Study on AAA Rated Companies

Credit rating evaluates the credit worthiness of a debtor, especially an individual, a business or a government. Generally, Credit rating agency involves in the evaluation process of debtor’s ability to pay off its debt and the possibility of default. In Bangladesh Over the years, the number of credit rating agencies (CRA) has increased several folds, from only two in 2009 to eight in 2015. Consequently, the competition among the CRAs for market share has become more competitive and complex. Since credit rating is very sensitive in relation to quality, this enhanced competition may lead to deteriorated or inflation ratings by the CRAs to keep hold of its clients and keep the cash-flow unharmed.

Credit rating has been playing a vital role in reinforcing the financial markets, regulating the financial markets, estimating risk premium, enhanced transparency in the credit and fixed income securities market, and standardization of credit evaluation process. However, there are also some drawbacks of the credit rating. These drawbacks include that credit rating can be biased in some cases, in absence of appropriate knowledge management by the credit rating companies altering the concerned analyst lead to discrepancies, and credit ratings cannot be treated as only a standalone measure to invest.

An investigation on the financial variables of the AAA rated companies has been conducted to find out whether the financial variables and the rating provided are consistent or not. The analysis differentiates the most important ratios i.e. Quick ratio, Times Interest Earned Ratio, Days of Sales outstanding Ratio, P/E ratio, Sustainable growth rate and the z score of the AAA rated companies. The trend of these financial variables over the last five years has been observed and the mean and sigma of these ratios over the five years has been compared. F test is used to test various hypotheses regarding the consistency of the mean and variance of the financial indicators of the AAA rated companies.

Finally, it was established that no consistent relationship lies between the financial indicators of the AAA rated companies and the ratings provided to them. Rather the relationship is ambiguous and inconsistent in nature. This raises the question whether to believe the credit rating or to believe the standards of the financial indicators.

Objectives of the study

The ultimate objective of preparing this paper is to assess the consistency in rating methodology of rating agencies. However, in Bangladesh the rating methodology of the rating agencies is strictly confidential and not disclosed to public. In addition a study on financial ratios has been executed to find out whether these ratios are consistent and fair with the rating provided. The analysis will also emphasize the extent to which the ratios vary over the years and how much consistent the variables are with the rating allotted to them. Accordingly some financial ratio and variables of the companies are analyzed in order to evaluate the origin and standards of providing credit rating to the companies. The mean and variance of the financial indicators are used as tool to find out the consistency in the rating methodology. Consistency in rating methodology of each individual rating agency is assessed by taking companies belonging to same rating class which is “AAA”.

Analytical Framework

The analytical framework of this study has been made by following ways:

Analytical Approach

This study has completed focusing on deductive approach as it makes mention of the report theme and does not intend to go beyond it. Moreover, this report topic primarily based on previously existed theories and studies in this area. The technique of this study is quantitative.

Here different financial ratios and variables are used to analyze data collected from the annual reports of the sample companies. The research has been conducted on the basis of outputs result from the financial variable. Since information regarding credit rating is so confidential, the analyses are presented by using descriptive approach. In addition the results have been described without providing further explanation on the issues.

Analytical Design

The analysis of the study is aim to find out if there is any dependable relationship between the financial variables of the AAA rated companies as well as the ratings provided to the respective companies. To clarifying the relationship, the financial performance of the companies over the

A study on AAA Rated Companies

Last five years has been taken into account. The financial performance is analyzed in the form of Quick Ratio, Times interest Earned Ratio, Days of Sales outstanding ratio, P/E Ratio, Sustainable growth rate and the Z score of the company. The mean and sigma of these ratios over the last five years has been calculated to contrast the ratios among the companies .F Test is conducted to test various hypothesis and find if the mean of the ratios of the two different companies which have been rated AAA are consistent or not.

Sampling

Basically, Grameenphone and Bata Shoe these two AAA rated companies have been chosen for performing the study. Annual reports from 2010 to 2014 of each company have been used to collect the financial data.

Literature Review

Credit ratings aim to measure the creditworthiness of an entity, e.g. a corporation, or small and medium industry. They provide an opinion of a rating agency that assess the fundamental credit strength of an issuer and his ability to meet its debt obligations (Gonzalez, et al., 2004). Credit ratings are produced by professional rating agencies and in most of the countries it requires establishment of regulatory guidelines that permits and monitors the credit rating agencies. For example, in the USA, agencies must be approved as Nationally Recognized Statistical Rating Organizations (NRSRO) by the Securities and Exchange Commission (SEC) (Hill, 2004). In Bangladesh, credit rating agencies has to be approved by Bangladesh Securities and Exchange Commission (BSEC). Subsequently, for the CRAs to rate issues and issuers under the BASEL II guideline has to be approved by Bangladesh Bank (BB) as External Credit Assessment Institution (ECAI). In an economic sense, rating agencies function as financial intermediaries, the existence of which would not be justifiable under the hypothesis of efficient markets

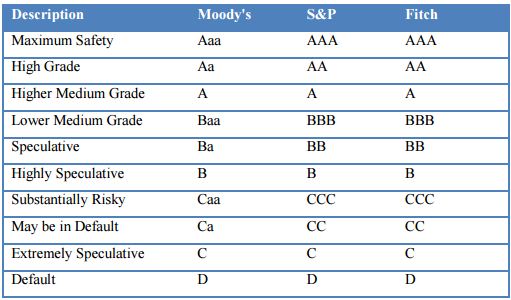

(Ramakrishnan & Thakor, 1984). Ratings are placed on a discrete ordinal scale, where for example under the S&P scale an AAA (the so called `triple A’) rating is the highest credit rating assigned to issuers with the highest credit-quality and a D rating is the lowest rating assigned to bonds or firms in default. Moreover, CRAs stress that ratings are just opinions. These opinions, which stem from fundamental credit analysis, are used to classify credit risk. In keeping with their status as opinions, ratings are determined by a rating committee. As such, ratings do not constitute a recommendation to buy, sell or hold a particular security, and do not address the suitability of an investment for a particular investor (Hilderman, 1999).

Empirical studies on credit ratings can be roughly divided into three lines of research (Blume, Lim, & MacKinlay, 1998). The first two measure the information content of credit ratings in different ways. The first line analyses whether credit ratings measure what they claim to measure, i.e. an issuer’s creditworthiness. More specifically, the relationship of ratings and corporate default is measured (Zhou, 2001). The second line measures the information content of ratings on capital markets. Here, capital market reactions around rating changes are analyzed to see if ratings contain additional information (Gonzalez, et al., 2004). The third line of research investigates the determinants of credit ratings. Here ratings as independent variables are modeled on a number of financial data (Ederington, 1985), corporate governance characteristics (Bhojraj & Sengupta, 2003), and macroeconomic factors (Amato & Furfine, 2004). These studies show that ratings can be replicated to a certain degree solely using publicly available data. Further studies in this context analyze the stability of credit ratings with respect to their ‘through-thecycle’ approach and the determining factors of rating changes and transition probabilities.

The CRAs attempt to assess the long term quality of a corporation. They therefore, take a through-thecycle approach in contrast to a more point-in-time perspective. The through-the-cycle approach means that agencies try to form their opinion independently of short term business cycle effects (Amato & Furfine, 2004). The quality of credit rating has been criticized in many of the literatures done over the years. However, most of those literatures were primarily targeted to the bond market of the United States of America. According to some researches credit rating agency is likely to issue less accurate ratings in boom times and in high competition (Bar-Isaac & Shapiro 2013) (Doherty, Kartasheva & Phillips 2007).

Moreover, Bo Becker, an Assistant Professor in Finance unit at Harvard Business School also argued the increased competition because of emergence of Fitch as a peer of Standard & Poor and Moody’s has led to lower quality products in the US corporate bond rating (Becker & Milbourn 2010). Additionally, by definition rating should be monotonous and not affected by any kind of cyclicality or sudden surge in business activities (Bar-Isaac & Shapiro 2013).

Several academic studies have examined the behavior of credit ratings over time, for instance through the analysis of credit upgrades and downgrades. Altman and Kao (1992) for example analyze the stability of newly issued S&P ratings for two sub-periods (1970 to 1979 and 1980 to 1988). They show that for every rating and time horizon (one to five years) newly-rated issues from the earlier period exhibit greater stability.

Credit Rating Definition

A credit rating evaluates the credit worthiness of a debtor, especially a business (company) or a government. It is an evaluation made by a credit rating agency of the debtor’s ability to pay back the debt and the likelihood of default. Credit ratings are determined by credit ratings agencies.

The credit rating represents the credit rating agency’s evaluation of qualitative and quantitative information for a company or government; including non-public information obtained by the credit rating agencies analysts. Credit ratings are not based on mathematical formulas. Instead, credit rating agencies use their judgment and experience in determining what public and private information should be considered in giving a rating to a particular company or government. The credit rating is used by individuals and entities that purchase the bonds issued by companies and governments to determine the likelihood that the government will pay its bond obligations.

Types of Credit Rating

Sovereign Credit Rating

A sovereign credit rating is the credit rating of a sovereign entity, i.e., a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors looking to invest abroad. It takes political risk into account.

Short-Term Rating

A short-term rating is a probability factor of an individual going into default within a year. This is in contrast to long-term rating which is evaluated over a long timeframe. In the past institutional investors preferred to consider long-term ratings. Nowadays, short-term ratings are commonly used. First, the Basel II agreement requires banks to report their one-year probability if they applied internal-ratings-based approach for capital requirements. Second, many institutional investors can easily manage their credit/bond portfolios with derivatives on monthly or quarterly basis. Therefore, some rating agencies simply report short-term ratings.

Corporate Credit Ratings

The credit rating of a corporation is a financial indicator to potential investors of debt securities such as bonds. Credit rating is usually of a financial instrument such as a bond, rather than the whole corporation. These are assigned by credit rating agencies such as A. M. Best, DBRS, Dun & Bradstreet, Standard & Poor’s, Moody’s or Fitch Ratings and have letter designations such as A, B, C. The Standard & Poor’s rating scale is as follows, from excellent to poor: AAA, AA+, AA, AA-, A+, A, A-, BBB+, BBB, BBB-, BB+, BB, BB-, B+, B, B-, CCC+, CCC, CCC-, CC, C, D. Anything lower than a BBB- rating is considered a speculative or junk bond. The Moody’s rating system is similar in concept but the naming is a little different. It is as follows, from excellent to poor: Aaa, Aa1, Aa2, Aa3, A1, A2, A3, Baa1, Baa2, Baa3, Ba1, Ba2, Ba3, B1, B2, B3, Caa1, Caa2, Caa3, Ca, C. A. M. Best rates from excellent to poor in the following manner: A++, A+, A, A-, B++, B+, B, B-, C++, C+, C, C-, D, E, F, and S.

The Importance of Credit Rating Agencies

Credit rating agencies provide investors and debtors with important information regarding the creditworthiness of an individual, corporation, agency or even a sovereign government. The credit rating agencies help measure the quantitative and qualitative risks of these entities and allow investors to make wiser decisions by benefiting from the skills of professional risk assessment carried out by these agencies. The quantitative risk analysis carried out by credit rating agencies include comparison of certain financial ratios with chosen benchmarks and the qualitative analysis focuses on the management character, legal, political and economic environment in a jurisdiction.

Development of Financial Markets

Credit rating agencies help provide risk measures for various entities and make it easier for financial market participants to assess and understand the credit risk of the parties involved in the investing process. Individuals can get a credit score in order to be eligible for easy access to credit cards and other loans. Institutions can borrow money easily from banks without having to go through lengthy evaluations from each individual lender separately. Also corporations and governments can issue debt in the form of corporate bonds and treasuries to attract investors based on the credit ratings.

Credit Rating Agencies Help Regulate Financial Markets

The credit ratings provided by popular rating agencies including Moody’s, Standard & Poor’s and Fitch, have become a benchmark for regulation of financial markets. Legal policies require certain institutions to hold investment graded bonds. Bonds are classified to be investment graded based on their ratings by these agencies, any corporate bond with a rating higher than BBB is considered to be investment graded bond.

Estimation of Risk Premiums

The credit ratings provided by these agencies are used by various banks and financial institutions in determining the risk premium they will charge on loans and corporate bonds. A poor credit rating implies a higher risk premium with an increase in the interest rate charged to corporations and individuals with a poor credit rating. Issuers with a good credit rating are able to raise funds at a lower interest rate.

Enhanced Transparency in the Credit Markets

The credit rating agencies provide improved efficiency in the credit markets and allow for more transparency in dealings. The ratings help monitor the credit soundness of various borrowers through a set of well-defined rules.

Standardization of the Evaluation Process

Most credit agencies use their own methodology for determining credit ratings, but since only a handful of popular credit rating providers exist, this adds a great deal of standardization in the rating process. The credit ratings of different borrowers can be easily compared using ratings provided by a credit rating company and the applications can be easily sorted.

Limitations of Credit Rating

Biased rating and misrepresentations:

In the absence of quality rating, credit rating is a curse for the capital market industry, carrying out detailed analysis of the company, should have no links with the company or the persons interested in the company so that the reports impartial and judicious recommendations for rating committee. The companies having lower grade rating do not advertise or use the rating while raising funds from the public. In such cases the investor cannot get information about the riskiness of instrument and hence is at loss.

Static study

Rating is done on the present and the past historic data of the company and this is only a static study. Prediction of the company’s health through rating is momentary and anything can happen after assignment of rating symbols to the company. Dependence for future results on the rating, therefore defeats the very purpose of risk indicativeness of rating. Many changes take place in economic environment, political situation, government policy framework which directly affect the working of a company.

Concealment of material information:

Rating Company might conceal material information from the investigating team of the credit rating company. In such cases quality of rating suffers and renders the rating unreliable.

Rating is no guarantee for soundness of company:

Rating is done for a particular instrument to assess the credit risk but it should not be construed as a certificate for the matching quality of the company or its management. Independent views should be formed by the user public in general of the rating symbol.

Human bias:

Finding off the investigation team, at times, may suffer with human bias for unavoidable personal weakness of the staff and might affect the rating.

Reflection of temporary adverse conditions:

Time factor affects’ rating, sometimes, misleading conclusions are derived. For example, company in a particular industry might be temporarily in adverse condition but it is given a low rating. This adversely affects the company’s interest.

Down grade:

Once a company has been rated and if it is not able to maintain its working results and performance, credit rating agencies would review the grade and down grade the rating resulting into impairing the image of the company.

Difference in rating of two agencies:

Rating done by the two different credit rating agencies for the same instrument of the same issuer company in many cases would not be identical. Such differences are likely to occur because of value judgment differences on qualitative aspects of the analysis in tow different agencies.

Rating Grades

Each rating agency has developed its own system of rating sovereign and corporate borrowers. Fitch Ratings developed a rating system in 1924 that was adopted by Standard & Poor’s. Moody’s grading is slightly different. Moody’s sometimes argues that their ratings embed a conceptually superior approach that directly considers not only the likelihood of default but also the severity of loss in the event of default.

Credit Rating in Bangladesh

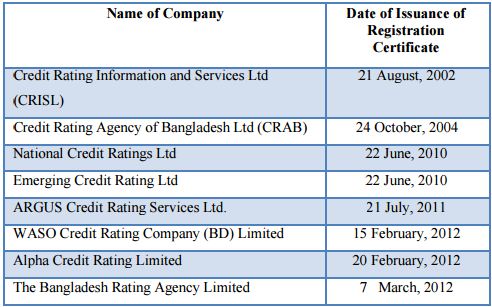

Bangladesh credit rating industry started its journey with the mandatory requirement of having credit rating for all public debt instruments, right offer issues and shares issued at a premium before the same were offered to the public. In the year of 2002, Credit Rating Information & Service Limited (CRISL) started its operation as the first registered credit rating agency of Bangladesh. The second rating agency,

Credit Rating Agency of Bangladesh Limited (CRAB) went to its operation on 2004, thus, making the sustainability more difficult for two rating agencies.

Credit Risk Grading Manual of Bangladesh Bank was circulated by Bangladesh Bank vide BRPD Circular No. 18 dated December 11, 2005 on Implementation of Credit Risk Grading Manual which is primarily in use for assessing the credit risk grading before a bank lend to its borrowing clients. By that time CRISL rating reports were appearing to be very useful for the users; specially CRISL rating report on the then Al Baraka Bank convinced the Bangladesh Bank of the need of credit rating and it took the initiative to make mandatory for all banks to have credit rating before it goes for public offering. The banking regulator further decided to make it mandatory for all banks to submit credit rating reports to the regulator within six months after the finalization of accounts.

Following the example of the central bank, the insurance regulator also came up with the requirement to make rating mandatory for all general insurance companies every year and for the life insurance companies bi-annually. The Dhaka Stock Exchange, while issuing the direct listing regulations, made the credit rating mandatory before a company apply for direct listing. The above regulations created an enabling environment for credit rating in the country’s capital and financial markets. The concept of client rating by the rating agencies to support capital adequacy of the banks came up in view of the need for implementation of Basel II capital adequacy framework by Bangladesh Bank.

According to Basel II framework, BB adopted a standardized approach for credit risk in which the services of rating agencies were required under certain strict terms and conditions. Bank client rating is a very sensitive issue in view of the fact that most of the private sector companies, enjoying banking facilities, are not maintaining standard financials for appropriate evaluation. Unless and until all the above factors are properly evaluated through sector wise studies, the ratings are bound to give wrong signals. Security and Exchange Commission of Bangladesh (SECB) allows 2% default rate of the credit rating agencies. There are certain penalties in case default rate of more than 2% including cancellation of license of the defaulter rating agency as the highest penalty by BSEC.

Other credit rating companies National Credit Ratings Ltd and Emerging Credit Rating Ltd started their journey on 2010. ARGUS Credit Rating Services Ltd. is on operation since 2011. Lastly, new four credit.

A list of credit rating companies operating in Bangladesh can be found in Exhibit 3: List of CRAs. According to Association of Credit Rating Agencies of Asia, Bangladesh has the highest number of credit rating companies. India, one of the largest economies of Asia has only two credit rating companies. On the other hand China, another largest economy is continuing its economic growth with a single credit rating company. The rating industry In Bangladesh is now considered to be a parentless industry. The behavior of the regulators towards nourishing this industry does not appear to be rational. The rating agencies are still defined by the SEC rules as an investment advisory company. This has not changed over a long time. The paid-up capital still remains at Tk. 5.0 million, to start a rating agency by any group of sponsors.

Credit Rating Process

Rating is an interactive process with a prospective approach. It involves a series of steps. The main steps are described as follows:

Rating Request:

Ratings in CRAs are usually initiated on formal request from the prospective Issuer. An undertaking is also obtained on a Taka 150 non-judicial stamp paper before commencement of a Rating assignment; which spells out the terms and conditions of the engagement of credit rating agency.

Rating Team

The Rating team usually comprises two members. The composition of the team is based on the expertise and skills required for evaluating the business of the Issuer. The team is usually led by the primary analyst with adequate knowledge of the relevant industry/instrument to be Rated.

Information Requirements:

Issuers are provided with a list of information requirements and broad framework for discussions. These requirements are derived from the experience of the Issuers business and broadly conform to all the aspects, which have a bearing on the Rating.

Secondary Information:

CRA draws on the secondary sources of information including its own in-house research and information obtained through meetings with the Issuers’ bankers, auditors, customers and suppliers among many other relevant market participants. CRA also has a panel of industry experts who provide guidance on specific issues to the Rating team. The secondary sources generally provide data and trends including changes in industry structure, sector outlook, global trends and government policies, etc. for the industry.

Management Meetings and plant visits:

Rating involves assessment of number of qualitative factors with a view to estimate the future earnings prospects of the Issuer. This requires intensive interactions with the Issuers’ management specifically with a view to understanding the business plans, future outlook, competitive position and funding policies, etc.

Other Meetings:

The CRA’s analyst team may also decide to meet the auditors (accounting policies followed, quality of internal controls, standard of disclosures, etc.), bankers/lenders (relationship, reputation, dealings in the past in respect of timeliness of servicing obligations), lawyers (if there are major litigations pending which may have serious impact on credit quality), trade union leaders (if industrial relations is a sensitive issue), key functional executives as well as a few investors, customers and suppliers, depending upon the circumstances to get a direct feedback from different stakeholder.

Meeting with the Issuers’ CEO /CFO:

This would be a very important meeting (usually, the last meeting) when the Rating team would discuss all the critical issues/findings that may impact the Rating decision with the CEO/CFO of the Issuer (in the absence of CEO/CFO, with a senior executive nominated by the Issuer for this purpose).

Internal Review Committee Meeting

Once the draft report is prepared by the Analyst team, it is placed before the Internal Review Committee (IRC) Meeting. The committee comprise of senior analysts. The committee reviews the draft rating report and analysis made by the analysts. Committee also reviews the due diligence, documents, meetings, site visits etc.

Rating Committee Meeting:

The authority for assigning Ratings is vested in the Rating Committee of individual CRA. The Rating reports are sent by the analyst team in advance to the Rating Committee members. A presentation about the Issuers business and the management is made by the Rating team to the Rating Committee at the meeting. All the key issues are identified and discussed at length during the meetings and all relevant issues, which influence the Rating, are considered. The differences if any arise during the discussion are taken note of. Finally, a Rating is assigned either by a consensus or by majority votes.

Surveillance:

It is obligatory on the part of CRAs to monitor ratings over the tenure of the rated instrument or till any amount is outstanding under the program rated. The Issuer is bound by the agreement to provide information to CRAs to facilitate such monitoring. In case the Issuer do not co-operate by way of providing information, etc, for the purpose of surveillance, CRAs may on its own carry out the surveillance on best efforts basis based on the available information and possible interactions after giving the Issuer adequate notice requesting him to co-operate. The Ratings are generally reviewed every year, unless the circumstances of the case warrant an earlier review due to changes in circumstances or major developments that were not anticipated/factored in the Rating decision. The Ratings may be Upgraded, Downgraded or retained after the surveillance.

The CEO, at his sole discretion, may give one opportunity to the Issuer to represent his case if he

is not satisfied with the rating decision after the surveillance process. However, the Issuer would not have any option of not accepting the Rating after the surveillance.

Importance of Credit Rating: Bangladesh

The motives act behind the entities’ paying fees to secure a credit rating depends on the surrounding regulatory environment and form of financial market. There are several reasons of getting a rating. The reasons are different in different markets and economies. The motives of getting a rating in Bangladesh are not identical as USA or UK. As same, the motives of American entities are not same as those of European or Australian entities. However, there are some common reasons for which the entities all over the world are spending money to get rating from the rating agencies. The identical reasons are enumerated here within the context of Bangladesh:

Market access

Any company that wishes to enter capital markets and issue debt in capital market is obliged to obtain a credit rating. Rating conveys the entity’s ability and willingness to the market participants regarding repayment of its borrowed money or equity capital. In Bangladesh, as per Credit Rating Companies Rules 1996, all the companies are required to be rated before issuing its debt or floating its equity share at premium in the market.

Build up market reputation

New companies that seek to build a reputation in the international financial markets demand credit ratings to increase the exposure of their brand name. This brand exposure is important when companies for example initiate foreign direct investments. An entity with a higher rating is considered as a reputable organization. Recently, Delta BRAC Housing (DBH) has been awarded as an “AAA” rated company of the country, which excels the company’s reputation that was reflected through the share price the company at DSE and CSE.

Lower cost of funding

A less known company can lower their cost of borrowing if they obtain a higher investment grade rating. Banks or financial institutions consider rating as an indication of an entity’s performance measurement yardstick. Entities with a higher rating are sanctioned loan at a lower interest rate whereas a lower graded entity is charged at a higher interest rate. So, it is going to be a common practice of the country to require an entity to be rated itself before applying for a loan to the banks or financial institutions.

Distinguish oneself from the competition

In sectors that are characterized by a limited number of competing companies such as the banking or insurance industry, a credit rating is a tool to distinguish them from the competition. Our banking sector is an example of this practice. In 2006, only Standard Chartered Bank was rated “AAA” by CRISL that makes the bank unique. But in 2007, both Standard Chartered Band and HSBC operation of Bangladesh has been awarded the highest rating “AAA” by CRISL and

CRAB respectively that creates some competitive advantage for both the banks.

Regulatory Requirement

All over the world entities are rated for the regulatory bindings by the securities commissions and other authorities. In Bangladesh, SEC, Bangladesh Bank and Department of Insurance are the three regulators who issued regulations, circulars and notifications for the entities for rating. Our banks and insurances are now rated once in a year for these requirements of the regulatory authorities.

Implementation of BASEL II

Bangladesh Bank (BB) issued new guidelines on capital adequacy for Banks under the implementation process of Basel II framework. Under the guidelines, Banks require to link the minimum size of their capital to the credit risk in their portfolios. So far Banks were calculating required capital as proportion of the entire loan portfolio, regardless of the degree of credit risk. To determine credit risk in their loan portfolios, banks will need to use credit ratings assigned by approved External Credit Assessment Institutions (ECAIs).

Basel II

Basel Accord

The world financial market is an extremely complex system that involves many different participants from local banks to the central banks of each nation and even the investor. Due to its importance on the global economy and our everyday lives it is vital that it is functioning properly. One tool that helps the financial markets run smoothly is a set of international banking agreements called the Basel Accords. These accords coordinate the regulation of global banks, and are “an international framework for internationally active banks”. The accords are obscure to people outside banking, but they are the backbone of the financial system; the Basel Accords were created to guard against financial shocks, which is when a faltering capital market hurts the real economy, as opposed to a mere disturbance. Basel II is recommendatory framework for banking supervision, issued by the Basel Committee on Banking Supervision in June 2004. The objective of Basel II is to bring about international convergence of capital measurement and standards in the banking system. The Basel Committee members who finalized the provisions are primarily representatives from the G10 countries, but several countries that are not represented on the committee have also stated their intention to adopt this framework. Basel II is the second accord of the Basel Committee on Bank Supervision’s recommendations, and unlike the first accord, Basel I, where focus was mainly on credit risk, the purpose of Basel II was to create standards and regulations on how much capital financial institutions must have put aside. Banks need to put aside capital to reduce the risks associated with its investing and lending practices

Basel II and Credit Rating

Basel II is recommendatory framework for banking supervision, issued by the Basel Committee on Banking Supervision in 2004. The objective of Basel II is to bring about international convergence of capital measurement and standards in the banking system. BB, in December

2008, issued guidelines on the New Capital Adequacy Framework (BRPD Circular 09, dated 31.12.08) to banks operating in Bangladesh, based on the Basel II framework. These guidelines inform that BB suggests implementation of Basel II with the following approaches:

i. Standardized approach for calculating RWA against credit risk

ii.Standardized approach for calculating RWA against Market Risk; and

iii. Basic indicator approach for calculating RWA against Operational Risk

Under standardized approach for measuring credit risks, the risk grades are determined on the basis of ratings assigned by ECAIs. Basel II is implemented from January 2009. In this regard a quantitative impact study (QIS) to assess the preparedness for implementing Basel II as well as the bank’s view on the optional approaches for calculating Minimum Capital Requirement (MCR) as stated in Basel II was carried out in April-May 2007. Study & subsequent discussion with few related banks revealed that bankers should be more acquainted with the New Capital

Accord (Basel-II). To address this challenge capacity building of concerned implementing & supervisory officials were given first priority in the Action Plan/Roadmap.

Analysis of Financial Variables

Objective of the Study

The rating procedures of the rating agencies in Bangladesh are strictly confidential and not disclosed to public. Therefore, an analysis of the financial ratios has been conducted to figure out whether these ratios are consistent with the rating provided. The core objective of the study is to assess the consistency in rating methodology of rating agencies. The analysis will also highlight how much the ratios vary over the years and how much consistent the variables are with the rating assigned to them. So to find out the basis and standards of providing credit rating to the companies some financial ratio and variables of the companies are analyzed. The mean and variance of the financial indicators are used to find out the consistency in the rating methodology. Uniformity as well as Reliability in rating methodology of each individual rating agency is evaluated by comparing with the companies belonging to same rating class which is “AAA”.

Methodology and Data Collection

The analysis is primarily based on the secondary data and the time period considered for the study is from 2010 to 2014. Rating methodology has been analyzed corresponding to six variables. The financial ratios and variables which are considered for this analysis are

- Quick Ratio

- Times Interest Earned Ratio

- Days Sales Outstanding Ratio

- P/E Ratio

- Sustainable growth rate

- Z score

These financial ratios are selected as these are commonly used by all the credit rating agencies and some of the previous studies support these ratios. The data regarding various rating grades has been collected from the reports of the rating agencies including various issues and websites of the rating agencies. Further, the data relating to various financial ratios relating to the given period has also been collected from their Annual Reports. Two public limited companies which are rated AAA are considered as the sample for this analysis.

A study on AAA Rated Companies

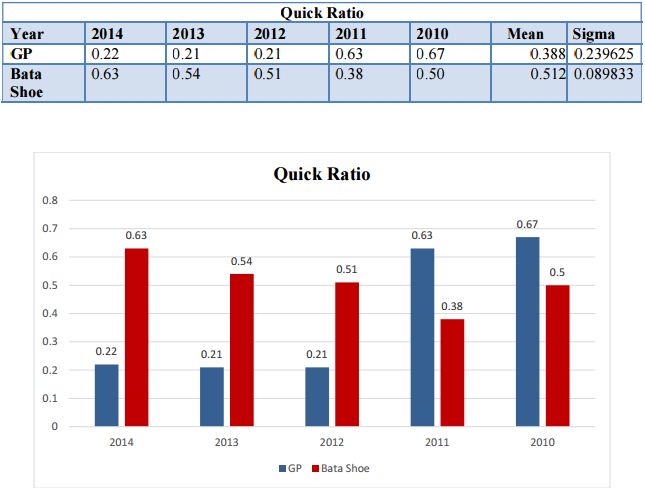

Quick Ratio:

Quick ratio is termed to examine the strength of a company to pay its short-term debts. It calculates the relationship between liquid assets and current liabilities. Quick ratio is considered a more reliable test of short-term solvency than current ratio since it shows the ability of the business to pay short term debts immediately.

The Quick ratios of the Grameenphone and Bata Shoe of the last five years are given in the table below and plotted in a bar chart to make them well understand.

Analysis:

By analyzing all the above information we can figure out that the Quick Ratio of Grameenphone varies from .67 to .22 over the last five years. The mean of the Quick ratio over the 5 years is .388 and the sigma is .239625.The quick ratio of Grameenphone has seen drastically decreased from the year 2010 to 2014. In 2010 we can observe that the quick ratio was .67 which started to decrease from 2011 and had a sharp decrease in 2011 to .21 from .63.Such a sharp decrease in the quick ratio is certainly a red signal for the investors as it shows a poor ability of the company to pay its short term debt immediately. As we know a Quick ratio with less than .5 is a red signal for the company and still Grameenphone has been rated AAA. If we look at the Quick ratios of the Bata Shoe Ltd we can see that their quick ratio has fluctuated from .38 to .63 over the last five years. The mean of the quick ratio of the last five years is .512.So the quick ratio of Bata

Shoe Ltd is around .5 over the last five years with a sigma of 0.089

Now if we compare the mean and sigma of the quick ratio of the two companies we find that Garameenphone has been rated AAA with a mean of Quick ratios of .388 and on the other hand Batashoe is also rated AAA with a mean of .512.The sigma the quick ratio of Grameenphone is .239625 whereas the sigma is lower in the case of Bata Shoe. Thus we can see that while providing AAA rating there is no standardized benchmark on the quick ratio.

Findings and Conclusion

From the above mentioned analyses of the financial variables we get the following findings:

- The financial ratios of the companies that rated AAA vary significantly over the years but still the rating grades are same.

- Despite of having a quick ratio which is below than .5 Grameenphone has been rated with AAA rating. This question’s the reliability of the credit rating provided.

- The Times interest Earned Ratio varies drastically between the two sample companies and yet both of them are awarded with the same rating AAA.

- The Days of Sales Outstanding Ratio of the two sample companies vary to a great extentThe Days of Sales Outstanding for Grameenphone is very high in comparison to Bata Shoe. And still both are awarded with AAA rating.

- The P/E ratios of the two companies are almost steady and constant over the years.

- The Sustainable growth rate of the two companies shows that Grameenphone despite of having a negative Sustainable growth rate has been awarded AAA rating since the last five years. Whereas Bata shoe with almost 2 digit growth rate is also a AAA rated company.

- The z score of the two companies indicates that both the companies are in no bankruptcy risk. Yet the z score of Grameenphone is decreasing over period significantly which may be a red signal in the near future.

- Since the clients provide the rating fees for rating assignments, there is a possibility that the client would try to influence the credit ratings assigned.

- The CRAs to attain and retain new clients may try to inflate the credit ratings.

Based on the above findings it can be said that the financial variables and the rating provided have an ambiguous and vague relationship between each other. If we believe in the financial variables and their interpretation the credit rating seems to be irrelevant. So the relationship between the financial variable and the rating provided is ambiguous in nature rather than liner and simple.