plans that would support organizational excellence. As a result, strategic initiatives were adopted in recruitment, selection, development, individual performance management, team performance management, career planning, diversity, employee attitude surveys, and employee communication.

Objectives of Human Resource Planning

Managers and HR departments achieve their purpose by meeting objectives.

Objectives are benchmarks against which actions are evaluated. Sometimes they are carefully thought out and expressed in writing. More often objectives are not formally stated. Either way, they guide the HR function in practice. Consider the objectives of Hewlett-Packard’s founders:

Human resource objectives not only need to reflect the intention of senior management, they also must balance challenges from the organization, the HR function, society, and the people who are affected. Failure to do so can harm the firm’s performance, profits, and even survival. These challenges spotlight four objectives that are common to HR management and form a framework around which this book is written. To recognize that HR management exists to contribute to organizational effectiveness. Even when a formal HR department is created to help managers, the managers remain responsible for employee performance. The HR department exists to help managers achieve the objectives of the organization. HR management is not an end in itself; it is only a means of assisting managers with their human resource issues To maintain the department’s contribution at a level appropriate to the organization’s needs. Resources are wasted when HR management is more or less sophisticated than the organization demands. To be ethically and socially responsive to the needs and challenges of society while minimizing the negative impact of such demands on the organization. The failure of organizations to use their resources for society’s benefit in ethical ways may result in restrictions. To assist employees in achieving their personal goals, at least insofar as those goals enhance the individual’s contribution to the organization. The personal objectives of employees must be met if workers are to be maintained, retained, and motivated. Otherwise, employee performance and satisfaction may decline and employees may leave the organization.

Not every HR decision can meet these organizational, functional, societal, and personal objectives every time. Trade-offs does occur. But these objectives serve as a check on decisions. The more these objectives are met by the department’s actions, the larger its contribution will be to the organization’s bottom line and the employees’ needs. Moreover, by keeping these objectives in mind, HR specialists can see the reasons behind many of the department’s activities.

The first step in HR planning is to collect information. A forecast or plan cannot be any better than the data on which it is based. HR planning requires two types of information data from the external environment and data from inside the organization

Figure: Human Resource Planning Model

Any of these may affect the organization’s business direction and volume and thus the need for human resources. Human resource planners must also be aware of labor-market conditions such’ as unemployment rates, skill availabilities, and the age distribution the labor force. Finally, planners need to be aware of federal and state regulations: those that directly affect staffing practices, such as affirmative action or retirement-age legislation, arid those that indirectly affect demand for services or ability to pay staff. External benchmarking data also can be useful in human resource planning. One might, for instance, discover that other companies are doing the same work with fewer people, which could lead to a consideration of more efficient ways to work. Benchmarking efforts by Duke Power Company’s consulting arm showed them new ways to organize. Historically, they had staffed projects exclusively with highly experienced (and expensive) professionals. Benchmarking showed them that other successful consulting firms used a small number of top-class experts working with a large support staff of less skilled and experienced people, and they were able to replicate this approach successfully. The second major type of information comes from inside the organization. Internal information includes short- and long-term organizational plans and strategies. Obviously, plans to build, close, or automate facilities will have HR implications, as will plans to modify the organization’s structure, buy or sell businesses, and enter or withdraw from markets. A decision to compete en the basis of low cost rather than personalized service also will have staffing implications. Finally, information is needed on the current state of human resources in the organization, such as how many individuals are employed in each job and location, their skill levels, and how many are expected to change positions or depart the organization during the forecast period.

Once planners have the external and internal information they need, they can forecast the future demand for employees. At a minimum, this forecast includes estimating the number of employees who will be needed in the coming year. Longer-term demand forecasts also may be made. Next, planners forecast the supply of labor, the internal supply of employees and their skills and promo ability, as well as the probable availability of potential new employees, with requisite skills in the external labor market.

The final step in HR planning is to plan specific programs to ensure that supply will match demand in the future. These programs often include recruiting plans and also may include training and development activities, incentives or disincentives to early retirement, Modifications of career paths in the organization, or a variety of other HR management programs. Note that the feedback loop shown in Figure 3.1 allows for learning from past planning efforts. If demand or supply forecasts have not been as accurate as desired, forecasting processes can be improved in subsequent years.

Practices in the Southeast Bank Limited

The bank follows most of steps of HR planning i.e. integrate HR planning with corporate planning, assessment of internal HR capabilities and so on. The bank has an integrated HR plan. Their manpower ratio is satisfactory for smooth and quality services to the potential customers.

Dhaka Bank Limited is forecasting future manpower requirements. This is done either in terms of mathematical projections or in terms of judgmental estimates. Mathematical projections are done extrapolating factors like, economic, environment, development trends in the bank. Judgmental estimates are done depending on the specific future plans of the bank by managerial discretion which is based on past experience. Dhaka Bank Limited is preparing an inventory of present manpower. Such inventory contains data about each employee’s skills, abilities, work preferences and other items of information.

Dhaka Bank all times prepares anticipating problems of manpower. This is can be done by projecting present resources into the future and comparing the same with the forecast of manpower requirements. This helps in determining the quantitative and qualitative adequacy of manpower.

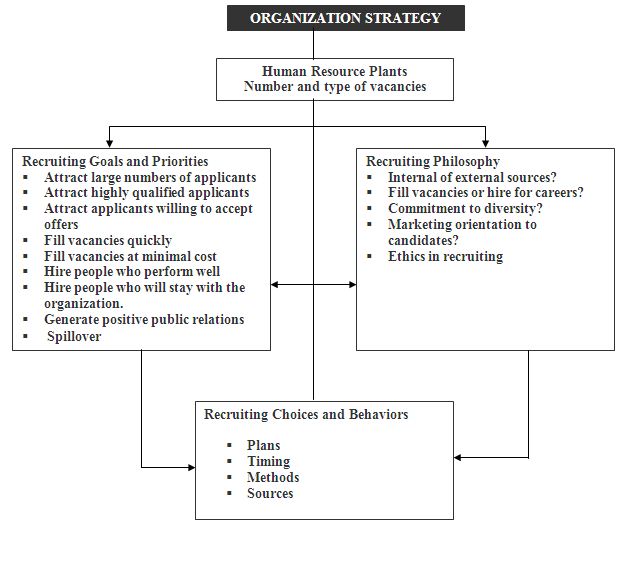

Concepts of Recruitment:

Recruitment is the process of finding and attracting capable applicants for employment. The process begins when new recruits are sought and ends when their applications are submitted. The result is a pool of applications from which new employees are selected. In large organizations specialists in the recruiting process, called recruiters, are often used to find and attract capable applicants. The HR plan can be especially helpful because it shows the recruiter both present openings and those expected in the future.Figure presents an overview of the’ recruitment process from the perspectives of the organization and the candidate. This flow chart displays the process as it unfolds over time. When a vacancy occurs and the recruiter receives authorization to fill it, the next step is a careful examination of the job’ and an enumeration of the skills, abilities, and experience needed to perform the job successfully. Existing job analysis documents can be very helpful in this regard. “In addition, the recruitment planner must consider other aspects of the job environment—for example, the supervisor’s management style, the opportunities for advancement, pay, and – geographic location—in deciding what type of candidate to search for and what search methods to use. After carefully planning the recruiting effort, the recruiter uses one

In the recruitment and selection process, the organization’s and individual’s objectives may conflict. The organization is trying to evaluate the candidate’s strengths and weaknesses, but the candidate is trying to present only strengths. Conversely, although the candidate is trying to ferret out both the good and the bad aspects of the prospective job and employer, the organization may prefer to reveal only positive aspects. In addition, each party’s own objectives may conflict The organization wants to treat the candidate well to increase the probability of job-offer acceptance, yet the need to evaluate the candidate may dictate the use of ‘methods that may alienate the prospect, such as background investigations or stress Interviews.” Analogously, the applicant wants to appear polite and enthusiastic about the organization to improve the probability of receiving an offer, but he or she may also want to ask penetrating questions about compensation, advancement, and the company’s financial health and future.

STRATEGIC ISSUES IN RECRUITING

The nature of a firm’s recruiting activities should be matched to its strategy and values as well as to other important features such as the state of the external labor market and the firm’s ability to pay or the wise induce new employees to join.

Selection

Selection

Selection is the process by which managers and others use specific instruments to choose from a pool of applicants a person or persons most likely to succeed in the job(s) given management goals and legal requirements.

Personnel selection is a process of measurement, decision making, and evaluation. The goal of a personnel selection system is to bring into an organization individuals who will perform well on the job. A good selection system also should be fair to minorities and other protected groups.

Internal Recruitment Process:

Current employees are a major source of recruits for all but entry-level positions. Whether for promotions or for “lateral” job transfers, internal Candida already know the informal organization and have detailed information alibis formal policies and procedures. Promotions and transfers are typically ceded by operating managers with little involvement by the HR department

Job-Posting Programs

HR departments become involved when internal job opening are publicized employees through job-posting programs, which inform employees at openings and required qualifications and invite qualified employees to apply.

Self-nominations may even apply to management trainees. Many organizations hire recent college graduates for management training programs, and this may be little more than an extended job rotation through several departments. After this rotation is completed, some companies allow trainees to nominate themselves to fill posted job openings.

Departing Employees

An often overlooked source of recruits consists of departing employees. Many employees leave because they can no longer work the traditional forty-hour workweek. School, child-care needs, and other commitments are the common reasons. Some might gladly stay if they could rearrange their hours of work or their responsibilities. Instead, they quit when a transfer to a part-time job may retain their valuable skills and training.

External Recruitment Process:

When job openings cannot be filled internally, the HR department must look outside the organization for applicants. The remainder of the chapter discusses the external recruitment channels most commonly used by employers and applicants.

Walk-ins and Write-ins

Walk-ins are job seekers who arrive at the HR department in search of a job; write-ins are those who send a written inquiry. Both groups normally are asked to complete an application blank to determine their interests and abilities. Usable applications are kept in an active file until a suitable opening occurs or until an application is too old to be considered valid, usually six months.

Employee Referrals

Employees may refer job seekers to the HR department. Employee referrals have several advantages. First, employees with hard-to-find job skills may know others who do the same work. For example, a shortage of welders on the Alaskan pipeline was partially solved by having welders ask their friends in the “lower forty-eight states” to apply for the many unfilled openings. TRW and McDonald’s pay employees a referral bonus when qualified candidates arc recommended at some locations. Second, new recruits already know something about the organization from the employees who referred them. Thus, referred applicants may be more strongly attracted to the organization than arc referrals casual walk-ins. Third, employees tend to refer their friends, who are likely to have similar work habits and attitudes. Even if their work values are different, these candidates

Advertising

What ads describe the job and the benefits, identify the employer, and tell those who are interested how to apply. They are the most familiar form of employment advertising. For highly specialized recruits, ads may be placed in professional journals or out-of-town newspapers in areas with high concentrations of the desired skills. For example, recruiters in the aerospace industry often advertise in Los Angeles, St. Louis, Dallas-Fort Worth, and Seattle newspapers because those cities are major aerospace centers.

Want ads have severe limitations. They may attract thousands of job seekers for one popular job opening, or few may apply for less attractive jobs. For example, few people apply for door-to-door sales jobs if they know the product is vacuum cleaners or encyclopedias. Likewise, the ideal recruits are probably already employed and not reading want ads. Finally, secret advertising for a recruit to replace an incumbent cannot be done with traditional want ads. These limitations are avoided through the use of blind ads. A blind ad is a want ad that does not identify the employer. Interested applicants are told to send their resumes to a mailbox number at the post office or to the newspaper. A resume, which is a brief summary of an applicant’s background, is then forwarded to the employer. These ads allow the opening to remain confidential, prevent countless telephone inquiries, and avoid the public relations problem of disappointed recruits.

State Employment Security Agencies

Every state government has a state employment security agency. Often called the unemployment office or the employment service, this agency matches job seekers with job openings. The agencies result from a federal and state partnership that was

Private Placement Agencies

Private placement agencies, which exist in every major metropolitan area, arose to help employers find capable applicants. They take an employer’s request for recruits and then solicit job seekers, usually through advertising or among walk-ins. Candidates are prescreened, matched with employer requests, and then told to report to the employer’s HR department for an interview. The matching process conducted by private agencies varies widely. Some placement services carefully prescreen applicants; others simply provide a stream of applicants and let the HR department do most of the screening.

Professional Search Firms

Professional search firms are much more specialized than placement agencies. Search firms usually recruit only specific types of human resources for a fee paid by the employer. For example, some search firms specialize in executive talent, while others find technical and scientific personnel. Perhaps the most significant difference between search firms and placement agencies is the approach taken. Placement agencies hope to attract applicants through advertising, but search firms actively seek out recruits among the employees of other companies. Although they may advertise, search firms use the telephone as their primary tool to locate and attract prospective recruits.

Educational Institutions

Many educational institutions offer current students and alumni placement assistance. Although some applicants sought through educational institutions are experienced, many are not. And new entrants are more likely to be swayed by the recruiter’s manner and behavior during the interview than by the attributes of the job, which appears to be the deciding factor for experienced workers. Educational institutions also are an excellent source for hiring foreign nationals. Foreign students in domestic schools have the advantage of being bilingual and bicultural. Some foreign students desire jobs with domestic firms to gain experience or secure citizenship.

International Recruiting

Recruitment in foreign countries presents special challenges. In advanced industrial nations, recruiters find many of the same channels that exist in North America. Additional help can sometimes be obtained from embassy or consular offices. Recruitment help from consultants or other professionals may be necessary for higher-level positions. These positions may require social acceptance, school ties, and other appropriate hallmarks of success, which may be considered more important than past experience or the other, more traditional criteria used in the home country.

In developing nations, recruiters often find that they have to develop their own network of contacts, ranging from newspaper reporters to government officials in the host country. Of particular importance are cultural conflicts. Historical animosities may exist between different factions within the country, whether different native tribes, elements of a formal caste system, or enmity by virtue of long-standing traditions.

Recruitment of employees to move internationally has many similarities with domestic efforts; unfortunately, the problems encountered by recruiters are often more difficult to resolve. Members of two-career families may be reluctant to apply for overseas jobs. Immigration barriers, employment laws, and other roadblocks may prevent a promising recruit from a becoming a bona fide

The Selection Process

Selection activities typically follow a standard pattern, beginning with an initial screening interview and concluding with the final employment decision. The selection process typically consists of eight steps:

- Initial screening interview

- Completing the application form

- Employment tests

- Comprehensive interview

- Background investigation

- a conditional job offer

- Medical or physical examination and

- The permanent job offer.

As a culmination of our recruiting efforts, we should be prepared to initiate a preliminary review of potentially acceptable candidates. This initial screening is, in effect, a two-step procedure: (1) the screening of inquiries and (2) the provision of screening interviews.

Completion of the Application Form

Once the initial screening has been completed applicants are asked to complete the organization’s application form. The amount of information required may be only the applicant’s name address, and telephone number. Some organizations, on the other hand, may request the completion of a more comprehensive employment profile. In general terms, the application form gives a job-performance-related synopsis of what applicants have been doing during their adult life, their skills, and their accomplishment.

Organizations historically relied to a considerable extent on intelligence, aptitude, ability, and interest tests to provide major input to the selection process. Even handwriting analysis (graphology) and honesty tests have been used in the attempt to learn more about the candidate—information that supposedly leads to more effective selection. It is estimated that more than 60 percent off all organizations use some type of employee test today. For these organizations there is recognition that scrapping employment test was equivalent to “throwing out the baby with the bath water”. They have come to recognize that some tests are quite helpful in predicting who will be successful on the job.

The comprehensive Interview:

The applicant may be interviewed by HRM Interviewers, senior managers within the organization, a potential supervisor, and potential colleagues of some or all of these. The comprehensive interview is designed to prove areas that cannot be addressed easily by the application form or tests, such as assessing one’s motivation, ability to work under pressure, and ability to “fit in” with the organization. However, this information must be job related. The question asked and the topics covered should reflect the jobs description and job specification information obtain in job analysis.

Background Investigation:

The next step in the process is to undertake a background investigation of those applicants who appear to offer potential as employees. This can include contacting former employers to confirm the candidate’s work record and to obtain their appraisal of his or her performance, contacting other job-related and personal references, verifying the educational accomplishments shown on the application. Common sense dictates that HRM find out as much as possible about its applicants before the final hiring decision is made. Failure to do so can have a detrimental effort on the organization, both in terms of cost and morale. But getting the information may be difficult, especially when there may be a question about invading one’s privacy. In the past, many organizational policies stated that any request for information about a past employee be sent to HRM.

Conditional Job Offer:

If a job applicant has “passed” each step of the selection process so far, it is typically customary for a conditional job offer to be made. Conditional job offers usually are made by an HRM representative (we’ll revisit this momentarily). In essence, what the conditional job offer implies is that if everything checks out “Okay-passing a certain medical, physical, or substance abuse test-“ the conditional nature of the job offer will be removed and the offer will be permanent.

Physical / Medical Examination:

The next to last step in the selection process may consist of having the applicant take a medical / physical examination. Remember, however, that in doing so a company must show that the reasoning behind this requirement is job related. Physical exams can only be used as a selection device to screen out those individuals who are unable to physically comply with the requirements of a job. For example, firefighter are require to perform a verified to activities that require a certain physical condition.

Job offer:

Those individuals who perform successfully in the preceding steps are now considered to be eligible to receive the employment offer. Who makes the final employment offer? The answer is, it depends. For administrative purposes, the offer typically is made by an HRM representative. The actual hiring decision should be made by the manager in the department where the vacancy exists. While this might not be the situation in all organizations, the manager of the department should have the authority. First, the applicant will eventually work for this manager and therefore a good “fit” between boss and employee is necessary. Second, if the decision made is not correct, the hiring manager has no one else to blame. It also important to remember- as we previously mentioned in recruiting – that those finalist who don’t get hired deserve the courtesy of being notified that they didn’t get the

Practices in the Southeast Bank Limited

The set-vise rule of Southeast Bank Limited sates the recruitment, the recruitment policy of the bank. In general the board of directors determines the recruitment policy of bank from time to time. The bank advertisement of the daily newspapers to wants their requirements from verities positions. They select the qualified applicants among the candidates. The call for the written test, those candidates who are successfully completion of the written test, they are select for the viva. The minimum entry level qualification for any official position other than supportive management is a bachelor degree. The management prefers a minimum master’s degree for the appointment of probationary officers in the executive officer position. The recruitment for entry level positions begins with a formal written test which is conducted and supervised buy the Institute of Business Administration, University of Dhaka. After successful completion of the written test, a personal interview is conduct for the successful candidates by a panel of experts comprising of renowned and prominent bankers of the country.

Concepts of Training:

Training is defined as any attempt to improve employee performance or a currently held job or one related to it. This usually means changes it is specific knowledge, skills, attitudes, or behaviors. To be effective, training should involve a learning experience, be a planned organizational activity, and be designed in response to identified needs. Ideally, training also should be designed to meet the goals of the organization while simultaneously meeting the goals of individual employees.

Concepts of Development

Development refers to leering opportunities designed to help employees grow. Such opportunities do not have to be limited to improving employee’s performance on their current jobs. At ford, for example, a new systems analyst is required to take a course on ford standards for user manuals. The content of this training is needed to perform the systems analyst job at ford. The systems analyst, however also may enrolled in a course entitled “self Awareness” the content of which is not required on the current job. This situation illustrates the difference between training and development.

The focus of “Development” is on the long term to help employees prepare for future work demands, while training often focuses on the immediate period to help fix any current deficits in employee’s skills. The most effective companies look at training and career development as an integral part of a “human resources development” (HRD) program carefully aligned with corporate business strategies.

Most of the organization prefers internal manning of positions than external hiring for obvious motivational benefits and cost effectiveness. Even ‘though training prime facie, emphasizes on increasing the performance level of an employee, a continuous training function enables the organization to develop employees for future responsible positions in the organization itself.

The needs for manpower training in an organization may be categories as follows:

- Technological advancement, business environmental changes and new management philosophies have now made it imperative for the organization to renew and update the knowledge and skills of the employees so that they do mil become redundant for obvious functional incompetence. The first and foremost need for manpower training therefore, is to renew and update knowledge and skills of employees to sustain their effective performance and so also to develop them for future managerial positions.

- Recent economic liberalization programs of Government of India is necessitating Organizational restructurings, which inter alia, calls for training the employees, irrespective of their functional level, for their redeployment in restructured

- Continuous training being required to renew and update knowledge and skills of employees, it makes them functionally effective. The- third need is therefore, to make employees effective in their performance through continuous training.

- Apart from emphasizing on technical and Conceptual skills, new training programmed also emphasize on developing human skills of employees. Such human skill is necessary for effective interpersonal relations and sustaining healthy work environment. This need for training therefore also cannot be all together ignored.

- In industrial employment, the convention is to recruit workers and an employee through compulsory apprenticeship training such apprenticeship training enables an organization to impart industry and trade specific skills to workers. This also, therefore, is an important need for manpower training.

- Throughout the world the importance of training is now increasingly felt for stabilizing the workforce to withstand the technological change and for making the organization dynamic in this changed process. Management theorists now unanimously agree that it is the responsibility of the organization to train and develop their manpower as continuous process.

Methods of Training:

On-the –job Training (OJT) means having a person learn a job by actually doing it, every employee, from mailroom clerk to company president, gets on the job training when he or she joins a firm. In many firms, OJT is the only training available. The most familiar type of on the job training is the coaching or understudy method. Here, an experienced worker or the trainee’s supervisor trains the employee. At lower levels, trains may acquire skills by observing the supervisor. But this technique is widely used at top-management level too. A potential future CEO might spend a year as assistant to the current CEO, for instance. Job rotation, in which an employee (usually a management trainee) moves from job to job at planned intervals, is another OJT technique. There are some steps to help insured OJT Success

Prepare the Learner

- Put the learner at ease— relieve the tension.

- Explain why he or she is being taught,

- Create interest, encourage – encourage find out whit the learner already knows about this or other jobs.

- Explain the whole job and relate it to some job the worker already knows.

- Plane the learner is dose is the normal working position as possible.

- Familiarize the worker with equipment, materials, tools, and trade

Present the Operation

- Explain quantity and quality requirement?

- Go through the job at the normal work pace.

- Again go through the job at a slow pace several times; explain the key points.

- Have the learner explain the steps is you go through the job at a slow pace,

Have the learner go though the job several times explaining: slowly, explaining each step to you. Correct mistakes and mistakes and, if necessary, do some of the complicated steps the first few times. Run the job at the normal pace. Have, the learner do the job, gradually building up skill and speed. As soon as the learner demonstrates ability to do the job, let the work begin, but don’t abandon him or her,

- Designate to whom the learner should go for help

- Gradually decrease supervision, checking work from time to time against quality and quantity standards.

- Correct faulty work patterns before they become a habit. Show why the learned method is superior,

- Compliment good work; encourage the worker until he or she is able to meet the quality and quantity standards

Apprenticeship Training

More employers are implementing apprenticeship programs, an approach that began in the middle Ages. Apprenticeship training is a structured process which people become killed workers through a combination of classroom Instruction and on-the job training. It is widely to train individuals for many occupations. It traditionally involves having the learner/apprentice study under the tutelage of a master craftsperson.

Informal Learning

Employers should not underestimate the importance or value of informal training. Surveys form the American Society for Training and Development estimate that as much as 80% of what employees learn on the job they learn not through formal training programs but through informal means, including performing their jobs on a dally basis in collaboration with their colleagues.

Job Instruction Training

This is training through step-by-step learning. Usually steps necessary for a job are identified in order of sequence and an employee is exposed to the different steps of a job by an experienced trainer.

Managerial On-the-Job Training

On –the – job training is not just for non managers. Managerial on –the –job training methods include job rotation the coaching/understudy approach, and action learning.

Job Rotation:

Job rotation means moving management trainees from department to department to broaden their understanding of all parts of the business and to test their abilities. The trainee – often a resent college graduate may spend several months in each department. The person may just be an observer in each department, but more commonly gets fully involved in its operations.

Coaching/Understudy Approach:

Here the trainee works directly with a senior manager or with the person he or she is to replace, the latter is responsibly for the trainee’s coaching. Normally, the understudy relieves the executive of certain responsibilities, giving the trainee a chance to learn the job.

Action Learning:

Action learning programs give managers and others released time to work full-time on projects, analyzing and solving problems in departments other than their own. The basics of a typical action learning program include. Carefully selected teams of 5 to 25 members; assigning the teams real world business problems that extend beyond their usual areas of expertise and structured learning through coaching and feedback.

Lecturing has several advantages. It is a quick and simple way to provide knowledge to large groups of trainees as when the sales force needs to learn the special features of a new product. You could use written materials instead, be they may require considerable more production expense and won’t encourage the give-and-take questioning that lectures do. Here are some useful guidelines for presenting lectures.

- Give your listeners signals to help them follow your ideas. For instance, if you have as lost of items start by saying something like? There are four reasons why the sales reports are necessary. The first …………..the second……………….

- Don’t start out on the wrong foot. For instance, don’t open with an irrelevant joke or story or by saying something like. “I really don’t know why I was asked to speak here to day.

- Keep your conclusions short. Just summarize your main point or points in one or two succinct sentences.

- Be alert to your audience. Watch body language for negative signals like fidgeting and crossed arms.

- Maintain eye contact with the trainees. At least look at each section of the audience during your presentation.

- Make sure everyone in the room can hear. Use a mike if necessary. Repeat questions that you get from trainees before you answer.

- Control your hands. Get in the habit of leaving them hanging naturally at your sides rather than letting them drift.

- Talk from notes rather than from a script. Write out clear, legible notes on large index cards or on PowerPoint slides, and use these as an outline, rater than memorizing your presentation.

Programmed Learning:

Whether the medium is a textbook, computer, or the Internet, programmed Leering (Or programmed instruction) is a step-by-step, self-leaning method that consists of there parts.

- Presenting questions facts or problems to the learner

- Allowing the person to respond

- Providing feedback on the accuracy of answers.

Generally, programmed learning presents facts ad follow-up questions. The learner can then respond, and subsequent frames provide feedback on the accuracy of his or hear answers. What the next question is often is often depends on the accuracy of the learner’s answer to the previous question.

Audiovisual-Based Training

- Audiovisual-based training techniques like, PowerPoint’s, vide conferencing, audiotapes, and videotapes can be very effective and are widely used. The Ford Motor Company uses videos in its dealer training sessions to simulate problems and sample reactions to various customer complaints, for example.

- Audiovisuals arc more expensive than conventional lectures but offer some advantages. Of course, they usually tend to be more interesting. In addition, consider using them in the following situations:

- When there is a need to illustrate how to follow a certain sequence over time, such as when teaching fax machine repair. The stop-action, instant replay, and fast- at slow-motion capabilities of audiovisuals can be useful here.

- When there is a need to expose trainees to events not easily demonstrable in live lectures, such as a visual tour of a factory or open-heart surgery.

- When you need organization wide training and it is too costly to move the trainers from place to place.

- Simulated training (occasionally called vestibule training) is a method in which trainees learn on the actual or simulated equipment they will use on the job, but are actually trained off the job.

- Simulated training may take place in a separate room with the same equipment the trainees will use on the job. However, it often involves the use of equipment simulators. In pilot training, for instance, airlines use flight simulators for safety’, learning efficiency, and cost savings, including sayings on.

- Case study method helps students to learn on their own by independent thinking. A set of data or some descriptive materials are given to the participants asking them to analyze, identify the problems and also tc 5 recommend solutions for the same.

- This training method particularly helps in learning human relations skills through practice and imbibing an insight into one’s own behaviors. Trainees of such a programmed are informed of a situation and asked to play their roles in the imaginary situation before the rest of the class. This therefore, helps in the enriching of interact ional skills of the employees.

- T-group is sensitivity training, and takes place under laboratory conditions and is mostly instructed and informal kind of training. The trainer in such a training programmed is catalyst. He helps the individual participants to understand how others perceive his behavior, how here acts to the behavior of others and how and when a group acts either in a negative or in a positive way.

- Training programmers delivered via intranet are now thought of as the most cost-effective route. It is not only cost effective but also caters to the real time information need of employees. However, it involves convergence of several technologies, like, hardware, software, web designing and authoring, instructional design, multimedia design, telecommunications and finally internet-intranet network management. Organization can outsource e-learning training modules at relatively cheaper rate. Even though training through e-learning is globally increasing, we do not have adequate empirical evidence to justify this.

Methods of Development:

Some development of an individual’s abilities can take place on the job. We will review several methods, three popular on-the-job techniques:

- job rotation

- Assistant to position

- Committee assignments

And three off-the jobs methods

- Lecturer courses and seminars

- Simulation exercise

- Outdoor training.

Job rotation:

Job rotation involves moving employees to various positions in the organization in an effort to expand their skills, knowledge, and abilities. Job rotation can be either horizontal or vertical. Vertical rotation is nothing more than promoting a worker into a new position. We will emphasize the horizontal dimension of job rotation, or what may be better understood as a short-term lateral transfer. Job rotation represents an excellent method for broadening an individual’s exposure to company operations and for turning a specialist into a generalist. In addition to increasing the individual’s experience allowing him or her to exposure new information. It can reduce boredom and stimulate the development if new ideas. It can also provide opportunities for a more comprehensive and reliable evaluation of the employee by his or her supervisors.

Assistant-to positions:

Employees with demonstrated potential are sometimes given the opportunity to work under a seasoned and successful manager often in different areas of the organization. Working as staff assistants or, in some cases, serving on “special board,” these individuals perform many duties under watchful eye of a supportive coach. In doing so, these employee get exposure to a wide variety of management activities and are groomed for assuming the duties of the next higher level.

Committee Assignment:

Committee assignments can provide an opportunity for the employee to share decision making, to learn by watching others, and to investigate specific organizational problems. When committees are of a temporary nature, they often take on task-force activities designed to develop into a particular problem, ascertain alternative solutions, and make a recommendation for implementing a solution. These temporary assignments can be both interesting and rewarding to the employee’s growth.

Lecture course and seminars:

Traditional forms of instruction revolved around formal lecture courses and seminars. These offered an opportunity for individuals to acquire knowledge and develop their conceptual and analytical abilities. For many organizations, they were offered in house by the organization itself, through outside vendors, or both. Technology is allowing for significant improvements in the training field. The use of digitized computer technology, a facilitator can be in one location giving a lecture, while simultaneously being transmitted over fiber-optic cable, in real time, to several other locations.

Simulations:

Simulations are probably ever more popular for employee development. The more widely used simulation exercises include case studies, decision games, and role plays. The case-study analysis approach to employee development was popularized at the Harvard Graduate School of business. Taken from the experiences of organization, these causes represent attempts to describe, as accurately as possible, real problem that managers have faced. Trainees study the case to determine problem, analyze causes, develop alternative solutions, select what they believe to be the best solution, and implement it. Role playing allows the participants to act out problems and to deal with real people.

Outdoor Training:

Outdoor training typically involves some major emotional and physical challenge. This could be white-water rafting, mountain climbing, paint-ball games, or surviving a week in the ‘jungle.’ The purpose of such training is to see how employees react to the difficulties that nature presents to them. Do the face these dangers alone? Do they “freak”? Or are they controlled and successful in achieve their goals? The reality is that today’s business environment does not permit employees “stand alone”. This has reinforced the importance of working closely with one another, building trusting relationship, and succeeding as a member of a group.

Development:

Having noted the requirement to match the of both the individual employee and the organization . Generaly an ornization as being in one of three stages of development With respect to its HRMS. The stages are discuss below:

Basic personnel system:

A bare-bones HRMS approach incorporateing databases that may mix written records on file with other data elements stored on a computer database.The data maintained by type Of system focus on the following areas:

- Employee records ( e.g. individual profile , personal information sheet ,application form, orientation acknowledgment , employment agreement or contract.

- Payroll ( wage or salary , attendance and vacation entries, and pention and benefit data.

- Staffing( job descriptions for executive and key ornizational job only.

- Basic data required for compliance with pertinent labour legislation.

Augmented HR System:

Augmented HR system occurs when the organization decides to commit the resources To become more proactive with resoect to HR policy decisions. HRMS becomes entirely comter based, and the elements in stages one typically are augemented by a variety of information determined by needs analysis.

Comprehensive and interactive HRMS:

Relatively few companies have elvoled to the stages- three of a comprehensive interactive HRMS. This tyes of HRMS configuration enables the HR planning Staff to run future “ what –it” scenarios to determine the best future policy alternative Given a range of possible outcomes. In such an instance, the computer search could Select candidates who had performance appraisal ratings of “above average “ or higher over the past five years successfully completed a graduate degree a minimum of five years seniority in the organization . the program coordinator of management develop could then review by HR review the list produce by the database search, using input from senior mangers and executives , to decides whom to include or Excludes from the list

Practices in the Southeast Bank Limited

The bank arranges sufficient training and development programs for its staffs that make them competent to face modern and technological challenges. Its follows both on-the-job and off-the-job training methods. Dhaka Bank Limited believes it in letter and spirit. As such in order to select right type of people the bank is maintaining a very transparent and neutral mould operational as regards requirements. Requirements are usually done through open invitation of applications by the advertisement in the national dallies. Candidates are requiring through stringent examinations and tests some of wish is conducted by the Institute of Business Administration of Dhaka University. Doors of appointment are kept open for the graduates/post –graduated of all disciplines from all kinds of universities vie public, private and National universities.

A good organization makes sure that it itself and the people who work for it succeed tougher, and the Human Resource Division’s prime concern is the success of the people who for the organization. Dhaka Bank Limited, Human Resource Division is in constant pursuit of providing for the optimum benefits and career support to its personnel through scores of mechanisms it has fashioned- Dhaka Bank Limited Bank Recreation and welfare centre, Dhaka Bank Limited Foundation, the library at the training Institute , Best Performance Award and so on.

Organizational Development:

There are many ways to identify the need for an organizational change ,and to implement the change itself.One of the most widely used is organizational development (OD).Organizational development is aspecial approach to organizational change in which the employees themselves formulate the change that’s required and implement it, often with assistance of a trained consultant.particularly in large companies ,the OD process(including hiring of facilitator)is almost always handled through HR.As an approach to changing organizatons, OD has several distinguishing characteristics:

Human Process Applications:

Human process OD techniques generally aim first at improving human relations skills. The goal give employees the insight and skills required to analyze their own and others behavior more effectively, so they can then solve interpersonal and intergroup problems. These problem might includes, for instance, conflict among employees , or a lack of interdepartmental communications. Sensitivity training is perhaps the most widely used technique in this category . Team building and survey research are others.

Group:

Sensitivity , laboratory, or t-group training was one the eaeliest OD techniques, Its use has diminished, but still find today. Sensitivity training’s basic aim is to increase the participant’s insight into his or her onw hehavior and the behavior of others by encouraging an open expression of feelings in the trainer-guided t-group.Typically 10 to 15 people meet, usually away from the job , with no specific agenda.

Process consultation:

Instead, the focus is on the feelings and emotion of the members in the group at the meeting . the facilitator encourages participant to pottraty themselves as they are in the group rathe than interms of past behaviors or future problems.

Third party intervention:

It’s not surprising that 4-group training is a controversial technique. The personal nature of such training suggests that participation should be voluntary . Some view it as unethical because really consider participation “suggested” by onesuperior as strictly voluntary.

Team building:

OD’s distinctive emphasis on action research is quite evident in team building, which refers to a specific process for improving team effectiveness.According to expert French and Bell, the typicall team-building meeting begins with the consultant interviewing each of the group members and the leaders before the meeting.

Organizational confrontation meeting:

They are all asked what their problems are, how they think the group functions and what obstacles are keeping the themes( such as “inadequate communications”) and present themes in terms of importance and the most important ones become the agenda of the meeting. The group then explores and discusses the issues examines the underlying causes of the problems and begins devising solutions.

Technostructural interventions: