The main objective of this report is to analysis Developing Countries in the World Trade in Agricultural. Other objectives of this reports are to establish a fair and market-oriented agricultural trading system, to defend the interest of the developed countries, Finally this report make swot analysis Developing Countries in the World Trade in Agricultural.

Developing Countries in the World Trade in Agriculture: Bangladesh Perspective.

Agriculture directly or indirectly, is the main source of livelihood of most of the people all over the world. It provides a considerable portion of the national GDP of all developing countries and for the poor countries it provides the main portion of GDP. However, the World Trade Organisation (WTO) is the key organisation for controlling the world trading system and of which agriculture is one of the key concerns. The WTO Agreement on Agriculture (AoA) is the sole instrument controlling the world trade in agriculture and agricultural products.

The object of the agreement is to “establish a fair and market-oriented agricultural trading system” and it contains rule regarding three broadly categorised groups, a) market access, b) domestic support, and c) export competition. Has it so far managed to establish a fair and market-oriented agricultural trading system? This is the main concern for the developing countries and especially for the least developing countries (LDC). The text does not properly reflect the will and aspirations of the developing countries, rather it contains some rules which are inconsistent with the interest of the developing countries. It seems that the agreement is more intent to defend the interest of the developed countries.

However, as a signatory party of WTO Agreement on Agriculture, Bangladesh have a lot of concerns on the agreement in order to gain its own interest. Bangladesh is crucially facing the high price rate of food in world market. It cannot effort to feed 150 millions of people by importing from the world market at a higher price, where the rice price is now double than one year before. In order to provide food to our people we have to increase production of food and at the same time Bangladesh as well as other developing countries need to have equal opportunities to export their agricultural products in the world market. But we have lack of technology, research methodology and indeed easy access to fertiliser which are must to increase food production. This paper shall discuses the problems and prospects of the agreement and the interests of Bangladesh in world trade in agriculture shall also be critically analysed.

Referring to the multilateral trading system, Martin Wolf of the Financial Times noted:

The multilateral trading system at the beginning of the twenty-first century is the most remarkable achievement in institutionalised global economic cooperation that there has ever been.

Through out this article, we will discuss whether the multilateral trading system makes a level playing field for the developing countries in the world trading system or not.

This paper consists of six separate chapters. Following the introductory first chapter, the second chapter is a brief of the General Agreement on Tariffs and Trade, 1947. The third chapter is the most important part of the paper as it scrutinises the WTO ‘Agreement on Agriculture’ from different point of views and its positive sides as well as its lacks along with the governing principles of the WTO. However, the fourth chapter deals with the interests of the developing countries in the world trade in agriculture and it also contains a separate part on Africa. The fifth chapter analyses agriculture of Bangladesh from different point of views. It tries to find out the reasons why Bangladesh is lacking behind in comparison with other countries in agricultural sectors. It also speaks of the on going WTO negotiations and how we can defend our interest in future negotiations. Finally the concluding chapter ends with some recommendations how Bangladesh can compete with the world trade in agriculture in future.

‘The General Agreement on Tariffs and Trade (GATT 1947)’

International trade needs some guiding mechanisms to benefit the people allover the world. In order to control the world trade in 1947 the ‘General Agreement on Tariffs and Trade’ (GATT) was established. The Governments of 24 countries mutually entered into reciprocal and mutually advantageous arrangement directed to the substantial reduction of tariffs and other barriers to trade and to the elimination of discriminatory treatment in international commerce which was the main instrument to control the international trade and tariff. Recognising that their relations in the field of trade and economic endeavour should be conducted with a view to raising standards of living, ensuring full employment and a large and steadily growing volume of real income and effective demand, developing the full use of the resources of the world and expanding the production and exchange of goods.

However, among all of the principles embodied in the said instrument some majors were, General Most-Favoured-Nation Treatment, National Treatment on Internal Taxation and Regulation, Freedom of Transit, Anti-dumping and Countervailing Duties, Valuation for Customs Purposes, Fees and Formalities connected with Importation and Exportation, Marks of Origin, Publication and Administration of Trade Regulations, General Elimination of Quantitative Restrictions, Restrictions to Safeguard, Exceptions to the Rule of Non-discrimination, Subsidies, Governmental Assistance to Economic Development, etc. These principles were the rules to regulate the international trade.

In addition, the GATT, 1947 had lack of a strong mechanism in case of any violation of the rules embodied here. There was no dispute settlement authority which would take steps to give remedy where any contracting member suffers substantial injury by the acts of other members. Moreover, the GATT, 1947 did not has rules about the agricultural trading system which is now one of the most important concern of world trade.

Sources of the WTO Laws.

The GATT, 1947 was established for the substantial reduction of tariffs and other barriers to trade and to the elimination of discriminatory treatment in international commerce. But in course of time it proved as insufficient to control the world trade, which became very wide and spread by couple of decades. World’s ruling economies and also the developing countries felt it necessary to establish a new mechanism to control the world trade. In order to establish a new organisation to manage the world trade, negotiation was going on for several years. Finally in 1995 the World Trade Organisation (WTO) was established as a result of 10 years long Uruguay Round of multilateral trade negotiations. Here we will discuss about the sources of the laws of the WTO.

Basic Principles of WTO.

The law of the WTO is specialised and focuses on the world trade only. It contains various issues like tariffs, import quotas, customs formalities, intellectual property right, national security measures etc. However, there are distinct six groups of basic rules and principles of the WTO.

These basic rules and principles of the WTO law make up the multilateral trading system. This chapter contains a brief review of these basic rules and principles constituting the multilateral trading system.

The principles of non-discrimination:

There are two principles regarding non-discrimination in WTO law: the most favoured-nation (MFN) treatment obligation and the national treatment obligation.

The MFN treatment obligation provides that a WTO member is not allowed to discriminate between its trading partners, for example, by giving more favourable treatment with respect to market access for the products imported from some countries than the products imported from other countries. This rule is so important that without it the multilateral trading system would not exist.

The national treatment obligation requires a WTO member to treat the foreign products, services and service suppliers in a same manner as it does for the like domestic products, services etc. it means a WTO member is not allowed to discriminate against foreign products, services and service suppliers. The foreign products once crossed the border and entered the market it will not be subject to different taxation or regulation than like domestic products. However, for trade in goods the national treatment obligation has general application to all trade. By contrast, for trade in service, the national treatment obligation does not have such general application. It applies only to the extent a WTO member has explicitly committed itself to grant ‘national treatment’ in respect of specific service sector.

The rules on market access

WTO law contains four groups of rules regarding market access:

- rules on custom duties;

- rules on other duties and financial charges;

- rules on quantitative restrictions;

- Rules on other ‘non-tariff barriers’.

The imposition of custom duties is not prohibited in WTO law. However, WTO law calls upon members to negotiate mutually beneficial reduction of custom duties. These negotiations results in the tariff concessions or bindings set out in the Member’s Schedule of Concessions. The products for which tariff concession or binding exists, the customs duties may no longer exceed the maximum level of duty agreed to.

While customs duties are, in principle, not prohibited, quantitative restrictions on trade in goods are, as a general rule, forbidden. Unless one of many exceptions applies, WTO members can not ban the importation or exportation of goods or subject to quotas.

Among ‘other non-tariff barriers’, the lack of transparency of national trade regulations definitely stands out as a major barrier to international trade. Transparency and the fair application of fair trade regulations are therefore part of the basic rules on market access.

The rules on unfair trade:

WTO law does not directly provides general rules on unfair trade rather it does have a number of relatively detailed and highly technical rules relating to unfair trade. These rule deals with dumping and subsidised trade.

Dumping means to export a product onto the market of another country at a price less than the normal value of the product. It is condemned but not prohibited in WTO law. However, when the dumping causes substantial injury to the domestic industry of a Member then WTO law allows that member to impose anti-dumping duties on the dumped products in order to offset the dumping. Subsidies i.e. financial contribution by a government or by public body that confers a benefit, are subject to an intricate set of rules. Some subsidies, such as export subsidies, are, as rule prohibited. Other subsidies are not prohibited but when they cause adverse effects to the interests to the interests of other Members, the subsiding Members should withdraw the subsidy or take appropriate steps to remove the adverse effects. If the subsiding Member fails to do so, counter measures commensurate with the degree and nature of the adverse effect may be authorised.

Trade liberalisation versus other societal values and interest:

The rule regarding ‘Trade liberalisation versus other societal values and interest’ allow a WTO member to take account of economic and non-economic values and interest. Economic interests include the protection of domestic industry from serious injury inflected by as unexpected and sharp surge in import. Non-economic interests include the protection of the environment, public health, public morals, national treasures and national security.

Special and deferential treatment for developing country members:

WTO law recognising the need for positive efforts designed to ensure that developing country Members and especially the least-developed countries among them are integrated into the multilateral trading system. WTO law includes many provisions granting a degree of special and differential treatment to the developing country Members. In many areas they provide for fewer obligations differing rules for developing countries as well as for technical assistance.

Institutional and Procedural rules:

The multilateral trading system includes and depends on, institutional and procedural rules relating to decision-making and dispute settlement. The WTO’s procedure for resolving trade quarrels under the Dispute Settlement Understanding is vital for enforcing the rules and therefore for ensuring that trade flows smoothly. Countries bring disputes to the WTO if they think their rights under the WTO agreements are being infringed. Judgments by specially-appointed independent experts are based on interpretations of the agreements and individual countries’ commitments. The system encourages countries to settle their differences through consultation. Failing that, they can follow a carefully mapped out, stage-by-stage procedure that includes the possibility of a ruling by a panel of experts, and the chance to appeal the ruling on legal grounds.

Agreements on Agriculture:

Overview of the Agreement on Agriculture:

In 1995, the year that the WTO was established, the first effective rules governing international trade in agriculture and food were introduced. Following the Uruguay Round negotiations, all agricultural products were brought under multilateral trade rules by the WTO’s Agreement on Agriculture. The main object of the agreement, “is to establish a fair and market-oriented agricultural trading system”.

Agriculture was brought under the purview of GATT, 1994 with a view to minimise distortions in global trade in agricultural and food products. Negotiations on agricultural trade had earlier been excluded from GATT, 1947 on the ground of food security and socio-political stability, which made agriculture different from other sectors of the economy. By the time the Uruguay Round of negotiations began, many countries had started voicing the need to liberalise agriculture, particularly for opening this highly protected sector in the developed countries to more efficient producers from developing countries. For implementation of the rules agreed during the Uruguay Round of multilateral trade negotiations, the GATT Secretariat has been transformed into the World Trade Organisation on January 1, 1995.

The commitments under the Agreement on Agriculture (AoA) may be broadly categorised into thee groups, a) market access, b) domestic support, and c) export competition:

- Market access envisages tariffication of all non-tariff barriers (that is removal of quantitative restrictions and export and import licensing).

- Domestic support measures or subsidies are disciplined through reduction in the total Aggregate Measurement of Support (AMS).

- Export competition contains rules to control the export subsidies in order to give the developing countries an opportunity to compete with the developed countries in exporting agricultural products. Further, they also result in distorting the world prices of agricultural commodities and thereby adversely affecting the interest of the developing countries.

However, the provisions under the market access call for conversion of non-tariff trade barriers to bound tariff equivalents, reduction of bound tariffs over time, and setting of “low” import tariffs for a fixed quota of imports. In case of commodities for which the import level was negligible, a minimum level of access of three percent of domestic consumption during the base year was required to be made for the developing countries and five percent for the developed countries. Being an LDC, Bangladesh is not required to undertake any such commitment. However, Bangladesh will not be allowed to increase its bound tariff. Tariff bound for Bangladesh has been set at a uniform ceiling rate of 200% for all agricultural goods except 13 items for which bound rate is 50%. Bound tariff rates for green and black tea were lower than actual operative tariff.

Under the provision of domestic support the countries were asked to quantify all trade distorting domestic policies, translate them into an aggregate measure of support (AMS) and progressively reduce them. The value of AMS should not exceed five percent of the value of output for the developed countries and 10% for the developing countries. Policies that are not trade distorting in nature are excluded from AMS calculations. These include investments in R&D, development of infrastructure and marketing information, programs for environmental protection and direct payments scheme based on fixed area and production that subsidises farmers’ incomes.

Under the provision of export subsidies countries were committed to reduce subsidies on 22 different agricultural commodities, and the developed countries were required to reduce the value of export subsidies by 36% and reduce the quantities of subsidised exports by 21% during 1995 to 2000. The least developed countries are exempted from commitments to reduce domestic support and export subsidy, while the developing countries have been allowed delayed implementation in these respects.

Developments since the signing of AoA have raised concerns among the developing and the least developed countries regarding market access to developed countries for their exports. Instead of reducing agricultural subsidies the developed countries had in fact raised them in many cases. The OECD producer subsidy equivalent had been increased from 31% in 1997 to 40% in 1999. The United States (US) farm bill signed in May 2002 includes over US$135 billion in new subsidies over the next 10 years. It is estimated that the rice farmers in USA receive US$75,000 per household from the government in the form of direct payments.

Revising the Special Safeguards

In almost all WTO members some sectors are politically sensitive, and members reserved the right to take action quickly through the special safeguards of the URAA if imports threaten domestic producers. The first issue is whether the special safeguards should be continued. One interpretation of the URAA is that the safeguards will continue as long as the reform processes continues, and so will continue if further reform is undertaken. Opponents of extending the special safeguards point to the “emergency safeguard”(Article XIX) provisions that allow members to take action if increased imports cause or threaten to cause serious injury to a domestic industry. They argue that this safeguard is sufficient for agricultural trade. They see the elimination of special safeguards as an important step toward subjecting agricultural trade to the same rules that apply to other goods.

The political reality of agricultural reform in developed countries is that stakeholders demand some discretionary control of trade flows. They need assurance that they can counter large, price-depressing inflows of products if necessary. Special safeguards are inherently distorting, so accepting the mechanism as a compromise to obtain further tariff liberalisation requires rules to ensure that special safeguards do not become more distorting than the measures they replace. Providing smaller offsets (tariff increases) for a fall in domestic prices or shortening the period for the quantity trigger would tighten the current criteria. Negotiators should keep the mechanism as transparent as possible, so that affected parties receive adequate notification and information about additional duties. The use of the special safeguards provision could be time limited and regulated, with renewals and extensions judged by a technical committee, and possibly involve an injury test.

Developing countries have made only limited use of special safeguards. The issue is whether the provision represents a satisfactory alternative to such devices as price bands.

The expanded use of special safeguards in agricultural trade could contribute significantly to a compromise in the negotiations, in particular if it allows developing countries to open markets to imports. The proposals on special safeguards laid out in the Harbinson draft envisage that they would be phased out for developed countries but suggest a possible new mechanism “to enable developing countries to effectively take account of their development needs.” This new safeguard is under technical discussion along with possible disciplines on state trading importers and rules for the administration of tariff rate quotas. The notion of a developing country safeguard has been a feature of several pre-Cancún proposals. The EU-US draft argued for the creation of such a safeguard for some products, and the G-20, Castillo, and Derbez drafts all call for the negotiation of such a safeguard.

The Framework Agreement called for the creation of a modified safeguard for developing countries, known as a special safeguard mechanism, that would apply to a defined range of products and involve both price and quantity triggers. Such a safeguard could not be used together with Article XIX safeguards or the special safeguard provision of the URAA but could be combined with antidumping and countervailing actions consistent with WTO agreements. The fate of the special safeguard is still under negotiation.

Options for Improving Export Competition:

Negotiations on export competition have focused on the reduction or elimination of export subsidies, the need for disciplines on export credit, the curbing of any misuse of food aid, and the disciplining of the activities of state trading enterprises. As in the case of market access, these issues form an integrated package in the negotiations, though they can be discussed separately from an analytical perspective.

Eliminating Export Subsidies

The inclusion of disciplines on export subsidies was a major accomplishment of the URAA. The question in current negotiators was whether to set a date for eliminating export subsidies and, if such a date were set, how to continue cuts in permitted expenditures and volumes from the final 2000 bound levels. The use of both value and volume commitments constrains export subsidies in times of both low and high prices, weakening the ability of export subsidies to maintain fixed internal price supports. When world prices are low, the value limit becomes more constraining because the wedge between the domestic support price and the competitive export price becomes larger. Volume limits prevent exports of excess supply when domestic prices are low. When world prices are high, the value constraint becomes less binding, but the volume constraint can still be effective.

Country proposals on export subsidies showed a general desire to see their rapid elimination. The European Union was initially among the few WTO members to argue against this position. Its main contribution was to insist that export credits and food aid, along with the activities of monopoly state exporting agencies, be disciplined. The United States agreed with the European Union about the need to curb state trading agencies in the export field and on the need for rules for export credit. The Cairns Group argued for a “down-payment” in the form of immediate cuts in volume and expenditure.

In search of a compromise, the Harbinson draft suggested further sharp reductions and elimination within a few years, albeit with some flexibility. The longer time period for half of the export subsidies is a concession to the European Union, which has claimed that it would be difficult to remove export subsidies on dairy products in the short term. There would be no carryover of unused subsidy entitlements from year to year. The United States is no longer dependent on such subsidies and so can argue strongly for their removal. The different schedule for developing countries is an almost empty gesture, as export subsidies are rarely used as a development tool. The US-EU proposal elaborates on the Harbinson notion of flexibility by suggesting elimination of export subsidies on “products of interest to developing countries” and reductions in subsidies on other products using both quantity and expenditure limits, as in the URAA. The suggestion by the G-20 is more explicit: all export subsidies should be eliminated, even if those on products of interest to developing countries go first. The Castillo draft and the Derbez text agree with the EU-US formulation, though they include the provision that the date for the eventual elimination of all subsidies can be discussed. A major turning point in this aspect of the agricultural talks came when the European Union agreed to the setting of a date for elimination of export subsidies, providing that other forms of export assistance were also eliminated, notably subsidised export credits, export-displacing food aid, and the implicit subsidies given by state exporters. This shift in position was incorporated into the Frame-work Agreement, which calls for the negotiation of a credible date for eliminating export subsidies and similar export aids, though that date may be several years away. The proposals for the Zurich meeting took this a stage further, with the United States suggesting a date of 2010 for the elimination of subsidies and agreeing to put limits on export credit guarantees and food aid. Finally, at the Hong Kong ministerial in December 2005, a date was agreed of 2013 for the end of export subsidies, subject to the conclusion of other parts of the negotiations.

Disciplining Export Credits, Food Aid, and State Trading Enterprises

Though it was agreed at a political level that “parallel” disciplines on export aids other than export subsidies are needed, the modalities in this area are more problematic. Negotiations on the need to discipline officially supported agricultural export credits has raised issues related to the extent to which export credit programs contain subsidies, the extent to which they distort trade, and how disciplines on credit programs would limit distortions. According to OECD (2000) estimates, the subsidy value of existing programs is relatively low. Only for US programs are subsidy values above 4 percent and credit terms longer than one year. In all cases the relatively low subsidies are likely to create small trade distortions. Evidence from the literature suggests that programs may create additional demand, and to the extent that this is true their negative impact on competing exporters is likely minimal. Disciplining officially supported export credit programs is more likely to be accomplished by limiting the term of loans offered and by constraining government budgetary outlays than by adjusting program parameters such as minimum interest rate requirements. The Framework Agreement of July 2004 goes some way toward this by calling for the elimination of export credits, guarantees, and insurance programs with repayment periods of more than 180 days. Constraining interest rates or other program parameters risks interfering with commercial relationships and may negate the value of a program to importers. Special and differential treatment of credit programs for developing countries is already mandated by the URAA.

Difficult issues arise where credit programs overlap other subsidies, such as food aid. The most prominent food aid program that operates on a concessional basis is the US PL 480 Title I Program, which uses subsidised credit and has the stated goal of promoting US agricultural exports. Thus it has elements of both food aid and export credit. Food aid programs are also mandated to provide terms favorable for least developed countries and net food importing countries. Including PL 480 Title I in the context of export credit negotiations may meet the desires of both donors and recipient countries to eliminate unclear distinctions between food aid and export credit programs. Sometimes food aid is used as an export subsidy to reduce unwanted surpluses.

This is most explicit when aid is tied to the requirement that the recipient import only from the donor. The URAA prohibits this, but it does not discipline more implicit subsidies, such as those for which disciplines are being sought by the European Union. Adequate (increased) levels of food aid guaranteed in advance by donors and delivered through the World Food Programme would solve some of the problems. By weakening the link between surplus production and food aid, such a change could help to ensure that food aid was available in times of shortage. For countries concerned about the impact of food aid on world markets, such a change would divorce food aid from sporadic surplus disposal. Political realities may make this solution unworkable. However, to secure the necessary political support to pay for food aid programs, donor governments, rely on food aid to achieve both producer support and humanitarian objectives Questions remain on the definition and treatment of emergency food relief and whether food aid should have to be triggered by UN agencies (Food and Agriculture Organisation, United Nations Development Programme, or World Food Programme). In addition, there is still disagreement on whether food aid should always be given as a grant (the EU position) and whether more complete reporting of food aid to the WTO is necessary (as the United States suggests).

Concerns have been raised about the monopoly power exercised by state trading enterprises, in particular in the context of export crops. Their ability to use price discrimination among markets and to engage in price pooling has been challenged in the WTO negotiations, especially in the face of the lack of transparency in their operations. The possibility of state trading importers discriminating against imports even when tariff rate quotas are in place has caused concern for exporting countries. However, disciplines on the action of such entities, though they exist in the WTO (in Article XVII of the GATT), have been hard to enforce. In many countries state trading enterprises are charged with achieving a broad set of domestic policy goals. To the extent that domestic constituencies support these goals, there can be high political costs in abandoning these institutions. In some cases the politically costly process of reform has resulted in the implementation of new methods to achieve the same domestic policy goals. In other cases public monopolies have been replaced by private monopolies, doing little or nothing to alleviate concerns about market power, transparency, and price discrimination.

The most sensitive issue facing the WTO in the discussion of state trading is that of single-desk sellers of temperate zone agricultural products and more particularly the conduct and status of the Canadian Wheat Board. The Framework Agreement included an obligation to eliminate trade-distorting practices of state trading enterprises but merely anticipated “further negotiation” on the use of monopoly powers. That question is unlikely to be resolved except as part of a more comprehensive package.

Consideration of changes in the treatment of state trading enterprises under Article XVII of the GATT has not progressed far. Developing countries have a major stake in this issue and could benefit from an agreement that reduces conflicts between domestic decisions on marketing agencies and agricultural trade rules on market access and export competition.

Each of these three export policy instruments—export credits, food aid, and state trading—has been discussed extensively in the negotiations. The Harbinson modalities draft supported the notion of disciplining export credits (no hidden support) and food aid (no commercial advantage). In addition, it picked up on the notion of private competition with state trading exporters and other disciplines on state trading exporters (no exports at less than the purchase price, and no special financing). The US-EU proposal of August 2003 also addressed export competition issues as a package, in accord with the EU suggestion to introduce disciplines on export credits in parallel, while also avoiding export credits on products that developing countries export. Disciplines would also be applied to food aid, and state trading exporters would have to relinquish their monopoly positions. The G-20 draft called for rules to discipline export credits and for the elimination of the subsidy element of such credits. State trading enterprises would be similarly disciplined. The Castillo draft would eliminate the trade-distorting element of export credits in parallel with export subsidies on products of interest to developing countries and would phase out the subsidy provided by state trading enterprises.

The Framework Agreement confirmed the link between export subsidy elimination and the removal of subsidies provided through these other export policies. A key provision was inserted that there be parallel treatment for the export subsidy component of export credits (long time periods and below market interest rates) and of state trading exporters (low-interest loans and government underwriting of losses). Food aid is to be disciplined to avoid disruption of commercial trade flows. The goal is set as the elimination of food aid that is not in conformity with disciplines still to be agreed. These disciplines will be aimed at preventing commercial displacement, but the thorny problem of how to translate this aim into practical rules has yet to be tackled.

Options for Reforming Domestic Support:

Reducing the level of domestic support has proved to be among the most controversial elements of the agricultural negotiations, even though the economic impact is limited to a few countries and the overall gains to the trade system are not as great as for improved market access. The initial proposals highlighted a range of issues, including the accommodation of “non-trade” concerns, the role of the blue box, possible limits on green box subsidies, the role of the peace clause, provisions for special and differential treatment for developing countries, and reductions in aggregate support (including refinement of the definition and criteria for exempt policies, consideration of inflation and exchange rate changes in measuring support, the desirability of the de minimis provisions, and whether to have total or product-specific aggregate measurement of support commitments).

One challenge facing negotiators has been to identify ways to reduce trade distorting domestic support while providing flexibility for achieving important societal goals. The urgency of this issue has increased as the amount of support allowed within the amber and blue boxes have declined. Over time, criteria must be refined to provide clearer definitions of acceptable minimal trade distorting domestic policy measures that allow countries to pursue important societal objectives for environmental standards, rural development, food security, poverty alleviation, and others. In essence, the tension is between countries that consider domestic support a form of subsidy that should be controlled by international rules and those that consider it a legitimate aspect of domestic policymaking that should not be overly constrained by international bodies. The compromise between these positions is reflected in the differential treatment of the URAA boxes in the Doha Round and the weight given to domestic support relative to the other two pillars of the agricultural negotiations.

Further Reducing Limits for Trade-Distorting Support

The URAA placed limits on individual countries’ total aggregate measurement of support and specified reductions, resulting in a final, bound support level. The main issue for the current negotiations is how much further to reduce those levels. The bound aggregate measurement of support varies greatly among countries, with most having a zero commitment but some having high levels in relation to the size of their agricultural sectors. In addition, negotiators have had to consider the modalities of reductions. Should support be reduced by a given amount or to a particular level? Reducing support by a given amount provides advantages to countries with high levels of support.

Reducing support to a particular level would result in a more level playing field among countries but would impose greater adjustments on countries with high levels of support. A number of other issues are significant in the renegotiation of the disciplines on domestic support. The current de minimis rules specify the level of support that is exempt for developed and developing countries. Negotiators are considering whether such exemptions should be retained, in particular whether and by how much (or to what level) the de minimis threshold should be reduced. Some countries have proposed that developing countries be allowed to increase the level of support provided under the de minimis provision.

Currently, aggregate measurement of support commitments and levels are reported in nominal terms. Negotiators are considering the development of criteria that account for inflation or exchange rate fluctuations in determining a country’s aggregate measurement of support level. Since the URAA was implemented, a number of countries have shifted significant portions of their domestic support from the nonexempt category to the green and blue boxes. The issue is, whether all domestic policies currently categorised as exempt truly fit the criteria of the current agreement. The next agreement will seek more specific criteria to determine the status of domestic support policies. And finally, there is the question of product specificity. Under the URAA, countries have the flexibility to adjust the level of support among products in the amber box, provided that the total aggregate measurement of support does not exceed their commitment. Setting aggregate support limits on a product-specific basis would increase the discipline of the URAA.

Country proposals have reflected a range of opinions. Some have argued for expanding the scope for trade-distorting support on the grounds that such support of the “multifunctional” nature of agriculture can lead to the rapid elimination of all such support. The Cairns Group proposal argued for the reduction and eventual elimination of amber (and blue) box support, with an “early harvest” reduction of 50 percent at the start of any transition period. The United States proposed a reduction in the level of amber box domestic support to no more than 5 percent of agricultural GDP (but retaining the de minimis provisions). The EU proposed the reduction of all amber box payments (by 55 percent) but rejected the need to tie payments to the level of agricultural GDP.

The domestic support reductions suggested by the Harbinson draft were even more ambitious. They would have cut the aggregate measure of support by 60 percent from the 1999–2000 average over 5 years (but only 40 percent over 10 years for developing countries) while still aggregating support across all products. Amber box payments by commodity would not be allowed to rise relative to the 1999–2000 base. Developed countries would have their de minimis allowance (currently 5 percent) reduced by one-half percentage point each year over 5 years. Developing countries could include a “negative” element in their aggregate measurement of support in cases where there are taxes on agricultural production.

The US-EU proposal of August 2003 introduced a new idea, that of using bands analogous to the Harbinson market access formulation to limit domestic support. Countries with high levels of support would reduce them by a higher proportion. This, together with the proposed reduction in the de minimis exemptions, would require significant reductions in domestic support. The G-20 proposal agreed on banding, but suggested product-specific reductions in the aggregate measurement of support and a limit on domestic support for export crops.

The Framework Agreement of July 2004 introduced a new notion into the discussion of domestic support. The Framework Agreement calls for harmonisation of levels of the “overall trade-distorting domestic support,” comprising the total aggregate measurement of support (or amber box payments), the blue box, and de minimis levels. Overall trade-distorting domestic support would be reduced progressively, with higher levels coming down by a greater percentage. A “down-payment” of a 20 percent cut in the first year would be followed by annual cuts. In addition, there would be substantial cuts in the individual components of this overall trade-distorting domestic support, with the aggregate measurement of support itself reduced, also on a harmonisation formula, which would bring the highest levels down by more.

The G-20 announced its own ideas in July 2005, which built on the Framework Agreement. The reductions in the overall trade-distorting domestic support and the aggregate measurement of support would differ depending on the current level of a country’s support. Three bands would be distinguished, and the cuts would be higher for countries in the top band (80 percent for both overall trade-distorting domestic support and the aggregate measurement of support) and less for countries in the lowest band (70 for overall trade distorting domestic support and 60 percent for the aggregate measurement of support). In practice, the European Union would be in the highest band, with the US and Japan also making large cuts in support. The October 2005 proposals by the United States and the European Union are along similar lines, but the United States requested an 83 percent cut in overall trade distorting domestic support by both the European Union and Japan, while the European Union envisaged only a 70 percent cut in its trade-distorting support. Some distance still separates the main parties, but as with tariff cuts the emphasis is now on numbers rather than on different methods of reduction.

Determining the Future Role of the Blue Box

The intent of the blue box category in the URAA was to make it easier for the European Union and the United States to meet their domestic support reduction commitments. Some argue that the blue box was transitional and should be phased out, encouraging countries to adopt measures that fit green box criteria. Blue box payments are not included in the aggregate measurement of support calculation and are exempt from reduction commitments. However, blue box policies can have output and trade impacts, which exporting countries may want to discipline.

The key issues are whether the blue box should be eliminated and, if so, at what rate. The European Union and Japan have insisted that the blue box plays a useful role and should be retained. Other countries are unconvinced and have argued for reduction commitments for the blue box, at a minimum. The Cairns Group has argued for its eventual elimination, and the United States, by seeking to bring the blue box under amber box limits, also appears to envisage its eventual demise.

The G-20 paper proposed the elimination of the blue box. The Harbinson plan called for either capping the blue box or reducing it by 50 percent in 5 years (33 percent in 10 years for developing countries) or including it in the aggregate measurement of support (the amber box) immediately for developed countries and after 5 years for developing countries. The US-EU proposal of August 2003 argued for a redefinition of the blue box and a limit of 5 percent of agricultural GDP. The Castillo draft adopted the US-EU approach, including a declining budget ceiling for the newly defined blue box. These provisions were also incorporated in the Derbez draft. This compromise between the two parties with the greatest interest in the issue might have been expected to prove acceptable for other countries, but this was not the case. Disagreement over the fate of the blue box was one of the points of contention when the Cancún Ministerial Meeting ended.

The Framework Agreement moved this discussion forward somewhat. The blue box criteria would be modified to include payments on fixed acres and yields but not linked to production cuts, and the total blue box would be limited to 5 percent of the value of production. Such a redefined blue box would have the direct effect of allowing the United States to notify the countercyclical payments introduced in the 2002 Farm Bill as blue box payments. The US proposal of October 2005 offered to reduce the blue box limit to 2.5 percent: the European Union indicated that it was prepared to consider some reduction from the 5 percent limit in the Framework Agreement. That flexibility depends in part on the results of discussions on other aspects of domestic support.

Limiting Green Box Subsidies

The URAA placed no limits on the level of support within the green box framework, which is supposed to include measures that have no, or at most minimal, distorting effects on trade or production. Any support must be government funded (not involving transfers from consumers) and must not provide price support to producers. A number of policy-specific criteria and conditions also apply. However, the imprecise nature of the criteria has left considerable room for interpretation. Beyond requests for clarification of acceptable green box policies, several countries have called for limits on the amount of support. While limiting green box expenditures will be a contentious issue, the agreement could involve improved definition of policies that have no, or at most minimal, trade-distorting effects or effects on production. The European Union has been the most enthusiastic proponent of a more capacious green box that would include payments for programs linked to animal welfare, the environment, food security, and rural development programs. This approach is supported by several countries interested in “multifunctionality” and has its parallel in the concern among developing countries that WTO constraints may limit development policies. The Cairns Group would by contrast prefer to strengthen and clarify the criteria for the green box, particularly by moving safety net, investment, and some forms of direct payment into the amber box. The United States has essentially argued to keep the green box intact, as it too seeks to shift the emphasis of farm spending from commodities to decoupled producer payments and to rural development programs. The US-EU draft of August 2003 suggests no major changes to the green box. It was left to the G-20 to suggest a cap on certain green box expenditures (including direct payments, crop insurance, and disaster relief).

The Castillo draft did not mention these restraints but left the green box criteria open for discussion. The Derbez draft also followed this path, leaving open the possibility of further restricting green box policies by tightening the rules rather than by reducing the level of payments. There has been no convergence of opinion between the developing and the industrial countries on this issue.

Deciding on the Peace Clause

The peace clause provides an incentive for countries to shift domestic policy instruments toward the green box in order to eliminate the threat of countervailing duties and other actions. It also shelters policies that exporters could otherwise challenge under the Agreement on Subsidies and Countervailing Measures. Steinberg and Josling conclude that several EU and US farm policies could be vulnerable to such challenges, and recent cases such as that involving US cotton policy confirm that Brazil and some other exporters consider the legal route to policy change to be potentially productive. Agreement on some form of extension of the peace clause seems probable if there is substantial progress in the Doha Round. No specific proposal has been made on this issue in recent months, though the European Union has argued vigorously for its extension. The Harbinson draft provides no guidance, and the chairman’s report to the Trade Negotiating Committee is also silent on the issue. Neither the EU-US proposal nor the G-20 paper includes any suggestions on the peace clause, and it is not mentioned in the Castillo draft. But the Derbez draft discussed at Cancún did suggest the possibility of a continuation of the clause. The Framework Agreement is silent on the question of the peace clause as are the October 2005 proposals from the G-20 and European Union presented at Zurich. Only the US proposal mentions the reintroduction of the peace clause, as a way of discouraging other members from taking legal action to further restrict US domestic policies. If it was to be extended, countries would have to decide on the terms of the extension. One question is the form that it should take to encourage the greatest shift toward support that does not distort trade.

Developing Countries: In the World Agricultural Trade.

We are simply asking for fair and equitable rules that would take into account our development needs and allow us to participate fully in the trade system. But instead we risk being pressured once again into accepting rules we don’t need and can’t afford.

Ambassador Nathan Irumba, Mission of Uganda and Representative of the Least Developed Countries (LDC) at the WTO.

Developing Countries in the WTO:

The participation of developing countries in the WTO has increased greatly compared with their participation in the GATT. A majority of the WTO Membership consists of developing countries. During the period 1980-2000, the share of developing countries trade was almost unchanged- 28.8% in compared to 27.4% in 1980. However, in the aftermath of the opening of the Doha Development Agenda in 2001 and vigorous growth in the world economy, the trade share of developing countries surged to a fifty-year high in the 2004, of 31%. Service trade is, however, growing even more rapidly for developing countries than merchandise trade. Yet, developing countries differ greatly in the degree to which their economies are integrated into the international trading system. While some have made enormous progress, others still trade largely in a few primary commodities. At the Doha Ministerial Conference in 2001, the WTO continued its concerns for developing country Members. The Declaration and the Implementation Decision adopted at the Ministerial Conference call for new WTO initiatives in three areas:

- Initiatives to provide market access in product areas of particular concern to developing countries, such as agriculture and textile;

- Additional special and differential treatment provisions in WTO agreements to benefit developing countries.

- Technical assistance to increase the capacity of developing countries to implement WTO obligations and to participate more fully in the WTO.

Agricultural Trade Reform and Developing Countries:

Among the many reasons that agricultural trade reforms are important, two stand out: the importance of agriculture in developing countries and the slow growth of agricultural trade from developing countries to developed countries.

Agriculture: Especially Important to Developing Countries:

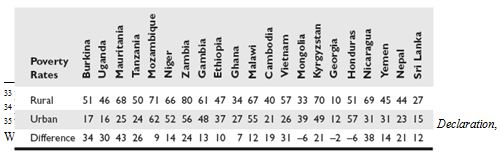

It is now well established that agricultural development is critical to developing countries, especially the least developed. Agriculture remains the largest employer, the largest source of GDP, and the largest source of exports and foreign exchange earnings in most developing countries. About 75 percent of poor people worldwide reside in rural areas, and most of them are dependent on agriculture. The rural poverty rate exceeds the urban rate by a large margin in almost all developing countries for which Poverty Reduction Strategy Papers have been prepared (table).While agriculture declines relative to the rest of a growing economy as incomes improve, its growth is absolutely critical at early stages of development, and it can often drive export-led growth.

Source: Calculations from Poverty Reduction Strategy papers for each country.

A vibrant agricultural sector is therefore crucial to reducing poverty through economic growth, as well as improving global food security and conserving natural resources. Agricultural trade reform to better integrate this sector into global markets is equally crucial to developing countries for a number of reasons. Agriculture has the highest levels of trade distortions and therefore the greatest potential for gains from reform. In addition, domestic reforms are necessary to implement trade reforms benefit for developing countries more than developed countries.

- Relatively Slow Growth of Agricultural Trade from Developing Countries to Developed Countries is a Problem:

World trade has been booming over the past two decades, and developing countries share of the total trade has been expanding. The share of developing countries in exports of manufactured goods to industrial countries has risen dramatically, as has their share in exports of manufactured goods to developing countries . Their share of agricultural exports in trade to other developing countries has also risen, although not as much as in manufactured products. But the share of developing countries in agricultural exports to the industrial world has stagnated. Of course, developed economies’ barriers to agricultural trade have effectively stifled this segment of global trade. If the developing countries are not allowed to expand their agricultural trade in the developed world then they would not be able to obtain economic stability as agriculture is still the main source of income for them specially for the LDCs.

So, developing countries potentially have a lot to gain from global trade reform. Recent estimates are that developing country income would be some 0.8 percent higher by 2015 than it otherwise would be if all merchandise trade barriers and agricultural subsidies were removed between 2005 and 2010, with about two-thirds of the total gain coming from agricultural trade and subsidy reform. The high share of the gains attributable to agriculture may seem surprising, since agriculture contributes only about 4 percent of world GDP and 9 percent of merchandise trade. But the sector’s importance in trade reform is magnified by the much higher protection of agricultural products than manufactured products in countries all over the world.

Bangladesh in the World Trading System:

Bangladesh is a developing country in the south Asia having 150millions of population. But 37 years after its independence it is still suffering from food insecurity and economic stability which were the major aims of its war of liberation. We will try to find out the reasons behind it.

Agricultural sector.

- Almost 80 percent of Bangladesh’s population lives in the rural areas, with 54 percent of them employed in agriculture and the remainder in the rural non-farm (RNF) sector.

- The rural economy constitutes a significant component of the national GDP, with agriculture (including crops, livestock, fisheries and forestry) accounting for 21 percent and the non-farm sector, which is also driven primarily by agriculture, for another 33 percent.

ISSUES AND CHALLENGES

- High levels of rural poverty: Poverty in Bangladesh is primarily a ‘rural phenomenon’, with 53 percent of its rural population classified as poor, comprising about 85 percent of the country’s poor. Achieving the Millennium Development Goal (MDG) of halving poverty to 26.5 percent by 2015 will require a growth rate of at least 4.0 percent in agriculture and 7.0 percent in the non-farm sector. However, economic and institutional realities, the country’s geographical and demographic characteristics, and its vulnerability to natural disasters, make this a very challenging task.

- Low agricultural productivity: Another challenge is rapidly shrinking land base. While the country’s population is growing at the rate of 1.6 percent per year, demographic pressures and increased urbanisation have caused cultivated area to decline at a rate of 1 percent per year. As cropping intensity has approached its limit (about 175 percent now), growth will need to come from intensification of cereal production, diversification into high-value crop and non-crop activities, and value addition in the agro-processing sector, including storage, processing and marketing. This will require reforming the agricultural research, Land administration, extension systems, and financial and other regulations.

- Poorly functioning input and output markets: The lack of easily accessible markets and collusion by the traders pose significant constraints in both agricultural input and output markets. Marketing margins are high relative to services provided. Lack of market information and infrastructure, the poor law and order situation, the existence of syndicates, and collection of illegal tolls further aggravate the situation.

- Lack of enabling rural investment climate: For nearly 45 percent of the rural population, who are already landless or functionally landless (owning less than 0.05 acre of land), and a majority of the new labor force every year, a declining land base and a small urban employment means that employment in the rural non-farm sector presents the best chance to escape poverty. The growth of the rural non-farm sector, however, is constrained by lack of or poor quality of rural infrastructure and services, highly centralised government framework, weak rural financial systems, and a poor law and order situation.

- Vulnerability to natural disasters: Bangladesh is the terminal floodplain delta of three large rivers – Ganges, Brahmaputra and Meghna. Every year about 20 to 30 percent, and every few years about 40 percent, of the country is flooded, causing serious damage to infrastructure, crops and the overall economy. Projected climatic changes and rise in the sea level are likely to worsen the situation. Since independence in 1971, the Government has made large investments to protect against floods and cyclones.

Crop Sector: Importance and Concerns:

The crop sector is of strategic importance to Bangladesh, as in most other low-income countries. It is the source of staple food for 130 million people and the major means of livelihood of 13 million farm households in the country. In 2000-01 the crop and horticulture sector contributed US $8,450 million to the economy, accounting for 18% of the gross domestic product (GDP) at current market prices. According to the report of the Household Income and Expenditure Survey-2000 conducted by the Bangladesh Bureau of Statistics, the consumers spent nearly US $9.8 billion on the crop sector output (Table 1), which comprises 25% of the private sector consumption expenditure in Bangladesh. Crop production activities generated 2,065 million person days, equivalent to full-time yearly employment of 7.9 million people in labor force. The average import of the crop sector output for the 1998-2000 period is estimated at US $1.2 billion, about 24% of the export earnings of the country. So any change in the domestic production and import for the sector following the liberalisation of trade would make a large impact on producers’ and consumers’ welfare, government’s revenue earnings, the balance of trade and the rural sector employment situations.

TABLE: IMPORTANCE OF THE CROP SECTOR OUTPUT IN NATIONAL

EXPENDITURE AND EMPLOYMENT, 2000

| Crop sector output | National expenditure (US $ million) | Employment (million person days) | Imports | |

| (US $ million, 1998-2000) | Percent of Expenditure | |||

| Cereals | 6,030 | 1,476 | 547 | 9.1 |

| Pulses | 430 | 49 | 85 | 19.8 |

| Oils | 575 | 52 | 473 | 82.3 |

| Vegetables | 1398 | 266 | 0 | – |

| Spices | 1092 | 145 | 30 | 2.7 |

| Sugar & Gur | 279 | 77 | 51 | 18.3 |

| Total | 9804 | 2,065 | 1,186 | 12.1 |

Source: BBS, Report of the Household Income and the Expenditure Survey, 2000 and IRRI survey on cost and return in crop cultivation, 2000-2001.

A major issue concerned with the crop sector is the inflexibility of resources tied in production activities. Land is the dominant factor of production. Because of specific agro-ecological situation that determine the suitability of land for the production of different crops, land cannot be easily shifted from one crop to another without some loss in yield. For example rice is the only crop that can be grown in low-lying land that remains submerged with water during the monsoon season. So whatever be the price of rice the farmer has no alternative but to grow aman rice during the wet season, while they can choose among alternative crops during the dry season depending on the relative productivity and profitability. The crop sector is also ‘employer of last resort’ and the main source of livelihood for the illiterate and low-educated people who do not have alternative employment opportunities. A reduction in price and the profitability for the crop sector activities may not necessarily lead to reallocation of labor to more productive activities outside the sector, an argument made by proponents of free trade. Under Bangladesh conditions it may lead to lower earnings for the farmers and lower wage rate for the agricultural laborers, thereby worsening the poverty situation in the country.

Another important issue regarding the trade and price policy in the crop sector is the balancing of interests for the producers and consumers. The crop sector is the source of production of staple food. Too much protection of the sector will raise food prices out of line in the international market that will benefit farmers at the cost of consumers, and vice-versa. A major concern for the government is maintaining stability in food prices, since price instability affects the food security of the poor. The bottom 40% of the rural households in the per capita income scale spends nearly 52% of their budget on the crop sector output, 35% on rice and wheat alone (Table 2). The corresponding numbers for the urban areas are 42% and 25% respectively. While the top 10% of the households in the income scale allocate 18% and 13% of their budget on crop sector output. Thus maintaining the price of the crop sector products at an affordable level is a major element in the strategy for poverty alleviation. Trade policies that allow consumers to access food from the lowest cost source in the international market is thus important for the welfare of the low-income consumers, but it is equally important to protect them from large fluctuations in the prices of staple food in the world market. It is also important to maintain an incentive price for farmers to sustain the long-term growth in production of staple food, and the balance between the demand and supply for maintaining the stability in prices in the domestic market. A fair price for farm products is also important for poverty alleviation, since two-thirds of the farmers operate a size of holding of less than one hectare, which is incapable of generating the poverty level income.

TABLE 2: AVERAGE BUDGET SHARE (%) OF THE CROP SECTOR OUTPUT FOR THE BOTTOM 40% AND THE TOP 10% OF HOUSEHOLDS IN RURAL AND URBAN AREAS

| Crop sector output | Rural Area | Urban Area | ||

| Bottom 40% | Top 10% | Bottom 40% | Top 10% | |

| Cereals | 34.6 | 9.7 | 25.0 | 5.9 |

| Pulses | 1.8 | 1.0 | 2.1 | 0.9 |

| Oils | 2.4 | 1.2 | 2.4 | 1.1 |

| Vegetables | 6.9 | 2.8 | 6.4 | 2.0 |

| Spices | 4.9 | 2.3 | 4.5 | 1.8 |

| Sugar & Gur | 1.0 | 0.8 | 1.1 | 0.9 |

| Total | 51.6 | 17.8 | 41.5 | 12.6 |

Source: BBS, Household Income and Expenditure Survey-2000.

Unit Cost of Production and Prices:

This section provides a comparative picture of the cost of production of Bangladesh with the major exporting countries in the region for rice, and with India for non-rice crops. The data will reveal the position of Bangladesh with regards to unit cost of production and returns to land at current market prices for inputs and output.

The costs and returns data for Bangladesh was collected for 2000 crop seasons from a nationally representative sample of 1880 farm households from 62 villages belonging to 57 of the 64 districts. The original sample was drawn by the Bangladesh Institute of Development Studies (BIDS) in collaboration with the International Rice Research Institute (IRRI) in 1987 by using a multistage random sampling framework, taking random samples at the union, village and household levels. The 2000 survey was conducted by Socio-Consult Ltd for an IRRI sponsored study on determinants of rural livelihoods in Bangladesh. The data for India are obtained from Reports of the Commission for Agricultural Costs and Prices (CACP) and refers to the crop seasons 1998-99 and 1999-2000. The data for Thailand and Vietnam are obtained from the large-scale village studies conducted by IRRI and refer to the 2000 crop year.

The cost includes variables costs of production (all material inputs, irrigation charges and machine rental) and imputed value of family labor and family supplied animal power. The rental value of land and the depreciation of other fixed assets are not included because of the problem of comparing these values across countries. The Indian data shows that the costs on land and other fixed assets may account for an additional 60% of the costs. The net returns to land and other fixed factors per ha are estimated by multiplying the difference of the unit variable cost from the farm-gate price with the yield per ha, for comparison of returns from crop cultivation per unit of land across countries. For international comparison the values have been converted in US dollars using the exchange rate for the reference year. The details of the cost structure and the farm-gate prices can be seen from appendix tables. Key information as revealed from the data is reported below.

For rice, the variable cost of production per unit of output is the lowest for Punjab in India followed by Vietnam and Thailand (Table 3). For Bangladesh the cost of production is higher in the cultivation of boro rice than in aman rice. However, the cost for Bangladesh is lower than that in the neighboring Indian state of West Bengal. Comparison with Punjab and Andhra Pradesh is however more appropriate since most of the marketable surplus of rice in India is generated in those two States. Compared to Thailand, which is the largest rice exporter in the world market, the cost of production in Bangladesh is 62% higher for the dry season crop (boro) and 18% higher for the wet season (aman).

The farm-gate price as well as the margin for the farmer (price over variable cost) is however substantially higher in Bangladesh and India compared to Thailand and Vietnam (Table 3). Thai farmers can offer rice at a lower margin to consumers because of the substantially larger size of farm compared to other rice growing countries in Asia. The average farm size in Thailand is over 5 ha, compared to 0.68 ha in Bangladesh. Thus, even with lower margin per unit of output Thai farms could have substantially higher household incomes than Bangladeshi farmers. The farm-gate price is 50% higher in Bangladesh compared to Vietnam and Thailand, and 15 to 20% higher than the Indian States of Punjab and Andhra Pradesh.

TABLE 3: UNIT COST PRODUCTION, FARM GATE PRICE AND FARM

OPERATING SURPLUS IN PADDY CULTIVATION

| Region, Year and season | Unit Cost (US $/ton) | Farm Gate Price (US $/ton) | Return to land & organisation (US $/ha) |

| India (1998-99) | |||

| Punjab | 47.95 | 113.25 | 345 |

| Andhra Pradesh | 69.00 | 119.28 | 244 |

| West Bengal | 93.28 | 135.28 | 151 |

| Thailand (2000) | |||

| Wet Season | 65.74 | 100.23 | 79 |

| Dry Season | 53.62 | 91.52 | 158 |

| Vietnam (2000) | |||

| Wet Season | 69.28 | 100.95 | 116 |

| Dry Season | 57.16 | 91.61 | 181 |

| Bangladesh (2000-01) | |||

| Wet Season | 77.48 | 137.13 | 198 |

| Dry Season | 86.81 | 136.65 | 240 |

Source: For India, GOI (2002); for Thailand and Vietnam, IRRI survey on cost and return in crop cultivation, 2000; and for Bangladesh, IRRI survey on cost and return in crop cultivation, 2000-2001.

The above information indicates that Bangladesh will not be able to compete in the world market for rice at the prevailing costs and market prices. Considering the transport cost and trade margin, Bangladesh may be able to withstand competition from imports from India, but may not be able to do so from imports from Thailand and Vietnam.

For wheat, India (Punjab) is in a much superior position compared to Bangladesh (Table 4). The variable unit cost of production is about 129% higher in Bangladesh compared to Indian State of Punjab, and the domestic market price is higher by about 14%. The CACP in India however reports that the economic cost of the procurement of wheat by the Food Corporation of India (FCI) is higher than the world market price. Thus, at current prices, Bangladesh cannot withstand competition from imported wheat from the world market.

TABLE 4: UNIT COST, FARM GATE PICE AND RETURNS TO LAND IN NON-RICE CROPS

| Crop | Unit cost (US $/ton) | Farm Gate price (US $/ton) | Returns to land (US $/ha) | |||

| India | Bangladesh | India | Bangladesh | India | Bangladesh | |

| Wheat | 46.47 | 106.49 | 135 | 154 | 428 | 104 |

| Pulses | 106.23 | 118.64 | 308 | 311 | 180 | 148 |

| Rape seed & Mustard | 110.10 | 141.96 | 263 | 303 | 213 | 122 |

| Jute | 136.21 | 129.05 | 190 | 185 | 114 | 101 |

| Sugarcane | 8.26 | 16.06 | 15.47 | 30.19 | 571 | 573 |

Source: For India, GOI (2002); and for Bangladesh, IRRI survey on cost and return in crop cultivation, 2000-2001.

For sugarcane, Bangladesh’s position is almost similar to the wheat. The unit cost of production is almost double in Bangladesh compared to India (Maharastra). For rapeseed and mustard also India’s (Rajasthan) position is better compared to Bangladesh. India’s unit cost of production and farm-gate price is about 23% and 13% respectively lower than those for Bangladesh. Only for pulses (lentil), Indian unit cost and prices are comparable with Bangladesh. So is the case with jute.

Factors behind the Differences in Unit Costs:

What are the reasons for the relatively high unit cost of production in Bangladesh for most of the crops? The most important factor is obviously the agro-ecological conditions and the development of irrigation infrastructure that determine the suitability of land for growing a particular crop. The other is the extent of adoption of improved production technologies. These two factors determine the level of crop yield. For HYV rice, the yield in Bangladesh is comparable to other countries in the region (Table 5). But there is potential for increasing the yield in the aman season and thereby further reducing the unit cost. For all other crops, Bangladesh has lower yield compared to that for the highest yielding state in India (Table 6). The difference is large for Wheat and Sugarcane.

TABLE 5: THE YIELD (T/HA) OF HYV RICE IN BANGLADESH COMPARED TO THE EXPORTING COUNTRIES IN THE REGION

| Region | Yield (t/ha) |

| India | |

| Punjab | 5.28 |

| Andhra Pradesh | 4.86 |

| Thailand | 4.17 |

| Vietnam | 4.71 |

| Bangladesh | |

| Aman Season | 3.33 |

| Boro Season | 4.83 |

Source: For India, GOI (2002); for Thailand and Vietnam, IRRI survey on cost and return in crop cultivation, 2000; and for Bangladesh, IRRI survey on cost and return in crop cultivation, 2000-2001.

TABLE 6: THE YIELD RATE (T/HA) OF NON-RICE CROPS IN

BANGLADESH COMPARED TO INDIA

| Crop | Bangladesh | India |

| Wheat | 2.20 | 4.83 |

| Lentil | 0.77 | 0.89 |

| Rape Seed & Mustard | 0.76 | 1.39 |

| Sugarcane | 40.54 | 79.21 |

| Jute | 1.83 | 2.12 |

Source: For India, GOI (2002); and for Bangladesh, IRRI survey on cost and return in crop cultivation, 2000-2001.

The other source of the difference in cost is the prices of inputs. The prices of three major agricultural inputs: urea fertilizer, irrigation and labor, can be seen from Table 7. The price of urea is about one-third lower in India, but are comparable in Thailand and Vietnam compared to Bangladesh. The difference in the price of fertilizer would not however make a large difference in unit cost of production, since chemical fertilizers account for only 15% of the total variable costs.

TABLE 7: PRICES OF AGRICULTURAL INPUTS

| Region | Urea (US $/ton) | Wage rate (US $/day) | Irrigation (US $/ha) | ||||||||

India | |||||||||||

| Bangladesh | 176 | 1.20 | 50.98 | ||||||||

| Thailand | 165 | 5.21 | 17.93 | ||||||||

| Vietnam | 170 | 1.64 | 26.38 | ||||||||

Source: For India, GOI (2002); for Thailand and Vietnam, IRRI survey on cost and return in crop cultivation, 2000; and for Bangladesh, IRRI survey on cost and return in crop cultivation, 2000-2001.

Rice Import and support to agriculture:

This section links Bangladesh’s rice market with the international trade of rice. A country specific analysis has been drawn to show how the poor farmers in Bangladesh are being affected. The case has been illustrated through India since it is the main partner of Bangladesh in international rice trade, in which Bangladesh is the rice deficit country and India is the rice exporting country. Bangladesh has liberalised the private rice imports in early 1990s whereas India’s private food exports were liberalised in 1994 as a part of the macro economic reform including exchange rate depreciation. Also it is important to note that during that period India has increased its agriculture subsidy under the new economic reforms while the same has been decreased in Bangladesh. In the fiscal 2003-04, the government of Bangladesh has marginally increased agriculture subsidy. Given the scenario, Bangladesh’s import of rice from India has risen to unprecedented levels since then. Trade Liberalisation Import tariff reduction is critical in the trade liberalisation policies that are strongly advocated and many times mandated by international financial institutions like the International Monetary Fund (IMF) and the World Bank in the loan packages they negotiate with LDCs such as Bangladesh. Therefore, the Government of Bangladesh adopted a sweeping trade liberalisation measures in 1990s by reducing the import duties on food grain substantially. The unweighted average tariff rates have been reduced dramatically to 27.5 per cent for 12 categories of agricultural products in FY04 from 51.98 per cent in FY92.The tariff on rice import has been reduced substantially to 7.5 percent in FY04 from 33 per cent in FY91. The rice imports have made it more difficult for local rice producers to compete with the rest of the world.

Before import liberalisation Thailand and Vietnam were the main sources of import, though the extent of import was limited. However, following the liberalisation measures India replaced as the main source of rice import.

The competition between Bangladeshi and Indian rice growers can hardly be termed as fair. While Indian rice production is subsidised through a variety of mechanisms, the small, struggling domestic rice producer in Bangladesh receives almost no support from the government. Rice farmers do not receive export subsidies but a negligible amount of domestic support, which in fact shows a downward trend. Thus import surge from India and consequent decline in the demand for local rice has had a devastating impact on the desperate rural population who has no other means of living but agriculture.

Conclusion

So far we have seen the role of agriculture in the life of the people of developing countries as well as its role in the economy in those countries too. This paper also analyses different governing principles of the WTO and the WTO Agreement on Agriculture. Though the object of the agreement is to establish a fair and market-oriented agricultural trading system, but the paper analyses that the rules of the agreement is of such nature that the object of the agreement can not be achieved in its the present form. Changes need to be brought out in the agreement for the protection of the interests of the developing countries and especially for the LDCs.

As agriculture, directly or indirectly, is the main source of livelihood of the people of all developing countries and for the poor countries it provides the main portion of GDP, so it needs strong concerns. The agreement lacks of the reflection of the will and aspirations of the developing countries, rather it contains some rules which are inconsistent with the interest of the developing countries. It is also evident that the agreement is more intent to defend the interest of the developed countries.

The developing countries need to have more opportunities to expand agricultural trade with the developed world which will definitely help their economy as industrialisation is not the affordable option for their development in the present stage. Obviously it is industrialisation which can change the fate of any nation faster than any other way, but at the same time we have to keep it in mind that there are lots of matters are related with that. And developing countries are not able to afford those in a short term. Nevertheless, they can afford agricultural diversification and use of modern technology to increase agricultural production in short term for their economic development.

Bangladesh needs more access to agricultural development not only to feed the 150 millions of people but for food security too. At the same time we can not ignore the role of agriculture as the major sector of employment. Indeed we need industrialisation for economic development but that needs foreign investment which depends on various factors. We will try to bring foreign investment for economic development but at the same time we have to work hard for agricultural development.

Bangladesh needs to in crease domestic support for agricultural development and at the same time we need to increase research in this sector. In the era of modern science and technology we must take resort not only to the modern agricultural technologies but to information and technology for agricultural development too.

So what we have to do is to defend our interest in the ongoing negations of WTO and we have to bring diversification in agriculture. Simultaneously a change in the agricultural methodology is of such importance that we can not ignore in any way, no way. If we fail to do so, then really we will face more difficult and crucial time in the future just to provide basic food to our people.