The process of a business raising the production of products or services in the same part of the supply chain is a horizontal merger, also known as horizontal integration. It is a merger of two firms that are operating in the same market or in a similar one. The aim of a horizontal merger is to allow more effective use of economies of scale, increase market strength, and exploit synergies based on cost and revenue. In other words, it happens when one organization purchases out its rival or they consent to unite and make another consolidated organization. An organization may do this by means of inner development, obtaining, or consolidation. The cycle can prompt restraining infrastructure if an organization catches by far most of the market for that item or administration. This form of the merger is mostly due to larger corporations seeking to build economies of scale that are more effective. Conversely, as companies from different parts of the supply chain consolidate to make the manufacturing process more competitive or cost-effective, a vertical merger takes place.

Horizontal integration diverges from vertical integration, where organizations coordinate various phases of the creation of a few creation units. A flat consolidation can help an organization pick up upper hands. For instance, if one company sells goods identical to the other, the combined horizontal merger revenues would give the new company a larger market share. An effective merger should generate value in which it would be worth more to combine the businesses than if each business were under separate ownership. 1 + 1 (referring to two separate companies) should be greater than 2 in a horizontal merger (the merged company).

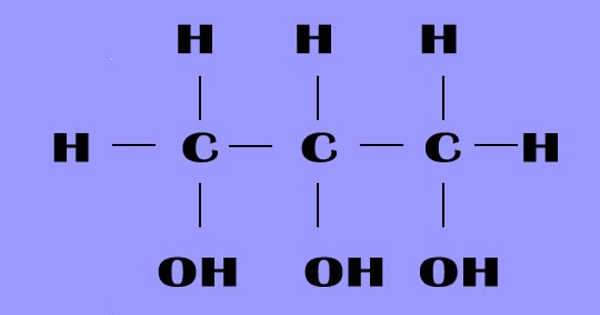

(Example of Horizontal Merger)

Reasons for merging horizontally:

- Increase market share and decrease industry competition

- Further, utilizing economies of scale (thus reducing costs)

- Increase diversification

- Reshape the business reach of the organization by decreasing intense competition

- Realize economies of scope

- Share complementary skills and resources

On the off chance that one organization makes items reciprocal to the next, the recently combined organization may offer a more extensive scope of items to clients. Merging with an organization offering various items to an alternate area of the commercial center assists the new organization with differentiating its contributions and enter new business sectors. In highly fragmented industries where fewer companies compete, most mergers take place, and the synergies are beneficial. When the two businesses operate at the same stage of the supply chain, by integrating activities, they are able to develop economies of scale. A horizontal merger between two companies that are already excelling in the sector could be a better investment than investing a lot of time and money into the separate production of goods or services. A horizontal merger can build an organization’s income by offering an extra scope of items to existing clients.

The horizontal integration of the horizontal alliance is connected to (also known as horizontal cooperation). In the case of a horizontal partnership, however, the partnering firms set up a deal, but remain separate. A horizontal merger also helps reduce the marketplace threat of rivalry. Likewise, the recently made organization may have more noteworthy assets and pieces of the overall industry than its rivals, letting the business practice more prominent authority overestimating. While a horizontal merger has several advantages, they may not be completely understood and the merger may not in fact produce added value.

Benefits of Horizontal Integration (Merger):

- Horizontal integration helps businesses to benefit from greater economies of scale in sectors with high fixed costs. With higher production, the business would benefit from greater productivity, reduced costs and lower prices for customers.

- Likewise, the recently made organization may have more noteworthy assets and pieces of the overall industry than its rivals, letting the business practice more prominent authority overestimating.

- More benefit and money for spending in R&D (research and development). For industries such as the drug industry and commercial aircraft, this is significant.

Advantages of flat joining to both the firm and society may incorporate economies of scale and economies of degree. For the firm, even incorporation may give a fortified presence in the reference market. When the merged businesses have access to a larger range of goods or services, it will significantly raise sales. If the horizontal merger produces a corporation that can be called a monopoly, there may be legal consequences. In the US, horizontal mergers are scrutinized because the combination of rivals will create a monopoly and increase consumer prices. The horizontally integrated business will also be able to participate in monopoly pricing, which is disadvantageous to society as a whole and may cause regulators to prohibit or limit horizontal integration.

Mergers between enormous associations are seen as monopolistic. A firm that exploits its monetary, innovative, and HR can turn into syndication. Additionally, on the off chance that one firm has 35% of the market and the other firm has 15% of the market, the new firm will have half of the market. For these corporations, this is a relatively unfair competitive advantage, since they establish an oligopoly by merger. The effects on the market won’t be too heavy if two smaller companies combine horizontally.

Information Sources: