Corporate Governance is based on several critical principles. They include an independent, active and engaged Board of Directors which has the skill to properly evaluate and oversee the business process, business and financial performance, internal control and compliance structure and direct management on strategic and policy issues. On the other hand, the Board has to ensure that the management headed by Chief Executive Officer (CEO) fully discharge their day to day administrative responsibilities prescribed by BB and the Board itself and necessarily refrain themselves from micro management of the management affairs.MBL, recognizes the importance of good corporate governance as a major factor in enhancing the efficiency of the organization. The Bank therefore seeks to encourage the conduct of its business to be in line with the principles of good corporate governance, which form a basis for sustainable growth.

Intention of the Study:

The intention to prepare this report is stated below:

- Briefly observe the banking environment of Bangladesh and look at Mercantile Bank Limited as an Organization at some length.

- To know about the overall banking activity.

- To know about the management style and organizational structure of Mercantile Bank Limited.

- To identify the problems and weakness of the banking systems of Mercantile Bank Limited.

- Market scenario of banking sector and the current position of Mercantile Bank Limited.

- To know the product and services of Mercantile Bank Limited.

- To identify the major strength of the bank’s customer service division.

Methodology:

Different data and information are required to meet the goal of this report. Those data and information were collected from various sources. Such as primary and secondary which is showed bellow:

Primary sources:

- Personal observation.

- Face to face conversation of officers & clients.

- In-depth study of selected cases.

- Interviewing officers & clients.

- Relevant file study provided by the officers concerned.

- Working at different desks of the bank.

- Daily note taken during the internship period.

Secondary sources:

- File study.

- Annual reports

- MBL website.

- Bangladesh Bank website.

Background of MBL:

Mercantile Bank Limited was established in June 2, 1999 as a private commercial bank and started its operation. The then Prime Minister Sheikh Hasina inaugurated the bank. The renowned 30 industrialists establish this bank with everybody’s consent. Mr. Abdul Jalil elected as the chairman. Mercantile Bank Limited is a private commercial bank with Head Office at 61, Dilkusha C/A, Dhaka, Bangladesh started operation on 2nd June 1999. The Bank has 93 branches spread all over the country and introducing some braches. With assets of TK. 155143.746 million, the bank has diversified activities that cover all the areas of corporate/commercial, retail/personal, SME banking business and international trade.

Mercantile Bank is playing an important role while giving loan for the small and medium enterprises. In the terms of credit mercantile bank has introduced new schemes mostly for the business people in Bangladesh. Different categories of loan been provided to the businessman. Total loans and advances of the Bank stood at BDT 93,610.87 million as on December 31, 2012 its main investing projects are business, garments, micro credit, construction and others. Consumer Credit Scheme: Mercantile Bank has been providing loan to medium and low-income peoples. This policy has gained a great popularity among consumers.

MBL is working with the slogan of “efficiency is our strength” and their logo contains a dialogue “Banglar Bank”

Function of MBL:

Mercantile Bank Limited performs all types of functions of a modern commercial bank, which generally

includes flowing-

- Mobilization of savings of the people and safe keeping of all types of deposit account.

- Making advances especially for productive activities and for the other commercial and socio-economic needs.

- Providing banking services to common people through the branches.

- Introduce modern Banking services in the country.

- Discounting and purchasing bills.

- Various information, guidance and suggestions for promotion of trade and industry keeping in view of the overall economic development of the country.

- Finance for both capital machinery and working capital.

- Finance under small business of self employed clients

- Finance of farming and non-farming activities to rural people including purchase of agricultural equipments.

- Developing new products Market surveys before making any finance.

- Finance for small transport.

- Monitoring and forecasting.

- Developing marketing campaigns.

- Finance for household durables.

Introduction to Corporate Governance:

Corporate Governance is the process of practicing accuracy, accountability, smart stewardship, effective internal control, customary corporate behavior in an organization. It is the means, by which an organization is operated and controlled. It protects the interests of all stakeholders of an organization. Good Corporate Governance should be ensured in the banks, as they deal with huge public money and interests of the depositors. Fairness, Transparency, Accountability and Responsibility are the minimum standard of acceptable corporate behavior today. At MBL, the

Board is committed to maintaining high standards of corporate governance with a view to enhancing stakeholder value, increasing investor confidence, establishing customer trust and building a competitive organization to pursue the Bank’s corporate vision to be a financial services leader in the country. The Board’s fundamental approach in this regard is to ensure that the right executive leadership, strategy and internal controls for risk management are well in

place. Additionally, the Board is committed to achieving the highest standards of business integrity, ethics and professionalism across all of the Bank’s activities. A key objective of our governance framework is to ensure compliance with applicable legal and regulatory requirements and with best governance practice as set out in the concerned Securities and Exchange Commission’s Notification. MBL also examines developments in corporate

governance standards of leading and reputable organizations and institutions in the region and around the world to ensure that its approach in Bangladesh and in countries the Bank has presence is in line with the latest international best practices.

The Board continuously reviews its governance model to ensure its relevance and ability to meet the challenges of the future.

MAIN PRINCIPLES:

To ensure Corporate Governance, MBL always sticks to the principles, which cover the following areas:

• Board of Directors, its formation, roles and responsibilities;

• Delegation of financial, business and administrative power to the Management;

• Accountability and Internal Control;

• Transparent and neutral Audit Function;Corporate Governance Practices of MBL 28

• All-out compliance in Legal Matters;

• Effective Communication with the Stakeholders.

The state and nature of corporate governance in Bangladesh are guided by several factors: a) company law, b) government regulations, c) Bangladesh Securities & Exchange Commission (BSEC) requirements and d) pressure from buyers. The cumulative impact of these factors results in a corporate behavior which is followed in Bangladesh. Bangladesh Securities and Exchange Commission (BSEC) vides its notification no. BSEC/CMMRRCD/2006-158/Admin/02-08 dated 20 February 2006 has issued guidance for corporate governance practice. The guidelines include areas like board size, independent directors, chairman and chief executive officer, internal control and audit function of company secretary, audit committee and appointment of external auditor.

The Board of Directors:

Composition of the Board:

MBL’s Board of Directors currently comprises 22 (twenty two) members, including the Managing Director & CEO. It is well-structured with a Chairman and Vice Chairmen. Alhaj Akram Hussain (Humayun) is the Chairman, while A. S. M. Feroz Alam are the Vice Chairmen of the Board.

The Board is committed to ensure diversity and inclusiveness in its deliberations. The Directors bring to the Board a wealth of knowledge, experience and skills in the key areas of accountancy, law, international business operations and development, finance and risk management, amongst others.

Appointment of Board Members and their Remuneration:

There is a formal and transparent procedure for the appointment of Directors to the Board. The members of the Board are appointed each year in the Annual General Meeting (AGM) by the Shareholders of the Bank. The members of the Board are appointed in compliance with Central Bank’s Guidelines and other applicable rules of the country. As per Bangladesh Bank’s Guidelines, the Board of Directors is paid remuneration as they compensate their valuable time and efforts.

Board Meetings and Agenda:

Board meetings are normally held to discuss and decide on major corporate, strategic and operational issues, as well as to evaluate major investment opportunities. The consent of the Board is normally given by majority votes at Board meetings. The agenda and materials for each Board meeting are provided to the Directors well in advance of the Board meeting for their convenience to take preparation on the agenda. They are provided substantial input and

comments on agenda items. The Board Agenda is prepared by the Company Secretary as per directives of the Chairman of the Board. All Board papers are organized and circulated by the Company Secretary of the Bank. In 2011, 20 (twenty) Board Meetings were held wherein; policies and major business strategic decisions were formulated. Role and Responsibilities of the Board of Directors MBL’s Board of Directors, the prime policy making Body always remains concerned to protect the interests of all Stakeholders, including the Depositors. The Board has the responsibility to periodically review and approve the overall strategies, business, organization, and significant

policies of the Bank. The Board also sets the Bank’s core values and adopts proper standards to ensure that the Bank operates with integrity and complies with the relevant rules and regulations.

Key Responsibilities of the Board of Directors

The Board has a formal schedule of matters reserved for its decision which include, amongst others, the following:

• Determine the objectives and goals of the Bank; formulate strategies and work plans to achieve the goals;

• Determine the Key Performance Indicators for the Managing Director & CEO and other Executives in formulating annual plan of the Bank and apprise the performance indicators time to time;

• Approve policies, strategies and action plans for recovery of loans, rescheduling, interest rebates and write off abiding by existing laws and regulations;

• Formulate policy for risk management and scrutinize the implementation status of the policy;

• Review the report presented by the Audit Committee, regarding the implementation status of recommendation made by the Bangladesh Bank’s inspection team, internal auditors and the external auditors;

• Formulate and approve policy regarding appointment, promotion, transfer, Code of Conduct, human resources development and job rules;

• Concentrate on sufficient training facilities for improving the efficiency of the employees, ensure that information systems and technology are sufficient to operate banking activities effectively and maintain competitiveness

• Approve the Budget and Financial Statements of the Bank; review the achievement of Budget and modify the Budget as per varying economic and business environment;

• Review the income-expense, liquidity management, past due claims, capital base and its adequacy, maintenance of provisions, and initiatives of loan recovery including legal actions;

• Formulate and approve purchase policy; Capital Plan of the Bank;

• Ensure that the Bank complies with all relevant laws and regulations, including Central Bank’s Guidelines, Dhaka and Chittagong Exchange’s Listing Regulations and Securities & Exchange Commission’s Notifications;

• Approve the minutes of Executive Committee, which is formed to resolve on regular business and also approve the minutes and findings of Audit Committee, which is formed in order to ensure compliance at Head Office and Branch level in every aspects so that Stakeholders’ right is protected to the extent of highest degree.

• Ensure the Codes of Corporate Governance, codes of best business practice, emphasizing importance on effective operating infrastructures and system of control;

• Ensure financial transparency, integrity of accounting and sustainable corporate behavior

are in right place;

• Appoint External Auditors, Consultants, and other Advisors, after having approval in the AGM of the Shareholders;

• Encourage and ensure the Bank’s active participation in Corporate Social Responsibility activities

Role and Responsibilities of the Chairman of the

Board and the Managing Director & CEO:

In line with the best practices and to ensure appropriate supervision of the Management, the roles and responsibilities of the Chairman and the CEO are separated with clear division of responsibilities, defined and documented as approved by the Board

CHAIRMAN

The Chairman leads the Board and is also responsible for the effective performance of the Board. The Chairman continuously works together with the rest of the Board members in setting the policy framework and strategies to align the business activities driven by the senior management with the Bank’s objectives and aspirations and monitors its implementation. The Chairman ensures orderly conduct and proceedings of the Board, where healthy debate on issues being deliberated is encouraged. The Chairman takes the lead to ensure the appropriateness and

effectiveness of the succession-planning program for the Board and senior management levels.

He also promotes a healthy working relationship with the CEO and provides the necessary support and advice as appropriate. He continues to demonstrate the highest standards of corporate governance practices and ensures that these practices are regularly communicated to the stakeholders.

MANAGING DIRECTOR & CEO

Managing Director & CEO is primarily accountable for overseeing the day-to-day operations to ensure smooth and effective operation of the Bank. Furthermore, he is responsible for mapping the medium to longer term plans for Board approval, and is accountable for implementing the policies and decisions of the Board, as well as coordinating the development and implementation of business and corporate strategies. The CEO ensures that the financial management practice is performed at the highest level of integrity and transparency for the benefit of the shareholders.

The CEO, by virtue of his position as a Board member, also functions as the intermediary between the Board and the management.

Role of the Company Secretary:

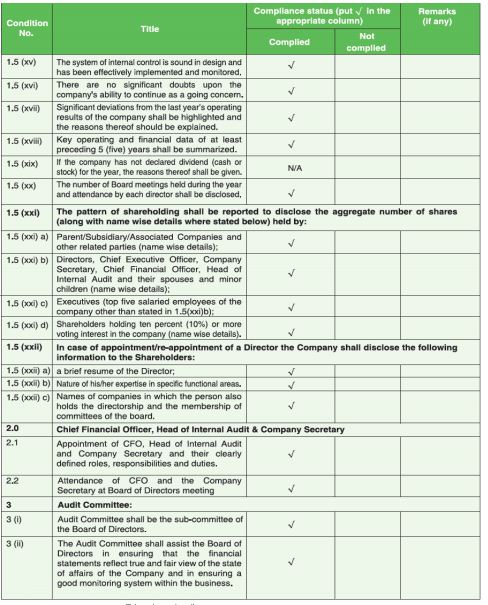

The Company Secretary of the Bank provides assistance to the Board of Directors and the Management. He is responsible for advising the Board audit members on issues relating to compliance with the relevant laws, rules, procedures and regulations, as well as best practices of governance. The Company Secretary keeps the records of the Bank’s compliance non compliance status of the conditions imposed by Bangladesh Securities and Exchange Commission (BSEC) which has been shown in the Compliance Report on BSEC Notification.

BOARD COMMITTEES:

As per Bangladesh Bank’s guidelines, all banks have to form an Executive Committee and an Audit Committee of the Board to take decisions on urgent matters of the banks. Without Executive Committee and Audit Committee, Banks cannot form any other Committee or Sub Committee of the Board. MBL’s Board of Directors has formed 2 (two) Committees

i) Executive Committee and ii) Audit Committee, complying with Central Bank’s guidelines. The Board delegates some of its governance responsibilities to the following Board Committees, which operate within clearly defined terms of references, primarily to assist the Board in the execution of its duties and responsibilities. Although the Board has granted such discretionary authority to these Board Committees to deliberate and decide on certain operational matters, the ultimate responsibility for final decision on all matters lies with the entire Board.

THE ROLE OF EXECUTIVE COMMITTEE:

Executive Committee (EC) considers, approves business and operational proposals. EC decides upon all routine and day-to-day operational functioning of the Bank beyond delegated power of the Management. In the year 2012, forty meetings of Executive Committee were held to consider the proposals placed by the Management. Among others, Executive Committee according to its Charter discharges the following duties:

• Decides upon all routine and day-to-day operational functioning of the Bank beyond the power delegated to the Management.

• Ensures implementation of policies, as per approval from the Board of Directors.

• Reviews the policies and guidelines issued by the Central Bank regarding credit, foreign exchange, treasury and other operations of the Bank.

• Approves the credit proposals as per the approved policy of the Board of Directors.

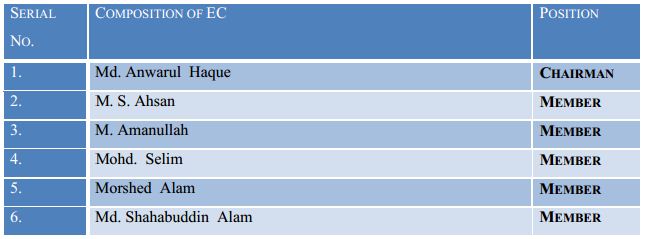

THE COMPOSITION OF EXECUTIVE COMMITTEE:

Audit Committee:

THE ROLE OF AUDIT COMMITTEE:

The Audit Committee of the Board plays significant role to ensure implementation of policies, guidelines etc. provided by Bangladesh Bank, other regulatory bodies and the Board of Directors of the Bank. The committee also reviews the policies, audit plan and its execution, financial statements, audit reports, internal control and compliance report etc. In the year 2012, eleven meetings of Audit Committee were held. The Audit Committee of the Board plays significant role in proper functioning of the Bank, some of which are as follows:

- Reviews the implementation status of guidelines, provided by Bangladesh Bank and other regulatory bodies;

- Reviews Bank’s own policies and procedures; such as Credit Policy, Foreign Exchange Policy, Human Resources Policy etc.;

- Reviews the Bank’s audited and un-audited Financial Statements, discusses and exchanges views with the External Auditors and Tax consultants on the adequacy of disclosures of Financial Statements;

- Reviews the corrective measures taken by the Bank’s Management as recommended by the Board Audit Division, Internal Control and Compliance Division, Bangladesh Bank’s Inspection Team and External Auditors relating to deficiencies in internal control or other similar issues;

- Reviews whether Internal Control strategies recommended by the Board of Directors have been implemented by the Management;

- Reviews the Human Resource management and evaluates whether the Management is setting the appropriate compliance culture by communicating the importance on Internal Control;

- Reviews the audit plan of Bank’s internal audit and inspection;

- Reviews the internal audit report of Head Office and Branches.

Salient Features of the Audit Committee Charter

MBL’s Board of Directors has set some salient features for its Audit Committee Charter, such as:

- The Audit Committee should be composed of at least 3 (three) members from the Board;

- The Chairman of the Audit Committee should have professional knowledge and relevant financial expertise

- The Chairman of the Board of Directors shall not be a member of the Audit Committee;

- Audit Committee meetings must be held quarterly to monitor internal and external audits;

- Audit Committee must prepare reports on all meetings for the Board of Directors and report annually to Shareholders;

- The Managing Director & CEO or the Chairman of the Board may be invited to attend on the Audit Committee meetings as and when required.

Management Committees:

MBL has formed a number of committees with a view to support the management in carrying out banking operation smoothly. Management Committee (MANCOM), Asset Liability Committee (ALCO), Basel II Implementation Unit, Risk Management Committee, ICAAP Preparation Committee, Management Reporting System (MRS) Committee, Investment Committee, Credit Assessment Committee, Purchase Committee have been supporting the Bank’s management in discharging its duties efficiently and effectively.

Management Committee (MANCOM):

As per directives of Bangladesh Bank and for setting a strong internal control framework, each bank must have an effective ‘Management Committee (MANCOM)’, which is responsible for overall management of the Bank. MANCOM is considered the highest decision and policy making authority of the Bank

RESPONSIBILITIES OF MANCOM:

MANCOM of the Bank is primarily responsible to:

- Formulate procedures to identify, measure, monitor and control all risks;

- Assign clear responsibility, authority and reporting relationship;

- Monitor adequacy and effectiveness of the internal control system;

- Review overall effectiveness of the control system of the Bank;

- Recommend/ rectify alternatives in case of any deviation from desired goal.

MANAGING DIFFERENT TYPES OF RISK:

Credit Risk:

Credit Risk is the potential that a bank borrower or counterparty fails to meet its obligation in accordance with agreed terms. Credit Risk Management of MBL is passed through the following procedures:

- Articulate Lending Guideline

- Credit Risk Grading Process

- Proper Assessment of Credit Proposal

- Precise Lending Process

- Separate Credit Administration Division

- Credit Recovery and Monitoring of Non-Performing Loans

Market risk:

Market risk is defined as the risk of loses in on and off-balance sheet positions arising from movements in market price. Major market risks include: Interest Rate Risk, Foreign Exchange Risk, Equity Risk, and Commodity Risk. MBL’s strategies to address these risks are as under:

A. Managing Interest Rate Risk Interest rate risk is the risk (variability in value) borne by an interest-bearing asset, such as a loan or a bond, due to variability of interest rates. Bank faces various types of Risks including Basis Risks, Yield Curve Risk, Re-pricing Risk, Option Risk and Model Risk. MBL’s Interest Rate Risk Management Strategies

Market Trend Analysis Interest Rate Sensitivity Analysis Gap Analysis

B. Managing Foreign Exchange Risk Foreign exchange risk or exchange rate risk is a form of financial risk that arises from the potential change in the exchange rate of one currency in relation to another.

MBL’s Foreign Exchange Risk Management Strategies Policies and Manuals with a view to reducing the foreign exchange risk

Treasury division of the Bank manages and controls day-to-day trading activities under the supervision of ALCO that ensures continuous monitoring of the level of assumed risks

All the transactions are carried out on behalf of the customers, i.e. MBL’s foreign exchange trading exposures are principally derived from customer driven transactions, and major risk arises from movement of price

All foreign exchange transactions are revalued at Mark-to-Market method according to Bangladesh Bank’s guidelines and position maintained by the Bank at the end of day within the stipulated limit prescribed by Bangladesh Bank

All Nostro accounts are reconciled on monthly basis and verified by the external auditors and reports are submitted to Bangladesh Bank

C. Equity Price Risk Management

Equity price risk is the risk that one’s investments will depreciate because of stock market dynamics causing one to lose money. Equity price risk may arise from general or specific risk or for both.

LIQUIDITY RISK:

Liquidity Risk is the potential for loss to an institution arising from either its inability to meet its obligations or to fund increases in assets as they fall due without incurring unacceptable cost or losses. Liquidity risk is considered a major risk for banks. It arises when the cushion provided by the liquid assets are not sufficient enough to meet its obligation.

- MBL’s Liquidity Risk Management Strategies

- Acceptable assets and liabilities mix

- Diversified sources and stability of liabilities

- Scientific cash flow projections

- Various ratios to maintain liquidity and to create limits for liquidity management

- Ratios are used in conjunction with more qualitative information about borrowing capacity

Operational risk:

Operational risk is the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. It is a very broad concept which focuses on the risks arising from the people, systems and processes through which a company operates. It also includes other categories such as fraud risks, legal risks, physical or environmental risks. MBL’s Board of Directors and Senior Management have established an organizational culture that places a high priority on effective operational risk management and adherence to sound operating controls. Senior Management transforms the strategic direction given by the Board through operational risk management policy.

Asset Liability Committee:

Asset Liability Committee (ALCO) is mainly accountable for managing the market risks. The results of Balance Sheet analysis along with recommendations are placed before ALCO meeting to aid the decision making process of the Senior Management. In each ALCO meeting following issues are addressed:

- Review of actions taken in previous ALCO;

- Review of the assets’ and liabilities’ pricings;

- Review of interest rate structure in different economic scenarios;

- Liquidity risk related to the Balance Sheet;

- Economic and market scenario

Management Reporting System (MRS) Committee:

MBL has formed a committee as per Central Bank’s requirement, namely, ‘Committee for Management Reporting Systems (MRS)’. MRS fulfills the following objectives:

- Collection of information from the internal as well as external sources against any product of the Bank which is apparently found ineffective or unacceptable to the ultimate user;

- Identify the actual weakness / defects for taking appropriate decision by the Management/ Board of Directors;

- Locate the reason of weak performance of any of the branches through collection of relevant information of other banks of the same locality;

- Other internal/external issues may be raised by the Committee to the Management/ Board of Directors for proper solution.

Purchase Committee:

A Purchase Committee is functioning with a group of executives headed by a senior most Executive to examine the procurement procedure of goods, services or works whether it has been placed on the basis of actual requirement and maintained necessary formalities as per guidelines of the purchase policy. Among others, the followings are the main responsibilities of Purchase Committee of the Bank:

- To evaluate the proposal (s) received and find out the effectiveness of each proposal;

- To prepare a report on the basis of evaluation of the purchase proposal (s) with recommendation and send to concerned division for obtaining approval from the competent authority against procurement of goods, services or works;

- To supervise the entire activities against procurement.

Investment Committee:

With a view to achieve diversification in asset portfolio and generating a healthy revenue (as income from buy/sale of shares through secondary market), MBL has formed an Investment Committee, which is primarily responsible to take investment decision in shares. Responsibilities of Investment Committee:

- The Committee will sit for meeting at least once in a week, or as and when necessary after having consent from the Chair;

- The Committee will take primary decision for investment in shares;

- The Committee will ensure compliance of investment policy while maintaining portfolioof shares;

- The Member Secretary will prepare a weekly report on status of investment and report

the same to Managing Director & CEO through Chairman; - The Committee will determine buy range, sale range and loss limit for every share in the portfolio and Member Secretary will convey the same to the Front Office.

Accountability & Internal Control:

Accountability:

Accountability is central to the concept of good corporate governance. Accountability mainly ensures that management’s action is reviewed by the Board. MBL’s Board of Directors is accountable to the Shareholders (owners of the Bank). The Management is accountable to the Board for their activities. MBL’s Board of Directors Responsibilities in preparing Financial Statements MBL Board of Directors ensures that the financial statements of the Bank reflect a true and fair view of the state of affairs of the Bank as at the end of the accounting period and of

the profit and loss and cash flow for the period then ended. In preparing the financial statements, the Directors have applied suitable accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent. The Directors have also ensured that all applicable accounting standards have been followed and financial statements are prepared on a going concern basis as the Directors have a reasonable expectation, having made enquiries that the Bank has adequate resources to continue in operational existence for the foreseeable future.

Accountability in Disclosure of Material Facts:

The Board has a Responsibility and takes it upon itself to present to the shareholders and the public at large, a clear, balanced and meaningful evaluation of the Bank’s financial position, performance and prospects. In order to meet the Fiduciary Responsibility expected of the Board, the Board with the assistance of the Audit Committee oversees the financial reporting process and the quality of the Bank’s financial statements to ensure that the reports present a true and fair view of the Bank’s performance.

Accountability in Maintaining Confidentiality of Information:

Information of the customers, prospective customers, suppliers, shareholders and employees is kept confidential. Information is used solely for corporate purposes and never to be discussed with or divulged to unauthorized people including family, friends and acquaintances. Examples of confidential information broadly include: (a) customer’s account or business details, (b) shareholder’s holding or transaction details, (c) employees’ job records, pay perquisites, benefits, tax issues etc. (d) suppliers’ price, sales strategy etc. (e) Internal documents like strategy papers, Product Program Guidelines (PPG) etc.

Internal Controls:

MBL’s Board of Directors has established a management structure that clearly defines roles, responsibilities and reporting lines for Internal Control and Compliance. The Board has overall responsibility for maintaining sound internal control systems that cover financial controls, operational compliance controls and risk management to ensure that shareholders’ investments, customers’ interests and the Bank’s assets are safeguarded. The systems of internal controls are continuously reviewed to ensure that they are working via the ongoing review through internal

audit process. The Audit Committee (AC) reviews audit recommendations and management’s responses to these recommendations. Lending to the members of the Board or Controlling Shareholders is strictly prohibited by the Bank.

INTERNAL CONTROL ON KEY RISKS FACED BY THE BANK AND RISK MANAGEMENT POLICIES:

There exists risk in every transactions of a bank. So, Risk Management is important in financial sector. Bangladesh Bank has identified six Core Risks and provided guidelines to identify and thereafter minimize the risks. The Board of Directors of the Bank formulated policies for identifying, measuring and controlling the risks involved with banking activities. The Board makes sure that employees have been assigned responsibilities for managing risks, and proper training has been provided to enable them to understand, identify and minimize risks as well.

Audit Function:

In the case of financial audits, a set of financial statements are said to be true and fair when they are free of material misstatements – a concept influenced by both quantitative (numerical) and qualitative factors. Traditionally, audits were mainly associated with gaining information about financial systems and the financial records of a company or a business. However, recent auditing has begun to include non-financial subject areas, such as safety, security, information systems performance and environmental concern and compatibility.

Internal Audit Function:

BOARD AUDIT FUNCTION:

A separate Audit Division, namely, Board Audit Division has been formed within the Bank. Board Audit Division reviews the compliance status of Policy Guidelines of the Board of Directors of the Bank and also of the regulators. Board Audit Division visits the Branches and Other Divisions of the Bank for verification and inspection purpose.

INTERNAL CONTROL AND AUDIT FUNCTION COMPLIANCE:

For an effective control system, a separate and independent Internal Control and Compliance Division (ICCD) has been established in the Bank. ICCD provides assurance to the Bank’s Management that systems are operating effectively; internal controls are effective; laid down procedures are followed; financial and other information being produced is sound and reliable. The Bank, by its Internal Audit Team conducts regular audit functions on the business activities of the Bank based on different manuals, instructions, guidelines and procedures laid down by the Bank as well as by the regulatory bodies from time to time.

INFORMATION TECHNOLOGY (IT) AUDIT:

MBL service delivery is designed on IT platform and hence a number of inherent risks such as data collapse, data loss, data modification, unauthorized access to data etc. may arise within the Bank. IT Audit Team has been formed as per the Central Bank’s Guidelines to identify the inherent risks and manage those risks in an effective and efficient manner. IT Audit Team follows the prescribed guidelines, solves the unsettled issues and also suggests the higher

Management for needful action.

External Audit Function:

EXTERNAL AUDITORS:

Khan Wahab Shafique Rahman & Co., Chartered Accountants and K. M. Hasan & Co. have been appointed as the External Auditors of the Bank in the 13th AGM of the Shareholders. They audited the Financial Statements of the Bank namely, Balance Sheet, Profit and Loss Account, Cash Flow Statement, Statement of Changes in Equity, Statement of Liquidity Analysis and put explanatory notes to financial statements. External Auditors were entitled to enquire from the Bank’s employees such information and explanation as they thought necessary for the performance of their duties as External Auditors. Bank employees provided accurate, timely information and explanations as and when required by the External Auditors.

CENTRAL BANK’S INSPECTION:

Bangladesh Bank conducts comprehensive inspection at Head Office and Branches of the Bank. Central Bank’s Inspection Team exchanges their views with the Bank’s Auditors regarding Financial Operation, Treasury Operation, IT Operation, and various process of the audit.

Inspection report of the Central Bank is reviewed by the Board of Directors and corrective actions are taken for the lapses mentioned in the report.

COMPLIANCE WITH REGULATORY MATTERS:

Compliance with relevant Rules and Regulations:

MBL runs its business activities in full compliance with relevant rules and regulations. While conducting its operation, the Bank follows strictly Bank Companies Act 1991, The Companies Act 1994, Central Bank’s Guidelines, Bangladesh Securities and Exchange Rules 1987, Dhaka Stock Exchange and Chittagong Stock Exchange Listing Rules, Bangladesh Accounting Standards (BAS), Bangladesh Financial Reporting Systems (BFRS), IAS/IFRS guidelines, SAFA & CAPA guidelines, BIS and UCPDC and other ICC rules.

Environmental Promotion:

MBL concentrates on environment preservation by financing Projects in the field of renewable energy, organic agriculture across the entire value chain including health food shops and environment technology such as recycling companies and nature conservation projects. MBL always encourages projects which take care of following points while financing them viz., (a) sustainable development and use of renewable natural resources (b) protection of human health, bio-diversity, occupational health and safety, efficient production, delivery and use of energy (c)

pollution prevention and waste minimization.

Communication with Stakeholders:

Communication with Shareholders:

MBL takes critically its corporate responsibility to provide shareholders with the information necessary to form an informed opinion of the Banks performance. Press releases, interim and final results announcements, interim and annual reports, and other information of interest to shareholders are uploaded to Company’s corporate website www. mblbd.com. Half Yearly and Annual Reports of the Bank are also sent to shareholders within the respective deadlines stipulated by the regulatory bodies.Corporate Governance Practices of MBL 49

Communication with Employees:

To enhance mutual understanding and promote cooperation at all levels, the Board of Directors and the senior management of the Bank always maintains communication with the employees; discuss matters such as safety and the work environment, as well as broader issues relating to staff welfare.

Communication with the General Public:

The Bank’s website www.mblbd.com serve as a easy access for key information source for business, financials and other relevant information about the businesses of the Bank. In addition, from time to time, the Bank publishes reports and information brochures which set out specific aspects of the Bank’s operations for the general public.

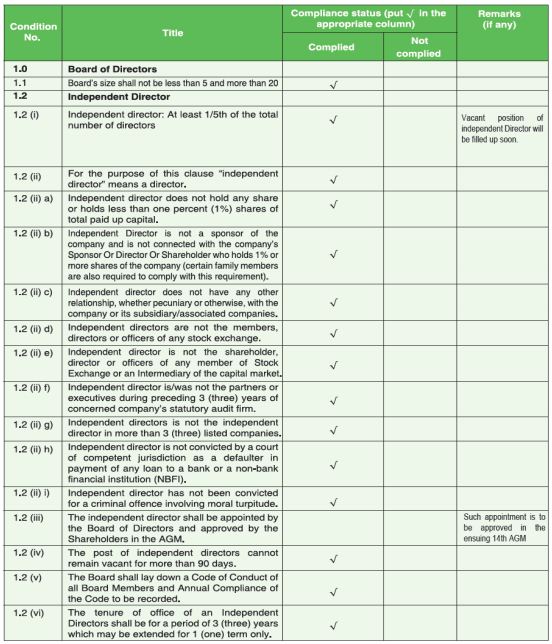

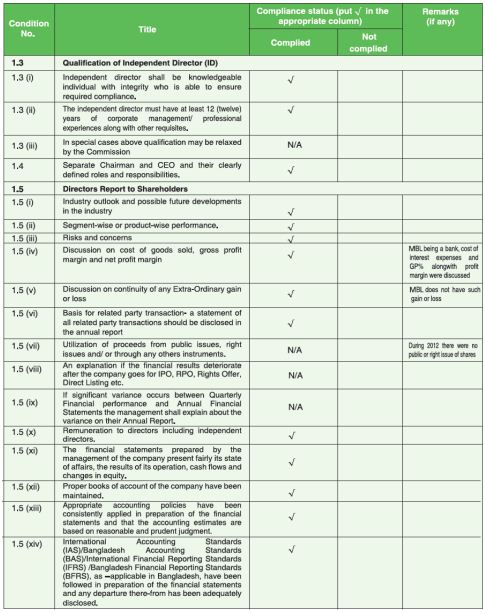

Compliance Report on SEC Notification:

The Securities and Exchange Commission has issued a notification for all listed companies in order to improve Corporate Governance in the interest of the investors and capital market on ‘Comply or Explain’ basis. Status report on compliance with the conditions imposed by SEC is given below in prescribed format:

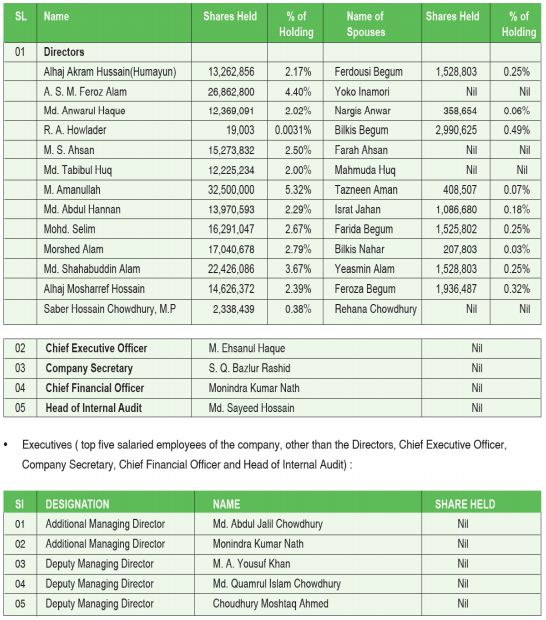

The Pattern of Shareholding:

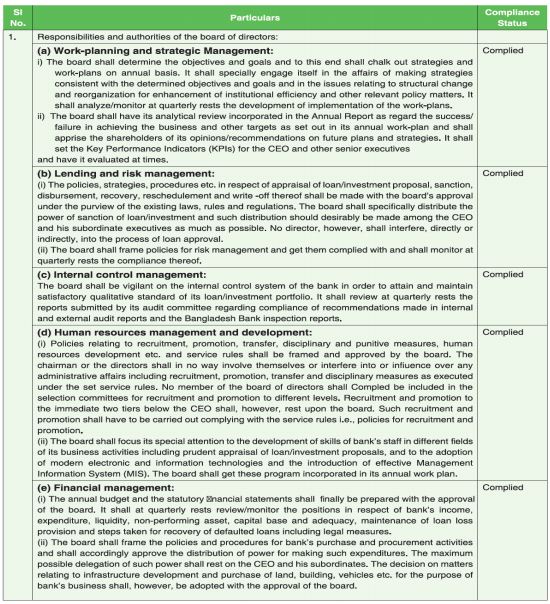

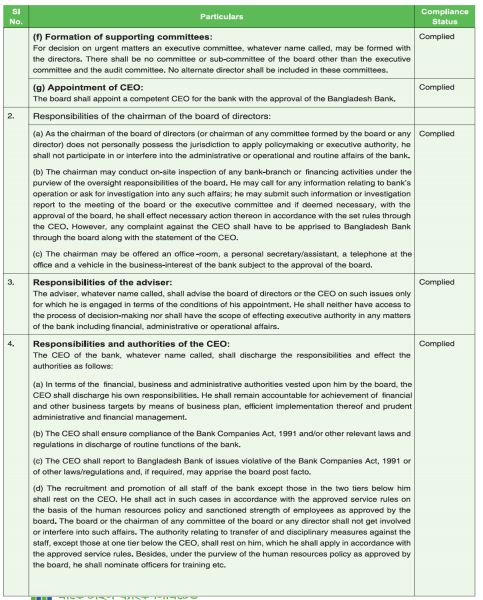

Status of Compliance Bangladesh Bank bGuideline’s for Corporate Governance:

SWOT analysis:

Strengths:

Mercantile Bank Limited has nationwide image of providing quality service. It provides excellent and prompt services with higher degree of secrecy to corporate and mass level of customers even internationally.

- It has an excellent management team and disciplined workforce.

- MBL abides by a set of core values that reflects high commitment to customer:

1. Responsive to customers’ needs.

2. Flexible in approach

3. Professional in manner

4. Strive for service excellence.

- A group of qualified experienced, dedicated and well-trained personnel employing the best effort to accomplish the organizational objective.

- Strong network throughout the country and correspondent relationship with almost all international and local banks operating in Bangladesh created a good accessibility and relationship with people.

- It also has advanced their technology with modernized Temenus Software.

- MBL has devoted much more in CSR activities

- They have adopted ‘Green Banking’ – an eco friendly move by placing solar panel.

Weakness:

- Most to the employees are not properly trained.

- The appropriate employees are not in the appropriate position.

- Online Banking quality and service is poor than the other private bank.

- ATM booths are not available like DBBL, Prime Bank etc.

Opportunities:

- Bonus is given for more than one time in a year this is another reason of the employees’ satisfaction.

- Promotion system of MBL is perfectly structured for the employees’ inspiration. Generally promotion has been every three years after.

- Incentives are given to the employees from profit.

Threats:

- Some foreign and private banks are becoming so advanced that can be a threat to mercantile Bank Ltd. At present in retail banking Standard Chartered Bank and in business banking American Express Bank, Hong Kong Shanghai Banking Corporation are going well.

- Bangladesh bank provides some rules and regulations for all banking institutions. Whether the rules and regulations suit the organization or not, it must obey these that sometimes impose barriers on daily normal operation.

- Also some private banks like Dutch Bangla Bank, Prime Bank, Bank Asia, etc. had introduced ‘Shariah based Banking which is a new concept that attracts almost every level people towards them.

Findings:

Board Members do not have necessary trainings on the updated circular. The Policy on training of Directors includes providing training and updated information on all the latest policy guidelines, circulars and Acts issued by the regulatory/legislative authorities. One third of the members did not attend the meetings regularly. From the report we can see that only one board member has attained all the meetings.

The CEO, CFO, Head of Internal Audit does not have any shares in the company. No implementation of Whistle Blowing policy. The whistle blowing policy of the Bank aims to promote transparency and serves as a channel of corporate fraud risk management. The policy enables an employee, who has a legitimate concern on an existing or potential wrong-doing, to raise the issues and bring the same to the notice of the competent authority.

- No remuneration review Committee.

- MBL does not have any succession planning process.

- Employee productivity analysis is not done and there is no measurement scale to evaluateit

- Annual reports and other information of interest to shareholders are uploaded to

- Company’s corporate website www.mblbd.com. But for last year no annual or half yearly report was published in the website.

- General Public does not hold more than 50% of shares. Al most 40% shares are hold by the directors.

- Lack of efficient executives or officers especially in the general and credit division hampers the customer service process.

- Lack of dedication of some employees is the main obstacle of the growth of this particular branch.

- There are various products and schemes of loans and advances but customer are not known to all of them.

- There were lack of employees to meet the needs of the customers.Corporate Governance Practices of MBL 65

Recommendations:

The Policy on training of Directors includes providing training and updated information on all the latest policy guidelines, circulars and Acts issued by the regulatory/legislative authorities. So proper training has to be given so that the MBL can perform in a better way.

Central Complaint Cell has been established and a vigilance team has also been formed to protect fraud and error. Risk Management Wing (RMW) also acts as the whistleblower of the Bank. Board members must attend the meetings regularly. Though Bangladesh Bank Guidelines do not permit to form a separate committee of Board on remuneration. As such, MBL does not have such committee. However, the Board of Directors should time to time

review and evaluate the remuneration paid to all level of employees, director and others and decides on the issue. In addition, Board Members should directly involve in recruitment, promotion and remuneration process of top executives (Up to two-level below the rank of the Managing Director & CEO) as per the Bangladesh Bank Circular

(BRPD Circular No.11dated 27 October 2013.

Efficient succession planning is an integral part of efficient employee management and MBL should possesses a sound HR Policy covering succession planning to carefully avoid the problems of leadership vacuum under any circumstances Employee productivity should be measured in terms of total deposit, investment, income profit. Annual Reports need to be published annually. Percentage of the shares of the directors should be reduced. It should give more concern in their management quality to improve it satisfactory position.

- The Bank has to go through the proper online banking for better service to the customer.

- The Bank should try to follow modern marketing system.

- The Bank should promote their product by advertisement.

- The Bank should introduce new and attractive product to their customer.

- The Bank should emphasize on training its employee on a frequent basis.

Conclusion:

As an organization the MBL is much more structured compared to any other listed bank operation in Bangladesh. Mercantile Bank Limited is a customer oriented financial institution. It remains dedicated to meet up with the ever growing expectations of the customer.

In MBL, Board of directors formulates bank’s policies, management functions on aproved policies In addition, board of directors takes care the interest of shareholders & all other stakeholders, management remains compliant with the policies, regulations, laws given by board of directors, Bangladesh bank, other regulators However, MBL gives importance on their customers, employees and shareholders. They want to achieve strong corporate growth through

financial inclusion. They try provide solutions at a minimum cost based on a high level of satisfaction of all segments of our customers, thus also contributing to the prosperity of our employees and shareholders.

MBL is trying to develop innovative and technologically advanced products and services that satisfy their customer needs. At the end of the report, I have identified several findings & recommendations of this banking system. In spite of some weakness & lacking, MBL remains strong position in banking sector. If MBL follows effective corporate, uses its strengths, overcomes its weakness, develops some promotion works & changes its services little bit user friendly, then it is sure that MBL will get competitive advantages over its major competitors.