The earnings multiplier, often known as the price-to-earnings ratio (P/E), is a financial statistic that compares a company’s current stock price to its earnings per share (EPS), which is simply calculated as price per share/EPS. In straightforward words, it is a proportion of valuation to figure out the thing financial backers will pay for each and every measure of dollar an organization can acquire. It is utilized as a valuation instrument to look at the offer cost of an organization with that of comparative organizations.

On an earnings-relative basis, the earnings multiplier can also assist investors in comparing current company values to previous stock prices. It may be used to evaluate the financial health of a firm. When making investing selections, the price-to-earnings ratio of different firms can be compared. The market value per share is the current exchanging cost for one offer an organization, a generally clear definition.

Earnings per share (EPS), on the other hand, may not be as straightforward for most investors. The earnings multiplier can assist investors in determining how pricey a stock’s current price is in comparison to the company’s earnings per share. It assesses the return on an investor’s investment in relation to the amount invested. Furthermore, the share price of a corporation is determined by the firm’s future worth.

The earnings multiplier likewise shows the exhibition of an organization contrasted with its industry partners. Earnings Per Share (EPS) is a key monetary metric that financial backers use to evaluate an organization’s exhibition and productivity prior to contributing. It is determined by isolating absolute profit or all-out total compensation by the complete number of remarkable offers. The most conventional and generally used variant of the EPS computation, known as a trailing earnings multiplier or trailing P/E, is based on the preceding four quarters of the price-to-earnings ratio.

Investors can utilize the profit multiplier for the valuation of a company’s stocks and contrast it and industry partners or market files like the NASDAQ Composite. The income multiplier is an incredible, however, restricted device. It provides investors with a rapid overview of the company’s finances without getting mired down in the specifics of an accounting report. It’s a great tool for measuring how pricey a stock’s current price is in comparison to the company’s profits per share.

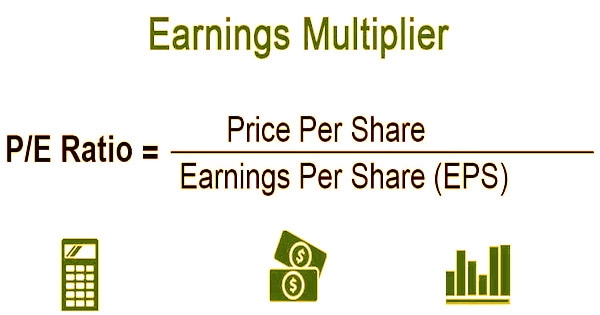

The earnings multiplier can be calculated using the following formula:

Earnings Multiplier or P/E Ratio = Price Per Share/ Earnings Per Share

Where:

- Price per share is the prevalent market price of a company’s stock. It is the price at which the company’s shares are trading in the exchange market.

- Earnings per share is the net profits earned by the company per share outstanding in the stock market.

The earnings multiplier is like a limited income in that future profits are moved back to decide the amount they are worth in the present dollars. If a stock’s price is historically high in relation to the company’s earnings, it may signal that now is not the best time to buy since the stock is overpriced. Investors can analyze the P/E ratios of different firms to determine where they should invest.

Comparing earnings multipliers among similar firms may also show how pricey different companies’ stock prices are in comparison to one another. The earnings multiplier is restricted; it does not provide a complete picture for a potential investor; rather, it is a useful tool in a financial toolbox. Because of the following factors, the profits multiplier might be large or low:

- When a larger number of investors express interest in a company’s shares, the price of those shares rises, resulting in a bigger profits multiplier. When a company’s stock is cheap, the earnings multiplier is low.

- Companies that are growing typically have a high-profit multiplier. Companies with poor or negative growth, on the other hand, have a low profits multiplier.

Financial backers utilize the earnings multiplier to sort out how much an organization is worth, today, in view of how it is relied upon to fill later on. On the off chance that the forward income multiplier is lower than the following earnings multiplier, it suggests that the investigators are anticipating an increment in the organization’s income. In contrast, if the future earnings multiplier is bigger, experts expect the company’s earnings to fall.

Information Sources: