Determining Audit Fees by Ahsan Rashid & Co. (Audit Firm)

This internship report is based on practical experience at the Ahsan Rashid & Co., CA Firm. This report contains several parts. In the first part of this report contains some description about the Auditing and perspective of the ICAB. The next part is about the Determination of Audit fees and Current situation of the Company.

Origin of the Report

Internship is the part of BBA course and it is an opportunity to any fresh graduate gain practical experience in corporate world. I had opportunity to work with Auditors of CA Firm. With this company I tried to implement educational experience in this company. Auditing section of CA firm support me to do audit in different type of organization and share with me their experiences.

This research report is the reflection of my working experience at this company and summary of my responsibilities that had been bestowed on me. The report topic is “Critical analysis on determining Audit fees by an Audit firm”

Scope

I audited different types of company through this CA firm. I had scope to learn about the group’s activities while I came into contact with different departments. I had opportunity to inform about the Audited Company’s performance and financial condition.

Objective

My intern topic was “Critical analysis on determining Audit fees by an Audit firm”. CA firm evaluate and verify all the financial and non-financial activity of its client company and give them valuation report after the end of evaluation for the fairness of the company which is most important document for a company. I was worked with this Audit group and perform my job according to the rule.

Methodology

I prepared this report in two segments. In my first part I explained about the “Auditors and Audit” and in second part I focused on the “Determination of Audit fees”. I had to collect data for analyzing Audit fees. I had to rely on Audit Report of the client companies for regression analysis. Secondly, I talked with officials to know about the Audit fees system.

Audit:

Audits are performed to ascertain the validity and reliability of information; also to provide an assessment of a system’s internal control. The goal of an audit is to express an opinion on the person / organization / system (etc.) in question, under evaluation based on work done on a test basis.

Due to practical constraints, an audit seeks to provide only reasonable assurance that the statements are free from material error. Hence, statistical sampling is often adopted in audits.

In the case of financial audits, a set of financial statements are said to be true and fair when they are free of material misstatements – a concept influenced by both quantitative (numerical) and qualitative factors.

Auditing is a vital part of accounting. Traditionally, audits were mainly associated with gaining information about financial systems and the financial records of a company or a business (see financial audit). However, recent auditing has begun to include non-financial subject areas, such as safety, security, information systems performance, and environmental concerns. With nonprofit organizations and government agencies, there has been an increasing need for performance audits, examining their success in satisfying mission objectives. As a result, there are now audit professionals who specialize in security audits, information systems audits, and environmental audits.

In financial accounting, an audit is an independent assessment of the fairness by which a company’s financial statements are presented by its management. It is performed by competent, independent and objective person(s) known as auditors or accountants, who then issue an auditor’s report based on the results of the audit.

In cost accounting, it is a process for verifying the cost of manufacturing or producing of any article, on the basis of accounts measuring the use of material, labor or other items of cost. In simple words the term, cost audit, means a systematic and accurate verification of the cost accounts and records, and checking for adherence to the cost accounting objectives. According to the Institute of Cost and Management

Accountants of Pakistan, a cost audit is “an examination of cost accounting records and verification of facts to ascertain that the cost of the product has been arrived at, in accordance with principles of cost accounting.”

Types of auditors

Auditors of financial statements can be classified into two categories:

External auditor / Statutory auditor: External auditor / Statutory auditor is an independent Public accounting firm engaged by the client subject to the audit, to express an opinion on whether the company’s financial statements are free of material misstatements, whether due to fraud or error. For publicly-traded companies, external auditors may also be required to express an opinion over the effectiveness of internal controls over financial reporting.

External auditors may also be engaged to perform other agreed-upon procedures, related or unrelated to financial statements. Most importantly, external auditors, though engaged and paid by the company being audited, are regarded as independent auditors.

The most used external audit standards are the US GAAS of the American Institute of Certified Public Accountants; and the ISA International Standards on Auditing developed by the International Auditing and Assurance Standards Board of the International Federation of Accountants.

Internal auditor: Internal auditors are employed by the organization they audit. They perform various audit procedures, primarily related to procedures over the effectiveness of the company’s internal controls over financial reporting. Due to the requirement of Section 404 of the Sarbanes Oxley Act of 2002 for management to also assess the effectiveness of their internal controls over financial reporting (as also required of the external auditor), internal auditors are utilized to make this assessment. Though internal auditors are not considered independent of the company they perform audit procedures for, internal auditors of publicly-traded companies are required to report directly to the board of directors, or a sub-committee of the board of directors, and not to management, so to reduce the risk that internal auditors will be pressured to produce favorable assessments.

The most used Internal Audit standards are those of the Institute of Internal Auditors.

Objectives and advantages of Audit

The objectives of an audit may broadly be classified as

Primary Objectives

Secondary Objectives.

Primary Objectives:

The main purpose of audit is to judge the reliability of the financial statements and the supporting accounting records for a particular financial period. The Companies Act, 1956 requires that the auditor of a company has to state whether in his opinion the accounts disclose a true and fair view of the state of company’s affairs, profit and Loss Account and Balance Sheet of the state of affairs of a business, the auditor carries out a process of examination and verification of books of accounts and relevant documents. Such an examination will enable the auditor to report to his client on the financial condition and working results of the organization. While carrying out the examination of the various books of accounts, relevant documents and evidences, the auditor may came across certain errors and frauds. Despite such a possibility the detecting of errors and frauds is an incidental object. However, laymen have always associated the detection of errors and frauds as the main function of an auditor which is not true. At the same time audit also discloses how far the accounting system adopted in the organization is adequate and appropriate in recording the various transactions as well as the weakness of these systems.

Secondary Objectives:

As stated above, an auditor has to examine the books of accounts and the relevant documents in order to report on the financial condition of the business. In the process of such an investigation of accounts certain errors and frauds may be detected. These are discussed under the following two heads:

- Detection and Prevention of Errors

- Detection and Prevention of Frauds

Detection and prevention of Errors: Various types of errors are mentioned below:

Clerical Errors: Such an error arises on account of wrong posting. For example, an amount received from Thomas is credited to Sunny. Though there is wrong posting still the trial balance will agree. Clerical errors are of three types as follows:

- Errors of Commission: There errors are caused due to wrong posting either wholly or partially of the amount in the books of original entry or ledger accounts or wrong calculations, wrong totaling, wrong balancing, and wrong casting of subsidiary books. For example Rs. 500 is paid to a vendor and the same is recorded in the cash book. While posting to the ledger, the Vendor’s account is debited by Rs. 500. It may be due to carelessness of the clerk. Most of the errors of commission are reflected in the trial balance and these can be discovered by routine checking of the books.

- Errors of Omission: Such errors arise when the transactions are not recorded in the books of original entry or posted to the ledger. For example, sales are note recorded in the sales book or omission to enter invoices in the purchase book. For example Rs. 200 is paid to a vendor. The entry in the cash book is made on the credit side but posting to the vendor side is omitted. Errors due to entire omission will not affect the trial balance whereas errors due to partial omission will affect the trial balance and can be detected.

- Compensating Errors: When two or more errors are committed in such a way that the result of these errors on the debits and credits is nil, they are referred to as a compensating errors. For example, Anil’s account which was to be debited for Rs. 500 was credited for Rs. 500 and similarly, Sunil’s account which was to be credited for Rs. 500 was debited for Rs.500. These two mistakes will nullify the effect of each other. Both the sides of the trial balance are equally affected. As such, these errors are difficult to locate unless detailed investigation is undertaken.

Errors of Principle: Such errors are committed when some fundamental principle of accounting is not properly observed in recording transaction. For example, if there is incorrect allocation of expenditure or receipt between capital and revenue or when closing stock is over-valued. Though trial balance will not disagree, the Profit and Loss Account may be very much affected. Sometimes, such errors are committed deliberately to falsify the accounts or unintentionally due to lack of knowledge or sound principles of accounting. Thus, a thorough examination is to be done to locate such errors.

Detection and Prevention of Frauds: Frauds are always committed deliberately and intentionally to defraud the proprietors of the organization. If the frauds remain undetected, they may affect the opinion of the auditor on the financial condition and the working results of the organization. It is, therefore, necessary that the auditor should exercise utmost care to detect such frauds.

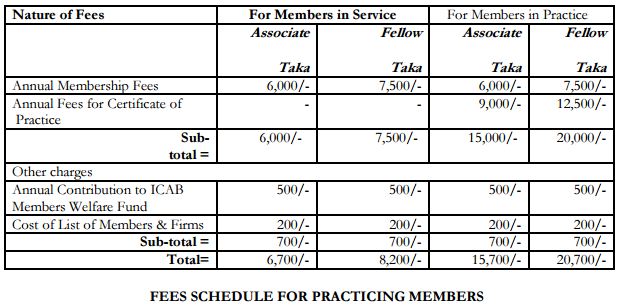

Current status of Audit fees in Bangladesh according to ICAB:

Basis of Charging Minimum Fees for Audit and Other Professional Service Rendered by Chartered Accountants in Practice or Firms of Such Chartered Accountants

Part-1

The Institute of Chartered Accountants of Bangladesh (ICAB) was established under the Bangladesh Chartered Accountants Order 1973 (President’s Order No. 2 of 1973) for the purpose of regulating the profession of Accountants and for matters connected therewith in the country.

Schedule C (Part-1) of the Bangladesh Chartered Accountants Bye-Laws 1973 framed under the aforementioned Order, stipulates, inter alia , that a Chartered Accountant in practice shall be guilty of professional misconduct if he/she:

- accepts a position as Auditor previously held by another Chartered Accountant without first communicating with him in writing;

- accepts an appointment as Auditor of a Company without first ascertaining from it whether the requirements of Section 210 of the Companies Act 1994 in respect of such appointment have been duly complied with;

- accepts a position as Auditor previously held by some other Chartered Accountant in such conditions as to constitute undercutting;

- solicits clients or professional work either directly or indirectly by circular, advertisement, personal communication or interview or by any other means;

Part-2

The Council of the Institute resolved that a Chartered Accountant in practice or a firm of such Chartered Accountants may:

- respond to advertisements inviting applications for appointment of Auditors;

- respond to tenders or circulars inviting quotations for professional services restricted to Chartered Accountants either by statute or in terms of such tenders or circulars;

- request for inclusion of the firm-name in the panel for appointment as Auditors; and

- quote fees within the framework of the enclosed Fees Schedule as approval by the Council-ICAB in its meeting held on 18, April 2004.

It shall not, however, be permissible for a Chartered Accountant in practice or a firm of such Chartered Accountants to pay earnest money, security deposit, etc. in reply to such advertisements, tenders, circulars or enquiries.

Part-2: of the Fees Schedule will not be applicable for non-audit work.

PART-3-Fees Schedule

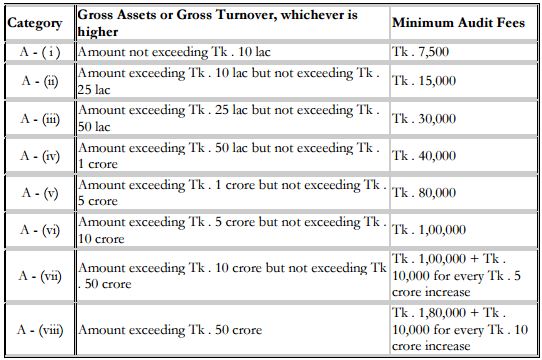

A. Private Limited Companies:

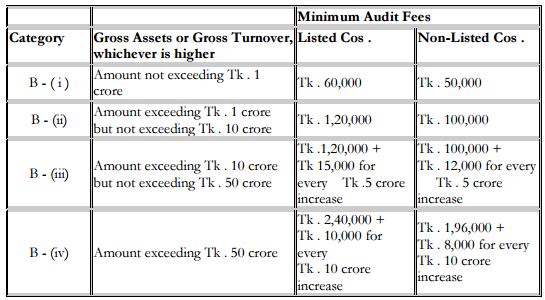

B. Public Limited Companies:

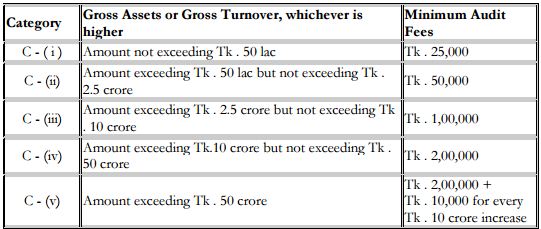

C. Sector Corporation Including Insurance, Autonomous and Semi autonomous Bodies:

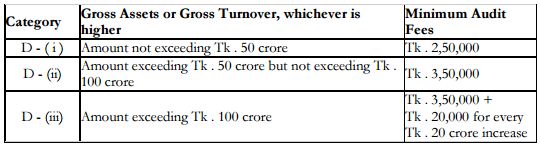

D. Banks and Other Financial Institutions Excluding Insurance:

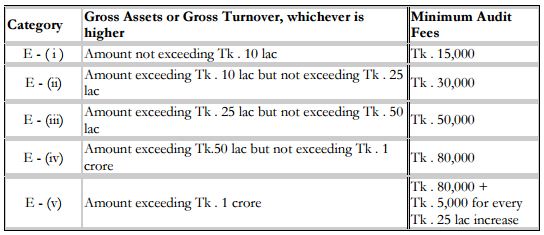

E. Non-Government Organization:

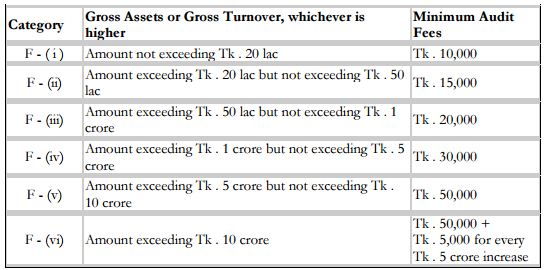

F. Proprietorship Concerns, Partnership Firms, Provident Funds and Charitable Institutions, Voluntary Organizations and Others Not Covered Under Paragraphs:

G. Educational Institutions:

In view of national importance of education and educational institutions being non-trading in nature, audit fees as prescribed by the concerned appointing authorities in consultation with ICAB from time to time shall be acceptable.

H. Co-Operative Societies:

The audit fees chargeable for auditing the accounts of co-operative societies including co-operative banks shall be as per provisions of the Co-operative Societies Act, 1940 and the Co-operative Societies Ordinance, 1984.

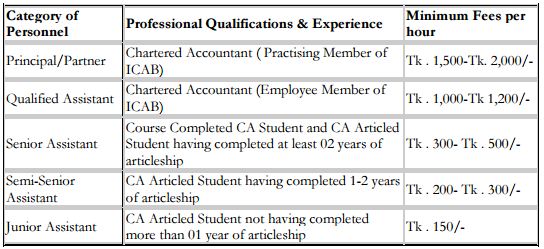

Minimum Hourly Rates of Fees Chargeable in Respect of all Professional Work as Referred to Under Paragraphs above:

Subject to the Provisions as Contained in the Following Sub-Clauses:

For the purpose of charging the minimum audit fees as approved under paragraphs A, B and C of Clause 1.00 of part-3 above, 150% of the previous year’s audit fees shall be deemed to be the minimum audit fees of the year if the fees calculated on the basis of the approved rates exceed 150% of the previous year’s audit fees;

For the purpose of calculating the minimum audit fees as approved under paragraphs D and F of clause 1.00 of part-3 above, Gross Assets shall mean and include total fixed assets and current assets excluding fictitious assets, if any, of an organization as appear on the balance sheet under audit;

While charging fees, members in practice may quote fees, broadly based on the afore-mentioned minimum rates of fees;

Notwithstanding anything contained in the normal definition of Gross Turnover, for the purpose of calculating the approved minimum audit fees of any organization, ‘Gross Turnover’ shall mean and include;

- Total amount of sales including all other income and earnings of the year in case of all manufacturing and trading organizations;

- Total gross premium income including all other income and earnings of the year in case of all insurance organizations;

- Total amount of interest, discount, commission, exchange brokerage and all other income and earnings of the year in case of banks and other financial institutions;

- Total amount of commission including all other income and earnings of the year in case of travel agencies, inventors , brokers and other organizations running on commission earning basis;

- Total income in the form of contributions, subscriptions, donations, grants, aids and all other income and earnings of the year in case of provident funds, charitable institutions and voluntary organizations ; and

Total receipt/bills accounted for and all other income and earnings of the year in case of construction companies and other organizations not covered under 1 to 5 above.

Appointment of Auditors for any special audit of branches of banks, insurance corporations/companies or other organizations shall be treated as an appointment relating to a separate audit , and audit fees payable for such special audits shall be treated as part of the approved annual or statutory audit fees payable by the clients concerned;

In case of organizations under installation/awaiting commissioning, acceptance of minimum audit fees at a reduced rate of 50% of the approved minimum audit fees, may be considered until such time as such organizations go into commercial production;

In case of dormant companies (i.e. companies not in commercial operation), acceptance of minimum audit fees shall be subject to mutual consent of the clients and the Auditors;

In the context of the above-stated approved rates of minimum audit fees , ‘under-cutting’ shall not include any reduction of fees which may arise due to natural reduction of Gross Assets, Gross Turnover or Gross Grants, as appropriate, of the year under audit as compared to those of the previous year, of any organization;

- The minimum audit fees calculated at the rates as approved under paragraphs A, B, C, D and E of clause 1.00 of part-3 above, shall mean minimum audit fees payable to each of the Joint Auditors where more than one Auditor is appointed.

Determinants of Audit Fees:

In order to identify the factors affecting auditor choice, a multivariate test of association between auditor choice and auditor and client-specific variables is carried out. Auditor choice is examined against a number of explanatory variables. The explanatory variables used are: client size, degree of sponsor ownership, whether the client firm is categorized as a Z-category company by the DSE and the market value of equity-to-book value of equity ratio of client firms. Detailed description on each of these variables is provided in the next section.

Hypothesis

The expected association between auditor choice and selected client characteristics is examined by testing the following hypothesis:

Ho: There is no significant association between a number of corporate attributes and auditor choice in Bangladesh.

The analysis is carried out at two levels. At the first level, all the companies in the sample are considered in order to develop a model representing both financial and non-financial companies. At the second level, only the non-financial companies are considered. The multiple linear regression technique is used to test the above hypothesis. In both cases, the dependent variable was a dichotomous variable representing auditor choice.

Model for Auditor Choice

The dependent and explanatory variables used in the present study are described below:

Dependent variable:

Auditor Reputation:

The choice of auditor (Big 4 affiliated firm versus an unaffiliated local firm) by the sample companies is used as the dependent variable in both the models. Typically a dummy variable is used to capture the auditor size in auditor choice studies. Segregation is usually made between Big 4 (formerly Big 8, Big 6, or Big 5 in earlier studies) and non-Big 4 firms. Generally audit fee studies are interested in auditor size as a potential explanatory variable explaining variations in auditor size.

Simunic (1980) found no evidence of significantly higher audit fees charged by the Big Eight firms in the US except Price Waterhouse, regardless of the audit size. Firth (1985) also reported no significant influence of auditor size in New Zealand. But other studies including Taffler and Ramalinggam (1982), Francis (1984), Palmrose (1986), Francis and Stokes (1986) and Francis and Simon (1987) found the existence of a Big Eight premium. In the present study, it was difficult to partition the audit firms in the absence of internationally recognized Big and non-Big firms category.

However, from the available information, it was possible to identify the international link of the audit firms, mostly with the Big Four. Four local firms affiliated with the international Big 4 and two affiliated with two non-big four firms were classified as large. Both Big 4 and Big 6 affiliations were studied. This produced six audit firms which could be recognized as large firms in the context of Bangladesh. Four of these firms are affiliated with the international big 4 firms while the other two are affiliated with two international non-big firms. The variable is labeled AFS.

Explanatory variables:

- Audit size: There are a number of reasons why a large client would want to employ a more reputed auditor. A large client has a bigger volume of transactions under audit, has more and wider range of stakeholders, is likely to have greater agency tension and have more to lose should anything go wrong. Large companies also typically have more dispersed ownership and diversified operations that may tend to make its auditing more complex and potentially risky. Therefore, client size should have a positive link with demand for auditor reputation. Copley and Douthett (2002) provide argument in line with the above contention. Large firms can also afford to pay higher audit fees and typically they appear to pay higher fees. Audit size is the most commonly used explanatory variable in audit fee studies and is consistently found to be the most significant variable in determining audit fees (Hay et al, 2005). In the present study, both total assets and sales were transformed into natural logs and the log of total assets is used in the model because of its higher correlation with the dependent variable. The variable was labeled LOGASSET.

- Audit profitability: A more profitable company is likely to go for higher quality audit as it may wish to signal the quality of its earnings. Client profitability as measured by net profit to sales ratio or return on shareholders’ equity has been used to explain the link between profitability and auditor choice. Relative measures of profitability are usually preferred to absolute measures because absolute profit may be highly correlated with company size. In the present study, the net profit to sales ratio is considered for use in the auditor choice model but was dropped to avoid possible multi co-linearity with the market category variable.

- Leverage: Agency literature (Jensen and Meckling, 1976) suggests increased agency tension as leverage increases. Debt-holders have incentives to engage in costly monitoring to prevent potential wealth transfers from debt holders to equity holders or to managers. They also have incentives to ensure that the financial information produced by the borrower is of acceptable quality. The borrower also has incentives to employ higher quality auditor (even voluntarily) to signal quality of its earnings and asset values. Leverage has been used in a number of audit fee studies as well, although the findings of these studies are mixed (Hay et al 2006). The debt-equity ratio is used as the measure of leverage. Some other leverage measures were also computed such as debt to total assets, total debt, and capital gearing ratio. The debt-equity ratio was selected for analysis because it showed the highest correlation with the dependent variable. A few problems arise in the computation of the ratio. One such problem stems from the lack of a uniform definition of debt that could consistently apply to both banks and non-bank financial institutions (such as insurance and leasing companies) as well as to non-financial companies. Computing the ratio for non-financial companies was rather straight-forward. However, for banks and other financial institutions that was not the case. While customer deposits are liabilities for banks, it cannot be conveniently called a debt. A second problem is caused by the existence of negative equity companies in the sample. In the present study, the first problem was resolved by defining debt to include borrowing from other banks and from the central bank (if applicable) and other borrowings (if any). Similar procedure was employed for non-bank financial institutions. The second problem was averted by replacing book value of equity by market value of equity for negative equity firms. The variable demonstrates significant positive correlation with the selected size variable – log asset. Therefore, in the final model the variable is dropped.

- Market category: Recently DSE listed companies have been categorized into 3 categories A, B, and Z based o their regularity of holding AGMs and/or payment of dividend. It is expected that companies in the Z category are likely to have financial and/or other difficulties and have no incentives to demand reputation by paying higher audit fees and also risking potential revelation of further weaknesses with the firm. The phenomenon is captured with a dummy variable with the value of 1 if it is in the Z category and 0 otherwise. The variable is labeled MKTCAT1. A negative sign is expected for this variable, as companies in the Z category are likely to engage non-big audit firms.

- Audit risk: Some measure of audit risk was considered in the present study. The measures of audit risk used include: leverage ratio, and existence of accumulated loss. In this study, leverage and the existence of loss in clients’ accounts were used as the measures of audit risk. The RISK variable was given the value of one if the company had an accumulated loss and zero otherwise. However, the variable is found to be highly correlated with market category variable and was dropped to avoid multi co-linearity.

- Multi-nationality: Subsidiaries of multinational companies observe higher accounting standards and disclose more information than their domestic counterparts. This may require higher quality audit work which arguably could only be provided by more reputed auditors. In the current sample, all the MNC subsidiaries are clients of big audit firms and pay higher than average audit fees. A dichotomous variable called MNCSUB was used with the value of one if the company was a subsidiary of a multi-national parent and zero otherwise. The variable shows significant positive correlations with the client size (LOGASSET) and was, therefore dropped from the analysis.

- Management shareholding: External audit is commonly viewed as a corporate governance mechanism to resolve agency conflict between managers and absentee owners (Fan and Wong, 2004). Unless statutorily required, in the absence of separation of management from ownership, an entity has no incentive to have an audit for assurance purpose alone. While it is almost impossible to find a modern corporation without any separation of management from ownership, it is not uncommon to find companies with high proportion of management shareholding. Under an agency framework, the relationship between management (or board) shareholding and demand for high quality audit work may be drawn to be inverse. In companies with high management shareholding, less information asymmetry could be expected and hence the reliance on auditor to resolve agency conflict is consequently less. Therefore, companies with high proportion of management (or board or sponsor) shareholding are expected to opt for high quality audit work and vice-versa. In the present study, management and directors’ shareholdings are used to mean the same as in Bangladesh, except in the financial services sector, most director’s act as inside directors. The variable is labeled MGTSHARE.

- Market-to-Book Ratio: Market value of equity to book value of equity shows a company’s growth opportunities and investment in intangible assets. Companies with high ratio of market-to book ratios are likely to demand higher quality audit as they wish to signal higher quality of accounting numbers. The variable is used as an explanatory variable and is labeled MVEBVE.

- Regression Models: Four auditor choice models are developed, two based on the combined sample and the other two on non-financial sub-sample. The first of the two models based on the combined sample uses Big 4 versus non-Big 4 dichotomy in the dependent variable while the second model uses Big 6 versus non-Big 6 dichotomy. The Big 6 firms comprise the local affiliates of the international Big 4 plus two local firms who are affiliated with two no-Big 4 international firms, namely Moore Stephen (M J Abedin and Co.) and BDO Spicer (Howlader Yunus and Co.).

A comparative analysis to charge Audit fees in different sectors and firm size:

Our motive of this research paper is to determine the Audit fees and nature and how it varies in different sector and in case of DSE listed and non-listed firms. According to the process of determination of Audit fees and for the regression test and interpretation, from my internship experience, I’ve collected some important data which is Audited company’s Total Assets, Net profit After Tax and Audit fees. On the basis of these data Critical Analysis is given below:

The test result using SPSS regression line model:

Interpretation:

R-Square:

R-Square, also known as the Coefficient of determination is a commonly used statistic to evaluate model fit. R-square is 1 minus the ratio of residual variability. When the variability of the residual values around the regression line relative to the overall variability is small, the predictions from the regression equation are good. For example, if there is no relationship between the X and Y variables, then the ratio of the residual variability of the Y variable to the original variance is equal to 1.0. Then R-square would be 0. If X and Y are perfectly related then there is no residual variance and the ratio of variance would be 0.0, making R-square = 1. In most cases, the ratio and R-square will fall somewhere between these extremes, that is, between 0.0 and 1.0. This ratio value is immediately interpretable in the following manner. If we have an R-square of 0.4 then we know that the variability of the Y values around the regression line is 1-0.4 times the original variance; in other words we have explained 40% of the original variability, and are left with 60% residual variability. Ideally, we would like to explain most if not all of the original variability. The R-square value is an indicator of how well the model fits the data (e.g., an R-square close to 1.0 indicates that we have accounted for almost all of the variability with the variables specified in the model).

Anova:

SS Error and SS Effect. The within-group variability (SS) is usually referred to as Error variance. This term denotes the fact that we cannot readily explain or account for it in the current design. However, the SS Effect we can explain. Namely, it is due to the differences in means between the groups. Put another way, group membership explains this variability because we know that it is due to the differences in means. Significance testing. The basic idea of statistical significance testing is discussed in Elementary Concepts, which also explains why very many statistical tests represent ratios of explained to unexplained variability.

ANOVA is a good example of this. Here, we base this test on a comparison of the variance due to the between-groups variability (called Mean Square Effect, or MS Effect) with the within-group variability (called Mean Square Error, or Ms Error; this term was first used by Edge worth, 1885). Under the null hypothesis (that there are no mean differences between data), we would still expect some minor random fluctuation in the means for the two groups when taking small samples. Therefore, under the null hypothesis, the variance estimated based on within-data variability should be about the same as the variance due to between-data variability. We can compare those two estimates of variance via the F test, which tests whether the ratio of the two variance estimates is significantly greater than 1. If greater 1 then its highly significant, and we would in fact conclude that the means for the two data are significantly different from each other.

Coefficient:

Customarily, the degree to which two or more predictors (independent or X variables) are related to the dependent (Y) variable is expressed in the correlation coefficient R, which is the square root of R-square. In multiple regression, R can assume values between 0 and 1. To interpret the direction of the relationship between variables, look at the signs (plus or minus) of the regression or B coefficients. If a B coefficient is positive, then the relationship of this variable with the dependent variable is positive (e.g., the greater the IQ the better the grade point average); if the B coefficient is negative then the relationship is negative (e.g., the lower the class size the better the average test scores). Of course, if the B coefficient is equal to 0 then there is no relationship between the variables.