Objective of the Study :

The main objective of practical orientation in banks is to get a clear idea about banks, how it runs and what function it does. That is, how the bank mobilizes funds from surplus economic to deficit economic units, how an account is opened, how a remittance is sent, how a loan, is sanctioned and L/C opened and import is done. Besides these, the trainee able to get knowledge about;

- A general description of the Banks and their branches.

- Banking environment of Bangladesh

- Different banking activities in MBL

- Observed existing rules, regulation theories and practices for banking

- The strategy and objectives of the banks.

Again as the environment of a bank is totally new, the trainee gets a chance to familiarize himself with a new situation. Further this orientation is very useful to detect the points that theory does not cover .

Sources of Data:

The report is based on both primary and secondary sources of data

a) Primary Sources:

- Interviewing Manager and FVP of the bank

- Interviewing officers of the bank

- Conversation with clients of this bank

- Conversation with clients of other competing banks.

b) Secondary Sources:

- Annual report of the bank

- Prospectus of the bank

- Procedures manuals of the bank

- Website

- Statement of affairs

Scope of the Study:

MBL is one of the new generation private banks in Bangladesh. The scope of the study is limited to the branch only. The report covers the organizational structure, background, functions and the performance of the bank.

Methodology of the Study:

For the internship I went to Mercantile bank limited, Head office for guidance. They sent me to Mercantile Bank, Bijoynagar Branch. As my objective was to get a clear idea about the functional works of the bank I worked in few desk/ department of the bank with permission from the Head official in charge of the bank branch. While working in different departments I mainly observed the files/ documents of different parties and of different categories. I also reviewed the annual reports and different publications regarding banking functions, foreign exchange operation, credit policies maintain by me. I extended my efforts for collecting as much information as possible.

Limitation of the Study

The following limitations were apparent in preparing this report:

- The main objective of internship program is to observe the functions of the bank but the time allocated was only 3 months which is too short to learn the overall functions of bank.

- My study is based on Bijoynagar Branch and this branch is too new branch than others.

- Another limitation is bank’s policy of not disclosing some data and information for obvious reasons .

Introduction:

Mercantile Bank Limited (MBL) has started its operation on 2nd June 1999. Numerically it is no doubt just another commercial bank, one of the many now operating in Bangladesh, but the founders are committed to make it a little more different and a bit special qualitatively. This bank has new vision to fulfill and a new goal to achieve. It will try to reach new heights for realizing its dream.

Mercantile Bank Limited – Banglar Bank, is not a mere slogan. The Bank has been manned with talented and brilliant personnel, equipped with most modern technology so as to make it most efficient to meet the challenges of 21st century. As regard the second slogan of the bank efficiency is our strength is not a mere pronouncement but a part of our belief which will inspire and guide us in our long and arduous journey ahead.

Objective:

Mission:

Will become most caring, focused for equitable growth based on diversified deployment of resources, and nevertheless would remain healthy and gainfully profitable Bank.

Objectives:

Strategic objectives:

- To achieve positive Economic Value Added (EVA) each year.

- To be market leader in product innovation.

- To be one of the top three Financial Institutions in Bangladesh in terms of cost efficiency.

- To be one of the top five Financial Institutions in Bangladesh in terms of market share in all significant market segments we serve.

Financial Objectives:

- To achieve a return on shareholders equity of 20% or more, on average.

Company Profile:

Mercantile Bank Limited, a private commercial Bank with Head office at 61 Dilkusha C/A Dhaka, Bangladesh started operation an 2nd June 1999.The Bank has 42 branches spread all over the country. With assets of Tk, 37159.65 million and more than 600 employee, the bank has diversified activities in retail banking, corporate banking and international trade.

The corporate structure:

The organizational structure and corporate governance of Mercantile Bank Limited strongly reflect its determination to establish, uphold and gain a stronger footing as an organization which is customer-oriented and transparent in its management.

- Board of directors: The board of directors, the apex body of the bank, formulates policy guidelines, provides strategic planning and supervises business activities and performance of management while the board remains accountable to the company and its shareholders. The board is assisted by the executive committee and audit committee.

- Executive committee: All routine and day to day operational matters beyond delegated powers of management are decided upon by the executive committee, subject to ratification of the board of directors.

- Audit committee: The audit committee assists the board in fulfilling its auditing responsibilities. The audit committee maintains effective liaison with the board of directors, management and the internal and external auditors.

Name of the Corporate Bodies:

- Name of Chairman:

¨ Md.Abdul jalil ( Board of directors)

¨ A.K.M. Shaheed Reza (Executive committee)

¨ Saber Hossain Chowdhury (Audit Committee)

Management:

The Board of Directors consists of eminent personalities from commerce and industry of the country. Mr. MD. Abdul Jalil, Former M.P., Founder Chairman of the Board of Directors, is a businessman besides being an eminent personality of the country.

The bank is manned and managed by highly qualified and efficient professionals. The Chief Executive Officer of the Bank is Shah Mohammad Nurul Alam who has rich experience of managing both the nationalized and the private sector banks. He brings with him a wealth of experience of managing private sector banks .

Branch Network:

The Bank commenced its business on June 2, 1999. The first branch was opened at Dilkusha commercial Area in Dhaka on the inauguration day of the Bank. The number of branches of the bank stood at 42 up to 2009.

Financial Products and Services:

The bank has launched a number of financial products and services which are given bellow :

- Masik Sanchay Prokalpa (Monthly saving Scheme): The prime objective of this scheme is to encourage people to build up a habit of saving. Under this scheme one can save a fixed amount of money every month and get a lucrative amount of money after 5 years/8 years/10 years.

- Family Maintenance Deposit: Under this scheme, one can deposit certain amount of money for 5 years and in return he will receive benefits on monthly basis. In this scheme ,Minimum amount of required deposit is TK 50,000 and maximum or its multiple.

- Double Benefit Deposit Scheme: This scheme offers one can double his amount with 6 years. Minimum amount of deposit shall be TK 100000 or its multiple. One can take 80% loan on this scheme.

- Special Saving Scheme: Under this scheme, depositors money will be tripled in 15 year period. The minimum amount of deposit shall be TK 50000.

- Pension and Family Support Deposit: This scheme is evolved especially for old age. Under this scheme, one can get life long benefit if he deposits specific amount per month for a period of 10 or 15 years. More than two members of same family could not open this account .Minor can not open this account

- Consumer Credit scheme: Consumer credit scheme is relatively new field of collateral-free finance of the bank. People with limited income can avail of this credit facility to buy household goods including computer and other consumer durable.

- Small Loan Scheme: This scheme has been evolved especially for small shopkeepers who need credit facility for their business and cannot provide tangible securities.

- Lease Finance: The scheme has been designed to assist and encourage the genuine and capable entrepreneurs and professionals for acquiring capital machinery’s, medical equipment’s, computers and other items. Terms and conditions of this scheme have been made easier in order to help the potential entrepreneurs to acquire equipment’s of production and services and repay gradually from earnings on the basis of ‘pay as you earn’.

- Doctors credit Scheme: Doctors credit scheme is designed to facilitate financing to fresh medical graduates and established physicians to acquire medical equipment’s and set up clinics and hospitals.

- Rural Development scheme: Rural Development scheme has been evolved for the rural people of the country to make them self-employed through financing various income generating projects. This scheme is operated on group basis.

- Women Entrepreneurs Development Scheme: Women Entrepreneurs Development scheme has been introduced to encourage women in doing business. Under this scheme, the bank finances the small and cottage industry projects sponsored by women.

- SME financing Scheme: Small and Medium Enterprise (SME) Financing scheme has been introduced to assist new or experienced entrepreneurs to invest in small and medium scale industries.

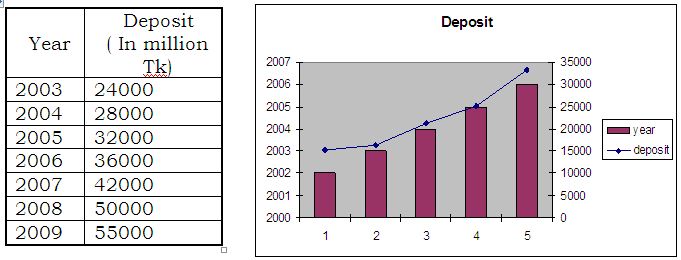

Deposit:

The Bank mobilized total deposits of tk.48,317.65 million as of December 31,2009 as compared to tk.35,087.43 million in 2008. Competitive interest rate, deposit mobilization efforts of the bank and confidence reposed by the customers in the bank contributed to the notable growth in deposits. The bank evolved a number of attractive deposit schemes to cater to the requirement of small and medium savers.

This improved not only the quantum of deposits; it also brought about qualitative changes in the deposits structure.

Credit Portfolio:

Credit Portfolio

| Components | Amount | % of Total (Million Tk) |

| Trade & Commerce | 10727.83 | 32.50 |

| Export | 088.41 | 18.96 |

| Housing | 1997.37 | 7.44 |

| Food beverage | 1518.54 | 5.66 |

| NBFIs | 1476.47 | 5.50 |

| Engineering (Iron and steel) | 1231.03 | 4.59 |

| Textile (linkage Industries) | 969.62 | 3.61 |

| Transportation | 665.96 | 2.48 |

| Hospital and Medical Services | 595.49 | 2.22 |

| Telecommunication | 355.48 | 1.32 |

| Information Technology | 307.17 | 1.14 |

| Pharmaceuticals | 288.75 | 1.08 |

| Paper and publication | 258.47 | 0.96 |

| Glass and Glass products | 204.72 | 0.76 |

| Plastic and plastic Materials | 152.70 | 0.57 |

| Agriculture | 117.45 | 0.44 |

| Storage | 54.87 | 0.20 |

| Others | 135939 | 5.06 |

| Total | 26842.14 | 100.00 |

Advances:

The Bank has formulated its policy to give priority to small and medium businessmen while financing large enterprises though consortium of banks. Total loans and advances of the bank stood at 36842.14 million as of December 31,2009 as compared to Tk.31857.05 million in 2008.Major sectors in which the bank extended credit included trade and commerce, garments industries, large and medium scale industries and construction.

Investment portfolio:

In an effort to secure more stable earnings from its investments, the bank focused its attention on investment in government securities and call money market. This strategy also reflected the bank’s intention to improve its capital adequacy ratio by securing assets with lower risks.

Investment Portfolio:

| Components | Amount | % of Total |

| Deposit with other Banks | 3693.12 | 44.59 |

| Treasury Bills and T & T Bond | 2070.00 | 34.27 |

| Money at call & Short Notice | 1240.00 | 20.53 |

| Investment in Shares and Bonds | 56.90 | 0.61 |

| Total | 100.00 |

Import Business:

From the very beginning, the bank has embarked on extensive foreign exchange business with a view to facilitating international trade transactions of the country. The bank has established 16436 letters of credit amounting to Tk. 72442.80 million as of December 31,2009 as against 34852 letters of credit amounting to Tk.53271.90 million in 2008. Items of imports financed wheat, seeds, CDSO, palmolein, cement clinkers, dyes, chemicals, raw cotton, garments accessories etc.

Export Business:

The Total export business handled by the Bank amounted to Tk.54592.10 million as of December 31,2009 as compared to tk.34108.57 million in 2008. The Bank has made significant contribution to ready-made garments sector which was responsible for 75.06% of total exports of the country in 2006-2007. Ready-made garments has not only generated employment of semiskilled men and women, it has also led to emergence of forward looking entrepreneurs in the country, absence of which was regarded as a constraint to development efforts. Apart from ready-made garments, export items handled by the bank included jute goods, leather, plastic scrap, handicrafts etc.

Total Income:

Total Income increased from Tk.3472.51 million in 2006 to TK.4631.41 million in 2007. Interest income accounted for 75.54%, exchange gains 8.96%, commission 8.18% and other income 7.32% of total income in 2007 as against 78.38%, 7.46%, 8.66% and 5.54% respectively in 2006.

Operating Profit :

The operating profit of the Bank amounted to Tk.1178.76 million in 2009 as against Tk.967.23 million in 2006. After necessary provision net profit stood at Tk.494.22 million as of December 31, 2009. An amount of Tk.211.41 million has been set aside for our tax contribution to national Exchequer.

Net Profit The Bank earned net profit of Tk.494.22 million in 2007, break- up of which is as under :

| Particulars | Amount (million Tk.) |

| Interest Income 3129.55 | |

| Interest Expenses (2000.00) | |

| Net Interest Income | 466.97 |

| Provision against Unclassified Loans | (85.00) |

| Provision for Classified Loans | (71.00) |

| Net- Interest Income 466.97 | |

| Net-Interest Expenses (298.58) | |

| Net Non -Interest Income | 102.47 |

| Net Profit | 494.22 |

Correspondent Relationship:

The bank has established correspondent relationship across the world with a number of foreign banks namely Citibank N. A., The bank of Tokyo Mitsubishi ltd., Standard chartered Bank, American Express Bank, HSBC, Commerz bank, Mashreq Bank, Commonwealth Bank of Australia, Scotia Bank, Toronto Dominion Bank, Unicredito Italiano, Wachovia Bank, N.A., Huttton National Bank, HypoVereinsbank, Bank Austria, Sumitomo Mitsui Banking Corp. ING Bank, United Bank of India, ICICI Bank etc. The number of major foreign correspondents is 41 according to Annual Report 2007. Efforts are being continued to further expand the correspondent relationship to facilitate Bank’s growing foreign trade transactions.

Human Resource Development:

In today’s competitive business environment, the quality of human resources makes the difference. The bank’s commitment to attract high quality persons to work for it is reflected in the efforts of the bank. In the face of today’s globalization, the bank envisages to develop highly motivated workforce and equip with latest skills and technologies. The bank evolves human resources development strategy with a view to ensuring good working environment, a high level of loyalty and commitment, devotion and dedication on the part of the employees.

The bank has set up a training institute for providing training facilities to its executive /officers. The Training institute has already conducted a number of foundation and specialized training courses. A number of officers was sent to Bangladesh Institute of Bank Management (BIBM) and other training institutes at home and abroad for specialized training on various aspects of banking. The bank believes in professional excellence and considers its working force as its most valuable asset and the basis of its efficiency and strength.

R&D: Investing into the Future :

Excellence in banking operation depends largely on a well-equipped and efficient Research and Development Division. Such activities require the investment of substantial resources and a set of qualified personnel with multidisciplinary background. Although it is not possible at this stage to undertake R&D activities similar to those of the banks in the developed countries, Mercantile Bank has established a core Research and planning Division comprising skilled persons from the very inception of the Bank.

Highlights of Mercantile Bank Limited:

(Amount in Million Taka)

| SL NO. | PARTICULARS | 2009 | 2008 |

| 1 | Paid-up Capital | 1,199.12 | 999.27 |

| 2 | Total Capital Fund | 2,554.29 | 2,045.85 |

| 3 | Capital Surplus/Deficit | 401.50 | 273.47 |

| 4 | Total Assets | 37,159.65 | 28,890.48 |

| 5 | Total Deposits | 33,317.65 | 25,087.43 |

| 6 | Total Loans and Advances | 26,842.14 | 21,857.05 |

| 7 | Total Contingent Liabilities and Commitments | 20,627.47 | 14,674.25 |

| 8 | Credit Deposit Ratio (in %) | 85.16 | 91.68 |

| 9 | Percentage of Classified Loans against Total Loans and Advances (in %) | 3.79 | 4.14 |

| 10 | Profit after Tax and Provision | 494.22 | 386.83 |

| 11 | Amount of Classified Loans during the year | 112.25 | 179.58 |

| 12 | Provision kept against Classified Loans | 594.00 | 523.00 |

| 13 | Provision Surplus | 0.0081 | 0.18 |

| 14 | Cost of Fund (in %) | 9.00 | 8.42 |

| 15 | Interest Earning Assets | 32,882.99 | 26,117.93 |

| 16 | Non-interest Earning Assets | 4,276.66 | 2,772.55 |

| 17 | Return on Investments (ROI) (in %) | 8.76 | 9.51 |

| 18 | Return on Assets (ROA) (in %) | 1.50 | 1.46 |

| 19 | Income from Investments | 369.12 | 314.94 |

| 20 | Earning Per Share (BDT) | 41.22 | 32.26 |

| 21 | Net Income Per Share (BDT) | 41.22 | 32.26 |

| 22 | Price Earning Ratio (approximate) | 9 Times | 10 Times |

Mercantile Bank Foundation:

The Bank has set up Mercantile Bank Foundation for extending benevolent services to the society. The bank contributes 1% of operating profit or Tk 4.00 million, whichever is higher, to Mercantile Bank Foundation every year.

The Foundation has been established with following objectives:

- Mercantile Bank gives prize to 8(eight) eminent personalities of the country for their outstanding contribution in the fields of Economics and Economic Research, Bengali Language and Literature, Science and Technology, Education and Culture, Journalism, Sports, Research on Librarian War and Industry and Commerce.

- Interest free education loan for the meritorious but poor students.

- To conduct research on Bengali language and literature.

- Book purchase and distribution Policy to encourage writers and publishers of the country.

- Interest free loan to the unemployed educated people.

- Donation for handicapped artists, literature and distressed people.

- Project for the development of shelter-less children.

Opening of the Branch

Mercantile Bank has been incorporated on May 20th, 1999 in Dhaka, Bangladesh as a public limited company with the permission of the Bangladesh Bank; MBL commenced

formal commercial banking operation from the June 02, 1999. The bank stood 42 branches all over the country up to December,2008.

My study is completed at Bijoynagar Branch. Bijoynagar Branch started their operation in 24th December, 2006 with initial deposit of Tk. 54246200/- as a new branch of Mercantile Bank Limited.

This branch is doing well. Already this branch have managed the most valued customer of this area. The staff of this branch have a friendly relation with the client.

The Function of general banking

The main function of general banking are

- Opening Account

- Accepting Deposit

- Issuance withdrawal Instruments, e.g., Cheque book, PO, Transfer.

Account Opening

The relationship between banker and customer begins with the opening of an account by the customer. Opening of an account binds the banker and customer into contractual relationship under the legal framework of the “Contract Act -1872”.But selection of Customer for opening an account is very crucial for a Bank. In fact, fraud and forgery of all kinds start by opening account. So, the Mercantile Bank Ltd. Takes highest caution in this regard.

Mercantile Bank Ltd. Opens the following accounts:

- Saving accounts

- Current accounts

- Fixed Deposit Receipt (FDR)

- Short Term Deposit (STD) accounts

- Term Deposit Accounts

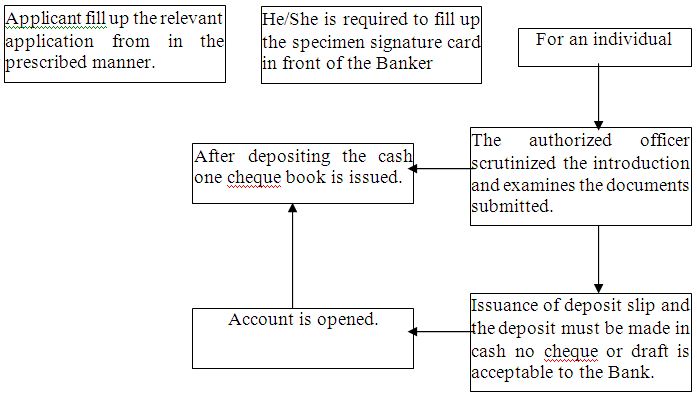

Opening General Account Procedure is given bellow:

Types of deposit accounts and their formalities

To open an account, MBL offers following formalities for different types of account :

a) Savings Account

To encourage savings habit amongst the general public, banks allow depositors to open savings accounts. Interest is awarded on the balance of the account. The number of withdrawals is generally restricted. Requirements to open an account is as follows :

- Account opening form to be filled up by the applicant.

- To open an account an applicant should have an introducer in any branch of MBL.

- Two passport- size photograph of applicant and one passport- size photograph of nominee to be attested by the introducer.

- Specimen signature of the application is taken on the signature card.

- With the account opening form an applicant have to fill up KYC (Know your customer) profile form.

- In saving account minimum TK. 500.00 is taken as deposit.

b) Current Accounts

In the name of Individual

The client has to fill up a white account opening form. Terms and conditions are printed on the form. The account opening form contains three parts.

- The 1st part of the form contains the introduction of customer

- The 2nd part is the Nomination form

- And the 3rd part is KYC (Know your customer) portfolio form.

- Specimen card

- Two passport size photograph of applicant and one passport size photograph of nominee. Photographs must be attested by the introducer.

In Joint name

In this type, more than one person can open an account with joint name. The formality is same as individual account. Here the separate signature of applicants is needed. Without their signature they can not withdraw their money. That’s why the special instruction clause, either or survivor’ or ‘former or survivor’ clause is marked. A minor can open an account in joint name of another person who will be guardian of him.

Proprietorship

In addition to the above general rules the customer has to submit the valid Trade licensee and Tax paying Identification Number (TIN) along with the application

Partnership

In case of partnership account, in addition to the general requirements the bank asks for,

- A copy of the partnership agreement (partnership deed)

- Resolution of the partner regarding account opening

- Trade license

- TIN Number

- The signature of all the member of partnership firm will be needed on the form.

Public Limited Company

In addition general erqurements trade license and TIN number a public limited company need to meet following formalities:

- Certificate of Incorporation

- Copy of memorandum and articles of association

- Certificate of commencement

- Copy of resolution of board of directors

Private limited Company

For Private limited company the bank asks for

- Certificate of incorporation

- Memorandum of Association

- Articles of association

- Copy of resolution of the board of directors

Societies, Clubs, Association

In case of these types of accounts,in addition to general requrements the bank requires the following documents:

- Registration Certificate under the Societies Registration Act, 1962

- Copies of Memorandum, Articles of Association

- Resolution of Managing Committee

- Power of attorney to borrow

NGO

The account opening procedure is same as above but the exception is that the Registration Certificate come the Social Welfare Department of Government must be enclosed with the application

For opening every type of account a signature card and different register for different types of account is maintained in the bank. An account number is given for each account and the description of the account is entered in the computer.

Accepting deposits:

The deposits that are accepted by the branch like other branch of the MBL may be classified in to :

a) Demand deposits

b) Time deposits

a) Demand Deposits

These deposits can be withdrawal without notice. MBL accepts demand deposits through the opening of Current Account and Saving Account

b) Time Deposits

A deposit which is payable at a fixed date or after a period of notice is a time deposit. MBL accepts time deposits through –

- Short Term Deposit (STD)

- Fixed Deposit Receipt (FDR)

- Term Deposit Accounts

While accepting these deposits, a contract is made between the bank and the customer. When the banker opens an account in the name of a customer, there arises a contract between two. This contract will be a valid one only when both the parties are competent to enter into contracts.

a) Short Term Deposit (STD)

In short term deposit, the depositor can deposit their money for a short period of time. The bank maintain following rules:

- The deposit should be kept for at least seven days to get interest

- Only corporate clients are eligible to open STD accounts

- Current of interest is 6.00%

- No interest is payable if the balance falls bellow TK.100000 on any day in a particular month.

b) Fixed Deposit

They are also kwon as time liabilities or term deposits. These are deposits, which are made for a fixed period in advance. The bank need not maintain cash reserves against these deposits and therefore, the bank offers high rate of interest on such deposits. The characteristics of Fixed Deposit accounts are:

- To open a fixed deposit account a depositor has to fill up an application form where in he mentions the amount of deposit, the period for which is to be made & the name in which the fixed deposit receipt is to be issued.

- Fixed deposit could be issued in joint name

- A passport size photograph will be attached with specimen card

- To open this account an applicant must have saving account in that branch where he interested to open Fixed deposit account.

- Fixed deposit account can be open for less than one year but not more than one year.

- Unless otherwise mentioned by the account holders in the account opening forms, FDR will be renewed automatically for 1month term upon expiry of existing terms.

- In case of lost FDR, the customer is asked to record a GD (General Diary) in the nearst Police Station. After that, the customer has to furnish an Indemnity Bond to branch a duplicate FDR is then issued to the customer by the bank.

- In case of premature encashment of FDR a certain percentage of agreed rate will be cut from the interest. Normally the SB rate is allowed.

Closing of an Account

A banker can close the account of his/her customer. The stoppage of the operation of the Account can be under following circumstances:

- Notice given by the customer himself.

- Death of customer.

- Customer’s insanity and insolvency.

- Order of the court / Injunction of the court.

An application to close the account from customer is received. Signature must be verified by the respective officer. The following activities are the part and parcel of account closing:

- Account holder can draw amount from the A/C keeping Tk. 50 for saving and Tk. 100 for current A/C as closing charge.

- Cheque book or outstanding cheques (if any) are destroyed.

B) The 2nd phase of general banking: Here the banker is responsible

for the following activities :

- Issuance of cheques, DD, TT, payment order and maintenance of related register

- OBC, IBC, IBCA, IBDA and maintenance of related register

- Reconciliation of inter branch transaction

- Voucher checking, sorting, register maintenance

- Income and expenditure statement

- vouching of salary

- Deposit mobilization and procurement of business

Cheque Book

According to Section 6 of Negotiation Instrument Act, 1881, a cheque is “ A bill of Exchange drawn of a specified banker and not expressed to be payable otherwise than on demand”. To facilitate withdrawals and payments to third parties by the customer, bank provides a cheque book to the customer cheque book contains 10 leaves for savings account while for current account there are 20 or 50 leaves.

Dishonor of cheque

If the cheque is dishonored, the branch sends a memorandum (cheque return memo) to the customer stating one of the the following reasons :

- Refer to drawer

- Not arranged for

- Effects not cleared. May be presented again

- Exceeds arrangements

- Full cover not received

- Payment stopped by drawer

- Payee’s endorsement irregular/ illegible/required

- Payee’s endorsement irregular, require bank’s confirmation

- Drawer’s signature differs/ required

- Alterations in date/ figures/ words require drawer’s full signature

- Cheque is post dated / out of date/ mutilated

- Amount in words and figures differs

- Crossed cheque must be presented through a bank

- clearing stamp required cancellation

- Addition to bank’s discharge should be authenticated

- Cheque crossed “Account payee Only”

- Collecting bank’s discharge irregular/ required.

If the cheque is dishonored due to insufficiency of funds, branch charges TK 50 as penalty.

If the cheque book is lost then have to take the account holder copy of GD from police station. To get another new cheque book, the customer need to fill an indemnity form guarantying that the cheque is lost. When the authority of the branch is convinced with having the above documents they will give new cheque book to the customer.

Remittance

Cash handling from one place to another is risky. So, bank remits funds on behalf of the customers to save them from any mishaps through the network of their branches. There are four modes of remitting money from one place to another. These are–

- Pay Order (PO)

- Demand Draft (DD)

- Telegraphic Transfer (TT)

- Mail Transfer (MT)

a) Payment Order

Bank’s payment order is an instrument which contains an order for payment to the payee to effect local payment on the bank or its constituents. In the beginning stage, PO was issued only to effect local payment of banks own obligations. But at present it is also issued to the customers which they can use for purchases to deposit as secondary money or earnest money. The bank payment order is in the form of receipts and issued by joint signature of two officials. It ensure payment to the payee as the money deposited by the purchaser of PO is kept in the banks own A/C and pay order A/C. It is not transferred, it can be paid to:

- The payee in identification

- The payee’s banker, who should certify that the amount will be payee A/C

- A person holding the letter of authority from the payee whose signature must be authenticated by the payee

b) Telegraphic Transfer (T T)

Telegraphic Transfer is effected by mobile phone, telegram, telephone, telex or Fax as desired by the remitter. Transfer of funds by telegraph is the most rapid and convenient but expensive method. The drawer and the payee should have accounts with MBL. TT is issued against cash, cheque, and letter of instruction.

Process of Issuing TT :

- Customer fills up the TT form and pays the amount along with commission in cash or by cheque.

- The respected officer issues a cost memo after receiving the TT form with payment seal, then sign it and at last give it to the customer.

- Next a TT confirmation slip is issued and its entry is given in the TT issue register.

- A text number is also put on the face of the slip. Two authorized officers signs this slip.

- The respective officer transfers the message to the drawee branch mentioning the amount, name of the payee, name of the issuing branch, date, test number and his/her power of attorney (P.A.) number.

- The confirmation slip is send by post by courier.

c) Demand Draft

Process of Issuing DD

- Customer is supplied with DD form.

- Customer fills up the form which includes the name of the Payee, amount of money to be sent, name of the Drawee branch, signature and address of the drawer.

- The customer may pay in cash or by transferring the amount from his / her account (if any).

- After the money is paid and the fo\rm is slaled and signed accordingly it is given to the DD issuing desk.

- Upon receiving the form concerned officer issue a DD on a particular block.

- DD block has two parts, one for bank and another for customer.

- Bank’s part contains issuing date, drawer’s name, payee’s name, sum of the money and name of he drawee branch, Customer’s parts contains issuing date, name of the payee, sum of the money and name of the drawee branch.

After furnishing all the required information ,entry is given in the DD issue register and at the same time bank issues a DD confirmation slip addressing the drawee branch. This confirmation slip is entered into the DD advice issue register and a number is put on the confirmation slip from the same register. Later on the bank mail this slip to the drawee branch.

- At last two Grade–1 officer sign the DD block and amount is sealed on the DD with a special red seal to protect if from material alteration.

- The number of DD is put on the DD form

- Next the customer of DD is supplied with his/her part

Clearing and Billing

Mercantile Bank Ltd. Bijoy Nagar Branch receives different types of instruments, such as cheque, PO, DD etc from its customers for collection or received for payment through clearinghouse it is called Inter Bank Clearance of IBC.

Cash Department

Cash is treated to be the most sensitive and vital issue particularly in a bank. Generally banking activities is so risky but the handling of cash is regarded as the most risky and it calls for strict protection and supervision. The place where cash is kept in a bank is known as strong room.

Cash section is a very important and busy section MBL, Bijoynagar Branch handle with extra care. I was not authorized to deal in this section. But I was fortunate enough to know the procedures of this section. Operation of this section begins at the start of the banking hour. Cash officer begins his / her transaction with taking money from the vault, known as the opening cash balance. Vault is kept in a very secured room. Keys to the room are kept under control of cash officer and branch incumbent. The amount of opening cash are the clearing balance is remain in the cash counter is put back in the vault and known entered into a register. After whole days’ transaction. the surplus money as the closing balance.

The withdrawal and deposit from/ in the branch will be entered to the cash book, the entire being checked and balanced initialed by both the head cashier and the supervising officer. While conducting checking in the cash balance book, any shortage in the cash should be recovered from the head cashier and any excess in the balance must be credited to sundry deposit account, under advice to controlling office. Total banks transaction is done through cash section. Again after opening an account most of the customer of the bank deals only with cash section. So it is an important section for the bank.

In this section bankers have to do following function

- Payment of cash and maintenance of cash payment register

- Deposit mobilization and procurement

- Management of cash remittance

- Passing cash withdraw cheque

- Verification of daily cash book and cash position

- Verification of daily cash received and payment register

- Custodian of security papers/ block prize bond, adhesive stamp,

Limitation

Mercantile Bank Limited ( Bijoynagar Branch) has established in 24th December 2006. It has just completed one year that’s why it can not able to overcome all of limitations yet comparatively with others. During working in this branch I have observed some limitations which are given bellow:

- Number of Employees

To become a successful organization, they should have enough efficient and skilled worker. But according to the working pressure or responsibility the number of employees in this branch is also small. Actually all employees are not skilled.

- Rules and Regulations

This branch is very much popular to the customer for the Monthly Saving Scheme but now a days customers are disappointed for the different formalities which are offered by the bank ,most of the customers are closing their account.

- Lease Financing

Leasing has significant and multifaceted contribution to capital formation and therefore, becomes an effective means of allocating, scarce financial resources to capital investment through funding on capital machinery/ equipment, which further stimulate the industrial development of the country. But this branch does not offer lease financing to the customer which can encourage the customer to save money

- Q Cash Card service

MBL has offered Q cash card (ATM Card) service, which is available in many other banks and it is very important desire of a financial institution at present . And in this branch the customer of Q cash card is very few, even most of the employees of this branch have more than one credit card of other bank but they do not have ATM Card of their bank.

- Number of Customer

To encourage the customer for saving money, a bank should offer different financial products and services to the customer. Bank management has to create maximum access of banking services , which is conditioned by convenience as to its location and time in relation to need and helpfulness of the personnel .But this branch can not able to have a large number of customer like other branch of MBL.

- Rate of Interest

The management of the banks should have clear idea about customers perception of needs for services, problems they experience in fulfilling these needs and deferential in experience by social strata and groups. But they don’t have enough idea about customers needs. Day by day, bank is decreasing the rate of interest of different deposit scheme which is creating negative impact on customer.

- Network System

Mercantile Bank Limited has not yet set up proper network system, which is very important to compete with the others in this electronic world.

- Commitment

MBL has commitment to their prospective customers to honor its of cheques within 30 seconds after submission but unfortunately they are not able to fulfill this.

- Staff Loan

MBL does not offer loan to its own staff accept AVP level, where other banks are doing it promptly. To get loan they have to wait for 5 years working experience in their bank.

Recommendation

I have focused and analyzed on over all general banking activities of Bijoynagar Branch of Mercantile Bank Limited. MBL is a new bank in Bangladesh but its contribution in socio-economic aspect of Bangladesh has greater significance. Though my topic is connected on the overall banking divisions or sectors, I have tried to identify the process of disbursement of loan, performance and problems of the bank as a whole. I have found a fewer number of factors, which impede the achievement of ultimate goals of MBL. It is not easy to find out the solution for an inexperience internee like me. But I do believe that the suggestions mentioned below will obviously increase the efficiency of Mercantile Bank Limited.

- Deposit Mobilization

Deposit is the blood of any bank. A banker’s primary job is to seek resources i.e. the deposit from the prospective depositors by way of selling their services and some value in exchange i.e. payment of interest against some kinds of deposits. While attracting customer, banks and banker initially learned a lesson- attraction people to a bank are easy, converting them into satisfied customers is very difficult. Banks had to search for a new basis for differential advantage. Bank must realize that they are in the business of meeting the evolving financial needs of their customers. A successful innovation provides the innovative bank with a competitive lead. Financial services however are easily copied, and advantage is short-lived. But if the same bank invests in continuous innovation, it can stay ahead of the other banks.

- A Sound Lending Policy

The commercial bankers of the day experience the mounting problem of recovery of advances in our country. A credit officer should always bear it in mind that the funds that are lent at interest as loans belong to depositors. It is their money that is placed at risk. Nearly 94% of the total of a bank consists of public deposits while the balance 6% only belongs to the directors and shareholders. Therefore, strict adherence to a very cautious lending policy by a banker is a must. If a bank’s advances perpetually turn bad or unprofitable, it will reflect in deposits, sooner or later.

- Monitoring of advance

After the sanction of an advance, a system of continuing evaluation helps to identify potential problems before they reach a critical stage. It is, therefore, essential to more careful the monitoring ,the more effective it is as a preventive medicine. The prime objective of monitoring is to look for signs of trouble and detect them at the earliest possible moment. Monitoring has to be systematic by using information from as many available sources but selecting the most fruitful.

- Follow Up Of Advances

Close follow up begins after selection of the borrower and sanction of loan. A good advance may turn bad in the absence of proper and timely follow up. Quite often bankers do not bother to follow up and monitor newly sanctioned loans and advances. Where as, their main function should being after sanctioning of the loan. They have to be vigilant that the funds sanctioned for a particular purpose are not diverted elsewhere without their knowledge. Otherwise, the aim of the advance would be missing. Besides, bank may even lose the fund because of the misuse or abuse of the same by the borrower.

- Recovery of Advances

A prudent credit officer is expected to take the following steps for ensuring recovery of loans. He should remain patient, tolerant, reasonable and amicable to the complaining borrower and maintain smooth personal relationship with debtor, despite trying situations so as to secure full repayment. He should also explore ways and means of getting repayment through negotiation without resort to litigation since legal suits cost each party both money as well as time, which each could use for more productive endeavors. He should adopt curative measures to arrest further deterioration in the borrower’s financial position and that by monitoring constantly and closely the plan that evolved from discussion. Certain obligations are likely to arise on either side, the faithful performance of which leads to a satisfactory solution of the problem.

- Bank Management

A bank is a borrower and a lender at the same time, and borrowing in a cost efficient manner and lending in a return maximizing way, the banks produce returns for its shareholders, assure its stakeholders and contribute to growth of the economic through efficient allocation of financial resources to agents of production. The management of the banks should have clear idea about customers perception of needs for services, problems they experience in fulfilling these needs and deferential in experience by societal strata and groups. To the best of my knowledge bank management has rarely attempted to know about customer’s needs and customers experiences. Bank management has to create maximum access of banking services, which is conditioned by convenience as to its location and time in relation to need and helpfulness of the personnel.

- Capital

Banking Industry has undergone tremendous changes in recent years. The changes occurred mainly due to changes in government policy, structural changes in banking industry and changes in bank management.

Besides, priority sector lending by banks in developing countries also make banking activities risky. Capital adequacy has been defined as that minimum amount of capital, which is needed to protect a bank from its portfolio losses. Its has, therefore, been said by the financial analysis that ultimate strength of a bank lies in its capital funds. Bank’s capital performs three major primary functions, first, bank’s capital protect depositors balances by furnishing a cushion to absorb opening losses. Second, it provides bank regulators with a basis for limiting the risk taking activities of banks. Third, capital is needed for fixed capital expenditures like construction of buildings, purpose of equipment’s and other physical facilities for the initial start of a business.

In this competitive environment, banks capital standard should be adequately monitored by the Bangladesh Bank to cope with the present change. Ratio analysis of banks capital in Bangladesh showed very poor standard particularly in respect of nationalized banks. The private banks also could not maintain the required paid up capital ratio as prescribe by the Bangladesh Bank.

- Weak Network

There is no question about the returns to scale for the banks that developed their financial products and built the delivery system on a global scale. The Bank whose network system is strong, they can achieve competitive advantage over the financial institutions. In the electronic world the nature of competition is different and efficient bank can get a benefit from being an innovator, which sticks with a bank for a long time. Mercantile Bank Limited as a new Bank hasn’t yet setup proper network system. At present all the branches of MBL can’t share online banking at the same time. Now MBL is thinking to implement software where a client can deposit, withdraw, get loan by only one account. This should be implementing as early as possible to meet the challenge of 21st century.

- Keep the Given Commitment

MBL has committed to their prospective customers to payment of cheque within 30 seconds after submission but unfortunately they are not able to payment of that cheque. I think the bank should try to keep its commitment. Otherwise the customers can think that the bank has no uniformity between its word and action.

- Credit Management

MBL Elephant Road Branch is now doing well in credit management especially in Micro Credit Division. Moreover the bank may face problem if it does not take some necessary steps to correct the flows that are identified.

For increased effectiveness of various activities of MBL-the bank should not sanction any loan to those clients / customers, whose necessary information is not fully disclosed to the bank. To get information, which is needed for credit appraisal, the bank should not only depend on the client but also should try to explore the other sources of information for its authentication. They must rationalize portion of loans and advances to different sector for risk diversification. The bank also should go for long-term investment, which will diversify the risk.

- Banking Training

Training is the most important, effective and efficient mechanism through which human resources of any organization can be developed in a planned way. Since banks play the most vital role in the economic development process of the country, human resources working in this sector need to be trained thoroughly to bring about a development change in their knowledge, skill and attitude through building and increase capabilities

Conclusion

Financial system of a country should be contributed toward the development of an economy. The Banking sector in any country plays an important role in economic activities. As because it’s financial development and economic development are closely related. In Bangladesh, banks are leading the financial system. And the private commercial banks are playing significant role in this regard. So, it is obvious that banks should contribute to make the financial system more deep. In the arena, PCBs are playing vital role. But government & Bangladesh Bank have plays a crucial role to the PCBs through imposition of deposit restriction, lending rate & other banking operation.

This report focused and analyzed on overall general banking activities of Mercantile Bank Limited, Bijoynagar Branch. Mercantile Bank Limited is a new bank in Bangladesh but its contribution in socio-economic prospect of Bangladesh has the greater significance. In the short period of banking business, MBL has shown better performance in every aspect viz. Deposit mobilization, advance, foreign exchange and innovation of different schemes. MBL is not only doing business but also contributing to the society through its service. MBL has already taken a significant position in the private sector banking. If the govt. implements nominal policy then MBL like PCBs will achieve their expected goal & will able to contribute a vital role in the socio-economic perspective.