The cost of depreciation is the part of a capital asset assumed to have been consumed in the current period. This is because the asset is generally economically valuable and produces returns outside that accounting period, so expensing it will overestimate the cost in that period and understate it in all subsequent periods in that period. This amount would then be paid as an expense. As their value is absorbed over time, the purpose of this fee is to progressively decrease the carrying amount of fixed assets. Depreciation is used to adequately balance the cost of a long-term asset to the income it earns to prevent this.

Example of Depreciation Asset

Depreciation expense may be a non-cash expense; that’s, there’s no associated cash outflow. There are different methods wont to calculate depreciation, and therefore the style of depreciation accounting used is mostly selected to match the character of the equipment. For instance, an accelerated depreciation approach is often preferred for vehicles that depreciate much more rapidly in the first few years.

The identification of depreciation expenses comes from the accrual basis, which suggests that the money invested by the corporation to buy the properties should not be regarded immediately as expenses in that purchase period. There are three simple ways for a corporation to measure depreciation:

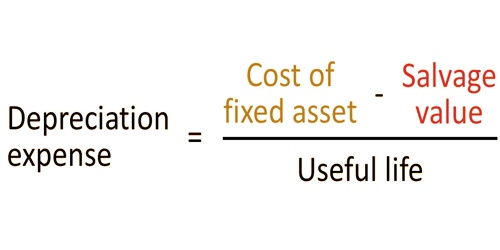

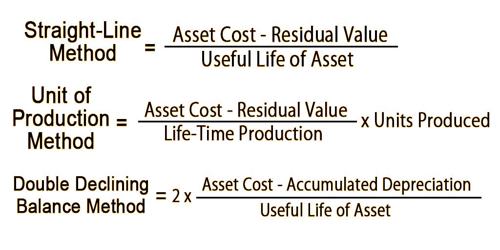

Straight-line Depreciation – The most simple way to record depreciation is usually to depreciate assets using the straight-line process. Each year, over the useful life of the asset, this approach simply takes on an equivalent depreciation cost.

Periodic Depreciation Expense = (Fair Value – Residual Value) / Useful life of Asset

It reports equal depreciation expense annually throughout the complete useful life until the whole asset is depreciated to its salvage value. Business A, for instance, buys a house for $50,000,000, to be used with no residual value for over 25 years. The annual cost of depreciation is $2,000,000, discovered by dividing $50,000,000 by 25.

Declining Balance (accelerated depreciation) – Declining balance depreciation is employed when the asset depreciates faster in earlier years. Because the name implies the depreciation expense declines over time. Since the carrying value of an asset is higher in previous years, the same percentage creates a greater amount of depreciation cost in previous years, decreasing each year. The cost is contained in straight-line depreciation by multiplying the fair value with 1 / useful life. The factor can be 1.5, 2, or more with the declining balance process. A 2x factor declining balance is thought as a double-declining balance depreciation schedule. As this can be a preferred option with accelerated depreciation schedules, it’s often observed because of the “double declining balance” method.

Periodic Depreciation Expense = Beginning Value of Asset × Factor / Useful Life

The system costs $5,000, has a salvage value of $1,000, a 5-year life, and is depreciated at 20 percent per year, following the straight-line example above, so the expense in the first year is $800 ($4,000 depreciable sum × 20 percent), $640 in the second year (($4,000-$ 800) × 20 percent), and so on.

The depreciation expense changes once a year because it’s multiplied with the start value of the asset, which decreases over time thanks to accumulated depreciation.

Units-of-Production – This technique requires an estimation of the total units generated by an asset over its useful life. This approach sets a higher cost to balance the higher use of the equipment when demand is higher. Obviously, it is most useful for machinery for processing.

Unit Depreciation Expense = (Fair Value – Residual Value) / Useful Life in Units

Periodic Depreciation Expense = Unit Depreciation Expense × Units Produced

The cost of depreciation is then measured every year depending on the amount of manufactured units. Depreciation expenditures dependent on the depreciable value are also determined by this method. In mining operations, the units-of-production approach is also used.

The balance within the depreciation travel and entertainment account increases over the course of an entity’s twelvemonth and is then flushed out and set to zero as a part of the year-end closing process. In the next fiscal year, the account is then used again to store depreciation costs. Expenses paid during the duration shall be based on the rate at which the company offers particular fixed assets and shall usually vary from entity to entity.

Information Sources: