EXECUTIVE SUMMARY

Banking service in Bangladesh is characterized as a highly competitive and highly regulated sector. With a good number of banks already in operation and a few more in the pipeline, the market is becoming increasingly competitive by the day.

With the global slowdown in the face of rising competition, the commercial banks are constantly looking for ways to develop their market and product offers to remain ahead of others. A significant amount of regulation by Bangladesh Bank prevents the scope of introducing newer products into the market and thereby restricts a banks’ ability to outperform others with a diversified product range.

However, recent trends have shown banks shifting away from vanilla products (basic products) towards higher value added products that are highly structured, to meet the needs of the clients.

The City Bank Ltd. is the oldest multinational bank operating in Bangladesh. It has, over the years, created one of the largest networks among all the foreign banks in Bangladesh. Although a trendsetter in offering various types of credit card to the credit card holders in the market, the product offers of The City Bank Ltd. are quickly imitated by competitors. Substitutes offered by other commercial banks make their way into the market and thereby eat a portion of the margin.

This report takes a look at the customer satisfaction on the credit card holders on the basis of current product offer of the Transaction Banking at The City Bank Ltd. alongside with a look at the untapped opportunities that lie ahead for the bank to take advantage of Know Your Customer (KYC) project. An earnest attempt has been made to analyze the customer satisfaction on the credit card holders and Transaction Banking products that drive competitor banks.

An idea of the current portfolio structure of nationalized, private and other foreign commercial banks has helped to generate ideas regarding the areas that The City Bank Ltd. itself can explore into. Having established itself as the leading foreign commercial bank in Bangladesh is not by itself sufficient unless a hearty attempt is made to sustain this position. Based on above, this report looks in depth towards the opportunity for Credit card Banking.

Introduction of Research Topic

Credit is a method of selling goods or services without the buyer having cash in hand. A credit card is only an automatic way of offering credit to a consumer. Today, every credit card carries an identifying number that speeds shopping transactions. Imagine what a credit purchase would be like without it, the sales person would have to record your identity, billing address, and terms of repayment.

According to Encyclopedia Britannica, “the use of credit cards originated in the United States during the 1920s, when individual firms, such as oil companies and hotel chains, began issuing them to customers.” However, references to credit cards have been made as far back as 1890 in Europe. Early credit cards involved sales directly between the merchant offering the credit and credit card, and that merchant’s customer. Around 1938, companies started to accept each other’s cards. Today, credit cards allow you to make purchases with countless third parties.

In 1950, the Diners Club issued their credit card in the United States. The Diners Club credit card was invented by Diners’ Club founder Frank McNamara and it was intended to pay restaurant bills. A customer could eat without cash at any restaurant that would accept Diners’ Club credit cards. Diners’ Club would pay the restaurant and the credit card holder would repay Diners’ Club. The Diners Club card was at first technically a charge card rather than a credit card since the customer had to repay the entire amount when billed by Diners Club.

American Express issued their first credit card in 1958. Bank of America issued the BankAmeria card (now Visa) bank credit card later in 1958.

Origin of the Study

This research paper has been prepared as a part of the thesis Program of Bachelor of Business Administration of ASA University Bangladesh . The report titled, A Comprehensive Study of Credit Card Holders of The City Bank Ltd is an outcome of three months’ long thesis Program at The City Bank Ltd. The report topic was approved by the faculty supervisor to satisfy the organizational requirements and fulfillment of the thesis program. This report has been prepared under both of their direct supervision.

Objectives of the Study

The broad objective of the study is to draw an overall view of the credit card market and then identify the prospects of CBL. The specific objectives of the study are:

- To discover the preferred attributes and satisfaction level of the clients of CBL to choose credit card.

- To analyze the services offering and charges of CBL regarding Credit cards comparing with other banks.

- To identify the weakness and problems of the Credit card service offering of To suggest necessary measures to improve the service quality of the Branch and the CBL as a whole.

Significance of the Study

The report titled A Comparative Analysis on Credit Card: Fees, charges, documentation and customer satisfaction of The City Bank Ltd. is prepared as a requirement of the three months long thesis program at The City Bank Limited. Entering into a new line of business requires careful research and analysis on the market and competitors’ strategies, strengths, weaknesses etc. Under this circumstance a comparative analysis on the existing Credit Card Market would be very helpful for the bank to accumulate various data and information regarding the product/service offerings, customer bases, customers’ satisfaction level etc and in the process help to explore opportunities and set strategies etc. It would be a huge boost for me to get acquainted with the credit card business. So this study is very significant for both the bank and me.

Expected Findings of the Study

Prior to all research works, there are some expected results, which are hypothesized for the evaluation of the study. The expected findings of the study were:

- To analyze the services offering and charges of CBL regarding Credit cards comparing with other banks. in the process of card delivery times, interest rate, merchant pricing, different fees & charges

- Customers’ credit card selecting criteria, attitude of keeping various cards, their wants, needs that can be overcome by CBL.

- CBL’s sources of areas of improvement in the whole process of credit card business.

- Cardholders’ personal background regarding their age, income, occupation and education to evaluate their card usage pattern, habits, and other features.

- To identify the weakness and problems of the Credit card service offering of CBL.

Methodology of the Study

The whole system of data collection and analysis included the following procedures:

Sources of data

Both primary and secondary sources of data have been used to gather the necessary information for the analyses of the study. Primary data sources are the cardholders. The secondary data sources are the organization booklets of charges and fees, application forms, credit card agreements of the card offering organizations.

Sampling Technique Used

a) Population: Cardholders of The City Bank Limited (CBL)

b) Sampling Design and Sample Size:

Currently 9 banks are providing credit card facility. Among these I have chose to do my research on the CBL credit card holders. But, as the population size of cardholders is large, it was difficult to determine a representative sample size. So, a purposive quota sampling was used for the cardholders. The total sample size was 120. The Cardholders were selected on a convenient basis for the face-to-face personal interview as well as survey.

Data Administering Method

The cardholders and the issuers were personally interviewed. Due to some inconvenience and also to avoid wastage of time, some respondents were also interviewed over the telephone by making them understand the technical terms. A set of questionnaire were developed to collect all the data and information.

Techniques of Data Analysis

Quantitative approaches like frequency distribution, cumulative percentage measurement, regression, Chi square test, Beta value, significance level, reliability test have been used for analyzing the collected data with the statistical software SPSS version 12.

SCENARIO REGARDING THE MAIN TOPIC OF THE REPORT IN BANGLADESH

City bank exists wherever one currency is traded for another. It is by far the largest financial market in the world, and includes trading between large banks, central banks, currency speculators, multinational corporations, governments, and other financial markets and institutions. Retail traders (individuals) are a small fraction of this market and may only participate indirectly through brokers

Foreign Exchange Market allows currencies to be exchanged to facilitate international trade and financial transactions. Evolution of the market in Bangladesh is closely linked with the exchange rate regime of the country. It had virtually no foreign exchange market up to 1993. bangladesh bank, as agent of the government, was the sole purveyor of foreign currency among users.

It tried to equilibrate the demand for and supply of foreign exchange at an officially determined exchange rate, which, however, ceased to exist with introduction of current account convertibility. Immediately after liberation, the Bangladesh currency taka was pegged with pound sterling but was brought at par with the Indian rupee. Within a short time, the value of taka experienced a rapid decline against foreign currencies and in May 1975, it was substantially devalued. In 1976, Bangladesh adopted a regime of managed float, which continued up to August 1979, when a currency-weighted basket method of exchange rate was introduced. The exchange rate management policy was again replaced in 1983 by the trade-weighted basket method and US the dollar was chosen as intervention currency.

Up to 1990, multiple exchange rates were allowed under different names of export benefit schemes such as, Export Bonus Scheme, XPL, XPB, EFAS, IECS, and Home Remittances Scheme. This led to a wide divergence between the official rate and the SEM rate. The situation also gradually gave rise to a number of conflicting regulations, poor risk management, and various types of implicit or explicit government guarantees to the users of foreign exchange. This resulted in a number of macro-economic imbalances prompting the government to adjust the official rate in phases and to liquidate its difference with the rate at SEM. The two rates were finally unified in January 1992. The first step towards currency convertibility was taken on 17 July 1993 and this marked the beginning of a relatively open foreign exchange market in the country. Until then the Bangladesh Bank used to declare mid-rate along with the buying and selling rates for dollar applicable to authorized dealers. Initially the spread was Tk 0.10, which was gradually widened to Tk 0.30.

At present, the system of exchange rate management in Bangladesh is to monitor the movement of the exchange rate of taka against a basket of currencies through a mechanism of real effective exchange rate (RFER) intended to be kept close to the equilibrium rate. The players in the foreign exchange market of Bangladesh are the Bangladesh Bank, authorized dealers, and customers. The Bangladesh Bank is empowered by the Foreign Exchange Regulation Act of 1947 to regulate the foreign exchange regime. It, however, does not operate directly and instead, regularly watches activities in the market and intervenes, if necessary, through commercial banks. From time to time it issues guidelines for market participants in the light of the country’s monetary policy stance, foreign exchange reserve position, balance of payments, and overall macro-economic situation. Guidelines are issued through a regularly updated Exchange Control Manual published by the Bangladesh Bank.

The foreign exchange market of the country is confined to the city of Dhaka. The 32 scheduled banks operating as authorized dealers in the inter-bank foreign exchange market are not permitted to run a position beyond certain limits. In the event of speculation on an appreciation of the value, an authorized dealer may buy more foreign currencies than it needs, but at the end of the day it must maintain its limit by selling excess currencies either in the inter-bank market or to customers. Authorized dealers maintain clearing accounts with the Bangladesh Bank in dollar, pound sterling, mark and yen to settle their mutual claims. If there any excess foreign exchange holdings exist after these transactions, it is obligatory for them to sell it to the Bangladesh Bank. In case of shortfall of the limit, authorized dealers have to cover it either through purchase from the market or from the Bangladesh Bank.

Before deregulation of foreign exchange market the volume of inter-bank transaction was low. The assured access to funds from Bangladesh Bank at known cost as well as the assured buy-sell margins and transaction fees contained in the pre-determined exchange rate provided little inducement for authorized dealers to engage in inter-bank transactions. However, the situation has been changing and the reliance of authorized dealers on the Bangladesh Bank is gradually declining.

The average monthly transactions of foreign exchange in the inter-bank market accounted for $23.46 million in 1991-92 and crossed the $1 billion mark in 1998-99. The average monthly turnover for the six months between July and December 2000 was $1.5 billion. The phenomenal growth of inter-bank transactions was due mainly to relaxation of exchange control regulations and expansion of the activities of the Bangladesh Foreign Exchange Dealers Association (BAFEDA) formed on 12 August 1993.

The-inter bank foreign exchange market of Bangladesh is still at its rudimentary stage. The market is an oligopolistic one and is dominated by a few relatively large banks, which have remained only as dealers instead of developing themselves into buyers or sellers. The most widely used practice is spot transaction; this covers 95% of the total transactions. Only forward transactions offer protection against foreign exchange risks.

The year of 1993 saw a significant shift in the country’s foreign exchange regulatory policies and the Bangladesh Taka (BDT) was declared convertible in the current account. Most restrictions related to current account activities were relaxed where commercial banks were given the responsibility to ascertain genuineness of the transactions and the central bank’s prior approval requirements in these regards were withdrawn. The responsibility of exchange rate quotation was left to the commercial banks where Bangladesh Bank only committed support to the commercial banks to plug any net foreign currency gaps in the market at their pre-specified buying and selling rates. Many circulars and guidelines were issued at that time to communicate the changes as well as to guide the market participants. Subsequently, a new “Guidelines for Foreign Exchange Transactions” was issued summarizing instructions as of 31s t December, 1996 replacing the old Exchange Control Manual (1986 edition).

A financial organization’s balance sheet is formed from its core activities. However, as perfection in the balance sheet is almost impossible, organizations require access to the wholesale market to plug in gaps and mismatches (though, wholesale activities are primarily for managing gaps and mismatches, this is also done for proprietary trading and arbitrage purposes). As the two types of wholesale activities i.e. foreign exchange and Bangladesh Bank Focus Group 22 money market are heavily interdependent, these are required to be housed in the same area. This means that an organization’s foreign exchange and money market activities are to be unified in the same department for efficiency. When these two functions are centralized in the same treasury department, the foreign exchange dealer, in completing the deal. As we know that inter-bank dealing is highly time critical, the money market dealer can make an optimum decision in an efficient way when s/he receives the information at the earliest possible time. Similarly, the foreign exchange dealer can immediately pass on the foreign currency funding information to the relevant money market dealer who can immediately make an efficient decision of the foreign currency funds effected through the USD/BDT deal.

Central banking is conducted by the Bangladesh Bank, which has its head office in Dhaka. It is responsible for the circulation of money, supervision of commercial banks, and control of credit and foreign exchange. There are four commercials government owned banks, 6 development financial institutions, 27 domestic private banks, and 12 foreign bank branches operating in Bangladesh. The four major banks are all state-owned: Sonali Bank, Janata Bank, Agrani Bank, and Rupali Bank. The International Monetary Fund reports that in 2001, currency and demand deposits—an aggregate commonly known as M1—was equal to $4.3 billion. In that same year, M2—an aggregate equal to M1 plus savings deposits, small time deposits, and money market mutual funds—was $16.9 billion. The discount rate, the interest rate at which the central bank lends to financial institutions in the short term, was 6%.

AN OVERVIEW OF THE ORGANIZATION

Background:

Credit is a method of selling goods or services without the buyer having cash in hand. A credit card is only an automatic way of offering credit to a consumer. Today, every credit card carries an identifying number that speeds shopping transactions. Imagine what a credit purchase would be like without it, the sales person would have to record your identity, billing address, and terms of repayment.

According to Encyclopedia Britannica, “the use of credit cards originated in the United States during the 1920s, when individual firms, such as oil companies and hotel chains, began issuing them to customers.” However, references to credit cards have been made as far back as 1890 in Europe. Early credit cards involved sales directly between the merchant offering the credit and credit card, and that merchant’s customer. Around 1938, companies started to accept each other’s cards. Today, credit cards allow you to make purchases with countless third parties.

In 1950, the Diners Club issued their credit card in the United States. The Diners Club credit card was invented by Diners’ Club founder Frank McNamara and it was intended to pay restaurant bills. A customer could eat without cash at any restaurant that would accept Diners’ Club credit cards. Diners’ Club would pay the restaurant and the credit card holder would repay Diners’ Club. The Diners Club card was at first technically a charge card rather than a credit card since the customer had to repay the entire amount when billed by Diners Club.

American Express issued their first credit card in 1958. Bank of America issued the BankAmeria card (now Visa) bank credit card later in 1958.

Credit cards were first promoted to traveling salesmen (more common in that era) for use on the road. By the early 1960s, more companies offered credit cards, advertising them as a time-saving device rather than a form of credit. American Express and MasterCard became huge successes overnight.

By the mid-’70s, the U.S. Congress begin regulating the credit card industry by banning such practices as the mass mailing of active credit cards to those who had not requested them. However, not all regulations have been as consumer friendly. In 1996, the U.S. Supreme Court in Smiley vs. Citibank lifted restrictions on the amount of late penalty fees a credit card company could charge. Deregulation has also allowed very high interest rates to be charged.

The Shape of Credit Cards: Credit cards were not always been made of plastic. There have been credit tokens made from metal coins, metal plates, and celluloid, metal, fiber, paper, and now mostly plastic cards.

The inventor of the first bank issued credit card was John Biggins of the Flatbush National Bank of Brooklyn in New York. In 1946, Biggins invented the “Charge-It” program between bank customers and local merchants. Merchants could deposit sales slips into the bank and the bank billed the customer who used the card.

Since credit card has become part of our life and becoming more and more popular I have decided to do my internship report based on this. For my report I have selected The City Bank Limited’s (CBL) credit card. Before moving on to the main research analysis I have added information regarding CBL product and services and their company structure.

The City Bank Limited (CBL) is the first private sector bank in Bangladesh. The bank has been operating since 1983 with an authorized capital of Tk.1.75 billion. The noble intention behind starting this bank was to bring about qualitative changes in the sphere of Banking and Financial Management. Today the City Bank serves its customers at home and abroad with 86 branches spread over the country and about three hundred oversea correspondences covering the entire major cities and business center of the world. The services encompass wide diversified areas of trade, commerce and industry which tailored to the specific need of customers and are distinguished by an exceptional level of prompt and personal attention. Over the years the bank has expanded the spectrums of its services. The extensive and ever growing domestic network provides and carries various products and services to the doorsteps of millions.

The CBL was incorporated as a public limited company with limited liability on the 14th March, 1983 and its formal inauguration was on March 27, 1983 under company act, 1913 in Bangladesh with the primary objective to carry on all kinds of banking business. Functioning as a conventional Bank in the country since 1983, it has been able to consolidate its position in the banking sector. The bank has been able to establish a solid presence with the customers and general public through its improved services, value addition in the economy and increasing shareholders value. The bank is listed with Dhaka Stock Exchange and Chittagong Stock Exchange.

Vision Statement

To be the bank of 1st choice through maximizing value for our clients, shareholders and employees and contributing to the national economy with social commitments.

Mission Statement

- To become the leader in the industry attaining highest level of customer satisfaction with strong corporate culture and good governance.

- To maximize profit with steady growth ensuring major market share

- To engineer enterprise and creativity in business and industry with a commitment to social responsibility

- To introduce fully automated systems through integration of ICT.

- To maintain high moral and ethical standard and participative management

- To nurture an enabling environment where the innovativeness and performance is rewarded

- To develop and retain a quality workforce through effective HRM system

- To offer an array of products & services in the search for excellence and create an impressive economic value.

Product & Services Scheme

As a service oriented business, image is a central factor in a bank’s effort to differentiate itself from competitors. Generally, the way products or services are made available to customers helps to create the image of the particular institution in the mind of the customers. This image is reflected in the customers’ perceptions and feelings about the products or services offered. This is important because customers experience with a particular product or services will affect their attitude towards the bank and other product and services as well even if they had never used the other products.

Objective

Despite extreme competition among banks operating in Bangladesh, both local and international the City Bank Limited has made a remarkable progress practically in every sphere of its functions. The activities of the CBL are very implicit and vast comparing to that of other banks in the country today. The theme of the bank is “For Relationship Banking”. The prime objectives of the CBL are to create a strong capital base, to earn good profit and pay satisfactory dividend to honorable shareholders with proper social commitments. To achieve the objectives the management is continuously working for the improvement of bank’s assets quality by identifying potential depositors and good borrowers. Because it believes “The line of excellence never ends”. The strategic plans and business will be its strength in this very competitive environment.

Strategies Of The City Bank Limited

CBL believes in the practice of Market-Oriented Strategic Planning, developing and maintaining a viable fit between the organization’s objectives, skills and resources. The aim of such approach is to shape and reshape the bank’s businesses and services so that they yield target profits and growth. The strategic planning of CBL consists of two organizational levels, which are

4Location Based Strategy

4Business Level Strategy

Location Based Strategy

Since the growth and profits of banking business largely depend upon the locations of branches where large concentration of other businesses and industries are involved, CBL Main Strenghth is its location based strategy. The 84 branches of CBL are divided into five different regions, which are

1. Dhaka Division comprise 30 branches.

2. Chittagong Division, comprising 17 branches.

3. Comilla Division, comprising 7 branches.

4. Sylhet Division, comprising 10 branches

5. Bogra Division, comprising 20 branches

The concentration of businesses and lifestyles of the people are not the same in these five areas. So, the strategies of the five areas differ from one another; but they are designed with distinctive local touch. Head office constantly monitors the progresses of all the five areas. The bank is not interested in launching more branches. Currently CBL is focusing in strengthening the existing branches.

Business Level Strategy

The business strategy of the Bank is to strengthen its retail business, following a conservative lending approach. But the Bank’s major portion of the profit generates from its Retail banking and SME Banking.

Retail Banking Strategy

The City Bank Ltd. recently has started its journey in Retail Banking. More than 700 staffs have been trained so far on the vital concepts of service excellence and sales. In the product side ATM fleet has been launched, Debit card and credit has been issued, SMS Banking has been offered, 3 new deposit products have been introduced, manifold in the endeavor to build a Retail Banking brand namely “City Retail Happiness Counts”.

SME Banking Strategy

Considering the potential growth and demand situation the City Bank Limited has extended credit facilities to small and medium enterprises through SME Banking in the year 2005 and 2006.A separate division has established in the Head Office with collaboration of all branches to process and handle loans under SME for attaining a respectable market share and successful operation of the scheme. The bank has organized several training program for development of adequate human resources.

Products And Services

Since commencement of banking operation, The City bank Limited has not yet only gained enormous popularity but also been successful in mobilizing deposit and loan products. The bank has made significant progress within a very short time period due to its dynamic management and introduction of various consumer-friendly loan and deposit products. All the products and services offered by the bank can be classified under two major heads:

- Deposit Products

- Monthly Benefit Deposit Scheme

- Fixed Deposit Scheme

- Saving Deposit Account(Three Stage Saving Scheme)

- NFCD (Non Resident Foreign Currency Deposit Account)

- NITA (Non Resident Investor’s Taka Account)

- Loan Products

- Consumers’ Credit Scheme

- Lease Finance

- Hire Purchase

- Small and Medium Enterprise Credit Scheme (SME)

- Loan Against Shares and Securities

- HouseBuilding Financing Scheme

- Financing Scheme For Contractors

- Computerized Online Banking with “Finacle Core”

- City Bank VISA Credit Card

- Working Capital Financing

- Import Financing

- Export Financing

- Industrial Financing

- Other Service

Consistent with the modern edge and competing in the competitive market, City Bank Limited has introduced some innovative banking services that are remarkable in a country like Bangladesh. The services offered by the bank are as follows:

On-line Banking

The bank has set up Wide Area Network (WAN) across the country within its all branches to provide on-line branch banking facility to tits valued customers. The service named “Finacle Core” has opened up several possibilities of improved customer services. Under this facility client of one branch are able to do banking transaction at any other branch of the bank. The bank hosted its Web Site to facilitate dissemination of information about the banking services and facilities of City Bank Limited all over the world.

Information Technology in Banking Operation

City Bank Limited is providing comprehensive range of banking services with utmost care and efficiency to its customers. Auto Teller Machine is used to count money properly to save client’s valuable time as well. The customer can draw money/cash from their account within a minute.

SWIFT Service

City Bank Limited is one of the first few Bangladeshi Banks to obtain membership of SWIFT (Society for Worldwide Inter-bank Telecommunication). SWIFT is a members’ owned cooperative which provide a first and accurate communication network for financial transactions such as Letter of Credit, Fund Transfer etc.

Maintenance of Accounts of The City Bank Ltd

Account Opening Section

To establish a Banker and customer relationship Account opening is the first step. Opening of an account binds the Banker and customer into contractual relationship. But selection of customer for opening an account is very crucial for a Bank. Indeed, fraud and forgery of all kinds start by opening account. So, the Bank takes extremely cautious measure in its selection of customers.

Types of Account

- Current Account.

- Savings Account.

- Fixed Deposit Account.

Procedure to open an Account

For opening an account, at first the prospective account holder will apply for opening an account by filling up account opening form. Account opening form consists of the name of the branch, type of account, name of the applicant(s), present address, permanent address, passport number (if any), date of birth, nationality, occupation, nominee(s), special instruction (if any), initial deposit, specimen signature(s) of the applicant(s), introducer’s information etc.

The prospective customer should be properly introduced by the followings:

- An existing customer of the bank.

- Officials of the bank not below the rank of Assistant Officer.

- A respectable person of the locality who is well known to the manager or authorized officer.

- Two copies of passport size photograph duly attested by the introducer.

- Signature of the prospective account holder in the account opening form and on the specimen signature card duly attested by the introducer.

- Then the concerned authority will allocate a number for the new account.

- The customer than deposit the “initial deposit” by filling up a deposit slips. Initial deposit to open a current account in PBL is Tk. 1000.00 and saving account is Tk. 500.00.

After depositing the initial deposit, the account is considered to be opened. CBL maintains all of its accounts in computer. After depositing the initial deposit, CBL records it in the computer by giving new account number. Then it issues cheque book requisition slip by the customer. Then it distributes all relevant papers to respective department.

Activities and papers necessary for opening an account

Joint Account

If the account is a joint account, then the joint account holder should submit a declaration and operational instructions of the account along with their signature. The declaration is

“Any balance to the credit of the account is and shall be owned by us as joint depositors. Any liability whatsoever incurred in respect of this account shall be joint and several.”

Partnership firm

The following documents have to be submitted for preparing an account of a partnership firm:

(a) If the partnership firm is a registered one, then one copy of registration forms.

(b) If not, then a copy of certificate from the notary public.

Limited Company

For the opening of an account of a limited company, following documents have to be submitted:

- A copy of resolution of the company that the company decided to open an account in the City Bank.

- Certified true copy of the Memorandum & Articles of Association of the Company.

- Certificate of Incorporation of the company for inspection and return along with a duly certified Photocopy for Bank’s records.

- Certificate from the Registrar of Joint Stock Companies that the company is entitled to commence business (in case of Public Ltd. Co. for inspection and return) along with a duly certified Photocopy for Bank’s records.

- Latest copy of balance sheet.

- Extract of Resolution of the Board/General Meeting of the company for opening the account and authorization for its operation duly certified by the Chairman/Managing Director of the company.

- List of Directors with address (a latest certified copy of Form-XII)

Club/Society

Following documents have to be obtained in case of the account of the club or society:

- Up to date list of office bearers.

- Certified copy of Resolution for opening and operation of account.

- Certified copy of Byelaw and Regulations/Constitution.

- Copy of Government Approval (if registered).

Cooperative Society

Following documents have to be obtained in case of the account of Cooperative Society:

- Copy of Byelaw duly certified by the Co-operative Officer.

- Up to date list of office bearers.

- Resolution of the Executive Committee as regard of the account.

- Certified copy of Certificate of Registration issued by the registrar, Co-operative societies.

Computerized Online Banking

Finacle Core

The Bank has set up a Wide Area Network (WAN) across the country to provide Online Branch Banking facility to its valued clients. Under the Scheme, clients of any branch shall be able to do banking transaction at other branches of the bank.

- Under this system a client will to be able to do following type of transactions:

- Cash withdrawal from his/her account at any branch of the Bank irrespective of location.

- Cash deposit in his/her account at any branch of the Bank irrespective of location.

- Cash deposit in other’s account at any branch of the Bank irrespective of location.

- Transfer of money from his/her account with any branch of the Bank.

- Any amount can be deposited or transferred under Prime Line. In the system, however, at present there is a limit for cash withdrawal through bearer or by account holder himself.

- Under this system, client will be able to do the following type of transactions:

- Easy to withdraw or deposit from any online branch

- Fund transfer with one click, no need TT/DD.

- Customer can easily tell which payments have cleared

- Under this system, client will be able to do the following type of transactions:

Requirement of Finacle Core service

The Clients who has account in City bank or who will open account in City bank and would be interested to maintain substantial deposits in Savings, Current or STD accounts, will be eligible to get Finacle Core Service. Intending and eligible clients have to apply in prescribed application form to the branch to get the online service from the bank. The client should submit two copies photographs and signature cards along with the application form. To avail the Finacle Core service, no charge should be paid for online transaction within a locality where the account is domiciled. But charges should be paid by the customer for inter city online transaction.

Deposit Schemes of City Bank Limited

Bank is the largest organization of mobilizing surplus domestic savings. For poverty alleviation, we need self-employment, for self-employment we need investment and for investment we need savings. In the other words, savings help capital formations and the capital formations help investments in the country. The investment in its turn helps industrialization leading towards creation of wealth of the country. And the wealth finally takes the country on road to progress and prosperity. As such, savings is considered the very basis of prosperity of the country. The more the growth of savings, the more will be the prosperity of the nation. The savings rate in Bangladesh is one of the lowest in the world rate of domestic saving being 17.78 %. In order to improve the savings rate, Financial Institutions responsible for mobilization of savings should offer attractive Savings Schemes so that the marginal propensity to save increases. The savings do not, of course, depend only on the quantum of income but largely depend on the habit of savings of the people.

CBL has formulated the following Savings Schemes:

- Monthly Benefit Deposit Scheme,

- Fixed Deposit Scheme,

- Three Stage Savings Scheme,

Monthly Benefit Deposit Scheme

This is a Deposit Scheme where the depositor gets a fixed amount of profit every month without disturbance to the principle. The Scheme is designed to attract:

The retirement benefits of service holders.

- The investment of Wage Earners who want to pay a fixed amount monthly to their family’s dependents in Bangladesh from the profit of their investment.

- The deposit of those persons who intend to meet the monthly expense of their family from the income of their deposit.

- Investment of fund of Trusts and Foundations which award monthly Scholarships / Stipends to students.

- Trusts and founders or other associations, which award monthly scholarship/stipends to students etc.

Principal Activities:

- Payment of monthly profit shall start from the subsequent month after a clean minimum gap of 30 days from date of deposit.

- Normally, the deposit will not be en cashable before maturity. But if any depositor intends to withdraw his deposit before maturity, the following rules will apply:

- No benefit including interest shall be allowed for premature encashment within one year.

- If the accounts/ deposits are closed/ encased after one year of its opening, benefit shall be allowed on the deposits at exiting savings deposits rate.

- If the amount of monthly profit already paid exceeds the amount payable at exiting savings rate, the difference shall be realized from the principal deposit amount, if and when necessary.

- If the client fails to deposit installment for consecutive 3 months, in this case the scheme will be closed for adjusting loan.

- In case of death of a depositor, the A/C shall cease to be operative and the amount deposited so far shall be paid to the nominee, as mentioned in the account opening form, and in absence of nominee, to the legal heirs of deceased as per rules in force.

Utility Services Scheme

Like any other country of the world, the people living in the urban areas of our country lead a very busy life. Times are very valuable to them. Despite this, they are to waste their valuable time at the counter of. Different Banks and other Institutions for payment of their monthly bills of different utility services like Electricity, Telephone etc. They, as such, face enormous difficulties for payment of their monthly bills in time. Such inconveniences of the urban people can be removed by making an arrangement to collect all the bills of various utility services at one Point.

Scope of Services: – The scheme is designed to provide all the required services to the customer in making payment of their following bills on their behalf from the counter of the Bank:

- To pay Electricity Bills

- To pay Telephone Bills

- To pay Gas Bills

- To pay WASA Bills

- To pay Insurance Premium

- To pay House Rent

- To collect House Rent

- To pay Municipal Taxes

- To collect Pension Money

- Issuance and Renewal of License of TV, Radio, etc.

Objectives

- To help the customers in payment of their different utility Bills in time and thereby relieve them of their worries and save their valuable time.

- To help different corporations/ organizations in timely collection of their Bills.

- To help the senior citizens of the country in collecting their Pension Money every month.

- To extend financial assistance to the customers by way of overdraft in timely payment of their Bills.

Account Closing

How to Control the Account Closing

Ensure that:

- Application for closing a/c received and signature verified.

- Account closing be referred to manager

- Unused cheque leaves are taken back and destroyed physically and system.

- No liability.

- No legal instruction.

- All the instruction is checked and no instruction remains unattended.

- All charges are realized.

- A/C “closed” is marked in AOF.

- “Close AOF” is duly filed in the closed file.

- Close marking in red color in a/c opening register is done and destroyed cheque must be mentioned.

After debiting all charges a pay slip is issued to debit the account for final payment to the a/c closer.

Cheque Book Issue

Ensure that:

- Cheque book issue register is maintained properly.

- Requisition slip properly filled in and signature of the a/c holder duly verified and found correct.

- Account is not inoperative.

- All Cheque leafs are used in seriatim.

- Cheque book against client application (other than requisition slip) is issued after proper verification of the signature.

- Approval of manager is obtained to issue cheque book in case of loss of requisition slip.

Stop payment

Ensure That

- Instruction of stop payment is confirmed by a written application of drawer. In case of the instruction received by telephone or third party a formal application by drawer is must date and time.

- Signature of the applicants is verified and found correct.

- Stopped Cheque register is properly maintained.

- Immediate action is taken as per rules on receipt of the application from the account holder for stop payment of a Cheque.

- Cheque in question has not been paid. If paid advise the account holder on the day of receipt of the application.

- The particulars of stopped cheque are recorded in the respective ledger with time and date of receipt of application.

- Special warning for security system is adopted in case of computer system.

Clearing Section

According to the Article 37(2) of Bangladesh Bank Order, 1972, the banks, which are the member of the clearinghouse, are called as Scheduled Banks. The scheduled banks clear the cheque drawn upon one another through the clearinghouse. This is an arrangement by the central bank where every day the representative of the member banks gathers to clear the cheque. Banks for credit of the proceeds to the customers’ accounts accept Cheque and other similar instruments. The bank receives many such instruments during the day from account holders. Many of these instruments are drawn payable at other banks. If they were to be presented at the drawee banks to collect the proceeds, it would be necessary to employ many messengers for the purpose. Similarly, there would be many cheque drawn on this the messengers of other banks would present bank and them at the counter. The whole process of collection and payment would involve considerable labor, delay, risk and expenditure.

All the labor, Risk, delay and expenditure are substantially reduced, by the representatives of all the banks meeting at a specified time, for exchanging the instruments and arriving at the net position regarding receipt or payment. The place where the banks meet and settle their dues is called the Clearinghouse.

Activities of the Section:

(a) Preparation of Clearing Outward and Inward Lodgment and record maintenance of the same.

(b) Batch posting as and when required.

On receipt of instruments, the same is endorsed here. Then clearing section will sent IBDA to head Office for clearing purpose and on receipt of IBCA from Head Office amount is credited to customers account and vice versa. If the instrument is return then the same is given back to the customer.

Collection Section:

Checks, drafts etc. are drown on bank located outside clearing house are sent for collection. B.B. Avenue Branch collects its client’s above-mentioned instruments from other branches of CBL and branches other than CBL. In case of out ward bills for collection customers account is credited after finishing the collection processor. And in case of in ward bills customers account is debited for this purpose. So it place dual role as follows:

- Collecting Banker

- Paying Banker.

Training Program of CBL

The City Bank Ltd. has launched a huge training program for its staff as part of its restructuring plan. So far, 774 staffs have received training on Customer Service and face to Face Sales; 65 staff received training on Departmental operating Instructions and 268 staff received training on Orientation to Credit. Apart from these regular training are going on with BIBM, BIM, CRISL etc. City Bank Management gives top priority to its peoples learning and development issues. That’s why the current training project of City Bank is given a name “Learning & Development Making the winning Moves”.

Functional Divisions of CBL

The Bank accomplishes its functions through different functional divisions/ departments. The divisions/departments along with their major functions are listed below:

Financial Division

Financial planning, budget prepartion and monitoring

Payment of salary

Controlling inter-branch transaction

Disbursement of bills

Preparation of financial reports and annual reports

Preparation/Review of returns and statements

Maintenance of Provident Fund, Gratuity, Superannuation Fund

Reconcilliation

Credit and risk management

Loan administration

Loan disbursement

Project evaluation

Processing and approving credit proposals of the branches

Documentation, CIB (Credit InformationBureau) report etc

Arranging different credit facilities

Providing related statements to the Bangladesh Bank and other departments

Human Resource Division (HRD)

Recruiting

Training and development

Compensation, employee benefit, leave and service rules program and upgration

Placement and performance appraisal of employees

Preparing related reports

Reporting to the Executive Committee/ Board on related matters

Promotional campaign and press release

Information Technology (IT) Department

Software development

Network management and expansion

Software and Hardware management

Member banks reconcilliation

Data entry and processing

Procurement of hardware and maintenance

SWOT Analysis Of CBL

SWOT analysis refers to analysis of strengths, weaknesses, opportunities and threats of an organization. This facilitates the organization to make its future performance improved in comparison to its competitors. An organization can also study its current position through SWOT analysis. For all of these, SWOT analysis is considered as an important tool for making changes in the strategic management of an organization.

Identification Of Strengths, Weaknesses, Opportunities & Threats

Strengths:

- CBL Bank is already well established in the banking industry of the country. It is one of the leading first generation private sector commercial banks in Bangladesh.

- CBL Bank has the reputation of being the provider of good quality services to its present and potential customers.

- Excellent Management

- High Commitment of Customer

- Qualified and experienced Human Resource

- Strong network.

- Sophisticated Automated System

- CBL Bank has already achieved a high growth rate. Deposits as well as loans & advances are increasing rapidly.

Weaknesses:

- Lack of motivation of work among some employees.

- Heavily depended on Head Office for decision making.

- Some of the job positions in the CBL Bank have no growth or advancement path which brings job dissatisfaction among some employees.

- The promotional activities of the Bank are not adequate to widen its market share.

- CBL Bank does not provide ATM card which limits its competence in the fast changing banking industry.

Opportunities:

- Increasing demand of customer finance.

- Relationship Management.

- A large portion of our population is middle class. Different types of retail lending products have a great appeal to this class. So, a wide variety of retail lending products has a very large and easily pregnable market. Thus, CBL Bank can adopt variety scheme for retail lending.

- Bank can introduce special corporate scheme for corporate customers or service holders according to the professions, such as engineers, lawyers, doctors etc.

- As many private banks are operating in the market in recent time. CBL Bank must have to expand its product line to enhance its sustainable competitive advantage.

Threats:

- Some commercial/ foreign as well as private bank.

- Similar types of retail banking products.

- Certain Bangladesh Bank rules and regulations.

- Customer awareness of pricing and services.

- Industries are becoming sick at an increasing rate and growth of industrialization is very slow in the country. Therefore, it is very likely that poor industrial growth will affect the potentiality of CBL Bank.

Conclusions

From the SWOT analysis mainly focus that the CBL Bank is already well established in the banking industry of the country. It is one of the leading first generation private sector commercial banks in Bangladesh. CBL has the reputation of being the provider of good quality services to its present and potential customers. But it has some obstacles which occurred for its weakness & threats. It is Possible to prevent these obstacles by implementing proper action plan.

Action Plan

- Improvise compensation and other fringe benefits to motivate the employees as well as retain employee’s performance.

- Decentralization in decision making is required.

- Focusing customer needs and wants and improvise company’s service policies.

- Taking competitive advantage from others.

- Offer diversified retail products which will be more economical to the customers.

Performance of CBL for last two years

The City Bank Ltd., since its incorporation, continued to maintain its stable position in the industry. The bank has been able to show a strong performance in business and financial accounts. With better customer service, fulfillment of commitments to corporate social responsibilities, ensuring sound corporate governance Bank consolidated a solid presence with the customers and general public and in the industry. During the last few years, significant improvement was evident in deposit mobilization, advance portfolio augmentation and recovery of non-performing loan. Foreign trade, in terms of import, export and inward foreign remittance have also shown noteworthy growth in the year 2006. Last few years performances are described below-

| Year | 31stDecember, 2009 (Amount in Tk.) | 31stDecember, 2010 (Amount in Tk.) |

| Operating Profit | 1249 Million | 1494 Million |

| Authorized capital | 1750 Million | 1750 Million |

| Paid up capital | 720 Million | 1080 Million |

| Total capital | 2,080,700,000 | 2,601,000,000 |

| Capital surplus | 140,500,000 | 59,500,000 |

| Total assets | 35,303,744,444 | 47,445,751,884 |

| Total contingent liabilities | 9,040,114,395 | 13,623,395,805 |

| Total loan deposit ratio (%) | 76.11 | 77.81 |

| Ratio of classified loan to total loans & advances % | 5.71 | 7.18 |

| Profit after tax & provision | 540,924,588 | 420,021,913 |

| Amount of classified loan during the current year | 470,081,000 | 197,826,000 |

| Provision kept against classified loans | 40,879,000 | 1,996,447,000 |

| Provision surplus | 22,265,513 | 13,518 |

| Cost of fund (%) | 5.34 | 6.94 |

| Interest earning assets | 31,913,926,565 | 40,820,243,647 |

| Non-interest- earning assets | 3,389,817,878 | 6,625,508,237 |

| Return on investment (%) | 8.38 | 8.58 |

| Year | 31stDecember,2005 (Amount in Tk.) | 31stDecember, 2006 (Amount in Tk.) |

| Return on assets (%) | 1.75 | .58 |

| Income from investment | 285,323,890 | 431,448,405 |

| Net income per share (Tk.) | 75.13 | 22.22 |

| Price Earning Ratio (Tk.) | 10.24 | 17.55 |

| Capital adequacy ratio | 9.65 percent | 9.21 |

| Deposit | Tk 30648 Million | Tk. 39571 Million |

| Loans and advance | Tk 23326 Million | Tk. 30789 Million |

| Recovery | Tk. 498 Million | Tk.538 Million |

| Import | Tk. 21363 Million | Tk. 32096 Million |

| Export | Tk. 18219 Million | Tk.28211Million |

| Foreign remittance | Tk. 4158 Million | Tk. 6780 Million |

| Syndicate/corporate finance | Tk. 597 Million | Tk. 3070 Million |

| Operating Profit | 1249 Million | 1494 Million |

| Authorized capital | 1750 Million | 1750 Million |

| Total capital | 2,080,700,000 | 2,601,000,000 |

| Capital surplus | 140,500,000 | 59,500,000 |

| Total assets | 35,303,744,444 | 47,445,751,884 |

| Total contingent liabilities | 9,040,114,395 | 13,623,395,805 |

| Total loan deposit ratio (%) | 76.11 | 77.81 |

| Ratio of classified loan to total loans & advances % | 5.71 | 7.18 |

| Profit after tax & provision | 540,924,588 | 420,021,913 |

| Amount of classified loan during the current year | 470,081,000 | 197,826,000 |

| Provision kept against classified loans | 40,879,000 | 1,996,447,000 |

| Provision surplus | 22,265,513 | 13,518 |

| Cost of fund (%) | 5.34 | 6.94 |

| Interest earning assets | 31,913,926,565 | 40,820,243,647 |

Table 3: Financial Performance

Earning Per Share

Earnings stood at Tk. 22.22 per share in the year 2006 while it was tk. 75.13 in the preceding year. Increase in number of share through issuance of bonus share and decrease in net profit after tax due to charge of higher provision resulted the decrease for earning per share.

Deposit

Banks deposit grew by 29 percent in 2006. Customer deposits of the Bank grew by 28 percent. Total deposit stood at Tk. 39572 million with an increase of Tk. 8924 million. the deposit position in the year 2005 was Tk. 30648 million. The growth was supported by branch network and high standard service provided to customers. For last five years the deposits are given below with diagram-

Loans Advances

The portfolio of loans and advances at end of the year 2006 stood at Tk. 30789 million with an increase of Tk. 7463 million growth was 32 percent. The outstanding amount at the same period of previous uear was Tk. 23326 million.

Import

The import business including local L/Cs of the bank increased to TK 32096 million in the year under review from TK 21363 million of the previous year. Increase in the import business is 50% compare to the previous year

Export

The volume of export business including local bills rose to TK 28211 million from TK 18219 million in 2005 showing a growth of 55 percent. Ready Made Garments, frozen food and leather continue to remain major export items in 2006.

Foreign Remittance

In the year 2006 CBL has established new inward foreign remittance relationship with 8 exchange houses located in UK, UAE, Oman and Qatar which helped the Bangladeshi expatriates to remit their foreign currency through proper banking channel. The bank handled foreign remittance business amounting BDT 6780 million directly through 14 exchange houses in the year 2006. The growth of the foreign remittance business in the year 2006 is 104 percent compare to the previous year.

Investment Operation

Bank was involved in utilization of surplus funds through investment in treasury bills, bonds, government approved securities, debentures shares and money at call and short notice. Investment in government securities like treasury bills and treasury bonds was Tk. 2945 million and Tk. 2707 million respectively. Increase in these heads were Tk. 642 million and Tk. 2036 million respectively. Investment in private sector share, debenture, and bond increased by Tk. 86 million and stood at Tk. 531 million as at 31st December,2006. Growth under this head was 19 percent.

Capital Market Services

In an effort to promote industrialization and economic development of Bangladesh, City Bank considered it appropriate to seize this opportunity by playing its due role in capital market related activities. Accordingly the bank obtained Membership of Dhaka Stock Exchange (DSE) for operating a brokerage house. To provide infrastructural facilities for Local & Nonresident Bangladeshi (NRB) Investors through this brokerage house and all other capital market related activities, a new Division namely ‘Capital Market Services Division’ has been created and a Consultant with proper background has been appointed.

Future Direction of CBL

Due to good poet flood harvest recovery of agricultural output, stable manufacturing growth supported by strong export demand of knit garments, robust service sector growth and steady flows of inward remittances. Due to high international prices of many other commodities like oil, gold etc. interest rate is on rising trend in global economy with associate increase in the inflationary expectation. Bangladesh Bank is alert to contain the inflationary pressure and tightened monetary measures are expected to continue for facilitating smooth credit flow to productive pursuits only for targeted output growth. The rate of interest of the country has already shown a changing trend in both deposit and advance due to the tightened monetary measures.

CBL is well positioned to meet the challenges of 2008 and will continue to strive to innovate and capture for modest growth, value creation and quality improvement. The Bank will focus on its existing customers and potential customers also. This strategy is supported by wide spectrum of product and services and level of customer service delivery. The Bank will continue to harness the potential of retail banking, SMS banking and remittance market. However, there are continued pressure on interest margins, commission and fee earnings, exchange income and increased provision requirement for retail. In its pursuit for growth, CBL will always adhere to good corporate governance and best practices and sound risk management policies and strict credit evaluation procedure.

Credit Card of City Bank

The City Bank Limited (CBL) launched Visa Credit Card business back in April 14, 2004. Presently it has only 8,500 cards in market whereas other contemporary competitors have grabbed a remarkable market share. Lack of dynamic product features, proper marketing effort, structured credit process, supervision of delinquency etc. is behind this miserable situation. Hence, The City Bank Limited has re-launch its City Card shortly with all dynamic features, proper marketing strategy, smooth distribution channels (Direct Sales Team), structured collection team and above all with a best Credit Process for Cards Division. There are 7 packages in the “City Card”. Information regarding those 7 packages are mentioned below according to their website, leaflets, and brochures.

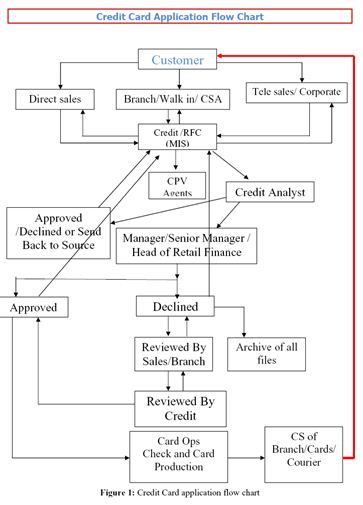

Credit Card Application Process

In this segment of the report all findings of the survey are provided with detail analysis. This part is further divided in to two parts. In the first part I have talked about the frequency distribution of different demographic variables. In the second part I have discussed the findings from my questionnaire.

Frequency Test of Demographic Variables

Here in this part I have explained the frequency distribution of my demographic variables. The demographic variables I used in this project are age, sex, individual’s monthly income, and profession.

Age Group

The age group was ranged from 20 to above 60 and divided into five segments. These are 20 to 25, 25-35, 35-50, 50-60 and above 60. The frequency distribution is shown below:

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Between 25-35 | 24 | 15.1 | 20 | 20 |

| Between 35-50 | 60 | 37.7 | 50 | 70 | |

| Between 50-60 | 36 | 22.6 | 30 | 100 | |

| Total | 120 | 75.5 | 100 |

Table 7: Frequency Distribution of Age Group

All of my respondents were between age of 25 to 60 years. There were no respondents that belonged in the age group between 20 and 25 and above 60 years. About 50% of the respondents were in the age group of between 35-50 years.

Analysis

In this section I have represented a graphical presentation of the responses of the respondents regarding the CBL credit card services. Accordingly, based on those responses I will qualify the satisfaction level of the CBL credit card holder as per the hypotheses added.

To analyze the survey result I have input the data in SPSS statistical software. I have used version 12.0 of SPSS. Several statistical tools is used to analyze and interpreting the findings of the research by using SPSS. I have built a frequency distribution table from the findings for the variables. Then the table have shown graphically, also the shape of the distribution will be measured. Correlation from a regression has developed and it indicates the relation between each independent variable with dependent variable.

The research includes number of hypothesis tests. Each has null & alternative hypothesis and have significance level for each test. I have also used cross-tabulation, mean analysis to justify the findings in my recommendation.

Regression Analysis

Table 11: Regression Analysis

Model Summary(b)

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

R Square Change | F Change | df1 | df2 | Sig. F Change | |||||

| 1 | .637(a) | .405 | .390 | 1.75477 | .405 | 26.357 | 3 | 116 | .000 |

a Predictors: (Constant), attributes, fees and interest rates, ATM booths

b Dependent Variable: satisfaction

ANOVA(b)

Model |

| Sum of Squares | df | Mean Square | F | Sig. |

1 | Regression | 243.479 | 3 | 81.16 | 26.357 | .000(a) |

| Residual | 357.188 | 116 | 3.079 | |||

| Total | 600.667 | 119 |

a Predictors: : (Constant), attributes, fees and interest rates, ATM booths

b Dependent Variable: satisfaction

Regression Equation

| Y =α + ß1×1 + ß2×2 + ß3×3 + €

|

| Customer Satisfaction = constant + ß1 (attributes) + ß2 (fees & interest rates) + ß3 (ATM booths) + error |

Here Y is the dependent variable “Customer Satisfaction”, α is constant, ß1, ß2, and ß3 are coefficients of independent variables x1 (attributes), x2 (fees & interest rates), and x3 (ATM booths) and € is representing error.

So, from the regression table (table-7) I have found the following regression equation-

Customer satisfaction = -.339 + .228 (attributes) + .101 (fees & interest rates) + .411 (ATM booths) + error.

Interpretation of the Regression Equation

It means if there is one unit change in attributes customer satisfaction will change by .228 units holding fees and interest rates and ATM booths constant. Positive beta value indicates that attributes are positively related to customer satisfaction. It means if there is one unit increase in attribute then customer satisfaction will increase by .228 unit and vice versa holding other variables constant.

If there is one unit change in fees and interest rates, customer satisfaction will change by .101 units holding attributes and ATM booths constant. Positive beta value indicates that fees and interest rate is positively related to customer satisfaction. It means if there is one unit increase in fees and interest rate then customer satisfaction will increase by .101 unit and vice versa holding other variables constant.

If there is one unit change in ATM booth, customer satisfaction will change by .411units holding attributes and fees and interest rates constant. Positive beta value indicates that service quality is positively related to customer satisfaction. It means if there is one unit increase in ATM booths then customer satisfaction will increase by .411 unit and vice versa holding other variables constant.

Analysis of Each Variable

Now I am going to discuss the variable’s reliability, significance, and findings and identify the weakness and strengths of each variable and provide recommendation for improvement of those weaknesses.

- Attributes of the Credit Card

Reliability Test

“Reliability refers to the extent to which a scale produces consistent results if repeated measurements are made”. Basically, it measures the internal consistency of the questions that are asked under each variable. This internal consistency is measured by the value of Cornbach’s alpha. A value less than 0.60 generally indicates unsatisfactory internal consistency reliability.

Interpretation

The significance of attribute is .015 at 95% confidence level which is lower than 0.05. It also has quite high beta value and t-value.

According to statistics, the decision rule for a t-distribution is-

Reject Ho,if tcal >tn-1, a/2 or tcal < – tn-1, a/2

Here, tcal = 2.479, a= 5%=.05, n=120, tn-1, a/2 = t120, .025= 1.960

Therefore, tcal > tn-1, a/2.

So, reject null hypothesis, which is attribute has insignificant impact on customer satisfaction. It means location has significant impact on customer satisfaction.

P-Value

P-value for location is 0.66%. It means we can reject null hypothesis at 0.66% significance level of any level above it.

Beta value (coefficient of variable)

Attributes of credit card has the second highest beta value (.228) among all other variables used in this model. It suggests that it has significant impact on the dependent variable customer satisfaction. It is obvious that customers will definitely want the attributes of the credit card to be attractive and effective in order to make better use of credit card facility.

Mean Test

Table 14: Mean test for Attributes of Credit Card

| N | Minimum | Maximum | Mean | Std. Deviation | |

| Q6 I use credit card for security. | 120 | 1 | 4 | 1.7 | 0.913 |

| Q7 I use credit card for personal image | 120 | 1 | 5 | 1.88 | 1.261 |

| Q8 I use credit card for convenience | 120 | 1 | 5 | 1.68 | 0.945 |

| Q9 I use credit card for short term loan | 120 | 1 | 3 | 2.1 | 0.703 |

| Q10 I use credit card for mental satisfaction | 120 | 1 | 5 | 2.34 | 1.452 |

| Q11 I use credit card for source of financial support in emergency time. | 120 | 1 | 5 | 2.09 | 1.167 |

| Q12 I use credit card for cash withdrawal facility | 120 | 1 | 4 | 2.37 | 0.777 |

| Q13 I use credit card for discount facility | 120 | 1 | 5 | 1.73 | 1.13 |

| Q14 I use credit card to pay utility bills | 120 | 1 | 5 | 3.02 | 1.577 |

| Q16 I consider bill processing period as an important attribute. | 120 | 1 | 5 | 1.98 | 1.119 |

| Valid N (listwise) | 120 |

In the questionnaire 1 goes for strongly agree, 5 goes for strongly disagree, and number 3 refers to neutral. So, mean value close to 1 is superior for proving my hypothesis.

From the above table it is visible that customers don’t use credit card to pay their bills. Mean value of this question is 3.02, which clearly identifies that more customers can be persuaded to pay their bills with the credit card which mena more business for CBL in the wrong run.

The above table also shows that many of the CBL card holders use credit card for security reasons. Mean value of this question is 1.70 (second strongest to support my hypothesis), which clearly identifies that more and more people are concerned about security and they are willing to pay the extra fees and interest rates in order to have a safer life. The question related to convenience also reflects that credit card holders use the cards for convenience

The mean of this question 1.68, which is most superior among all the means to support my hypothesis.

Frequency Test of Attributes Associated with Credit Card

Security: To find the response level of respondents regarding the security associated with use of credit card, I asked them a question- ‘I use credit card for security’- and I asked it in liquored scale. The responses that I received from the survey are given in the table below.

| Observed N | Expected N | Residual | |

| Strongly Agree | 66 | 30 | 36 |

| Agree | 31 | 30 | 1 |

| Nutral | 16 | 30 | -14 |

| Disagree | 7 | 30 | -23 |

| Total | 120 |

Overall satisfaction on the Attributes of Credit Card

To assess the overall effect of attributes of the credit card on the customer satisfaction of CBL we can go through the results of each questions asked to the respondents and see that most on the attributes are affecting the satisfaction level of the customers. There are few which are affecting more than others. Those attributes are, convenience, personal image, security, discount facility, bill processing time, use for emergency, and for short term loan. Even though the other attributes are less important to the customers it is safe to assume that with proper marketing and offer CBL’s credit card’s other attributes can also be part of this strong chain of attributes stated above.

Findings’ Summary on “Attributes”:

- Questions regarding Attributes has Beta value of .228

- Significance (.015)

- Reliability of 0.611

Drawbacks:

- Limited facility to pay utility bills.

Fees and Interest Rates of the Credit Card

Reliability Test

| Cronbach’s Alpha | Cronbach’s Alpha Based on Standardized Items | N of Items |

0.667 | 0.676 |

|

Table 19: Reliability Statistics

Accommodation has Cronbach’s Alpha of .667, which is more than the minimum requirement 0.60. So, my questions under the variable “fees and interest rates” are internally consistent and reliable.

Regression Table

Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | 95% Confidence Interval for B | |||

B | Std. Error | Beta | Lower Bound | Upper Bound | ||||

1 | (Constant) | -0.339 | 0.746 | -0.455 | 0.65 | -1.816 | 1.138 | |

| var_eff_Attrib | 0.117 | 0.026 | 0.411 | 4.438 | 0 | 0.065 | 0.17 | |

| var_eff_IntFee | 0.059 | 0.05 | 0.101 | 1.166 | 0.246 | -0.041 | 0.159 | |

| var_eff_ATM | 0.12 | 0.048 | 0.228 | 2.479 | 0.015 | 0.024 | 0.216 | |

a Dependent Variable: satisfaction

Table 20: Regression table.

Interpretation

The significance level of fees and interest rates is .246 at 95% confidence level which is higher than 0.05. It also has lower beta value and t-value.

Again, According to statistics, the decision rule for a t-distribution is-

Reject Ho,if tcal >tn-1, a/2 or tcal < – tn-1, a/2

Here, tcal = 1.166, a= 5%=.05, n=120, tn-1, a/2 = t119, .025= 1.960

Therefore, tcal < tn-1, a/2.

And tcal > -tn-1, a/2.

So, we fail to reject null hypothesis which is fees and interest rates have significant impact on customer satisfaction.

P-Value

P-value of fees and interest rates is 12.1%. It means we can reject null hypothesis at 12.1% or any level above it.

Beta value (coefficient of variable)

Fees and interest rates have the least beta value (.101) among all other variables used in this model. It suggests that it does not have significant impact on the dependent variable customer satisfaction. Customers usually expect a lower interest rates and fees on credit cards. So, it can be assumed that they require an excellent service with respect to fees and interest rates alongside great packages with different sets of offers.

Frequency Test of Fees and Interest Rates Associated with Credit Card Use

The fees and interest rates of credit card is significantly higher than others. A bank can earn lots of profit from doing a successful credit card business. That is why I have asked few questions in order to find out whether or not my hypothesis regarding fees and interest rates as one of the independent variable of customer satisfaction is right or not.

The first question I asked in liquored scale is “The options in fees and interest rates are satisfactory”. The outcome’s frequency distribution from my survey is stated below.

Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Agree | 31 | 19.5 | 25.8 | 25.8 |

| Neutral | 50 | 31.4 | 41.7 | 67.5 | |

| Disagree | 25 | 15.7 | 20.8 | 88.3 | |

| Strongly Disagree | 14 | 8.8 | 11.7 | 100.0 | |

| Total | 120 | 75.5 | 100.0 | ||

| Table 21: The options in interest rates and fees are satisfactory

The table above shows that 50 out of 120 respondents are thinking this from neutral point of view. 31 person agree with that statement and a total of 39 respondents think that the options in interest rates and fees are not satisfactory.

| |||||

| N | Minimum | Maximum | Mean | |

| Q22 The options in interest rates and fees are satisfactory. | 120 | 2 | 5 | 3.18 |

| Q15 Interest charges and fees are important attributes in maintaining a credit card | 120 | 1 | 3 | 1.72 |

| Q23 Interest charges and fees adjust often with better offers and more options. | 120 | 1 | 4 | 2.47 |

| Q24 More attractive offers with respect to interest rates and fees of credit cards are needed. | 120 | 1 | 3 | 1.48 |

| Valid N (list wise) | 120 |

Table 22: Mean of questions asked under the variable “Fees and Interest Rates”

Above table shows that half of the questions that were asked under the variable “Fees and Interest Rates” have mean value of approx. 2 . It suggests that most of the answers were around agree and neutral. It means customers are in between agree and neutral and if fees and interest rates are not further improved then the mean value may cross 3. Among all the questions satisfaction regarding fees and interest rates has the highest mean value (3.18) and it is followed by how frequent the offers regarding fees and interest rates been adjusted.

Cross Tabulation of Questions asked regarding Fees and Interest Rate

In order to find out the level of satisfaction by cross referencing between different variables I have picked 3 questions and created a crosstab. The result is stated below.

| Q31 Sex.

| Q24 More attractive offers with respect to interest rates and fees of credit cards are needed. | Total | ||||

Strongly Agree | Agree | Neutral | ||||

| Male | Q5 How frequently do you use credit card? |

Once a week | 5 | 3 | 1 | 9 |

| Once in 2 weeks | 32 | 11 | 4 | 47 | ||

| Once a month | 25 | 14 | 1 | 40 | ||

| Total | 62 | 28 | 6 | 96 | ||

| Female | Q5 How frequently do you use credit card? | Once a week | 2 | 1 | 0 | 3 |

| Once in 2 weeks | 5 | 6 | 2 | 13 | ||

| Once a month | 3 | 4 | 1 | 8 | ||

| Total | 10 | 11 | 3 | 24 | ||

Table 23: Cross tabulation of Question# 5, 24, and 31: frequency of use, attractive offer, and gender.

We can see from the table that males uses more credit card than female. We can also see that out of total 24 female 13 of them uses credit card at least once every 2 weeks. This means on an average about 54% percent of total female respondents are using credit cards once every two weeks. At the same time out of 96 men 47 (49%) men uses credit card once every two weeks. And 40 of them (42%) uses once each month.

It is quite clear that people who use the credit card more frequently want more attractive offer. During my survey I have noticed that fewer female were using credit card compared to men. That is why the frequency should have been greater for men but the data analysis shows that females are using more credit card then men. It might be because of the safety issue associated with it or the convenience.

Chi Square Test on Feedback Result Regarding Fees and Interest Rate

There are few things that determine the satisfaction level regarding Fees and interest rates and they are options in the credit card packages, maintenance, periodic adjustment of credit card fees and interest rates, and new offers. I have explained the responses regarding those factors below by doing “Chi square test”-

Options in Credit Card Packages: To find out the satisfaction level of the credit card packages I have asked this question – “The options in interest rates and fees are satisfactory” and the result I got was in liquored scale. The result is analyzed and interpreted below with graphical presentation.

| Observed N | Expected N | Residual | |

| Agree | 31 | 30 | 1 |

| Nutral | 50 | 30 | 20 |

| Disagree | 25 | 30 | -5 |

| Strongly Disagree | 14 | 30 | -16 |

| Total | 120 |

Table 24: The options in interest rates and fees are satisfactory.

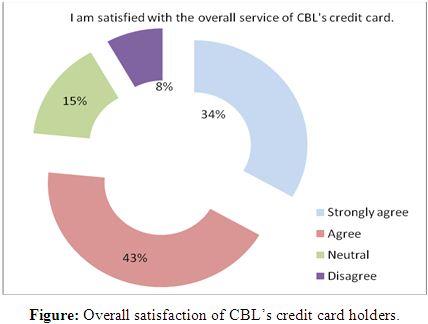

Overall Customer Satisfaction