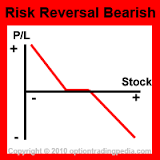

Basic purpose of this article is to define and discuss on Risk Reversal. A risk reversal is often a position which simulates benefit and loss actions of owning a underlying security; it is therefore sometimes called any synthetic long. This is a investment strategy in which amounts to both investing out-of-money options concurrently. In this technique, the investor will first come up with a market hunch; if that inkling is bullish he may wish to go long. This plan protects against bad, downward price moves but limits the profits which can be made from beneficial upward price moves. Risk reversal techniques go by a number of names, but the majority of us are familiar having guarantees and refunds.

Define and Discuss on Risk Reversal