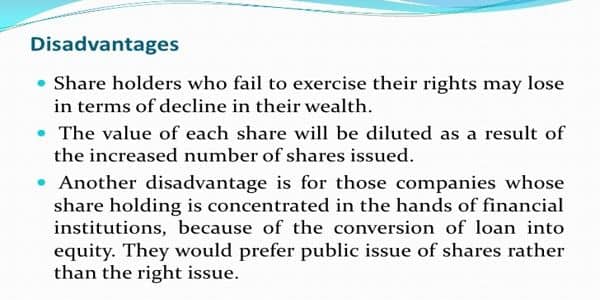

Preference shares are issued by companies seeking to raise capital, combine the characteristics of debt and equity investments, and are consequently considered to be hybrid securities. The main disadvantage of owning preference shares is that the investors in these vehicles don’t enjoy the same voting rights as common shareholders. Another major disadvantage is that it is a costly source of finance and has preferential rights everywhere.

Disadvantages of Preference Shares

The main disadvantage of owning preference shares is that the investors in these vehicles don’t enjoy the same voting rights as common shareholders. This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders.

Although the guaranteed return on investment makes up for this shortcoming, if interest rates rise, the fixed dividend that once seemed so lucrative can dwindle. During significant market fluctuations, there are doubts about how much dividends the shares will yield. This could cause buyer’s remorse with preference shareholder investors, who may realize that they would have fared better with higher interest fixed-income securities. Thus, those with slightly lower risk appetite may not prefer taking too many chances in this specific investment option.

- There are no voting rights for preference investors

The key disadvantage of owning preferred shares is the absence of ownership rights in the business. From an investor perspective, the business is not liable to preferred shareholders as opposed to equity shareholders.

- Heavy and Accumulation of Dividend

Usually, preference shares carry a higher rate of dividend than the rate of interest on debentures. The arrears of preference dividend accumulate in case of cumulative preference shares. It is a permanent burden for the company.

- Higher cost than debt for issuing company

In order to finance projects, businesses will try to raise capital through debt and equity issues which are basically costs associated with operations. Businesses that choose equity in place of debt issues are able to attain a lower debt to equity ratio. This offers them a significant benefit in terms of leveraging for additional financing from new investors.

- Way to Liquidation

Sometimes, instead of using the available limited cash for productive purpose, the Board may give it to the preference shareholders as dividend. In the long run, this may lead to insolvency.

- No Income Tax exemption:

Since preference dividend is not deducted for income tax purpose, the company has to earn more. Otherwise, the dividend to equity shareholders will be affected.

Lastly, these shares are issued primarily by companies that have a substantial market capitalisation and can provide substantial dividends to a very large subscriber base for a sustained period. It might seem a risk-mitigating factor but may or may succeed in the real world.

Information Source: