Customer Service of Jamuna Bank

The primary purpose of this report is to fulfill the degree requirement of Bachelor of Business Administration at BRAC Business School, BRAC University. Internship is must to fulfill academic requirement. The program provided me the opportunity to interact with the clients of Jamuna Bank and gather insights of Jamuna Bank’s customer service.

Financial institutions have wide range of activities in the economy of a country. Banks are the most important one in the financial sector as they play a very crucial role for the economy.

Banking business mainly maintains flow of funds from depositors to investors. In this process, banks need to collect deposit from the depositors and then distribute those as loan to the investors. Besides, banks provide assistance in international trade, money transfer, collection and payment of utility and other bills, etc. all of which are fully customer oriented. Therefore, commercial banks are treated as service organizations and their business is largely dependent on the quality of services they provide towards its clients. Hence, the efficiency and success of commercial banks depend entirely upon the satisfaction of their clients. So the key factor of any commercial bank is the customer service provided by them.

This report ”Jamuna Bank Ltd. and its customer service ” is the picture of quality services provided by one of the well-known private commercial bank of Bangladesh„Jamuna Bank Limited‟ . The study covers the following sections:

- Brief Discussion about Jamuna Bank Limited (JBL)

- Services provided by Jamuna Bank Limited

- Customer Satisfaction and Expectations

- Findings & Recommendations

Rationale of the study:

Only curriculum activity is not enough for handling the real business situation for any business school student. Therefore, it is an opportunity for the students to know about the field of business through the internship program as internship program is a perfect blend of the theoretical and practical knowledge. This report is originated to fulfill the requirement of the assign project internship report on “Jamuna Bank Ltd. and its customer Service” has been assigned to me by Human Resource Division (HRD) of Jamuna Bank Limited, Head Office, Motijheel. In this regard an organization attachment at Jurain SME Branch of Jamuna Bank has been given to me a period of three months commencing from 9th June, 2015 to 8th September, 2015. Basically The BBA program is designed to focus on theoretical and professional development of the students to take up business as a profession as well as service as a career. It is designed with an excellent combination of theoretical and practical aspects. The internship program provides the students to link their theoretical knowledge into practical fields. For this reason I have chosen this topic to work on for my internship affiliation report.

Objective of the report:

Broad Objective:

The main objective of the report is to make an in depth analysis of “customer service of Jamuna Bank Limited.

General Objective:

The general objectives of this report are:

- To know about the management system of Jamuna Bank Limited as a private commercial bank, its formation and functions

- To have a clear knowledge about all the division and departments of Jamuna Bank Limited Jurain Branch.

- To achieve the practical knowledge that will be helpful for future life.

- To justify the extent of the use of marketing in General Banking

- To apply theoretical knowledge in the practical field.

- To observe the working environment in commercial banks.

- To study existing banker customer relationship.

- To be acquainted with the procedures of several schemes of deposits.

- To improve corresponding, report writing ability

Compnay Profile:

Jamuna Bank Limited (JBL) is a private commercial bank of Bangladesh registered under the Companies Act, 1994 with its Head Office at Chini Shilpa Bhaban, 3, Dilkusha C/A, Dhaka. The Bank started its operation from 3rd June 2001. The Bank undertakes all types of banking transactions to support the development of trade and commerce of the country. JBL’s services are also available for the entrepreneurs to set up new ventures and BMRE of industrial units. Jamuna Bank Ltd., the only Bengali named new generation private commercial bank was established by a group of successful local entrepreneurs conceiving an idea of creating a model banking institution with different outlook to offer the valued customers, a comprehensive range of financial services and innovative products for sustainable mutual growth and prosperity. The sponsors are reputed personalities in the field of trade, commerce and industries. Jamuna Bank Limited, a highly capitalized new generation Bank started its operation with an authorized capital of Tk.1600.00 million and paid up capital of Tk.390.00 million. As of December 2006 paid up capital of the bank raised to Tk.1072.5 million and number of branches raised to 29 (Twenty nine). Currently Jamuna Bank has 97 branches and 168 ATM booths all over the country.

At present the Bank has real-time centralized Online banking branches (Urban & Rural) throughout the country having smart IT-backbone. Besides these traditional delivery points, the bank has ATM of its own, sharing with other partner banks & consortium throughout the country.

The GAPS model of service Quality

CONSUMER GAP

Gap is the difference between customer expectation and perception. It can go either way; Positive or Negative. Most importantly every Gap must be explained in numbers. Jamuna Bank Ltd. is a private commercial bank and depositors of this bank expect high quality service from them. From the research (survey) we found that, the lower income people have limited expectation. As a result they have lower gap here. A person, whose income level is higher and has accounts in several banks, has higher expectation of service from this bank. As a result their gap is higher in numbers.

PROVIDER GAP

Provider gaps occur within the organization providing the service and include; not knowing what customer expects, not selecting the right service designs and standards, not delivering to service designs and standards and lastly, not matching performance to promises.

Through the customer survey, I have calculated several gaps and describing few of them which are very important for service sectors like Banking:

GAP 1:

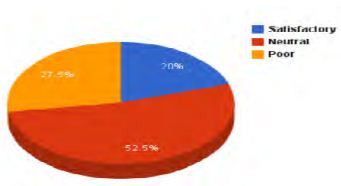

This gap addresses the difference between consumers‟ expectations and management‟s perceptions of service quality. I found 52.5% of customers have neutral feelings for meeting the expectations. People who have neutral feeling; some of them said, as Jamuna Bank Ltd. is not Government‟s bank they do not expect much from them. Even they have doubt on their mind about the durability of this Bank. Moreover, 27.5% customers said that expectation fulfilling power of Jamuna Bank is poor. Therefore if we consider the natural review (52.5%) as negative then the gap is 80% here.

GAP 2:

This gap addresses the difference between management‟s perceptions of consumer‟s expectations and service quality specifications. In case of Jamuna Bank, they need to rephrase their service designs in terms of selecting right service designs and standards. Around 80% people from our research said that they want to see improvement in “Online Banking and ATM booth sectors”. Last of all, their failure to develop tangibles in line with customer expectations is something that needs to be well defined. There is a huge gap (30%) in terms of physical evidence on the basis of locations. Differences between Gulshan branch and Jurain branch in terms of physical evidence like equipments and facilities used to deliver the service are vast.

GAP 3:

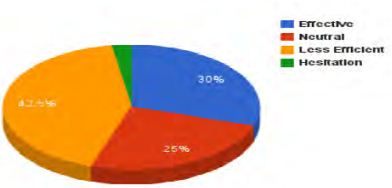

This gap addresses the difference between service quality specifications and service actually delivered. In another word it‟s “service performance gap”. In JBL Jurain Branch, technological knowledge of employee is very low. Most of the case, they need to call IT department (located in Head Office) for help. As a result it takes higher time to complete any task. We found the gap is 45.5% (hesitation and less efficient) here.

Gap 4:

This gap addresses the difference between service delivery and the communications to consumers about service delivery. For communication, I found customer has higher expectation and lower perception. From the survey I found customers think as a private bank, Jamuna Bank has the possibility of having well developed communication system. Unfortunately, many of them said, people not having previous banking experience may find it difficult to communicate about the services with the officials. But most of them agree that it happens due to overloaded crowd or clients in the banking hour. When the number of clients in the bank are less, that time the employees try to help the customers as much as they can do. We found gap is 42.5 here.

GAP 5:

This gap addresses the difference between consumer‟s expectation and perceived service. As a private bank, Jamuna Bank rarely meets the expectations or comes any near to fulfill consumers‟ perception. Research says that consumers‟ expectations from all services they get are moderate which around 70% and their perception is lower than, 50%. Mainly, at the time of receiving remittance, they have to wait for a long time and interestingly there are some consumers who do not have any complaint against it. They are the loyal consumers of JBL.

In case of service designing gap, we found very poor service design compare to modern day banking system. Mr. Rakib Ur Rashid, First Executive officer of Jamuna Bank (Jurain SME Branch) said that, due to geographic and demographic factors, it‟s not possible for them to provide updated services or technology based services. The Head office of Jamuna Bank sets target for all the branches annually. As a result the branch becomes desperate to fulfill that target within the time frame. After all, end of the day the Head office only counts how many new accounts they are able to create and the deposit amount the branch are able to collect.

As it‟s a private commercial bank, from the beginning of its service Jamuna Bank is trying to minimize service performance gap. People will found a complaint box in every branches of Jamuna Bank. The clients have easy access to talk with the branch manager in any manners. They also have care line center to listen customer complaints. Apart from that, The

Human Resource Department (HRD) is frequently providing training to the employees to improve their attitude toward the customers. Finally we can say that, the bank is trying to improve their services but because of lengthy rules and regulations provided by the State Bank (Bangladesh Bank) it‟s become difficult for them to minimize the service gap as they are strictly forced to obey the rules of Bangladesh Bank.

Consumer Behavior in banking services

Now a day‟s consumer behavior is such a big issue in each and every industry. Banking sector is not out of it. As a service oriented business, obviously consumer behavior has a great impact on it. We know that recently in our country the banking industry is making growth rapidly, so the competition is huge and intense here. Before considering them as a successful bank they need to manage this important issue (consumer behavior) efficiently.

To complete the research, I select the clients of Jamuna Bank (Jurain SME Branch) and try to find out how the bank manages this consumer behavior factor effectively. Consumer perceptions as well as their behavior are changing day by day and it creates a great risk for a particular bank but at the same time it creates some opportunities too. Here confidence is big factor. Through the survey and interview, we can say that Jamuna Bank is confident enough. The bank is operating successfully more than 15 years. Every day the branch is opening more than 15 new accounts and many of them are new in the banking service. That means many clients start their banking journey with Jamuna Bank. Therefore they trust Jamuna Bank and have confidence on it. Even many clients already have accounts in other banks but still they are creating a new account in Jamuna Bank. Good reputation and attracting schemes able to grab their attention towards Jamuna bank.

According to the consumer survey, most of the customers open an account in this bank because of the security and higher interest rate purpose. After completing the research my findings is that many people especially, the younger consumers and the less educated consumers do not have sufficient knowledge of understanding these financial factors. Most of them rely on the suggestions of their friends and relatives. One of the main reasons behind selecting Jamuna Bank is; its reputed brand name. People think that Jamuna Bank belongs to Jamuna Group and Jamuna Group is one of the most successful companies of Bangladesh. Unfortunately, Jamuna Bank is not related to Jamuna Group. Due to same brand name, people misjudge it. Here some factors that influence consumer‟s behavior in banking service are:

- Age plays an important role in customer behaviors. It decides how consumer will prefer to interact with their banks. Normally younger people are more motivated to use digital mediums like ATM booth, Mobile banking rather than frequent use of physical branch.

- Preference of mobile and online channels arises because of time consuming banking practices at the branch. Our research says that consumer under age of 25 mostly prefer using a branch as an alternative of the online banking. On the other hand consumer over age of 35, mostly prefers branches over the Internet. However considering these younger generation as customers of the future, these preferences have a big impact on the bank to go forward.

- Therefore for these reasons, to attract the modern generation (mainly youth segment) Jamuna Bank investing huge amount of money for technical advancement. As a result, each and every branch of Jamuna Bank connected with online banking service.

- Flexibility and personalization of service are other two factors that also have great impact on banking consumers. Today‟s banking clients more or less expect that their financial institutions will offer personalized or customized service to meet their growing needs quickly and efficiently. According to our research customers are willing to provide more personal information with their main bank, but in return they expect to receive better tangibles or physical evidences (like Govt. stamp paper or well written documents) from the service provider.

- Customers are also prefer flexible access to their bank so that they can get chance to choose how they want their offered services and accessibility options. For example, giving them multiple options to withdraw their money. In case of emergency they can use either ATM card or cheque book to withdraw the money. Jamuna bank is very efficient like other private banks in this aspect. They are more flexible in their working process.

- Lastly, customer‟s decision to select a particular bank depends on the upgraded technology used by that bank. There is a huge difference in terms of physical evidence on the basis of locations. Differences between Gulshan branch and Jurain branch in terms of physical evidence like equipment, presence of wireless internet and facilities used to deliver the service are vast. Branches located in old Dhaka looks like traditional Government‟s Bank. As a result new consumers are not getting attracted by their external and internal structure. Even existing customers losing their interest in this regard. In these branches all the procedures designed are similar to government office. These branches are not ready to accommodate modern day requirements such as voice and video communications. Jamuna Bank is going slow to bring new technical services and failed to change the outlook of every branch. Resulting, competitive disadvantage.

As the situation is changing as well as consumers are changing their banking behaviors, so it is high time to change the traditional way that bank used to deliver their services. Consumer behaviors are changing but this is not a one-time process. This change will continue and perhaps even go faster, based on the rapid pace of change of consumer‟s use of technologies like smart phones and tablets. Maybe ten years ago it would have been hard to think of the need for mobile banking applications. Now it‟s hard to believe that some financial institutions yet to offer internet based banking system. For example, by sitting at home and accessing the website of Jamuna Bank, a client cannot transfer his balance to other account. These are challenging issues for financial institutions like Jamuna Bank. Lacks of technical innovations makes it really difficult for the bank to bring new services.

To solve their problems this bank needs to be serious about growing its business and find out an agile solution. Normally a bank must have the ability to bring the offers into the market in a reasonable time; preferably before the bank‟s competitors are able to deliver a similar types of offer. As the competitor is intense in private ltd, many new banks already come up with new ideas, what Jamuna Banks needs to do is that, observing this ideas very fast and think about new innovations. They have to find out the changes in consumers behavior before their competitor does.

In this case first of all they must give concentration to their loyal customers or making loyal customers. This bank needs to develop new strategies to target dissatisfied customers and stop attrition. Bank must invest in customer retention units to take more complete view of customer concerns across service areas. As we said before that the customer also opens accounts in other banks, to stop customer attrition bank should start developing services bundles for customers. As a result, customer will see the tangible benefits and which influence them not to jump into another bank.

Now a day‟s banks atmosphere influences consumer behavior heavily. Bank‟s atmosphere includes overall environment of the bank like attitude of the staff‟s towards the clients. The atmosphere of a particular bank is the key to maintain its service quality. For example, if a customer comes for a service and receives special treatment from the officials; then for him the bank‟s atmosphere is very energetic and attractive. As a result, he/she will feel comfortable to spend some time in this bank. These external infrastructures also work as 1st impression of customer‟s behavior. Unfortunately, the external infrastructure or the outlook of Jurain SME Branch is very poor. Surely it is not going to attract the new clients easily.

After seeing current situation of banking industry, I can definitely say that, customers are gaining control of their banking relationships. Changes in today‟s consumer behaviors are driving the banks to bring new services in market quickly. Now this sector is more competitive in our country. Most of the company‟s especially private commercial banks are more concern about consumers. Whenever consumer behavior changes, the company grabs it, find out opportunities and use it properly. But some banks like Jamuna Bank still not properly acknowledge that. They cannot be responsive to their consumer demands because of their traditional strategies.

Customer expectation of Service

Customer expectation and believe about service is a predetermination of idea along with customer‟s needs and wants. There are so many factors that can influence to create customer expectation of service such as, customer‟s perception of the product or service and his\her past experience on that product or service. These are actually, customer‟s personal sources to create customer expectation. Apart from internal sources there are some external sources as well to create expectation of service. Like from of advertisement, word of mouth and brand image which shifts constantly. It‟s actually creates problem when the customer finds difference between expectation of service and the delivery of that particular service. Therefore, at the time of delivering of service company should maintain a standard of their service and performances.

The two main things are very important to determine expectation standard of service. Those are the differences between customer‟s expectations regarding service what they want from the service provider and the services they received from the particular service provider. Service should be given on customer perspective. Expectation is nothing but beliefs and standard. Standard also varies with industry to industry. There are some factors that can influence the expectations are money or price, education and behavior etc.

I conducted survey on customers of Jamuna Bank Jurain SME Branch and took interview of Mr. Rakib Ur Rashid, First Executive officer, Jurain SME Branch. The results of some of their (clients) expectations are given below:

- All of them want to use payment card (Visa or MasterCard) services.

- Higher number of ATM booths.

- Fast Banking Services (receiving the remittance, creating bank accounts etc.)

- Fair treatment from the officials

- Technological upgrade (installation of CC camera, wireless internet service, online banking)

Level of expectation:

The level of expectation largely depending on the information and the reference point the customer hold for a particular organization. There are four types of level of expectation. The level of expectation varies according to customer understanding of particular service.

- Ideal expectation or desire, in that level the expectation level is so high. As Jamuna bank is a private bank so the customer‟s expectation is so high about its security system . Clients think that private banks are using latest technologies to protect the privacy of their clients. Existing customer of the Jamuna bank, most of them are satisfied with their security system. So it‟s a positive sign to create customer expectation on Jamuna Bank. Maintaining 100% client‟s satisfaction is not possible by any banking organizations. Therefore, there are some dissatisfactory sectors like the employee behavior, overall environment of that company and infrastructure of the branch.

- Normative should expectation, as the company is service oriented, their service should be on time based, behavioral of employee and security based. From the survey, we got that their service mainly on security and interest rate based rather than behavioral of employee. As a result, improvement is required in this sector yo reduce client‟s dissatisfaction.

- Experience based norm, it actually depends on customer previous experience on a particular service. Jamuna Bank‟s existing customers know that, the work process rate is moderate level based on their previous banking experience. They also know that, private banks are bound to follow strict rules of the central bank. That is why they are facing some problems such as lengthy or time consuming services.

- Acceptable expectation; acceptable expectation comes from the understanding between service provider and service receiver. A new account holder cannot withdraw the money from the first day of account opening. After completing address and identity verification the bank issues him\her cheque book. Therefore, it takes 3-4 days to complete these formalities and clients accept these conditions.

- Minimum tolerance expectation, as the services and facilities of Jamuna bank is low compare to other private commercial banks. So, customer minimum expectation towards the bank is, the interest rate or schemes must be attractive enough compare to other banking organization.

Factors influence expectations:

Source of Desired service:

Impression the bank gives towards its customer; influences customer expectations. It should be equal for both new and existing customers. Behavior of employee towards customers, how politely they talk with clients is very important to create customer expectation. According to the survey, the behavior of officials at Jamuna bank is not friendly. As a result, the clients not expecting high quality service from them.

Adequate service

The desire level of service expectations varies customer to customer. Jamuna bank should pay attention on that. Same level of service will not be able to satisfy everyone. One client may feel happy, one may not. It varies. Each customer measure the service level in their own measurement scale. From the survey we found that, official‟s behavior toward customer is not that much satisfactory.

Service encounter Vs overall service:

Service encounter starts from the moment whenever a conversation with client takes place. The service is yet to receive by the clients but it already creates expectations on their mind. Communicate with customer and providing information about their service with a good manner is very important to create an impression on consumers mind. According to the research, Jamuna Bank fails to match client‟s expectation. One reason behind that is they are not as much updated as other banks. Lack of ATM booths could be one of them.

Desire and predicted service:

After receiving data from reference group, customer makes some prediction on a particular organization. By adding individual expectation and collected data from peer group; consumers predict about the serving quality of a particular bank. Then after experiencing the service customer makes the final judgment about a particular organization. Jamuna bank customer also make some judgment about their service such as their behavior of employee is not so cooperative, overall environment and relationship with customer is not very good. Due to that, customer may feel that Jamuna Bank‟s service is not high class.

Sometimes customers demand regarding service is idealistic or not realistic, which is difficult to fulfill or often impossible. For instance, some consumers want high interest rate and less paperwork to be done. This is not possible to offer by the bank. Therefore, it is not possible by Jamuna Bank to fulfill all the expectations of its customers. They can offer other facilities to convince them (clients) that they are trying their level best to match expectations.

Last of all, service should maintain professionally. Customers should not face any troubles regarding bank‟s service. Customer‟s safety, privacy and the social issues should be maintained properly.

Consumer perception on Jamuna Bank’s service

Perception is a process. It starts with consumer exposure, attending to marketing stimuli and ends with consumer interpretation. Therefore we can say that perception is, “how we see the services around us”. Naturally perception occurs or comes after enjoying or experiencing any particular service. As perceptions are always considered relative with expectations, so it differs individual to individual and from culture to culture.

Consumer perception of Service Quality and Consumer satisfaction

Reliability: Reliability is the measurement of satisfaction or success about the service from consumer‟s point of view. In our survey most of the customers rank their satisfaction as average and few of them (about 4 to 5) are dissatisfied with the service of Jamuna bank. As a result, we can see that the service of Jamuna bank is average.

Responsiveness (Solve customer’s problems): It reflects the attentiveness and willingness to help its consumers. That means when an inquiry or complain is lodge, how fast Jamuna bank respond to it. Among 20, only 3 persons said that, the responsiveness of Jamuna Bank is Poor. Rest of the population is either satisfied or neutral with responsiveness of Jamuna Bank.

Assurance: It reflects the consumers trust and confidence on the service. High confidence from consumers on a particular service states that, consumer trust the service. The majority of the depositors are senior citizens and less educated. Therefore they trust Jamuna Bank‟s service. One of the key factors behind their high confidence is, the brand name “Jamuna”. As I mention it earlier that, majority of the people believes that Jamuna Bank belongs to Jamuna Group. So when they (clients) think of “Jamuna”, it stimulates “Jamuna Future Park”, “Jamuna group” on their subconscious mind.

Empathy: Defined as the individual attention provides by the Organization towards its customers. Here the service provider has to think from the consumer‟s point of view. Jamuna Bank has different schemes for the depositor. When a person wants to open a bank account in Jamuna Bank, the manager or the executives of that particular branch personally interact with the person. Bank official‟s shares all the required information and suggests a particular type of account (saving, current or long term accounts) toward the depositor based on the deposit amount.

Tangibles: Tangibles reflect the physical layout or appearance of equipment‟s and materials. Tangibles give an image or impression towards its customers about the Bank. Apart from that, Service Company use tangibles to enhance their image or brand value. Jamuna Bank has 97 branches and 168 ATM booths. These physical infrastructures are part of Tangibles. ATM cards, cheque books, account opening documents these are also part of tangibles.

Determines of Customer Satisfaction

Product and Service Feature: Product and service features influenced a customer highly at the time of evaluation or purchase of the service. The services and schemes of Jamuna Bank are possible to classify in the Personal, Corporate, Business, Agri & Rural, SME, Merchant, NRB and Islam divisions. They also offer consumer loans such as Home loan, Car loan and agricultural loan.

Consumers Emotions: Consumers emotions also have an impact on their perception about the service quality. To protect agriculture and farmers of Bangladesh, Jamuna Bank offering “10 Taka Account” service in rural areas. In this service, a farmer can open his bank account with 10 taka only. The primary deposit of these accounts will be Tk 10 only without any minimum balance requirements. In the year of 2014, Jamuna Bank

Foundation handed over 5000 nos blanket to Prime Minister’s relief fund for winter distressed people. These initiatives or CS activities emotionally influence the consumers. They feel themselves as a contributor in these social activities.

Attributes for service success and failure: Jamuna Bank started its journey in 2001. It has 97 branches all over the country. Therefore even in the rural areas the Bank is functioning successfully. Depositors find Jamuna Bank Branches very near to their house. It is one of the key factors behind the success of Jamuna Bank.

Perception of equity or fairness: Private Bank deals differently with the clients based on their deposit amount. In Jamuna Bank Limited, different types of services are applicable for different types of depositors. Therefore, questions may arise in this case. Many depositors think that, it is an unfair practice. Service standard should not be set based on the deposit amount.

Other Consumers and Family members: It is similar like referencing. When a service becomes famous, Reference works like a magic. Jamuna Bank started its journey in 2001. Therefore almost every elder person of a family knows about the Bank. Their reference and involvement with Jamuna bank will inspire new generation.

E-service Quality of Jamuna Bank:

The official website of Jamuna Bank is http://www.jamunabankbd.com. In our consumer research we found very interesting thing. Many of the depositors future expectation from Jamuna Bank is “online Banking” service. But they do not even know that the service is already established. Every branches of Jamuna Bank Limited (97) are incorporating with online banking.

Efficiency: Reflects the ability of consumers to access in the website, retrieving his\her desire information. Basically this part talks about how fast the webpage loads. The website of Jamuna bank is much faster than many other banks. Therefore we can say that, the website of Jamuna Bank is efficient enough to process the information.

Fulfillment: It reflects the result or outcome. Whatever the visitor wants to know from the website; is the website sufficient enough to provide that information or not. Every service related information and Financial reports of Jamuna Bank can be found in their website.

Reliability: It‟s about the numbers. How many times a web visitor successfully retrieves their desire information through the Website of Jamuna bank? The main purpose of the website is to share the information with its clients. Therefore if we talk about the information quality, the website is reliable and sufficient enough. But the online banking service is not available in the website. So the website is not reliable in term of online banking function.

Responsiveness: The website of Jamuna bank is responsive enough. Whenever an applicant‟s submits his\her CV for a particular post, Jamuna bank sends him a confirmation mail. That means the applicant can easily understand that his CV is in the database of the Bank. But the online response is not very fast, it takes up to 48 hours to inform an applicant.

Privacy: The website of Jamuna bank is secured enough. They never shares applicant personal information such as address, phone or email with third parties for marketing purpose. It also protects depositor‟s accounts related information.

Contract: Through their website a visitor will be able to know the history, address and phone number of every branch, Location of ATM booths. That means all information to contact with the bank is available in the website of Jamuna Bank.

Sources of pleasures and Displeasure:

Recovery: Recovery takes place right after the product damage or service failure. It talks how the employees of Jamuna bank response to service delivery system failures. If a depositor complains that his money is not transferred or added successfully, the authority collect the account number and phone number from the depositor. When the bank is able to fix the service, they inform the depositor through a phone call or sms service. It‟s a time consuming process. It may lead depositors to dissatisfaction.

Adaptability: Adaptability is the learning part. The process of learning from the previous mistakes and incorporates the learning. Banking service of Jamuna Bank Jurain SME branch is not efficient enough. It may take more than hours to withdraw the remittance or to deposit the money because of heavy crowd. But the bank is not taking any major initiatives to change this scenario. Sometime it frustrates the consumers.

Building Customer Relationship

Relationship is a term that is indispensable in almost every aspect of human society. In the case of marketing, it is more like a shift from transaction to a relationship focus. It requires communicating with the customers or consumers by giving appropriate service which will turn to build the relationship gradually. Consumers are like the core values for an organization. They are the main players for the organization. So, an organization has to be very much careful about their product and services. In terms of relationship marketing every organization should keep the following things in mind:

1) Customers become partners

2) Firms must make long term commitments

3) Maintenance relationship with quality, service and innovation

Managing Customer Relationships

Relationship marketing: Establishing long-term mutually satisfying buyer-seller relationship is very important. For Jamuna Bank Limited, there is a problem that, every year little portion of customers are switching to other banks for better service. As the number of alternative banks are high, it is high time for Jamuna bank to think again about the retain strategies to lower down the turnover ratio.

Customer relationship management (CRM): Using information about the customers to create marketing strategies that going develop and sustain desirable customer relationships is necessary for any organization. Jamuna Bank need to conduct market research which will help them to understand the needs of the customers. There are still lots of GAPs in Jamuna Bank’s service that need to be identified.

Customer lifetime value: Customers are increasingly viewed in terms of their lifetime value to a firm, rather than being measured simply on the value of an individual transaction. Jamuna Bank is more prone to loosing loyal customers since they do not have adequate rewarding policy for these customers. This effectively shortens the life time value of many customers of Jamuna Bank

Goals of Relationship Marketing:

1) Acquiring Customers: It‟s the basic concepts about capturing new customers in business. Jamuna bank have to focuses on important issues like interest rate, lower service charge, easy loan system that attracts the new customers to open a bank account.

2) Satisfying Customers: It‟s the concepts to satisfy the existing customers. For example: by providing visiting cards, New Year calendars, flowers etc. Aim is to make clients happy. In this case, Jamuna Bank‟s performance is less than satisfactory. They are still lagging behind other private banks in term of satisfying customer.

3) Retaining Customer: It is basically to do something extra so that the existing customer will not switch to competitors. Firms spend more than five times as much to obtain a new customer than to retaining an existing one. Unless they conduct research, it becomes difficult for the bank to identify whether their customers are planning to switch or not. Jamuna Bank still do not have a sound strategy for retaining its customers for a long period and for that reason many customers are switching to its competitors

4) Enhancing Customer: It‟s literally giving the best priority towards the best loyal customers to make the relationship stronger. As some of the branches of Jamuna Banks following this type of practice (send of sms on client‟s birthday). Attractive and unique way is needed to make the customer relationship strong

Benefits for Customers in Long Term Relationship:

1) Confidence Benefits: It comprises feelings of trust in the provider along with the comfort in knowing what to expect. But unfortunately Jamuna Bank is yet to give much confidence to its customers. As a result, many of the customers are switching to other banks.

2) Socials Benefits: Due to longer period of interaction, Customers develop a sense of familiarity and even a social relationship with their service providers. In some cases Jamuna Bank’s employees have close relationship with the customers, but in most cases customers are unfamiliar to them.

3) Special Treatment Benefits: It refers to getting a special deal or prize, or getting preferential treatment. Those who have been customers of Jamuna Bank for at least ten years, they are given special priority when giving out loans

Service Recovery

Recovery takes place right after the product damage or service failure. Service recovery is an attempt by a company to correct a problem. Service recovery plays an essential role in achieving or re-establishes customer satisfaction. The service failure can take place for many reasons such as, it‟s not available, delivered late or too slowly, incorrect outcome or employees are not caring. All these types of failures bring negative feelings and responses form customers.

Jamuna Bank Limitedd is one of the leading commercial banks of Bangladesh. They try to provide their service effectively and efficiently towards the customers. If any service failure happens, they make an effort to recover it. However, their service recovery system is poorly executed. Verification of the client‟s information makes the procedure longer than the expectation. They are not fast responsive like the other commercial banks.

After a service failure, some customer takes complaint action and some customer takes no complaint action. Complaint customer is better than no complaint customer. Complaint customer gives opportunity to improve the company‟s performance by informing bank‟s mistakes. Whereas, customer who do not lodge any complaint are more likely to exit or switch the bank silently. Therefore, competitors grab this lost customer of Jamuna Bank Limited. Jamuna Bank Limited has complaint box in each branch to collect customer complaints. This complaints box requires time to time supervision from the authority to keep its complaint track perfectly.

SERVICE RECOVERY STRATEGIES:

Jamuna Bank Limited‟s service recovery strategies to retain their customers are given below:

Make the service fail-safe -Do it right the first time!

When Jamuna bank designs a new service; they do market testing for limited number of people. This trial option gives them the opportunity to evaluate the performance of their service. For example, establishment of new ATM booths. The IT division and engineers try their level best to make it error free so that need for recovery does not arise.

Encourage & Track complaints:

Jamuna Bank Limited has complaint box in every outlets. On a particular day of every month they supervise this box. According to the complaints, the respective branch takes necessary action. There is a “care line center” located in Head office. Their task is to listen client‟s problem and take necessary actions over the telephone or internet.

Act quickly:

Complaint customer would like to get quick and immediate possible solution .If problem solves immediately it can obtain complete customer satisfaction. For service recovery, Jamuna Bank Limited should act instantly rather than waiting for the proper verification of account holder. For example, if a customer wants to get any loan approval they have to go through a complex procedure which is time consuming. Therefore we can say that jamuna bank jurain branch cannot act quickly due to its service design. The authority should take actions immediately to solve these kinds of responsive loan approval problems.

Treat all customers fairly:

Jamuna Bank Limited is a reputed private commercial bank of Bangladesh, so it is important for them to treat their customers fairly. For service recovery customer expect fair treatment from the organization. Apology for the inconvenience that happens and putting efforts to solve the issue are perceived by customer as fair treatment. In that case, JBL does not treat all its customers fairly. Bank takes action for valued clients. For example, a very important person (VIP) never stands on queue in Jurain branch rather he\she sits in manager‟s office and official‟s withdraw the money on behalf of him\her.

Cultivate relationships with customers:

For a banking company it is very important to maintain a good relationship with the customers. Reputation and goodwill are essential issues for banking industry. Jamuna Bank Limited always tries to maintain a good relationship with their customers, especially with the elite and premier customers. Customer relationship management system should be well-managed. It will help to preserve a long term profitable relationship with customers.

It is important to maintain a service recovery process that include above strategies. Jamuna Bank Limited can use these service recovery strategies to address the service failure issues. They should follow up the problems of clients. It will ensure customer satisfaction. Jamuna Bank Limited can give emphasize on relationship marketing strategy for marinating relation with the customers. Relationship marketing will focus on customer satisfaction and retention. Jamuna Bank Limited should maintain regular communication with their customers to provide better service recovery. For holding long term customer relationship; communication is an essential factor. From the survey, 42% customers of Jamuna Bank Limited think that their communication method is less efficient. To increase the customer relationship, bank can utilize online complain box where customer can drop their review without any hesitation.

Service Development and Design

Service design and development is very important for a bank like Jamuna. From our observation we find out that they are far behind than other banking service providers.

So in this section they have to come up with new plans and findings. If we are thinking about design new services for Jamuna Bank then we have to find out those sectors where we are going to implement those programs. From our findings we come to know about they are much behind in online banking, customer service, ATM system and infrastructure. So in these sectors we need to work more to satisfy our second God, our customers.

According to Mr. Rakib Ur Rashid, First Executive officer of Jamuna Bank (Jurain SME Branch), “service development and design” functions are handled by the “Research and development (R&D) department; located in head office. Officials of R&D department sit with the directors and president to design new service and schemes for the clients. Therefore the procedures are credential and not shareable towards the externals. So in the upcoming part I am going write my suggestions about “service development and design” Basically product design and development sector divided in two parts. They are planning section and implementation. In planning section we got new service strategy development then idea generation, concept development evaluation and business analysis. In implementation section we got service development and testing, market testing, commercializing and post interaction evaluation.

As Jamuna Bank do not have a good online banking system they have to come up with a good team adding up with the manager himself with service manager and IT head and other people who are specialists in this section. This team should seat together and generate the idea of developing online banking system to satisfy their customers. After that they have to develop their concept and evaluate the current situation and the service they are coming up with.

Then they have to do business analyses where they are going to do the cost benefit part. They have to invest more on the online web site where they are going to create their business platform. They have to count the profit margin and find the break event point from where they are going to bring out the profit money. After that they have to find out the project feasibility analyses part. They have to be confirmed about the sustainability of the new online banking program they are coming with.

After that, it‟s the implementation part. Here they have to open a web site where they are going to operate. It is accessible only for the people who are working directly with the project. After that they have to enroll some of their customers into it to have a trial test of the project. Then they have to lunch it for the entire customers they have on the market. This part known as “commercialization”. The last part is the “post introduction evaluation part” where they will do research to identify if the customers are satisfied or not.

For designing and developing the customer care part they have to select a team who are going to organize the entire nicety and palming. These people are the part of the new service strategy development part. They will generate new ideas about customer care system that is used by the current corporate world. They have to develop the concept of customer care and find out how they are going to serve their customer. They have to bring processes like, over phone customer service and specific customer section. After that they have to do the business analysis part. They have to find out the cost, profit and the number of customers they are going to get by providing this care. After that they have to find out if this project is feasible in the real market or not. In the implementation part they have to develop the service. After that they have to test the project in the market for some selected customers in some of their branches.

Then they have to market it and open it for all of their customers. And then comes the post introduction evaluation part from where they are going to find out if their new service is getting success or not.

They have to continue the same process when they will open new services like ATM and new infrastructure. In the service strategy part they have to select high profile team consist of managers and the people who are concern of it. Then they have to generate the idea of establishing new ATMs. Then come up with the idea of decorate their branches. After brainstorming, they have to develop the concept to find out the places where they are going to have their ATMs and new branches. Just after that they have to do the business analysis part where they are going to find out the cost analysis part and bring the amount of cost they are going to have in this new service establishment. After finding out the cost they have to find out the benefits of having this kind of service in their bank. After all of this they have to find out the project feasibility and the percentage of the sustainability of their new service towards their customers.

In implementation part they have to fix the places where they are going to open new ATM booths and branches. After that they have to do market testing. Initially they are going to provide this service to limited number of customers which is the part of market testing. Then heavy promotional activity is needed to let their customers know about their new service and have to open it for all. At the ends they have to conduct a research which is known as “the post introduction evaluation”. From this research they have to find out the customers view about their new services, its lackings and bring the best out of its new services.

Findings:

On the basis of previous analysis and practical experience of 3 months internship program, my observations on Jamuna Bank‟s customer service are given below:

Capacity of the Branch is too small to provide quality service towards its clients. The size of the branch (Jurain) is too small to serve multiple customers at a time. For that reason, the branch always remains over crowded. The clients who remain in the queue always complain to make the processes faster. Therefore, it‟s become difficult for the employee to spend longer time with the clients. It hampers the quality of the service.

Sitting capacity for the clients is not sufficient at Jurain Branch. Only one set of sofa (capacity of 4 persons) in the entire branch for the clients. Additionally, the bank is not offering tokens to the clients to maintain standing queue. As a result, in the rush hour, mainly on Sunday and Thursday when the number of clients in the cash counter is high, they (clients) have to remain stand for 1-1.5 hours. It‟s really embarrassing for the clients; especially for the women. Lengthy processes to create a bank account leads to customer dissatisfaction. Due to Bangladesh bank‟s regulation; all the required information in the KYC (Know your Customer) form has to be filled. Therefore it takes time to retrieve required information from the client and his\her nominee. For that reason sometimes client wants to take the account form with him/her but the bank refuses his\her proposal due to the policy. Apart from that, it takes 7-10 working days (after receiving the cheque requisition letter from the client) to provide a new cheque book.

As the branch does not have the authority to print out cheque book. It comes from Head office of Jamuna Bank. As a result, without this cheque book clients can not withdraw their money in the meantime. Lastly, taking loan from the bank is toughest part in banking. Verification of papers and identity, approval from a lawyer etc. these processes are expensive and time consuming too. “Introducer” is a difficult issue for the clients to deal with. To increase the account number, every day the marketing executives visit near markets and households. Through personal marketing or by having direct conversation with client, they (executives) invite them to create an account in Jamuna Bank. But when they come to create an account, the officials cannot proceed as client do not have any introducer (already have an account in this bank) to verify their identity. As it is little bit risky to be an introducer of an account; the officials do not want to take any responsibilities. That mean, you are inviting new people to come; at the same you are stopping them to create their account.

The procedures to close an account or to stop a particular scheme are not easy to deal with. In case of premature encash, firstly applicant has to talk with the branch manager. He has to mention the reason for not continuing the service toward the manager. If the manager approves, then the client can close his\her account. This procedure leads to customer dissatisfaction in case of an emergency.

Continuing banking service by an illiterate person is very difficult at Jamuna Bank (Jurain Branch). He\she faces extremely difficult situation at the time of withdraw or deposit the money as he\she cannot write the cheque book by his own. When the client requests to write on behalf of him, the officials reply that they do not have the permission. Ask someone else (except the officials) to write. Even they stop the interns (like us) to doing that. They even say that, are you going to take the risk if money laundering occurs? Therefore, it remains very embarrassing for the clients.

Recommendations:

Jamuna Bank has focused on enhancing the long term sustainability of the bank, building value for the shareholders, employees and the wider community. Its activities are driven by ethical business practices and sense of responsibilities to all stakeholders. According to the observations some suggestions for the improvement of the situations are given below:

Expand the area: As the branch is located in a shopping mall, it‟s not difficult to expand by acquiring more space. It‟s an expensive way to follow but to provide quality customer service; sufficient space is needed.

Re-decorate the entire branch: As the capacity of the existing branch is small, they need to re-decorate the entire branch. By adding more seats and introduce of token system will reduce the overcrowded situation. It will give the employee‟s opportunity to spend more time with the clients.

Ensure Sufficient Forms and Brochures: There are always shortages of application forms, brochures, etc. in the branch. These Forms and Brochures must be maintained in sufficient quantity. Otherwise, customer service will be hampered

De-centralization: Jamuna Bank has become centralized recently. Bank should giveauthority to the branches in some extent, so that they can take swift decisions. Like, if the branch issues new cheque book; customer will be able to withdrawn their money easily without waiting for 7-10 working days.

Ensure Proper Maintenance of Office: Every branch is supposed to be very neat and clean and well decorated because it matters to attract customers. The cleaners are not regular in their duties and files and papers are kept here and there by the officers during the busy hour. This habit must be changed. JBL Jurain Branch must pay attention to these issues.

Ensure proper training: Banking is service oriented business. Its business profit depends on its service quality. Therefore, the service delivery of the branch should be closely monitored. Proper training should be given to all employees on regular basis to deal with the clients. Especially illiterate clients deserve more from the officials.

Redesign the system of work processes: All the existing procedures like, creating new accounts, withdraw remittance and loan approval are time consuming. The bank stores customer information both in paper and database. It‟s not eco-friendly too. In general banking department it is necessary to implement modern banking process instead of traditional system. It should be more computerized.

Enhance Tangibles: Tangibles reflect the physical layout or appearance of equipment‟s and materials. Tangibles give an image or impression towards its customers about the Bank. Apart from that, Service Company use tangibles to enhance their image or brand value. Bank‟s ATM booth should be spread more so that it can cover more customers and it should use better technology to fasten their services. Apart from that, branch should give requisition for few more printers and photocopy machines to improve their service.

Conclusion:

Bank plays a vital role in the economic development of the country. The popularity of banks is increasing day by day which leads to increase competition as well. All the Commercial banks are offering almost the same products and services but the ways they provide the services are different from each other. Therefore, people choose their Bank according to their wants and needs. They will prefer a bank which service is easily accessible and understandable. One the other hand, Bank innovate new products and services to attract their desired customers. To conclude this report it can be said that it was a great opportunity to study the operational activities of JBL. Having passed three months in JBL Jurain Branch, I have learned many activities practiced in the bank. Since the working areas were in General banking; the report may not cover all the practices of the branch. The work experience in JBL Jurain Branch was very interesting and this experience will help me in my professional career. Jamuna Bank Limited also a pioneer in online customers services, foreign exchange and distinctive loan offerings. In these ways JBL is helping accumulating domestic savings, resource mobilization and creating job opportunities for many people which will gear up the economy as a whole.

Without bank‟s cooperation it is not possible to run any business or production activity in this era. The job environment is very good at JBL Jurain Branch. At the same time the services and schemes the bank provides to its customers are very attracting compare to other private banks.

Therefore, Jamuna Bank Limited will survive in the banking sector with the slogan “Your Partner for Growth”.