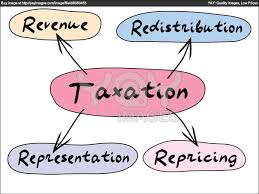

Major objective of this article is to Discuss on Impacts of Globalization on Taxation. While operating in a global economy, there are bound to get dissimilarities and incompatibilities between laws or regulations between individual economies. One in particular is taxation. Two important issues surrounding taxation in a global economy are tax havens and double taxation treaties. Dual taxation is another critical issue surrounding taxation along with globalization. Double taxation occurs any time an MNC is operating in a host country. The MNC is responsible for paying the taxes levied by both their home and host countries.

Discuss on Impacts of Globalization on Taxation