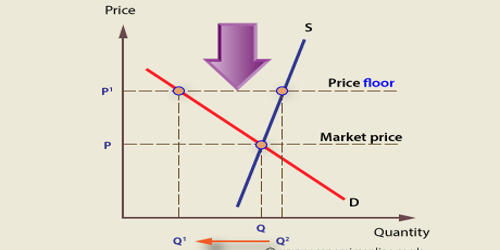

Floor Price prevents a price from falling below a certain level. It is the minimum price of a commodity determined by a government. A floor price is determined to save the interests of producers of raw materials. It is an established lower boundary on the price of a commodity in the market. It is the lowest price at which a product can be sold. It is a government- or group-imposed price control or limit on how low a price can be charged for a product, good, commodity, or service. Governments usually set up a price floor in order to ensure that the market price of a commodity does not fall below a level that would threaten the financial existence of producers of the commodity. When government laws regulate prices instead of letting market forces determine prices, it is known as price control.

The price floor is a situation when the price charged is more than or less than the equilibrium price determined by market forces of demand and supply. It has been found to be of great importance in the labor-wage market. This helps the government ensure higher wages and a good standard of living for the workers. They are also used often in agriculture to try to protect farmers. An effective price floor needs to be higher than the equilibrium price, the price at which supply and demand are equal.

Price floors are sometimes called “price supports,” because they support a price by preventing it from falling below a certain level. Its aim is to increase companies’ interest in manufacturing the product and increase the overall supply in the market place. Typically, a price floor is imposed when the economic activity slows down, and the supply of certain products is low, resulting in an increase in prices at levels that consumers cannot handle.

Types of Price Floors:

- Binding Price Floor –

A binding price floor is one that is greater than the equilibrium market price. A binding price floor is a required price that is set above the equilibrium price. The government is inflating the price of the good for which they’ve set a binding price floor, which will cause at least some consumers to avoid paying that price. This has the effect of binding that good’s market.

- Non-Binding Price Floor –

A non-binding price floor is one that is lower than the equilibrium market price. Producers and consumers are not affected by a non-binding price floor.