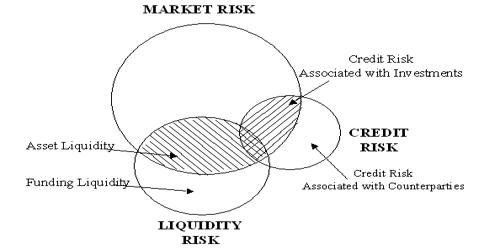

Liquidity is how easily an asset or security can be bought or sold in the market, and converted to cash. Funding liquidity is the availability of credit to finance the purchase of financial assets. It is the ability to satisfy the demand for money with immediacy. It is defined as the ability to settle obligations immediately when due. The International Monetary Fund (IMF) defines funding liquidity as “the ability of a solvent institution to make agreed-upon payments in a timely fashion”. Consequently, a bank is illiquid if it is unable to settle obligations on time.

- Sources of funding

Liquidity is the key source of revenue for banks and can be provided by either depositors or markets. Examples of fund sources include selling of assets and securities, syndicated loans, secondary market mortgages, capital markets, inter-bank markets, and capital by borrowing from a central bank. Funding or cash flow liquidity risk is the chief concern of a corporate treasurer who asks whether the firm can fund its liabilities. Funding liquidity is related to the degree of freedom and economic efficiency in relation to the borrowing of financial assets, whereas market liquidity is related to the selling of financial assets.

- Funding liquidity risk

The possibility that a bank could become unable to settle obligations with immediacy is called Funding Liquidity Risk. It refers to the risk that a company will not be able to meet its short-term financial obligations when due. Funding liquidity is essentially a binary concept: a bank can either settle obligations or it cannot. Funding liquidity risk, however, can take infinitely many values because it is related to the distribution of future outcomes. This risk is a major concern for cyclical companies where operating cash flows and debt obligation due dates might not match up perfectly. A different time scale is implicit in this distinction. Funding liquidity is associated with one particular point in time. Conversely, funding liquidity risk is always forward-looking and measured over a specific horizon. For example, a company may experience a season of strong performance followed by a season of weak performance.

Funding liquidity is essentially a zero-one concept, i.e. a bank can either settle obligations, or it cannot. The liquidity and profitability of the funding vary inversely. If cash is the most liquid asset and a non-profit asset at the same time, it is unlikely to bring benefits to an enterprise. Moreover, funding liquidity is a point-in-time concept, while funding liquidity risk is forward-looking. Like other risks, funding liquidity risk is forward-looking and measured over a specific horizon