Executive Summary

Non-bank financial institutions (NBFIs), banks, and insurance companies represent most of the important parts of a financial system. In Bangladesh, NBFIs are new in the financial system as compared to banking financial institutions (BFIs) and insurance companies. Credit rating is an assessment of the creditworthiness of an individuals or firms or it securities which is generally conducted by an independent credit rating agency. It measures the probability of the timely repayment of principal and interest of a bond. We have tried to analyze the credit rating system of NBFIs, banks, insurance companies in Bangladesh. And then we have determined and analyzed the credit rating Mutual Trust Bank Limited. For this purpose we have done some analysis here.

First- we have tried to show some qualitative analysis. In this segment we have done

- Industry Risk

- Keys to succeeds

- Diversification factors

- Firm Size

- Evaluation of Management

- Accounting Quality: Income recognition, depreciation and inventory pricing methods and off balance sheet items

- Profitability

- Profit Margins

Second- we have tried to show some quantitative analysis. This segment includes-

- Ratio Analysis

- Credit Rating based on Regression model.

- Bankruptcy Risk measured based on Multiple Discriminant Model

(Altman Z score).

And finally we have tried to run Eviews software to find the rating of union capital Limited. After analyzing all aspects of Mutual Trust Bank Limited, Fidelity Assets and Securities Limited and Mercantile Insurance Company Limited.

Objectives of the study

The broad objective of this study is to assign the rating on the Credit Rating of Mercantile Bank Limited, Union Capital Limited. To perform ratings, we take other banks, insurance companies, and NBFIs information as industry information. Here ratings are our opinion on the creditworthiness of Mutual Trust Bank Limited, Fidelity Assets and Securities Limited and Mercantile Insurance Company Limited considering qualitative and quantitative factors. For this we collect data from published annual report and various websites. Here, we also consider its ability and willingness of discharging its obligations in timely manner. Ratings are issued on the basis of information available to us from the various sources and also on the basis of information we believe to be reliable.

The other objectives of the study are to—

- Analyze the performance of Mercantile Bank Limited & Union Capital Limited.

- Analyze the performance of the Non- Banking, banking, and insurance industry.

- Analyze the quality of the management of Mercantile Bank Limited & Union Capital Limited.

- Analyze the potentiality of growth, success, sustainability etc. of Mercantile Bank Limited & Union Capital Limited.

Limitations of the study

- For any type of rating of a company, independent and accurate information is an important factor. But here we have feel the lack of qualitative and accurate information. As it is well known that in a developing country like Bangladesh there is very little study on the various industries. Banking, NBFIs, industries contain strong focus on both domestically and internationally because these industries are strongly related to the international business activities. But the information contains in the annual report is not sufficient to perform this task. Time limitation is also an important factor to do this task satisfactorily. We had very limited access to the management of Mercantile Bank Limited & Union Capital Limited.

CREDIT RATING OF “MUTUAL TRUST BANK Limited”

Company Profile (Mutual Trust Bank Limited)

| The Company was incorporated on September 29, 1999 under the Companies Act 1994 as a public company limited by shares for carrying out all kinds of banking activities with Authorized Capital of Tk. 38,00,000,000 divided into 38,000,000 ordinary shares of Tk.100 each. |

| The Company was also issued Certificate for Commencement of Business on the same day and was granted license on October 05, 1999 by Bangladesh Bank under the Banking Companies Act 1991 and started its banking operation on October 24, 1999. As envisaged in the Memorandum of Association and as licensed by Bangladesh Bank under the provisions of the Banking Companies Act 1991, the Company started its banking operation and entitled to carry out the following types of banking business: |

The Company (Bank) operates through its Head Office at Dhaka and 67 branches. The Company/ Bank carries out international business through a Global Network of Foreign Correspondent Banks.

Mission

We aspire to be one of the most admired banks in the nation and be recognized as an innovative and client-focused company, enabled by cutting-edge technology, a dynamic workforce and a wide array of financial products and services.

Vision

Mutual Trust Bank’s vision is based on a philosophy known as MTB3V. We envision MTB to be:

One of the Best Performing Banks in Bangladesh

The Bank of Choice

A Truly World-class Bank

Rating Methodology

For the credit rating of Mutual Trust Bank we have considered the guidelines provided by our course teacher. Credit rating is “an objective and impartial opinion on the ability and willingness of an issuer to make full and timely payments of financial obligations.” This opinion is conveyed in a simple alphanumerical scale, for easy reference and comparability.

Rating is essentially an opinion. Here we have also give our opinion within various limitations. For this purpose we have analyzed both the qualitative and the quantitative factors of the banking industry as a whole and also various factor of Mutual Trust Bank itself. In the part of qualitative analysis we have analyze the industry risk, keys to success, diversification factors, firm size, management quality, quality of the financial reporting, performance in the industry. In the quantitative analysis we consider the profitability, cash flow adequacy, capital structure and financial flexibility. We have assigned some points on both the qualitative and quantitative information to get the exact rating. As for the sustainability of an organization both the quality of the management and quantitative figure that means company’s financial performances are equally important we have assigned equal weights for bother he qualitative part and quantitative part.

Our ratings are based on the mostly to historical data which have been adjusted for future looking and we assume sustainable normal business condition. Nonetheless, changing conditions, new complexities and risks which may emerge could affect the assigned ratings. As such, changes in ratings can happen after the initial assignment.

CRAB RATING SCALES AND DEFINITIONS

LONGTERM – Banks

| AAATriple A(Highest Earning Prospect) | Banks rated in this category are adjudged to be the strongest organizations, characterized by excellent financials, healthy and sustainable franchises, and a first rate operating environment. The level, growth and quality of earnings over the medium term are of the highest grade and changes in business/economic circumstances, as may be envisaged, are unlikely to significantly impair the underlying fundamentals. |

| AA1, AA2, AA3*(Double A)(Very High Earning Prospect) | Banks rated in this category are adjudged to be very strong organizations, characterized by very good financials, healthy and sustainable franchises, and a first rate operating environment. The level, growth and quality of earnings over the medium term are of very high grade and changes in business/economic circumstances, as may be envisaged, may vary slightly impair the underlying fundamentals. |

| A1, A2, A3Single A(High Earning Prospect) | Banks rated in this category are adjudged to be strong organizations, characterized by good financials, healthy and sustainable franchises, and a first rate operating environment. The level, growth and quality of earnings over the medium term are of high grade and changes in business/economic circumstances, as may be envisaged, may slightly impair the underlying fundamentals. |

| BBB1, BBB2, BBB3Triple B(Above Average Earning Prospect) | Banks rated in this category are adjudged to be very solid firms, characterized by above average financials, valuable and defensible business franchises, and an attractive and stable operating environment. The level, growth and quality of earnings over the medium term are of above average grade and changes in business/economic circumstances, as may be envisaged, may impair the underlying fundamentals. |

| BB1, BB2, BB3Double B(Average Earning Prospect) | Banks rated in this category are adjudged to be solid firms, characterized by average financials, valuable and defensible business franchises, and an attractive and stable operating environment. The level, growth and quality of earnings over the medium term are of average grade and changes in business/economic circumstances, as may be envisaged, may significantly impair the underlying fundamentals. |

| B1, B2, B3Single B(Below Average Earning Prospect) | Banks rated in this category are adjudged to be almost solid firms, characterized by nearly average financials, valuable and defensible business franchises, and an attractive and stable operating environment. The level, growth and quality of earnings over the medium term are of nearly average grade and changes in business/economic circumstances, as may be envisaged, may greatly impair the underlying fundamentals. |

| C(Inadequate Earning Prospect) | Banks rated in this category are adjudged to have adequate financial strength but maybe limited by one or more of the factors as: a vulnerable or developing business franchise; weak financial fundamentals; or an unstable operating environment. The level, growth and quality of earnings over the medium term are of poor grade and changes in business/economic circumstances, as may be envisaged, may highly impair the underlying fundamentals. |

| D(Extremely Speculative) | Banks rated in this category possesses very weak intrinsic financial strength, requiring periodic outside support or suggesting an eventual need for outside assistance. Such institutions may be limited by one or more of the factors as: a business franchise of questionable value; financial fundamentals that are seriously deficient in one or more respects; or a highly unstable operating environment. The level, growth and quality of earnings over the medium term are of speculative grade and changes in business/economic circumstances, as may be envisaged, may highly impair the underlying fundamentals. |

Qualitative Analysis

Qualitative analysis deals with the subjective evaluation of both the internal and external factors related to the concerned firm, its peer groups and the industry. Based on the analysis, an overall evaluation is made regarding the concerned firm Mutual Trust Bank Limited. While rating Mutual trust Bank Limited, qualitative analysis was performed considering the following areas:

Industry risk Analysis

Keys to success

Diversification factor

Firm size

Evaluation of the management

Accounting quality

Industry Risk Analysis

This type of risk usually comes from the existing conditions of the industry. These conditions are not an isolated part, rather being affected by various macro economic variables in the industry as well as the country. This type of risk can be estimated by:

Historical profit and profit prospect

Risk of the expected profit.

The first one can be estimated by observing the basic performance variables of the industry. By considering the 15 companies of the industry, we can have the following information about the industry:

Industry Average | |

| Return on average assets | 5.80% |

| ROE | 26.80% |

| Net interest margin | 19.22% |

| Total Capital to total asset | 18.02% |

| Capital adequacy ratio | 70.07% |

As from the above table it can be shown that there is a huge profit potential and can be considered as an emerging industry, we can say that the overall performance of the industry is very much satisfactory. Other factors that must be considered:

There is no risk of expropriation (nationalization) from the government body.

The industry has well established rules and operating guidelines from Bangladesh Bank, which can ensure more transparency within the operations and outside of the firm. Credit Risk Grading Manual of Bangladesh Bank was circulated by Bangladesh Bank vide BRPD Circular No. 18 dated December 11, 2005 on Implementation of Credit Risk Grading Manual which is primarily in use for assessing the credit risk grading before a bank lend to its borrowing clients.

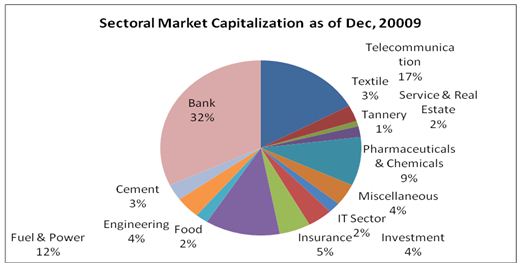

Above pie chart indicates sectoral market capitalization as of December, 2009. We see that bank has more market capitalization than any other industry operating in our country and it is 32%.

Liquidity risk

Liquidity risk arises when a company is unable to meet the short term obligations to its lenders and stockholders. MTB manages on day to day basis through treasury department, its liquidity requirements. In order to ensure effective management of liquidity, MTB maintains diversified and stable funding base comprising of retail, corporate and institutional deposits of various mixes and maturities. Although recent share market debacle revealed that many commercial banks were engaged in above limit investment which questionned their sound liquidity state.

Market risk

Market risk may be defined as the risk potential change in earnings due to changes in rate of interest, foreign exchange rate and equity prices. To alleviate the market risk MTB’s Asset-Liability Committee regularly meets to address factors such as changes in interest rate, market conditions, carry out liability maturity gap analysis etc.

Credit risk

It arises mainly from lending, trade finances, and treasury businesses. This can be described as potential losses arising from the failure of a counter party to perform as per contractual agreement with the bank. The failure may result from unwillingness of the counter party or decline in his/ her financial condition. Therefore, the banks credit risk management activities have been designed to address all

Interest rate risk

Interest risk may arise either from trading portfolio. The trading portfolio of the bank consists of Government treasury bills and Treasury bonds with maturity varied from 1 to 20 years.

Reputation Risk

Reputation risk arises from money laundering incidences money laundering risk is defined as the loss of reputation and expenses incurred as penalty for being negligent in prevention of money laundering. Falling business volume or income as well as reduced value of the company arising from business events that may reduce confidence of the customers, shareolders, investors, regulators, general public, creditors are also reputation risk. To mitigate the risk MTB ensures adequate awareness amongst the branches and the operational divisions of any changes in the market perception.

Operational risk

Operational risk may arise from error and fraud due to lack of internal control and compliance. Management through internal control and compliance division controls Operational procedure of the bank. Internal control and compliance division undertakes periodical and special audit of the operation and compliance of statutory requirements. The audit committee of the board subsequently reviews the report of the internal control and compliance division.

Threat of New Entrants in the Industry

Threat of new entry is one of the factors influencing the profitability of the industry. To earn abnormal profit, the new entrants may be attracted in the industry. The ease with which a new firm can enter an industry is a key determinant of its profitability. The other parameter attracting investments are economies of scale, first mover advantage, and access to channels of distribution and relationship and legal barriers maybe cited. As the said industry requires large economies of scale as well as investment, the threat of new entrants is moderate. On the other hand, the customer switching cost and high initial investment may be a barrier. The law for this particular sector is not so strict which allow common investors to invest in this sector.

Bargaining Power of the Industry’s Suppliers

There are many suppliers available in this sector. It results high control over the industry to be put by the suppliers. This provides the industry-selecting supplier as per the choice of the industry.

Bargaining power of the industry’s customers

The choice of the final product is depends on the consumers can choose any company’s product because the products of various companies’ are of different in nature. The products of this industry are mainly sold as per the comparative high benefit of the depositors. They can switch over any company’s product without incurring any cost. Hence, customer’s switching cost is very low resulting bargaining power of buyer is very high.

Income recognition

The main income comes from interest income, income from investment, and other income. The firm shows huge amount of other operating income and they explained each and every item of the generation of these income. In terms of provisions of the BAS-18 “Revenue”, the interest income is recognized on accrual basis. As per financial statements, there was no material adjustment or misstatements regarding the condition of the company.

Disclosure is satisfactory

Reports were published in time

There were detailed analysis of their portfolio and capitalization and value addition’s statement.

No mismatch among the annual reports over the periods

No significant amount of deferred costs and revenues

Based on the above, we can say that the firm has moderate level of standard to report to the stakeholders about the financial condition of the company.

Reputation of auditor’s:

MTB formed its audit committee on January 18, 2003 comprising 3 memebers of the Board as per BRPD Circular no.12 dated December 23, 2002. They are Mr. Syed Manzur Elahi, Mr. Rashed Ahmed Chowdhury, and Mr. Md. Abdul Malek. In 2009 audit fee was Tk. 0.4 million

Quantitative Analysis

Two parts are included in the quantitative analysis of ULC:

- Ratio Analysis

- Credit Rating based on Regression model.

Ratio Analysis

Ratios provide meaningful relationship between individual values in the financial statements. By ratio analysis we measure the performance of the firm on historical basis. Ratios provide better performance measurement than absolute numbers.

Required Ratio | ||

1 | Return on average assets | Net income/Total Assets |

2 | Return on equity | Net income/Shareholder Equity |

3 | Rate paid on Fund | Total interest expense/ Total Earning asset |

4 | Net interest Margin | Net interest income/ Total earnings’ asset |

5 | Provision for loan losses | Provision kept against classified loan /Total loan |

6 | Total capital to Total Asset | Total Capital/Total Assets |

7 | Loan to assets | Loan/ total assets |

8 | Capital adequacy Ratio | Total Capital/Risk Weighted Asset |

9 | Loan/credit to deposit ratio | Total Investment/Total Deposit |

10 | Total asset to total equity | Total Asset/Total Equity |

11 | Classified loan to Total loan | Total Classified loan/Total loan |

- Return on average assets (Highest point is 5 and lowest is 3)

Company

Return on average assets

Point

Peer Prime Bank

0.012

4

OurMutual Trust

0.01

3

PeerDhaka Bank

0.012

4

From the table we can conclude that MTB’s average return on average assets is 1%, whereas peer groups are 1.2%, peer groups performance is better is this regard.

- Return on Equity

Company

ROE

Point

Peer Prime Bank

0.102

3

OurMutual Trust

0.249

5

PeerDhaka Bank

0.209

4

From the table we can conclude that MTB’s ROE is 24.9%, whereas Prime bank’s is 10.2% and Dhaka Bank’s 20.9%. Our bank’s performance is better in this regard.

- Rate Paid on Fund

Company

Rate Paid on Fund

Point

Peer Prime Bank

0.088

3

OurMutual Trust

0.082

4

PeerDhaka Bank

0.080

5

From the table we can conclude that MTB’s Rate paidd on fund is8.2%, whereas Prime bank’s is 8.8% and Dhaka Bank’s 8.0%. Our bank’s performance is better comparing to prime bank.

- Net Interest Margin

Company

Net Interest Margin

Point

Peer Prime Bank

0.096

4

OurMutual Trust

0.021

3

PeerDhaka Bank

0.111

5

From the table we can conclude that MTB’s net interest margin is only 2.1%, whereas peer groups are 9.6% for Prime bank and 11.1% for Dhaka Bank. Peer groups performance is better is this regard.

- Provision for loan losses

Company

Provision for loan losses

Point

Peer Prime Bank

0.002

5

OurMutual Trust

0.019

4

PeerDhaka Bank

0.019

4

Provision for loan losses is 1.9% for Dhaka Bank and our Bank, But prime Bank has lower provision for loan losses and it is 0.2%.

- Total Capital to Total Asset

Company

Total Capital to Total Assets

Point

Peer Prime Bank

0.019

3

OurMutual Trust

0.074

5

PeerDhaka Bank

0.069

4

From the above table we see that prime bank has lower capital base to total asset which is only 1.9% MTB has 7.4%, and Dhaka Bank has 6.9%. Our company’s capital base is strong comparing to peer group.

- Loan to Assets

Company

Loan to total assets

Point

Peer Prime Bank

0.489

3

OurMutual Trust

0.693

4

PeerDhaka Bank

0.692

4

Point 4 has been given to our company comparing with other banks ratio. Loan to asset ratio is higher than Prime Bank’s ratio, which indicates that loan distributing is higher than Prime Bank.

- Capital Adequacy Ratio

Company

Capital Adequacy Ratio

Point

Peer Prime Bank

0.041

3

OurMutual Trust

0.096

4

PeerDhaka Bank

0.113

5

We see that Capital adeuacy ratio of our bank is satisfactory comparing to Prime bank’s Capital Adequacy Ratio, but lower than Dhaka Bank’s.

9. Loan to deposits Ratio

CompanyLoan to deposits Ratio

Point

Peer Prime Bank

0.835

3

OurMutual Trust

0.857

4

PeerDhaka Bank

0.854

4

If we consider loan to deposits Ratio should be maximum 90% then our conpani performance is better.

10. Total Asset to Total Equity

CompanyTotal Asset to Total Equity

Point

Peer Prime Bank

3.914

3

OurMutual Trust

15.253

4

PeerDhaka Bank

17.275

5

From the table we see that Prime has lower equity base to it’s total assets. Our company’s equity base is satisfactory and above Prime Bank’s equity base but lower than Dhaka Bank’s.

| SUMMARY OUTPUT | ||||||||

Regression Statistics | ||||||||

| Multiple R | 0.936955099 | |||||||

| R Square | 0.877884857 | |||||||

| Adjusted R Square | 0.430129331 | |||||||

| Standard Error | 0.747673719 | |||||||

| Observations | 15 | |||||||

| ANOVA | ||||||||

| df | SS | MS | F | Significance F | |||

| Regression | 11 | 12.05629 | 1.096026 | 1.960634 | 0.316505 | |||

| Residual | 3 | 1.677048 | 0.559016 | |||||

| Total | 14 | 13.73333 | ||||||

| Coefficients | Standard Error | t Stat | P-value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% |

| Intercept | 13.57195847 | 12.68814 | 1.069657 | 0.36319 | -26.8074 | 53.95127 | -26.8074 | 53.95127 |

| X Variable 1 | -28.98823818 | 79.19058 | -0.36606 | 0.738614 | -281.008 | 223.0315 | -281.008 | 223.0315 |

| X Variable 2 | 1.880784883 | 6.136685 | 0.306482 | 0.779277 | -17.6489 | 21.41046 | -17.6489 | 21.41046 |

| X Variable 3 | 3.237042541 | 3.201979 | 1.01095 | 0.386499 | -6.95309 | 13.42717 | -6.95309 | 13.42717 |

| X Variable 4 | -10.52185724 | 6.284176 | -1.67434 | 0.192657 | -30.5209 | 9.477194 | -30.5209 | 9.477194 |

| X Variable 5 | -80.00530534 | 197.076 | -0.40596 | 0.711991 | -707.189 | 547.1786 | -707.189 | 547.1786 |

| X Variable 6 | -4.162988407 | 4.460636 | -0.93327 | 0.419524 | -18.3587 | 10.03275 | -18.3587 | 10.03275 |

| X Variable 7 | 7.579182307 | 18.20669 | 0.416286 | 0.70519 | -50.3626 | 65.52099 | -50.3626 | 65.52099 |

| X Variable 8 | 1.550077225 | 1.06795 | 1.451451 | 0.242566 | -1.84862 | 4.948771 | -1.84862 | 4.948771 |

| X Variable 9 | 1.797140732 | 5.746394 | 0.312742 | 0.774956 | -16.4904 | 20.08473 | -16.4904 | 20.08473 |

| X Variable 10 | -0.216207319 | 0.147337 | -1.46744 | 0.238547 | -0.6851 | 0.252683 | -0.6851 | 0.252683 |

| X Variable 11 | 32.52343637 | 87.58773 | 0.371324 | 0.73507 | -246.22 | 311.2667 | -246.22 | 311.2667 |

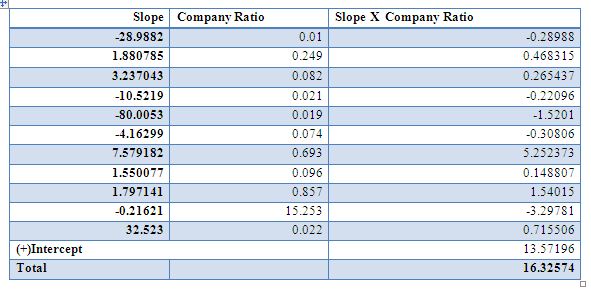

From the regression analysis we found total score for MTB and it is 16. According to the rating standard our company should be rated as A1

Conclusion

We tried to show a comprehensive analysis for a fair rating of Mutual Trust Bank is presented above with adequate qualitative, quantitative and technical analysis. In qualitative analysis the overall industries as well as the firm specific factors like firm’s diversification factors, accounting quality, firm size, management quality and key success factors are described broadly. The qualitative analysis result also close to the result got from quantitative analysis. In the quantitative sector the profitability ratio, capital adequacy ratio and capital structure of the firms are analyzed in detailed. After analyzing all aspects of MTB we recommend that the company should be rated at AA which is currently rated at A1.