Executive Summary

We prepared the report on “Corporate Governance Researches in Bangladesh” fully based on secondary data and information. The study has been conducted mainly on the basis of literature survey and secondary information. For this specific purpose we collected data and information from various sources like published materials such as Various journals and research papers, conference papers presented in the international conference on CG in Bangladesh, seminar papers, World Bank reports, diagnostic study reports and newspaper articles have been surveyed in making this study. We furnished the full contents of the report in Four chapters. We concentrated on arranging and putting the data in such a way that the report progressively anchors to a desired destination of understanding.

In the very first chapter we point out the information about the report. That is its origin, objective, data collection and presentation. It will facilitate the understanding what the report is for and how it is designed.

As we prepared the report on “Corporate Governance Researches in Bangladesh”, we think a brief discussion about the Corporate Governance with a full effort to clear the term -definition of corporate governance, Views of corporate governance in mainstream research, the importance of corporate governance for transition economies will enhance the understanding of the report. With this view in the mind, through out the chapter two we highlight on the above matters.

In chapter three, we focused mainly on the Corporate Governance Scenario of Bangladesh in the light of some Scholarly articles. There has been some work done in the area of corporate governance by the World Bank and ADB in Bangladesh, but overall there is a lack of material on corporate governance issues in Bangladesh. Some discussion regarding specific aspects of corporate governance has been undertaken by organizations like Centre for Policy Dialogue (CPD), Institute of Chartered Accountants (ICAB), and the Institute of Bank Management (BIBM). The brief summaries of the major articles and studies relating to CG are presented here The summaries explain the authors’ major points that relate to corporate governance. The chapter four is the concluding part of the report. It covers the Problems and findings of corporate governance in Bangladesh & conclusion drawn on the basis of data presented earlier.

Introduction

Corporate Governance is the system by which business corporations are directed and controlled. Its structure specifies the distribution of rights and responsibilities among company’s different actors such as board, management, share holders and other stake holders. Transparency and accountability are its major attributes. Beyond this there is a growing recognition that a good Corporate Governance system actively adds value to the long run. Viewed in this context, Corporate Governance is the enhancement of the long term shareholders value while at the same time protecting the interest of other stake holders.

The frame work for Corporate Governance deals mainly with executive and non executive directors, separation of CEO from chairmanship, rights of all shareholders including minority, accountability forwards stake holders, internal control to deal with risk, director’s remuneration to deal with shirking behavior and statement of going concern. It can be interpreted as a broad and somewhat vague term for a range of corporate controls and accountability mechanisms designed to meet the corporate objectives. This paper will focus on the above Corporate Governance issue with special reference to the corporate governance research in Bangladesh.

1.2. Rationale of the Study

During the last three decades of the last century, there has been occurred a significant changes and improvements in the corporate world. Because of the expansion and diversion of most of the companies into public limited companies, an emergence of the separation of ownership and management was obvious. So professional expertise were needed to manage and operate the giant organizations so that shareholders wealth can be maximized. Ownership was diverged into sponsors, government, institutions, foreign investors and general public. As there so many stakeholders are related to the corporate body, it became a complicated matter to run the corporations. Agency problem began to exist. As a result, corporate governance emerged to help the corporations perform in the desired way. Firm’s performance is influenced by corporate governance and ownership structure. A significant number of research papers have been published on the topic ‘Corporate Governance’ in which most of the authors have considered some actors of corporate governance. Moreover, still now there have been very few formal and recognized studies on the concerned issue. So, it is a burning issue today to work on the topic. For this reason, there is much rationale to find out the existing scenario corporate governance in Bangladesh.

1.3 Objectives of the Study

The objectives of the study are

To provide an understanding of corporate governance,

To provide an analysis of corporate governance environment in Bangladesh.

To present the hindrance in having good corporate governance and

To understand the corporate governance culture in the corporate sector in Bangladesh.

To analysis the various corporate governance issues.

1.4 Methodology of the Study

The study has been conducted mainly on the basis of literature survey and secondary information. Various journals and research papers, conference papers presented in the international conference on CG in Bangladesh, seminar papers, World Bank reports, diagnostic study reports and newspaper articles have been surveyed in making this study.

1.5 Limitations of the Study

There were several constraints while performing this report. The following are the limitation of the study:

The study is conducted under limited time allowed. Only few weeks were not sufficient time to visit all the related area of corporate governance.

There is a significant difference between theoretical concept and practical field.

Insufficiency of necessary information and data.

Chapter -2

Literature Review

2.1 Definition of Corporate governance

Corporate governance has received wide attention in recent years both in practical and in academic research. But there is a disagreement about the boundaries of the subject of corporate governance. Depending on their perspective, different authors define corporate governance in different ways.

Dr. Dhiman chowdhury, professor of Accounting & Information Systems, University of Dhaka, defined Corporate Governance in such way, “Corporate Governance is probably a control mechanism used for efficient utilization of corporate resources. It can be defined as an organizational control device, which is a hybrid of internal and external control mechanisms with view to achieving efficient utilization of Corporate Resources. In his on going research he is trying to prove that Corporate Governance is a network among various corporate players such as shareholders, managers, suppliers and consumers for increasing the value of the firm. He always tries to emphasize on the fact “Equitable Distribution of resources and reducing agency problem” in respect of Corporate Governance. Corporate governance is defined by the mainstream accounting and finance literature as “the range of control mechanisms that protect and enhance the interests of shareholders of business enterprises” (Fama & Jensen, 1983). There is a focus in this line of research on the structure and functioning of boards of directors audit committees of such boards (Rosen & Wyailt, 1990, Shleifer & Vishny, 1997). Cohen and Hanno (2000) using the Public Oversight Board’s (POB 1993) perspective, defined corporate governance as “those oversight activities undertaken by the board of directors and audit committee to ensure the integrity of the financial reporting process”. This view of governance focus on the control environment and control activities (Committee of Sponsoring Organizations of the Tread way Commission (COSO) 1992; POB. In its narrowest sense, corporate governance can be viewed as a set of arrangements internal to the corporation that define the relationship between the owners and managers of the corporation. An example is the definition by Monks and Minow (2001): corporate governance is the relationship among various participants in determining the direction and performance of corporations. The primary participants are (1) the shareholders, (2) the management, and (3) the board of directors.” The World Bank defined corporate governance from the two different perspectives. From the standpoint of a corporation, the emphasis is put on the relations between the owners, management board and other stakeholders (the employees, customers, suppliers, investors and communities). Major significance in corporate governance is given to the board of directors and its ability to attain long-term sustained value by balancing these interests. From a public policy perspective, corporate governance refers to providing for the survival, growth and development of the company and at the same time its accountability in the exercise of power and control over companies. The role of public policy is to discipline companies and, at the same time, to stimulate them to minimize differences between private and social interests. (World Bank, 1999). The OECD (1999) original definition is “Corporate governance is the system by which business corporations are directed and controlled. The corporate governance structure specifies the distribution of rights and responsibilities among different participants in the corporation, such as the board, managers, shareholders and other stakeholders, and spells out the rules and procedures for making decisions on corporate affairs. By doing this, it also provides the structure through which the company objectives are set, and the means of attaining those objectives and monitoring performance.” The OECD also offers a broader definition: “…corporate governance refers to the private and public institutions, including laws, regulations and accepted business practices, which together govern the relationship, in a market economy, between corporate managers and entrepreneurs (‘corporate insiders’) on one hand, and those who invest resources in corporations, on the other.” (OECD, 2001) According to some experts “Corporate Governance means doing everything better, to improve relations between companies and their shareholders; to improve the quality of outside Directors; to encourage people to think long-term; to ensure that information needs of all stakeholders are met and to ensure that executive management is monitored properly in the interest of shareholders.” An article published in the June 21, 1999 issue of the Financial Times quoted J. dolfensohn, President, World Bank as saying that “Corporate Governance is about promoting corporate fairness, transparency and accountability” According to some economists, Corporate Governance is a field in economics that investigates how corporations can be made more efficient by the use of institutional structures such as contracts, organizational designs and legislation. This is often limited to the question of shareholder value i.e. how the corporate owners can motivate and/or secure that the corporate managers will deliver a competitive rate of return. In order to understand the problem of corporate governance it is most important to stress that it is dependent on the political system of any country and the country’s historical and cultural characteristics. To summarize, we can say that a precise definition of corporate governance does not exist, even in developed market economies. Moreover, scholars have not, to date, given sufficient attention to providing a policy-oriented definition suitable for the transition countries and their ongoing fundamental structural reform.

2.2 Views of corporate governance in mainstream research

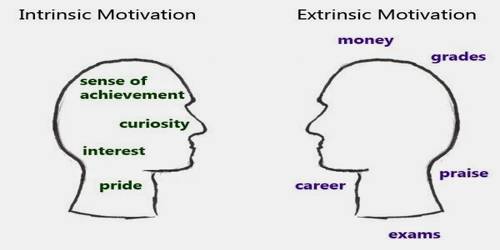

Cohen et al. (2000) point out that prior research in accounting, finance and management has presented a number of diverse views of corporate governance. The first view, which is broadly held in accounting and finance, relies on agency theory ( Beatty & Zajac, 1994; Bathala & Rao, 1995; Core et a!, 1999). This view of corporate governance assumes that managers act from self interest, even if this is detrimental to share holders. Within agency theory, the concept of corporate governance is focused primarily on designing contractual mechanisms to control self-interested managerial behavior. Central to the agency theory perspective that those performing the monitoring function (members of the board of directors) should be independent from those being monitored (management). Hence, the most desirable attributes for board members under the agency theory perspective are independence from management and expertise in monitoring and control (Cohen et al., 2000).

A second view of corporate governance, drown from the management literature, is the resource dependence perspective. Within this view, management is viewed as relying on the board of directors for access to scarce information and other resources as well as help in determining the strategic direction of the company (Williamson, 1999). Under the resources dependence perspective, the primary role of the board of directors Shifts from being a monitor, as in the agency perspective to acting collaboratively with managers to set policies and strategies. The board of directors concentrates on identifying new products, markets and technologies, and helping management execute the strategic plans (Boyd, 1990). Hence, the most valuable attributes of a board member under the resource dependence perspective are industry expertise, knowledge, and the ability to provide access to external resources (Cohen et a!., 2000).

A third view of corporate governance focuses on managerial domination. In contrast to the agency and resource dependence perspectives, the hegemonic perspective views corporate governance as an unavoidable annoyance. Corporate governance mechanisms are viewed as being ineffective at monitoring and largely symbolic in terms of oversight of management. In effect, senior management selects friends and colleagues to be members of the board rather than choosing independent minded directors (Batton and Baker, 1987). The board members are passive participants in the governance process and are dependent on the company’s management for information about the firm and its industry (Wolfson, 1984). Pursuant to the hegemonic perspective the board’s functions are limited to ratifying management’s actions, satisfying regulatory requirements, and increasing senior management’s compensation (Core et. al., 1999).

It should be noted that each of these views of corporate governance involves only two groups, that is, the management of the company and the board of directors. Shareholders are not included in these views, even though it is presumably for the benefit of shareholders that corporate governance takes place. Other stakeholders and society as a whole are absent from these theories. Moreover, auditors are not mentioned as playing a significant role in corporate governance.

Corporate governance came to the center of the international development agenda following the East Asian financial crisis. Increased privatization and financial market liberalization also contributed to increased scrutiny of corporate behavior, management and policies. Governance of the banking sector has received particular attention due to the sector’s enormous influence on developing economies, especially where stock markets are underdeveloped. Recent, high profile corporate failures have brought renewed focus on the importance of good corporate governance, and have broadened interest in the topic to a broader audience. The resulting international debate has shown that underlying principles of fairness, transparency, accountability and responsibility reflect minimum standards necessary to provide legitimacy to the corporate sector, reduce financial crisis vulnerability, and broaden and deepen access to capital.

2.3 The importance of corporate governance for transition economies like Bangladesh

Strong governance has long been considered crucial for enhancing the long term value of stakeholders in the business environment. In the new technology driven information age, strong corporate governance is more than good business practice. Recent demand from investors and others for greater accountability from corporate boards and audit committees will likely further enhance the quality of managerial stewardship and eventually lead to more efficient capital markets.

In transition economies like Bangladesh development of positive corporate governance through the adjustment of corporate control mechanisms is really a complicated task due to the underdeveloped institutional infrastructure, complex corporate ownership between the state and financial sectors, weak legal and judicial systems and scarce human resources capabilities.

The recent experience of countries in transition shows that the assumption that a strong system of corporate governance will appear automatically as a result of ownership transformation is unrealistic. Even in developed market economies, differences in the ownership structure and level of concentration or dispersion of owners influence the selection and adjustment of corporate control mechanisms. For the countries in transition, the problem of good corporate governance development becomes more complicated due to the underdeveloped institutional infrastructure. For this reason there is a need for a careful approach to governance restructuring so that a private sector can be formed, powerful enough to realize successful economic transformations towards a market economy.

The importance of sound corporate governance for transition economies can be explained through its four main influences: (1) creation of the key institution, the private corporation, which drives the successful economic transformation to a market based economy, (2) effective allocation of capital and development of financial markets, (3) attracting foreign investment and (4) making a contribution to the process of national development (Babic, 2000).

1) The development of corporate governance demands the establishment of certain market economy institutions necessary for economic growth. Without good corporate governance, corporations cannot fulfill their main missions of profit-making and contributing to the social welfare with maximum effectiveness. Companies cannot operate successfully without adequate rules of governance and the institutions that support them, or without the acceptance of a culture of corporate governance among managers, owners and other stakeholders. Well-developed corporate governance requires that all relevant actors recognize and understand their roles. Managers understand their roles of agents when they are compared to owners, but they run companies as if they were their property, satisfying own interest to the detriment of owners and the company as a whole. Corporate governance requires coherent and strict legal regulations which implies an urgent mission for the makers of economic policies of countries in transition. Furthermore, it is important to provide for systems to recruit, train and reward professional managers who can be held to / high standards of competency, ethics, and responsibility.

2) Corporate governance is directly related to financing and investments. Making managers disciplined by means of corporate governance mechanisms results in an efficient allocation of resources. For countries in transition it is doubly important: the scarcity of domestic savings demands that capital be directed towards the most profitable companies, which is possible only if principles of corporate governance are given publicity, transparency and monitoring. We can conclude that good corporate governance is an important factor for the functioning of a financial market, which leads to efficient allocation of financial resources and is the key to economic growth. The efficient financial market itself should promote better practice of corporate governance, reinforcing market discipline for corporate managers.

3) To attract long-term capital, any country must follow clear standards of corporate governance at the international level. Corporations use basic principles for good corporate governance is a relevant factor for investment decisions as well. It is especially important when we talk about direct investments, which are of the greatest benefit to countries in transition because they mean not only capital, but the transfer of skills, technology and know how as well.

4) Corporate governance is of great importance for national development because for overcoming barriers to achieving sustained productivity growth, such as the actions of vested interest groups. In the financial sector, attention must also be given to measures to strengthen the banking sector and a country’s financial institutions as a whole. In the “real” sector, close attention must be given to competition policy and sector specific regulatory reform (OECD, 2001)

Chapter -3

Findings of the Study

Corporate Governance Scenario of Bangladesh in the light of some Scholarly articles

There has been some work done in the area of corporate governance by the World Bank and ADB in Bangladesh, but overall there is a lack of material on corporate governance issues in Bangladesh. Some discussion regarding specific aspects of corporate governance has been undertaken by organizations like Centre for Policy Dialogue (CPD), Institute of Chartered Accountants (ICAB), and the Institute of Bank Management (BIBM). The brief summaries of the major articles and studies relating to CG are presented here The summaries explain the authors’ major points that relate to corporate governance.

3.1 Research taken from Academicians

1.“Knowledge Management”. Arifur Rahman Khan, Dewan Mahboob Hossain

This study highlights the issue of “Knowledge Management” within the organizations through describing the several aspects of this concept. It also highlighted the issue of knowledge management as a burning question in today’s corporate world and how to evaluate the implementation of knowledge management. When raw and unorganized data are organized and given a proper shape for using in a particular purpose, it becomes an information to become a knowledge, all these data and information should be mind with instruction and experience of the human resource of the organization. Knowledge management is a combination of many disciplines from human resources and personal development to corporate re-ingenuring and information technology. According to Stephens, “Knowledge Management is getting the right knowledge to the right people at the right time to serve the right objectives.” The article also identifies the tools for knowledge management and highlights the technical aspects of knowledge management. Knowledge management is a complex process that must be supported by a strong foundation of enablers of knowledge management the process usually involves the following stages in the use of knowledge:

1. Creation of knowledge goals.

2. Knowledge identification.

3. Collection of knowledge.

4. Organization of knowledge.

5. Sharing of knowledge.

6. Adoption of knowledge.

7. Knowledge use.

Stephens identified four tools for knowledge management-

a. Recruitment

b. Re-organization

c. Training

d. Leadership.

As the process of knowledge management involves sharing and gathering of knowledge, the use of technology is an integral part of this concept. Information technology is considered as a valuable enabler of knowledge management. Common technologies used now a days in modern organizations are- a) Internet b) Intranet c) Date warehousing/ Mining) d) Document Management system e) Decision support systems f) Group ware g) Extract h) Artificial Intelligence. This article also identifies the characteristics required in an organizational climate in order to implement knowledge management and the barriers in implementing the knowledge. The appropriate accomplishment of knowledge management is an organization is an extensive task. The executives in the organization should identify and invest in the elements of organizational knowledge that drive innovation and more new products and severer swiftly through the commercialization. The following by factors are the key factors for the success of a company:

1) Mapping knowledge management directly to the business strategy and supporting it clearly with technology strategy.

2) Developing process for continuously linking major decisions with the knowledge management system.

3) Getting senior management’s commitment

4) Building an intelligence system by first focusing on a few intelligence topics and achieving short term target.

5) Establishing legal and ethical guidelines for intelligence activity.

People’s mindset in an organization can be a big barrier for proper knowledge management. Through the use of information technology plays a vital role in knowledge management, it is the people who have to implement it. As not all people have the some level of expertise in the field of technology, over emphasis on technology may prove to be an obstacle for knowledge management. Executives may full that there may be an information overload for the employees if they are exposed to too much information. Sharing knowledge may be difficult to implement in everyday organizational practice. There may be no space for reflection, bearing or knowledge transfer. As knowledge management is a mammoth process and it has a huge impact on several aspects of an organizations affairs, it is very difficulty to measure the effect of implementation of knowledge management. Knowledge management involves connecting people with people as well as people with information. It is a management philosophy that combines in purposeful information management with a culture of organizational learning in order to improve the business performance. It should be the task of the organizational leaders to create and the environment in the organization for managing the knowledge. Without an efficient use of human knowledge, an organization cannot get a competitive advantage in the market. So, it can be easily said that the corporate world would give a better importance if this issue in near future.

2. Development of Accounting and Auditing Standards in Bangladesh, lAS 18: Revenue Recognition.

Prof. Santi Narayan Ghosh, Institute of Chartered Accountants of Bangladesh

The report explains various theoretical views on the definition of revenue, the measurement of revenue, the recognition of revenue and the timing of revenues. Revenue must be recognized in the period in which the major economic activity leading to revenue creation takes place. Furthermore, the exchange value of revenue must be measurable, the value of revenue be verified by a market transaction, and revenue should be recognized concurrently with the related expenses. In addition, the business’ value- adding activity should be substantially complete when revenue is recognized. There are various methods of matching the timing of revenue with value-adding activity. Depending on the type of product and the terms of sale, the identification of substantial completion can vary; revenue can be recognized at the time of production, completion, sale, cash collection, or some combination of those points in time. The theoretical summary of revenue recognition provides the background for the specific application of lAS l8. The author further details the accounting treatment of revenue under LAS 18, providing specific examples of how various transactions would be treated under lAS 18. Identification of transactions under lAS 18 and revenue measurement is explained. The article details lAS treatment of some specific revenue activities, including real estate sales, sale of services, franchise fees, interest, royalties, and dividends. Finally, the article mentions the disclosure requirements for lAS 18: an enterprise complying with lAS 18 must disclose the accounting policies used for revenue recognition and the method used to determine the stage of completion. Furthermore, an enterprise must provide the categories of revenue arising from the various activities of the enterprise. The author states that Bangladesh companies do not provide such disclosures.

3. Corporate Governance: Bangladesh Perspective Mamtaz Uddin Ahmed, Professor, Department Of AIS. Mohammad Abu Yusuf. Former Lecturer Of AIS

This paper provides a conceptual framework of corporate governance (CG) along with an analysis of CG scenario in Bangladesh. Various factors including poor legal enforcement, discretionary powers of the corporate top management, overriding regulatory provisions, lack of standard practice in financial reporting and auditing, and absence of strong pressure groups have caused the weak CG in Bangladesh. The paper suggests some policy recommendations to improve and assure good corporate governance in Bangladesh. In this paper, fundamental of corporate governance (CG) and various elements of corporate governance in Bangladesh have been discussed. The discussion includes the legal framework, ownership structure, shareholding and protection of minority shareholders. Board of Division and the role of capital markets and the Securities and exchange Commission (SEC) incorporation governance, accounting and auditing standards. The paper argues that weak enforcement of the regulatory framework, lack of well-functioning board, lack of clarity in the company law, lack of guidelines on International Accounting Standards on Auditing (BSAs), poor quality of audit reports, lack of board committees and weak pressure groups are the underlying reasons for weak corporate governance in Bangladesh. The discussion has been followed by some recommendation to ensure good corporate governance in Bangladesh. Corporate governance is seen as a means of improving efficiency in the economy. I emirates from a set of relationships, imposed through separation of ownership from managers. In this regard, Sir Adrian Cadbury perfectly said, “corporate governance is considered withholding balance between economic and social goals and between individual and community goals. The governance framework is required to encourage the efficient use of resources and equality to ensure accountability for the stewardship of those resources. The aim is to align as nearly as possible the interests of individuals, corporations and society”. (Cadbury, 2003). Corporate governance has become a top priority for the regulatory bodies with the objective of providing better and effective protection to all stakeholders and also to make the market confident as research reveals a positive correlation between corporate governance and share prices (Ahmad, 2004). Corporate governance practices in Bangladesh are quite absent in most companies and organizations. In fact, Bangladesh has lagged behind its neighbors and the global economy in corporate governance (Gillibrand, 2004). One reason for this absence of Corporate Governance is that most companies are family oriented. Moreover, motivation to disclose information and improve governance practices by companies is felt negatively. There is neither any value judgment nor any consequences for corporate governance practices. The current system in Bangladesh does not provide sufficient legal, institutional and economic motivation for stakeholders to encourage and enforce corporate governance practices. There has been failure in most of the constituents of corporate governance. Finally government cannot legislate the personal integrity of key players (Walker, 2003). And no amount of legislation can substitute trust, faith and confidence necessary for good corporate governance practice (Chaudhury, 2004). But as the lead regulatory body overseeing corporate accounting and reporting, the SEC has a critical role to ensure that public company boards are properly structured and organized and have the resources to accomplish the objectives of adding value to shareholders, minimize risk of key shareholders and hold management responsible for corporate results 9Walker, 2003). Ruthless monitoring of compliance and severe punishment of transgressors can ensure good corporate governance (Chaudhury, 2004). But Bangladesh has to wait a lot to ensure enforcement of any corrective measures properly. If the policymakers implement the recommendations suggested above, undoubtedly a good CG environment will prevail in Bangladesh.

4. Implementation of international Accounting Standard (lAS) in Banks and Financial institutions A Step Towards Sound Governance System

Dr. Sujit Saha, Professor, and Md. Saidur Ralunan, Assistant Professor, BIBM

This report discusses the financial disclosure practices of banks and financial institutions before adoption of IAS-30 mid the disclosure requirements now that JAS-30 has been adopted. Prior to the adoption of IAS-30, the Bank Companies Act, 1991 governed financial disclosures of banks and financial institutions. Compared to international standards, the requirements were lax; for example, provisions for loan losses (specifically for bad/doubtful debt and generally for unclassified loans) ‘were not required. If a loan loss provision was made, it was not counted against profit and loss. hi addition. the reporting of capital adequacy was insufficient. The report includes further detail about reporting requirements before the adoption of IAS-30. After encouragement from the World Bank, IMF, and other international donor agencies, the Bangladesh Bank directed banks and financial institutions to comply with the requirements of IAS-30.IAS-30 introduced a number of improvements in disclosure, which are detailed in the report, but will only be briefly summarized here. There are three major, new disclosure requirements in the Profit and Loss Account. First, categories of income and expenses must be disclosed separately. For instance, interest income, investment income, and dividend income must be shown. Second, a specific loss provision for individually classified bad and doubtful debts and a general provision for potential, but not specifically classified, loans must be identified in the Profit and Loss Account, the notes should provide details on the movement in provision for losses throughout the year. Third, it requires that unrealized losses on securities investments be shown in an investment loss provision account. However, unrealized gains may not be shown in the financial statements. With regard to Balance Sheet reporting, assets (loans, advances, and investments) must be shown by category. Categories should include: type of asset, maturity, geographic location (domestic or international), borrower, and classification (substandard, doubtful, etc.). IAS-30 also requires disclosure of secured and unsecured liabilities and the type of security provided. Under the new requirements, banks must prepare a cash flow statement, which was previously not required. Banks and financial institutions will also have to prepare a statement showing changes in Equity Finally, in addition to the financial statements required, detailed notes to the financial statements will be necessary. Compliance with IAS-30 is a key step in improving the reputation of banks and financial institutions, both domestically and internationally. The new requirements will begin to reveal the true state of affairs to stakeholders and hopefully motivate management to make improvements. The author believes that “the positive results would come out only when the quality disclosure would take place instead of simple compliance with the lAS-prescribed formats”. To achieve this level of compliance, the author recommends that the Bangladesh Bank issue instructive circulars and develop a training module for bank personnel.

3.2 Research Published in The Bangladesh Accountant.

1. Annual Financial Statements of Banking Companies – Are Those Serving the Purpose? The Bangladesh Accountant, April-June 2000, Vol.29; No. 2.

Khan Tariqul Islam, FCA

In this article from The Bangladesh Accountant, the author explains the various elements of a bank’s financial statements, the importance of accurate financial statements, and the difficulties in implementing international accounting standards in the banking sector. Annual financial statements for banks include a balance sheet, profit and loss account, cash flow statement, and notes to the financial statements. The article explains the major elements of each financial statement, Of particular interest are the discussions regarding loan loss provisions and shareholders’ equity. A review of the guidelines for loan classification and provision, as established by Bangladesh Bank’s Circulars, is provided and the importance of accurate loan reporting is emphasized. The author states, “without true and fair reflection of loans the entire balance sheet of a bank can be misleading for its users and any banking company can be bankrupt overnight if its loans are not truly and fairly reflected in the balance sheet.” With respect to Shareholders’ Equity, the article points out that the present form of bank balance sheets make it difficult to identify and understand the amount of shareholders’ equity. The article underscores the importance of making bank financial statements properly reflect the true and fair financial position of the institution. The quality of information regarding banks is the cornerstone of the economy. If internal or external actors in the economy lack confidence in the banks, the whole financial system may collapse or transactions with international banks or companies may be limited. In fact, the author believes that the lack of international-level accounting and auditing standards is a major factor in the low level of foreign investment in the country. The major obstacle to improving the quality of bank financial statements, as identified by the article, is legal inconsistency between the Bank Company Act and the BAS. The implementation of BAS-30, which is equivalent to IAS-30 and governs the treatment of loans, would bring banks closer to international standards. However, BAS-30 is, in many cases, iii conflict with the Bank Company Act, 1991. Other instances of legal inconsistencies are also mentioned in the article.

2. Corporate Governance: The role of Accountants

Wendy Werner

The Bangladesh Accountant/ January-March 2003

This report focuses on the structures and institutions in place to support good corporate governance practices. A valid preliminary question is, therefore, why one should focus on corporate governance in Bangladesh. Although the motivations for improvement in corporate governance usually come from investors and the capital markets, these stakeholders are weak in Bangladesh and are unlikely to wield the influence necessary to change corporate practices. However, there are still compelling reasons for the corporate to encourage better corporate governance practices. First Bangladesh should strive to reach international standards with regard to corporate practices not only as a prerequisite to attracting international capital, but also to enhance the commercial reputation of the country generally. Second, good corporate governance practices can be an important tool in improving domestic economic efficiency, business management, and risk management, which will assist in the development of the private sector. Finally the corporate sector should strive to improve corporate governance as a way to prove corporate responsibility and attain the trust and support of the public. As the global markets have re-evaluated corporate governance practices in developed countries, the developing countries has gained momentum. This report originated from the fact that no systematic effort has been undertaken to develop and improve the quality of corporate governance in Bangladesh. This report seeks to focus on key areas that have been identified internationally as important to good corporate governance practices. The report doesn’t attempt to study every aspects of the economy on financial sector that may have some bearing on corporate governance, but instead focuses on the most important areas in which there is likelihood of seeing changes come about in the near future. In keeping with the OECD principles of corporate governance, five topics were the focuses of the diagnostic study:

1) The rights of shareholders.

2) The equitable treatment of shareholders.

3) The role of stakeholders in corporate governance.

4) Disclosure and transparency.

5) Responsibility of the Board.

This report is a diagnostic tool from which a consensus can emerge regarding the way forward for corporate governance in Bangladesh. At this stage, only very board recommendation are provided, identifying institutions on sections that should be studied further. Specific recommendations will be framed in subsequent stages of this report. Further work should convert rate on the following areas to develop specific recommendations to reform:

• Registrar of joint stock companies.

• Securities and Exchange commission and the capital market scenario.

• Institute of Chartered Accounts of Bangladesh to the auditing profession.

• Adoption of International Accounting Standards.

• Examining the requirements for and qualifications of directors, including independent directions.

• Shareholders education and awareness of corporate governance.

• Strengthening bombing practices and encouraging the including of corporate governance issues in credit analysis.

3. Corporate Governance: An issue for Financial Institutions in Bangladesh

Corporate Governance is the major part in Bangladesh. Now a days corporate governance has been emerged as an important issue for financial institutions in Bangladesh. In most of the financial institution of Bangladesh, there is no employment contract, no agency relationship. So day by day agency cost in increasing. To reduce the corporate problem, corporate governance is now a major issue in financial institution. Performance of financial public or private are directly related to economic development and social progress. Any disruption in this area due to weak governance can cause misery and suffering to the people in general and poor in particular. As such corporate governance has become a critical issue closely related with the proper functioning of financial institution. Corporate governance means a decision making process which maximizes value for the shareholders in a fully transparent manner. For a group of people working in particular institution, CG is a culture and for an individual it is an mindset. The concept of corporate governance mainly focuses on transparency, accountability and fairness together with responsibility in making decisions for the institution. In order to develop the society as well as the country sustainable development of growth is necessary. Banks are playing a vital role in the financial sector. Corporate Governance build confidence and trust among the depositors, investors. In order to get best results in financial institutions particularly in bank corporate governance should include accurate information in time on management activities good business practices, proper accounting and central system and rigorous monitoring system. In corporate governance, the Board will balance the interest of the shareholders with other stakeholders such as customers, investors, suppliers and employees. There are three clearly defined areas in financial institution such as shareholders, Board of Directors and Management. Globalization of trade and commerce is also putting subtle pressure on local banks and other financial organizations to adopt corporate governance which in turn help tap international market and expand their business. IAS (International Auditing Standard) would help achieve quality in auditing to reflect greater accountability of corporate management and transparency of published financial information. In Bangladesh context, the application of IAS would not only benefit the investors but restore financial discipline through more objective disclosures. Finally, countries that fail to induce and implement corporate governance in financial institutions particularly in Banks will remain prove and susceptible to potential crisis and place their economy at significant disadvantage.

3.3 Research taken from ICAB

1. Moving to International Standards

Anwaruddin Chowdhury, President ICAB

This report reviews Bangladesh’s progress towards harmonization of fmancial reporting and auditing with international standards, as well as provides recommendations for future steps. The author sees accounting harmonization as a necessary step for Bangladesh to remain competitive in the face of globalization and to attract capital into the economy. The author explains some of the challenges involved in implementing and monitoring lAS and ISA in Bangladesh. Some of the primary limitations to compliance are: a lack of monitoring by regulatory agencies, the low level of compensation for auditors, and differences between financial and tax reporting where the ICAB adopted lAS requirements are at odds with the legal requirements in the Companies Act or the tax law. Furthermore, there is a lack of consistency between the standards required and enforced by the relevant regulatory agencies (SEC. Bangladesh Bank, etc.) and the standards adopted by profession organizations like ICAB. lAS and ISA adopted by the ICAB may be made legally enforceable through the relevant laws (Companies Act 1994, Securities Exchange Rules 1987, Bank Company Act 1991, etc.) and/or professionally enforceable through the application of Chartered Accountants Bye-laws 1973. In spite of the challenges, some positive steps have been taken. ICAB voted in 2001 to amend its Bye- laws so that compliance with adopted lAS and ISA is “professionally enforceable” for its members. In addition, effective April 1, 2000 Bangladesh Bank required that the financial statements of banking companies comply with IAS-30, which spells Out rules on non-performing loans, Both steps provide avenues to enforce compliance with lAS and ISA once they have been adopted for Bangladesh. The author makes a number of recommendations for further harmonization of accounting policies. Those of interest include:

The Companies Act should be amended to require public companies comply with lAS and ISA as adopted by ICAB. In 1997, the SEC amended the Securities and Exchange Rules 1987 so that all listed companies must comply with the lAS that have been adopted by ICAB. However, a further amendment in 2000 changed the rules to bypass the ICAB adoption of lAS.

The SEC and ICAB should have a forum for regular interaction to work towards proper implementation and monitoring of the adoption of lAS by companies.

The SEC needs additional staff qualified to monitor companies at a level consistent with international standards.

The report includes a survey of the financial reports of 36 listed companies and four foreign companies for compliance with lAS. The results show that, although there has been progress in ensuring harmonization of financial accounts in Bangladesh, there is still a significant degree of non-compliance with GAAP. Inventory cost basis, depreciation, accounting for leases, and earnings per share calculations were all areas in which the survey found financial statements did not comply with lAS and GAAP. At the time of the report, 31 lAS had been adopted 1w IASC for practice. The ICAB had adopted 21 lAS in their original versions and six more were approved by the Technical and Research Committee of ICAB, but not yet adopted by ICAB. (IASC often revises the standards after they have been issued, hence the appellation “original versions.”) ICAB is reviewing the revised versions of the adopted standards. With regards to auditing standards, the IAPC has issued more than 40 ISA, of which ICAB has adopted 22 in their original versions.

2. CPE Seminar on Microfinance – Governance and Reporting Parveen Mahmud, FCA, ICAB, November 6, 2001

The article explains the regulatory structure governing microfinance institutions (MFIs) and microfinance NGOs in Bangladesh. The Paili Karma-Sahayak (PKSF) is an agency set up by the Government of Bangladesh (GOB) to oversee MFIs and to provide subsidized loans to such organizations. The PKSF has policy and standards guidelines, which should be followed by MFIs. The guidelines relating to governance and financial accountability include:

Standards for microfinance accounting

Policy for loan classification and debt management reserve: Similar to banks arid financial institutions, MFI must classify their loans and account for loan loss provisions.

Financial ratio analysis: Analysis of financial ratios covering portfolio quality, operating efficiency, and rates of return allow managers to identify strengths and weaknesses.

Guidelines for Management Audit

Guidelines for Internal Audit: The PKSF internal audit cell carries out management and financial audits of MFIis each year.

Terms of Reference for an external auditor auditing PKSF

Terms of Reference for an external auditor of PKSF auditing MFIs: When an external audit of PKSF takes place, the external auditor also audits the MFIs under PKSF’s purview.

Terms of Reference for an external auditor auditing MFIs appointed by the MFI

If an MFI deviates from the guidelines set by PKSF, the audit report should explain the nature of each deviation and management’s reasons for not complying. PKSF’s guidelines are not official accounting standards and therefore only serve as a source of assistance to an analyst looking at the accounts of an MFI. Furthermore, the article outlines the PKSF’s principles of good governance that discuss the composition and function of the MFIs boards of directors.

3. Corporate Governance for Transparency and Accountability The Bangladesh Accountant, April-June 2000, Vol.29; No.2 Jamal Uddin Ahmad, FCA and MA. Barec, FCA

The authors summarize the principles and standards of corporate governance as agreed and put forth by OECD. Cadburv Committee (UK). and other international committees. The problems of implementing international corporate governance norms in Bangladesh arc then explored. Finally, the authors make some recommendations for reform of corporate governance in Bangladesh. The article identifies eight characteristics of the private sector in Bangladesh as the primary obstacles to good corporate governance in Bangladesh. They are: (1) boards and management tend to avoid disclosure; (2) closely-held family ownership leads to limited transparency and accountability; (3) bank finance is the primary source of financing; (4) a lack of independent directors and skilled audit committee members; (5) a weak regulatory framework and inefficient bureaucracy; (6) low audit fees for external auditors and a dearth of qualified internal auditors; (7) the absence of sufficient institutional investors; and (8) a lack of active minority shareholder groups. The article recommends three substantive actions be taken to improve corporate governance in Bangladesh. First, a “high powered committee” including members from government, regulatory agencies, companies, and ICAB should write a code for CG in Bangladesh. Second, amendments to existing laws should be adopted to enforce CG norms. Third, academic and professional institutions should include CG principles in their syllabi. In addition, the authors encourage institutional investors to exercise their influence and discourage nominee directors from the GOB and financial institutions.

3.4 Research taken from international Institutions

1. Bangladesh: Financial Accountability for Good Governance

World Bank, 2002

This report primarily discusses the current state of public sector financial accountability and makes recommendations for reform and improvement. ft deals in depth with the problems of the Comptroller and Auditor General’s Office (CAG), internal audit, public accounts, parliamentary oversight, and public enterprises. It also contains a section on private sector accountants and auditors, which is of primary concern to corporate governance. The report finds a number of failings with the structure of the accounting profession in Bangladesh. First, the supply of accountants is low due to lack of adequate training facilities and lack of sufficient financial support for trainees. ICAB has concentrated on increasing the quality of training and strengthening requirements but the self-regulation of members of both professional institutes (ICAB and ICMAB) has been ineffective. There are three major recommendations for improvement of private sector accounting:

Professional institutes (ICAB and ICMAB) should to prepare strategic plans to expand the output of professional accountants and auditors without sacrificing quality.

The establishment of a sub-professional accounting qualification

ICMAB should introduce a code of ethics, and both professional institutes should enforce their codes strictly.

In general the report concludes that the most significant failing in financial accountability in Bangladesh is between national standards and national practices. “Laws and regulations exits, but are not enforced. At present there are few visible sanctions for wrongdoing.” Recommendations focus on creating a cohesive voice for reform by mobilizing support from beneficiaries of reform, including citizen groups. civil society, the business community, the donor community, and reform-minded government officials. However, as a starting point, the report recommends greater transparency of the public sector through public dissemination of data reports and information. This recommendation could just as easily apply to the corporate sector, where public disclosure is one of the cornerstones of good corporate governance.

2. Capacity Building of the Securities and Exchange Commission and Selected Capital Market Institutions (Asian Development Bank) November 2000

This document is a project document for a new technical assistance project being funded under the auspices of the Capital Market Development Program Loan of ADB. A related technical assistance project, which started in 1997 and was ongoing at the time of the report, focused on surveillance procedures for the SEC and other reform measures. In 1999, the GOB requested further assistance from the ADB to strengthen the Securities and Exchange Commission (SEC), this document details the objectives, scope. and budget of the technical assistance program (TA). The TA will focus on the SEC. the stock exchanges (CSE and DSE), and capital market participants. It will improve the SEC’s capacity to effectively regulate the markets and to audit listed companies. The TA will help CSE and DSE become more efficient in their function as a central securities depository. Finally, the TA will provide training for capital market participants. The focus will be on corporate governance, financial reporting, and compliance with international accounting and auditing standards. Some of the outputs detailed in the scope of the TA include:

Proposed amendments to existing laws to improve corporate disclosure, corporate governance. and the protection of shareholders

A corporate governance manual

A shareholder tights manual

A syllabus for CG training

Guidelines for governance audits

Corporate governance training sessions for listed companies

Accounting and auditing training for personnel of listed companies

SEC staff training on procedures for financial statement reporting and lAS/ISA compliance

3. Bangladesh Strategic Issues and Potential Response Initiatives in the Finance Sector: Banking Reform arid Development (BRD)

Yawer Sayeed, AlMS of Bangladesh Limited for the Asian Development Bank, July 22, 2002

In this working draft report prepared for the Asian Development Bank, Mr. Sayeed describes the current banking environment and establishes a road map for future initiatives in banking reform and development. Major failures in the banking sector identified by the report are: (i) the level of non-performing assets; (ii) operating practices in state-owned commercial banks; (iii) ineffective oversight by the Bangladesh Bank; and (iv’) the legal and judicial framework for default loan recovery. Overall, the report questions the health of most banks in Bangladesh. The author states, “while there are sound banks, the banking sector as a whole is technically insolvent.” The primary symptom of the problem is a very high percentage of classified loans as a percentage of total outstanding loans. In 2001, classified loans comprised 31.3% of total outstanding bank deposits and 8.7% of GDP. A number of operational failings are at the root of this situation. Practices of particular concern are policy lending to loss-making state-owned enterprises, political patronage and directed lending, insider lending in private local banks, unproductive assets, and a pervasive culture of default by borrowers. The Bangladesh Bank, whose mandate is the oversight of the banks, does not fulfill its duties in this respect. “The Bangladesh Bank (BB) has questionable financial standing; its prudential regulations are lax arid enforcement quite ineffective.” Primary obstacles to improvement of the BB are the organizational structure, excessive union activity, and politicized appointments to the BB board and top senior management positions. Some upcoming policy measures may improve the situation. Amendments to the legislation governing the BB will increase its autonomy from the Ministry of Finance. Second, the government plans to remove treasury functions from the BB, leaving it with more resources to fulfill its regulatory and oversight functions. The BB is also concentrating on monitoring non-performing loans, advising bank management on loan recovery, and controlling insider lending. The final major problem identified is the lack of a legal and judicial framework for default loan recovery. Use of Money Loan Court or Bankruptcy Court by banks pursuing loan defaulters does not yield satisfactory results, particularly with respect to executing judgments against defaulters. Recent directives by the BB regarding rescheduling installment loans also have the effect of condoning delays in loan repayment. In short, the author suggests that reform of the banking sector must start with improved loan recovery practices and stronger regulatory oversight. Simultaneously, banks can be relieved of their non- performing loans by pooling them into a separate organization overseen by a private asset management company. In addition, fast-track privatization of the SOEs and SCBs is recommended. The final Recommendations for a future program to improve the financial sector include detailed goals, performance targets, monitoring mechanisms, and assumptions and risks. iii addition, the author makes suggestions for government policy initiatives and areas in which technical assistance will be required.

4. Bangladesh: Strategic Issues and Potential Response Initiatives in the Finance Sector: Integrated Financial Development (lED) Yawer Sayeed, AIMS of Bangladesh Limited for the Asian Development Bank, July 22, 2002

Prepared for the Asian Development Bank, this report identifies ways in which the capital market can be expanded to provide more options to enterprises and to decrease the economy’s vulnerability to economic shocks. The report includes a discussion of the current capital market environment, explaining the function of and problems with the Investment Corporation of Bangladesh (ICB), Bangladesh Shilpa Rin Sangstha, Jiban Bima Corporation, and Sadharan Biman Corporation. Since the current capital market is essentially equity oriented, the report primarily catalogues the impediments to the development of capital market instruments. The capital market outside the equity market in Bangladesh is very limited primarily because state-owned institutions are dominant. In addition, legal and practical obstacles make it difficult for private participants to compete with state-sponsored offerings. Current policies favor state-owned financial institutions. For instance, the state-owned financial institutions operate in the capital market under different rules than private players; for instance, the ICB mutual funds do not publish their net asset value or Submit performance reports, which is re which non-bank financial institutions have been active is in leased assets, but they could expand into asset securitization if the current Stamp Duty is reduced. The largest impediment to the development of a fixed income securities market is the high yield structure on government savings schemes; in comparison to the savings schemes, any private sector fixed income offering would not be competitive. The government recently reduced the rate paid on the savings schemes, which will likely encourage future corporate debt securities issuances. The Capital Market Development Program, funded by the ADB, worked to strengthen market regulation and supervision to development capital market infrastructure. The author maintains that the program is perceived by market participants as being regulatory-focused and has not had a direct effect on the market. Therefore, a future capital development program should focus on capacity-building in the private sector and removing impediments to new capital market products. Specific goals and recommendations for a future capital market development program are discussed.

Chapter-4

4.1 Corporate governance in Bangladesh : An assessment

Corporate governance practices in Bangladesh are quite missing in most companies and organizations. Moreover, incentive to reveal information and improve governance practices by companies is felt negatively. Weak legal framework is one problem in Bangladesh but compliance in the socio cultural interface is another. Motivation instead of obligation is what is required for corporate sector in Bangladesh to accept and adopt a corporate governance framework. The major weaknesses of corporate governance in ensuring good corporate governance are portrayed below:

Weak Pressure Group:

Shareholders, investor associations, institutional investors and the financial press can play significant role in ensuring better corporate governance. Each of these potential pressure groups is weak in Bangladesh. Most shareholders have very little awareness about their rights and responsibilities. In most cases they are inactive in every cases. Public shareholders are not organized under a common platform to demand better corporate governance. Say in USA Call PERS (California Public Employees’ Retirement System). The Call PERS acted for various governance’s policies. In Bangladesh, the institutional shareholders have no common forum. In USA and UK, institutional shareholders are widely spreader among insurance companies, pension funds, banks and financial institutions and companies whereas in Bangladesh ICB is the main institutional shareholder. Some cases it is dysfunctional. Though ICB, as an institutional shareholder has the power to nominated one director from their own manpower but currently they cannot afford it for lack of manpower. So, the roles of ICB on those companies are very limited.

Absence of sufficient institutional investors:

In Bangladesh ICB is the main institutional investor which hold on average 1 5% of

Shares of the DSE listed companies where as in USA and UK, institutional shareholders hold about 65% of corporate resources. The shareholders in these countries are organized and they have common forum (like ISC, CII) from where they issue various guidelines about corporate governance.

Discrepancy between IAS Requirement and Actual Practice:

The IAS has been adopted in its original form and subsequent amendments have not been incorporated in the BAS. This creates significant difference between IAS and BAS in material aspects.

Limited or No disclosure about related Party Transactions:

Parties are considered to be related if one party has the ability to control the other party or exercise significant influences over the other party in marketing financial and operating decisions (IAS-24). In Bangladesh related party transactions is not disclosed properly in the financial statements.

Very limited transparency and accountability practice by the unlisted public

Limited companies:

Management structures of corporations in case of listed leading companies are mostly family based, exposed to limited transparency and accountability. But the unlisted public limited companies traded securities at OTC which is not under the area of control by SEC or other laws. Here corporate governance practice is rare to be found.

Capital Market role:

The capital market of Bangladesh is still a weak link in the movement towards strengthening corporate governance. The overall performance measures offerings and unsteady valuations more on the declining side. The stock market scandals in 1 996 has seriously decrease investor confidence in the stock market. But only recently the effect of the shock started receding. Moreover, there are no bonds, fixed income or debt instruments in the groups for enforcing corporate governance principles

Bank finance rather than fresh securities issue:

In some cases Bank finance is still regarded a better financing alternative by most of

the companies since domestic bank do not care very much about good accounting. or other disclosure, whereas foreign banks are less interested in long term industrial financing. If no equity will issue then no shareholders and mgt. arrange finance from bank to maintain their domains on existing structure. So, some people retired from directorship and re-elected again and again.

Functionalities of different Board Committees:

Board committees (audit, remuneration and nomination and risk management committee) are very important for corporate governance.

• Audit committee is now being treated as a principal player in ensuring good corporate governance and rebuilds public confidence in financial reporting. The role of audit committee among others are: monitoring integrity of financial statements, reviewing internal financial controls, recommending appointment of external auditor and reviewing auditors independence and objectivity and audit effectiveness.

• Among the responsibilities of remuneration committee are establishment and review of the managing Director’s remuneration package and senior management salary packages. Remuneration committee assists the Board to attract, retain and motivate high caliber executives and directors through proposing remuneration that increase their performance.

• Good corporate governance ensures the business is being soundly and effectively managed, with risks being properly assessed and controlled by the risk management committee. It encompasses planning and strategic development of the company day to day operations, knowledge of market and the business.

Despite significant importance of the board committees, few boards (except for banks) have audit committee and almost none have remuneration or risk committee

Scenario of AGM & EGM:

AGM are irregular which is a serious hampers good corporate governance practice. The scrutiny of minutes of annual general meetings showed that no shareholder raised the question about non—disclosure of directors remuneration in the company annual reports and accounts although the disclosure is a statutory requirement under the companies Act 1994 and the securities Exchange ordinance 1987. Most companies in Bangladesh are closely held. Small groups of shareholders own or control the majority of shares, and by using that majority, control the decision making processes of the companies. Here, minority interest sometimes ignored.

Board of Directors:

In case of leading non-banking listed companies in our country, the board is heavily dominated by sponsor shareholders who generally belong to a single family. The boards are actively involved in management. The Chairman and the CEO should be separate and the responsibility should be clearly identified. But most often the same person holds the same post. Normally the most senior member of the family hold the two posts according to seniority in the family relationship and juniors are director. Most independent directors represent current or former, government officials or bureaucrats or sometimes university teachers who are skilled in the field of accounts and finance. They are appointed directors to assist company in getting licenses or as payback for previous favors when he was govt. officer. Very often they do not act as an advocate for minority shareholders.

Lack of knowledgeable Shareholders:

The number of shareholders with sufficient knowledge and skills to understand company operations is very low. Moreover, general shareholders do not pay attention about the issues like performance, business strategy, future business plans, disclosures and processes that could give them a greater voice in the policy decisions of a company. In fact, there is very little awareness about shareholders rights and responsibilities.

Audit Independence is questionable:

In our country auditors are not fully independent and sometimes they are less qualified to attest to the validity of the F/S of corporate entity.

Corporate governance practice within the organization and within the industry:

Sometimes, people are recruiting ignoring the legal procedure, even the wage and remuneration structure are not always justified according to their competence, skills and responsibility or job attachment. Most family oriented business appoints relatives who have no skill. Sometimes, promotion is given avoiding profession codes and conducts. So, unskilled manpower operates the corporation which may sometimes lead low performance of the entire company. For example: Current turbulent situation by the labor in Garments Sector is the outcome of weak corporate governance practice within the firm. Their salary, promotion etc are not justified.

4.2 Conclusions

At present the need for strengthening the corporate governance in Bangladesh arises with a global demand for a sound and transparent corporate world system. Corporate governance was viewed as the total system or control mechanisms, external or internal, that provided an effective means of good corporate behavioral process. This process ensures accountability of those who matter most in the process and maximizes the value for the shareholders in a fully transparent manner. Failure in institutions, legal enforcement and market behavior resulted in weak corporate governance in Bangladesh. A large number of companies listed in the stock exchange in Bangladesh pay inadequate attention to follow the ‘rules of businesses’ and full disclosure of information and demonstrate lack of corporate norms and responsibility. But this is hopeful that there is no serious scandal in respect of corporate governance in Bangladesh. It is seen that in many areas, system did not provide adequate incentives and motivations in terms of legal, institutional or economic, for the shareholders to encourage and enforce good corporate governance. As a result, they added, there were hardly any rewards for the companies that instituted good corporate governance practices and no penalties for failing to do so. Dhaka Stock Exchange is going to incorporate corporate governance principles in the list of the stock exchange to ensure a competitive atmosphere in the capital market. However, the Securities and Exchange Commission notified certain further conditions for the public listed companies with any stock exchange in Bangladesh, on mandatory basis, in order to improve corporate governance in the interest of investors and the capital market.

To conclude, government cannot legislate the personal integrity of key players and no amount of legislation can substitute trust, faith and confidence necessary for good corporate governance practice. But as the lead regulatory body overseeing corporate accounting and reporting, the SEC has a critical role to ensure that public company boards are properly structured and organized and have the resources to accomplish the objectives of adding value to shareholders, minimize risk of key shareholders and hold management responsible for corporate results. Ruthless monitoring of compliance and severe punishment of transgressors can ensure good corporate governance. But Bangladesh has to wait a lot to ensure enforcement of any corrective measures properly.