The degree of operating leverage measures the effects that operating leverage has on a company’s earnings potential and indicates how earnings are affected by sales activity. The combination of operating leverage and financial leverage is called combined leverage or total leverage. The degree of financial leverage is calculated by dividing the percentage change in a company’s EPS by its percentage change in EBIT. Operating leverage measures operating or business risk whereas financial leverage measures financial risk. The ratio indicates how a company’s EPS is affected by percentage changes in its EBIT. Combined leverage measures the total risk of the business. A higher degree of financial leverage indicates that the company has more volatile EPS.

The degree of operating leverage is calculated by dividing the percentage change of a company’s earnings before interest and taxes (EBIT) by the percentage change of its sales over the same period.

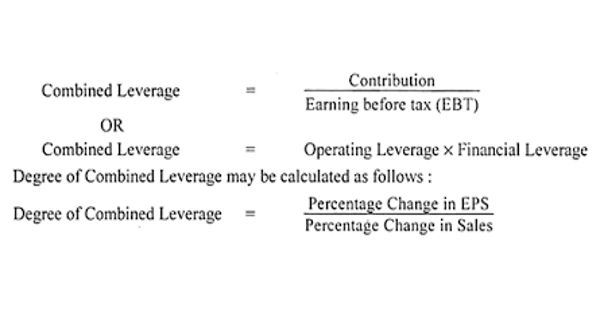

This ratio helps in ascertaining the best possible financial and operational leverage that is to be used in any firm or business. Operating leverage is measured by the percentage change in earnings before interest and tax due to percentage change in sales whereas financial leverage is measured by the percentage change in earnings before tax or earning per share due to percentage change in earnings before interest and tax. This ratio has been known to be very useful to a company or firm as it helps a firm understand the effects of combining financial and operating leverage on the total earnings of the company. Thus, the combined leverage is measured by the percentage change in earnings per share (EPS) due to a percentage change in sales. A high level of combined leverage shows the risk involved in the company as there are more fixed costs in the company, while low combined leverage would mean better for the company.

Measuring Degree of Combined Leverage (DCL) on the Basis of Income Statement

DCL = DOL x DFL = (CM/EBIT) x (EBIT/EBT) = CM/EBT

Where,

DCL = degree of combined leverage

DOL = degree of operating leverage

DFL = degree of financial leverage

CM = contribution margin

EBIT= earning before interest and tax

EBT = earning before tax

Measuring Degree Of Combined Leverage By Using Formula

DCL = Sales- variable cost/Sales – variable cost – fixed cost – interest

= S_VC/S-VC-FC-I

The degree of total leverage is a ratio that compares the rate of changing a company experiences in earnings per share (EPS) to the rate of change it experiences in revenue from sales. High financial leverage indicates that the firm increases its ROE after applying debt-financing in its capital structure. The degree of total leverage can also be referred to as the “degree of combined leverage” because it considers the effects of both operating leverage and financial leverage. So it can be concluded that a firm should always have high financial leverage corresponding to low operating leverage.

Information Source: