Current Purchasing Power (CPP) Method

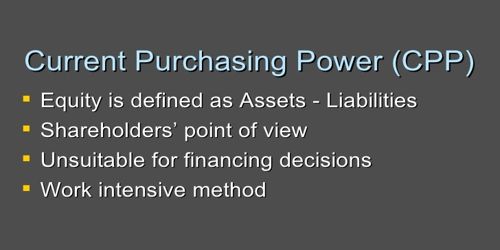

The introduction of the current purchasing power (CPP) method is one of the greatest revolutions in the field of accounting. Current Purchasing Power Method (C.P.P.) is also known as General Price-Level Accounting. The introduction of the CPP method is one of the greatest revolutions in the field of accounting. This is a mixed-method in which financial statements are prepared on a historical basis these statements, in the end, are converted on the current purchasing power of the currency. It involves the restatement of some or all of the items in the historical financial statement for changes in the general price level.

Current Purchasing Power (CPP) Method is a mixed-method in which financial statements are prepared on a historical basis these statements, in the end, are converted on the current purchasing power of the currency.

Under the current purchasing power (CPP) method, any established and approved general price index is used to convert the values of various items in the balance sheet and profit and loss account. Under the CPP method, any established and approved general price index is used to convert the values of various items in the balance sheet and profit and loss account. This method adjusts historical cost for changes in the general level of prices as measured by the general price-level index. It involves the restatement of some or all of the items in the historical financial statement for changes in the general price level. This is a mixed-method in which financial statements are prepared on a historical basis these statements, in the end, are converted on the current purchasing power of the currency. For this purpose, the approved price index is used to convert the various items of historical financial statements. The items of profit and loss and Balance sheet are adjusted with the price index. This method helps to present the financial statements in terms of units of equal purchasing power. The basic ideas of the method are to incorporate changes in the value of money as a result of changes in the general price index.

The CPP method makes a distinction between monetary items and non-monetary items; monetary items are those assets and liabilities that represent a claim to receive, or an obligation to pay, a fixed amount of foreign currency. Under this method, financial statements are prepared on the basis of historical cost and a supplementary statement is prepared to show historical items in terms of current value on the basis of the general price index. Examples of monetary items include cash, accounts payable, accounts receivable, long-term debt.

The retail price index or wholesale price index is taken as an appropriate index for the conversion of historical cost items to show the changes in the value of money. The index used here could be the cost of living index or the consumers’ expenditure deflates or the general index of retail prices. This method takes into consideration the changes in the value of items as a result of the general price level, but it does not account for changes in the value of individual items. This method helps to present the financial statements in terms of units of equal purchasing power.