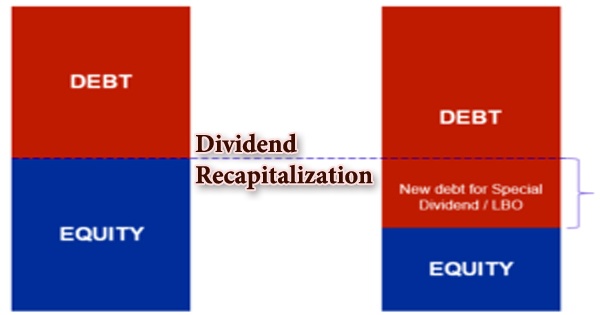

A dividend recapitalization (also known as a dividend recap) is a financial arrangement in which a business borrows money to pay a big (or “special”) dividend. It is a form of leveraged recapitalization in finance that involves a private company issuing new debt, which is then used to pay a special dividend to shareholders (thereby, reducing the company’s equity funding in relation to debt financing). It happens when an organization assumes a new obligation to deliver an extraordinary profit to private financial backers or investors. This kind of profit differentiates forcefully to a conventional profit. A customary profit is generally little and upheld by the progressing income of the business and, hence, doesn’t change the capital design tangibly.

In contrast to a traditional dividend, which is paid on a regular basis from the company’s profits, a dividend recapitalization happens when a company increases debt to finance the dividend, such as by issuing bonds. The newly incurred debt, not the company’s profits, is the source of dividends distributed as a consequence of dividend recapitalization. The recapitalization straightforwardly impacts the organization’s capital construction since its influence increments. A dividend recapitalization is often used to free up funds for the PE company to return to its investors without having to go public, which can be risky.

The dividend recap is one of two so-called leveraged recap strategies, with the leveraged equity buyback being the other. It’s a rare thing, and it’s not the same as a corporation declaring daily earnings-based dividends. These kinds of recapitalization can be minor acclimations to the capital design of the organization, or can be huge changes including an adjustment of the force structure also. It has exploded in popularity, largely as a way for private equity firms to recoup some or all of the money they spent to buy a company.

Creditors and common shareholders usually dislike the practice because it lowers the company’s credit rating while helping only a few people. After a dividend recap, the corporate balance sheet resembles that of a traditional LBO balance sheet (i.e., a dividend recap is a form of leveraged transaction). Therefore, two main changes occur:

- The company’s ownership hasn’t changed, but current shareholders now have more money in their pockets and a lower equity claim on the company (and less capital at risk).

- Since the company is now much more leveraged, it will need to focus more on producing cash flows to sustain the increased debt burden (cost control, efficiencies etc.).

If a company cannot make its debt payments, satisfy its loan covenants, or rollover its debt, it experiences financial distress, which sometimes leads to bankruptcy, as it does with other leveraged loans. Preceding leaving a portfolio organization, some private value firms and dissident financial backers pick to bring about extra obligation on the monetary record of the organization to convey early installments to their restricted accomplices or potentially directors. This lessens the danger for the organizations and their investors. As a result, a leveraged recapitalization’s additional debt burden makes a company more vulnerable to unanticipated market challenges, such as recessions and financial crises.

Uses of Dividend Recapitalization:

- To exit an investment: Private equity companies and private equity groups (PEG) are the most common users of dividend recapitalization. It is commonly used as a means of leaving a private equity fund. In such a case, a dividend recapitalization is a practical option in contrast to customary leave courses, for example, an offer of the stake to another private value firm or an Initial Public Offering (IPO).

- To recover an initial investment: Dividend recapitalization can also be used when an investor (investment firm) wants to recover their initial investment without losing their interest in the company.

- To avoid using earned profits for dividends: Furthermore, dividend recapitalization removes the need to pay dividends to shareholders from the company’s received income. In a low-interest rate setting, some businesses can depend on it.

This exceptional profit, notwithstanding not financing the portfolio organization’s development, weighs further on its asset report as influence. Critical new obligation can possibly turn into a drag in unfriendly economic situations, following the organization’s exit. It’s a popular strategy used by private equity firms to capitalize some of their gains while keeping control. When equity investors want to realize value from a private company but don’t want to sell their stake in the company, a dividend recapitalization is usually sought.

As a result, a dividend recap (or even a leveraged share buyback) is a viable alternative to more conventional exit strategies like outright selling or IPO. However, portfolio organizations chose for profit recapitalizations have truly been for the most part sound and ready to withstand extra obligation. This is generally because of new turns of events, moved for by private value supports, which produce more grounded incomes. However, financial sponsors aren’t the only ones that use the recap process. Ordinary corporations may also decide to do a dividend recap. Reasons for this could include:

- Increased use of tax shield

- Room for maneuver without affecting the existing credit rating

- To force management to greater efficiencies and cash flow focus

- To benefit from low-interest rates

The solid incomes empower private value patrons to get quick halfway profits from their venture since different roads of liquidity, like public business sectors and consolidations, take additional time and exertion. While dividend recapitalization benefits shareholders by allowing them to recoup their initial investments, it can also be risky for the company undergoing the phase. The likelihood of a corporation defaulting on its financial commitments rises as its debt rises. As a result, the recapitalization could result in financial hardship and, eventually, bankruptcy.

Typically, the high influence for the most part coming about because of a profit recap ought to be stayed away from by organizations that have a high operational danger or that as of now have high influence or a feeble credit score. Creditors and shareholders who are not entitled to a special dividend (e.g., common shareholders) are usually opposed to the practice due to the increased financial risk. It leaves the organization more defenseless against unanticipated business issues and antagonistic economic situations. Likewise, the organization’s credit score may diminish.

Information Sources: