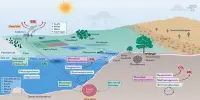

Researchers at the University of California San Diego’s School of Global Policy and Strategy have developed a new method for predicting the financial impacts of climate change on agriculture, which can help support food security and financial stability in countries that are becoming more vulnerable to climate disasters.

The study, published in the Proceedings of the National Academy of Sciences, makes use of climate and agricultural data from Brazil. It discovers that climate change has a cascading effect on agriculture, resulting in higher loan defaults for one of the country’s main public sector banks. According to the report, loan defaults caused by climate change might rise by up to 7% over the next three decades.

The forecasts in the article revealed that, while temperatures are rising everywhere, there is significant difference in what that looks like from place to region, emphasizing the importance of developing diverse types of physical and financial resilience.

A difficulty in studying climate impacts on agriculture is that there are all sorts of adaptations happening all the time that aren’t easily observed, but are really important for understanding vulnerability and how risk is changing.

Jennifer Burney

For example, parts of northern Brazil are expected to experience more dramatic seasonal swings by 2050, with heavier rainfall in the winter and drier summers, so policymakers should consider the need for water storage by constructing dams and reservoirs, as well as increasing groundwater storage capacity. Central Brazil, on the other hand, may experience more consistent weather but higher total temperatures, indicating the need for heat-resistant crops.

The authors of the paper used a statistical approach pairing past climate data in Brazil with information on crop productivity, farm revenue and agricultural loan performance. They combined this data with climate simulations to predict future weather conditions and their impacts on farming and how those changes will affect financial institutions.

“A difficulty in studying climate impacts on agriculture is that there are all sorts of adaptations happening all the time that aren’t easily observed, but are really important for understanding vulnerability and how risk is changing,” said coauthor Jennifer Burney, professor of environmental science at UC San Diego’s School of Global Policy and Strategy and Scripps Institution of Oceanography. “We were able to distinguish signals from different types of climate impacts and which ones led to this larger financial risk.”

Systematic thinking about building resilience against climate change around the globe

A key objective of the research is to support resilient food security under a changing climate, which requires understanding of when small climate shifts might have outsized impacts, spilling across regions or into other sectors through institutions like trade and banking.

Understanding the systemic risk posed by climate change is especially important for politicians and disaster relief organizations, as climate change has become a major national security issue. To that goal, the statistical approach described in the study might be implemented globally.

“The technique we developed will help populations identify where they are most vulnerable, how climate change will hurt them the most economically, and what institutions they should focus on to build resilience,” said study coauthor Craig McIntosh, an economics professor at the School of Global Policy and Strategy.

For example, some governments in the Western Pacific region buy extra food on the global market in emerging El Niño years, when their own crop productivity suffers. The statistical approach used in the study could help governments around the world understand their own climate conditions and whether local, regional or international institutions will be best placed to address them.

The findings could be especially useful in developing the United Nations’ loss and damage fund, which is set to be formed in 2022. The fund is intended to help pay developing countries who have contributed the least to the climate problem but have borne the brunt of its disastrous floods, droughts, and sea level rise.

“Our technique could help countries think about where the resilience returns would be highest for the money spent,” said Krislert Samphantharak, an economics professor at the School of Global Policy and Strategy. “This technique also helps to identify where international reinsurance might be needed.”