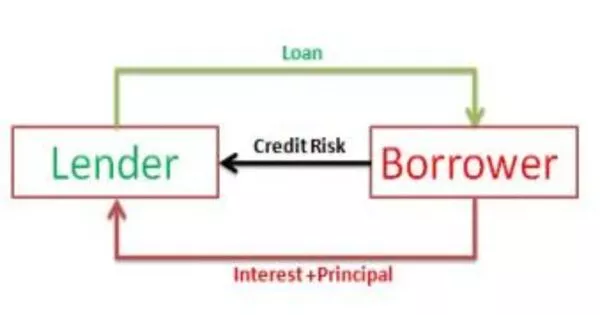

A credit derivative is a financial contract that allows investors to transfer or manage credit risk associated with a particular asset, such as a bond or loan. A credit derivative is any one of “various instruments and techniques designed to separate and then transfer the credit risk” of a corporate or sovereign borrower, transferring it to a party other than the lender or debtholder. Credit derivatives can be used to hedge against credit risk, speculate on credit events, or enhance returns on investments.

In a credit derivative contract, one party (the protection buyer) pays a premium to another party (the protection seller) to protect against the risk of default or other credit events associated with a specific asset or a portfolio of assets. If a credit event occurs, such as a default or bankruptcy, the protection buyer receives a payout from the protection seller.

An unfunded credit derivative is one in which credit protection is bought and sold between bilateral counterparties without the protection seller having to put money up upfront or at any point during the life of the deal unless a default event occurs. These contracts are typically traded under an International Swaps and Derivatives Association (ISDA) master agreement.

Credit derivatives can take different forms, such as credit default swaps (CDS), total return swaps (TRS), credit linked notes (CLN), and others. These instruments allow investors to customize their exposure to credit risk and tailor their investment strategies to specific needs and objectives.

Credit default swaps are the most common type of credit derivative. A funded credit derivative is one in which a financial institution or a special purpose vehicle (SPV) enters into a credit derivative and the payments under the credit derivative are funded using securitization techniques, such that a debt obligation is issued by the financial institution or SPV to support these obligations.

However, credit derivatives have also been associated with increased systemic risk in the financial system, as they can amplify market volatility and create interconnectedness between financial institutions. Therefore, credit derivatives are subject to regulatory oversight and risk management guidelines.

While a security, a credit derivative is not a physical asset. It is, instead, a contract. The contract allows one party to transfer credit risk associated with an underlying entity to another without transferring the underlying entity itself. A bank, for example, that is concerned that a borrower will be unable to repay a loan can protect itself by transferring the credit risk to another party while keeping the loan on its books.