A general obligation (GO) bond is a form of municipal bond in which the bond repayments (interest and principal) are guaranteed by the applicable government entity’s or agency’s overall revenue. These securities are given with the conviction that a region will actually want to reimburse its obligation commitment through tax assessment or income from projects. At the end of the day, the city guarantor can make interest and head installments utilizing any wellspring of income accessible to them, for example, charge incomes, expenses, or the issuance of new protections. This means that if the municipality runs into financial trouble, it will increase taxes to make up the difference.

All in all, the reimbursement is ensured by both duty income and working income created by different tasks. GO bonds are essentially used to sponsor the improvement of public activities. Most municipal authority general obligation pledges include a promise to impose a property tax to fulfill debt service obligations, and holders of general obligation bonds have the right to force the borrowing government to levy the tax in order to satisfy the local government’s obligation.

Not at all like income securities, GO bonds are not sponsored by guarantee and don’t repay lenders based on pay produced from subsidized tasks. The reimbursement of income securities is gotten simply by operational income streams created by the venture and can’t be ensured by charge incomes. However, as previously mentioned, GO bonds allow for the use of both revenue streams. A local government as a whole is much less likely to face severe financial difficulties than a single municipal project that fails to produce the expected revenue.

General obligations bond ordinarily convey a lower loan fee as a result of the lower hazard of default. Accordingly, the obligation is more affordable to neighborhood governments. Nonetheless, general commitment bonds are viewed as a risk on a nearby government’s accounting report. The amount of taxes that a specific GO bond can collect can be defined as restricted or unlimited. If a municipality issues an unlimited GO bond, it can raise property taxes to fund its payments and obligations.

Investors can purchase GO bonds directly, but there are also mutual funds and exchange-traded funds (ETFs) that specialize in general obligation securities and make the process simpler. Pledges made at the local government level which include a promise to levy property taxes to fulfill the bondholders’ obligations.

Credit rating agencies, for example, rate general obligation pledges with good credit values and give them high investment-grade ratings so property owners stop losing their interest in their respective assets due to unpaid property tax bills. In the event that the property owners can’t pay their local charges at the latest the assigned due date, the public authority is lawfully permitted to build the local charge rate to compensate for any wrongdoings. On the assigned due date, the overall commitment promise requires the neighborhood government to cover the obligation with its accessible assets.

Types of General Obligation Bonds:

Local municipalities’ ability to offer and sell general obligation bonds is governed by state statute. A limited-tax general obligation bond or an unlimited-tax general obligation bond are two types of general obligation bonds.

- Limited-tax general obligation bond: To meet current debt service obligations, a limited-tax general obligation pledge asks the issuing municipal authority to increase property taxes if possible. However, this increase is bound by a statutory limit. With restricted assessment general commitment promises, governments can, in any case, utilize a piece of as of now demanded local charges, utilize another flood of pay, or raise local charges to a sum comparing to existing obligation administration installments to answer its obligation commitments.

- Unlimited-tax general obligation bond: The characteristics of an unlimited-tax general obligation bond are similar to those of a limited-tax bond, except the property tax increase is unrestricted. The property tax can be increased by up to 100%, but only with the approval of the taxpayers. That element gives the political benefit of elector certification of the utilization of the bonds and permits the nearby government to try not to raise its local charge straightforwardly or to discover room in its financial plan to pay for obligation administration. Note that for restricted assessment GO bonds, the citizens’ endorsement isn’t generally needed.

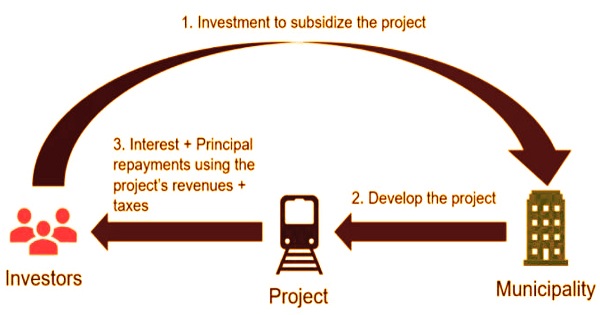

Local governments may also use general obligation (GO) bonds to collect funds for projects that generate revenue sources, such as highways, parks, equipment, and bridges. General obligation bonds are typically used to finance government programs that benefit the general public. Envision a circumstance when a region chooses to dispatch another task, however, it needs adequate money to back the drive. In such a case, the region can give general commitment bonds.

The bonds are purchased by investors who provide funding to the municipality. In exchange, the developers will receive a share of the project’s income as well as tax revenue. The revenue sources allow the municipality to keep up with bond interest and principal payments. Many bond fund managers will typically invest in both general obligation and income bonds. More information about the investments held within a particular fund can be found in the fund company’s literature.

Information Sources: