Major purpose of this report is to analyze overall performance appraisal of Mercantile Bank limited. Report focus mainly in three parts- General Banking, Loan and Advances and Foreign Exchange. Here also focus on customer satisfaction level about overall performance of the bank. Mercantile Bank is committed to seize the opportunities that lie ahead of it and its capable to build up an even more robust and profitable organization maintaining its commitments and standards.

Introduction:

The word “Bank” refers to the financial institution deals with money. Commercial banks are the primary contributors to the economy of the country. On the other hand they are borrowing money from the locals and lending the same to the business as loans and advances. So the people and the government are very much dependent on these banks as the financial intermediary. Moreover, banks are profit – earning concern, as they collect deposit at the lowest possible cost and provide loans and advances at higher cost. The differences between two are the profit for the bank. Involvement of the banking sector in different financial events is increasing day by day. At the same time the banking process is becoming faster, easier and the banking arena is becoming wider. As the demand for better service increases, the banking organizations are coming with innovative ideas. In order to survive in the competitive field of the banking sector, all banking organizations are looking for better service opportunities to provide to their clients. As a result, it has become essential for every person to have some idea on the bank and banking procedure. A student takes the internship program when he or she is at the last leg of the bachelor’s degree; internship program brings a student closer to the real life situation and thereby helps to launch a career with some experience.

Objectives of the Study:

The objectives of the orientation are—

- To study various desk works of the satmoshjid Branch of Mercantile Bank Limited.

- To analyze overall performance of the branch as well as Mercantile Bank limited.

An overview of Mercantile Bank Ltd

Introduction:

Mercantile Bank Limited is a private commercial bank with Head Office at 61 DilkhushaC/A, Dhaka, Bangladesh started operation on 2nd June 1999. The Bank has 14 branches spread all over the country. With assets of Tk. 13078.93 million and more than 300employees, the bank has diversified activities in retail banking, corporate banking and international trade.

Historical Background:

Mercantile Bank Limited (MBL) was incorporated in Bangladesh as a banking company under the company acts 1913 and commenced operation on 2nd June 1999. Numerically it is just another commercial bank, one of many now operating in Bangladesh, but the finders are committed to make it a little more different and a bit special qualitatively. This bank will have a new vision to fulfill and a new goal to achieve. It will try to reach new heights for realizing its dream. Mercantile Bank Limited (MBL), a bank for 21st century, it is not a mere slogan. The bank has been manned with talented and brilliant personnel, equipment with most modern technology so as to most efficient to meet the challenges of 21st century. As regards the second slogan of bank Efficiency is our strength is not a mere pronouncement but part of their belief, which will inspire and guide them in their long and arduous journey ahead.

Objective:

Mercantile Bank Limited (MBL) aims at excellence and is committed to explore a new horizon of banking and private a wide range of quality products and services comparable with those available with any modern bank in the world. It is a bank for the common people including businessman and professionals. It intends to serve with quality at a price competitive to achieve in the financial market. It would constantly keep on exploring the needs of the clients.

The management of the bank bears in mind the fact they are on the threshold of a new millennium, which will pose extra ordinary challenges to be faced and at the same time open up new opportunities and possibilities. As young and talented team of business entrepreneurs and managers will be required to guide the destiny of nation in the 21st century. For this reason the bank will be developed a youthful and exuberant management team-technologically sound and rich in experience. They would work hand in hand with zeal and enthusiasm to achieve the objectives of the bank in the new millennium.

Vision of Mercantile Bank Limited:

- Would make finest corporate citizen.

Mission of Mercantile Bank Limited:

Mercantile Bank will become most caring, focused for equitable growth based on diversified deployment of recourses and nevertheless would remain healthy and gainfully profitable Bank.

Strengths of Mercantile Bank Limited:

- Well- capitalized Bank with potential to increase capital base.

- Homogenous Board of Directors.

- Computerized customer services.

- Customer’s faith as a stable and dependable Bank

Corporate Structure of Mercantile Bank Limited:

The sponsor directors of MBL are successful group of prominent local and non-resident of Bangladesh investors who have earned high credentials and excellent reputation in their respective fields of business at home and abroad. The board of directors of MBL consists of 13 members. The board of directors, the apex body of the bank, formulates policy guidelines, provides strategic planning and supervises business activities and performance of management while the board remains accountable to the company and its shareholders. The board is assisted by the Executive Committee and Audit Committee. Presently a team of experienced professional headed by the Managing Director and Executives manages the Bank.

Special Savings Scheme:

- Under this scheme, depositor’s money will be tripled in 15-year period.

- Help in meeting specific needs like education, marriage etc.

- Triple of the amount deposited after 15 years.

- Minimum deposit shall be Tk.50, 000.00 or it’s multiple

ATM Card:

Mercantile Bank Limited offers e-cash ATM card with all of its Deposit accounts. To get ATM card customer has to apply separately while opening an account. It has a joint venture with E-cash, offers this card with the help of them. If an account holder has an ATM card with his/her account then Mercantile Bank hold a fixed amount of that account after concerning with the customer that hold amount only can withdrawal by ATM card. At a time a cardholder can withdraw tk 5000 (five thousand) and as many time he/she wants but not more than the hold amount.

Credit Card:

Dual Card (two in one):

Single card with double benefits. No hassle to carry two cards (local and international). A single credit card can bemused both locally and internationally to withdraw cash from ATM for POS This is the special feature of MBL Visa card.

No cash withdrawal fee:

For withdrawals of cash from MBL ATM by MBL cardholders no cash advance fee is necessary and from any other Q-cash ATM the fee is Tk.10 only. MBL is the only bank offering such unique facility. Moreover, our Visa cardholder can also withdraw cash from any Visa logo ATM locally and internationally.

Acceptability:

International/Dual card is accepted all over the world at millions of outlets and ATMs. A Dual card is also accepted in most of the big cities like Dhaka, Chittagong, Khulna, Rajshahi, Sylhet at more than10,000 outlets including 4500 POS. It covers various kinds of merchant’s like hospital, hotel, restaurant, department, store and the card have accessibility to any outlet having Visa logo.

Credit facility:

Mercantile Bank Ltd. Visa Credit card offers maximum 45 days credit facilities free of interest and minimum payment is 5% of outstanding billing payment for easy repayment and convenience of the customers.

Supplementary card:

A principal cardholder may apply for unlimited supplementary card under one principal card (local) where one supplementary card will be charged to the principal card.

Advance against Credit card:

MBL cardholder can take advance astern loan up to 50% of the card limit to be repaid on the monthly installment basis. Repayment period of such loan may be from 6 months to 36 months.

Checking facility against Credit card:

Cardholder maybe allowed enjoying chequing facility to avail the credit limit on case to case basis. For convenience in life, one can settle their day to day payment by cheque against any transaction where card is not accepted. Cheque maybe issued upto the limited amount with maximum 45 days interest free credit facilities like POS transaction.

Overdraft Facilities:

Overdraft facilitesupto 80% of the credit card limit may also be allowed for payment of the installment of scheme deposit with our Bank.

Payment of utility Bill:

Payment of utility bills like telephone bills, gas bills, electric bills, water bills, may be settled by card.

Prepaid Card:

Those who have no account with MBL may avail prepaid card facilities. The prepaid cardholders pay first buy later. Prepaid cardoffers the convenience and security of electronic payment in situations where onemight otherwise use cash, such as paying for a gift or a monthly allowance for ayoung adult. Examples also include gift cards and salary payment, etc.

Lost or Stolen Card:

If card is lost or stolen, just make a call to our customer service centre, at Head Office, card division which is open to receivecall 24 hours a day, 365 days a year. We shall stop operation of your cardinstantly at the call. But for replacement of card, customer should give a letter.

Repayment:

Credit Card account statement is generated to the cardholder on monthly basisif there is any balance outstanding in the cardholder account.(ii) If the cardholder repays the entire amount within the due date of payment, nointerest will be charged

Interest:

(i) In case of POS transactions, if entire amount is not paid within payment duedate, interest will be charged @ 2.5% on the outstanding balance on daily basisfrom date of transaction.

(ii) In case of cash withdrawal, interest will be charged @ 2.5% per month ondaily basis from the date of transaction irrespective of payment due date.

Cash advance fee:

(a) MBL card to MBL ATM: no fee.

(b) MBL card to other Q-Cash ATM: Tk.10 per transaction.

(c) MBL card to other ATM: 2% of transaction amount or Tk.100 whichever ishigher

(d) For international card: USD 3 or 2% of transaction whichever is higher.

Locker:

Customers could use the locker facility of Dhaka Bank Limited and thus have theoption of covering many valuables against any unfortunate incident. It offer securityto our locker service as afforded to the Bank’s own property at a very competitive price. It would be at customer’s service from Saturday through Thursday from 9:00am to 4:00 pm. Lockers are available at Gulshan, Banani, Dhanmondi, Uttara, CDAAvenue & Cox’s Bazar Branch.

Phone Banking:

Mercantile bank phone banking services allows account holder to conduct a variety of transactions by simply making a phone call from anywhere.

Project Part: Performance Appraisal

Objectives of Performance Appraisal

Performance Appraisal can be done with following objectives in mind:

- To maintain records in order to determine compensation packages, wage structure, salaries raises, etc.

- To identify the strengths and weaknesses of employees to place right men on right job.

- To maintain and assess the potential present in a person for further growth and development.

- To provide a feedback to employees regarding their performance and related status.

- To provide a feedback to employees regarding their performance and related status.

- It serves as a basis for influencing working habits of the employees.

- To review and retain the promotional and other training programmes.

Advantages of Performance Appraisal

It is said that performance appraisal is an investment for the company which can be justified by following advantages:

- Promotion: Performance Appraisal helps the supervisors to chalk out the promotion programmes for efficient employees. In this regards, inefficient workers can be dismissed or demoted in case.

- Compensation: Performance Appraisal helps in chalking out compensation packages for employees. Merit rating is possible through performance appraisal. Performance Appraisal tries to give worth to a performance. Compensation packages which includes bonus, high salary rates, extra benefits, allowances and pre-requisites are dependent on performance appraisal. The criteria should be merit rather than seniority.

- Employees Development: The systematic procedure of performance appraisal helps the supervisors to frame training policies and programmes. It helps to analyse strengths and weaknesses of employees so that new jobs can be designed for efficient employees. It also helps in framing future development programmes.

- Selection Validation: Performance Appraisal helps the supervisors to understand the validity and importance of the selection procedure. The supervisors come to know the validity and thereby the strengths and weaknesses of selection procedure. Future changes in selection methods can be made in this regard.

- Communication: For an organization, effective communication between employees and employers is very important. Through performance appraisal, communication can be sought for in the following ways:

- Through performance appraisal, the employers can understand and accept skills of subordinates.

- The subordinates can also understand and create a trust and confidence in superiors.

- It also helps in maintaining cordial and congenial labour management relationship.

- It develops the spirit of work and boosts the morale of employees.

All the above factors ensure effective communication.

Motivation: Performance appraisal serves as a motivation tool. Through evaluating performance of employees, a person’s efficiency can be determined if the targets are achieved. This very well motivates a person for better job and helps him to improve his performance in the future.

Performance apprival in H.R process :

A performance appraisal is a review and discussion of an employee’s performance of assigned duties and responsibilities. The appraisal is based on results obtained by the employee in his/her job, not on the employee’s personality characteristics. The appraisal measures skills and accomplishments with reasonable accuracy and uniformity. It provides a way to help identify areas for performance enhancement and to help promote professional growth. It should not, however, be considered the supervisor’s only communication tool. Open lines of communication throughout the year help to make effective working relationships.

Each employee is entitled to a thoughtful and careful appraisal. The success of the process depends on the supervisor’s willingness to complete a constructive and objective appraisal and on the employee’s willingness to respond to constructive suggestions and to work with the supervisor to reach future goals.

Why Appraise Performance?

Periodic reviews help supervisors gain a better understanding of each employee’s abilities. The goal of the review process is to recognize achievement, to evaluate job progress, and then to design training for the further development of skills and strengths. A careful review will stimulate employee’s interest and improve job performance. The review provides the employee, the supervisor, the Vice President, and Human Resources a critical, formal feedback mechanism on an annual basis, however these discussions should not be restricted solely to a formal annual review.

A Pay-for-Performance Structure

Annually, the appropriate supervisor evaluates each employee’s performance. In the case where an employee has changed jobs part-way through the appraisal period, both of the employee’s supervisors during the appraisal period should submit an appraisal of the employee’s performance. During the performance evaluation process, the most recent job description on file with Human Resources will be reviewed and updated if necessary, by both the employee and the supervisor.

Employees are reviewed for a salary increase, annually, effective July 1st. The amount of the salary increase pool of funds is recommended by the administration and approved by the Board of Trustees. The method for allocating funds is based on rewarding meritorious performance. Merit increases will be awarded on a pay-for-performance basis and are based on individual performance. When used as intended, a pay-for-performance structure achieves the goal of rewarding truly top performers with merit increases that match their achievements and contributions.

Major Activities of Mercantile Bank at a glance:

- General Banking Services;

- Investment Banking;

- International Trade;

- Money Market and Foreign Exchange Dealing;

- Corporate Finance & syndications;

- Capital Market Services;

- Merchant Banking Services;

- Personal & Retail Banking;

- Risk Management & Portfolio Management;

- Training and Development;

- Social activities, etc

General Banking:

The general banking department does the most important and basic works of the bank. All other departments are linked with this department. It has vast range of activities. Ideals with the general activities of bank such as issuing TT, DD, Pay-Order, Chequeclearing etc. MBL provides different types of accounts, locker facilities d special types of saving scheme under general banking. For proper functioning and excellent customer service this department is divided into various sections namely as follows:1)Depositsection2)Account opening section3)Cash section4)Bills and clearing section5)Remittance section6)FDR section7)Accounts section

DEPOSIT:

A bask is essentially an intermediary of short-term funds. It can carry out extensive lending operations only when it can effectively channel the savings of community. A good bank is one who effectively mobilizes the savings of the community as well as makes such e of savings by making it available to productive and priority sectors of the economy thereby fostering the growth and the development of the economy of the nation. Therefore deposit is the blood of a Bank. From the history and origin of the banking system, we can know those deposit collection is the main function of a bank. The deposits that are accepted by MDL like other banks may be classified into:

- Demand Deposits,

- Time Deposits,

Current Account:

Both individual and businessperson can open this type of account concerns. Frequent transactions (deposits well as withdrawal) are allowed in this type of account. A current account holder can draw checks on his account for any amount for any numbers of times in a day the balance in his account permits. This account provides no interest. The minimum balance to be maintained is TK. 5000. No new account can be opened with a check. In this kind of account a customer can deposit this money and can write one or more check to withdraw their money. For doing this notice is not required.

He/she can deposit it whenever he/she wants to and can withdraw it whenever he/she wants to.

Procedure for opening of accounts:

Before opening of a currents or savings account, the following formalities must be completed by the customer:

- Submit application on the prescribed form.

- Furnishing photographs – 2(two) copies.

- Introduction by an account holder.

- Putting specimen signature in the specimen card.

- Mandate if necessary. After observation of all the formalities mentioned above the applicant is required to deposit the minimum TK. 100 for opening a savings bank account and TK.5000 for

- Current account,

- Savings account,

- Call deposit from the fellow bankers.

- Fixed Deposit Receipt(FDR),

- Short Time Deposit(STD),

- Bearer Certificate Deposit(BCD) etc.

Opening a current account. This is called initial deposit. As soon as this money is deposited, the bank opens account in the name of the applicant. It should be noted that the permission of the component authority for opening of an account is a must. The banker then supplies the following books to the customer to operate the customer’s accounts:

- Pay-in-slip book,

- A chequebook,

- Pass book (In modern banking it has been replaced with the periodical statement of account)

Saving Account:

Individuals for savings purpose open this type of account. A minimum balance is required to be maintained in a SB account. Interest on SB account is calculated and accrued monthly and credited to his/her account half yearly. Interest calculation is made for each month on the basis of the lowest balance at credit of an account in that month. A depositor can withdraw from his/her SB account not more than twice a week up to an amount not exceeding 25% of the balance in the account. This deposit is basically merit for small-scale savers. There is restriction on withdrawals in a month. Heavy withdrawals are permitted only against prior notice.

Fixed Deposit:

They are also known as time deposit or time liabilities. These are deposits, which are made with the bank for a fixed period, specified in advance. The bank need not maintain cash reserves against these deposits and therefore, the bank offers higher interest on suchdeposits.In MBL, fixed deposit account is opened in two forms-Midterm (MTD), which is less than one year and other is term deposit, which is more than one year.

Credit Approval Procedure:

After receiving the application form the client, MBL official prepares a Credit Line Proposal (CLP) (Annexure-l, 2, 3) and forwards the same to the Head Office to place before Head Office Credit Committee (HOCC) for approval. It includes:

a) Request for credit limit of customer.

b) Project profile/profile of business.

c) Copy of trade license duly attested

d) Copy of TIN certificate

e) Certificate copy of Memorandum & Articles of Association, certificate of incorporation, certificate of commencement of business, Resolution of the Board, Partnership Deed. (Where applicable)

Steps in lending can be sum up as follows:

a)Entertainment of application for loan proposal.

b)Preliminary screening of credit proposal.

c) Feasibility study & Appraisal of loan proposal or Credit

d) Sanction of 1os or advances.

e)Documentation’s)Disbursement of loans or advances’)Supervision and follow up loans and advances.

Credit Disbursement:

Having completed and accurately prepare the necessary loan documents, the Loan Officer ready to disburse the loan to the borrower’s loan account. After disbursement, the loan needs to be monitored to ensure whether the terms and conditions of the loan fulfilled by both bank and client or not.Credit Monitoring.

MBL Officer checks on the following points:

The borrower’s behavior of turnover.

b.The information regarding the profitability, liquidity, cash flow situation and trend in sales in maintaining various ratios. The review classification of credit facilities starts at Credit Department of the Branch with the Branch Manager and finally with Head Office credits division.

Loan Classification:

Loan classification is a process by which the risk or loss potential associated with the loan accounts of a bank on a particular date is identified and quantified to measure accurately the level of reserves to be maintained by the bank to provide for the probable loss on account those risky loan. All types of loans of a bank are fall into the following four scales:

- Unclassified : Repayment is regular.

- Substandard : Repayment is stopped or irregular but has reasonable prospect of improvement

- Doubtful debt : Unlikely to be repaid but special collection efforts may result in partial recovery.

- Bad/Loss: Very little chance of recovery

International Trade and Foreign Exchange Operations:

Foreign Exchange means and covers all business activities relating to import, export, inward and outward remittance and buying and selling of foreign currency.

Import/ Export:

Import and export means flow of goods/services purchased by a party of one location from a party of other location. Normally Import] Export is done through Letter of Credit(L/C). Letter of Credit is a definite undertaking by the L/C issuing bank on behalf of the purchaser (Applicant) to the seller (Beneficiary) that the bank will arrange payment against delivery of goods/services subject to fulfillment of certain terms and conditions mentioned in the L/C.

Letter of Credit:

Letter of Credit can be defined as a Credit Contract where by the buyer’s bank iscommitted (on behalf of the buyer) to place an agreed amount of money at the seller’sdisposal ur1er some agreed conditions. Since the agreed condition include among other things, the presentation of some specified documents, the Letter of Credit is called Documentary Letter of Credit.

Documentary credit may be either Revocable Credit:

A revocable credit is a credit, which can be amended are cancelled by the issuing bank at any time without prior notice to the seller.

Irrevocable Credit:

An irrevocable credit constitutes a definite undertaking of the issuing bank (since it cannot be amended or cancelled without the agreement of all parties thereto), provided that the stipulated documents are resented and the seller satisfies the terms and conditions. This sort of credit always referred to revocable letter of cre

Problems of Mercantile Bank Limited :

General problems of the Bank:

Now a day, Mercantile Bank Limited performs better in the banking sector but it has not achieved the best in the banking sector. However from the study of this bank, in spite of their well reputation, there are some problems in their services and policy implication. I have observed some lacking in some area of its operation during my three months internship program in Mercantile Bank Limited which I have furnished below:

- Growth in assets depends on how fast deposits grow. But in the deposit side Mercantile Bank is facing some problems from their competitors because the competitors are giving higher interest rate in deposit. That’s why lots of depositors are leaving Mercantile Bank Ltd;

- Number of branches of Mercantile Bank Ltd is not enough to serve the potential customer than its rival banks. The bank is concentrating less in the rural sector than the urban sector for that it cannot reach to the entire rural people like any other nationalized public bank such as Sonali Bank, Rupali Bank, etc.

- Mercantile Bank’s EPS is decreasing day by day which imposes negative impaction the potential investors of the bank as well as the negative image for the bank;

- Higher service charges comparing to other banks sometimes discourage opening or maintaining accounts of Mercantile Bank LTD. This is the biggest problems of Mercantile Bank Ltd which make the customer less attractive towards the banks;

- The bank is sometimes left behind because of the absence of innovation of new segment in deposit collection and loans;

Some Threats for Mercantile Bank Ltd:

- The emergence of several private and foreign banks with in the last few years offering similar services with less or free charge for the facilities can be major threat for the bank.

- The central Bank exercises strict control over all banking activities in local banks, which sometimes impose barriers in the normal operation and policies of the bank.

- Rival bank easily copy the product offering by Mercantile Bank.

- Sometimes political loans are threat for the banking services. If the management of Mercantile Bank Limited takes care of these things then thebank can perform best in the private banking sector in Bangladesh andsatisfying its customer properly

Findings and Analysis:

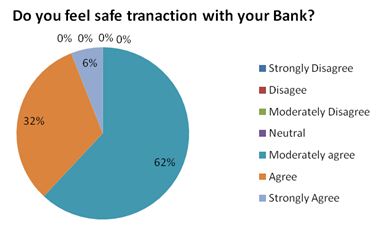

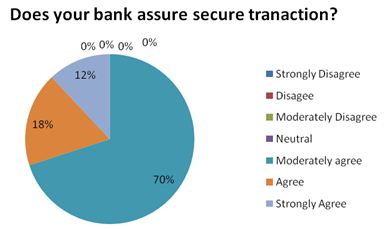

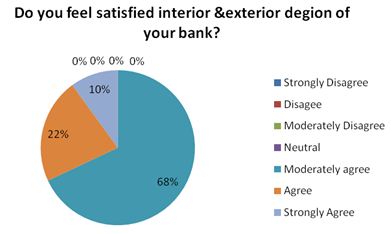

In this case study, I mainly focus on performance appraisal level of MBL. The sample size is 50.The numbers of variables are10. By using Questionnaire I try to take some inputs from the customers and try to understand the customer satisfaction level. Here I try to show the result of this study by Pie chart and now briefly describe this chart.

The sample size is 50. By using this variable I found this result,62% client moderately agree,32% agree , 6% strongly agree,0% strongly disagree , 0% Disagree, 0% moderately disagree & 0% Neutral.

By using this variable I found this result70% people moderately agree, 18% agree & 12% strongly agree.

By using this variable I found this result68% people moderately agree, 22% agree & 10% strongly agree.

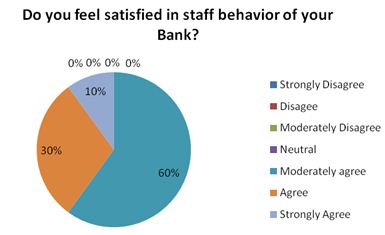

By using this variable I found this result, 60% people moderately agree, 30% agree & 10% strongly agree.

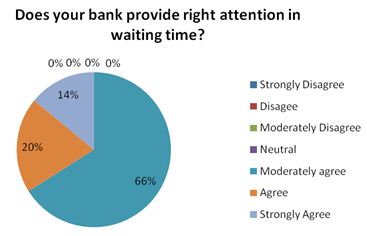

By using this variable I found this result, 66% people moderately agree, 20% agree & 14% strongly agree.

By using this variable I found this result, 68% people moderately agree, 22% agree & 10% strongly agree.

By using this variable I found this result, 62% people moderately agree, 18% agree & 20% strongly agree.

The sample size is 50. By using this variable I found this result, 60% client moderately agree,24% agree & 16% strongly agree.

By using this variable I found this result,64% people moderately agree, 24% agree & 12% strongly agree.

By using this variable I found this result,60% people moderately agree, 28% agree & 12% strongly agree.

In the end of this finding we can see that majority percentage (%) of the clients are moderately agree, some are agree and few are strongly agree.

SWOT Analysis:

Strength:

- First strength is that it is a shariah based bank.

- By this time it has established an integral, customer friendly relationship with its clients.

- It has prominent saving scheme named DPS for a fixed or lower income group of people of this society.

- It provides services even after the banking hour to special clients.

- Sound profitability growth and high asset quality.

- Experienced management.

- Honest, sincere, and dedicated employee competency.

- Wide market share and stable source of fund.

- High attention on recovery of overdue amount or pre-overdue situation.

- Close monitoring on investment clients.

- High attention on individual performance.

- High attention on making quality investment and disposal of proposals.

- All the officials/ manpower are dedicated and honest to serve its own duty.

Weakness:

- Traditional network system and lack of full scale automation.

- Lack of required ideas in modern investment products.

- Poor marketing of investment products.

- Lack of required information specifically on SME.

- No growth on carrier advancement. So the employee wants to switch anywhere.

Opportunity:

- Scope of market penetration through diversified investment products.

- Increasing awareness of Islamic banking among the clients.

- Scope of develop new committed entrepreneurs.

- Country wide branches having wide opportunities to access in different kinds of business.

- Service charges in other banks are comparatively lower than MBL

- No other banks could provide as much integral working atmosphere as Mercantile Bank Ltd.

Threats:

- Because of the intense competition, most of the competitor banks of Mercantile Bank are coming up with new service line ATM.

- In the money market of Bangladesh there is no call money system of Mercantile Bank.

Questionnaire:

Performance appraisal

Please help us to help you by completing this survey. The purpose of the survey is to improve the level of service in the Retail Banking.

Section

- Please indicate the extent to which you agree or disagree with the following statements about the service you received from the bank staff during your transaction.

- If you strongly disagree, please circle the number 1.

- If you strongly agree, please circle the number 7.

|

| Strongly Disagree | Strongly Agree | ||||||

| 1P) | Do you feel safe transaction with your Bank? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 2P) | Does your bank assure secure transaction? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 3P) | Do you feel satisfied interior & exterior design of your Bank? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 4P) | Do you feel satisfied in staff behavior of your Bank? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 5P) | Does your bank provide right attention in waiting time? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 6P) | Do you satisfy the employee behavior of your Bank? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 7P) | Do you feel satisfied the service charge of your Bank? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8P) | Do you feel satisfied using technology of your Bank? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 9P) | When you have a problem your bank should show a sincere interest in solving it? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 10P) | Does your bank provide individual attention in any work? | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

Conclusion:

The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central bank, 4 nationalized commercial banks (NCB), 5 government owned specialized banks,39 domestic private banks, 10 foreign banks and 28 non-bank financial institutions. Thefinancial system also embraces insurance companies, stock exchanges and co-operative banks. The commercial banking system dominates Bangladesh’s financial sector withlimited role of Non-Bank financial Institutions and the capital market. The Bankingsector alone accounts for a substantial share of assets of the financial system. The banking system is dominated by the 4 Nationalized Commercial Banks, which together controlled more than 54% of deposits and operated 3396 branches (55% of the total) as of June 30, 2003. So it’s difficult for a bank to survive unless it provides good quality and prompt services to its clients. The general banking division should provide utmostservices to retain the clients and should also try to attract more of them. The bank shouldhave a good amount of deposit, for this it already have good number of savings schemes, but reducing interest rate will certainly cut down depositor, so It should offer either thesame or higher than Its competitors.Borrower should be watched constantly and if borrower becomes defaulter the bank should issue legal notice to the defaulter. The bank should concentrate to recover the fullloans from the borrower. Experience and efficient employees should handle foreignexchange department. Foreign Trade section handles millions and millions taka everyday, so it should be done with caution and with utmost importance. On the whole thecustomer wants good, efficient and prompt service from a bank, so the bank shouldconcentrate on better customer service every time.MBL is steering a modern commercial bank, focused on the areas of core business of Consumer Banking, Corporate Banking and International Banking. The Bank’s greatestassets are the trust of its customers. To keep this trust the bank maintains professional andethical standards amidst all odds of competitive environment. Mercantile Bank iscommitted to seize the opportunities that lie ahead of it and its capable to build up aneven more robust and profitable organization maintaining its commitments and standards.

Recommendation:

- Though Mercantile Bank showed the reason of lowering the EPS issuing rightshares for the certain year. But itis not the satisfactory reasoning; the bank should increase its net income doing efficient utilization of investment of the Negative image often turns out the potential investors, whichlowers the market price of the share. Management should give keen eye onthis matter.

- Service charge should be reduced compared to other rival banks and shouldprovide extra facilities with its services.

- The existing ATM booths are not enough to meet the consumers demand. Sothe bank should increase the number of booths and those must be placed inconvenient locations. Moreover the bank should check the existing ATMbooths whether they are functioning properly on not;

- Good training and proper education have to be given to the personnel dealingwith the customers. So that they can motivate the customers and be moreinclined with the customer’s need and requirements, which leads to the overallcustomer satisfaction;

- Proper measure should be taken to reduce system failure to run the bank flawless;

- Mercantile Bank has to observe its competitors wisely and make its productmore attractive than its competitors. At any cost it has to be one step aheadfrom its competitors.

- The bank’s HR department should be more active, should communicate withthe employees directly to know their problems, quarries. At the time of performance evaluation they should be bias less, other wise it will hamper themotivation of the employees.

- Mercantile Bank should practice a participant managerial process because inthis all the workers get the chance for participating in problem recognition and problem solving, which will make the employees feel better. This will work asa motivation weapon. Also award-giving system should be activateddepending on the performance appraisal of the employees.