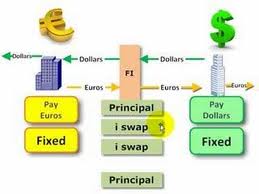

Broad objective of this article is to Explain Difference between Currency Swaps and Rate Swaps. The definition of a currency swap is basically just like any other rate swap. However, there are some unique differences between both. One of the largest ones, however is the fact this type of swap enables the exchange of key. This means a company can certainly exchange one debt regarding another. Often times this really is done because a business can reduce its potential risk by getting a debt in a diverse currency. Generally three ways a currency swap can be used, because of this difference, they are Exchange Principal, Principal and Interest and Interest Only.

Explain Difference between Currency Swaps and Rate Swaps