A Coverage Ratio is one of a group of financial ratios used to calculate the willingness of a company, such as interest payments or dividends, to pay its financial obligations. The greater the coverage level, the simpler it is to pay interest on its debt or pay dividends. Coverage ratios are normally utilized by loan bosses and moneylenders to decide the monetary remaining of a forthcoming borrower. The pattern of inclusion proportions after some time is additionally concentrated by investigators and speculators to determine the adjustment in an organization’s budgetary position.

Coverage ratios, both for their current customers and new customers applying for credit, are generally used by borrowers and lenders. It comes in many forms and can be used to help recognize businesses in a potentially distressed financial situation, although low ratios are not inherently an indicator of financial difficulties for the business. The ratios might be utilized inside, however typically just when advance contracts necessitate that a business must keep up a specific least proportion or, more than likely face an advance dropping. Numerous variables go into deciding these proportions and a more profound plunge into an organization’s fiscal summaries is regularly prescribed to discover a business’s wellbeing.

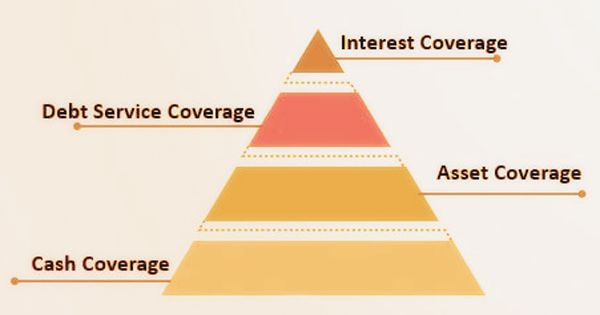

Four Types of Coverage Ratio

The most common coverage ratios are:

Interest coverage ratio: The willingness of a corporation to (only) pay interest on its debt. It is a method for financial institutions to assess a borrower’s ability to repay the interest on the loan. It is also called the Interest Coverage Ratio or Times Interest Earned. The ratio is defined as:

Interest Coverage Ratio = EBIT / Interest Expense

Where:

EBIT = Earnings before interest and taxes

An interest coverage ratio of two or higher is generally considered satisfactory.

Debt service coverage ratio: A company’s ability to pay all debt commitments, including principal and interest repayments. This ratio shows the potential of earnings from cash to fulfill the repayment of the financial loan. From the lending authority’s point of view, it is very significant as it shows the repayment potential of the person taking out the loan. The ratio is defined as: DSCR = Net Operating Income / Total Debt Service

A ratio of one or higher is representative of the generation of adequate earnings by a corporation to fully fund its debt obligations.

Cash coverage ratio: The willingness of a business with its cash flow to pay interest costs. This is a rather conservative metric since only cash on hand (no other assets) is related to the interest rate the business has in relation to its debt.

Formula: Cash coverage ratio = Total cash / Total interest expense

Asset coverage ratio: The willingness of an organization with its assets to repay its debt obligations. The appropriate level of coverage for assets depends on the field. The ratio is defined as:

Asset Coverage Ratio = Total Assets – Short-term Liabilities / Total Debt

Where:

Total Assets = Tangibles, such as land, buildings, machinery, and inventory

A coverage ratio could give a limited spotlight on simply the capacity to repay enthusiasm on a credit (the intrigue inclusion proportion) or analyze the capacity to take care of both the intrigue and booked head installments on an advance (the obligation administration inclusion proportion). Coverage ratios come in various forms and can be used to help classify businesses in a financial situation that is potentially distressed, but low ratios are not inherently an indicator that a business is in financial trouble. Based on the percentages, the creditors or shareholders make a decision as to whether or not to expand the company’s credit or loan or other kinds of financial help.

Coverage Ratio

Numerous components go into deciding these proportions and a more profound jump into an organization’s fiscal summaries is frequently prescribed to discover a business’s wellbeing. There is no specific inclusion different that is explicitly viewed as fortunate or unfortunate. As a rule, the higher the proportion, the better the likelihood that an organization will have the option to pay its obligations. Various coverage ratios are assessed by various stakeholders in an organization. For example, the debt service coverage ratio and interest service coverage ratio will be determined by a financial institution or bank extending a loan to the company or business and an investor will look at the dividend coverage ratio as an equity shareholder.

Coverage ratios are additionally important when taking a gander at an organization according to its rivals. The most ideal approach to look at an inclusion proportion is to plot it on a pattern line over an extensive stretch of time; if the pattern is declining, this can be a marker of future issues, regardless of whether the proportion is presently sufficiently high to demonstrate a sensible degree of liquidity. While it can offer important insights into their relative financial positions to compare the coverage ratios of companies in the same industry or sector, doing so across companies in different industries is not as useful, as it may be like comparing apples to oranges.

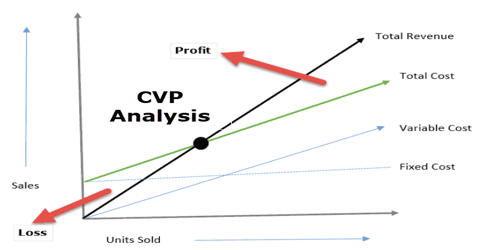

The estimation of coverage ratio has profit/income as the numerator and the denominator comprises of the obligation or the fixed charge for which the proportion is being determined. Inclusion proportions ought to be assessed working together with the unpredictability of organization incomes. Also, a high coverage ratio cannot offer an acceptable indicator of the willingness to pay if cash flows fluctuate a great deal over time. Usually, a ratio greater than 1 means that it is possible for the profits or cash flows to pay off the liabilities for which the ratio is measured.

Information Sources: