The balance of payments (also known as BOP or BoP) is an economical statement that summarizes the transactions made by residents of a given country with the rest of the world during a given time period. The entire amount of money entering into a country from overseas minus the total amount of money leaving the country within the same time period. The current account and the capital account are normally separated.

Imports and exports of goods, services, and capital, as well as transfer payments like foreign aid and remittances, make up the balance of payments (BOP). There are two parts to it: the current account and the capital account. The current account measures a country’s net revenue, whereas the capital account measures the change in ownership of national assets.

A double-entry method governs the balance of payments account. On the credit side, all receipts are entered, while on the debit side, all payments are entered. The term “balance of payments crisis” has political connotations. However, because any current account deficit is likely to be small in comparison to the country’s national revenue and wealth, a country may often sustain a current account deficit for many years without harming its economy.

International trade was strictly regulated until the early nineteenth century, and it accounted for a modest percentage of national output. Because growth was slow, the major means of bolstering a country’s financial situation was to encourage a trade surplus.

However, because national economies were not highly integrated, large trade imbalances rarely resulted in crises. International economic integration increased as a result of the industrial revolution, and balance of payment crises became increasingly common.

European trade was often regulated at the municipal level in the Middle Ages to ensure the safety of local industries and established merchants. Countries abandoned the gold standard during the Great Depression and engaged in competitive devaluation of their currencies, but the Bretton Woods system, which lasted from 1945 to the 1970s, introduced a gold-convertible dollar with set exchange rates to other currencies.

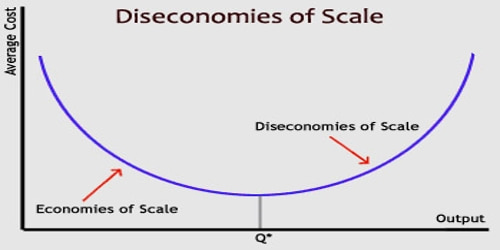

Mercantilism became the main economic doctrine influencing European rulers in the 16th century. Local trade controls were phased out in favor of national regulations aimed at maximizing a country’s economic production. In the mercantilist era, economic growth remained low; average global per capita income is not thought to have increased considerably in the 800 years leading up to 1820 and is believed to have expanded by less than 0.1 percent per year on average between 1700 and 1820.

However, when the United States money supply grew and its trade deficit grew, the government was unable to properly redeem foreign central banks’ dollar holdings for gold, and the Bretton Woods arrangement was dismantled. BOP crises were uncommon due to low levels of financial integration between nations and international commerce accounting for a small percentage of each country’s GDP.

Hume claimed in his articles Of Money and Of the Balance of Trade that accumulating precious metals would result in monetary inflation with no real effect on interest rates. It is the cornerstone of what is now known as the quantity theory of money, the neutrality of money, and the treatment of interest rates as a real phenomenon rather than a monetary phenomenon in modern economic studies.

On this basis, Adam Smith built, accusing mercantilists of being anti-free trade and equating money with riches. Since the Nixon shock, which marked the end of the dollar’s convertibility to gold, currencies have been allowed to float freely, allowing a country with a trade deficit to artificially depress its currency by hoarding foreign reserves, for example, by making its products more appealing and increasing exports.

Balance-of-payments crises can emerge as a result of greater capital mobility across borders, resulting in dramatic currency devaluations such as those seen in Southeast Asian countries in 1998. Nixon Shock is a term used to characterize the aftermath of former President Richard Nixon’s economic policies, which he promoted in 1971.

Economists began to worry in the early twenty-first century that the United States would face a balance of payments crisis. Its current account deficit expanded to more than 5% of GDP, putting the country’s economy at risk of becoming increasingly reliant on foreign borrowing. According to historian Carroll Quigley, the advantages of Great Britain’s geographical location, naval force, and economic superiority as the first nation to experience an industrial revolution allowed her to act benevolently in the nineteenth century.

At the time, all of the world’s major central banks responded to the financial crisis by implementing the significant monetary expansion. As a result, the currencies of other countries, particularly those in developing economies, have appreciated versus the US dollar and other major currencies.

The Bretton Woods system ushered in an era of rapid global prosperity known as the Golden Age of Capitalism, but it was put under strain due to countries’ incapacity or unwillingness to maintain effective capital controls, as well as instability associated to the dollar’s central role. Businesses utilize BOP to assess a country’s market prospects, particularly in the short term.

A country with a significant trade deficit is less likely than a country with a huge trade surplus to import as much. If the government has a high trade deficit, it may impose trade restrictions such as quotas or tariffs. While a country’s balance of payments must balance its current and capital accounts, mismatches across countries’ current accounts can and do occur.