Freight out is the cost of transportation associated with delivering goods from a supplier to a customer. It is the cost of transportation from the supplier to the customer, whether another business or a private customer. This expense should be charged to expense as it is incurred and recorded on the income statement under the cost of goods sold classification. Because freight-out expenses are only incurred when goods are sold, they are not recorded as an operating expense.

Freight out is not an operating expense because it is incurred only when the supplier sells goods to a customer (rather than incurring it as part of day-to-day company operating activities). Unless the manufacturer forwards the shipping to the customer, it should be charged as an occurrence and recorded in the cost of goods. In that case, it is recorded as a cost of goods sold expense but also in accounts receivable. This cost is included in the cost of the goods and is supposed to be added to the customer’s total cost for the goods.

Freight-out billings to customers should be treated as revenue only when they are the primary source of revenue for the shipping entity. Freight revenue should be recorded in a separate revenue account in this situation so that management can clearly see how much revenue is generated by this activity. And, because freight revenue is separately recorded, so should freight expense. This makes determining the amount of profit generated by these freight billings easier.

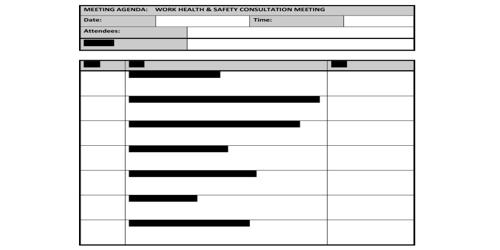

How do you record freight out?

Here are three steps to consider when recording your freight out expenses in your income statement:

(1) Charge freight out when you incur the cost

When you incur the cost of shipping your goods, account for your freight out charges. Unfortunately, because certain freight out charges may not be known until they are invoiced, you may be unable to do so right away. To account for the problem, many businesses record their freight out expenses in the period they receive the invoice, regardless of when the cost was incurred.

(2) Record freight out as a cost of goods sold

Because freight out shipping costs are proportional to the number of goods sold, they are classified as a cost of goods sold. Calculate your freight costs under the costs of goods sold section of your income statement to record this. This demonstrates that freight shipping costs are not an operational expense, but rather a variable cost based on the number of goods sold. Because the cost fluctuates with sales rather than acting as a fixed cost, you can budget for it more efficiently.

(3) Bill the customer

If you send the freight out cost to the customer, you can record it in the income statement as an unpaid bill next to the freight expense. This way, when the customer pays, the cost is offset. Depending on what you charge the customer and what you pay for the invoice, you may have a negative freight out expense. However, if you run a business that relies heavily on freight out shipping, you can include the billing to the customer as revenue rather than a bill.