Objective of the Study:

The objective of this study is to have a clear concept and some practical experience about the overall banking Systems of the United Commercial Bank Limited and analyze the ratio of this organization and identify the financial condition of this organization. In addition, the study seeks to achieve the following objectives:

a. To find out the General banking activities of UCBL.

b. To examine the Credit management activities of UCBL.

c. To evaluate the financial analysis of United Commercial Bank Ltd.

d. To suggest some possible measures for the improvement of UCBL.

Methodological Aspects:

In order to make the report more meaningful and presentable, two sources of data and information have been used widely.

The “Primary Sources” are as follows:

- Face-to-face conversation with the respective officers and staffs of the Branch.

- Informal conversation with the clients.

- Practical work exposures from the different desks of the departments of the Branch covered.

- Relevant file study as provided by the officers concerned.

The “Secondary Sources” of data and information are:

Annual Report of UCBL.

Various books, articles, compilations etc. regarding general banking functions, foreign exchange operations and credit policies.

Different ‘Procedure Manual’, published by UCBL.

Different circular sent by Head Office of UCBL and Bangladesh Bank.

Data Collection procedure:

Annual Reports of the UCBL.

Periodicals Published by Bangladesh Bank.

Different books, articles etc. regarding Foreign Exchange Operations

Data Processing:

In order to process the data MS Excel has been used to analyze the data and to prepare the graphical presentation.

Scope of the Study:

Banking sector of Bangladesh is a prospective, profitable and prestigious sector. These Banking sectors receive increase emphasis from the government over the past few years and achieved a beautiful growth rate annually over the past five years. Currently most of the market share of banking sector is owned by the local owners and some are by the multinational owner. There are several reasons for the dominance of local owners in the Banking sector of Bangladesh, which will be discussed in the following sections. With these advantages it is not surprising that national Banking sector like IBBL, DBBL, are making huge amount of money every year. Thus, undoubtedly there lies a considerable scope in understanding and analyzing this potential sector and identifying the right choice for United Commercial Bank Limited.

This strategic analysis will enable:

Understanding the Banking sector micro and macro-environmental factors in Bangladesh.

Understanding the functional, business, corporate, and global level strategy of UCBL.

Developing a picture of how the future Banking sector will look like.

Analyzing how strategic planning, implementation and execution are done in UCBL.

Finally, suggesting in what areas UCBL can adopt changes to make it the market champion

Limitation of the Study:

To prepare the internship I encountered some limitations. The limitations are given below-

Limitation of time was a major constraint in making a complete study, due to time limitation. The duration was only twelve weeks. It was too limited to cover all the banking area. Many aspects could not be discussed in the present study.

Confidentiality of data was another important barrier that was faced during the process of this study.

Lack of comprehension of the respondents was the major problem that created a lot of confusion regarding verification of conceptual question.

As being an intern, it also created some problems as I was unable to acquire hands-on-experience in all the departments, due to the bank’s policy of maintaining secrecy and also because I did not get the opportunity in all the departments.

In Bangladesh, first commercial banks started business back in 1983. United Commercial Bank Ltd. (UCB) is one of the first five private commercial banks started operation in Bangladesh. United Commercial bank Limited was established under the rules & regulations of Bangladesh bank & the Bank companies’ Act 1991, on the 26th June 1983 with the leadership of Late Mr. Shahjahan Kabir, founder chairman who had a long dream of floating a commercial bank which would contribute to the social-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream. Indeed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. M.A. Hashem became the honorable chairman after the demise of the honorable founder chairman. The Bank obtained permission to commerce business with effect from 26 June 1983 and started banking operations on 29 June 1983 with an authorized capital of Tk 100 million ordinary shares of TK 100 each. The paid up capital was Tk 35.5 million but now 119.8 corers. Later, both authorized and paid up capital were increased several times and on 31 December 200, they stood at Tk 1,000 million and Tk 230.16 million respectively. Of the total paid up capital, Tk 101.56 million was paid by its 37 sponsors; 3,048 members of general public shareholder paid Tk 114.54 million and the remaining Tk 14.06 million were subscribed by the government of the People’s Republic of Bangladesh. Reserve fund if the bank comprised statutory reserves and general reserves if Tk 334.78 million in 1999 as against Tk 85.88 million in 1990. The bank is listed with Dhaka and Citation Stock Exchange.

The management of the bank is vested in a 22-member board of director with the managing director as the chief executive. The bank carries out almost all types of commercial banking activities.126th branches covering all major cities of Bangladesh.

The Company started its banking operation and entitled to carry out the following types of banking business

a. All types of commercial banking activities including Money Market operations.

b. Investment in Merchant Banking activities.

c. Investment in Company activities.

d. Financiers, Promoters, Capitalists etc.

e. Financial Intermediary Services.

f. Any related Financial Services.

The Company (Bank) operates through its Head Office at Dhaka and 126th branches. The Company/Bank carries out international business through a Global Network of Foreign Correspondent Banks.

The Registered Office of the Bank is:

Plot: CWS (A)-1, Road: 34 Gulshan Avenue, Dhaka, Bangladesh.

PABX: +88-02-8852500.

E-Mail: info@ucbl.com.

Web site: www.ucbl.com

S.W.I.F.T: UCBLBDDH

Vision, mission & core values:

Vision:

To be the bank of first choice through maximizing value for their Clients, shareholders, Investors and Employees and contributing to the national economy with social commitment. To be the best performing community bank in the United States by continuing to expand our franchise in areas of high growth opportunities. To further differentiate ourselves by providing seamless service to customers doing business across the Pacific Rim by establishing offices in strategic locations in Asia

Mission:

We aspire to be the most admired financial institution in the country, recognized as a dynamic, innovative and client focused company that offers an array of products and services in the search for excellence and to create an impressive economic value. We will provide a sustainable, high level of financial performance, while continuously enhancing shareholder value. We will build long-term customer relationships by offering a full range of financial products and services while adhering to the highest ethical standards and providing quality personalized service. Our customers choose us because we deliver the best. We value and reward both individual initiative and teamwork. We foster an environment in which our employees are proud and eager to work. We actively participate in social and economic programs for the betterment of the communities we serve.

Core values:

1. We put our customers first

2. We emphasize on professional ethics

3. We maintain quality at all levels

4. We believe in being a responsible corporate citizen

5. We say what we believe in

6. We foster participative management

Objectives of UCBL:

Bangladesh is now integral part of global market. As such there is an urgent requirement for Bangladesh to place the traditional banking pretties in harness with the global trades, of a free market economy by following international banking customs, practices and standards. Today clients of a bank in Bangladesh are exposed as well as international markets. They have to stay update with their practice and standards to meet the demands of achieving harmony in the high standards of a free economy.

United Commercial Bank Limited fully appreciates the importance and implication of the rapidly emerging competition in banking and finance sector of Bangladesh. It intends financing its customer suited to his or her place in the market. In this regards UCBL emphasizes in its employment the software aspects of human resource capability. It also emphasizes competence among its banking professional to cater to vary customer requirements to the modern time.

The objective of UCBL is not only earn profit but also to keep the social commitment and to ensure its co operation to the person of all level, to the businessman, industrialist specially who are engaged in establishing large scale industry by consortium and the agro based export oriented medium and small scale industries by self inspiration.

UCBL is always ready to maintain highest quality of services by upgrading banking technology prudence in management and by applying high standard of business ethic through its established commitment and heritage.

UCBL is committed to ensure its contribution to national economy by increasing its profitability through professional and disciplined growth strategy for its customer and by creating corporate culture.

Business objectives:

Build up a low cost fund base.

Make sound loan and investment.

Meet capital adequacy recruitment at all the time.

Ensure 100% recovery of all advances.

Ensure a satisfied work force.

Focus on free based income.

Adopt an appropriate management technology.

Install a scientific MIS to monitor banks activities.

Corporate Information:

Auditors:

Syful Shamsul Alam & Co.

Chartered Accountants

Name of the Bank : United Commercial Bank Limited

Legal Status : Public Limited Company

Founded : June 26, 1983

Slogan : United we Achieve

Authorized Capital : 8000.00 Million

Paid up Capital : 7275.00 Million

Number of Branches : 126 (One Hundred Twenty Six)

Chairman : Mr. M.A. Sabur (Acting)

Company Secretary : Mr.Mirza Mahmud Rafiqur Rahman (AMD)

Managing Director : Mr. Muhammed Ali

Trading of shares in DSE : November 30, 1986

Trading of shares in CSE : November 15, 1995

Tax Consultants : Mr. Md. Mosharrof Hossain, Advocate

Legal Consultant : T.I.N. Nurun Nabi Chowdhury

Rating Agency : Credit Rating Information & Services Ltd. (CRISL)

Registered Office:

United Commercial Bank Limited, Head Office

Bulus Center, Plot – CWS- (A)-1, Road No – 34

Gulshan Avenue, Dhaka-1212, Bangladesh.

Phone : +88-02-8852500.

Fax : +88-02-8852500-6000, +88-02-8852504

E-Mail : info@ucbl.com.

Web site : http://www.ucbl.com/,

S.W.I.F.T : UCBLBDDH

Commitments of UCBL:

In carrying ourselves at work:

Discipline

Honesty & Integrity

Sincerity

Creativity

In serving the bank:

Loyalty

Total commitment and dedication

Excellence through teamwork

In serving customer:

Customer – first

Quality – focus

Credibility & secrecy

Credit Rating:

CRISL has rated the bank based on December 31, 2011 with ‘AA-`(pronounced as double a minus) in the long term and ST-2 for the short term. The date of rating was April 09, 2012.

Year | Long Term Rating | Short Term Rating |

2011 | AA- | ST-2 |

2010 | A+ | ST-2 |

UCBL has been rated as AA- which means Adequate Safety for timely repayment of financial obligations. This level of rating indicates a corporate entity with an adequate credit profile. Risk factors are more variable and greater in periods of economic stress than those rated in the higher categories.

The Short Term rating ST-2 indicates high certainty of timely payment. Liquidity factors are strong and supported by good fundamental production factors. Risk factors are very small.

Product & Services:

Performances of UCBL:

The business of banking consists of borrowing and lending. As in other businesses, operation must based on capital, but employ comparatively little of their own capital in relation to the total volume of their transactions. The purpose of capital and reserve accounts is primarily to provide an ultimate cover against losses on loans and investment.

UCBL was incorporated as a public Limited company on the 2nd June 1999 under Company Act 1994. The Bank started commercial banking operations effective from 3rd August 1999. During this short span of time the Bank has been successful to position itself as a progressive and dynamic financial institution in the country. The Bank widely acclaimed by the business community, from small business/entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers from forward-looking business outlook and innovative financing solutions.

In year 2009 UCBL made commendable in all business arenas like Deposit, Credit, Fund Management, Investment and Foreign Exchange related business.

Year-wise performance analysis of UCBL in different business arenas is shown below:

Table:(Amount in Crore)

| Particulars | Financial Year | ||||

| 2007 | 2008 | 2009 | 2010 | 2011 | |

| Authorized Capital | 1000 | 1000 | 1000 | 8000 | 8000 |

| Paid-Up Capital | 299 | 299 | 1194 | 2910 | 7275 |

| Reserve Fund | 1596 | 1889 | 2818 | 3451 | |

| Deposits | 42296 | 54485 | 77730 | 113071 | 139485 |

| Advances | 37556 | 44446 | 61692 | 93560 | 115506 |

| Investments | 5518 | 7201 | 9346 | 15048 | 19383 |

| Gross Income | 6052 | 7850 | 9540 | 13487 | 19498 |

| Gross Expenditure | 4034 | 5400 | 6415 | 8755 | 13525 |

| Net Profit(Pre-tax) | 1668 | 1463 | 1542 | 3632 | 5173 |

| Import | 60329 | 60009 | 58857 | 86667 | 90920 |

| Export | 27230 | 36500 | 38519 | 50712 | 76962 |

| No. of Foreign Correspondent | 235 | 257 | 274 | 296 | 333 |

| No. of Employees | 2082 | 2292 | 2508 | 2738 | 2982 |

| No. of Branches | 84 | 84 | 98 | 107 | 115 |

| Number of Shareholders | 7499 | 10337 | 10337 | 72793 | |

Corporate Social Responsibility (CSR):

Though business is a process of generating g revenue through economic transaction; At UCB we believe it is not a phenomenon out of the society. Aligned with revenue generation, there are some moral obligations for our Bank to contribute towards society. These moral obligations combined together in the form of charity or development is corporate social responsibilities. Certainly the Bank has moral debt for social commitment to integrate social, Environmental and economic concerns into its values and day to day operations activities.

United commercial Bank limited. One of the largest private banks of the country is highly concerned about the assimilation of social cause in its core process. As a part of our commitment to create real value in a changing world, we are determined to hold ourselves accountable for the social, Environmental and economic impacts of our operations. And we are committed to developing policies.

Business practices and social services which drive change in our industry we use the power of our brand the energy and passion of our people and the scale of our business to create meaningful changes in society.

Education:

United commercial Bank has long been practicing CSR In education sector through scholarship for poor and brilliant students, Education promotion scheme education for underprivileged children, Donation to education institution etc.

A donation was given to the One degree initiative to facilitate learning sessions for poor children in April 2011. Since children from poor and unfortunate families lack opportunities in having education and proper recreation in our country its urgent to take proper and adequate initiatives for the development of this less fortunate group. UCB and one degree initiative jointly made an attempt to conduct a learning session consisting of a series of intra and inter school quiz competition as well several recreational events in 11diffrent schools.

Financial assistance was provided to department of applied chemistry and comical engineering, university of Dhaka for enhancing their modern educational facilities during January 2011.

UCB always encourages the participation of students in extracurricular activities. Therefore a donation was made to st. Joseph higher secondary school for arranging their annual science fair 2001. On February 2011 a donation was also made to shikkhar manunnayane shammilito pracheshta a joint endeavor of the major schools and colleges of greater Dhaka for arranging a fair as a part of their ongoing education programmer named education and cultural fair 2011 on February 07 2011

Health:

UCB have always been directly or indirectly involved in projects for improvement in health sector of Bangladesh. As a continuous effort, UCB made a donation of BDT 1500000 to BIRDEM Dental Department to install a complete dental unit and dimplant surgical kit. BIRDEM dental department serve people since 1987 on that note with a social responsibly aspect this financial support was provided with an objective of better treatment of mass people.

A donation of taka 25lac was also given to Chittagong samitee for establishment of a hospital in Chittagong on December 2011.A donation was also made for sandman a voluntary institute of maniacal student of faridpur medical college unit for supporting their voluntary activates in January 2011

Financial assistance was also provided on November 01 2011 to Mr. Mohammad Mahboob Hosssain Khan. Assistant professor department of Bio-Technology & Genetic Engineering kushtia Islamic university, As he was suffering from acute lymphoblastic leukemia.

Environment:

As a conscious corporate citizen UCB is not only promoting environment friendly projects but also advising its clients to make their projects compliant as regards to environmental issues. Consequently the corporate where UCB financed be it large or small are becoming fully aware of environmental impacts and complying with the banks requirements besides UCB also provided financial support for a number of causes last year.

A donation was also provided for to the department of soil water and environment Dhaka university during June 24-26-2011 with an objective to enhance their environmental research work.

Disaster Management:

As a socially responsible corporate body UCB always comes forward whenever the country is stricken with a natural disaster or a tragic accident a fatal accident occurred on July 11 2011 in mirsarai Chittagong 41 school students died and 17 more were severely injured in a tragic road accident at mirsarai Chittagong most of them were 13 to 16 year old and students of Abu Torab high school. The tragic death of these young students shocked the whole country. While the country is still trying to recover from this massive shock, Different banks, business groups, professional organization, educational institutions donated to help the affected families from the accident.

A donation was also made to AXIATA limited for fund generation for the tsunami affected people on June 13, 2011.

Art & Culture:

Over the year UCB has been contributing for the development of art and culture sector in Bangladesh which includes donation to different cultural institution financial assistance to young and budding talents. Promoting agar and culture in grass root level etc. year 2011 was no exception accordingly a donation was made for Bangladesh shish academy Chittagong to construct the main entrance gate boundary wall and a room adjacent almost 2800 students are getting trained on different ground

Of arts and aesthetics in this academy to promote the future artists UCB came forward with financial support to this academy as a part of banks social responsibility.

A donation was given to” chattagram samity” Dhaka for organizing mezban and Chittagong festival 2011 held during December 1-3 2011 at sultana kamal stadium dhanmondi Dhaka mezban is the most popular local festival in Chittagong and in year 2011 they celebrated their 100years journey since inception.

Sports:

UC B is currently highlighting on youth development and sports UCB takes initiatives mostly to grass level so that the talents and skills may come from rural and district level.

Beside cricket has been supporting some other sports too. For example a donation of taka thirty five lack was made to late shikh jamal dhanmondi club football team in February 2011 financial assistance was provided to organize Olympic day 2011 arranged by Bangladeshi Olympic association the day was observed in all of the seven division of the country on June 23, 2011 from all over the country 30000 participants took part on this “Olympic Day”

Again, a donation was also given to organize bijoy dibosh hockey tournament 2011 hold during 10-20th December, 2011at moulana bhashani hockey stadium, Dhaka.

The word credit comes from the Latin word “Credo” meaning “I believe”. It is a lender’s trust in a person’s/ firm’s/ or company’s ability or potential ability and intention to repay. In other words, credit is the ability to command goods or services of another in return for promise to pay such goods or services at some specified time in the future. For a bank, it is the main source of profit and on the other hand, the wrong use of credit would bring disaster not only for the bank but also for the economy as a whole.

United Commercial Bank Limited is a third generation bank, which is committed to provide high quality financial services/products to contribute to GDP through stimulating trade & commerce, accelerating the pace of industrialization and boosting up export by allowing credit facilities. The failure of the commercial bank is mainly occurs due to bad loans, which occurs due to inefficient management of the loan and advance portfolio. The objective of the credit management is to maximize the performing asset and the minimization of the non-performing asset as well as ensuring the optimal point of loan and advance and their efficient management. Credit management is a dynamic field where a certain standard of long-range planning is needed to allocate the fund in diverse field and to minimize the risk and maximizing the return on the invested fund. Continuous supervision, monitoring and follow-up are highly required for ensuring the timely repayment and minimizing the default.

Therefore, while analyzing the credit management of BBL, it is required to analyze its credit policy, credit procedure and quality of credit portfolio. These three aspects of credit management are now discussed in the following section.

Credit Policy of UCBL:

One of the most important ways, a bank can make sure that its loan meet organizational and regularity standards and they profitable is to establish a loan policy. Such a policy gives loan management a specific guideline in making individual loans decisions and in shaping the bank’s overall loan portfolio.

Agriculture:

Credit facilities provided to the customers who transact agro business falls under this category. It is divided into two major sub-sectors:

a) Loans to primary producers: This sub-sector of agricultural financing refers to the credit facilities allowed to production units engaged in farming, fishing, forestry or livestock.

b) Loans to input dealers/distributors: It refers to the financing allowed to input dealers and (or) distributors in the agricultural sectors.

Loan to Agriculture sector may include short, medium and long term loans as well as continuous

Credits. As a product, it may fall under Term Loan/ Time Loan/Hire-Purchase/Lease

Finance/Cash Credit/Overdraft etc.

Term Loan to Large & Medium Scale Industry:

This category of advances accommodate the medium and long term financing for capital asset

formation of new Industries or for BMRE of the existing units who are engaged in Manufacturing of goods and services.

Term loan to tea gardens may also be included in this category depending on the nature and size.

As the financing under this category have fixed repayment schedule it may fall under the heads

Term Loan/Time Loan /Hire-Purchase/Lease Financing etc.

Term Loans to Small & Cottage Industries:

These are the medium and long term loans allowed to small & cottage manufacturing industries

[Regulatory definition of Small Enterprise means an entity, ideally not a public limited company, does not employ more than 50 persons (if it is manufacturing concern) and 25persons (if it is a trading and service & trading concern with total assets at cost excluding land and building from Tk.50,000 to Tk. 50 lac, manufacturing concern with total assets at cost excluding land and building from Tk.50,000 to Tk. 1.5 crore.].

Medium & Long term loans to weaver are also included in this category. Like the Large &Medium Scale Industry it is also allowed in the form of Term Loan/Time Loan/Hire Purchase/Lease Financing etc.

Working Capital:

Loans allowed to the manufacturing units to meet their working capital requirements, irrespective of their size – big, medium or small, fall under this category. These are usually continuous credits and as such fall under the head “Cash Credit” or” Overdraft”.

Export Credit:

Credit facilities allowed to facilitate export of all items against Letter of Credit and/or confirmed export orders fall under this category. It is accommodated under the heads “Export Cash Credit (ECC)”, Packing Credit (PC), Foreign Documentary Bill Purchased (FBPD), Inland Documentary Bill Purchased (LBPD) etc.

Commercial Lending:

Short term Loans and continuous credits allowed for commercial purposes other than exports fall under this category. It includes import financing for local trade, service establishment etc. No medium and long term loans are accommodated here. This category of advance is allowed in the form of (I) Loan against Imported Merchandise (LlM), (ii) Loan against Trust Receipt (LTR),

(iii) Payment Against Documents (PAD), (iv) Overdraft (OD), (v) Cash Credit etc. for commercial purposes.

Others:

Any loan that does not fall in any of the above categories is considered under the category “Others”. It includes loan to (i) transport equipments, (ii) construction works including housing (commercial/residential), (iii) work order finance, (iv) personal loans, etc.

Types of Credit:

Credit may be classified with reference to elements of time, nature of financing and provision base. Generally National Bank, Elephant Road Branch given these loans that are given below:

Secured Overdraft (SOD)

Loan against Imported Merchandise (LTM)

Loan against Trust Receipt (LTR)

Payment against Document (PAD)

House Building Loan

House Building Loan (staff)

Term Loan.

Loan (general)

Bank Guarantee »

Export Cash Credit

Cash Credit (Pledge)

Cash Credit (Hypo)

Foreign Documentary Bill Purchase (FDBP)

Local Documentary Bill Purchase (LDBP)

► Secured Overdraft (SOD):

It is a continuous advance facility. By this agreement, the banker allows his customer to overdraft his current account up to his credit limits sanctioned by the bank. The interest is charged on the amount, which he withdraws, not on the sanctioned amount. UCB Bank sanctions SOD against different security.

SOD (general):

Advance allowed to individual/ firms against financial obligation (i.e. lien on FDR\ DR/PSP/BSP/ insurance policy share etc.) This may or may not be a continuous Credit.

SOD (others):

Advances allowed against assignment of work order or execution of contractual works falls under this head. This advance is generally allowed for a definite period and specific purpose i.e. it is not a continuous credit. It falls under the category “others”

SOD (Export):

Advance allowed for purchasing foreign currency for payment against L/Cs (Back to Back) where the exports do not materialize before the import payment. This is also an advance for temporary period, which is known as export finance and under the category “commercial lending”.

LIM (Loan against Imported Merchandise):

Advances allowed for retirement of shipping documents and release of goods imported through L/C taking effective control over the goods by pledge in go downs under Banks lock & key fall under this type of advance. This is also a temporary advance connected with import, which is known as post-import financing, falls under the category “commercial lending”.

LTR (Loan against trust receipt):

Advance allowed for retirement of shipping documents, release of goods imported through L/C falls under trust with the arrangement that sale proceed should be deposited to liquidate within a given period- This is also a temporary advance connected with import, which is known as post-import financing, falls under the category “commercial lending”.

PAD (payment against document):

Payment made by the Bank against lodgment of shipping documents of goods imported through L/C falls under this head. It is an interim advance connected with import and is generally liquidated against payments usually made by the party for retirement of the documents for release of imported goods from the customer’s authority. It falls under the category “commercial Bank”.

House building Loan (General):

Loans allowed to individual/ enterprise construction of house (residential or commercial) fall under this of advance. The amount is repayable by monthly installment within a specified period, advances are known as Loan (HBL-GEN).

House building loans (staff):

Loans allowed to the Bank employees for purchase/construction of house shall be known as Staff Loan (HBFC-STAFP).

Term Loan:

UCB Bank considers the loans, which are sanctioned for more than one year as term loan. Under this facility, an enterprise is financed from the starting to its finishing, i.e. from installation to its production.

Loan (general):

Short term and long term loans allowed to individual/ firms / industries for a specific purpose but a definite period and generally repayable by the installments fall under this head. These types of lending are mainly allowed to accommodate financing under the categories.

a) Large and Medium Scale Industries-

b) Small and Cottage Industries, Very often term financing for agriculture and others are also included here.

Bank guarantee:

The bank is very often requested by his customer to issue guarantees on their behalf to a third party – committing to make an unconditional payment of certain amount of money to the third party, if the customer (on whose behalf it gives guarantee) becomes liable, or creates any loss or damage to the third party.

Export cash credit (ECC):

Financial accommodation allowed to customer for exports of goods falls under this head is categorized as “Export Credit “. The advances must be liquidated out of export proceeds within 180 days.

Cash Credit (Hypothecation):

The mortgage of movable property for securing loan is called hypothecation. Hypothecation is a legal transaction whereby goods are made available to the lending banker as security for a debt without transferring either the property in the goods or either possession. The banker has only equitable charge on stocks, which practically means nothing. Since the goods always remain in the physical possession of the borrower, there is much risk to the bank. So, it is granted to parties of undoubted means with the highest integrity.

Classification on The Basis of Time:

Continuous loans:

These are the advances having no fixed repayment schedule but have a date at which it is renewable on satisfactory performance of the clients. Continuous loan mainly includes “Cash credit both hypothecation and pledge” and “Overdraft”.

Demand loan:

Demand loan is used as one of the import finances. In opening letter of credit (L/C), the clients have to provide the full L/C amount in foreign exchange to the bank. To purchase this foreign exchange, bank extends demand loan to the clients at stipulated margin. No specific repayment date is fixed. However, as soon as the L/C documents arrive, the bank requests the clients to adjust their loan and to retire the L/C documents. Demand loans mainly include “Loan against imported merchandise (LIM)” and “Later of Trust Receipt”.

Term loans:

These are the advances made by the bank with a fixed repayment schedule. Terms loans mainly include “Consumer credit scheme”, “Lease finance”,” Hire purchase”, and “Staff loan”. The term loans are defined as follows:

Short-term loan: Up to 12 months.

Medium term loan: More than 12 months & up to 36 months.

Long-term loan: More than 36 months.

Classification on The Basis of Characteristics of Financing:

The making of loan and advance is always profitable to the bank. As the bank mobilize savings from the general people in the form of deposit the most important task of it is to disburse the said deposit as loan or advance to the mass people for the development of commercial, industrial, agricultural, who are in need of fund for investment. Like other business firm, the main purpose of the commercial banking is making profit. The profitability of the banks depends on the efficient manner and avenues in which the resources are employed. The United Commercial Bank Limited has made so far efficient use of the deposit and classified rates are almost zero. The UCBL disburse loan in different form. It varies in purpose wise. Mode wise and sector wise.

The varieties types of credit facilities provided by UCBL are briefly described below with the common terms and condition. The credit facilities of UCBL may be broadly classified into five categories. They are as follows:

Loans

Cash Credit

Overdraft

Bills purchased and discounted

Consumer Credit

Loan:

In case of loan the banker advances a lump sum for a certain period at an agreed rate of interest. The entire amount is paid on an occasion either in cash or by credit in his current account, which he can draw at any time. The interest is charged for the full amount sanctioned whether he withdraws the money from his account or not. The loan may be repaid in installments or at expiry of a certain period. Loan may be demand loan or a term loan.

Eligibility: Loans normally allowed to those parties who have either fixed source of income or who desire to pay it in lump sum.

Interest Rate: 15%-17% per annum (Quarterly paid).

Cash Credit:

In Cash credit, banker specifies a limit called the cash credit limit, for each customer, up to which the customer is allow to borrow against the security of tangible assets or guarantees The distinction between the current account and a cash credit account is that the former is intended to be an account with credit balance and the latter an account for drawing of advances. Operation of cash credit is same as that of overdraft. The purpose of cash credit is to meet working capital need of traders, farmers and industrialists.

Cash credit in true sense is against pledge of goods. Cash credit is also allowed against hypothecation of goods. In case of hypothecation the ownership and possession of the goods remain with the borrower. By virtue of the hypothecation agreement bank can take possession of the goods hypothecated, if the borrower defaults.

Rate of Interest: 15%-16%.

Overdraft:

Overdrafts are those drawings, which are allowed by the banker in excess of the balance in the current account up to a specified amount for definite period as arranged for. These advances are secured, immovable, like land & building and hypothecation of trade, if it is for working capital finance. The overdraft may extend against finished product of any industry as against pledge of the products. The loan holder can freely draw money from this account up to the limit and can deposit money in the account off course, this loan has an expiry date after which renewal or enhancement is necessary for enjoying such facility. Overdraft facility is given to the businessmen for increasing their business activity.

Eligibility: Overdraft facilities are generally granted to businessmen for expansion of their business, against the securities of stock-in-trade, shares, debenture, Government promissory notes, fixed deposit, life policies etc

Guiding Principle of Credit appraisal of UCBL:

The main objective of the relationship manager is to establish long-term relationships with clients with the expectation for on going commercial business. This type of business is expected to provide stability and growth in earnings in the short run as well as to continue in the long run, and therefore, also, should be diversified to avoid over reliance on any particular client group / industry segment.

To determine the worth of a client for such a relationship and thereby decide on development of the relationship, the following conceptual exercises should be undertaken. There are no fixed and set methods to perform credit-marketing job, and scope for application of individual judgment/ perception always plays over set rules in such work. For example, drop in revenue of a contractor may indicate the clients’ failure to get work, or it may be due to adaptation of policy to do higher margin, quality jobs.

Credit Ratification Authority of UCBL:

Credit decisions are heart of all credit works. The person who is held responsible for appraising a loan proposal is called the relationship manager. The customer request for credit limit and the relationship manager must decide whether to accept or refuse proposal. Making this decision is the most important credit activity; all other activities of the credit Department are supportive to this decision. To ensure the proper and orderly conduct of the business of the bank, the Board of Directors authorized the Managing Director and other top-level executive, that is, DMD and EVP to sanction the credit. It is mentionable that principal branch operates the credit division under the supervision of VP. The relationship manager of principal branch furnishes the credit proposal with the required information and sends it to the final authority, i.e. EVP, DMD & MD, of head office for final approval.

Credit Evaluation Principles:

In order to get the optimum returns from the deployed funds in different kinds of lending, more emphasis shall be given on refund of loans and advances out of fund generated by the borrower from their business activities instead of realization of money by disposing of the securities held against the advance which is very much uncertain and time consuming . Some principles or standards of lending are maintained loans in order to keep the risk to a minimum level and for successful banking business. The main principles of lending are:

Safety

Security

Liquidity

Adequate yield

Diversity

Safety:

Safety should get the prior importance in the time of sanctioning the loan. At the time of maturity the borrower may not will or may unable to pay the loan amount. Therefore, in the time of sanctioning the loan adequate securities should be taken from the borrowers to recover the loan. Banker should not sacrifice safety for profitability.

UCB Bank Ltd- exercises the lending function only when it is safe and that the risk factor is adequately mitigated and covered. Safety depends upon:

- The security offered by the borrower; and

- The repaying capacity and willingness of the debtor to repay the loan with interest.

Liquidity:

Banker should consider the liquidity of the loan in time of sanctioning it. Liquidity is necessary to meet the consumer need.

Security:

Banker should be careful in the selection of security to maintain the safety of the loan. Banker should properly evaluate the proper value of the security. If the estimated value is less than or equal to loan amount, the loan should be given against such securities. The more the cash near item the good the security, in the time of valuing the security, the Banker should be more conservative.

Adequate Yield:

As a commercial origination, Banker should consider the profitability. So banker should consider the interest rate when go for lending. Always Banker should fix such an interest rate for its lending which should be higher than its savings deposits interest rate. To ensure this profitability Banker should consider the prospect of the project

Diversify:

Banker should minimize the portfolio risk by putting its fund in the different fields. If Bank put its entire loan able fund in one sector it will increase the risk. Banker should distribute its loan able fund in different sectors. So if it faces any problem in any sector it can be covered by the profit of another sector.

Process of Credit Management:

The function of commercial bank is to accept deposit from the common people and to invest deposited money in different sectors for overall development of the economy of the country. So the banks have to be very much careful in credit appraisal. The person who is held responsible for appraising a loan proposal in United Commercial Bank Limited is called the relationship manager. The customer request for credit limit and the relationship manager must decide whether to accept or refuse proposal. Making this decision is the most important credit activity; all other activities of the credit department are supportive to this decision. To ensure the proper and orderly conduct of the business of the bank, the Board of Directors authorized the Managing Director and other top-level executive, that is, DMD and EVP to sanction the credit. It is mentionable that principal branch operates the credit division under the supervision of VP. The relationship manager of principal branch furnishes the credit proposal with the required information and sends it to the final authority, i.e. EVP, DMD & MD, of head office for final approval.

Steps Involved In Credit Processing:

There are several steps involved in credit processing in BBL. The steps are as follows:

Application for loan

Applicant applies for the loan in the prescribed form of bank. The purpose of this forms is to eliminate the unwanted borrowers at the first sight and select those who have the potential to utilize the credit and pay it back in due time.

Getting Credit information

Then the bank collects credit information about the borrower from the following sources:

- Personal Investigation

- Confidential report from other bank/ Head office/Branch/Chamber of commerce

- CIB report from central bank

Scrutinizing and Investigation

Bank then starts examination that whether the loan applied for is complying with its lending policy. If comply, than it examines the documents submitted and the credit worthiness. Credit worthiness analysis, i.e. analysis of financial conditions of the loan applicant is very important. Then bank goes for Lending Risk Analysis (LRA) and spreadsheet analysis, which are recently introduced by Bangladesh Bank. According to Bangladesh Bank rule, LRA and SA is must for the loan exceeding one core. If these two analyses reflect favorable condition and documents submitted appears to be satisfactory then, bank goes for further action.

The C’s of Good & Bad Loan

The relationship managers of NBL try to judge the possible client based on some criteria. These criteria are called the C’s of good and bad loans. These C’s are described below:

Character:

The outcome of analyzing the character is to have overall idea about the integrity, experience, and business sense of the borrower. Two variables, Interaction/interview and Market Research are used to analyze the character of the borrower.

Interaction/interview: the indicators are:

Prompt and consistent information supply, information given has not been found false

CIB also reveals business character.

Willingness to give owns stake/equity & collateral to cover.

Tax payer.

Market Research:

Information on business is verified.

Dealing with supplier and or customer as supplier is also a kind of lender; the payment character can also be verified.

Capital:

For identifying the capital invested in the business can be disclosed using the following indicators.

- Financial Statements

- Receivable, Payable, statements to practically assess the business positions. Net worth through financial statements or from declaration of Assts & Liabilities.

Capacity (Competence):

Capability of the borrower in running the business is highly emphasized in the time of selecting a good borrower. As the management of the business is the sole authority to run the business that is use the fund efficiently, effectively and profitably. The indicators help to identify the capacity of the borrower.

- Entrepreneurship skills i.e. risk taking attitude shown by equity mobilization.

- Management competencies both marketing and products detail, ability to take decision.

- Resilience or shock absorption: Connection, Back up (if first time falls second lines come to help.)

Collateral

Make sure that there is a second way out of a credit, but do not allow that to drive the credit decision.

Cash Follow

Cash flow is the vital factor that is used to identify whether the borrower will have enough cash to repay the loan or advance. Cash keeps the liquidity to ensure repayment. The relationship managers try to identify the annual cash flow from the submitted statements.

Conditions

Understanding the business and economic conditions can and will change after the loan is made.

Carelessness

Remember that documentation, follow-up and consistent monitoring is essential to high quality loan portfolios.

Contingencies

Make sure that you understand the risks; particularly the downside possibilities and that you structure and price the loan consistently with that understanding.

Documents for Credit:

For execution of different types of loans the bank usually uses two types of documents. One is application form and other is charge document. A detail of these documents are given below:

a) Application Form:

National bank ltd uses two types of application form for different types of loans. For CC (H), CC (P), Loan (G), UCBL, Project / Term loan, BG etc, the application form contains:

1. Name of the Applicant /Firm/ Company.

2. Applicant’s Address.

3. Nature of the A/C

4. Telephone/ Fax number.

5. Particulars of proprietor.

6. Nature of Business/ Industry.

7. Trade License No. and Validity

8. Date of Establishment/ Commencement/ Incorporation of Business.

9. Nature and Amount of Limit

10. Purpose.

11. Period

12. Mode of Repayment.

13. Details of Security Offered.

14. Particular of Guarantor.

15. Full particulars of Liabilities (if any) of the Borrower and their Allied/ sister concerns

with UCBL, other Banks and Financial Institutions etc.

16. Other Relevant Particular/ Information.

17. Declaration

18. Certificate of the organization

19. Photograph (two copies)

b) Charge Document:

Before disbursing the loan, the following documents must be completed by borrower. On these documents, the stamp needed for legislative reasons, which is paid by the borrower.

1. Letter of Guarantee

2. Letter of Hypothecation

3. Demand Promissory Note

4. Letter of Disbursement

5. Letter of Agreement

6. Letter of Authority

7. Letter of installment

Fees of Loans and Advances:

Pre Sanction Charge:

3 copy CIB inquiry from tk.50 each

Survey Report Charge: Tk.2000 and above (based on collaterals value and

Number)

Legal opinion charge about the security offered to mortgage.

Post Sanction Charge:

Stamp charge: Tk.150 to Tk.550

Mortgage Fee: From Tk.5000 to above (Based on collateral assets’ value )

Insurance of hypothecated goods (If goods are pawned as security) : Insurance

Charge on the hypothecated goods’ value.

Service Charge: 1% o the total loan amount.

Security Charge (For Small Business Loan, House Renovation and Repairing

Loan, Personal Loan): 1% on total loan value.

Risk Charge (For Small Business Loan, House Renovation and Repairing Loan,

Personal Loan): 1% on total loan value.

Security against Advances:

The different types of securities that may be offered to a banker are as follows:

(a) Immovable property

(b) Movable property

Pratiraksha Sanchaya Patra, Bangladesh Sanchaya Patra, ICB unit certificate, wage earner development bond.

Pledge of goods

Hypothecation of goods, produce and machinery

Fixed assets of manufacturing unit.

Shipping documents.

Modes of Charging Security:

A wide range of securities is offered to banks as cover for loan, in case of borrower inability to repay, the banker can full upon the securities. In order to make the securities available to banker, in case of default of customer, a charge should be created on the security. Creating charge means making it available as a cover for advance. The following modes of charging securities are applied in the National Bank.

Pledge:

Pledge is the bailment of the goods as security for payment of a debt or performance of a promise. A pledge may be in respect of goods including stocks and share as well as documents of title to goods such as railway receipt, bills of lading, dock warrants etc. duly endorsed in bank’s favor.

Hypothecation:

In case of hypothecation the possession and the ownership of the goods both rest the borrower. The borrower to the banker creates an equitable charge on the security. The borrower does this by executing a document known as Agreement of Hypothecation in favor of the lending bank.

Lien:

Lien is the right of the banker to retain the goods of the borrower until the Investment is repaid. The bankers’ lien is general lien. A banker can retain all securities in his possession till all claims against the concern person are satisfied.

Mortgage:

According to section (58) of the Transfer of Property Act,1882 mortgage is the ‘’transfer of an profit in specific immovable property for the purpose of securing the payment of money advanced or to be advanced by way of Investment, existing or future debt or the performance of an engagement which may give rise to a pecuniary liability”. In this case the mortgagor dose not transfer the ownership of the specific immovable property to the mortgagee only transfers some of his rights as an owner. The banker exercises the equitable mortgage.

Lending Risk Analysis (LRA):

The Financial Sector Reform Project (FSRP) has designed the LRA package, which provides a systematic procedure for analyzing and quantifying the potential credit risk. Bangladesh Bank has directed all commercial bank to use LRA technique for evaluating credit proposal amounting to Tk. 10 million and above. The objective of LRA is to assess the credit risk in quantifiable manner and then find out ways & means to cover the risk. However, some commercial banks employ LRA technique as a credit appraisal tool for evaluating credit proposals amounting to Tk. 5 million and above. Broadly LRA package divides the credit risk into two categories, namely ‑‑‑‑‑ Business risk and Security risk. A detail interpretation of these risks and the procedure for evaluating the credit as follows:

Business risk

It refers to the risk that the business falls to generate sufficient cash flow to repay the loan. Business risk is subdivided into two categories.

Industry risk

Risk; that the company falls for external reason. It is subdivide into supplies and sales risk.

Supplies risk

It indicates that the business suffers from external disruption to the supply of imputes. Components of supplies risk are as raw material, Labor, power, machinery, equipment, factory premises etc. Supply risk is assessed by a cost breakdown of the imputes and then assessing the risk of disruption of supplies of each item.

Sales risk

This refers to the risk that the business suffers from external disruption of sales. Sales may be disrupted by changes to market size, increasing in competition, and change in the regulation or due to the loss of single large customer. Sales risk is determined by analyzing production or marketing system, industry situation, Government policy, and competitor profile and companies strategies.

Company risk

This refers to the risk that the company fails for internal reasons. Company risk is subdivided into company position risk and Management risks.

Company position risk

Within an industry each and every company holds a position. This position is very competitive. Due to the weakness in the company’s position in the industry, a company is the risk for failure. That means company position risk is the risk of failure due to weakness in the companies’ position in the industry. It is subdivided into performance risk and resilience risk.

Performance risk

This risk refers to the risk that the company’s position is so weak that it will be unable to repay the loan even under Favor able external condition. Performance risk assessed by SWOT (Strength, Weakness, Opportunity and Threat) analysis, Trend analysis, and Cash flow forecast analysis and credit report analysis (i.e. CIB repot from Bangladesh Bank).

Resilience risk

Resilience means to recover early injury, this refers to risk that the company falls due to resilience to unexpected external conditions. The resilience of a company depends on its leverage, liquidity and strength of connection of its owner or directors. The resilience risk is determined by analyzing different financial ratio, flexibility of production process, shareholders willingness to support the company if need arise

Management risk

The management risk refers to the risk that the company fails due to management not exploiting effectively the companies’ position. Management risk is subdivided into management competence risk and integrity risk.

Management competence risk

This refers to the risk that falls because the management is incompetent. The competence of management depends upon their ability to manage the company’s business efficiently and effectively. The assessment of management competence depends on management ability and management teamwork. Management ability is determined by analyzing the ability of owner or board of the members first and then key personnel for finance and operation.

Security risk

This sort of risk is associated with the realized value of the security, which may not cover the exposure of loan. Exposure means principal plus outstanding interest. The security risk is subdivided into two major heads i.e. security control risk and security cover risk.

Management integrity risk

This refers to the risk that the company fails to repay the loan amount due to lack of management integrity. Management integrity is a combination of honesty and dependability. Management integrity risk is determined by assessing management honesty, which requires evaluating the reliability of information supplied and then management dependability.

Before completing the LRA form, the relationship manager collects data especially industry specific from published sources and company specific data that not usually published by personally visiting the company. After collecting the necessary data he/ she prepare financial spreadsheet. This spreadsheet provides a quick method of assessing business trend & efficiency and helps to assess the borrower ability to pay the loan obligation.

Credit Appraising & Presentation of Credit Proposal for Final Approval:

When relationship manager is satisfied with applicant’s credit worthiness, financial capability, management ability and feasibility of the project through credit appraisal on the basis above guiding principle, the applicant may hope for credit from the bank. Then relationship manger sent this credit proposal (Credit Memorandum) to higher authority (EVP, DMD & MD) for final approval.

Ratio Analysis:

Ratio analysis is a study of the relationships between financial variables. It is very important in fundamental analysis which investigates the financial health of any financial institution. This ratio analysis gives frank financial information in this current business world. By giving a glance anyone will be able to know what the position that institution is now. Therefore managers, shareholders, creditors etc. all take interest in ratio analysis. For example using liquidity ratios managers can use the information if the institution’s liquidity is struggling and they may have to take out short term finance. For this reason to evaluate the performance of UCBL the ratio analysis has been selected. Here in this report contains the most common ratios and analyze to evaluate the performance of UCBL over the year 2008, 2009 and 2010. The following types of ratios frequently are used:

1. Liquidity ratios

2. Leverage ratios

3. Profitability ratios

4. Dividend policy ratios

Liquidity ratio:

Liquidity ratios are the first ones to come in the picture. These ratios actually show the relationship of a firm’s cash and other current assets to its current liabilities. Two ratios are discussed under Liquidity ratios. They are:

CURRENT RATIO:

This ratio is calculated by dividing the total current assets of an institution by its total current liabilities. It shows how any institution like UCBL meets its current liabilities through its current assets.

Current Ratio = Current Assets / Current Liabilities

| Year | 2010 | 2009 | 2008 |

| Current Ratio | 3.69 | 2.58 | 3.61 |

Table: Current Ratio

According to result the current ratio of UCBL was 3.69 in 2010, 2.58 in 2009 and 3.61 in 2008. In 2010 the current ratio was 3.69 which mean UCBL had 3.69 taka of currents assets against 1 taka of short term debt or liability. It means UCBL had the ability to pay off its current liabilities with its current assets. In 2009 the current ratio was 2.58 which was a little than 2010 which means in 2009 UCBL invested less in short term assets. On the other hand in 2008 the current ratio was 3.61 which mean UCBL investment in current assets was lower than 2010 but higher than 2009. In fact the higher the current ratio is better for the institution because this higher ratio helps to prevent getting default.

Quick ratio:

This ratio indicates the firm’s liquidity position as well. It actually refers to the extent to which current liabilities are covered by those assets except inventories.

Quick Ratio= (Current Assets-Inventories)/Current Liabilities

| Year | 2010 | 2009 | 2008 |

| Quick Ratio | 3.12 | 2.21 | 3.05 |

Table: Quick Ratio

This ratio portray the idea that UCBL has so far an almost constant liquidity position which is good at some point, but at the same token it can be said that they have not been able to improve them-selves. Standing at this point, we can make an assumption that may be their profit margin was not so high that they can make some investments paying off the liabilities that could result in an increase in assets and decrease in liabilities to make the liquidity position far better.

Leverage ratio:

Leverage ratios are used to calculate the financial leverage of an institution. It helps to get an idea of the institution’s methods of financing or to measure its ability to meet financial obligations. There are several types of ratios which main factors are debt, equity, assets and interest expenses.

LONG-TERM DEBT TO EQUITY RATIO

Long term debt to equity ratio is one of the financial leverage ratios which are used in banking sectors to know the link between the long term debt and equity. The ratio is calculated by taking the institution’s long-term debt and dividing it by the total value of its equity.

Long-term Debt to Equity Ratio = Long-term Debt / Total Equity

| Year | 2010 | 2009 | 2008 |

| Long-term Debt to Equity Ratio | 11.41 | 9.13 | 9.93 |

Table: Long-term Debt to Equity Ratio

This ratio measures UCBL’s long-term sources of fund. Here from this figures it is noticed that most of the UCBL’s long term sources of fund come through the long term liability like fixed deposits and multiple saving schemes. In 2010 this leverage ratio was 11.41 which mean UCBL long term funds come from depositors’ deposits rather than the stockholders ‘equity. On the other hand in 2009 and 2008 the Long-term Debt to Equity Ratio was respectively 9.13 and 9.93 which was less than 2010.

TOTAL DEBT TO EQUITY RATIO

It is one of the banking financial leverage which is calculated by dividing its total liabilities by stockholders’ equity. It mainly indicates the proportion of equity and debt that a bank is using to finance its assets.

Total Debt to Equity Ratio = Total Debt / Total Equity

| Year | 2010 | 2009 | 2008 |

| Total Debt to Equity Ratio | 15.62 | 14.86 | 13.78 |

Table: Total Debt to Equity Ratio

Alike all bank UCBL’s most of the fund collected from deposits. In year 2010, 2009 and 2008 the ratio was 15.62, 14.86 and 13.78 consequently. The result shows that in 2010, 2009 and 2008 UCBL financed most of its assets through the debt which means through deposits. As a result the bank is doing well by increasing its deposits over years like 2010 and 2009. This higher outcome over years not only increases the risk but also increases the profit.

TOTAL DEBT TO TOTAL ASSET RATIO

Total debt to total asset ratio measures a bank’s financial risk. It determines how much of the bank’s assets have been financed by the debt. It is calculated by total debt dividing by the institution’s total assets.

Total Debt to Total Asset Ratio = Total Debt / Total Asset

| Year | 2010 | 2009 | 2008 |

| Total Debt to Total Asset Ratio | 93.98% | 93.69% | 93.23% |

Table: Total Debt to Total Asset Ratio

Almost all of the UCBL’s assets are financed by its debt. It works by taking the deposits from the general and invest it in different sectors. From the year 2008 to 2010 the ratios were 93.98%, 93.69% and 93.23% which are almost same. The higher ratio may increase more risk because if UCBL defaults in any investment than the depositors will also default.

TOTAL EQUITY TO TOTAL ASSET RATIO

Total equity to total asset ratio is one of the leverage ratios which is used by the organization like banking sectors. It determines how much of the bank’s assets have been financed by the equity.

Total Equity to Total Asset Ratio = Total Equity / Total Asset

| Year | 2010 | 2009 | 2008 |

| Total Equity to Total Asset Ratio | 6.02% | 6.31% | 6.77% |

Table: Total Equity to Total Asset Ratio

UCBL’s almost all the fund collected from the depositors so the shareholder’s contribution on this organization is too low. The outcome of this ratio over the years was downward. In year 2010, 2009 and 2008 the ratios were 6.02%, 6.31% and 6.77%. The reason behind this downward slope was that the bank’s deposits are increasing over years and shareholders are less exposed to the risk than the depositors or debtors are.

Profitability ratio:

Profitability Ratios measure the overall earnings performance of an institution and its efficiency in utilizing assets, liabilities and equity.

NET PROFIT MARGIN

Net Profit Margin is a ratio of profitability which is calculated by dividing the net profit after taxation by revenues or net interest income. It measures how much UCBL’s is actually earning from its every taka of revenue.

Net Profit Margin = Net Profit after Taxation / Net interest Income

| Year | 2010 | 2009 | 2008 |

| Net Profit Margin | 56.88% | 35.65% | 38.07% |

Table: Net Profit Margin

The greater the outcome the better the UCBL’s performance is. In 2010 the result was 56.88% that means in 100 taka of net interest income UCBL’s net profit was 56.88 taka. On the other hand in 2009 and 2008 the net profit was taka 35.65 and 38.07 against 100 taka of net interest. Between the years in 2010 the bank had a handsome profit margin in percentages and oppositely in 2008 UCBL net profit margin was better than the year 2009.

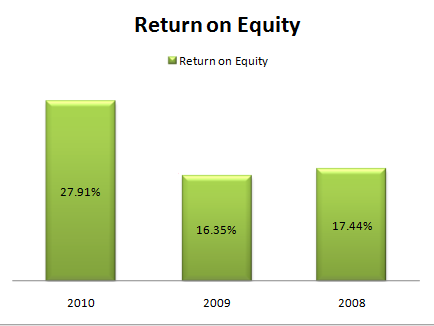

RETURN ON EQUITY

Return on equity measures a bank’s profitability which calculates how much net profit that bank may generates with the money that shareholders have invested as equity.

Return on Equity = Net Profit after Taxation / Equity

| Year | 2010 | 2009 | 2008 |

| Return on Equity | 27.91% | 16.35% | 17.44% |

Table: Return on Equity

Figure: Return on Equity

ROE is very popular ratio toward the shareholders of any bank. After doing the analysis from UCBL’s financial statements its shows those in years 2010, 2009, and 2008 the return from 100 taka invested by the shareholders was respectively 27.91, 16.35 and 17.44. The higher the percentage is the better for the bank as well as for shareholders.

RETURN ON ASSETS

ROA is a profitability ratio which shows how profitable a bank is related to its total assets. ROA gives an idea that how efficient the management of a bank is to generate profits using its assets.

Return on Assets = Net Profit after Taxation / Total Assets

| Year | 2010 | 2009 | 2008 |

| Return on Assets | 1.68% | 1.03% | 1.18% |

Table: Return on Assets

ROA is the most used profitability ratio. As UCBL was a part of banking industry and its most of the assets come from the debt which was the reasons for its low net profit as well as poor ROA. As a result the UCBL had low ROA in the year of 2010, 2009 and 2008 which were 1.68%, 1.03% and 1.18% respectively. In the year 2010 the net profit of the bank had increased as a better growth rate rather than its assets growth.

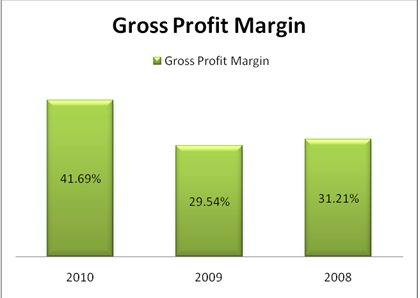

Gross Profit Margin:

Gross Profit Margin measures the profit of the company after deducting the cost of goods sold from the total profit.

Gross Profit Margin= Gross profit / Sales

| Year | 2010 | 2009 | 2008 |

| Gross Profit Margin | 41.69 | 29.54 | 31.21 |

Table: Gross Profit Margin

Figure: Gross Profit Margin

From the above analysis we can see that, UCBL has a higher Gross Profit Margin which indicates that they earning more that will be paid to its shareholders.

Dividend Policy ratio:

It describes how a firm pays their divided as they earn. On the other hand it also shows that a firm may earn and provide the dividend to its shareholders.

Dividend payout ratio:

It is equals the percentage of earnings paid out as individuals.

Dividend payout = Dividend/Net income

| Year | 2010 | 2009 | 2008 |

| Dividend payout | 5.41% | 3.53% | 3.61% |

Table: Dividend payout

Generally, growth firms have low dividend payout ratios as they retain most of their income to finance future expansion. Here UCBL has a high pay out rations, which indicates it is a well-esta

Major Findings:

As a pioneer of welfare banking, United Commercial Bank Limited has contributed a lot to the national economy as well as to social welfare through financial structure under Islamic banking. During the internship period in United Commercial Bank Limited (UCBL) I have found various things, which are as follows:

UCBL has a good set of customer service environment. It has provided very potential and dynamic customer service to its customer.

UCBL has a good set of institutional owners, which gives a better board of directors than many other banking companies.

UCBL has successfully developed a professional job environment where each officer has substantial level of authority and responsibility.

The organization is divided in to departments, and then in to units and subunits and thus the total flow of work has become very systematic.

The bank uses “PC Bank 2000” software for its banking operations as a computerized bank.

The marketing strategy and customer care department is not up to the mark.

This Bank can’t intestinal economic sectors, which are prohibited by the law of Islam.

This bank has limited activity to capitalize the huge potentials of the credit card market. It will verse that tomorrows payment will be considered of only plastic money (Credit Card). A large part of business transaction will be done by credit card III near future. So the branch should give special attention on credit card.

The bank has taken a 5-year plan from 2007-2012 to make a flexible and comfortable service to its clients.

It has diversified product line.

The growth of the bank has so far been very steady and high.

It lacks of ATM and Credit card facilities.

UCBL Bank Limited also hasn’t proper monitoring system.

This bank started on-line service newly. As a resulted customers are not getting the full service by the on-line service. Sometimes they have to face problem with on-line account.

The number of humn resources in the Computer section is really insufficient to give services to huge number of customers.

I have the practical experience in UCBL for only two months. United Commercial Bank Ltd introduces a new dimension of business among the local bank in the financial market of Bangladesh in Retail Product Management. But in the complex business environment and diversified business world these products cannot meet the customer needs. Today, customer classes are vibrant and it is difficult to keep the customers without an appropriately designed and also is not properly market driven. Developing a market driven product management system is essential for any company if the company would like to win the competitive condition and would like to survive in futuristic competitive market setting. In this regard, following specific recommendations are forwarded for the development of product management of United Commercial Bank Ltd.

United Commercial Bank limited is a leading Private commercial bank in Bangladesh with superior customer bases that are loyal, faithful, worthy towards the bank. The service provided by the young energetic officials of the United Commercial Bank Limited is very satisfactory. As a commercial bank UCBL has to follow the rules of Bangladesh bank despite the fact that these rules sometime restrict the foreign business to some extent. During my internship in this branch I have found its Investment department to be very efficient; therefore this department plays a major role in the overall profitability of the branch and to the Bank as a whole.

The Bank’s drive towards market leadership as well as quality in choosing business will continue in the coming years although competition is intensified with the opening of more financial institutions. The Bank is optimistic that the volume of business will increase in future through pragmatic and market friendly policies. The Bank shall continue to explore new Branches for Banking. We shall endeavor to adopt customer-oriented policies and introduce new techniques that will help to earn profit and increase greater confidence of the existing/ prospective customers. If United Commercial Bank Ltd, Uttarkhan Branch adopts professionalism within the framework of commercial, they will be able to earn handsome and higher return to the depositors and shareholders. Ultimately, public will get more confidence on this type of Banking.

Recommendations:

Taking into consideration of the experiences from working in the Uttarkhan branch, the following recommendations can be referred:

Though the performance of general customer services is very good, it has some problem of efficiency.

Officials whom are involved in Customer Services should be trained properly. Because some time they cannot give proper suggestions to the customer queries.

Their jobs should be mentioned more frequently.

They should be made somewhat free from doing business.

Link between Customer Service Officer’s and Customer Service Manager should be easier.

To provide better &smarter services, UCBL should also improve their call center service.

The bank should introduce more product and service based on market demand.

Number of ATM booth needed to be increased.

ATM should take good care. Because it has been seen that most of the time they remain out of order or out of cash.

Relationship between Bank and customer should be increased.

Charges and fees may be reduced for more customer satisfaction.

There should be a code of conduct for the UCBL officials, which should followed.

Uttarkhan Branch should have computerized token system.

The website of UCBL should upgrade regularly.

There sitting or waiting arrangement should be increased with cozy furniture.

Some officers behaviors are very infuriate, they should change this type of attitude.

Being a clear transparent the bank can provide the best support to customer as earn profit.

Conclusion:

United Commercial Bank Limited has formulate “Business Policy and Perspective Plan” to attain the financial strength, sustainable growth and operational efficiency. To protect the interest of the stakeholders, bank has formulated the perspective plan for consolidation of the growth and profitability. During the period of perspective plan, bank has the main objective to attain the highest operational excellence and consolidation to turn the bank into a dynamic Bank in the country.

During the period from 2007 to 2012, new & potential avenues of business in all areas of operation to be explored and expanded through the network of existing100 branches and more new branches to be opened gradually during the plan period subject to permission of Bangladesh Bank. The bank ensures optimum utilization of bank’s invested fund/ deposit to be mobilized in future in an organized way to maximize banks profit consolidating the financial strength of the bank and to achieve the overall objective, mission & vision of the bank as a whole.

It is great pleasure for me to have practical exposure in United Commercial Bank Limited, Uttarkhan Branch. Because without practical exposure it could not be possible for me to compare the theory with practice, and it is well established that theory without practice is blind. I have completed my internship in Uttarkhan Branch of United Commercial Bank Limited. During the practical orientation, I have observed the function of overall banking activities like cash department, clearing section, customer client division & various laws that comply with the sound business operations of United Commercial Bank of Bangladesh. The Bank which is fully customer oriented. Its performance specially based on prompt and swift services is busier than other department of United Commercial Bank Limited of Uttarkhan Branch. The more and more are coming in the branch through this department resulting deposit of the branch is increasing day to day.

On the other hand, for the concept of commercial banking system most valuable, and affluent, wise client are step forwarding to the corridor of the United Commercial Bank Limited. As a result, the Accountholder & liability of the bank is growing time to time, which will help to makes proper investment. That is why the number of account is opening more than previous year, which signifies the positive sign for our developing economy. In a word, the performance of United Commercial Bank Limited, Uttarkhan branch is growing rapidly and the volume of remittance is increasing effectively.

At last it can be said that, United Commercial Bank Limited will be turned into a dynamic commercial Bank in the country and will expand its Banking Business all over the country to provide the banking services to the groups including the deserving Economic groups of the society who have no easy access to the banking channel. This will help for alleviation of the poverty, income generation, creation of employment opportunity, up-gradation of the standard of living of the lower economic groups, which will also contribute to the emancipation of national economy of the country. The bank follows the Bank Companies Act 1991, the Companies Act 1994, the Negotiable Instrument Act 1881, the Foreign Exchange Regulation Act 1973 and many more to make the banking business in Bangladesh lawfully.