Consumer Behavior and Segmentation

Need for segmentation

PhilipKotler has described the dilemma of the seller (especially, a seller dealing with masses, e.g. banks) as follows:

“How the seller determines which buyer’s characteristics produce the best partitioning of a particular market? The seller does not want to treat all customers alike nor does he want to treat them all differently”.

Banks deal with individuals, group of persons and corporates, all of whom have their likes and dislikes. No bank can afford to assess the needs of each and every individual buyer (actual or potential).

Segmentation of the market into more or less homogenous groups, in terms of their needs and expectations from the banking industry, provides a solution to this problem.

This involves dividing the market into major market segments, targeting one or more of this segments, and developing products and marketing programs tailor-made for these segments.

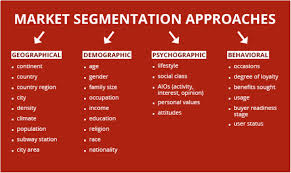

In the first segmentation, the market is divided from a unitary whole, to groups of buyers who might require separate products and marketing mix. The marketer typically tries to identify different segments in the market and develop profiles of resulting market segments.

The second step is market targeting in which each segment’s attractiveness is measured and a target segment is chosen based on tits attractiveness.

The third step is product positioning which is the act of establishing a viable competitive position of the firm and its offer in the target segment chosen.

In the process of segmentation, the market can be divided into major segments which are gross slices of the market, or into smaller specially formed segments, otherwise known as niches. Niche customers have a specific set of needs which the markerter tries to address. While a market segment attracts several competitors, a niche attracts fewer competitors and therefore, a company should clearly define its target segment and devise strategies to target the customer, so that it has a competitive advantage in the segment.

These concepts can be applied in personal banking by an Indian Bank. Traditionally, Indian Banks have not had any conscious strategy for selecting customers from the personal banking area, apart from some banks which have a geographic concentration strategy such as concentrating on a particular region or state. These banks will have to segment the market on certain basis, and identify market segments or niches which they want to cater to. For example, a bank like SBI may not be able to cater high income groups (say, managers, professional, NRIs, etc. who earn above Rs. 4,00,000 p.a. and who want a higher quality of products / services and who are willing to pay for them), as the services required by such a profile of customers are entirely different from the kind of products / services SBI can offer.

Initiation of Segmentation in Bangladesh

The private commercial banks of Bangladesh has already initiated to adopt the market segmentation concept. They actually segmented on the basis of major market segments dividing customers on the basis of activity and carved out 4 major market segments, viz. Commercial and Institutional, Small Industries and Small Business Segment, Agriculture, Personal and Services Banking. The objectives of this scheme were:

- Deeper penetration and coverage of market by looking outwards.

- Adequate flexibility of organization to accommodate growth and rapid change,

- Delegation of work for releasing senior management for more futuristic tasks.

Criteria for Segmentation

Segmentation in a right fashion makes the ways for profitable marketing. This helps policy planner in formulating and innovating the policies and at the same time also simplifies the task of bank professionals while formulating an innovating the strategic decisions. The following criteria make possible rig segmentation.

An important criterion for market segmentation the economic system in which we find agricultural sector, industrial sector, services sector, household sector, institutional sector and rural sector requiring of weightage while segmenting.