I have prepared this report on the offerings and contribution of a bank for Small and Medium Enterprises (SMEs) entire the country having an academic purpose. Small and Medium Enterprises (SMEs) are accounting for 25 percent of GDP, 80 percent of industrial jobs, and 25 percent of the total labour force in Bangladesh even though the prospective sector gets negligible facilitation from different support service providers. There are various constraints that hinder the development of SMEs in Bangladesh, such as lack of medium to long-term credit, limited access to market opportunities, technology, and expertise and business information. Lack of suitable incentives, inefficient and limited services from relevant government agencies as well as poor capacity of entrepreneurs are other reasons for the slow growth of SMEs. Obviously, the government has many things to do to flourish the SMEs because, if they flourish, SMEs will create new entrepreneurs, generate more jobs and contribute to a great extent to the national economy. This paper is an academic analysis in respect of SME financing.

BRAC Bank Limited is a scheduled Commercial Bank in Bangladesh. At present the Bank operating its business by 26 Branches. BRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country. The Bank has already established its network in different area of the country with assistance of BRAC. BRAC Bank is trying to develop economic condition of the country. So the bank provides loan facility 3 to 30 lacs taka to that small and medium enterprise that has no easy access to banks/financial institutes. The bank already established 36 Zones and 900 unit offices all over the country. There are 1185 Customer Relation Officers (CRO) providing door-to-door service to clients. Till December 2006, the bank provides loan facilities to 46000 clients which amount is Tk. 1909.64 crore. Average loan size is Tk. 4.16 lacs. The success of SME will largely depends on the selection of a business and man behind the business.

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on May 20, 1999 under the Companies Act, 1994. Its operation started on July 4, 2001 with a vision to be the market leader through to providing all sorts’ support to people in term of promoting corporate and small entrepreneurs and individuals all over the Bangladesh.

BRAC Bank will be a unique organization in Bangladesh. The Bank consists of major divisions named 1) Corporate banking, 2) Retail banking, 3) Treasury, 4) Small & Medium Enterprise (SME). At present the Bank operating its business by 26 Branches. BRAC Bank is the first local commercial banks that proving online banking service to its customers from the very beginning of its starts.

BRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country.

Objectives of the Report

- To analyze the SME loan processing activities

- To explore the impact of SME loan on socio-economic development of Bangladesh

- To recommend for more development of SME.

Scope of the Report

Scope of the study is quite clear. Since Asset Operations Department is dealing with all types of loan activities in the bank. So studying these core themes, Opportunities are there to learn other aspects of SME matters.

- Concept of SME and its impact on overall economy of Bangladesh

- Entrepreneurship development situation through SME banking

- Importance of SME banking in the context of Bangladesh

- Pioneer’s strategy regarding SME banking

- Other bank’s performance in comparison to the SME banking at BBL

- Small entrepreneurs of rural –urban spectrum are enjoying the BRAC Bank loan facility without the presence of bank at rural area.

- Virtual banking concept through SME banking

- Difference of different banking concept

Methodology

The study uses both primary data and secondary data. The report is divided into two parts. One is the Organization Part and the other is the Project Part. The parts are virtually separate from one another.

The information for the Organization part of the report was collected from secondary sources like books, published reports and web site of the BRAC Bank Limited. For general concept development about the bank short interviews and discussion session were taken as primary source.

Some of the secondary data is collected from the operational manual of Asset Operations Department.

The information for the Project “Analysis of SME loan in BRAC Bank Limited” both were collected from primary and secondary sources. For gathering concept of SME loan, the Product Program Guideline (PPG) thoroughly analyzed. Beside this observation, discussion with the employee of the SME department and loan administration division the said bank was also conducted. More over a market survey was conducted with a specific questionnaire. To identify the implementation, supervision, monitoring and repayment practice- interview with the employee and extensive study of the existing file was and practical case observation was done.

Limitations:

- My tenure was for 6 weeks or 45 days only, which was somehow not sufficient. After working whole day in the office it was very much difficult and also impossible to study again the theoretical aspects of banking.

- As I did not do the project job with the affiliation letter so sometimes bank personnel was not interested to share the information.

- Some bank personnel were so busy that they could not share me the information’s.

History:

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994. BRAC Bank will be a unique organization in Bangladesh. The primary objective of the Bank is to provide all kinds of banking business. At the very beginning the Bank faced some legal obligation because the High Court of Bangladesh suspended activity of the Bank and it could fail to start its operations till 03 June 2001. Eventually, the judgment of the High Court was set aside and dismissed by the Appellate Division of the Supreme Court on 04 June 2001 and the Bank has started its operations from July 04, 2001.

The importance of financial intermediaries in the development of the overall economy of country cannot be described in short. From the inception of the civilization the banking sector dominate the economic development of a country by mobilizing the saving from the general people and channeling those saving for investment and thus economic development and growth. In ancient time, the importance of commercial banks after the ravage of the liberation war to develop a better economy was severally needed and it is needed now and will be required in future also. In time-to-time Government of Bangladesh agreed to permit the private commercial banking in the country. BRAC bank will be knowledge-based organization where the BRAC Bank professionals will learn continuously from their customers and colleague’s world wide to add value. It will work as a team, stretch, they will innovate and break barriers to serve customers and create customers loyalty through a value chain of responsive and professional delivery. The bank promotes broad-based participation in the Bangladesh economy through the provision of high quality banking services. BRAC Bank will do this by increasing access to economic opportunities for all individuals and business in Bangladesh with a special focus on currently under-served enterprises and households across the rural – urban spectrum. BRAC Bank believes that the pursuit of profit and developmental goals is mutually reinforcing.

Increasing the ability of under – served individuals and enterprises to build their asset base and access market opportunities will increase the economic well being for all Bangladeshis at the same time, this will contribute significantly to the profitability of the Bank. BRAC Bank intends to set standards as the Market leader in Bangladesh. It will produce earnings and pay out dividends that can support the activities of BRAC, the Bank’s major shareholder. Development and poverty alleviation on a countrywide basis needs mass production, mass consumption and mass financing.

BRAC Bank goal is to provide mass financing to enable mass production and mass consumption, and thereby contribute to the development of Bangladesh. BRAC Bank intends to set standard as the market leader in Bangladesh by providing efficient, friendly and modern fully automated online service on a profitable basis aiming at offering commercial banking service to the customers’ door around the country, BRAC Bank limited established 26 branches up-to this year.

This organization achieved customers’ confidence immediately after its establishment. Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. It is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution. Thus within this short time it has been able to create an unique image for itself and earned significant solution in the banking sector of the country as a bank with a difference. The emergence of BRAC Bank Limited is an important event in the country’s financial sector at the inception of financial sector reform. The authorized capital of BBL is Tk. 1000 million and paid up capital of the same bank is Tk. 500 million.

Shareholders | Percent |

BRAC | 31.74% |

IFC | 9.50% |

Shore Cap International | 8.76% |

General Public through IPO | 40% |

Non-Residents Bangladeshi’s | 5% |

The Chairman of the Bank is Mr. Fazle Hasan Abed. Now the Managing Director of the bank is Mr. Imran Rahman. The bank has made a reasonable progress due to its visionary management people and its appropriate policy and implementation.

Vision

BRAC Bank will be a unique organization in Bangladesh. It will be a knowledge-based organization where the BRAC Bank professionals will learn continuously from their customers and colleagues worldwide to add value. They will work as a team, stretch themselves, innovate and break barriers to serve customers and create customer loyalty through a value chain of responsive and professional service delivery.

Continuous improvement, problem solution, excellence in service, business prudence, efficiency and adding value will be the operative words of the organization. BRAC Bank will serve its customers with respect and will work very hard to instill a strong customer service culture throughout the bank. It will treat its employees with dignity and will build a company of highly qualified professionals who have integrity and believe in the Bank’s vision and who are committed to its success. BRAC Bank will be a socially responsible institution that will not lend to businesses that have a detrimental impact on the environment and people.

Mission

BRAC Bank will adhere to highly professional and ethical business principles and internationally acceptable banking and accounting standards. Every BRAC Bank professional will need first of all a commitment to excellence in all that he/she does, a keen desire for success, a determination to excel and a drive to be the best.

Products

i) Small & Medium Enterprise (SME)

The most valuable natural resource of Bangladesh is its people. Micro lenders are working here in the financial field, providing very small amount and on the other hand regular commercial banks have been providing bigger amount of loans to larger industries and trading organizations. But the small medium entrepreneurs were over looked. This missing middle group is the small but striving entrepreneurs, who because of lack of fund cannot pursue their financial uplift, as they have no property to provide as equity to the commercial banks. With this end in view-BRAC Bank was opened to serve these small but hard working entrepreneurs with double bottom line vision. As a socially responsible bank, BRAC Bank wants to see the emancipation of grass-root level to their economic height and also to make profit by serving the interest of missing middle groups. 50% of our total portfolio usually collected from urban areas, channeled to support these entrepreneurs who in future will become the potential strength of our economy. We are the market lenders in giving loans to Small and Medium Entrepreneurs. We have been doing it for the last five years.

BRAC Bank Ltd has in total 900 unit offices, 80 zonal office, 12 territory and 1800 Customer Relationship Officers. These CRO’s work for the Bank to converge clients for getting the loan. Once CRO’s get the loan application and if it is less than 500,000 TK then zonal officer has the authority to approve the loan. But if it is above 500,000 then the CRO’s send it to Head Office for all necessary approval. After approving the loan then Asset Operation Department starts its work. As the growing, the amount of files and disbursement is getting bigger. In September 2006 AOD has processed 3249 files amounting Tk. 1,235,200,000. So SME Division’s success greatly relies on the performance. Up to April 2007, BBL provides loans for 70000 clients and in total 2265 crore TK. But the most important thing is only 17 crore TK is bad loan; this is a great achievement for SME unit of BBL. Currently they have 44147 outstanding clients and in total 1070 crore TK SME loan.

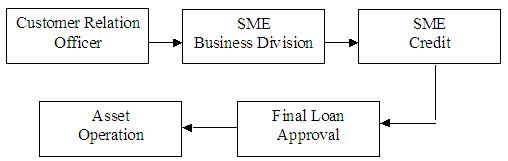

SME Loan process flow is shown below-

When a client comes for a loan request, first he meets a CRO, then the following process take place:

Services

Bank has adopted trust as a corporate value which is acronym for team work, respect for all people, unquestionable integrity, excellence in everything BRAC Bank of SME do, Sense of urgency in getting things done and total commitment.

All employees are expected to conduct themselves in accordance with the rules and regulations of the bank.

It is not acceptable to offer or receive any form of bribe or inducement, or direct anyone else to do on behalf of the bank. The following activities are strictly prohibited:

- Payment or other benefits which violate the country’s law or the bank’s policies

- Payment or other benefits for procurement of business

- Payment or other benefits to public officials or politicians to induce them to exercise their discretion in the bank’s favor

Literature Review:

Definition of Banking:

In general terms, the business activity of accepting and safeguarding money owned by other individuals and entities, and then lending out this money in order to earn a profit is termed as banking.

BRAC Bank Limited., one of the latest generations of commercial banks, which started its journey on the 4th of July 2001 with a vision to be the absolute market leader. BRAC Bank is a commercial bank scheduled bank extending full range of banking facilities as per the directives of Bangladesh bank. It intends to set standards as the absolute market leader by providing efficient, friendly and modern fully automated on-line service on a profitable basis. BRAC Bank in surviving in the large arena through its unique and competitive products and it is the only local bank providing 100% integrated on-line banking.

The bank is mainly owned by the largest NGO in Bangladesh-BRAC The Bank has positioned itself as a new generation Bank with a focus to meet diverse financial need a growing and developing economy.

The bank has embarked with a stated policy to promote broad based participation in the exile economy all the way through the provision of high quality banking service based on latest information technology. The bank will ensure this by increasing access to economic opportunities for all individuals and businesses in Bangladesh with a special focus on currently under served enterprises and households across the rural urban spectrum. We believe that growing the ability of underserved individuals and enterprises to build their asset base and access market opportunities will increase the economic well being for all Bangladesh.

ANALYSIS & FINDIGNS & RECOMMENDATIONS

Offerings

BRAC Bank, as we know, is one of the fastest growing banks in Bangladesh. SME banking which has made the performance of this bank so enlightened is its core product to offer to the small and mediocre business entrepreneurs. In fact no businessman could think ever before that they could take loan so easily, without any collateral and without going to bank. But BRAC Bank has made this improbable process so successfully through SME banking.

However from the analysis of SME loan repayment behavior I can make the following Offerings:

SME Products-

1. Anonno Rin:

Anonno is a term loan for small scaled business product type

Equated Monthly installment & Single Installment

Loan Ceiling:

BDT 3 lacs to below 10 lacs

Tenure:

EMI-12 to 36 single installment 3 to 9 months

Loan amount:

Required loan amount + up font installment (if any) + all fess and charges with applicable VAT Interest Rate.

- 22.50% for New loan

- 22.25 for 1st time repeat (if applicable)

- 22.00% for 2nd time repeat & so on (if applicable)

Security:

Hypothecation on present & futures assets, tow personal guarantors & dated cheques.

2. Aupurbo Rin:

Apurbo is a term loan for medium size business

Age have a significant impact on the recovery of SME loan. Young entrepreneurs have a lower rate of recovery. On the other hand as middle aged and experienced entrepreneurs are very loyal with their loan repayment they can make proper and timely repayment of their loans. And that’s why most of the SME loan borrowers age rages from 30 to 40.

Experience is the most significant variable which has a great impact on any kind of business and recovery rate as well. Experienced entrepreneurs run their business so tactfully, identify the exact time what is their pick time of sales and when they need fund. They take the loan in the pick season when they have excess demand but short of capital. Then they ensures the best use of the loan and finally they reach to success and make the dully installments. So their recovery rate is good and that’s why BRAC Bank looks always for experienced entrepreneurs.

Primary Data Analysis

| Name | Loan Amount | Previous income range | Present income range |

| Md. Ali Azar | 5,00000 | 10000-15000 | 20000-25000 |

| Md. Anwar Hossain | 10,00000 | 15000-20000 | 25000-30000 |

| Md. Abul Kalam | 5000000 | 12000-15000 | 20000-25000 |

| Minar Hossain | 10000000 | 15000-20000 | 25000-30000 |

| Ashraf Uddin | 10000000 | 15000-20000 | 25000-30000 |

Number of installments (term of loan) and amount of loan taken do affect recovery rate slightly. But trends show that BRAC Bank prefers to disburse loan of an amount of 300000 and at a term of 18 to 24 months.

Personal or family asset might have some impact while sanctioning the loan as well as when recovering the loan installments. Suppose if a borrower fails to pay one of his installments, bank can find his personal assets as back up for the recovery of the installments.

Security Documentation against Loan

A document is a written statement of facts and a proof or evidence of particular transaction between parties involved. While allowing any disbursements against credit facilities to borrowers, it should be ensured that prior to any disbursements; security documentation is fully and properly completed.

a) Purpose of Decorate Documentation and its Importance

Documentation is necessary for the acknowledgement of a debt and its terms and conditions by the borrower and the creation of charge on the securities in favor of the bank by the borrower. Correct and proper documentation allows a bank to take legal measures against the default borrowers.

If filing a suit with the courts against a default borrower becomes necessary, the court will first review all documents. If any of the documents is found to be defect or incomplete, the purpose of security documentation will be defeated and a court ruling in favor the bank cannot be expected. Proper care should, therefore, be taken while completing security documentation.

b) Type of Securities

The following listed securities may be obtained from borrower against loan to enterprises, either individually or in a combination.

It is really up to the bank what they would like to accept as security from the borrower as not all the securities stated below are suitable:

- Mortgage of loan and other immovable property with power of attorney to sell

- Lien of Fixed Deposits receipts with banks and other non-banking financial institutions, lined, these have to confirm by the issuer.

- Lien of Pratirakshay sanchay patra, Bangladesh sanchay patra, ICB unit certificates and wage earner development bond, all considered Quasi or Near cash items

- Lien of shares quoted in the stock exchange (This is rarely accepted)

- Pledge of goods (Banks are akin to stay away from such securities now a days)

- Hypothecation of Goods, Book Debt & Receivables, Plant & Machineries

- Charge on fixed assets of a manufacturing enterprise

- Lien of cheque, Drafts and order

- Lien of work orders, payment to be routed through the bank and confirmed by the issuer.

- Shipping documents of imported goods

c) Land Related Securities Documentation Process

Each SME unit offices are lilies with at least two local lawyers who will work on behalf of the bank. These always will be employed whenever a borrower and where the security will be landed and immovable property accept a loan sanction. Any one of the lawyers will be provided with photocopies of all the relevant land related documents and while handing over show the original documents to them, The lawyers will carry out checks of the originals and if satisfied returned to the borrower. The documents generally provided are:

- Title Deeds or Deed of conveyance otherwise known as ‘Jomeer Dalil’ which signifies ownership of a particular land.

- Baya Dalil or Chain of Documents, which signifies that the conveyance of titles has been proper and legal.

- Mutation Certificate if Khatian which signifies that the title if the land has been duly registered in the Government/Sub-registrar’s records.

- Duplicate Carbon Receipt or DCR

- Latest Khajna or land rent receipt

- Purchase such as CS Khatian, SA Khatian and BS Khatian

- Mouja Map

- Municipal rent receipts if the land falls within a municipal area

d) Mortgage

i) Equitable Mortgage or Memorandum of Deposit of Title Deeds

It is created by a simple deposit of title deeds supported by a Memorandum of Deposit of Title Deeds along with all the relevant land documents. All the searches and verification of documents as stated above must be carried out to validate the correct ownership of the property. This deed also provides the bank power to register the property in favor of the bank for further security, if needed.

ii) Registered Mortgage

It is created by an execution of a Mortgage Deed registered irrevocably in favor of the bank at the Sub-Registrar of land’s office. This virtually gives the bank the right to posses and self if accompanied with a registered irrevocable power of attorney to sell the property executed by the owner of the property, in case of default.

e) Basic Charge Documents

i) Sanction Letter

Once a loan is approved, the borrower is advised by a ‘Sanction or offer letter’ which states the terms and condition s under which all credit facilities are offered and which forms an integral part of there security documentation. If the borrower accepts, then a contract between the bank and the borrower is formed and which both party are obligated to perform. Accordingly, all other charge documents and securities are drawn up and obtained. A standard sanction letter is attached herewith. All documents shall be stamped correctly and adequately before or at the time of execution. An un-stamped or insufficiently stamped document will not form basis of suit. Stamps are of 4 (Four) kinds. These are Judicial, Non-judicial, Adhesive and embossed impressed. Documents to be executed (Signed) by the borrowers concerned must be competent to do so in official capacity.

Following precautions should be taken at the time of execution of the security documents:

- The signature on the documents should be made in the presence of the CRO. The CRO should sign as witness on all charge documents.

- The document are to be filled in with permanent ink or typed

- If the document consist more than I page, the borrower should sign on each page

- If the signature of any third party is required to be obtained whose specimen signature is not available, then the main applicant should verity the specimen signature of the third party

- No document or column in any document should remain blank

- As far as possible there should be no erasure, cancellation or alternation in the document. If, however, there is any correction, overwriting or alteration, then that must be authenticated by a full signature of the signatory.

Terms and Conditions of SME Loan

The SME department of BRAC Bank will provide small loans to potential borrower under the following terms and condition:

- The potential borrowers and enterprises have to fulfill the selection criteria

- The loan amount is between Tk. 2 lacs to 30 lacs.

- SME will impose loan processing fees for evaluation / processing a loan proposal as following;

Loan Amount | Loan Processing Fee |

| 2 lacs to 2.99 lacs | Tk. 5000 |

| 3 lacs to 5 lacs | Tk. 7500 |

| 5.01 lacs to 15 lacs | Tk. 10,000 |

| 15.01 lacs to 30 lacs | Tk. 15,000 |

- Loan can be repaid in two ways:

a) In equal monthly loan installment with monthly interest payment, or

b) By one single payment at maturity, with interest repayable a quarter end residual on maturity

- Loan may have various validates, such as, 3 months, 4 months, 6 months, 9 months, 12 months, 15 months, 18 months, 24 months, 30 months and 36 months.

- The borrower must open a bank account with the same bank and branch where the SME has its account

- Loan that approved will be disbursed to the client through that account by account payee cheque in the following manner: Borrower name, Account name, Banks name and Branch’s name

- The loan will be realized by 1st every months, starting from the very next months whatever the date of disbursement, through account payee cheque in favor of BRAC Bank Limited A/C . With Bank’s named and branches name

- The borrower has to issue an account payable blank cheque in favor of BRAC Bank Limited before any loan disbursement along with all other security.

- The borrower will install a signboard in a visible place of business of manufacturing unit mentioned that financed by “BRAC Bank Limited”.

- The borrower has to give necessary and adequate collateral and other securities as per bank’s requirement and procedures.

- SME, BRAC Bank may provide 100% of the Net Required Working Capital but not exceeding 75% of the aggregate value of the Inventory and Account Receivables. Such loan may be given for periods not exceeding 18 months. Loan could also be considered for shorter periods including one time principal repayment facility, as stated in loan product sheet.

- In case of fixed asset Financing 50% of the acquisition cost of the fixed asset may be considered. While evaluating loans against fixed asset, adequate grace period may be considered depending on the cash generation after the installation of the fixed assets. Maximum period to be considered including grace period may be for 36 months.

Monitoring

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a CRO to know the borrowers activities after the loan disbursement. This also facilitates the build up of an information base for future reference.

Monitoring System

a. The CRO can consider the following things for monitoring

The CRO will monitor each business at least once a month. He/she will make a monitoring plan/ schedule at beginning of the month

During monitoring the CRO must use the prescribed monitoring from and preserve in the client file and forward a copy of the report to SME head office immediately.

b. A SME branch will maintain the following files

The file will contain

Purchase Receipt,

Delivery Memo’s,

Quotations

In addition, all other papers related to furniture and fixture procurement

Macro Environmental Analysis

It is very important to carry out a macro environment scanning for the banking industry in order to identify and analyze the external factor that affected the growth and development of the banking sector in Bangladesh.

SME results for BBL is quite satisfactory, as they have surprised their stipulated targets despite the economic sluggishness going on in the country. Some practical example is as follows:

Technological Environment

BRAC bank of SME division has a strong network in the whole country.

Ecological Environment

To protect from these disasters BRAC bank do the insurance policy with the joint names of the client. So that client can get feedback from the insurance policy to run again his business.

SWOT analysis:

SWOT analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition.

Strengths

Company reputation

Sponsors

Top Management

Facilities and equipment

Impressive branches

Interactive corporate culture

Teamwork at mid level and lower level

Weaknesses

Advertising and promotion of SME loan NGO name (BRAC)

Low remuneration package

Opportunities

Diversification

Product line proliferation

ATM

Threats

Multinational banks

Upcoming banks

Contemporary banks

Default

Access to loan:

SMEs encounter great difficulties while rising fixed and working capital because of the reluctance of banks to provide loans to SMEs. Banks are shy to lend to SMEs because of high processing and monitoring costs of loans to SMEs. The loan application forms for investment financing from banks are long, tedious, and redundant. Since the removal of the interest rate subsidy without the removal of interest band, financial institutions find little incentive to lend to SMEs. SMEs find it difficult to use non real estate assets as collateral to obtain loans from the banks. In the past, the government has attempted to provide SMEs with access to finance through targeted lending. There was a government directive that 5 per cent of a bank’s loan portfolio be set aside for small and cottage industry financing. A new bank, namely, the Bank of Small Industries and Commerce Bangladesh Ltd (BASIC) was set up in 1988 with the objective of financing the small and cottage industries. There were also attempts to channelize fund received from international agencies such as the Asian Development Bank (ADB) to the sector through private banks. There were provisions of favorable debt equity ratio, special interest rates and credit guarantee scheme. The central bank also issued directives to both public and private commercial banks regarding working capital loans, use of standardized documentation procedure and time limits for credit sanctioning and loan disbursement.

Collateral:

The main problem of SMEs is that, they do not have enough collateral for getting fund from the bank.

Lack of experience:

Small and Medium Industry Entrepreneurs, in Bangladesh, have lack of experience in the business field.

Extremely short grace period:

In our country, grace period of repaying any credit is very low.

Cost of loan:

Another problem is that extremely high interest rate for the entrepreneurs.

Absence of comprehensive guidelines:

Another problem is that, there is an absence of comprehensive guidelines in the SME sector.

Longer loan processing time and associate cost of uncertainty:

Credit in this sector requires longer processing time.

Lack of basic infrastructure, inputs, managerial efficiency:

Most of the SMEs do not have basic infrastructure of their own i.e. there is a lack of planned infrastructure in this sector.

Inadequate sanction:

And, inadequate sanction of loan should also be stated here. The loan provided to this sector is inadequate.

Recommendations

Though BRAC Bank has performed better than other NCBs and in some cases better to many private banks, the recent trends shows that percentage of classified term loan has increased in every year. Following actions are recommended:

- The person behind the business should be given the highest priority for sanctioning loan. In fact, transactions dealt, the past behavior of the loaner concerned, the nature of the business, the competition status of the product, probable gestation period and all such important relevant factors should be formed the basis of determining whether a particular case for loan should have been entertained or not. The collateral should have played only a minor role as a matter of last resort.

- Rigid concern should be given to keep intact financial health of banks through proper classification and provisioning.

- More attention on supervision, monitoring and inspection.

- Skilled personnel should be recruited for the banks and professionalism should get priority.

- Collateral do not have any effective role in the performance of a particular credit facility is evident form the case of collateral free export credit where loan defaults are few and far between. However, the legacy of security oriented banking in Bangladesh left the banking system in Bangladesh left the banking system heavily dependant on disposing of real estate’s including building in the process of recovering debts. The lengthy procedure stands in the way of quick sale of these mortgaged properties.

- Prevention is better than cure. This should be the watch ward for monitoring and supervising loan accounts of a bank. Making classifications and pursuing the borrowers to regularize the accounts rarely meet success. The cost of such exercise is also heavy. So the bank should evolve appropriate system to detect deficiencies in the management of credit operations well before it calls for classification. In this regard, effective no-site and off-site supervision system should be in place both in the scheduled banks and central bank.

- Inspection department should be manned efficient and intelligent officials. It should be an exclusive department with promising career path for its members. Officers of this department should not be transferred to other departments. Person behind the desk is equally important in a well- knit and efficient system. So personnel placed in the inspection departments of banks should be of quality and integrity.

CONCLUSION

It is a great pleasure for me to have practical exposure in BRAC Bank because without practical exposure it couldn’t be possible for me to compare the theory with practice and it is well establish that theory without practice is blind. There are number of commercial banks operating their activities in Bangladesh. The BRAC Bank is a promising one in them. For the future planning and the successful operation in achieving its prime goal in this current competitive environment this report can be guideline. An evaluation of the Credit Department and the Reason of Default Rate was the basic concern of my study and I completed this report on this basis Credit Department of BRAC Bank. A retail loan files evaluate & approved by this department before disbursed a loan. Day by day, BRAC Bank increasing its business, that reason BRAC Bank Credit Department approved more loan files everyday to its retail customer and my study was find out few factors from which we can assumed a good or defaulter borrower and place few recommendation by which they can mitigate their risk. Banks always contribute towards the economic development of a country. BRAC Bank compared with other banks is contributing more by investing most of their funds in fruitful projects and risk free individual. It is obvious that the right thinking of the bank including establishing a successful network over the country and increasing resources, will be able to play a considerable role in the portfolio of development of financing in the developing country like ours.