Introduction

In the past decade, many developed countries and some emerging market countries started implementing floating exchange rate in their exchange rate system. Bangladesh has abandoned fixed exchange rate regime in 2003 and now practices floating exchange rate system. This exchange rate has clear institutional commitment to ensure transparency and accountability of Central Bank and is not required to constantly maintain exchange rates within specified boundaries. The advantages of this exchange rate system is that a country is more insulated from the inflation and unemployment problems in others countries. But freely exchange rate system can adversely affect a country that has high unemployment by making weak currency more weakness.

The remittances of Bangladeshi nationals working abroad went up by 13.68 percent to US$ 1793.91 million during January-June 2005 as compared to US$ 1578.06 million during July-December 2004 and 12.07 percent higher than US$ 1600.71 million during the same period of last year.

Financial Management means the efficient and effective management of money (funds) in such a manner as to accomplish the objectives of the organization. It includes how to rise the capital, how to allocate it i.e. capital budgeting. Not only about long term budgeting but also how to allocate the short term resources like current assets. It also deals with the dividend policies of the share holders.

Methodology:

The report has been prepared on the basis of the experience gained during the period of the internship the significant features of the report is the use of the both primary and secondary data.

I have collected the primary data from the sample units by direct interview method. I have worked full time in the bank and observed customers service & dealing of all department.

The secondary data were collected from books, paper, magazine, bulleting, circular, memorandum, documents, and monthly transaction record book of the bank. The collected data and information have been tabulated, processed analyzed and graphically presented in order to make the study more informative, useful, and purposeful.

Section As Per Issues Covered

Meaning Of Foreign Exchange Rates

When goods and services are exchanged, there has to be determined some rate or exchange ratio between them. In other words, there must be some ‘price’. In the case of domestic exchange of goods and services, the exchange ratios between different goods and services exchanged are determined by taking the ratios of their prices that are determined in the market and are expressed in terms of the domestic currency. The determination of exchange ratios is, however, not so simple when the different commodities exchanged are produced in the different countries having different currencies. Before the ratios of exchange between different goods and services traded between any two countries can be known we must know the exchange rate between the currency units of the two countries. Foreign exchange rates are the links-which connect different national currencies and make international cost and price comparisons possible.

Foreign exchange rate between the currency units of two countries means the number of the units of one national currency that are needed to buy one unit of the other national currency. Either money or currency unit may be used as the unit for expressing the price of the other.

By linking together the currencies or money units of different countries, foreign exchange rates make the comparison of international costs and prices of goods and services possible. Consequently, they play a dominant role in determining the volume and direction of international trade.

Determination Of Foreign Exchange Rate

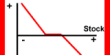

The foreign exchange rate has been defined either as the price of one unit of reign currency expressed in terms of units of the home currency or as the price of one unit of the home currency expressed in terms of the units of foreign currencies. Like the determination of price of a commodity or service in a free commodity market, the equilibrium foreign exchange rate is also determined in the free foreign exchange market by the demand for and supply of foreign exchange. To make the demand and supply functions of foreign exchange look like the familiar conventional market demand and supply functions we define the rate of exchange as the price of one unit of foreign currency expressed in terms of the units of the home currency.

Demand for Foreign Exchange

The functional relationship between the amount of foreign exchange demanded and the foreign exchange rate is expressed in the demand scheduled for foreign exchange. A demand schedule for foreign exchange is the list or schedule showing the different amounts of foreign exchange demanded at different rates of foreign exchange, ceteris paribus. It follows from the properties of this demand schedule that the amount of foreign exchange demanded and the rate of foreign exchange are inversely related such that a fall in the rate of exchange is followed by an increase in the quantity of foreign exchange demanded and vice versa.

The reason for this inverse relationship is that given the elastic demand for imports, a given percentage increase in exchange rate by making imports costlier reduces the demand for them by a still higher percentage. Consequently, it also reduces the total amount of foreign exchange demanded to pay for imports. On the other hand, a lower (a given percentage fall) rate of exchange by making imports cheaper increases by more than the given percentage fall in the rate of exchange the demand for imports and consequently increases the demand for foreign exchange needed to pay for higher imports. Thus, ordinarily the demand for imports and the quantity of foreign exchange demanded to pay for imports change in the direction opposite to that of changes in the rate of exchange.

Supply of Foreign Exchange

The supply schedule or curve of foreign exchange shows the different amounts of foreign exchange that are available at different rates of exchange in the foreign exchange market Autonomous components of aggregate supply of foreign exchange are the counterpart of the autonomous components of the aggregate demand for foreign exchange. The sources of supply of foreign exchange appearing on the credit side of the international balance of payments of a country are the exports of goods and services, capital inflows and inward unilateral transfer receipts. These sources of supply of foreign exchange depend largely upon the decisions of foreigners. The total amount of different goods and services which a country can export and, therefore, the total amount of foreign exchange which she can acquire through exports depends upon the quantity of different goods and services which the residents of foreign countries are willing to import from a particular country. The amounts of capital inflows and unilateral transfer receipts depend upon the decisions of the foreign investors to invest in any given country. These decisions are based on the same considerations on which are based the home decisions relating to the movements of domestic capital in the opposite direction. Thus, ceteris paribus, a country’s exports-which are imports of other countries-are a function of the foreign exchange rates because these determine, given their domestic prices, the prices of exports expressed in term of the foreign currencies.

Equilibrium Foreign Exchange Rate:

Having derived the demand and supply curves of foreign exchange, the equilibrium rate of foreign exchange in the free foreign exchange market is determined at the point of intersection of the supply and demand curves for foreign exchange.

Exchange Rate System:

Exchange rate systems can be classified according to the degree by which exchange rates controlled by the government. Exchange rate systems normally fall into one of the following categories:

- Fixed

- Freely floating

- Managed float

- Pegged.

Each of these exchange rate systems is discussed in follows:-

Fixed Exchange Rate System:

In a fixed exchange rate system, exchange rates are either held constant or allowed to fluctuate only within very narrow boundaries. If an exchange rate beings to move too much, governments interview to maintain it within the boundaries.

From 1944 to 1971, exchange rates were typically fixed according to a system planned at the Bretton Woods conference (held in Bretton Woods, New hampshire, in 1944) by representatives from various countries. Because this arrangement, known as the Bretton Woods Agreement, lasted from 1944 to 1971, that period is sometimes referred to as the Bretoon Woods era. Each currency was valued in terms of gold.

In December 1971, a conference of representatives from various countries concluded with the Smithsonian Agreement, which called for a devaluation of the U.S. dollar by about 8 percent against other currencies.

By March 1973, most governments of the major countries were no longer attempting to maintain their home currency values within the boundaries established by the Smithsonian Agreement.

Advantages of a fixed exchange rate system. In a fixed exchange rate environment, MNCs may be able to engage in international trade without worrying about the future exchange rate. Consequently, the managerial duties of an MNC are less difficult.

Disadvantages of a Fixed Exchange Rate System. One disadvantage of a fixed exchange rate system is that there is still risk that the government will after the value of a specific currency. Although an MNC is not exposed to continual movements in an exchange, it does face the possibility that its government will devalue or revalue its currency.

A second disadvantage is that from a macro viewpoint, a fixed exchange rate system may make each country more vulnerable to economic conditions in other countries.

An additional advantage of a freely floating exchange rate system is that a central bank is not required to constantly maintain exchange rates within specified boundaries.

A freely floating exchange rate system can adversely affect a country that has high unemployment.

Managed Float Exchange Rate System:

The exchange rate system that exists today for some currencies lies somewhere between fixed and freely floating. It resembles the freely floating system in that exchange rates are allowed to fluctuate on a daily basis and there afternoon official -boundaries. It Fs similar to the fixed rates international government can and sometimes do intervene to prevent their currencies from moving too far in a certain direction. This type of system is known as a managed float “dirty” float (as opposed a “clean” float where- rates float freely without government inter-venation).

Criticism of a Managed Float System. Some critics suggest that a managed float ”system allows a government to manipulate exchange rates in a manner that can benefit its own country at the expense of others. For example, a government may attempt to weaken its currency to stimulate a stagnant economy. The increased aggregate demand for products that results from-such a policy may reflect a decreased aggregate demand for products in other countries, as the weakened currency attracts foreign demand.

Pegged Exchange Rate System:

Some countries use a pegged exchange rate arrangement, in which their home currency’s value is pegged to a foreign currency or to some unit of account. While the home currency’s value is fixed in terms of the foreign currency (or unit of account) to which it is pegged, it moves in line with that currency against other currencies.

Analysis (Own)

Our Country export Scenario are as follows

The country’s export earnings during the last fiscal year amounted to over Tk. 532.33 billion (53,233 crore) against over Tk. 448.27 billion of the previous fiscal, up by about Tk. 84.07 billion 6r 18.75 percent.

The export earnings during the financial year was nearly Tk. 20.79 billion or 4.06 per cent higher than its target of around Tk. 511.55 billion.

The earnings during June 2005 rose to about Tk. 55.38 billion from Tk. 50.673 billion of the corresponding month of the last fiscal, showing an increase by nearly Tk. 4.71 billion or 9.29 per cent, according to the Export Promotion Bureau (EPB).

Of the total exports, -earnings from export of primary goods during the last fiscal amounted to about Tk. 39.88 billion while it was around Tk. 492.46 billion from industrial products.

The earnings from primary goods were nearly Tk. 3.49 billion and it was more than Tk. 50 billion from the industrial products during June this year.

The export earnings from primary goods went, up by 4.56 per cent compared to the target of about Tk. 38.14 billion and export earnings from industrial goods exceeded the Tk. 488.74 billion target by 0.76 percent.

The earnings from export of knitwear, jute goods, engineering products, raw jute, computer services, ceramic tableware, shoes, electronics, handicrafts, agricultural products and chemical products surpassed their export targets during the period.

On the other hand, the exports of woven garments, bicycle, petroleum by-products, leather, tea, other primary goods, frozen foods, textile fabrics, home textile and other industrial goods failed to reach their targets.

Exports of frozen foods, raw jute, woven garments, jute goods, engineering products, computer services, ceramic tableware, shoes, electronics, handicrafts, agricultural products, home textile, knitwear and chemical products increased from export during the previous fiscal.

The United States (US) retained its position as the top importing country of Bangladeshi goods by importing 27.87 per cent of total Bangladesh exportable in the US$ market during the fiscal, which amounted to US$ 2,412.05 million (about Tk. 148.37 billion.

The country exported goods worth US$ 1,353.80 million to Germany, US$ 943.17 million in Britain US$ 66.17 million in France, US$ 369.18 million in Italy and US$ 325.43 million in Belgium and Netherlands.

As per aforesaid export situation, exchange rate movement affect our country cash inflows received from exporting and other causes and the amount of cash outflows needed to pay for imports and for other reasons. As economic condition change exchange rate can change substantially. A decline in currency value is often referred to as deprecation.

Factors that influence our floating exchange rate.

The equilibrium exchange rate change overtime as supply and demand schedules. The factors that cause currency supply and demand schedules to change are-

1. Relative inflation rates:

Changes in relative inflation rates can affect international trade activities which influences the demand for and supply of currencies and therefore influences exchange rate movement.

2. Relative interest rates:

Changes in relative interest rates affect investment in foreign securities, which influences the demand and supply of currencies and therefore influences exchange rates.

3. Relative income level:

A third factor affecting exchange rates is relative income levels. Due to high income unnecessary and luxurious foreign goods will be imported. That case foreign currency will spend more which negatively effect our foreign currency reserve.

4. Government controls:

A fourth factor affecting exchange rates is govt. controls such as-

- Imposing foreign exchange barriers

- Imposing foreign trade barriers

- Intervening (buying and selling currencies) in the foreign exchange market.

Because of Bangladesh has been now adopted floating exchange rate that case demand and supply for currency occur openly and freely without any govt. intervention. Due to this, Bangladesh economy and foreign trade and financing is being influenced by following ways.

- Proper banking channel remittances.

- Reduce under invoicing & over invoicing practices.

- Reduce trade gap.

- Creation new employment.

- Industrialization.

- Enhance export volume.

But as our income distribution is not properly maintained, Inflation is high and currency is weaken gradually that case floating exchange rate adversely affect our country economy and foreign trade and foreign financing at all.

Summary & Conclusion

The overall economic situation in Bangladesh showed an upward trend during July 2004-June 2005. During the period reserve money, broad money, net foreign assets, foreign exchange reserves, export earnings, remittances, govt. revenue receipts, food production and industrial production increased as compared to those in the preceeding three (03) years.

On the other hand investment of Scheduled Banks decreased during the period as compared to the preceeding three (03) years. Rate of inflation on twelve month average basis increased to 6.83 percent in June 2005 from 5.35 percent in December 2004 and from 4.88 percent in December 2003 (Source –as per The Institute of Bankers, Bangladesh IBB, half yearly journal, June 2005).

Due to floating exchange rate system Bangladeshi national who working abroad are being highly encouraged for sending remittances because of after conversion of foreign currency (Specially against dollar & pound) they are getting more home currency.

On the other hand as inflation rate is high and our currency is gradually weaken that case direct foreign investment and indirect foreign investment i.e. portfolio investment is on decline trend.

Due to the hike in the prices of oil in the international market and unbridled rise in the number of LCS for importing essentials, luxury goods, capital machinery etc., during most part of the last financial year created a substantial pressure on the foreign currency reserve. The lowering of lending rates of commercial banks at the insistence of the IMF contributed to the rise in imports and inflationary pressure. Due to foreign reserve pressure govt. impose some restriction such as margin for letter of credit (LCs) on some special prohibited imported goods.

For that scenario floating exchange rate stimulates Bangladeshi nationals who are working abroad to remittances foreign currency in home by which we can restore our foreign reserve at minimal level (i.e. satisfactory level) and is helping partially to make payment of our imported daily necessary goods, capital machinery which again regenerate our income, productivity and export oriented goods.

In a nutshell I may draw a conclusion speech that as in recent year many developed countries and growing number of developing countries have adopted floating exchange rate in their exchange rate system that case we cannot abandon this exchange rate-which is very logical and acceptable for our international trade & foreign financing and economic emancipation.

Bibliography

1. Published Articles:

- Half-yearly Journal of The Institute of Bankers, Bangladesh (IBB), Volume-48 January-June-2002

- Half-yearly Journal of The Institute of Bankers, Bangladesh (IBB), Volume-51, Number-2, July-December-2004

2. Text Book:

i. International Financial Management

7th Edition, Jeff Madura

ii. Money, Banking and International Trade, Eighth Revised Edition, MC Vaish

iii. Shapiro, A. 1991. Foundations of Multinational Financial Management. Ally and Balon.

3. Published Articles: In Daily News Paper.

i. Editorial, The tariff cut riddle and forex reserve-

The Financial Express, Sunday 7th August 2005

ii. Editorial, Export earnings in Last FY-

The Financial Express- Friday- 2nd September 2005

4. BBO, 1972 Bangladesh Bank Order 1972, President Order No. 127

of 1972, Deptt. of Public Relations and Publications Bangladesh Bank, Dhaka.

5. BBO, 2003 Bangladesh Bank Order 1792. President Order No. 127 of 1972, Deptt. of Public Relations and Publications, Bangladesh Bank, Dhaka. Incorporating all amendments there up-to march 10.2003.