Analysis of Credit Proposal for Corporate Banking Division of

BRAC Bank Limited

BRAC Bank Limited, one of the latest generation of commercial banks started its journey on July 04, 2001 which is an affiliate of BRAC, the world‟s largest non-governmental development organization founded by Sir Fazle Hasan Abed in 1972. Though is the pioneer of SME loan in Bangladesh but the Corporate Banking Division of BRAC Bank enhanced it‟s footprint day by day with a superior consciousness. The report is all about the analysis of Credit Proposal for a particular client of Local Corporate of Corporate Banking Division where it mentioned all the important aspect of the deal between the BRAC Bank and their client. Basically, a Credit Proposal is prepared by BRAC Bank before starting a lender borrower relationship with their new or existing client where they include all the information provided by the client, which also evaluate by BRAC Bank. Besides, the report is containing a brief idea about the Local Corporate of Corporate Banking Division, such as, their product, customer segments, their working process, rules followed by them etc. Worked as an intern I have gathered different experiences in BRAC Bank which also include in this report with my job duties and responsibilities. Finally, the report has a findings part which I have got after conducting a survey between some clients of Local Corporate about their satisfaction level after getting the services from BRAC Bank.

Overview of the Banking Sector in Bangladesh

There is no denying the fact that the financial system plays a significant role in the economic development of a country. The importance of an efficient financial sector lays in the fact that, it ensures domestic resources mobilization, generation of savings, and investments in productive sectors. In fact, it is the system by which a country‟s most profitable and efficient projects are systematically and continuously directed to the most productive sources of future growth.

Financial sector in Bangladesh, like most in developing countries, is dominated by banking institutions. With recent gains in financial fronts Bangladesh’s financial sector is now comparable with most of the countries in South and East Asia in terms of financial deepening.

Bangladesh, like other developing countries, still has an underdeveloped financial system and is facing serious problems with the operation of its financial system and poor financial intermediation presents significant disincentives to foster economic growth.

Nevertheless, the banking sector occupies an important place in Bangladesh because of its intermediary role; it ensures allocation and relocation of resources and keeps up the momentum of economic activities. It plays a pivotal role in the economic development of the country and forms the core at the money market.

Banks can be defined in various ways. In Bangladesh, any institution which accepts for the purpose of lending or investment, deposits of money from the public, repayable on demand or otherwise, and is transferable by checks, draft order or otherwise, can be termed as a bank. The purpose of banking is thus to ensure transfer of money from surplus unit to deficit units or in other words, to work as the repository of money.

History of BRAC Bank

BRAC Bank Limited, one of the latest generation of commercial banks started its journey on July 04, 2001. It is an affiliate of BRAC, the world‟s largest non-governmental development organizations founded by Sir Fazle Hasan Abed in 1972. It has been the fastest growing Bank in 2004 and 2005. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh. BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Analysis of Credit Proposal for Corporate Banking Division

Corporation (IFC) and Shore Cap International, has been the fastest growing Bank in Bangladesh for the last three consecutive years. In the recent past the bank has gone public with price of shares reaching impressive heights, further showing promising future.

A fully operational Commercial Bank, BRAC Bank Ltd. focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last five years of operation, the Bank has disbursed over BDT 1,500 crore in loans to nearly over 50,000 SMEs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. Since inception in July 2001, the Bank’s footprint has grown to 157 branches, over 421 SME unit offices and 322 ATM sites across the country, and the client base has expanded to over 200,000 deposit and 45,000 advance accounts through 2006. The Bank is constantly coming up with new products. Recently BBL has introduced Visa Silver and Visa Gold both Local and International credit cards; and further more the Bank is in the process of introducing VISA Debit card. In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of SME unit offices, Retail Branches and ATMs across the country.

About BRAC Bank Limited

BRAC Bank Limited is a full service scheduled commercial bank. It has both local and International Institutional shareholder. The bank is primarily driven with a view of creating opportunities and pursuing market niches not traditionally meet by conventional banks. BRAC Bank has been motivated to provide “best-in-the-class” services to its diverse assortment of customers spread across the country under an on-line banking dais.

Today, BRAC Bank is one of the fastest growing banks in the country. In order to support the planned growth of its distribution, network and its various business segments, BRAC Bank is currently looking for impressive goal oriented, enthusiastic, individuals for various business operations.

The bank wants to build a profitable and socially responsible financial institution. It carefully listen to the market and business potentials, It is also assisting BRAC and stakeholders to build a progressive, healthy, democratic and poverty free Bangladesh. It helps make communities and economy of the country stronger and to help people achieve their financial goals. The bank maintains a high level of standards in everything for our customers, our shareholders, our acquaintances and our communities upon, which the future affluence of our company rests.

Special Features of BRAC Bank Limited

BRAC Bank Limited possesses a number of special features. BRAC Bank will attach special emphasis to the target group strategy of development. The Bank emphasizes on the creation of self managed institutions for its clients. These institutions will be based at the clients‟ localities.

A special feature of BRAC Bank will be the provision of training for its clients. The aim of the training will be to increase the capability of the borrower to utilized loans effectively. The Bank will encourage the use of new and improved technologies in order to increase employment opportunities and productivity of the poor. The credit activities will be structured in such a way that the use of appropriate technology is ensured and the poor can benefit from improved technology.

BRAC Bank will provide credit without security. The poor who do not have resources to offer as collateral have, so far, been denied access to formal credit. However, BRAC Bank will not normally seek collateral for providing credit and will use peer pressure to ensure timely repayment which has already proved effective. BRAC Bank will provide service at the doorsteps of the customers. Unlike the traditional banking system, BRAC Bank worker go to the villages regularly to collect savings and loan repayments. BRAC Bank also intends to attach special attention to women in development.

Corporate Banking

BRAC Bank‟s Corporate Banking Division provides banking services and financial partnership to different corporate bodies and institution of the country. With the expertise and dedication, Corporate Banking Division aims to provide the best possible services to the customers to achieve success in every business endeavor they have.

CBD operates in a centralized structure through on-line banking system. At every stage of its involvement, CBD hold to strict internal control guidelines and other legal and statutory compliance.

In addition to traditional industries like RMG, Steel, Pharmaceuticals, Textiles, Ship Breaking & Trading sector; CBD has enhanced its footprints into Packaging, Food, Power, Construction, Aviation, Glassware, Edible Oil Refinery, Healthcare, Renewable Energy, Plastic Polymer, Telecommunications, Ocean-Going Vessel financing, Agro-Business (Poultry, Food Processing), etc.

CBD expertise covers areas like Project financing, Trade Financing, Working Capital Financing, etc. It divided into 2 (two) Corporate Banking wings, one in Dhaka and the other in Chittagong, is an integrated & specialized area of the bank, which meets the diverse financial needs of the corporate customers by designing customized and structured solutions for their business.

Objectives of Corporate Banking Division

- To provide wide range of financial services professionally, efficiently and competitively to achieve pre-eminent position in chosen market.

- Diversify revenue stream through product innovation.

- A Well-diversified credit portfolio, which produces a reliable and consistent return to investment.

Corporate Banking Business Segments

Corporate Banking comprises of broadly 5 units detailed as follows:

- Structured Finance Unit (SFU): It drives loan syndication, corporate advisory and structured trade solutions business stream. In real meaning, SFU is engaged in raising funds through debt or equity instruments for large scale investment by arranging funds from financial institutions and multi lateral agencies. Syndicated financing diversifies the total risk of financing large scale projects and also enables the bank to earn big ticket non funded income (NFI) for the bank. The Structured Finance wing caters to this segment of the financing industry by taking the role of Lead Arranger, Co-Arranger, Participant Lender or Agent. Apart from arranging conventional project financing, SFU also arranges equity participation through investment instruments.

- Corporate Institutions: It provides multinational and large wallet size local clients engaged in the business sectors covering energy, telecom, infra structure, commodity, trading, agriculture and diverse manufacturing base. Large NBFIs (mainly leasing, insurance and investors) and leading micro financing units fall under the purview of this unit.

- Local Corporate: It furnish to the growth aspiration on existing and new to the bank names where BRAC Bank Ltd aspires to attain significant share of mind. This unit particularly focuses on expanding the business on commodity trading entities, service providers, and manufacturing businesses engaged in textiles & garments, construction materials, consumables, and other high growth manufacturing sectors.

- Emerging Corporate: It caters to middle market clients and clients transitioning from medium enterprises to middle market segment. This unit largely focuses on building the portfolio comprising of converting non-borrowing customers and increasing relationship penetration by promoting cash, trade and FX products to these transitioning clients. This unit is largely built on the supplier and buyer base of the large & local corporate clients. This unit is entrusted to nurture middle market clients and facilitate their transition to large and local corporate segment.

- Regional Corporate (Chittagong): This unit provides to all corporate businesses located and originating in greater Chittagong area. It has the same objective as the Large and Local Corporate units. It also assists the Emerging Corporate in the Chittagong Region.

Business Concentration and Target Market

- Business Concentration

Corporate Banking Division operates in a centralized structure, and runs its business through all parts of the country. Operations and processes are centrally managed in the Head Office located in Dhaka with a regional presence in Chittagong.

- Target Market

- Pharmaceuticals, toiletries, chemicals and pesticides

- Power Generation, oil exploration, industrial and household gases

- Edible Oil

- Bulk Trading – Essential Commodities, Industrial Raw Materials, Agricultural Inputs

- Cement

- Garments, Textiles and related backward linkages industries including spinning, knitting, yarn, garments accessories etc.

- Food Processing and Beverage Industries

- Cable and Cable wire

- Information Technology

- Telecommunication

- Leasing Companies / Non Banking Financial Institutions

- Non Governmental Organization (N.G.O) and other International Development Organizations

- Importers/dealers of machinery, industrial, electrical equipment

- Bone china, ceramics, melamine, plastic products

- Manufacturing and Trading of Consumer Durables.

- Contractor Finance

- Air Lines, Shipping Lines, Freight Forwarders, Testing and Inspection agencies

- Footwear and Leather

- Tea

- Any other sector that is not declared as discouraged sector and found to be commercially feasible.

Discouraged Industries

CBD avoids lending in sectors that have adverse effects on society or are against social values and ethics, and those that may be harmful to the environmental and health. CBD also alert in lending to sectors where liquidation may be difficult, socially harmful, or at the expense of the general public. Following are few of the discouraged industries:

Manufacturers/Service Providers that are environmentally threatening,

- Tobacco Products

- Alcoholic Beverages

- Ship Breaking

- Military Equipment/ Weapons Finance

- Industries using child labor

- Mining/Logging

Corporate Banking Procedure

Approval process

The Relationship Manager (RM) makes customer call to potential clients and discuss regarding the credit facility requirement, negotiating terms and conditions/facilities to be provided. As per collected business, market and other related information from client, RM conducts detailed quantitative and qualitative business analysis and send offer letter to client comprising details of pricing, tenor and facility offered. Once the client agrees with the offer letter they provide an excepted copy of it along with some basic required documents such as;

- 3 years audited/management financials

- CIB undertaking form of all the directors

- Stock Report (if a manufacturing/trading concern)

- Credit Rating of the client

- Other bank liability position

- Write up on present industry scenario

- Business Profile including nature of business, highlights of last five years business performance, Future business plan etc

- Other relevant certificates and licenses such as TIN, TAX certificate, IRC, ERC, COI, MOA, Schedule X, Form XII, etc.

With the documents provided by client, RM conducts credit analysis and prepares credit proposal which is then verified by credit department. The credit proposal is a report with reflection of

- Details of the facilities offered along with tenor, rate and purpose

- Feasibility of the client‟s business

- It‟s management structure

- Detailed analysis of the industry

- Comparison of the business with peers in the industry

- Financial analysis of the company

- Justification of the facilities offered

- Collateral agreed against the facilities offered

- Risk involved with the business and it‟s mitigates.

After both parties, i.e. CBD and CRM come to agreement, the proposal is placed on the Credit Committee Meeting, chaired by the Managing Director who has a certain approval Limit of BDT 250 million. If the facility is beyond the MD‟s approval limit then a Board Memo is prepared and proposal is placed on the monthly Board Meeting for approval. Once approved, the sanction letter is issued and sent to the client for acceptance along with security documents. After the accepted copy of the Sanction is received from the client together with related security and charge documents, the limit is uploaded into FINACLE and is live for client‟s usage.

Credit Proposal

BRAC Bank‟s local corporate mainly work on the front line so that they need to contact and deal with their customers about their transaction. The Civil Engineers Limited (TCEL) is one of their important client with whom they have lender borrower relationship for business purpose. Before execute their transaction at first they make a “Credit Proposal” where they mention every necessary thing related to their business, business deal and also about the loan facility. Here I am explaining a credit proposal prepared by BRAC Bank where The Civil Engineers Ltd. (TCEL) is the primary obligor and Transworld Sweaters Ltd. (TSL) is the co-borrower. BRAC Bank has prepared a credit proposal to response the application of TCEL and TSL for credit facility of BDT 2,500 million on May 11, 2014 where the approval authority is Board, not Managing Director and CEO. TCEL and TSL are two big companies which known as woven garments and these companies are under the Standard Group. They are private limited companies which lay under the Ready Made Garment industry. They have a new relationship with BRAC Bank that means they were not their client before.

Standard Group at a Glance

Standard Group established in 1984 which is one of the longest running garment manufacturing companies in Bangladesh. Over the years, the company has grown substantially in both size and customer base. It has one of the largest woven garments manufacturing facility in Bangladesh (Current woven capacity averages at 150,000 pieces per day) including sweater production facility. In addition, the accompany has its own in house garment washing, printing, embroidery, apparel design, garment testing and various accessories production facilities; 12 production locations and 21 factories situated near and around the capital. Standard Group has one of the most comprehensive and technical manufacturing system in the country which has vertically integrated facilities. It has over 40,000 full time employees throughout the company.

The Civil Engineers Limited (TCEL)

The Civil Engineers Limited is one of the flagship concerns of Standard Group which incorporated in 8 January, 1977 and started business in RMG segment from 1991. The concern operates in different areas like, real estate, construction, Garments, Washing etc. The Garments, Sweater and Woven units are 100% Export Oriented factory.

Transworld Sweaters Limited (TSL)

Transworld Sweaters Limited is 100% Export Oriented Sweater factory, established on 13 April 2002. The company is manufacturing all kind of Sweaters, Pullover, Cardigan, Vest, Tank Top, Knitted Polo Shirt, Knitted Blouse, Knitted Bottoms, Knitted Scarf for Men‟s, Ladies and Children. The total export of the company stood at USD $ 3,786,362 in 2013. Transworld Sweaters Limited is planning to convert into a 100% export oriented woven factory with 12 lines of machinery on the same premises. The existing sweater production facilities will be shifted to their other concerns.

Current Incident of Standard Group and recovery plan to overcome

Recently, one of the 10-storied buildings of Standard Group at Gazipur‟s, Konabarhi has been burned down by „agitated workers‟ following a rumor of two labors being shot to death. In addition, around 31 vehicles, including the seven covered vans carrying clothes ready for exporting, were torched. Bangladesh Garment Manufacturers and Exporters Association (BGMEA) have termed the fore incident at Standard Group as “sabotage”. The total estimated loss during the vandalism was around BDT 3,368 million. However, the group has already taken corrective measures to overcome the situation, as they have already placed 70% of the above mentioned workers to different units of the group.

At the time of fire incidents, the client has total Back to Back liabilities outstanding of USD 10 million (appx) and EDF outstanding of USD 22 million with different banks in the name of following concerns. Out of BTB OS of USD 10 million, the client has already fully settled entire BTB outstanding amount from their regular cash flow. For EDF outstanding amount of USD 22 million, Bangladesh Bank has already extended tenor of EDF facility from 270 days to 2.50 years for smoother settlement of due liabilities. However, the client has already settled USD 7 million out of USD 22 million from their own sources and rest will be adjusted within the stipulated time frame. There were some insurance claimed by different units by which they can try to recover the loss incidences through fire incident.

Industry Overview

Bangladesh apparel sector experienced 26% YoY growth last year. Global orders are shifting more to Bangladesh as larger retailers are following „China plus one strategy‟ and thus Bangladesh become the obvious choice. Bangladeshi exporters are also exploring new markets and introducing lingerie and other high end products. Bangladeshi Apparel manufacturers follow a low margin, low cost, mass production strategy. However, this low cost strategy sometimes fails to cover labor welfare. We have witnesses a few labor right violation issues and a couple of factory accidents. To improve the labor welfare and working condition, Wal-Mart and other international buyers have agreed to provide funding. Government and other local NGOs are also working to address these issues. Bangladesh has also enacted a new labor law to protect the right of worker.

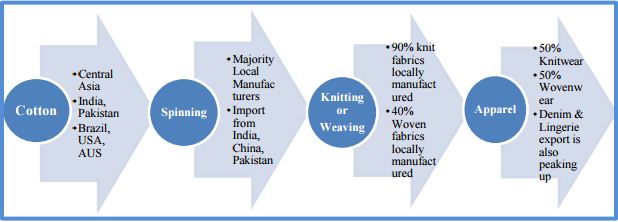

Textile and Apparel is the largest manufacturing sector of Bangladesh in terms of GDP contribution as well as employment generation. The country has established itself as a reliable supplier globally and gradually moving into high end market. Moreover exporters are reaching beyond the traditional export destination like EU and North America region, and exploring other market opportunity in Japan and South America. The sector generated around 79.6% of the total export receipt of the country. Bangladesh exported around USD 21.52 billion in the FY‟13, positioning itself as the second largest apparel exporter in the world. The country is the largest exporter of cotton t-shirt and second largest exporter of cotton pullover and jeans in the EU region; it is also the second largest exporter of cotton trousers to the US by volume. The industry value chain is provided below:

Although cost of Bangladeshi yarn is relatively expensive in comparison to international yarn price, local spinning manufacturers have an edge due to lower power cost along with the fact that imported fabrics stretches the lead time for fabric and apparel manufacturers. In terms of quality, Bangladeshi spinning mills is also superior in comparison to other neighboring countries. As a whole the Textile and Apparel industry is around 19.0% of the country‟s GDP and the industry employs around 4.0 million people.

Bangladesh is currently exporting 5.0% of the total apparel market of the world worth USD 400.0 billion. The country seconds to China in terms of volume. At the same time China is gradually producing more high end products or investing in other capital intensive industries and we are seeing low end orders shifting to Bangladesh. Over the years India, Pakistan, Vietnam and Turkey remain the core competitors for Bangladesh. However, many of these competitors produce cotton in their backyard, whereas Bangladesh has to import the cotton. On the other hand in terms of labor cost, quality and scale of operation Bangladesh holds the adventure.

Traditionally Bangladesh caters to the EU and North American region. However, the exporters are trying to expand the diversity of their cliental portfolio and recently Russia, Japan, Australia have emerged as new export destinations. Some of the Chinese manufacturers are considering outsourcing the Garments from Bangladesh as well. India can also emerge as another export destination soon. Bangladesh has started exporting more to India as the country granted duty free access of 46 RMG export items.

Future Outlook

Bangladesh‟s apparel exports could triple by 2020 as European and US buyers are planning to strengthen their presence in the country which is seen as „next China‟, according to McKinsey & Company, a global management consulting firm. Recent study conducted by McKinsey to review Bangladesh‟s RMG growth formula, reveals China starting to lose its attractiveness due to rise in costs of doing business. The sourcing caravan is moving on to the next hot spot like Bangladesh. Costs have also increased significantly in other key sourcing markets, leading buyers to question their current sourcing strategies.

Financial Performance

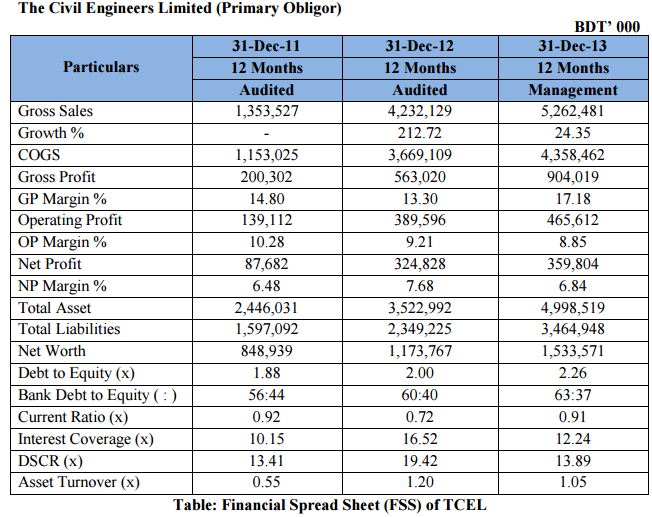

Financial analysis is done based on audited and management financial. As they are now preparing audited financial of all the concerns of the group, BRAC Bank obtained management financial which will be updated at the time of next review on the basis of audited financial. Management financial may vary with audited financial.

Revenue: The company has 07 business units – Construction, Real-Estate, Garments (Woven), Sweater, Packaging, Washing and Woven units. Out of the 07 units except washing and woven unit, rest units are fully functional in 2013. Revenue of TCEL grew at Compound Annual Growth Rate (CAGR) of 43% (appx) from 2011 to 2013. Most of the revenue generated from Garments Unit (69.80%) followed by Sweater Unit (17.90%). As mentioned earlier that Standard Group is more focused on Woven product, woven unit‟s share of revenue increased from 4.80% to 69.80% from 2011 to 2013. Due to more concentration on woven unit, other units share has gone down. Revenue from construction unit varies from year to year since its revenue depends on work order basis. Revenue from washing unit and woven unit started from early of 2014.

Woven unit is still under construction which production capacity will be 36 lines by end of July 2014 and expecting to increase to 48 lines by end of this year. And washing unit is the largest processing facility within Standard Group and one of the largest in the industry. So considering these two units revenue, client is expecting higher growth in upcoming years. Profitability: Stable COGS relative to sales from 2011 to 2013 helped the client to achieve stable profitability position. The client could be able to maintain gross profit margin from 14% to 16% for last three years.

Leverage: Leverage ratio is quite high i.e. 2.26x due to intercompany liabilities. It needs to mention that the client did not have any long term liability with any bank/FI. So excluding these intercompany liabilities, their leverage stood at 0.43x which is quite acceptable. The client availed this liability from its sister concerns due to its higher investment in new project for washing and woven units.

Liquidity: In 2013, TCEL‟s current ratio improved from 2012 due to decrease in short term bank liabilities. But still current ratio was below 1 which suggests a tight liquidity position.

However, this is basically mostly due to advances received as apartment sales (i.e. BDT 674.99 million in 2013) contributed from their Real Estate Business and Construction units.

Coverage: TCEL could be able to maintain satisfactory coverage position in last couple of years due to improved operating performances which resulted in EBIT/Interest of 13.89 times in the year 2013.

Besides, the credit proposal also include the cash flow of TCEL for 2011, 2012 and 2013, where it shows that NCAO was negative due to changes in payable and taxes paid. Financing surplus is negative due to (increase) in fixed assets. The client has incurred significant amount of investment for increase in assets (construction of factory building at saver and capital machinery for their washing unit) for last couple of years continued in 2013. The credit proposal also shoes the average Cash Conversion Cycle of TCEL which is 168 days. Stock and Accounts Receivable of TCEL also present here for January, February and March 2014.

Moreover, the credit proposal also presents the projected Financials and projected Cash Flow of TCEL for 2014, 2015, 2016 and 2017 from which BRAC Bank can gather a clear idea about the future financial condition of the company which is important for them before giving the approvals for the proposal. TCEL has projected high growth in revenue considering start of commercial operation of their new two projects.

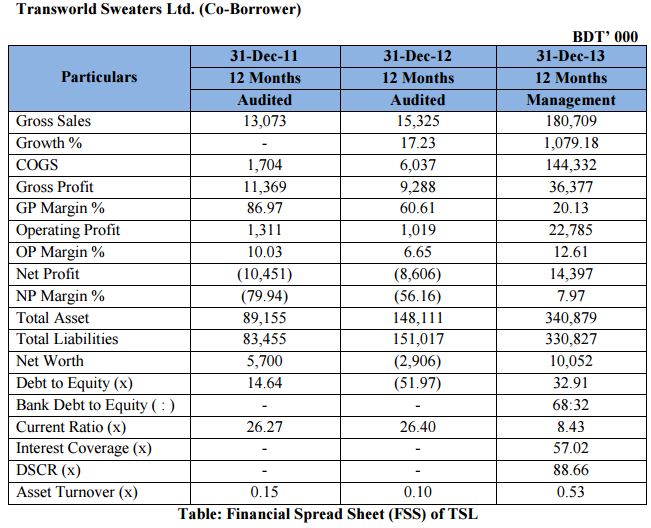

Revenue: The revenue of TSL has been showing increasing trend for the last three years, TSL was taken over from the previous management in 2010 by Standard Group. Afterward the present management of TSL started operation by sub-contracting. In 2013, they started full fledged operation by directly exporting toward EU & USA.

Profitability: Since till 2012 TSL was doing subcontracting their GP margin was high. But from 2013 they have started exporting directly. So their COGS gone up which resulted in lower Gross Profit margin however impact was lower on Operating Margin and Net Margin.

Current Ratio: Current ratio streamlined significantly due to an increase in current liability in the form of Bank borrowings.

DSCR and Interest Coverage: DSCR and Interest coverage ratio was found healthy in 2013.

Leverage Ratio: TSL has high leverage ratio for the last four years due to loan from sister concerns for factory renovation and expansion. However, the loan is interest free. It needs to mention that so far TSL did not avail any long term liabilities from bank.

Moreover, the credit proposal contains the Cash Flow, Cash Conversion Cycle, Stock and Accounts Receivable of TSL where the Cash Conversion Cycle showing unusual figure till 2012. Up to 2012, basically TSL‟s source of revenue was from subcontracting bills from their other sister concerns. Hence there were only inventory items which were supplied by their beneficiary.

However, TSL has started exporting directly from early of 2013. Since, they exporting from early of 2013, initially their receivables become very high because export precedes realization started mostly after June 2013. Receivable position showing here is on June 2013 and also realized totally by October 2013 (as per audit report). BRAC Bank is expecting to regularize this position by next year‟s financial statement.

Justification of Term Loan

The Civil Engineers Limited and Transworld Sweater Limited applied for the Term Loan facility of USD 10 million (Equivalent to BDT 800 million) to BRAC Bank. The reasons for the Term Loan has described by the clients where they show the purpose of borrowing the loan amount, in which sites they are going to expend the Term Loan. Basically they are going to use the amount for buying machineries, land, building and equipments for washing and woven units which are their expansion project planning. The projects located under same premises at Hemayetpur, Savar, Dhaka. They also mentioned the percentages of refinancing and finally the debt to equity ratio which is 30.48%.

Critical Risks and Mitigating Factors

Before giving the approvals BRAC Bank investigate some critical risks and mitigating factors which can affect the company or Group to repay the loan amount. So it seems so important for BRAC Bank to thoroughly study the risk and then make their decision about giving the loan.

Labor Unrest – Labor Conflict and worker strike are common problem in RMG sector in Bangladesh. Standard Group is known as an entity whose main driven force is it‟s human spirit. Through creating sense of trust and sharing across the group, this group is maintaining labor satisfaction from the beginning of the business. Therefore, since starting of the operational production of the company, no such hazards was carried out.

Industry Growth – Recently Bangladesh has become world‟s second largest knitwear exporter after China, replacing India. Also China is starting to lose its attractiveness due to a rise in costs of doing business; the sourcing caravan is moving on to the next hot spot like Bangladesh, Vietnam etc.

Stiff International Competition – The RMG industry of Bangladesh has been facing stiff competition from other countries specially India and China. However due to higher cost structure and other trade barrier like GSP facilities, buyer already shifting from those countries to the countries like Bangladesh, Vietnam etc. Basically Bangladesh is getting benefitted from its core competencies like lower labor and other costs and acceleration from GSP facilities from importing countries.

Timely delivery of goods and Quality Control – Historically Standard Group has been able to achieve consistent growth trend, which in turn proves its capacity to manage growth and live up expectation of buyers. Standard gives utmost importance in maintaining quality control and delivery schedule. The company also accommodates compliance requirements of buyers from time to time. In addition, they are continuously pursuing to increase their efficiency level through practicing industrial engineering.

Price Volatility of Raw Materials – Standard Group managed to overcome several turbulent cycles of volatility. The management has adequate experience, judgment and capability to predict to safeguard itself in price volatility. Besides, any price volatility in current scenario will affect the industry as a whole.

Management Expertise – The group has been operating the RMG industry for 30 years and has established themselves as a leading competitor. The running of their regular operations is well vested within the different management tiers of the group.

Buyer and Demand Risk – Standard Group has diversified customers based with reputed brands in world. They have been exporting to USA, EU, Canada and Asia region i.e. they are not bounded with specific region which helps them to get regular orders. In addition, Standard has maintained direct relationship with these buyers since long.

Supplier Risk – Main raw materials of the company are fabrics and accessories which they have been sourcing from both local and foreign sources. Since they are doing business since 1984, they have maintained good relationship from their suppliers.

Foreign Exchange Rate Risk – It is minimal because all receivables and payables are made through L/C which is denominated in foreign currency (majorly USD).

Default Risk – Client has been operating in this sector for about 30 years. They have excellent payment terms with existing lenders. Net worth position of sponsors is good. In addition, the management have diversified business portfolio including Real Estate, Construction, Banking, Insurance etc.

FINDINGS

For understanding the level of satisfaction of Local Corporate Clients I have conducted a survey between 10 corporate clients. I have asked them some question from which I can predict their satisfaction level about the services provided by BRAC Bank. A comprehensive analysis was done for the data gathered from the survey results of Local Corporate clients. Here I am discussing the findings.

- Most LC clients have been maintaining relationship with the Local Corporate segment of BRAC Bank for more than 5 years.

- They have a good knowledge about the services and solutions that LC offers them and thus they perceive their current awareness status and level of knowledge as sufficient.

- Most clients have rated LC services as reliable, but believe LC staff to be less responsive. Clients claimed that LC staff and services are easily accessible but the waiting time is pretty expensive. They also stated that LC staff can guarantee them service assurance, are consistently polite and courteous and shows empathy towards them. On the other hand, even if clients found LC rates to be in accordance with quality, they did not state it as reasonable. In fact, clients rated the overall quality and standard of LC services to be generally good.

- Majority of the clients have some complaints against the services of LC, mostly that LC staff is not supportive and efficient – but clients never share it with the relationship managers (RMs). Thus, they have rated the overall satisfaction level regarding the services of LC as moderate.

- Most clients did not want LC to add any other solution to their services, because they felt that existing solutions covered all aspects of a business. But those who wanted new solutions to be added to LC‟s range of services, requested for solutions relating to foreign exchange.

- Clients did not want LC to remove any solution from their offered services, because they felt that existing solutions were quite standard. However, those who wanted some solutions to be removed from LC‟s range of services voted against those solutions which are not much in use by the clients.

- Talking about changes in the Local Corporate segment, most clients want LC staff to make more frequent communication with the clients.

- Factors like service assurance, responsiveness and courteousness of LC staff and the rates of LC services have a strong relationship with client satisfaction of the Local Corporate segment. Also, the rates of LC services strongly impact the clients‟ rating of the overall quality and standard of LC services but not the rating of their level of satisfaction.

- Other factors like reliability of LC services, accessibility of the staff and services and empathy shown by the staff have a weak relationship with LC client satisfaction.

- Factors of service reliability, staff responsiveness, service and staff accessibility, service assurance, staff empathy and courteousness, and even rates of the services have a weak relationship with the longevity of the relationship that clients share with the segment of LC. Even the clients‟ rating of the overall quality and standard of LC services and their own satisfaction level has a weak relationship with the longevity of the clients‟ relationship with LC.

- Finally, the rating of the clients‟ satisfaction level regarding LC services have a weak relationship with the clients‟ rating of the overall quality and standard of LC services and their choice of the mostly used LC service.

- Customers feel that LC services as reliable but are not said to be responsive except for LC keeps them informed about when services to be provided. LC services can be said to be easily accessible except for one part that is waiting time for the service is expensive for clients, other than this clients feel that LC is easily accessible. Customers also feel that LC employees have the knowledge to answer clients‟ queries and can keep company secrets safe.

Clients do consider LC staffs as empathetic but not courteous. In general, customers rated LC services mostly as poor to good not beyond that. Analysis of Credit Proposal for Corporate Banking Division

Recommendation

- Since most clients share a relationship with Local Corporate for more than 5 years, Local Corporate should take special care to strengthen these relationships further and maintain their strong base of clients. For this, Local Corporate needs to continuously remind clients of their services and solutions through effective publicity and promotions. This can include billboards, brochures, leaflets and even web advertising.

- As cash management is the mostly used service by the local clients, the segment should invest more in the efficient utilization of the clients‟ cash assets in a manner which is consistent with the strategic objectives of Local Corporate. The segment should focus on providing international product quality and cross border capability to its clients. Local Corporate should concentrate on providing superior access to the world‟s fastest growing markets through their international network of branches, subsidiaries and alliances – supported by world-class electronic channels. They should try to develop comprehensive and integrated working capital solutions using leading-edge products and expertise – supported by consistent and seamless local service standards. Local Corporate can also include some local liquidity management solutions, multi currency cross border payments, trade ports and trade kiosks to its entire suite of transactional services and solutions.

- Since most clients have complaints against the staff of local corporate, the segment should employ more skilled, segment-aligned specialists with the experience and insights needed to provide trusted business advice to senior client executives of the local companies. Also, the segment should try to be responsive and make more client calls so as to communicate more frequently with the clients.

- As service assurance, responsiveness and courteousness of staff and the rates of services tend to have an impact upon client satisfaction of local corporate; the segment should focus on the enhancement and improvement of these factors. Local corporate should specially make its staff more responsive in providing services and attending clients and ensure that rates are reasonable for the local clients. For this, extensive training programs and attractive incentives can be useful to make the staff more responsive. Local corporate can also carry out a market survey to find out about the rates of the other banks of Dhaka and adjust their charges accordingly. As the rates strongly impact the clients‟ rating of the overall quality and standard of local corporate services, it should be cautiously charged. Although factors like service reliability, staff responsiveness, service and staff accessibility, service assurance, staff empathy and courteousness, and even rates of the services have a weak relationship with the longevity of the relationship that clients share with the segment – yet local corporate should take these factors into account.

- Staff training programs to speed up their ability to provide services can facilitate prompt services by local corporate and the staff can readily respond to the clients‟ requests. Clients are highly dissatisfied with the waiting time as it is time-consuming and costly for them. Therefore, local corporate can involve support staff to provide clients with services that require less time but for which clients have to wait longer – like statement printouts, signature verifications, etc. Also, call centers of the bank can hire teams to work and provide services to the local corporate clients specifically. In this way, a lot of trivial problems of clients will be solved without making them wait for long.

- Local Corporate can conduct surveys or telephone interviews or take suggestions from the clients during client calls to further improve and revamp their services and solutions. Relationship Managers (RMs) can play a vital role here as they are the intermediaries between the segment of the bank and the clients. It should be the RMs‟ responsibility to some extent to gather information about the services and solutions that clients are satisfied and dissatisfied with. Satisfactory services should be made consistent by the segment but the not so satisfied services and clients should be given special care and treatment. This is because a bit of negligence and ignorance on the part of the client relationship segment of local corporate can make them lose clients to their competitors.

Conclusion

The relationship of clients with a bank in usually set for a long-term period. When clients come to a bank for services and solutions relating to their company or business, they would definitely expect a superior quality and standard for these services. It is thus the bank‟s responsibility and more specifically the client relationship segment‟s duty to make sure that the clients receive their expected quality of services.

Local Corporate needs to fulfill this responsibility with special care as they represent the client relationship segment for local clients and are dealing with local companies. This segment brings in the most revenue for the bank owing to its strong client base. So to maintain relationships with this strong base of clients, Local Corporate should continuously improve their services and train their staff. They should understand clients‟ expectations and try to meet them – if possible, even surpass these expectations wherever feasible. They should prepare the Credit Proposal carefully where they can include all the essential things which can be important for their future deal with their corporate clients. Then only, local corporate can continue being the best client relationship segment of the Origination & Client Coverage (OCC) department and more importantly guarantee the satisfaction level of their local clients to a large extent.

Today, the banking industry in Bangladesh is a competitive field and to retain their position in the market, BRAC Bank needs to provide new and innovative solutions to their banking services for the local clients.

In this way, the bank can maintain a strong portfolio of local clients and stay in competition with other banks in the industry. To achieve this, client relationship segments should also be strengthened further – specially segments like Local Corporate. They should provide quality and prompt services and be more responsive to clients‟ requests. Only then, the satisfaction level of clients can be fully achieved.